A marketing plan must be a winner, helping businesses gain market share, increase sales, and lower marketing costs. This is especially crucial for small businesses aiming to maximize ROI. Pioneer Marketing offers a range of winning marketing consulting services, including strategic planning and tactical implementation. The strategic planning process includes identifying opportunities, market segmentation, product line analysis, financial planning, and competitive analysis, culminating in a detailed project implementation plan. Once completed, the tactical process leads to the real-world execution of the plan.

Pioneer Consulting is comprised of five graduate students from the top-ranked Marshall School of Management at State University. These students have won the Andrew Stiegman Marketing Competition, which recognizes the best strategic marketing plan for a proposed small business. The target client of Pioneer Consulting is the small business that cannot afford the services of a marketing firm. Pioneer Consulting is a results-driven firm, providing a complete range of services. We evaluate and combine marketing communications tools to create meaningful, effective marketing for optimal results.

1.1 Mission

Our focus is to closely work with clients and help them succeed in setting and meeting their marketing goals. We offer total support and a commitment to communicate their ideas in a strategic, creative, and cost-effective manner.

1.2 Keys to Success

To minimize the learning curve and expenses for our clients, we have the technical expertise. We aim to be a part of our client’s business team and ensure the timely launch of each marketing program. We also generate innovative strategies that result in a high-quality and cost-effective product.

Pioneer Consulting consists of five Masters program students from the Marshall School of Management at State University.

2.1 Company Ownership

Pioneer Consulting is co-owned by Susan Noyes, Elizabeth Rayburn, Issac Harris, Al Takemoto, and Chris Pin.

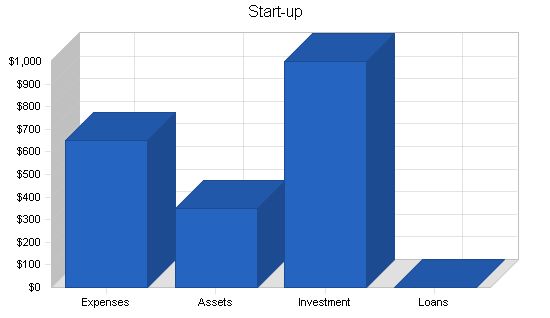

2.2 Start-up Summary

Each co-owner of Pioneer Consulting will invest $200. The start-up costs primarily cover marketing material and a company cell phone and messaging service.

Start-up Requirements:

– Legal: $100

– Stationery etc.: $150

– Brochures: $300

– Cell Phone Setup: $100

– Other: $0

– Total Start-up Expenses: $650

Start-up Assets:

– Cash Required: $350

– Other Current Assets: $0

– Long-term Assets: $0

– Total Assets: $350

Total Requirements: $1,000

Start-up Funding:

– Start-up Expenses to Fund: $650

– Start-up Assets to Fund: $350

– Total Funding Required: $1,000

Assets:

– Non-cash Assets from Start-up: $0

– Cash Requirements from Start-up: $350

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $350

– Total Assets: $350

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital:

– Planned Investment:

– Susan Noyes: $200

– Elizabeth Rayburn: $200

– Issac Harris: $200

– Al Takemoto: $200

– Chris Pin: $200

– Additional Investment Requirement: $0

– Total Planned Investment: $1,000

– Loss at Start-up (Start-up Expenses): ($650)

– Total Capital: $350

Total Capital and Liabilities: $350

Total Funding: $1,000

Services:

Pioneer Consulting will offer the following services:

– Development and preparation of strategic marketing plans and programs.

– Key market segment identification plans and programs.

– Design of overall advertising/public relations strategies.

– Industry trend analysis.

– Execution of marketing implementation plans and programs.

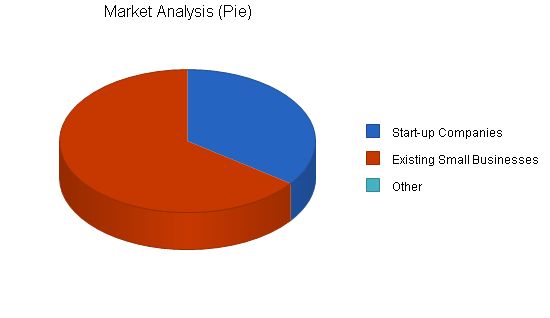

Market Analysis Summary:

Pioneer Consulting will be focusing on a very specific part of the business market:

– Small Start-up Companies.

– Existing Small Businesses.

Market Segmentation:

Pioneer Consulting will focus on two groups of businesses:

– Small Start-up Companies: These small start-up businesses can rarely afford marketing consulting services and don’t have the in-house expertise to create strategic marketing plans. The city is growing at a rate of 10% annually and the numbers of start-ups increase each year in all the city’s major industries and service areas. Pioneer Consulting believes that this is an underserved market segment and that they could provide an invaluable service to these target clients.

Market Analysis:

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Start-up Companies | 15% | 130 | 150 | 173 | 199 | 229 | 15.21% |

| Existing Small Businesses | 10% | 240 | 264 | 290 | 319 | 351 | 9.97% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 11.89% | 370 | 414 | 463 | 518 | 580 | 11.89% |

Strategy and Implementation Summary:

Pioneer Consulting will focus on small start-up companies and existing small businesses that need marketing consulting but cannot afford outsourcing the development of strategic marketing plans.

5.1 Competitive Edge:

Pioneer Consulting’s competitive advantage is twofold:

– Targeting customers that large professional marketing consulting firms don’t pursue actively, with no direct competition for Pioneer Consulting’s services.

– Offering a broad range of services to its customers.

To develop effective business strategies, perform a SWOT analysis of your business using our free guide and template. Learn how to perform a SWOT analysis.

5.2 Sales Strategy:

Pioneer Consulting’s sales strategy will be based on systematic person-to-person contacts with new and growing businesses. A list of potential customers has already been compiled and will serve as a launching pad for marketing the group’s services.

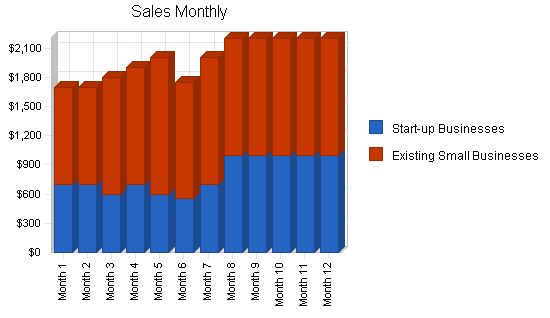

5.2.1 Sales Forecast:

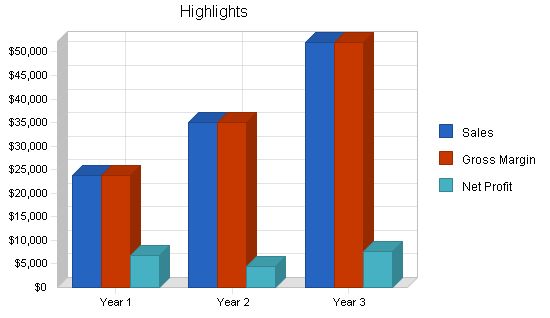

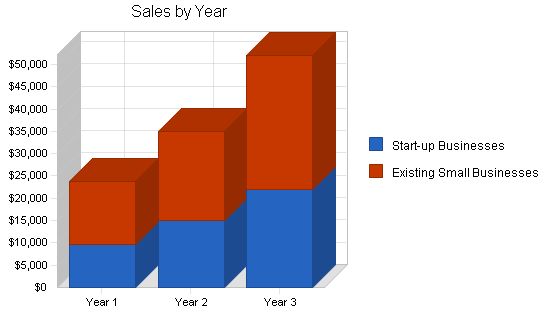

The following table and chart highlight forecasted sales for three years.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| $9,550 | $15,000 | $22,000 | |

| $14,300 | $20,000 | $30,000 | |

| $23,850 | $35,000 | $52,000 | |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| $0 | $0 | $0 | |

| $0 | $0 | $0 | |

| $0 | $0 | $0 | |

Management Summary:

Pioneer Consulting will be managed by project managers Susan Noyes and Issac Harris.

Susan Noyes was co-leader of the marketing team that won this year’s Andrew Stiegman Marketing Competition. She has worked for MediaHound as a marketing assistant for the past three years and has participated in successful direct-mail campaigns.

Issac Harris worked for Dynamic Marketing Research as a research assistant for two years before entering Marshall School of Management’s Marketing Graduate Program. He was also co-leader of the marketing team that won this year’s Andrew Stiegman Marketing Competition.

The remaining team members are:

– Elizabeth Rayburn, who has three years of experience in media marketing as a former employee of Premier Marketing Consultants.

– Al Takemoto, whose skill focus is Internet and e-mail marketing. He has worked as a staff member of Gold Online Marketing Services for three years prior to his admission to Marshall School of Management.

– Chris Pin, a marketing assistant at Quick Silver Advertising for the past two years. His area of expertise is print advertising.

Personnel Plan:

Pioneer Consulting will have a staff of five, the co-founders. They will pay themselves a moderate straight salary beginning with the fourth month after start-up.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| $2,400 | $4,800 | $7,000 | |

| $2,400 | $4,800 | $7,000 | |

| $2,400 | $4,800 | $7,000 | |

| $2,400 | $4,800 | $7,000 | |

| $2,400 | $4,800 | $7,000 | |

| 0 | 0 | 0 | |

| $12,000 | $24,000 | $35,000 | |

The following sections will present the break-even analysis, profit and loss, cash flow, and balance sheet.

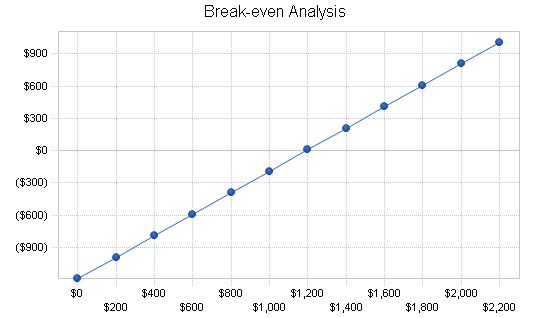

Break-even Analysis:

The Break-even Analysis is presented in the following table and chart.

Break-even Analysis:

Monthly Revenue Break-even: $1,190

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $1,190

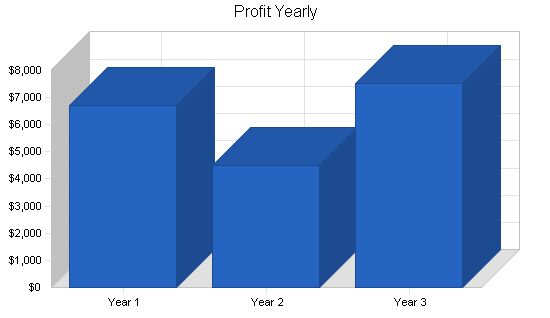

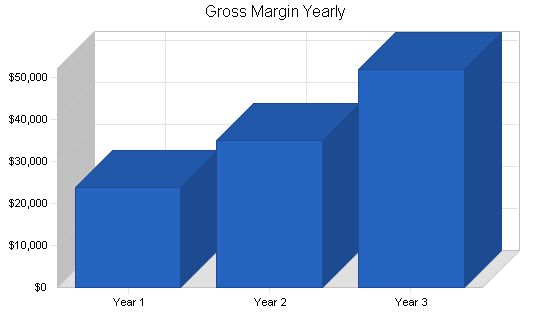

Projected Profit and Loss:

The table below shows the projected profit and loss for three years.

Pro Forma Profit and Loss

[table]

[colspan="4"] Pro Forma Profit and Loss

[] [align="right"] Year 1 [align="right"] Year 2 [align="right"] Year 3

[Sales] [align="right"] $23,850 [align="right"] $35,000 [align="right"] $52,000

[Direct Cost of Sales] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Other Production Expenses] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Total Cost of Sales] [align="right"] $0 [align="right"] $0 [align="right"] $0

[ ] [ ] [ ] [ ]

[Gross Margin] [align="right"] $23,850 [align="right"] $35,000 [align="right"] $52,000

[Gross Margin %] [align="right"] 100.00% [align="right"] 100.00% [align="right"] 100.00%

[ ] [ ] [ ] [ ]

[ ] [ ] [ ] [ ]

[Expenses] [ ] [ ] [ ]

[Payroll] [align="right"] $12,000 [align="right"] $24,000 [align="right"] $35,000

[Sales and Marketing and Other Expenses] [align="right"] $0 [align="right"] $500 [align="right"] $500

[Depreciation] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Cell Phone] [align="right"] $480 [align="right"] $480 [align="right"] $480

[Utilities] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Insurance] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Rent] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Payroll Taxes] [align="right"] $1,800 [align="right"] $3,600 [align="right"] $5,250

[Other] [align="right"] $0 [align="right"] $0 [align="right"] $0

[ ] [ ] [ ] [ ]

[Total Operating Expenses] [align="right"] $14,280 [align="right"] $28,580 [align="right"] $41,230

[ ] [ ] [ ] [ ]

[Profit Before Interest and Taxes] [align="right"] $9,570 [align="right"] $6,420 [align="right"] $10,770

[EBITDA] [align="right"] $9,570 [align="right"] $6,420 [align="right"] $10,770

[Interest Expense] [align="right"] $0 [align="right"] $0 [align="right"] $0

[Taxes Incurred] [align="right"] $2,871 [align="right"] $1,926 [align="right"] $3,231

[ ] [ ] [ ] [ ]

[Net Profit] [align="right"] $6,699 [align="right"] $4,494 [align="right"] $7,539

[Net Profit/Sales] [align="right"] 28.09% [align="right"] 12.84% [align="right"] 14.50%

[/table]

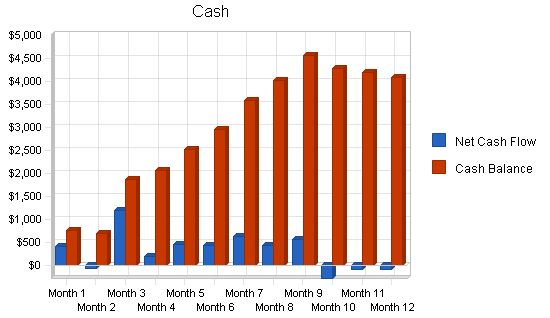

7.3 Projected Cash Flow

The following chart and table indicates projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $5,963 | $8,750 | $13,000 |

| Cash from Receivables | $14,643 | $24,733 | $36,687 |

| Subtotal Cash from Operations | $20,605 | $33,483 | $49,687 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $20,605 | $33,483 | $49,687 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $12,000 | $24,000 | $35,000 |

| Bill Payments | $4,863 | $6,259 | $9,218 |

| Subtotal Spent on Operations | $16,863 | $30,259 | $44,218 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $16,863 | $30,259 | $44,218 |

| Net Cash Flow | $3,742 | $3,224 | $5,469 |

| Cash Balance | $4,092 | $7,316 | $12,785 |

Projected Balance Sheet

| Projected Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $4,092 | $7,316 | $12,785 |

| Accounts Receivable | $3,245 | $4,762 | $7,075 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $7,337 | $12,078 | $19,860 |

| Long-term Assets | |||

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $7,337 | $12,078 | $19,860 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $288 | $535 | $778 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | |||

| Subtotal Current Liabilities | $288 | $535 | $778 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $288 | $535 | $778 |

| Paid-in Capital | $1,000 | $1,000 | $1,000 |

| Retained Earnings | ($650) | $6,049 | $10,543 |

| Earnings | $6,699 | $4,494 | $7,539 |

| Total Capital | $7,049 | $11,543 | $19,082 |

| Total Liabilities and Capital | $7,337 | $12,078 | $19,860 |

| Net Worth | $7,049 | $11,543 | $19,082 |

| Business Ratios | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 46.75% | 48.57% | 8.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 44.23% | 39.43% | 35.63% | 36.10% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 42.70% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 80.20% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 19.80% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3.93% | 4.43% | 3.92% | 46.70% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 9.80% |

| Total Liabilities | 3.93% | 4.43% | 3.92% | 56.50% |

| Net Worth | 96.07% | 95.57% | 96.08% | 43.50% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 71.91% | 87.16% | 85.50% | 79.10% |

| Advertising Expenses | 0.00% | 1.43% | 0.96% | 4.20% |

| Profit Before Interest and Taxes | 40.13% | 18.34% | 20.71% | 1.60% |

| Main Ratios | ||||

| Current | 25.47 | 22.59 | 25.54 | 1.70 |

| Quick | 25.47 | 22.59 | 25.54 | 1.43 |

| Total Debt to Total Assets | 3.93% | 4.43% | 3.92% | 56.50% |

| Pre-tax Return on Net Worth | 135.76% | 55.62% | 56.44% | 4.60% |

| Pre-tax Return on Assets | 130.43% | 53.16% | 54.23% | 10.50% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 28.09% | 12.84% | 14.50% | n.a |

| Return on Equity | 95.03% | 38.93% | 39.51% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 5.51 | 5.51 | 5.51 | n.a |

| Collection Days | 57 | 56 | 55 | n.a |

| Accounts Payable Turnover | 17.88 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 23 | 25 | n.a |

| Total Asset Turnover | 3.25 | 2.90 | 2.62 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.04 | 0.05 | 0.04 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $7,049 | $11,543 | $19,082 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Assets to Sales | 0.31 | 0 | ||

| General Assumptions | |||||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

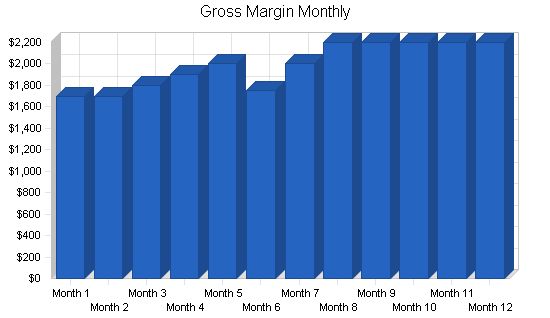

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $1,700 | $1,700 | $1,800 | $1,900 | $2,000 | $1,750 | $2,000 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | |

| Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Gross Margin | $1,700 | $1,700 | $1,800 | $1,900 | $2,000 | $1,750 | $2,000 | $2,200 | $2,200 | $2,200 | $2,200 | $2,200 | |

| Gross Margin % | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | |

| Expenses | |||||||||||||

| Payroll | $0 | $0 | $0 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $2,000 | $2,000 | $2,000 | |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Cell Phone | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | $40 | |

| Utilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Insurance | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Rent | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Payroll Taxes | 15% | $0 | $0 | $0 | $150 | $150 | $150 | $150 | $150 | $150 | $300 | $300 | $300 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $40 | $40 | $40 | $1,190 | $1,190 | $1,190 | $1,190 | $1,190 | $1,190 | $2,340 | $2,340 | $2,340 | |

| Profit Before Interest and Taxes | $1,660 | $1,660 | $1,760 | $710 | $810 | $560 | $810 | $1,010 | $1,010 | ($140) | ($140) | ($140) | |

| EBITDA | $1,660 | $1,660 | $1,760 | $710 | $810 | $560 | $810 | $1,010 | $1,010 | ($140) | ($140) | ($140) | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $498 | $498 | $528 | $213 | $243 | $168 | |||||||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $350 | $757 | $687 | $1,873 | $2,063 | $2,511 | $2,946 | $3,579 | $4,013 | $4,575 | $4,288 | $4,190 | $4,092 |

| Accounts Receivable | $0 | $1,275 | $2,508 | $2,583 | $2,730 | $2,878 | $2,763 | $2,769 | $3,100 | $3,245 | $3,245 | $3,245 | $3,245 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $350 | $2,032 | $3,194 | $4,455 | $4,793 | $5,389 | $5,708 | $6,348 | $7,113 | $7,820 | $7,533 | $7,435 | $7,337 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $350 | $2,032 | $3,194 | $4,455 | $4,793 | $5,389 | $5,708 | $6,348 | $7,113 | $7,820 | $7,533 | $7,435 | $7,337 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $520 | $520 | $549 | $390 | $419 | $346 | $419 | $477 | $477 | $288 | $288 | $288 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $520 | $520 | $549 | $390 | $419 | $346 | $419 | $477 | $477 | $288 | $288 | $288 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $520 | $520 | $549 | $390 | $419 | $346 | $419 | $477 | $477 | $288 | $288 | $288 |

| Paid-in Capital | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Retained Earnings | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) | ($650) |

| Earnings | $0 | $1,162 | $2,324 | $3,556 | $4,053 | $4,620 | $5,012 | $5,579 | $6,286 | $6,993 | $6,895 | $6,797 | $6,699 |

| Total Capital | $350 | $1,512 | $2,674 | $3,906 | $4,403 | $4,970 | $5,362 | $5,929 | $6,636 | $7,343 | $7,245 | $7,147 | $7,049 |

| Total Liabilities and Capital | $350 | $2,032 | $3,194 | $4,455 | $4,793 | $5,389 | $5,708 | $6,348 | $7,113 | $7,820 | $7,533 | $7,435 | $7,337 |

| Net Worth | $350 | $1,512 | $2,674 | $3,906 | $4,403 | $4,970 | $5,362 | $5,929 | $6,636 | $7,343 | $7,245 | $7,147 | $7,049 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!