Drapery Fabricator Business Plan

Cutting Edge Drapery is an established decorators’ workroom producing draperies, slip covers, and other textile products based on interior designers’ designs and concepts. The company has recently expanded its facilities to reach a wider client base and is dedicated to delivering high-quality workmanship according to the designer’s vision. This business plan aims to identify target clients, outline the marketing strategy, and improve internal procedures to increase profitability.

The Company

Cutting Edge Drapery, located in Loudon, New Hampshire, specializes in soft window treatments. The target market for soft window treatments in the communities the company serves is valued at approximately $2.7 million. The market share is directly influenced by disposable income and real estate valuations.

The company, operating for nearly 25 years as a sole proprietorship, recently moved from the owner’s home to rented space in Loudon due to increased business volume. This larger space allows for a stronger focus on draperies and window treatments. Employing seven full-time staff in a 2,200 square foot office, the company’s administrative processes are being enhanced by a new assistant and outside accountant.

The Products

Cutting Edge Drapery provides sewing services for high-quality soft window treatments such as draperies, swags, jabots, and slip covers. Although the company is considered a products-based business, clients supply the fabric for each custom unit, minimizing sourcing costs as fabric is the most expensive input in the production process.

The Market

The 17 communities in proximity to Cutting Edge Drapery have an estimated population of 277,253. This indicates a total soft window treatment market worth over $2.7 million annually. To secure a share in this market, the company primarily targets interior designers, who cater to high-income homeowners seeking unique products and exceptional customer service. Establishing a strong relationship between designers and workrooms is crucial for a company like Cutting Edge Drapery.

In the next twelve months, the company aims to market its services to the 15 targeted designer members of the American Society of Interior Designers (ASID) near its Loudon facilities, with the objective of establishing business relationships with at least three of them. This number will increase to five in the second year and seven in the third year. The company faces competition from other local workrooms, but plans to enhance its reputation through advertising in trade publications, ASID membership, and targeted marketing.

Financial Considerations

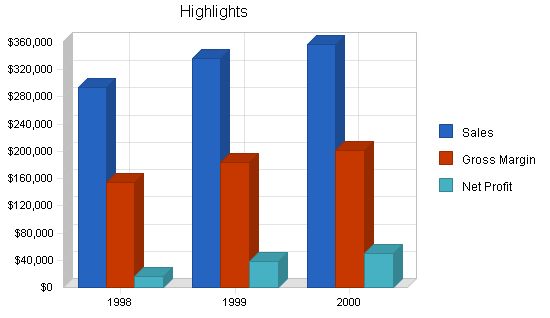

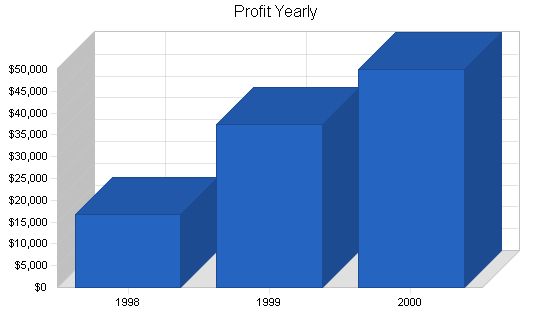

By conducting sufficient market research and implementing a tailored marketing strategy, the business anticipates consistent growth in profits. It is estimated that by the year 2000, the company will have captured an 11% market share of the local soft window treatment market.

Attaining monthly break-even is readily achievable. Current production is approximately 98 units, expected to increase to 115 by the end of 2000.

Since clients provide the fabric for soft window treatment products, the company enjoys low costs of goods sold and high gross margins. Additionally, the custom nature of the business minimizes inventory costs and accounts payable. With no debt or long-term capital assets affecting cash flow, the company can utilize its strong cash flow to expand its markets and production capacity in the near future.

1.1 Objectives

- To penetrate the interior designer-controlled share of the window treatment market. The company aims to market its services to the 15 targeted designer members of the American Society of Interior Designers (ASID) near its Loudon facilities, with the objective of establishing business relationships with at least three of them within the next twelve months. This number will increase to five in the second year and seven in the third year.

Cutting Edge Drapery is best positioned to serve the interior designer segment of the textile treatment market. The company cannot compete with mass production facilities or smaller home workrooms. Our commitment is to deliver high-quality workmanship, meet deadlines, and bring the designer’s vision to life.

The success of professional workrooms depends on several key factors, primarily reputation for interior designers. Private clients should be referred to a designer who collaborates with our company to avoid any concerns about potential savings.

Cutting Edge Drapery is a decorators’ workroom in Loudon, New Hampshire. We specialize in producing draperies, slipcovers, and other textile products based on interior designers’ concepts. Soft window treatments make up the majority of our production. The target market for these treatments in our communities is approximately $2.7 million and is influenced by disposable income and real estate value.

The company, currently registered as a sole proprietorship DBA, has considered incorporation but has not made a decision yet.

With nearly 25 years of experience, the owner of Cutting Edge Drapery initially operated from home before moving to rented space in Loudon to focus on draperies and window treatments. Our office spans 2,200 square feet and employs seven full-time staff members. Our owner is a member of the National Textile Museum and the Museum of Textile History and has applied for membership in the American Society of Interior Designers as an Industry Partner.

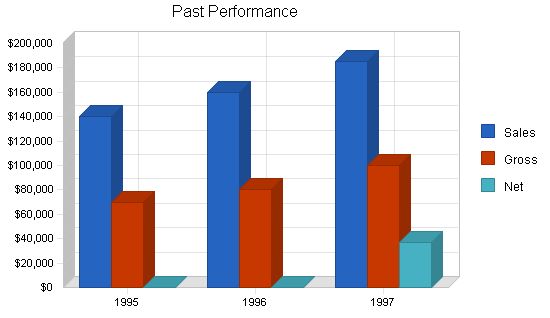

Past Performance

Sales

– 1995: $140,000

– 1996: $160,000

– 1997: $185,000

Gross Margin

– 1995: $70,000

– 1996: $80,000

– 1997: $100,000

Gross Margin %

– 1995: 50.00%

– 1996: 50.00%

– 1997: 54.05%

Operating Expenses

– 1995: $40,000

– 1996: $50,000

– 1997: $50,000

Inventory Turnover

– 1995: 0.00

– 1996: 0.00

– 1997: 0.00

Balance Sheet

Current Assets

Cash

– 1995: $0

– 1996: $0

– 1997: $2,000

Inventory

– 1995: $0

– 1996: $0

– 1997: $1,000

Other Current Assets

– 1995: $0

– 1996: $0

– 1997: $0

Total Current Assets

– 1995: $0

– 1996: $0

– 1997: $3,000

Long-term Assets

Long-term Assets

– 1995: $0

– 1996: $0

– 1997: $30,000

Accumulated Depreciation

– 1995: $0

– 1996: $0

– 1997: $0

Total Long-term Assets

– 1995: $0

– 1996: $0

– 1997: $30,000

Total Assets

– 1995: $0

– 1996: $0

– 1997: $33,000

Current Liabilities

Accounts Payable

– 1995: $0

– 1996: $0

– 1997: $0

Current Borrowing

– 1995: $0

– 1996: $0

– 1997: $0

Other Current Liabilities (interest free)

– 1995: $0

– 1996: $0

– 1997: $0

Total Current Liabilities

– 1995: $0

– 1996: $0

– 1997: $0

Long-term Liabilities

– 1995: $0

– 1996: $0

– 1997: $0

Total Liabilities

– 1995: $0

– 1996: $0

– 1997: $0

Paid-in Capital

– 1995: $0

– 1996: $0

– 1997: $0

Retained Earnings

– 1995: $0

– 1996: $0

– 1997: ($4,000)

Earnings

– 1995: $0

– 1996: $0

– 1997: $37,000

Total Capital

– 1995: $0

– 1996: $0

– 1997: $33,000

Total Capital and Liabilities

– 1995: $0

– 1996: $0

– 1997: $33,000

Other Inputs

Payment Days

– 1995: 0

– 1996: 0

– 1997: 0

Company Locations and Facilities

The company is located in Loudon, NH. The recently expanded workroom occupies 2,200 square feet, including a show window (150 sq. ft.), office and administration (700 sq. ft.), and production (1,350 sq. ft.).

Services

Cutting Edge Drapery provides sewing services in the creation of high-quality soft window treatment products, such as:

– Draperies

– Swags

– Jabots

– Balloon Shades

– Slip Covers

– Roman Shades

Although the company only provides sewing and installation services, as clients furnish their own fabric, it focuses on quality and scheduling. The company’s clients have significant buying power, as they represent the workroom’s reputation to the final consumer. Sourcing costs are minimal since fabric is not provided by the company. There are no plans for new service development in the near future.

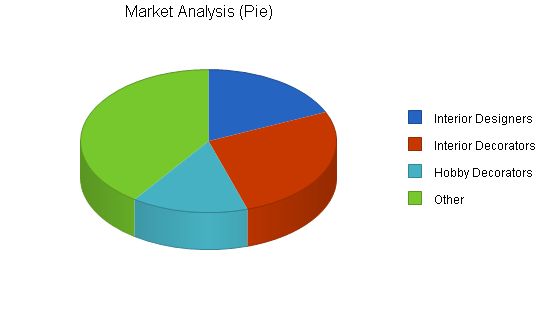

Market Analysis Summary

According to the U.S. Department of Commerce, the window treatment category reached $7.8 billion in 1996, with $2.34 billion representing soft window treatments. The population of the 17 communities near Cutting Edge Drapery is estimated at 277,253, creating a local soft window treatment market exceeding $2.7 million annually. Cutting Edge Drapery holds approximately 7.5% of this market.

Cutting Edge Drapery’s client base and volume have grown steadily without advertising or promotion, reaching nearly $200,000 annually. By increasing the company’s image through advertising and networking, the potential market will expand beyond its local boundaries. This strategy will also attract higher-tiered, less price-sensitive designers, improving margins.

Market Segmentation

The market for soft window treatments is segmented based on the buyer’s income bracket and standard of living, similar to the furniture market. The market segments, based on size of pocketbook and quality of production, include:

– Material Outlets: Low quality outlets where customers purchase drapery material and install it themselves.

Market Analysis

Potential Customers Growth 1998 1999 2000 2001 2002 CAGR

Interior Designers 2% 15 15 15 15 15 0.00%

Interior Decorators 2% 22 22 22 22 22 0.00%

Hobby Decorators 4% 12 12 12 12 12 0.00%

Other 5% 33 35 37 39 41 5.58%

Total 2.35% 82 84 86 88 90 2.35%

Target Market Segment Strategy

Cutting Edge Drapery currently serves the interior decorator market segment. Its skills and small size make it well positioned to compete in the higher-end interior designer segment. Shifting to this target market will improve profitability as it is less price sensitive and provides greater margins. Additionally, establishing a reputation among such clients will strengthen the existing word of mouth marketing strategy.

An analysis of marketing survey data indicates that the competition fails to meet the interior designers’ needs for quality, reliable delivery, and high customer service. This presents a significant opportunity for Cutting Edge Drapery, which already has the infrastructure to provide these services through its database and communication procedures.

Market Needs

The interior designer market segment requires:

1. High quality products.

2. Reliable product delivery.

3. Exceptional customer service.

Interior designers’ clients demand unique and high-quality products, requiring a workroom that can meet these standards. Excellent customer service and timely delivery are crucial to maintaining a good reputation.

Service Business Analysis

In order to develop a suitable market strategy, players in the greater Boston area were contacted. The investigation revealed that the market is competitive with unlimited competition and easy entry/exit. However, most competitors are small companies with limited geographic reach. The professional credentials and reputation of the workroom’s proprietor influence the choice of workrooms. Interior designers prefer establishing long-term relationships with their suppliers to ensure their clients’ demands are met.

Main Competitors

The top designers in the Boston area heavily rely on Finelines in Peabody, Paul Brown in Boston, and Inside Outlook in New Hampshire, all of whom advertise in trade journals. The long-term marketing strategy of Cutting Edge Drapery aims to elevate its image to the ranks of these competitors. Other contenders in Category Four directly compete with the present client base.

Strategy and Implementation Summary

Cutting Edge Drapery aims to lift its image in order to compete in the higher echelons of interior designers. The company plans to advertise in prestigious trade publications, join ASID, and market to a selected group of 15 interior designers located nearby.

Competitive Edge

Cutting Edge Drapery seeks to establish a competitive edge by providing superior customer contact and service, which other competitors often lack. The company’s high quality products and established work processes will strengthen word of mouth marketing and networking.

Marketing Strategy

Advertising in trade publications such as Design Times, Draperies & Window Coverings, and Interiors and Sources will help elevate the company’s image. Direct marketing to the selected 15 target clients who are members of ASID is also essential. Developing color literature, presenting a portfolio, and networking with important players in the design world will further promote the business.

Pricing Strategy

Workroom product pricing varies, but Cutting Edge Drapery aims to position itself slightly below the average price for item one, slightly above for item two, and 30% more expensive for item three. As a high-quality provider, the company does not strive to be the cheapest option in the market.

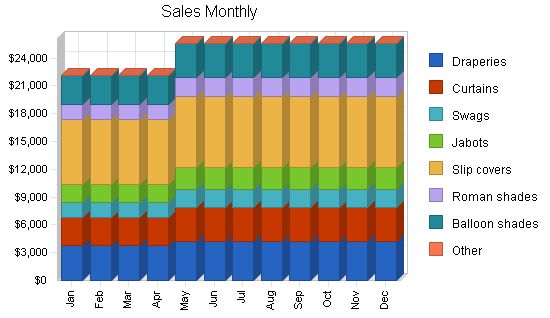

Sales Strategy

The marketing strategy discussed earlier in the business plan will generate sales. Close contact with potential clients is crucial, and prompt communication is vital to foster sales. Sales forecasts are divided into major categories, and the company aims to achieve an 11% market share by the year 2000.

By eliminating redundant words and phrases, the content is more concise and impactful, enhancing readability and clarity without losing the original meaning.

| 1998 | 1999 | 2000 | |

| Unit Sales | |||

| Draperies | 196 | 210 | 220 |

| Curtains | 272 | 280 | 290 |

| Swags | 148 | 153 | 160 |

| Jabots | 136 | 140 | 150 |

| Slip covers | 256 | 260 | 275 |

| Roman shades | 112 | 117 | 120 |

| Balloon shades | 148 | 155 | 165 |

| Other | 0 | 0 | 0 |

| Total Unit Sales | 1,268 | 1,315 | 1,380 |

| Unit Prices | 1998 | 1999 | 2000 |

| Draperies | $250.00 | $300.00 | $300.00 |

| Curtains | $150.00 | $200.00 | $200.00 |

| Swags | $150.00 | $165.00 | $165.00 |

| Jabots | $200.00 | $200.00 | $200.00 |

| Slip covers | $350.00 | $350.00 | $350.00 |

| Roman shades | $200.00 | $225.00 | $225.00 |

| Balloon shades | $285.00 | $300.00 | $325.00 |

| Other | $0.00 | $0.00 | $0.00 |

| Sales | |||

| Draperies | $49,000 | $63,000 | $66,000 |

| Curtains | $40,800 | $56,000 | $58,000 |

| Swags | $22,200 | $25,245 | $26,400 |

| Jabots | $27,200 | $28,000 | $30,000 |

| Slip covers | $89,600 | $91,000 | $96,250 |

| Roman shades | $22,400 | $26,325 | $27,000 |

| Balloon shades | $42,180 | $46,500 | $53,625 |

| Other | $0 | $0 | $0 |

| Total Sales | $293,380 | $336,070 | $357,275 |

5.4 Milestones

Cutting Edge Drapery has a big year upcoming. To achieve our sales and marketing goals, we have specific deadlines and ideas to implement:

– December 1, 1997, is the deadline mentioned by Design Times for a 15% discount on ads placed in 1998. Budgeted are 1/4 page four-color ads (price $1,425 assuming 3 insertions). Total = $4,275. After 15% discount = $3,634.

Milestones

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Design Times Ad commitment | 12/1/1997 | 12/1/1997 | $3,634 | Owner | Admin |

| Photo/logo design/ad film | 1/29/1998 | 1/29/1998 | $2,700 | Owner | Admin |

| Join ASID | 1/1/1998 | 1/1/1998 | $285 | Owner | Admin |

| Showroom | 3/1/1998 | 3/1/1998 | $2,000 | Owner | Admin |

| Networking Materials | 12/15/1997 | 12/15/1997 | $400 | Owner | Admin |

| Other | 1/1/1998 | 1/1/1998 | $0 | ABC | Department |

| Totals | $9,019 |

Management Summary

Cutting Edge Drapery currently has six employees and one principal. Outside installers are used. Four stitchers and one production supervisor are kept busy. Two stitchers work 30 hours/week and two work 40 hours/week. As business volume increases, a fifth stitcher will be hired, and longer hours will be worked by those currently working 30 hours/week. If necessary, a sixth stitcher can be added. Some less-critical work may be outsourced to subcontractors.

An administrative assistant has been hired and is being trained to handle paperwork and non-production related tasks.

A new outside accountant has been engaged to streamline the computerized accounts.

6.1 Personnel Plan

At the moment, all work is done by four production staff and one production supervisor. Additional stitchers will be hired as needed. By the end of March 1998, it is anticipated that two stitchers will work full-time. By the end of June 1998, increased volume will require hiring a new stitcher working 30 hours/week and increasing to 40 hours/week by the end of September. In 1999, Cutting Edge Drapery will have five stitchers working full-time, with some work outsourced to subcontractors. A sixth stitcher may be added in 1999 or 2000, depending on demand.

The personnel expenses include basic wages plus social security, unemployment tax, and workers’ compensation.

The owner’s income is calculated at $60,000 per year.

Personnel Plan

| 1998 | 1999 | 2000 | |

| Production Personnel | |||

| Stitcher 1 | $19,260 | $20,544 | $20,544 |

| Stitcher 2 | $17,244 | $18,394 | $18,394 |

| Stitcher 3 | $17,299 | $17,299 | $17,299 |

| Stitcher 4 | $16,358 | $16,358 | $16,358 |

| Supervisor | $24,000 | $24,000 | $24,000 |

| New stitcher | $6,134 | $12,269 | $12,269 |

| Subtotal | $100,296 | $108,864 | $108,864 |

| Sales and Marketing Personnel | |||

| Owner | $60,000 | $60,000 | $60,000 |

| Other | $0 | $0 | $0 |

| Subtotal | $60,000 | $60,000 | $60,000 |

| General and Administrative Personnel | |||

| Administrative assistant | $11,520 | $11,520 | $11,520 |

| Other | $0 | $0 | $0 |

| Subtotal | $11,520 | $11,520 | $11,520 |

| Other Personnel | |||

| Name or title | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| Total People | 6 | 0 | 0 |

| Total Payroll | $171,816 | $180,384 | $180,384 |

The business of Cutting Edge Drapery does not require substantial inventory and most sales are on a cash basis, so there won’t be initial cash-flow deficits with increased sales.

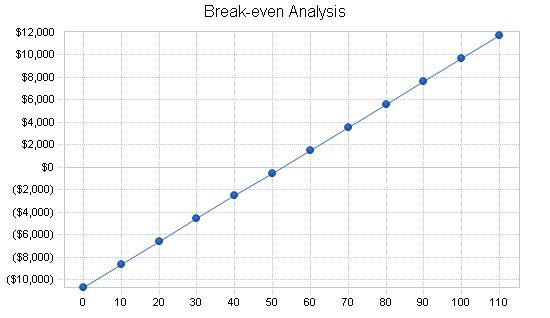

7.1 Break-even Analysis

Average per-unit revenue and variable costs are weighted averages based on sales/costs of each category of products. Total fixed costs include all other costs except production wages.

Monthly break-even is achievable.

Break-even Analysis

Monthly Units Break-even: 53

Monthly Revenue Break-even: $12,153

Assumptions:

Average Per-Unit Revenue: $231.37

Average Per-Unit Variable Cost: $27.76

Estimated Monthly Fixed Cost: $10,694

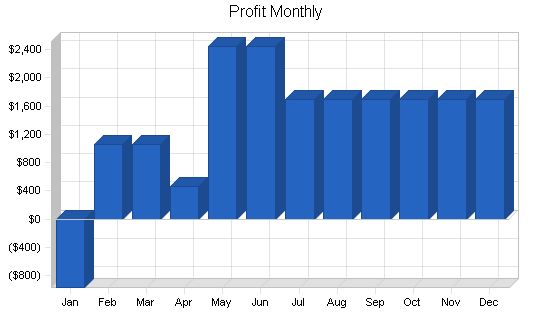

Projected Profit and Loss

Outlined below in the following table and chart are some of the intrinsic facets of the projected profit and loss for Cutting Edge Drapery.

Cost of sales reflects direct materials needed for sewing services, such as thread and sewing supplies.

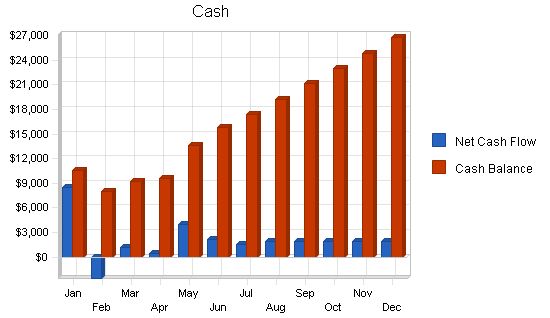

Projected Cash Flow

Cutting Edge Drapery has several advantages that contribute to significant growth in the company’s cash account. The company’s clients provide the fabric for the soft window treatment products, resulting in low cost of goods sold and high gross margin. Additionally, the custom nature of the business eliminates inventory costs and accounts payable. Moreover, the company has no debt or long term capital assets that would impact cash flow. With this strong cash flow, it is expected that the company will use it to expand its markets and production capacity in the near future.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 1998 | 1999 | 2000 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $293,380 | $336,070 | $357,275 |

| Subtotal Cash from Operations | $293,380 | $336,070 | $357,275 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $293,380 | $336,070 | $357,275 |

| Expenditures | 1998 | 1999 | 2000 |

| Expenditures from Operations | |||

| Cash Spending | $171,816 | $180,384 | $180,384 |

| Bill Payments | $96,856 | $115,518 | $124,504 |

| Subtotal Spent on Operations | $268,672 | $295,902 | $304,887 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $268,672 | $295,902 | $304,887 |

| Net Cash Flow | $24,708 | $40,168 | $52,388 |

| Cash Balance | $26,708 | $66,876 | $119,263 |

7.4 Projected Balance Sheet

The following table shows our projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| 1998 | 1999 | 2000 | |

| Assets | |||

| Current Assets | |||

| Cash | $26,708 | $66,876 | $119,263 |

| Inventory | $3,380 | $3,872 | $4,116 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $30,087 | $70,747 | $123,379 |

| Long-term Assets | |||

| Long-term Assets | $30,000 | $30,000 | $30,000 |

| Accumulated Depreciation | $2,000 | $4,000 | $6,000 |

| Total Long-term Assets | $28,000 | $26,000 | $24,000 |

| Total Assets | $58,087 | $96,747 | $147,379 |

| Liabilities and Capital | 1998 | 1999 | 2000 |

| Current Liabilities | |||

| Accounts Payable | $8,416 | $9,591 | $10,291 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $8,416 | $9,591 | $10,291 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $8,416 | $9,591 | $10,291 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | $33,000 | $49,671 | $87,156 |

| Earnings | $16,671 | $37,485 | $49,932 |

| Total Capital | $49,671 | $87,156 | $137,089 |

| Total Liabilities and Capital | $58,087 | $96,747 | $147,379 |

| Net Worth | $49,671 | $87,156 | $137,089 |

7.5 Business Ratios

The following table outlines some important ratios in the interior design/sewing industry. The final column, Industry Profile, details specific ratios based on the industry’s Standard Industry Classification (SIC) code, 7389.

| Ratio Analysis | ||||

| 1998 | 1999 | 2000 | Industry Profile | |

| Sales Growth | 58.58% | 14.55% | 6.31% | 8.20% |

| Percent of Total Assets | ||||

| Inventory | 5.82% | 4.00% | 2.79% | 3.80% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 44.20% |

| Total Current Assets | 51.80% | 73.13% | 83.72% | 74.30% |

| Long-term Assets | 48.20% | 26.87% | 16.28% | 25.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 14.49% | 9.91% | 6.98% | 49.00% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 13.80% |

| Total Liabilities | 14.49% | 9.91% | 6.98% | 62.80% |

| Net Worth | 85.51% | 90.09% | 93.02% | 37.20% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 52.52% | 54.48% | 56.47% | 0.00% |

| Selling, General & Administrative Expenses | 37.59% | 35.28% | 35.01% | 81.40% |

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | $22,135 | $22,135 | $22,135 | $22,135 | $25,605 | $25,605 | $25,605 | $25,605 | $25,605 | $25,605 | $25,605 | $25,605 | |

| Direct Cost of Sales | $2,656 | $2,656 | $2,656 | $2,656 | $3,073 | $3,073 | $3,073 | $3,073 | $3,073 | $3,073 | $3,073 | $3,073 | |

| Production Payroll | $7,238 | $7,238 | $7,238 | $8,050 | $8,050 | $8,050 | $9,072 | $9,072 | $9,072 | $9,072 | $9,072 | $9,072 | |

| Misc operating expenses | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | $316 | |

| Total Cost of Sales | $10,211 | $10,211 | $10,211 | $11,022 | $11,438 | $11,438 | $12,461 | $12,461 | $12,461 | $12,461 | $12,461 | $12,461 | |

| Gross Margin | $11,924 | $11,924 | $11,924 | $11,113 | $14,167 | $14,167 | $13,144 | $13,144 | $13,144 | $13,144 | $13,144 | $13,144 | |

| Gross Margin % | 53.87% | 53.87% | 53.87% | 50.21% | 55.33% | 55.33% | 51.34% | 51.34% | 51.34% | 51.34% | 51.34% | 51.34% | |

| Operating Expenses | |||||||||||||

| Sales and Marketing Expenses | |||||||||||||

| Sales and Marketing Payroll | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Advertising/Promotion | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Car insurance/depreciation/maint./fuel | $560 | $560 | $560 | $560 | $560 | $560 | $560 | $560 | $560 | $560 | $560 | $560 | |

| Miscellaneous | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Sales and Marketing Expenses | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | $6,560 | |

| Sales and Marketing % | 29.64% | 29.64% | 29.64% | 29.64% | 25.62% | 25.62% | 25.62% | 25.62% | 25.62% | 25.62% | 25.62% | 25.62% | |

| General and Administrative Expenses | |||||||||||||

| General and Administrative Payroll | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | $960 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $166 | $166 | $167 | $166 | $166 | $167 | $167 | $167 | $167 | $167 | $167 | $167 | |

| Accounting/consultants | $3,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Electricity | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | |

| Heat | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | |

| Postage | $42 | $42 | $42 | $42 | $42 | $42 | $42 | $42 | $42 | $42 | $40 | $40 | |

| Telephone | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Dues and Subscriptions | $90 | $90 | $90 | $90 | $90 | $90 | $90 | $90 | $90 | $90 | $90 | $90 | |

| Bank Charges | $17 | $17 | $17 | $17 | $17 | $17 | $17 | $17 | $17 | $17 | $17 | $17 | |

| Supplies/misc office expense | $84 | $84 | $84 | $84 | $84 | $84 | $84 | $84 | $84 | $84 | $80 | $80 | |

| Rent | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | $897 | |

| Payroll Taxes | 13% | $1,037 | $1,037 | $1,037 | $1,140 | $1,140 | $1,140 | $1,269 | $1,269 | $1,269 | $1,269 | $1,269 | $1,269 |

| Other General and Administrative Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total General and Administrative Expenses | $6,743 | $3,743 | $3,744 | $3,846 | $3,846 | $3,847 | $3,976 | $3,976 | $3,976 | $3,976 | $3,970 | $3,970 | |

| General and Administrative % | 30.46% | 16.91% | 16.91% | 17.37% | 15.02% | 15.02% | 15.53% | 15.53% | 15.53% | 15.53% | 15.50% | 15.50% | |

| Other Expenses: | |||||||||||||

| Other Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Consultants | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Contract/Consultants | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!