Arz al-Lubnan Hookah Bar is a new concept that caters to Middle Eastern and 22+ customers, offering an adult alternative to college-dominated hookah bars. The first bar will be in Trendytown, managed by founders Sayed and Yasmine Batroun. Revenue will come from flavored tobaccos, non-alcoholic drinks, and appetizers. Angel investor funding is sought for the launch.

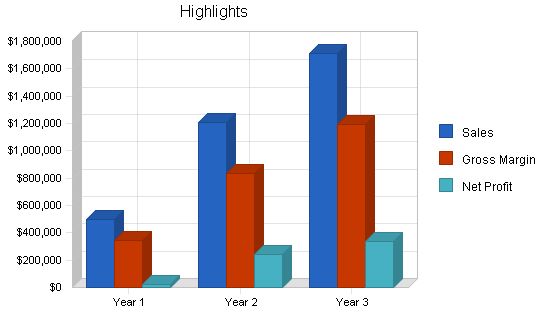

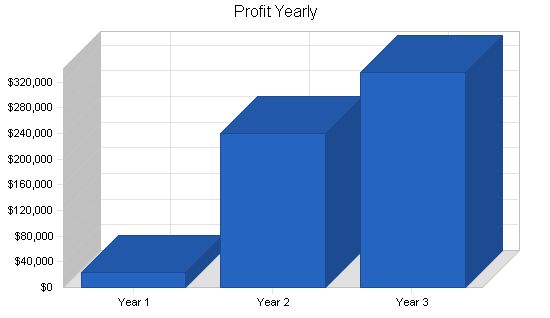

The business expects profitability in the first year, with strong sales. Sales will triple by the third year. Net profit will be high due to the product margins. Investors can exit through franchise sale to expanding bar chains.

Objectives:

– Establish a community of hookah smokers who contribute programming, events, and culture ideas resulting in 50 events or programs held in its third year.

– Maintain a Facebook Fan page of 5,000 individuals by the end of its third year.

– Become profitable in its second year through the sale of tobacco, food, and drinks.

– Establish a franchisable model for hookah bars and initiate fundraising and planning for franchising by its fifth year.

Mission:

Arz al-Lubnan Hookah Bar aims to provide a comfortable and stimulating environment where hookah enthusiasts can come together. Drawing on Middle Eastern and local culture.

Keys to Success:

– Create a comfortable environment.

– Provide high-quality tobacco, food, drinks, and hookah equipment.

– Establish a loyal core following.

– Expand the market of hookah smokers in the Trendytown area.

– Energize the customer base to generate their own culture and events.

Arz al-Lubnan Hookah Bar is a hookah lounge that emphasizes the community aspect. The business will launch its first location in Trendytown and aims to create a scalable model for franchising. Revenue will be generated through the sale of tobacco, drinks, and food. The target customers include those of Middle Eastern descent, those interested in Middle Eastern and hookah culture, and young urbanites seeking a community-oriented experience.

Company Ownership:

Arz al-Lubnan Hookah Bar is owned by Sayed and Yasmine Batroun, Lebanese-American residents of Trendytown. Sayed currently owns 51% of stock and Yasmine owns 49%. 40% of shares will be provided to investors in the initial round of funding, diluting the founders’ shares to 60% between them.

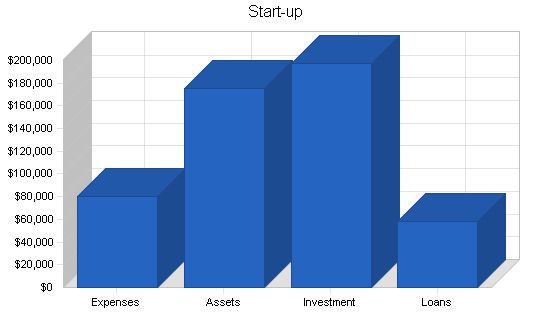

Start-up Summary:

Start-up expenses include legal consultation and permit fees, stationery, insurance, rent, marketing, and the website. Current and long-term assets include furniture, tables, kitchen supplies, silverware, plates, glassware, hookahs, improvements to the space, lighting fixtures, sound system, POS sales system, wireless devices, kitchen equipment, and office equipment.

Start-up Requirements

– Legal Help and Permits: $5,000

– Stationery etc.: $2,000

– Insurance: $2,000

– Rent: $6,000

– Start-up Marketing: $15,000

– Website: $50,000

– Total Start-up Expenses: $80,000

Start-up Assets

– Cash Required: $40,000

– Other Current Assets: $40,000

– Long-term Assets: $95,000

– Total Assets: $175,000

Total Requirements: $255,000

Products and Services

Arz al-Lubnan Hookah Bar specializes in non-alcoholic, organic drinks, and healthy appetizers and snacks of both Middle Eastern and American origin. The menu includes:

– Assortment of organic teas

– Assortment of organic coffees

– Fruit juices and juice blends

– "Mocktails" featuring fruit juices and fresh fruit

– Salads

– Crudite and dips

– Pita or pita chips and hummus/other dips

– Falafel

– Spinach fatayer

– Onion rings

– Fried fava beans

Prices for drinks range from $3 to $12. Prices for appetizers range from $5 to $8 for single servings and $12 to $25 for group dishes (serving 4-6 people).

Flavored tobacco for hookah pipes will be sold for $15 for the first round and $12 for subsequent rounds. Flavors include:

– Cherry

– Strawberry

– Blackberry

– Mixed Fruit

– Apple

– Licorice

– Candy

– Jasmine

– Banana

– Rose

– Grape

– Lebanese Blend

– Pistachio

– Lemon

– Cola

– Mint

– Orange

– Peach

– Vanilla

– Mango

The facility includes a stage area for performances, talks, and films organized by customer groups who book the space free of charge for acceptable events.

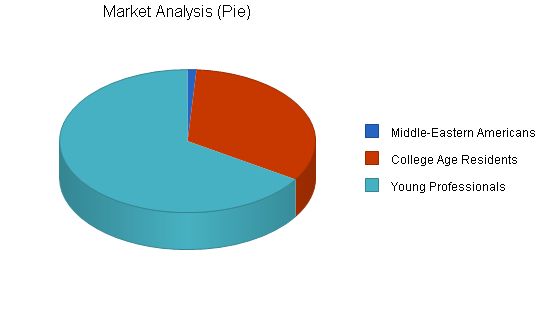

Market Analysis Summary

The market for hookah bars in the United States has grown significantly. As of October 2008, there were at least 470 hookah bars in the U.S., with an average of five new hookah bars opening every month. It is estimated that between 2-5 million hookah smokers live in the United States. Approximately 10% of these smokers are of Middle Eastern origin, while the remaining groups are of American origin but have embraced hookah culture.

In Trendytown, Arz al-Lubnan Hookah Bar will focus on locals of Middle Eastern origin and young professionals.

Market Segmentation

Arz al-Lubnan Hookah Bar targets the following customer segments:

– Middle Eastern Americans: Area residents with Middle Eastern origins who appreciate hookah bars for their cultural connections and non-alcoholic options.

– College Age Residents: College students who seek alternative experiences and are attracted to the exotic ambiance and group dynamics of hookah bars.

– Young Professionals: Professionals aged 22-35 who are looking for social spaces to gather with friends and share new experiences. They prefer hookah bars with fewer college-age customers.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Middle-Eastern Americans | 3% | 500 | 515 | 530 | 546 | 562 | 2.97% |

| College Age Residents | 3% | 15,000 | 15,450 | 15,914 | 16,391 | 16,883 | 3.00% |

| Young Professionals | 3% | 30,000 | 30,900 | 31,827 | 32,782 | 33,765 | 3.00% |

| Total | 3.00% | 45,500 | 46,865 | 48,271 | 49,719 | 51,210 | 3.00% |

Target Market Segment Strategy

Arz al-Lubnan Hookah Bar will target Middle Eastern Americans and young professionals, not college-age residents. By targeting these market segments, Arz al-Lubnan Hookah Bar aims to establish credibility and authenticity with Middle Eastern devotees. These devoted customers can then bring their non-Middle Eastern friends to the bar, further expanding its customer base. This strategy will prove Arz al-Lubnan Hookah Bar as a franchisable model for American consumers. The bar will be positioned as an alternative to traditional bars for young professionals, offering a fusion of American and Middle Eastern cultural aspects rather than a complete immersion in Middle Eastern culture.

These markets exist throughout the United States, and the Trendytown location will serve as a proving ground for the Arz al-Lubnan Hookah Bar model.

Service Business Analysis

Over 470 hookah bars exist in the United States, with some concentration in cities. From 2000 to 2004, 200-300 new hookah bars opened for business. As long as 80% of sales are derived from tobacco, smoking within hookah establishments is allowed by law.

The hookah bar industry is highly fragmented, with most bars being independent establishments. A small percentage of hookah bars open multiple locations. There are currently no national hookah bar franchises.

Indirect competitors to hookah bars are coffee shops, bars that serve liquor, and cigar stores/tobacconists.

Typically, hookah bars sell tobacco and provide pipes to customers. Tobacco is sold in rounds which serve groups of four to six people for about an hour. Food and drinks are served via waiter or bar service while customers sit in groups and smoke. While some people attend hookah bars alone, customers typically attend with groups and sit at round tables.

Competition and Buying Patterns

Hookah bar customers judge establishments based on location, variety of flavors served, atmosphere, and additional food and drink options.

Specific competitors for Arz al-Lubnan Hookah Bar include Ali Baba Hookah Bar, Babylon Hookah Lounge, Desert Cafe, and Zee’s Smoking Corner.

– Ali Baba Hookah Bar: With DJs and dance parties on weekends, Ali Baba’s serves a younger crowd who enjoy meeting others.

– Babylon Hookah Lounge: Also has DJs and tends to attract a young consumer base. Older customers complain about the loud atmosphere, similar to a rave concert.

– Desert Cafe: Loved by regulars for its owner and atmosphere, Desert Cafe has plasma TVs, outdoor seating in summer, and atmospheric lighting. The location is criticized for low-quality tobacco and poor upkeep of hookahs.

– Zee’s Smoking Corner: With an extensive list of flavors, Zee’s targets college-age residents but may drive away other customers with its loud music and party atmosphere.

Web Plan Summary

The website for Arz al-Lubnan Hookah Bar will present information about the bar’s products, services, location, and concept. It will also include a social community component tied to Facebook. The website will cater to casual customers interested in the bar as well as fans who become involved in creating cultural events and groups through the social portal.

Website Marketing Strategy

The website for Arz al-Lubnan Hookah Bar will be promoted through PR, direct advertising, search engine optimization, and word-of-mouth from the growing community of customers.

– PR efforts will include promotion to local area blogs and hookah bars/Middle Eastern culture blogs. The owners will also write guest posts for these blogs. PR will focus on the social media component of the website as it ties into developing programming for Arz al-Lubnan Hookah Bar.

– Direct advertising will include Google ads, Facebook ads, and targeted ads on specific local websites. $1,000 a month will be allocated for this type of advertising in the first year.

– Search engine optimization will be implemented during the initial website development and will continue with the help of an outsourced firm for $1,000 a month.

– The community of customers will generate word-of-mouth and online referrals by inviting friends to the website through Facebook or the bar’s social network component.

Development Requirements

Development of the website requires an experienced web development firm with past success in creating social networking components for businesses. The website will include basic front-end features such as an about us page, FAQs, menu, photo gallery, contact page, and location/directions page. The social portal of the site will include membership sign-up, a social calendar, event creation instructions, individual event pages, account pages for users, sharing buttons for easy distribution of event information, and automated tie-ins with the Facebook fan page.

Additionally, the developer will create a Facebook fan page and a back end for the site, which will allow management to make changes to menu offerings, approve/reject events, add/remove photos from the photo gallery, and organize them into albums.

Development of the website will take three months, with two months dedicated to producing a beta version. This version will be tested by management and revised based on feedback. Ongoing maintenance and development will be budgeted at $500/month for the first year.

Strategy and Implementation Summary

The focus for implementation will be on establishing the quality of the offering, its suitability for the target market, and the infrastructure to support a community-driven culture. The development of the Arz al-Lubnan Hookah Bar community will be crucial for the business’s growth and its potential as a franchisable model.

Competitive Edge

Arz al-Lubnan Hookah Bar’s competitive edge will be its ability to foster community through its website. The website will allow users to connect with each other and with the bar, organize group outings, propose events for the bar’s calendar, and send out event invitations. This sets it apart from other hookah bars that focus more on creating a party-like atmosphere.

Marketing Strategy

Arz al-Lubnan Hookah Bar’s marketing strategy will focus on attracting Middle Eastern American customers first, who will then bring in other young professionals as friends. Tactics include seeking mention in local area blogs, pitching the concept and opening to Middle Eastern cultural and language publications, and advertising with posters and flyers in the downtown Trendytown area. The bar’s grand opening will feature live music, free food and drink offers, and door prizes.

After the launch, promotional incentives such as group discounts, business card drawings, and incentives for organizing events via the website will be advertised. These expenses are included in the marketing budget.

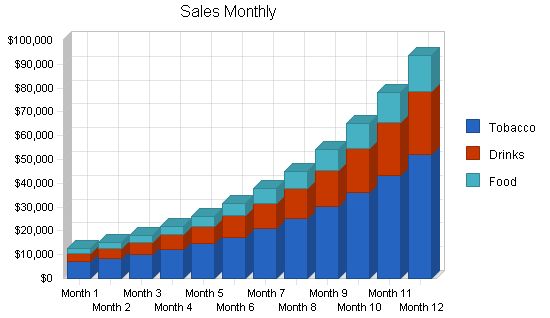

Sales Strategy

Arz al-Lubnan Hookah Bar will sell its products through attentive wait staff and bar counter staff. They will be compensated through hourly wages and tips. Wait staff will use wireless tablets to place orders, which will be sent over the bar’s wireless network to kitchen staff and bar staff for preparation.

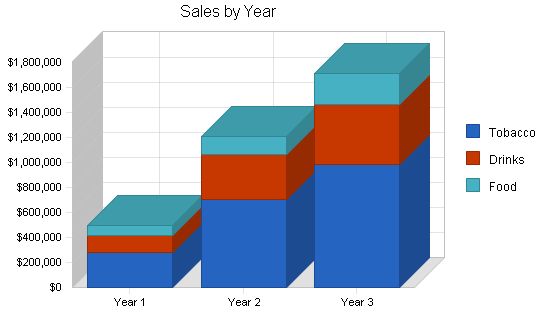

Sales will mainly come from tobacco revenues, with secondary revenue streams from food and drinks. Sharp growth is expected in the first three years as the community aspect of the bar is developed and customer-directed programming begins. It is projected that a customer will return to Arz al-Lubnan Hookah Bar an average of 15 times a year, participating in 20 rounds of tobacco in that time. This translates to 1,000 customer groups in the first year, 2,500 customer groups in the second year, and 3,500 customer groups in the third year.

Sales Forecast

Year 1 Year 2 Year 3

Unit Sales

Tobacco 19,791 50,000 70,000

Drinks 23,749 60,000 80,000

Food 15,831 30,000 50,000

Total Unit Sales 59,371 140,000 200,000

Unit Prices

Year 1 Year 2 Year 3

Tobacco $14.00 $14.00 $14.00

Drinks $6.00 $6.00 $6.00

Food $5.00 $5.00 $5.00

Sales

Tobacco $277,074 $700,000 $980,000

Drinks $142,494 $360,000 $480,000

Food $79,155 $150,000 $250,000

Total Sales $498,723 $1,210,000 $1,710,000

Direct Unit Costs

Year 1 Year 2 Year 3

Tobacco $4.20 $4.20 $4.20

Drinks $1.20 $1.20 $1.20

Food $1.50 $1.50 $1.50

Direct Cost of Sales

Tobacco $83,122 $210,000 $294,000

Drinks $28,499 $72,000 $96,000

Food $23,747 $45,000 $75,000

Subtotal Direct Cost of Sales $135,368 $327,000 $465,000

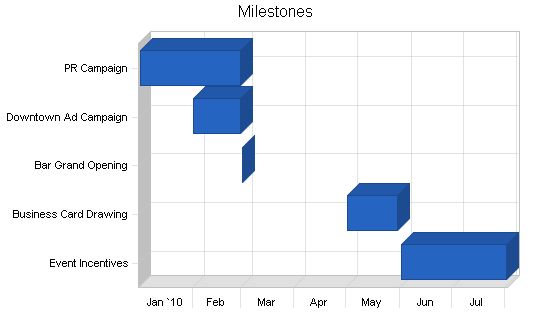

Milestones

The $15,000 in start-up marketing will be spent on the downtown ad campaign (design and production of posters and flyers, as well as purchasing ad space), PR campaign (creation and mailing of press kit), and the grand opening event (live music, door prizes, decorations, free food and drink offers).

After the launch, the business will hold a series of promotions – first the business card drawing and then event incentives – to initiate programming at Arz al-Lubnan Hookah Bar.

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| PR Campaign | 1/1/2010 | 2/28/2010 | $1,000 | YB | Marketing |

| Downtown Ad Campaign | 2/1/2010 | 2/28/2010 | $5,000 | YB | Marketing |

| Bar Grand Opening | 3/1/2010 | 3/1/2010 | $9,000 | SB | Operations |

| Business Card Drawing | 5/1/2010 | 5/30/2010 | $5,000 | YB | Marketing |

| Event Incentives | 6/1/2010 | 8/1/2010 | $5,000 | WG | Marketing |

| Totals | $25,000 | ||||

Management Summary

Arz al-Lubnan Hookah Bar is managed by Sayed and Yasmine Batroun, a Lebanese-American husband and wife team who developed the concept after working in hookah lounges overseas.

Sayed Batroun will handle store operations, train staff, and manage procurement and inventory. With ten years of culinary experience, he will also serve as the head cook during initial operations.

Yasmine Batroun, with an MBA and corporate experience as a marketing associate for a Fortune 500 business, will manage marketing, business development, and finance. She will oversee accounting and bookkeeping and provide general management support, including events management.

In the second year of operation, a general manager will be hired to supervise staff, training, procurement, and inventory management. Sayed Batroun will focus on strategic responsibilities and continue as the head cook.

Additional staff will include kitchen and wait staff.

Personnel Plan

Initially, the staff will consist of two bartenders, two wait staff, and one kitchen staff. As the business grows, it will expand to four bartenders, six wait staff, and three kitchen staff. Bartenders and wait staff earn lower wages as they receive significant tips. These assumptions are based on the bar being open for 80 hours per week.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Sayed Batroun | $36,000 | $36,000 | $36,000 |

| Yamine Batroun | $36,000 | $36,000 | $36,000 |

| Bar Staff | $48,000 | $75,000 | $110,000 |

| Wait Staff | $33,600 | $70,000 | $120,000 |

| Kitchen Staff | $30,000 | $70,000 | $120,000 |

| General Manager | $0 | $50,000 | $60,000 |

| Total People | 7 | 11 | 15 |

| Total Payroll | $183,600 | $337,000 | $482,000 |

The business is expected to experience significant growth in its first three years as it caters to the market demand for a different type of hookah bar targeted at young adults. Expansion to a second location is planned for the fourth year and will be funded by the business’s cash reserves.

Start-up Funding

While the owners will make substantial investments in the company, most of the start-up funding will come from outside investors, with an additional long-term loan secured against the bar’s assets. The remaining funding will be obtained through credit card debt.

Investors will receive 40% of shares in exchange for their investment, considering the partners’ contributions of sweat equity, financial equity, and their expertise as Lebanese-Americans.

| Start-up Funding | |

| Start-up Expenses to Fund | $80,000 |

| Start-up Assets to Fund | $175,000 |

| Total Funding Required | $255,000 |

| Assets | |

| Non-cash Assets from Start-up | $135,000 |

| Cash Requirements from Start-up | $40,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $40,000 |

| Total Assets | $175,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $8,000 |

| Long-term Liabilities | $50,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $58,000 |

| Capital | |

| Planned Investment | |

| Sivrihisar Geobekli | $35,000 |

| Willusa Geobekli | $35,000 |

| Other Investors | $127,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $197,000 |

| Loss at Start-up (Start-up Expenses) | ($80,000) |

| Total Capital | $117,000 |

| Total Capital and Liabilities | $175,000 |

| Total Funding | $255,000 |

Important Assumptions

We assume that the popularity of hookah bars will continue to grow and that the country is ready for a national chain. We also assume that anti-smoking lobbyists and anti-Middle Eastern sentiment in the United States will not have a negative impact on the reputation and image of hookah bars.

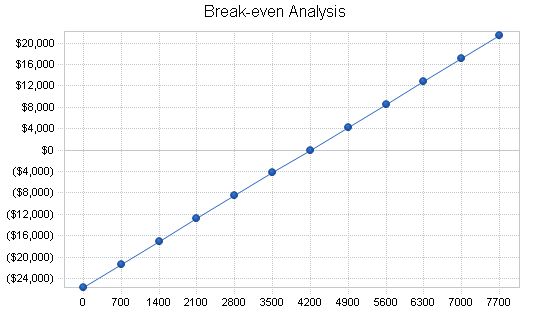

Break-even Analysis

The table below shows the projected monthly fixed operating costs. With these costs, we expect to break even in the sixth month of operation.

Break-even Analysis

| Monthly Units Break-even | 4,200 |

| Monthly Revenue Break-even | $35,279 |

| Assumptions: | |

| Average Per-Unit Revenue | $8.40 |

| Average Per-Unit Variable Cost | $2.28 |

| Estimated Monthly Fixed Cost | $25,703 |

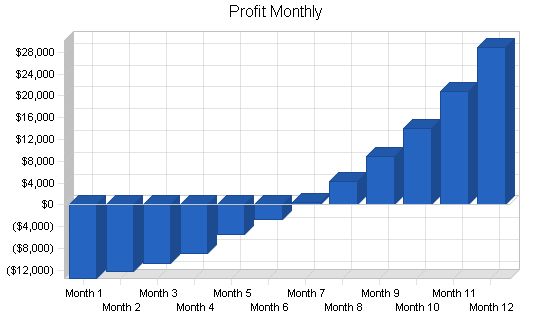

Projected Profit and Loss

The key expenses will include sales attributed to supplies and raw materials, payroll for the staff, marketing to promote the bar, and the bar’s rent and depreciation. The bar will show a profit in the first year and it will continue to grow. This is expected due to the high gross margins of selling tobacco through hookahs and the type of food and drinks sold.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $498,723 | $1,210,000 | $1,710,000 |

| Direct Cost of Sales | $135,368 | $327,000 | $465,000 |

| Other Costs of Sales | $15,914 | $48,400 | $51,300 |

| Total Cost of Sales | $151,282 | $375,400 | $516,300 |

| Gross Margin | $347,442 | $834,600 | $1,193,700 |

| Gross Margin % | 69.67% | 68.98% | 69.81% |

| Expenses | |||

| Payroll | $183,600 | $337,000 | $482,000 |

| Marketing/Promotion | $44,000 | $55,000 | $75,000 |

| Depreciation | $16,800 | $20,000 | $24,000 |

| Rent | $24,000 | $2,500 | $26,500 |

| Utilities | $3,600 | $4,000 | $4,500 |

| Insurance | $2,400 | $2,700 | $3,000 |

| Payroll Taxes | $27,540 | $50,550 | $72,300 |

| Permit Renewals | $500 | $2,000 | $800 |

| Supplies | $6,000 | $15,000 | $25,000 |

| Total Operating Expenses | $308,440 | $488,750 | $713,100 |

| Profit Before Interest and Taxes | $39,002 | $345,850 | $480,600 |

| EBITDA | $55,802 | $365,850 | $504,600 |

| Interest Expense | $5,341 | $3,200 | $1,400 |

| Taxes Incurred | $10,098 | $102,795 | $143,760 |

| Net Profit | $23,562 | $239,855 | $335,440 |

| Net Profit/Sales | 4.72% | 19.82% | 19.62% |

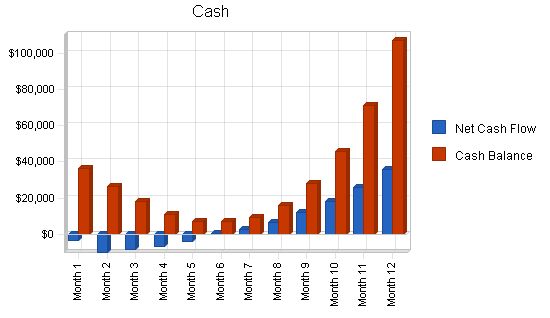

Projected Cash Flow

The cash flow table and chart show the business becoming cash flow positive within six months of operation. Cash will be retained and invested in preparation for expansion after the third year.

Long-term debt will be paid over the first three years of operation with a grace period for the first six months. Short-term borrowings will be paid within the first year of operation.

Some current assets must be replenished each year, and long-term assets must be replaced starting in the second year as equipment ages.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $498,723 | $1,210,000 | $1,710,000 |

| Subtotal Cash from Operations | $498,723 | $1,210,000 | $1,710,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $44,885 | $108,900 | $153,900 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $543,608 | $1,318,900 | $1,863,900 |

Projected Balance Sheet

The net worth of Arz al-Lubnan Hookah Bar will grow significantly due to low liabilities and high cash reserves as the business prepares for future self-financed expansion.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $107,464 | $340,213 | $689,146 |

| Other Current Assets | $42,400 | $45,400 | $48,900 |

| Total Current Assets | $149,864 | $385,613 | $738,046 |

| Long-term Assets | |||

| Long-term Assets | $95,000 | $105,000 | $115,000 |

| Accumulated Depreciation | $16,800 | $36,800 | $60,800 |

| Total Long-term Assets | $78,200 | $68,200 | $54,200 |

| Total Assets | $228,064 | $453,813 | $792,246 |

The business is compared here against Snack and Nonalcoholic Beverage Bars, industry SIC code 5812, NAICS code 722213, with over $1 million in annual revenue. Gross margin is expected to be higher than average due to the premium that can be earned from tobacco sales.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | n.a. | 142.62% | 41.32% | -3.07% |

| Percent of Total Assets | ||||

| Other Current Assets | 18.59% | 10.00% | 6.17% | 42.36% |

| Total Current Assets | 65.71% | 84.97% | 93.16% | 50.54% |

| Long-term Assets | 34.29% | 15.03% | 6.84% | 49.46% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | $46,502 | $50,395 | $71,388 | |

| Current Borrowing | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $46,502 | $50,395 | $71,388 | |

| Long-term Liabilities | $41,000 | $23,000 | $5,000 | |

| Total Liabilities | $87,502 | $73,395 | $76,388 | |

| Paid-in Capital | $197,000 | $197,000 | $197,000 | |

| Retained Earnings | ($80,000) | ($56,438) | $183,417 | |

| Earnings | $23,562 | $239,855 | $335,440 | |

| Total Capital | $140,562 | $380,417 | $715,857 | |

| Total Liabilities and Capital | $228,064 | $453,813 | $792,246 | |

| Net Worth | $140,562 | $380,417 | $715,857 | |

Valuation

40% of equity will be awarded to investors for their cash contribution, 22% to founders for their cash contribution, and the remaining 38% to owners for their sweat equity. This values the company at $317,500 initially.

Assuming valuations at either a multiple of earnings (10 is reasonable for this industry), or a multiple of sales (2 is reasonable for this industry), the valuation at the end of year 3 of the entire company is around $3.385 million (an average of the two methods of valuation). This yields a significant, 121% internal rate of return for investors. An exit event will be possible when the company raises money for franchising or sells to an existing franchisor at the point of expansion.

| Investment Analysis | ||||

| Start | Year 1 | Year 2 | Year 3 | |

| Initial Investment | ||||

| Investment | $197,000 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 |

| Ending Valuation | $0 | $0 | $0 | $2,120,400 |

| Combination as Income Stream | ($197,000) | $0 | $0 | $2,120,400 |

| Percent Equity Acquired | 62% | |||

| Net Present Value (NPV) | $1,269,171 | |||

| Internal Rate of Return (IRR) | 121% | |||

| Assumptions | ||||

| Discount Rate | 10.00% | |||

| Valuation Earnings Multiple | 10 | 10 | 10 | |

| Valuation Sales Multiple | 2 | 2 | 2 | |

| Investment (calculated) | $197,000 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | |

| Calculated Earnings-based Valuation | $240,000 | $2,400,000 | $3,350,000 | |

| Calculated Sales-based Valuation | $1,000,000 | $2,420,000 | $3,420,000 | |

| Calculated Average Valuation | $620,000 | $2,410,000 | $3,385,000 | |

Appendix

Sales Forecast

Unit Sales Tobacco 500 600 720 864 1,037 1,244 1,493 1,792 2,150 2,580 3,096 3,715

Drinks 600 720 864 1,037 1,244 1,493 1,792 2,150 2,580 3,096 3,715 4,458

Food 400 480 576 691 829 995 1,194 1,433 1,720 2,064 2,477 2,972

Total Unit Sales 1,500 1,800 2,160 2,592 3,110 3,732 4,479 5,375 6,450 7,740 9,288 11,145

Unit Prices Tobacco $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00 $14.00

Drinks $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00 $6.00

Food $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00

Sales Tobacco $7,000 $8,400 $10,080 $12,096 $14,518 $17,416 $20,902 $25,088 $30,100 $36,120 $43,344 $52,010

Drinks $3,600 $4,320 $5,184 $6,222 $7,464 $8,958 $10,752 $12,900 $15,480 $18,576 $22,290 $26,748

Food $2,000 $2,400 $2,880 $3,455 $4,145 $4,975 $5,970 $7,165 $8,600 $10,320 $12,385 $14,860

Total Sales $12,600 $15,120 $18,144 $21,773 $26,127 $31,349 $37,624 $45,153 $54,180 $65,016 $78,019 $93,618

Direct Unit Costs Tobacco 30.00% $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20 $4.20

Drinks 20.00% $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20 $1.20

Food 30.00% $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50

Direct Cost of Sales Tobacco $2,100 $2,520 $3,024 $3,629 $4,355 $5,225 $6,271 $7,526 $9,030 $10,836 $13,003 $15,603

Drinks $720 $864 $1,037 $1,244 $1,493 $1,792 $2,150 $2,580 $3,096 $3,715 $4,458 $5,350

Food $600 $720 $864 $1,037 $1,244 $1,493 $1,791 $2,150 $2,580 $3,096 $3,716 $4,458

Subtotal Direct Cost of Sales $3,420 $4,104 $4,925 $5,910 $7,092 $8,509 $10,212 $12,256 $14,706 $17,647 $21,177 $25,411

Personnel Plan

Sayed Batroun $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Yamine Batroun $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Bar Staff $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Wait Staff $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800

Kitchen Staff $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

General Manager $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total People 7 7 7 7 7 7 7 7 7 7 7 7

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $12,600 | $15,120 | $18,144 | $21,773 | $26,127 | $31,349 | $37,624 | $45,153 | $54,180 | $65,016 | $78,019 | $93,618 | |

| Subtotal Cash from Operations | $12,600 | $15,120 | $18,144 | $21,773 | $26,127 | $31,349 | $37,624 | $45,153 | $54,180 | $65,016 | $78,019 | $93,618 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 9.00% | $1,134 | $1,361 | $1,633 | $1,960 | $2,351 | $2,821 | $3,386 | $4,064 | $4,876 | $5,851 | $7,022 | $8,426 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $13,734 | $16,481 | $19,777 | $23,733 | $28,478 | $34,170 | $41,010 | $49,217 | $59,056 | $70,867 | $85,041 | $102,044 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | $15,300 | |

| Bill Payments | $314 | $9472 | $10747 | $12273 | $14047 | $14876 | $17487 | $20611 | $24354 | $28850 | $34557 | $40670 | |

| Subtotal Spent on Operations | $15,614 | $24,772 | $26,047 | $27,573 | $29,347 | $30,176 | $32,787 | $35,911 | $39,654 | $44,150 | $49,857 | $55,970 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $1,134 | $1,361 | $1,633 | $1,960 | $2,351 | $2,821 | $3,386 | $4,064 | $4,876 | $5,851 | $7,022 | $8,426 | |

| Principal Repayment of Current Borrowing | $300 | $300 | $300 | $800 | $800 | $800 | $800 | $1,000 | $1,000 | $1,000 | $900 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Purchase Other Current Assets | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $17,248 | $26,633 | $28,180 | $30,532 | $32,699 | ||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!