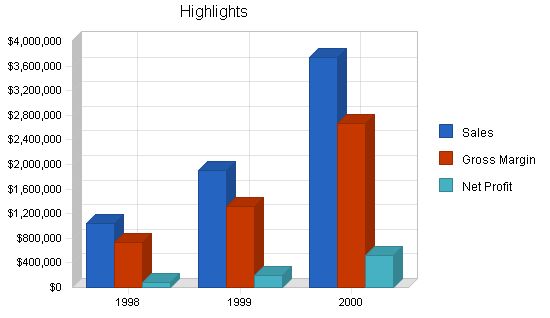

Supple Software Company, an S Corporation founded and owned by Ralph and Mabel Smith in 1993, sells three software products that have impressive market share. Ralph and Mabel aim to increase sales and double them by 2000. They also plan to achieve commensurate gross margin and net profit increases. Their goal is to have one employee for every $250,000 in revenue. With their flagship product, Product X, they aim to maintain a 30% market share as measured by PC Data. They believe market power, customer satisfaction, and the right management team are key to success.

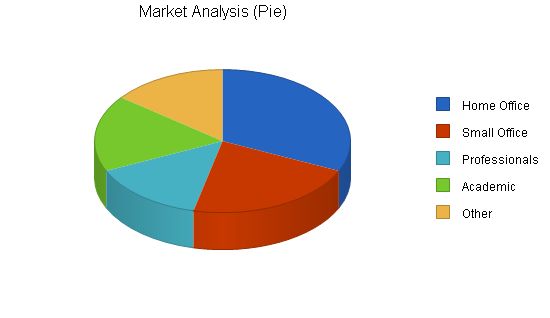

Supple operates in a $3.8 billion market with a projected 20% growth rate over the next three years. They target four customer segments: home offices, small offices, professionals, and academics. These markets are growing at rates of 2%, 5%, 8%, and 0% respectively, with potential customer bases of 22,000, 15,000, 10,000, and 12,000. The US market has experienced 22% growth in the past three years, but the international market is projected to grow at 40%.

Supple Software currently offers three products. Product X is the second-leading Windows task X software and the quality leader, combining an easy-to-use interface with a powerful business analysis model. Product Y is a standalone task Y application for Windows, while Product Z is a creative business process application.

To achieve growth, Supple will customize their standard products for specific customer groups, develop a strong marketing infrastructure, focus on small to medium-sized companies, and prioritize follow-up technology over leading technology. Ralph and Mabel, experienced managers, are responsible for executing these strategies. Ralph has a sales and marketing background, and Mabel’s consulting experience will contribute to the company’s growth.

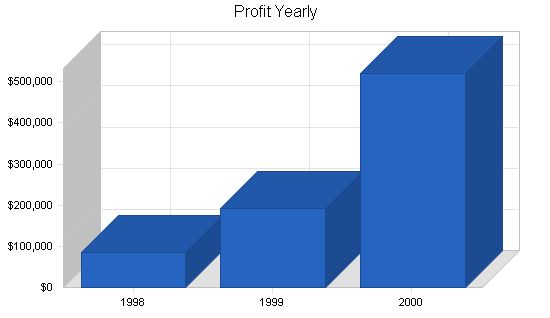

Despite humble beginnings and no outside capital, Supple Software has grown into a $1 million company with increasing revenue forecasts for 2000.

1.1 Objectives:

– Increase sales in 1999 and double sales in 2000.

– Increase gross margin and net profit margin.

– Maintain personnel at a ratio of 1 full-time person for every $250K in revenue.

– Maintain at least 30% market share of Product X according to PC Data.

1.2 Keys to Success:

– Marketing power: have products on shelves with attractive packaging and sufficient marketing power to maintain a 30% or higher market share according to PC Data.

– Product quality and customer satisfaction: all products guarantee promised functionality.

– Long-term customer satisfaction is critical.

– Strong management team with expertise in marketing, management, finance, and product development.

– Sufficient working capital to survive in the retail channel.

1.3 Mission:

Supple Software develops, publishes, and markets business tools and know-how in a software product, making them accessible to millions of users. The company generates profit and cash, offers a rewarding work environment and fair compensation to employees, a fair return to owners, and a fair royalty to authors.

Supple Software was founded in 1993 by Ralph Smith to market Product X software. It moved into its current space in 1996 and added new products, acquiring shelf space in retail.

2.1 Company Ownership:

Supple Software, Inc. is now a subchapter S Corporation owned by Ralph Smith and his wife Mabel. It became subchapter S in the 1996 tax year after previously being subchapter C. The fiscal year is the calendar year. The corporation was established with 100 shares, 51 owned by Ralph Smith and 49 owned by Mabel Smith.

2.2 Company History:

Supple Software, Inc. was originally founded in Ourtown in 1993 as Infoplan, a sole proprietorship. It was later incorporated in Delaware as Infoplan, Inc., and then in California as Supple Software, Inc. Infoplan, Inc. was dissolved.

For most of its existence, this was a one-man consulting company supporting a product company. It maintained a conservative approach to products and advertising, relying on published reviews and direct sales until the market expanded.

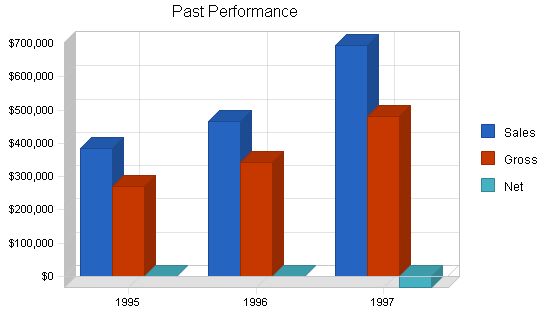

In 1995, a breakthrough product called Product X™ was introduced, featuring the first effective task X software with bundled spreadsheet and word processor capabilities and automatic charts.

| 1995 | 1996 | 1997 | |

| $384,113 | $464,592 | $695,136 | |

| $270,062 | $342,824 | $480,163 | |

| 70.31% | 73.79% | 69.07% | |

| $251,471 | $290,145 | $513,144 | |

| 0 | 0 | 34 | |

| 7.00 | 6.00 | 6.00 | |

| Current Assets | |||

| Cash | $0 | $0 | $625 |

| Accounts Receivable | $0 | $0 | $124,056 |

| Inventory | $0 | $0 | $28,623 |

| Other Current Assets | $0 | $0 | $431 |

| Total Current Assets | $0 | $0 | $153,735 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $35,577 |

| Accumulated Depreciation | $0 | $0 | $24,247 |

| Total Long-term Assets | $0 | $0 | $11,330 |

| Total Assets | $0 | $0 | $165,065 |

| Current Liabilities | |||

| Accounts Payable | $0 | $0 | $36,557 |

| Current Borrowing | $0 | $0 | $22,336 |

| Other Current Liabilities (interest free) | $0 | $0 | $25,526 |

| Total Current Liabilities | $0 | $0 | $84,419 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $84,419 |

| Paid-in Capital | $0 | $0 | $76,960 |

| Retained Earnings | $0 | $0 | $36,668 |

| Earnings | $0 | $0 | ($32,982) |

| Total Capital | $0 | $0 | $80,646 |

| Total Capital and Liabilities | $0 | $0 | $165,065 |

| Payment Days | 0 | 0 | 30 |

| Sales on Credit | $0 | $0 | $660,379 |

| Receivables Turnover | 0.00 | 0.00 | 5.32 |

Contents

Company Locations and Facilities

The company is located in Ourtown at 100 Main Street. We moved to our current space in 1996 from a home office. We rent 750 square feet for $900 per month under a two-year contract with limited rent increases.

Products

Our products are prescriptive software that provide guidance and empowerment to users. Our flagship product, Product X, is a best-seller. We also offer Product Y for Windows.

Customers don’t purchase our products for the software itself, but for the benefits they provide and the solution they offer to a problem. They want reassurance that the job is done right and that they are prepared when presenting their plans. Our products have a strong reputation and we have sold over 70,000 units through various channels. We are listed in product databases and have a network of direct buyers and registered users.

Product Description

- Product X: Suggested Retail Price $XX, street price $XX. According to PC Data, it is the second-leading Windows task X software in the U.S. market and the quality leader. It features an easy-to-use, step-by-step interface with a powerful business analysis model and complete financial analysis.

- Product Y: Suggested Retail Price $XX, street price $XX. It is a stand-alone task Y application for Windows, offering more than just that with its complete [omitted]. It is considered the best product available for creating a task Y and managing the [omitted] function.

- Product Z: Suggested Retail Price $XX, street price $XX. It is a stand-alone task Y application for Windows, offering more than just that with its complete [omitted]. It is considered the best product available for creating a task Y and managing the [omitted] function.

Competitive Comparison

In addition to books, magazines, courses, seminars, and consultants, we compete against three other task X packages sold through retail: Product A by Competitor A, Product B by Competitor B, and Product C by Company C. Our main competitor, AAA, is privately owned and well financed. While they imitated our early template products, we maintain a competitive edge in terms of product quality and reviews. BBB, the third-place competitor, is fading, and CCC, the fourth-place competitor, has the potential to become a serious competitor as they expand their product line.

Sales Literature

Refer to the appendices for our sales literature and collaterals, which showcase our consistent packaging and advertising theme.

Sourcing

A detailed discussion of vendors has been omitted for brevity.

Technology

Both Product X and Product Y are enhancements of previous products copyrighted by Ralph Smith and Supple Software. We have a software development engine that brings together guided text, spreadsheet tables, and charts in a user-friendly environment with wizards, help files, and on-line coaching.

- This discussion has been omitted as it contains specific product and company information.

- This discussion has been omitted as it contains specific product and company information.

Future Products

Our future product development is primarily driven by market needs. We have a strong understanding of our target market segment and a core product engine that serves as the foundation for future products.

- Our next big product will [material omitted]. It will be compatible with both Product X and Product Y future versions, creating a true management system for small businesses. We have already developed an in-house system that could serve as the prototype.

- Our second major product development effort, pending further research on customer needs, might be the [omitted].

- We are also considering a new product [omitted].

Market Analysis Summary

Our market includes millions of people in home offices, small offices, business schools, and professional offices. The growing need for people to perform tasks X, Y, and Z favors our business.

According to research published last year, the [product area] market is worth an estimated $3.8 billion and projected to grow at 20% per year. The [industry] Association estimates total retail sales of $3.075 billion.

Market Segmentation

Our target customers are adults in small businesses, home offices, and academic institutions. They have a range of computer and business skills, but are relatively unsophisticated in computing and business management. They are looking for a do-it-yourself product that helps them get the job done without the need for experts. Additionally, consultants, accountants, and experts use our products to maximize productivity. Our products are also used by business schools and teachers for their teaching power.

1998 1999 2000 2001 2002

——————————–

Potential Customers

Home Office 22,000 22,440 22,889 23,347 23,814

Small Office 15,000 15,750 16,538 17,365 18,233

Professionals 10,000 10,800 11,664 12,597 13,605

Academic 12,000 12,000 12,000 12,000 12,000

Other 10,000 10,000 10,000 10,000 10,000

Total 69,000 70,990 73,091 75,309 77,652

4.2 Target Market Segment Strategy

This should be a thoughtful discussion of why we have chosen our target markets. We compete in areas that lend themselves to local competition, product and channel areas that match our strengths, and avoid our weaknesses.

We operate only in the mainstream XXX and YYY channels, where we can compete with higher prices and better margins. We are positioned in the smaller stores and chains, where the customer base is sensitive to environment, ethics, and community, and in tune with our vision.

4.2.1 Market Growth

The market for non-U.S. personal computers has been growing approximately 22% per year during the last three years, according to a study by InfoQuest published in the Wall Street Journal. This level of growth presumably applies to related products as well and is higher than growth in the U.S. market.

The growth in specialty international marketing consulting is estimated at 40% per year, according to a report in the San Jose Chronicle.

In our market analysis, we suggest growth in the number of potential customers between 6% and 7% per year.

4.2.2 Market Trends

One important trend is the increase in international sales in personal computing products. All major manufacturers are recording more gains in the non-U.S. market than in the U.S. market.

Another trend is the greater use of specialized and focused consultants, instead of in-house resources. Companies are looking for more outsourcing and a preference for variable costs.

4.2.3 Market Needs

Our target SBs are dependent on reliable information technology. They use computers for a range of functions including accounting, shipping, inventory, communications, and personal productivity. They come to us for reliable service and support to substitute for their in-house people.

These businesses want reliable expertise and are not interested in shopping for rock-bottom prices. They value reliable providers.

Our standard SBs will be 5-20 unit installations, critically dependent on local-area networks. Back-up, training, installation, and ongoing support are important. They require database and administrative software as the core of their systems.

The software industry is frequently segmented according to product type. We prefer segmentation by economics and buying patterns:

1. OEM Software Development: software sold through others.

2. Mainline Packaged Software: software sold through direct sales to large buyers, direct response, catalogs, and retail stores.

3. Specialty or Vertical Market Software: sold outside the main software channels with careful target marketing.

Another segmentation divides the market by buyer/user types:

1. Consumer: users of home blippos.

2. Small Business: 10 million businesses in the United States.

3. Large Business: businesses with complex needs.

4.3.1 Competition and Buying Patterns

The most important factor in software is the bandwagon. Market share generates more market share. Brand names assure quality. Buyers are willing to pay high prices for solutions that work. Channels discount heavily. There is no consensus about software copying. Impulse buying goes on with products below $100. Distribution channels are clogged. Support becomes a serious factor at higher price levels.

4.3.2 Main Competitors

Supple Software Company distinguishes itself through specific business tasks.

The main competitors are sellers of cheap dealio software. Their strength is their price, but their weakness is their lack of usefulness and documentation.

4.3.3 Industry Participants

Supple Software Company is part of an immature industry with high growth rates, low barriers to entry, and many small competitors. Leaders in the industry have emerged and have revenues in the hundreds of millions of dollars annually.

The market for software is worth an estimated $3.8 billion and is projected to grow at 20% per year. The top 10 companies account for less than one third of the total market.

4.3.4 Distribution Patterns

Distribution channels are a bottleneck in the industry. Marketing costs are a barrier to entry. Brand names carry more weight. Developers often choose to work with major brands instead of marketing on their own. Royalties are low. There are exceptions to the rule.

Strategy and Implementation Summary

Our strategy is based on serving niche markets well. We focus on small and medium-sized businesses that can’t get good products or services from major vendors. We aim to reach specific types of businesses across the country.

5.1 Strategy Pyramid

Our main strategy is to position ourselves at the top of the quality scale, offering superb technology and fine programming to buyers who want the best quality. Our tactics include research and development, choosing the right distribution channels, and communicating our quality position.

Supple Software offers the discriminating personal computer user a combination of the highest quality software and latest technology, at a fair price.

5.3 Competitive Edge

Our competitive edge is our software engine, knowledge of the product area, and commitment to customer satisfaction.

Our marketing strategy emphasizes focus. We focus on certain kinds of products and users. We focus on product quality, reviews, consistent branding, and key media.

5.4.1 Pricing Strategy

Our pricing is determined by our focus on retail sales. We aim for prices in the high two-digits, which are acceptable to customers.

5.4.2 Promotion Strategy

Our advertising, co-promotion efforts, and PR are key parts of our promotion strategy. We focus on certain media and strong packaging.

5.4.3 Distribution Strategy

We concentrate our marketing efforts on the mainstream XXX and YYY channels. We leverage display advertising and look for interesting opportunities.

5.4.4 Marketing Programs

Our most important marketing program is focused on specific objectives that should be measured by concrete metrics. We have another key marketing program that focuses on different objectives.

5.4.5 Positioning Statement

For business owners and managers who need to deal with Task X, Product X is software that creates and helps manage professional Task X. For small businesses, professionals, and the self-employed who recognize the importance of managing cash flow, Product X is financial software that handles all essential bookkeeping functions.

5.5 Sales Strategy

Our sales strategy focuses on retail sales and point of purchase decisions. Our marketing aims to create knowledge and awareness of the product category.

5.5.1 Sales Forecast

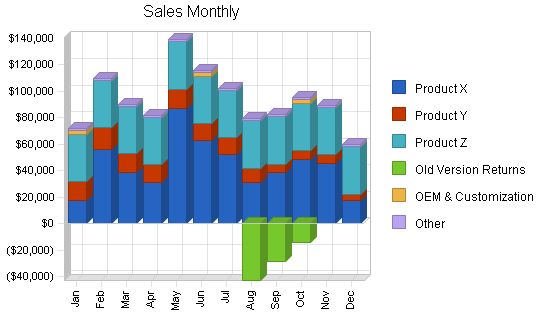

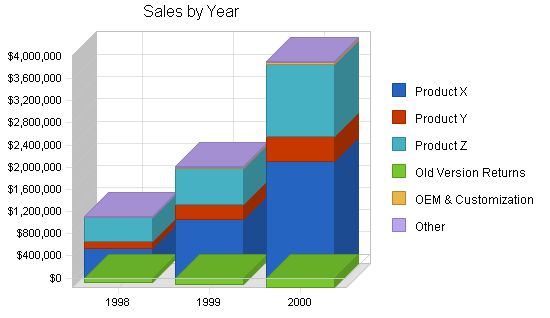

Our sales forecast for 1998 is based on estimated unit sales for Product X and Product Y. We expect Product X to sell 15,000 units and Product Y to sell 3,000 units.

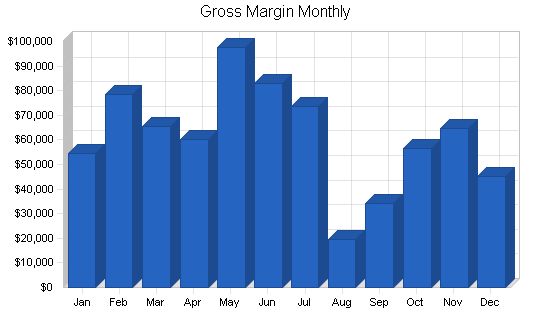

The Monthly Sales Chart shows some seasonality in our business.

Sales Forecast

(Unit Sales)

Product X

1998: 15,100

1999: 30,000

2000: 60,000

Product Y

1998: 2,976

1999: 6,000

2000: 10,000

Product Z

1998: 1,320

1999: 2,000

2000: 4,000

Old Version Returns

1998: -900

1999: -1,200

2000: -1,800

OEM & Customization

1998: 9

1999: 25

2000: 35

Other

1998: 12

1999: 15

2000: 20

Total Unit Sales

1998: 18,517

1999: 36,840

2000: 72,255

(Unit Prices)

Product X

1998: $35.00

Product Y

1998: $45.00

Product Z

1998: $325.00

Old Version Returns

1998: $95.00

OEM & Customization

1998: $1,000.00

Other

1998: $1,500.00

(Sales)

Product X

1998: $528,500

1999: $1,050,000

2000: $2,100,000

Product Y

1998: $133,920

1999: $270,000

2000: $450,000

Product Z

1998: $429,000

1999: $650,000

2000: $1,300,000

Old Version Returns

1998: ($85,500)

1999: ($114,000)

2000: ($171,000)

OEM & Customization

1998: $9,000

1999: $25,000

2000: $35,000

Other

1998: $18,000

1999: $22,500

2000: $30,000

Total Sales

1998: $1,032,920

1999: $1,903,500

2000: $3,744,000

(Direct Unit Costs)

Product X

1998: $7.82

1999: $8.50

2000: $8.00

Product Y

1998: $8.39

Product Z

1998: $0.00

Old Version Returns

1998: $0.00

OEM & Customization

1998: $0.00

Other

1998: $0.00

1999: $8.50

2000: $8.00

(Direct Cost of Sales)

Product X

1998: $118,082

1999: $255,000

2000: $480,000

Product Y

1998: $24,969

1999: $50,340

2000: $83,900

Product Z

1998: $0

1999: $0

2000: $0

Old Version Returns

1998: $0

1999: $0

2000: $0

OEM & Customization

1998: $0

1999: $0

2000: $0

Other

1998: $0

1999: $128

2000: $160

Sales Programs

– We work with [omitted] (XXX) to develop and consolidate our retail channel sales. XXX is a national sales rep firm operating in Ourtown. It has an office in Southern California, a rep in Canada, and good relations with our major distributors. XXX receives a 6% commission on sales to major distributors.

– We have tasked XXX with four key objectives for 1998: increase sell-through numbers, improve shelf stocking levels, gain entry into XXX, and secure representation in XXX. As of April, we have achieved entry into XXX and improved stocking levels. However, we are still working on gaining representation in XXX and achieving optimal sell-through.

– We aim to strengthen our relationship with XXX, the second-largest provider of personal computer software to retail channels.

Strategic Alliances

Product development: Our main focus is on developing and launching new versions of Product X and Product Y.

Marketing: We need to closely monitor sell-through and performance to evaluate the results of our 1997 marketing efforts. Initial sales reviews indicate a successful launch, but ongoing monitoring is necessary.

Finance: We are also working on enhancing our capital structure and management team.

Milestones

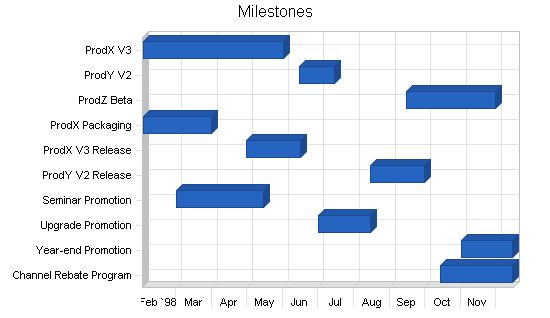

The milestones table and chart provide detailed information about program activities planned for the year. Each activity has its manager, start date, end date, and budget. We will track implementation against the plan and provide reports on timely completion.

Milestones:

ProdX V3: 2/1/1998 – 6/1/1998, $5,000, ABC, Department

ProdY V2: 6/15/1998 – 7/15/1998, $15,000, ABC, Department

ProdZ Beta: 9/15/1998 – 11/30/1998, $10,000, ABC, Department

ProdX Packaging: 2/1/1998 – 3/31/1998, $15,000, ABC, Department

ProdX V3 Release: 4/30/1998 – 6/16/1998, $10,000, ABC, Department

ProdY V2 Release: 8/15/1998 – 9/30/1998, $5,000, ABC, Department

Seminar Promotion: 3/1/1998 – 5/15/1998, $10,000, ABC, Department

Upgrade Promotion: 7/1/1998 – 8/15/1998, $50,000, ABC, Department

Year-end Promotion: 11/1/1998 – 12/15/1998, $25,000, ABC, Department

Channel Rebate Program: 10/14/1998 – 12/15/1998, $5,000, ABC, Department

Totals: $150,000

Management Summary

We are a small company owned and operated by Ralph and Mabel Smith, husband and wife, as a Subchapter S corporation. Ralph is the developer and designer of the products, and Mabel manages the office.

Management style reflects the participation of the owners. The company respects its community of co-workers and treats all workers well. We attempt to develop and nurture the company as community. We are not very hierarchical.

6.1 Organizational Structure

Ralph Smith, President, is responsible for overall business management. Our managers of finance, marketing, and sales report directly to Ralph.

Jim Graham, programmer, is responsible for product design and development.

As co-owners, Ralph and Mabel jointly develop business strategy and long-term plans. Ralph is strong on product know-how and technology, and Mabel is strong on management and business know-how.

6.2 Management Team

-Ralph Smith: President and founder. Smith worked for 10 years in sales and marketing with Arrog International before returning to California to found what has become Supple Software. He was sales manager of the eastern region when he founded the original software distribution company. MBA from Stanford, MA with honors from University of Oregon, BA magna cum laude from the University of Notre Dame. Forty years old, married, five children.

-Allen Lombard: on board of directors. ______, _________. Previously General Manager for ________, where sales increased during his 1982-1987 management from less than $3 million to $29 million annually. MBA Harvard Business School, BS Stanford.

-Mabel Smith: Consultant, general manager. Was the manager of XYZ Lumber in Standard before being hired by Acme six years ago. BA in Business Administration, University of North Carolina.

-Henry Callahan: on board of directors. Well-known and respected public relations and advertising consultant based in Blank.

-Perry Masonjar: attorney and secretary of board. Founding attorney of _____, _________, Austec, and other start-ups.

-Linda Wilson: Marketing Coordinator. 25 years old. BA Marketing, _____________.

6.3 Management Team Gaps

-The present team is very weak on professional sales.

-The present team, though strong on how to market at a high level, is short on practical front-line marketing experience.

-Product development requires a stable of entrepreneurial inventors willing to work for royalties.

6.4 Personnel Plan

Our people are compensated well, for the Ourtown market. Compensation includes complete HMO health care for the employee and all dependents, a dental plan, a 401K with generous profit sharing, and two weeks of vacations. The atmosphere at work is enhanced by teambuilding activities including river rafting, roller skating, pizza parties, etc.

We do expect to increase personnel significantly as sales increase.

Monthly personnel details for 1998 are in the appendix.

Personnel Plan

1998 1999 2000

Production Personnel

Technical Support Manager $33,300 $37,000 $41,000

Technical Support Staff $0 $25,000 $50,000

Other $0 $0 $0

Subtotal $33,300 $62,000 $91,000

Sales and Marketing Personnel

Marketing Manager $48,000 $53,000 $58,000

Other $0 $0 $0

Subtotal $48,000 $53,000 $58,000

General and Administrative Personnel

President $60,000 $66,000 $73,000

Office Manager $30,000 $33,000 $36,000

Other $0 $0 $0

Subtotal $90,000 $99,000 $109,000

Other Personnel

Development $30,300 $50,000 $100,000

Other $0 $0 $0

Subtotal $30,300 $50,000 $100,000

Total People 5 7 8

Total Payroll $201,600 $264,000 $358,000

Ideally, we would want to bring in some equity investment from investors compatible with our growth plan, management style, and vision, in return for some equity ownership. We are not going to talk about specifics of a deal until we have met the right partners. This plan does not call for equity from outside investors.

If and when the time for outside investors comes, we want compatible investors or no investors at all. Compatibility means:

1. A fundamental respect for giving our customers value, and for maintaining a healthy and happy workplace.

2. Respect for realistic forecasts, and conservative cash flow and financial management.

3. Cash flow as first priority, growth second, profits third.

4. Located in Oregon or the Northwest.

5. Willingness to follow the company carefully and contribute valuable input to strategy and implementation decisions.

Of these, only the last two are flexible.

We want to establish a mechanism for employees to acquire fair stock options that can become valuable as the company grows.

7.1 Important Assumptions

The financial plan depends on important assumptions, most of which are shown in the following table. The key underlying assumptions are:

-We assume a slow-growth economy, without major recession.

-We assume of course that there are no unforeseen changes in technology to make products immediately obsolete.

-We assume access to equity capital and financing sufficient to maintain our financial plan as shown in the tables.

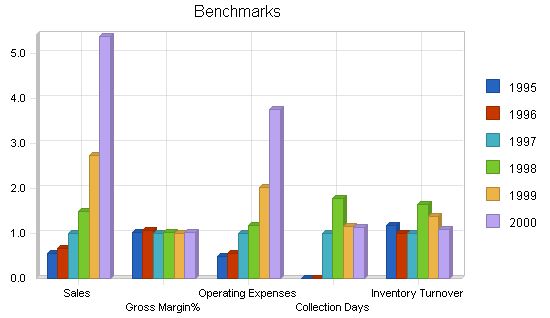

7.2 Key Financial Indicators

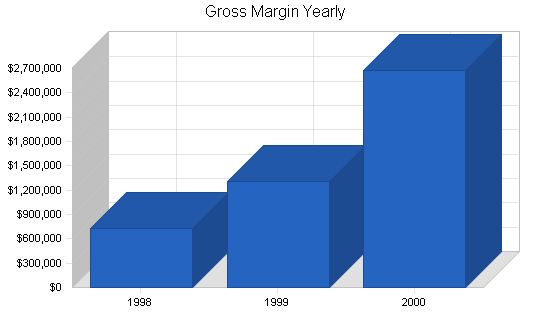

The following chart shows changes in key financial indicators: sales, gross margin, operating expenses, collection days, and inventory turnover. The growth in sales is the most obvious change, and operating expenses with sales. We believe the growing market for our products, the larger potential market, justifies the growth projections.

We expect to maintain gross margin at a high level without major changes.

The projections for collection days and inventory turnover show that we are already expecting improvements as our increasing sales gives us greater economies of scale, and greater negotiation strength with our channel partners.

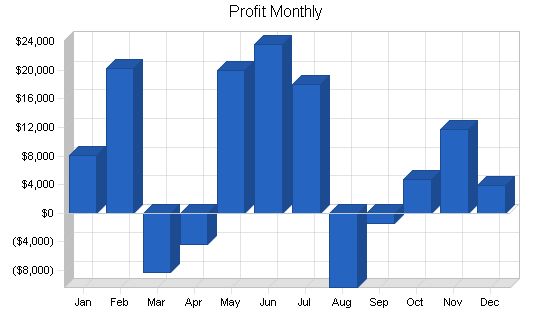

The table below outlines our projected profit and loss for the next three years. We aim to maintain our gross margin while increasing our net profit margin. The main factor contributing to this improvement is the economies of scale in our general and administrative expenses, which should decrease as a percentage of sales from 1998 to 2000.

However, we anticipate that sales and marketing expenses will remain unchanged as a percentage of sales. The nature of the packaged software business requires substantial marketing expenses.

Additionally, we plan to allocate a higher percentage of revenue towards development. By 2000, we anticipate spending approximately 7% of sales on product development. This investment is crucial to our future success.

Please note that the following table displays the annual figures only. The appendix contains more detailed monthly projections for 1988.

Pro Forma Profit and Loss

1998 | 1999 | 2000

Sales | $1,032,920 | $1,903,500 | $3,744,000

Direct Cost of Sales | $143,051 | $305,468 | $564,060

Production Payroll | $33,300 | $62,000 | $91,000

Freight | $20,546 | $29,000 | $33,800

Royalties | $103,298 | $197,550 | $385,200

Total Cost of Sales | $300,195 | $594,018 | $1,074,060

Gross Margin | $732,725 | $1,309,483 | $2,669,940

Gross Margin% | 70.94% | 68.79% | 71.31%

Operating Expenses

Sales and Marketing Expenses

Sales and Marketing Payroll | $48,000 | $53,000 | $58,000

Advertising/Promotion | $210,000 | $400,000 | $770,000

Sales Commissions | $61,981 | $118,530 | $231,120

Graphics and Collaterals | $35,000 | $70,000 | $140,000

Printing | $28,700 | $57,000 | $114,000

Public Relations | $14,400 | $29,000 | $58,000

Research | $2,000 | $4,000 | $8,000

Tollfree Telephone | $6,000 | $12,000 | $24,000

Trade Shows and Events | $6,000 | $12,000 | $24,000

Meals | $4,300 | $9,000 | $18,000

Travel | $12,800 | $26,000 | $52,000

Other Sales and Marketing Expenses | $12,000 | $24,000 | $48,000

Total Sales and Marketing Expenses | $441,181 | $814,530 | $1,545,120

Sales and Marketing% | 42.71% | 42.79% | 41.27%

General and Administrative Expenses

General and Administrative Payroll | $90,000 | $99,000 | $109,000

Marketing/Promotion | $0 | $0 | $0

Depreciation | $1,000 | $1,250 | $1,563

Online Services | $3,600 | $4,500 | $5,625

Contributions | $300 | $375 | $469

Dues and Subscriptions | $600 | $750 | $938

Maintenance and Repairs | $1,800 | $2,250 | $2,813

Office Supplies | $1,200 | $1,500 | $1,875

Postage | $2,400 | $3,000 | $3,750

Professional Fees | $6,000 | $7,500 | $9,375

Telephone | $9,000 | $11,250 | $14,063

Rent | $10,800 | $13,500 | $16,875

Utilities | $3,000 | $3,750 | $4,688

Insurance | $6,000 | $7,500 | $9,375

Payroll Taxes | $0 | $0 | $0

Other General and Administrative Expenses | $0 | $0 | $0

Total General and Administrative Expenses | $135,700 | $156,125 | $180,409

General and Administrative% | 13.14% | 8.20% | 4.82%

Other Expenses

Other Payroll | $30,300 | $50,000 | $100,000

Consultants | $0 | $0 | $0

Product Development | $1,200 | $15,000 | $100,000

Total Other Expenses | $31,500 | $65,000 | $200,000

Other% | 3.05% | 3.41% | 5.34%

Total Operating Expenses | $608,381 | $1,035,655 | $1,925,529

Profit Before Interest and Taxes | $124,344 | $273,828 | $744,411

EBITDA | $125,344 | $275,078 | $745,974

Interest Expense | $1,734 | $234 | $234

Taxes Incurred | $36,783 | $82,078 | $223,253

Net Profit | $85,828 | $191,516 | $520,924

Net Profit/Sales | 8.31% | 10.06% | 13.91%

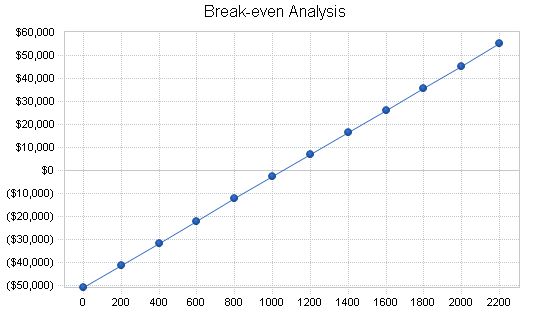

7.4 Break-even Analysis

Our break-even analysis is based on our current cost and price structure. As we grow, fixed costs will increase in proportion to our employee numbers.

Break-even Analysis:

Monthly Units Break-even: 1,055

Monthly Revenue Break-even: $58,848

Assumptions:

Average Per-Unit Revenue: $55.78

Average Per-Unit Variable Cost: $7.73

Estimated Monthly Fixed Cost: $50,698

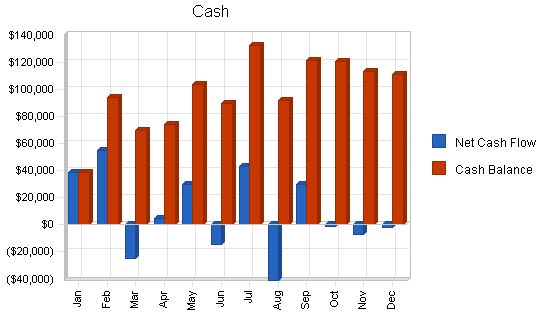

7.5 Projected Cash Flow:

The following chart illustrates our cash projections for the next 12 months. Due to our reliance on sales through channels and their tendency to pay slowly, we need working capital from short-term credit on receivables and inventory to support wide variations.

The table only shows annual results, which are less significant. The monthly cash flow table in the appendix is the key to our business plan and represents the key numbers in the following chart.

Pro Forma Cash Flow

[table]

[tr][td]Year[/td][td]Cash Received[/td][/tr]

[tr][td]1998[/td][td]$1,114,316[/td][/tr]

[tr][td]1999[/td][td]$1,829,645[/td][/tr]

[tr][td]2000[/td][td]$3,587,863[/td][/tr][/table]

7.6 Projected Balance Sheet

The table shows the annual balance sheet results, with a projected increase in net worth.

[table]

[tr][td]Year[/td][td]Assets[/td][/tr]

[tr][td]1998[/td][td]$216,988[/td][/tr]

[tr][td]1999[/td][td]$500,089[/td][/tr]

[tr][td]2000[/td][td]$1,135,896[/td][/tr][/table]

7.7 Business Ratios

Standard business ratios are included in the following table. The ratios show balanced, healthy growth.

[table]

[tr][td]Year[/td][td]Sales Growth[/td][/tr]

[tr][td]1998[/td][td]48.59%[/td][/tr]

[tr][td]1999[/td][td]84.28%[/td][/tr]

[tr][td]2000[/td][td]96.69%[/td][/tr][/table]

Note: Detailed monthly projections, additional ratios, and other information can be found in the appendix.

Sales Forecast

Unit Sales

Product X: 0%, Jan: 500, Feb: 1,600, Mar: 1,100, Apr: 900, May: 2,500, Jun: 1,800, Jul: 1,500, Aug: 900, Sep: 1,100, Oct: 1,400, Nov: 1,300, Dec: 500

Product Y: 0%, Jan: 325, Feb: 365, Mar: 325, Apr: 295, May: 315, Jun: 285, Jul: 285, Aug: 235, Sep: 145, Oct: 145, Nov: 145, Dec: 111

Product Z: 0%, Jan: 110, Feb: 110, Mar: 110, Apr: 110, May: 110, Jun: 110, Jul: 110, Aug: 110, Sep: 110, Oct: 110, Nov: 110, Dec: 110

Old Version Returns: 0%, Jan: 0, Feb: 0, Mar: 0, Apr: 0, May: 0, Jun: 0, Jul: 0, Aug: -450, Sep: -300, Oct: -150, Nov: 0, Dec: 0

OEM & Customization: 0%, Jan: 3, Feb: 0, Mar: 0, Apr: 0, May: 0, Jun: 3, Jul: 0, Aug: 0, Sep: 0, Oct: 3, Nov: 0, Dec: 0

Other: 0%, Jan: 1, Feb: 1, Mar: 1, Apr: 1, May: 1, Jun: 1, Jul: 1, Aug: 1, Sep: 1, Oct: 1, Nov: 1, Dec: 1

Total Unit Sales: Jan: 939, Feb: 2,076, Mar: 1,536, Apr: 1,306, May: 2,926, Jun: 2,199, Jul: 1,896, Aug: 796, Sep: 1,056, Oct: 1,509, Nov: 1,556, Dec: 722

Unit Prices

Product X: Jan-Dec: $35.00

Product Y: Jan-Dec: $45.00

Product Z: Jan-Dec: $325.00

Old Version Returns: Jan-Dec: $95.00

OEM & Customization: Jan-Dec: $1,000.00

Other: Jan-Dec: $1,500.00

Sales

Product X: Jan: $17,500, Feb: $56,000, Mar: $38,500, Apr: $31,500, May: $87,500, Jun: $63,000, Jul: $52,500, Aug: $31,500, Sep: $38,500, Oct: $49,000, Nov: $45,500, Dec: $17,500

Product Y: Jan: $14,625, Feb: $16,425, Mar: $14,625, Apr: $13,275, May: $14,175, Jun: $12,825, Jul: $12,825, Aug: $10,575, Sep: $6,525, Oct: $6,525, Nov: $6,525, Dec: $4,995

Product Z: Jan: $35,750, Feb: $35,750, Mar: $35,750, Apr: $35,750, May: $35,750, Jun: $35,750, Jul: $35,750, Aug: $35,750, Sep: $35,750, Oct: $35,750, Nov: $35,750, Dec: $35,750

Old Version Returns: Jan: $0, Feb: $0, Mar: $0, Apr: $0, May: $0, Jun: $0, Jul: $0, Aug: ($42,750), Sep: ($28,500), Oct: ($14,250), Nov: $0, Dec: $0

OEM & Customization: Jan: $3,000, Feb: $0, Mar: $0, Apr: $0, May: $0, Jun: $3,000, Jul: $0, Aug: $0, Sep: $0, Oct: $3,000, Nov: $0, Dec: $0

Other: Jan: $1,500, Feb: $1,500, Mar: $1,500, Apr: $1,500, May: $1,500, Jun: $1,500, Jul: $1,500, Aug: $1,500, Sep: $1,500, Oct: $1,500, Nov: $1,500, Dec: $1,500

Total Sales: Jan: $72,375, Feb: $109,675, Mar: $90,375, Apr: $82,025, May: $138,925, Jun: $116,075, Jul: $102,575, Aug: $36,575, Sep: $53,775, Oct: $81,525, Nov: $89,275, Dec: $59,745

Personnel Plan

Production Personnel

Technical Support Manager: Jan-Dec: $2,775

Technical Support Staff: Jan-Dec: $0

Other: Jan-Dec: $0

Subtotal: Jan-Dec: $2,775

Sales and Marketing Personnel

Marketing Manager: Jan-Dec: $4,000

Other: Jan-Dec: $0

Subtotal: Jan-Dec: $4,000

General and Administrative Personnel

President: Jan-Dec: $5,000

Office Manager: Jan-Dec: $2,500

Other: Jan-Dec: $0

Subtotal: Jan-Dec: $7,500

Other Personnel

Development: Jan-Dec: $2,525

Other: Jan-Dec: $0

Subtotal: Jan-Dec: $2,525

Total People: Jan-Dec: 5

Total Payroll: Jan-Dec: $16,800

Pro Forma Profit and Loss:

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales $72,375 $109,675 $90,375 $82,025 $138,925 $116,075 $102,575 $36,575 $53,775 $81,525 $89,275 $59,745

Direct Cost of Sales $6,637 $15,574 $11,329 $9,513 $22,193 $16,467 $14,121 $9,010 $9,819 $12,165 $11,383 $4,841

Production Payroll $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775 $2,775

Freight $1,201 $2,056 $1,651 $1,479 $2,694 $2,146 $1,921 $1,434 $1,516 $1,741 $1,666 $1,041

Royalties 10% $7,238 $10,968 $9,038 $8,203 $13,893 $11,608 $10,258 $3,658 $5,378 $8,153 $8,928 $5,975

Total Cost of Sales $17,851 $31,373 $24,793 $21,970 $41,555 $32,996 $29,075 $16,877 $19,488 $24,834 $24,752 $14,632

Gross Margin $54,524 $78,302 $65,582 $60,055 $97,370 $83,079 $73,500 $19,698 $34,287 $56,691 $64,523 $45,113

Gross Margin % 75.34% 71.39% 72.57% 73.22% 70.09% 71.57% 71.65% 53.86% 63.76% 69.54% 72.27% 75.51%

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Advertising/Promotion $10,000 $20,000 $20,000 $20,000 $30,000 $20,000 $20,000 $10,000 $10,000 $20,000 $20,000 $10,000

Sales Commissions 6% $4,343 $6,581 $5,423 $4,922 $8,336 $6,965 $6,155 $2,195 $3,227 $4,892 $5,357 $3,585

Graphics and Collaterals $1,000 $1,000 $30,000 $2,000 $0 $0 $0 $500 $0 $0 $500 $0

Printing $2,200 $500 $500 $18,000 $5,000 $0 $0 $500 $500 $500 $500 $500

Public Relations $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200

Research $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2,000

Tollfree Telephone $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Trade Shows and Events $2,000 $0 $0 $0 $2,000 $0 $0 $0 $0 $2,000 $0 $0

Meals $650 $250 $250 $250 $750 $450 $250 $250 $250 $250 $450 $250

Travel $2,000 $400 $400 $400 $2,000 $1,000 $500 $500 $1,700 $1,700 $500 $1,700

Other Sales and Marketing Expenses $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Total Sales and Marketing Expenses $28,893 $35,431 $63,273 $52,272 $54,786 $35,115 $33,605 $20,645 $22,377 $36,042 $34,007 $24,735

Sales and Marketing % 39.92% 32.31% 70.01% 63.73% 39.44% 30.25% 32.76% 56.45% 41.61% 44.21% 38.09% 41.40%

General and Administrative Expenses:

General and Administrative Payroll $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500 $7,500

Marketing/Promotion $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $1,000

Online Services $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300

Contributions $25 $25 $25 $25 $25 $25 $25 $25 $25 $25 $25 $25

Dues and Subscriptions $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50

Maintenance and Repairs $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150 $150

Office Supplies $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100

Postage $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Pro Forma Cash Flow

Cash Received

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Cash Sales

$28,950 $43,870 $36,150 $32,810 $55,570 $46,430 $41,030 $14,630 $21,510 $32,610 $35,710 $23,898

Cash from Receivables

$62,028 $63,476 $44,171 $65,419 $54,058 $50,353 $82,898 $69,375 $60,225 $22,289 $32,820 $49,070

Subtotal Cash from Operations

$90,978 $107,346 $80,321 $98,229 $109,628 $96,783 $123,928 $84,005 $81,735 $54,899 $68,530 $72,968

Additional Cash Received

Sales Tax, VAT, HST/GST Received

0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing

$0 $0 $0 $0 $0 $20,000 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-free)

$2,132 $6,313 $0 $0 $6,146 $0 $5,546 $0 $0 $866 $3,327 $636

New Long-term Liabilities

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received

$93,110 $113,659 $80,321 $98,229 $115,774 $116,783 $129,474 $84,005 $81,735 $55,765 $71,857 $73,604

Expenditures

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Expenditures from Operations

Cash Spending

$16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800 $16,800

Bill Payments

$37,918 $41,722 $68,146 $76,797 $69,221 $114,531 $69,206 $63,854 $25,014 $40,014 $62,473 $59,071

Subtotal Spent on Operations

$54,718 $58,522 $84,946 $93,597 $86,021 $131,331 $86,006 $80,654 $41,814 $56,814 $79,273 $75,871

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Principal Repayment of Current Borrowing

$0 $0 $0 $0 $0 $0 $0 $40,000 $0 $0 $0 $0 $0

Other Liabilities Principal Repayment

$0 $0 $20,000 $0 $0 $0 $0 $4,453 $10,000 $0 $0 $0 $0

Long-term Liabilities Principal Repayment

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Other Current Assets

$0 $0 $0 $0 $0

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!