Motel – Hunting Lodge Business Plan

The goal of Lowland Heights Roadhouse is to create a differentiated experience for temporary lodging, restaurant, bar, and RV Park. We aim to surpass the standard fare for Dusty Corners by providing pampered luxury. Expanding our online presence and introducing the Greenhorn Valley to new visitors will help us maintain high occupancy rates and above average profits.

Location

Lowland Heights Roadhouse is located in South Central Weststate, surrounded by the Ombligo de Dios mountain range and the Lost Pony hills. It is situated on Route 173, approximately 52 miles north of Silver Gulch and 47 miles southwest of Friday Falls.

The Company

Lowland Heights Roadhouse is an established Motel and RV Park, previously known as Thirsty Creek Lodge and The Lodge at Lowland Heights. After taking possession and initial establishment, we added a restaurant to ensure a steady flow of patrons. The property had been neglected by previous owners and will be revitalized. Our future plans include a coin-operated laundry facility and a self-serve car wash.

Lowland Heights Roadhouse is a dba of Golden Cholla Enterprises LLC, owned and operated by Tory Britts and Gisli Njerdginsyn.

Our Services

Lowland Heights Roadhouse was built in 1954. Each room is equipped with two double beds or a queen bed, and some rooms have second bedrooms or kitchenettes. We offer a full-service restaurant, a bar with live entertainment, and eight RV sites with hook-ups. Additionally, we plan to add full-service coin-operated laundry facilities and 10 more motel units next spring. Our premises are suitable for hosting various events, such as wedding receptions, club meetings, Christmas parties, and family reunions.

The Market

Lowland Heights Roadhouse targets people in the Greenhorn Valley who are seeking relaxation or a getaway. Our target markets include vacationers, honeymooners, family reunions, hunters, and drop-in customers. With the abundance of outdoor activities in the Greenhorn Valley, our location is naturally appealing to visitors. We anticipate a 30% yearly increase in unit rental, as there is no laundromat or car wash within a 50-mile radius. The restaurant has seen weekly sales growth due to minimal competition in the area. We aim to attract a 10% increase in customers annually.

Financial Considerations

Golden Cholla Enterprises LLC, dba Lowland Heights Roadhouse, will be acquired through a Small Business Administration (SBA) loan with a 20% down payment. We have already contributed to the initial capital start-up expenses. Monthly fixed costs, including operating expenses and mortgage payments, are estimated in the Financial Plan chapter. Off-season revenues will offset losses during the peak season, and as we build our market position, we expect to break even during the off-season.

1.1 Objectives:

– Open the Lowland Heights Roadhouse with existing bookings and new bookings at an increased rental rate.

– Exceed customer expectations for accommodations.

– Maintain a 90% occupancy rate each month.

– Assemble an experienced and effective staff.

– Increase the number of clients by 10% annually.

– Increase exposure and market through Internet technology and direct advertising.

– Increase off-season occupancy by 30% in the first year through incentives and increased Internet exposure.

– Expand into other uses for the property during the off-season.

1.2 Keys to Success:

– Provide a first-class facility with attention to detail.

– Give each guest a sense of top priority.

– Provide quality meals.

– Retain guests to ensure repeat bookings and referrals.

1.3 Mission:

– Become the best choice in Prickly Pear County for temporary lodging.

– Expand exposure via the Internet and introduce the area to new market segments.

– Provide an environment of conveniences that surpasses the standard fare for Dusty Corners.

– Meet guests’ every need for comfort.

– Offer catering services and special amenities for additional fees.

– Provide a fine restaurant for guests to dine at during weekends.

– Expand services to the residents of Dusty Corners and neighboring cities during the off-season.

– Utilize the large dining area for formal or informal gatherings.

– Take advantage of the outdoors and access to the mountains for additional opportunities.

– Provide outstanding attention to detail, service, and good food.

– The Lowland Heights Roadhouse is located in South Central Weststate at the northern end of the Greenhorn Valley, surrounded by the Ombligo de Dios mountain range on the east and the Lost Pony Hills on the west.

– The Roadhouse is situated on Route 173, approximately 52 miles north of Silver Gulch and 47 miles southwest of Friday Falls.

2.1 Company Ownership:

– Lowland Heights Roadhouse is a dba of Golden Cholla Enterprises LLC, owned and operated by Tory Britts and assisted by her husband Gisli Njerdginsyn.

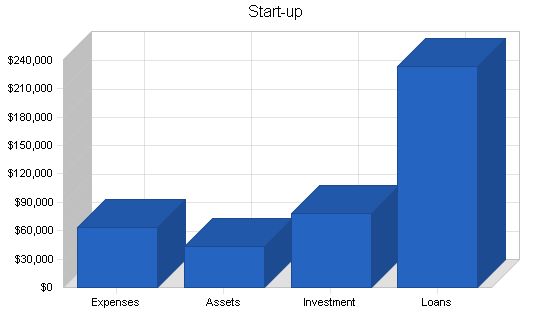

2.2 Start-up Summary:

– Tory Britts and her husband Gisli Njerdginsyn will heavily invest in the business.

– Golden Cholla Enterprises LLC dba Lowland Heights Roadhouse will be acquired through a Small Business Administration (SBA) loan, with Britts supplying a down payment on the property as part of her investment.

Start-up Funding:

– Start-up Expenses to Fund: $63,175

– Start-up Assets to Fund: $43,033

– Total Funding Required: $106,208

Assets:

– Non-cash Assets from Start-up: $25,033

– Cash Requirements from Start-up: $18,000

– Additional Cash Raised: $205,582

– Cash Balance on Starting Date: $223,582

– Total Assets: $248,616

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $232,000

– Accounts Payable (Outstanding Bills): $1,047

– Other Current Liabilities (interest-free): $744

– Total Liabilities: $233,791

Capital:

– Planned Investment:

– Tory Britts: $78,000

– Investor: $0

– Additional Investment Requirement: $0

– Total Planned Investment: $78,000

– Loss at Start-up (Start-up Expenses): ($63,175)

– Total Capital: $14,825

Total Capital and Liabilities: $248,616

Total Funding: $311,791

Requirements:

– Start-up Expenses:

– Legal: $2,300

– Stationery etc.: $75

– Brochures: $600

– Property Downpayment: $58,000

– Lodge Setup: $200

– Lease until closing of Property: $1,300

– Direct – TV: $200

– Insurance: $500

– Total Start-up Expenses: $63,175

Start-up Assets:

– Cash Required: $18,000

– Start-up Inventory: $0

– Other Current Assets: $9,827

– Long-term Assets: $15,206

– Total Assets: $43,033

Total Requirements: $106,208

Services:

Lowland Heights Roadhouse offers eight 1-bedroom units and two 2-bedroom units. Two units have a kitchenette and 2 units can be used together as a suite. Each unit is equipped with two double beds or a queen bed.

In addition, we have a full-service restaurant, a bar with a dance floor that provides live entertainment, and eight RV sites with hook-ups. Next spring we will be adding full-service coin-operated laundry facilities (washing, drying, and optional folding) along with a four-bay self-serve car wash.

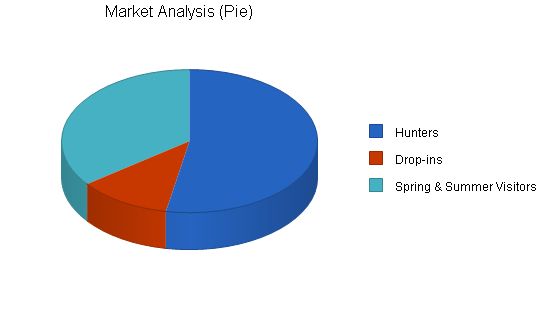

Market Analysis Summary:

The Lowland Heights Roadhouse’s target market strategy is based on becoming a destination choice for families and hunters in the greater Greenhorn Valley region who are looking for a place to relax, hunt, or recharge. We aim to attract vacationers and hunters from all over the United States. With our beautiful location and superior facilities, we anticipate a 10% increase in customers every year.

Market Segmentation:

Our target market strategy is focused on attracting vacationers and hunters who are seeking a vacation or hunting destination. We will differentiate ourselves through quality facilities, a beautiful location, and excellent customer service.

The target markets are divided into three segments: vacationers, hunters, and drop-ins. The primary marketing opportunity lies in catering to the vacation and recreational needs of these accessible market segments.

– Vacationers: During the spring and summer months, the Lowland Heights Roadhouse area offers a beautiful wilderness retreat with over 50 nearby hiking trails and outdoor recreational activities.

– Hunters: The Lowland Heights Roadhouse is located in one of the best hunting areas in the U.S.

– Drop-ins: We welcome drop-in customers who are looking for a place to stay for the night when rooms are available. Our sign is visible from Route 173, a main thoroughfare, and we expect to attract a significant number of drop-ins.

Market Analysis:

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Hunters 15% 90,000 103,500 119,025 136,879 157,411 15.00%

Drop-ins 10% 20,000 22,000 24,200 26,620 29,282 10.00%

Spring & Summer Visitors 15% 60,000 69,000 79,350 91,253 104,941 15.00%

Total 14.45% 170,000 194,500 222,575 254,752 291,634 14.45%

4.2 Service Business Analysis:

The Lowland Heights Roadhouse is a 10 room facility, restaurant, bar and RV Park with full hook-ups that provides overnight lodging, lunch, dinner, and spirits in a country setting in the Greenhorn Valley. There is only one other restaurant and motel in the area. Most people who need lodging in the area make reservations in advance to ensure room availability.

4.3 Competition and Buying Patterns:

The Lowland Heights Roadhouse offers a unique country environment that caters to an increasing group of travelers. Our Lodge creates a home-like climate, where guests become temporary members of a larger family. The Roadhouse’s homey feel allows guests to participate and share in the community, while still maintaining privacy. Meals or drinks can be shared with the innkeeper and other travelers, fostering new relationships. Alternatively, meals can be enjoyed in the privacy of the guest’s room.

A variety of settings are available at the Roadhouse, allowing individuals or small groups to find the perfect setting for their desired activity (eating, drinking, watching television, playing pool, etc.). At the Roadhouse, a guest is treated as a member of the family, not just a customer. It becomes a place to return to at the end of the day or during the next vacation.

Strategy and Implementation Summary:

The primary sales and marketing strategy for the Lowland Heights Roadhouse includes:

– Offering a motel, restaurant, and RV Park facility appealing to vacationers and hunters.

– Providing unmatched customer service to guests.

– Concentrating marketing efforts in the greater Greenhorn Valley area.

5.1 Competitive Edge:

The Lowland Heights Roadhouse sets itself apart from competitors in the following ways:

– Location: Having a motel, restaurant, bar, and RV Park all in one facility eliminates the need for guests to leave.

– Rooms: Each room is individually decorated with a tasteful and comfortable country setting.

– Customer service: Providing excellent customer service is our top priority, treating each guest like family.

Another advantage of the Lowland Heights Roadhouse is its location. Being situated in the Greenhorn Valley area, the Roadhouse is centrally located to hunting areas, a national park, and historical places.

5.2 Marketing Strategy:

Our marketing strategy focuses on becoming a destination for vacationers and hunters seeking beautiful and unique lodgings. Targeting the greater Greenhorn Valley area, we will advertise through the Yellow Pages and develop a website showcasing our Lodge, motel, restaurant, bar, and RV Park. An eye-catching sign on Route 173 will notify potential drop-ins of our presence. Word-of-mouth recommendations from past customers will play a significant role in reaching full capacity. Membership in WorldRes.com, an international Web catalog for lodging, will provide visibility to millions of potential guests.

The WorldRes partner network allows real-time reservations on popular websites like AOL, Yahoo!, and Lycos. Additionally, WorldRes has exclusive relationships with destination and special activity websites and call centers. Regional newspapers and major city magazines will be utilized for seasonal specific advertisements to reach non-computer savvy patrons.

5.3 Sales Strategy:

The Lowland Heights Roadhouse will rent rooms directly to repeat customers, as well as through traditional travel agents and online. Tory and Gisli will handle all reservations. Repeat customers will receive priority reservations during peak seasons. Listing the Roadhouse on www.worldres.com will increase exposure to international tourists.

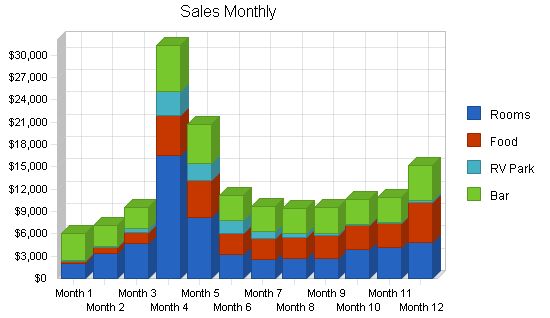

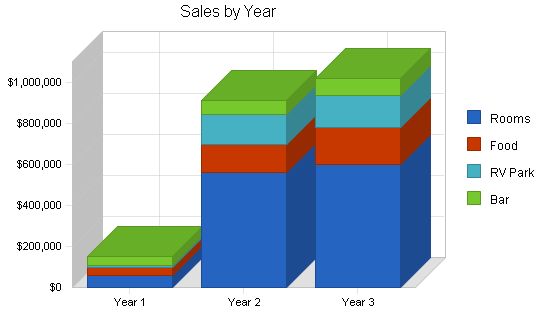

5.3.1 Sales Forecast:

The sales forecast is divided into two revenue streams: Reservations and Drop-ins. With a growth rate of 10% per year, for direct sales, the Lowland Heights Roadhouse expects an increase in occupied rooms as the year progresses. The forecast takes into consideration the changing economic environment. Growth rates for 2005 and 2006 are projected at 10% for both reservations and drop-ins.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Rooms | $58,838 | $560,000 | $600,000 |

| Food | $36,556 | $140,000 | $180,000 |

| RV Park | $10,147 | $145,000 | $160,000 |

| Bar | $45,854 | $70,000 | $82,000 |

| Total Sales | $151,394 | $915,000 | $1,022,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Rooms | $300 | $500 | $600 |

| Food | $6,865 | $28,000 | $36,000 |

| RV Park | $180 | $250 | $350 |

| Bar | $3,926 | $6,100 | $7,200 |

| Subtotal Direct Cost of Sales | $11,271 | $34,850 | $44,150 |

Contents

Web Plan Summary

The Lowland Heights Roadhouse website will focus on the features, options, and pictures of the Roadhouse, as well as the lunch/dinner menu, room rates with maps, local attractions, and online reservations.

6.1 Website Marketing Strategy

Our website marketing strategy will target Vacationers & Hunters in the Weststate area. We will promote the Roadhouse through detailed photos, room and restaurant price lists.

6.2 Development Requirements

Gisli Njerdginsyn and Website Pros, Inc. will develop and maintain the website for the Lowland Heights Roadhouse. Gisli has 25 years of experience in computer management and website development.

Management Summary

The Lowland Heights Roadhouse will operate as an owner-occupied business with a small staff consisting of a cook, maid, and maintenance man. Tory and Gisli will handle the majority of the tasks, including management, reservations, and promotion.

7.1 Personnel Plan

The personnel needed for the Lowland Heights Roadhouse are: Manager, Assistant manager, Cook (to be hired in 2005), Maintenance person (to be hired in 2005), and Cleaning person (to be hired in 2005). The Britts/Njerdginsyn family will not take a salary for the first year of the business.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $0 | $45,000 | $48,000 |

| Assistant Manager | $0 | $39,000 | $42,000 |

| Cook | $1,200 | $39,000 | $42,000 |

| Maintenance Staff | $0 | $52,000 | $55,000 |

| Cleaning Staff | $1,200 | $76,000 | $79,000 |

| Total People | 5 | 10 | 10 |

| Total Payroll | $2,400 | $251,000 | $266,000 |

7.2 Management Information Systems

Tory Britts will use a sophisticated point-of-sale Royal cash register system and a computerized reservation system to maintain financial and accounting controls. Quickbooks will be used for tracking and financial reporting.

7.3 Key Management

Tory Britts, President and principal owner of Golden Cholla Enterprises LLC, has previous experience in running a successful internet business and worked as a Behavior Management Specialist and Therapeutic Provider. Tory plans to incorporate past experiences into the operation of the Lowland Heights Roadhouse.

Financial Plan

The Lowland Heights Roadhouse expects steady growth in business, reaching over 60% capacity in 2004 and over 90% capacity in 2005. Expenses will be well managed to maintain profitability, even with a capacity rate as low as 50%.

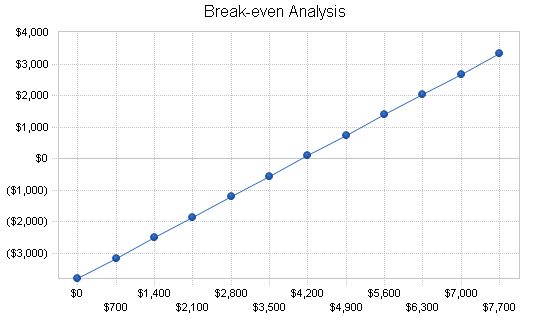

8.1 Break-even Analysis

We estimate average monthly fixed costs shown below. On-season revenues will offset off-season losses in the first year. As the Roadhouse builds its market position, we anticipate breaking even during the off-season. A rate increase may be considered in Fiscal Year 2005.

Monthly Revenue Break-even: $4,103

Assumptions:

– Average Percent Variable Cost: 7%

– Estimated Monthly Fixed Cost: $3,797

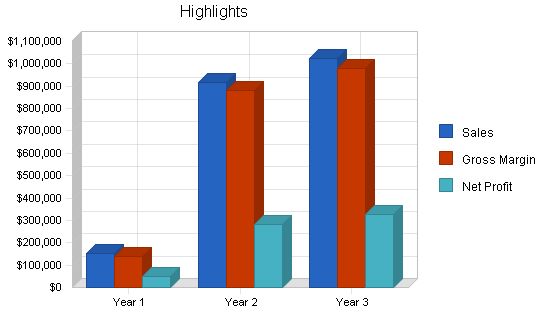

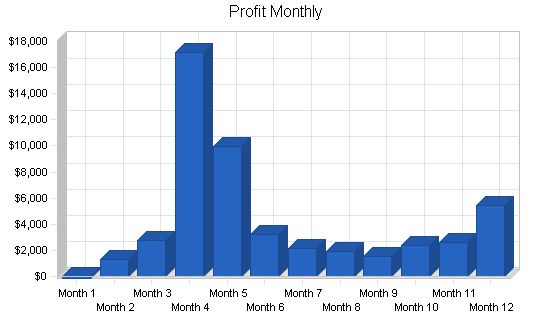

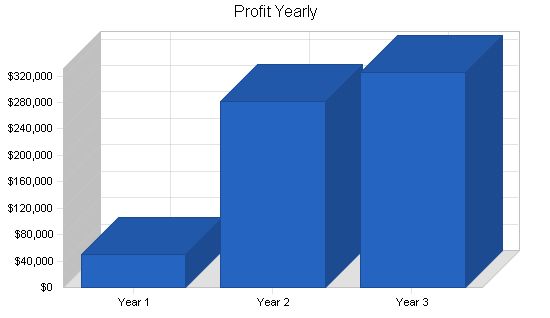

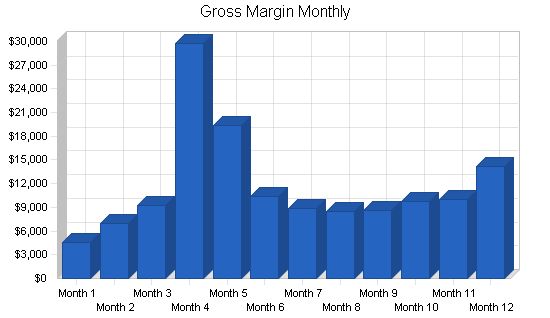

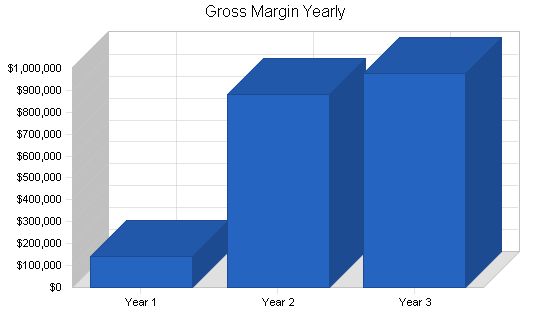

8.2 Projected Profit and Loss

Below is the projected income statement for Lowland Heights Roadhouse for the next three years. Earnings are subject to seasonal fluctuations, but the new owners will strengthen the roadhouse’s market position among local communities who patronize it during the low season, offsetting the negative impact of the season.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $151,394 | $915,000 | $1,022,000 |

| Direct Cost of Sales | $11,271 | $34,850 | $44,150 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $11,271 | $34,850 | $44,150 |

| Gross Margin | $140,123 | $880,150 | $977,850 |

| Gross Margin % | 92.56% | 96.19% | 95.68% |

| Expenses | |||

| Payroll | $2,400 | $251,000 | $266,000 |

| Sales and Marketing and Other Expenses | $1,160 | $80,000 | $100,000 |

| Depreciation | $14,280 | $14,280 | $14,280 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $3,725 | $26,000 | $26,000 |

| Insurance | $2,700 | $24,000 | $24,000 |

| Lease | $7,300 | $0 | $0 |

| Mortgage Payment | $14,000 | $62,100 | $65,700 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $45,565 | $457,380 | $495,980 |

| Profit Before Interest and Taxes | $94,558 | $422,770 | $481,870 |

| EBITDA | $108,838 | $437,050 | $496,150 |

| Interest Expense | $22,850 | $20,500 | $17,500 |

| Taxes Incurred | $21,512 | $120,681 | $139,311 |

| Net Profit | $50,195 | $281,589 | $325,059 |

| Net Profit/Sales | 33.16% | 30.77% | 31.81% |

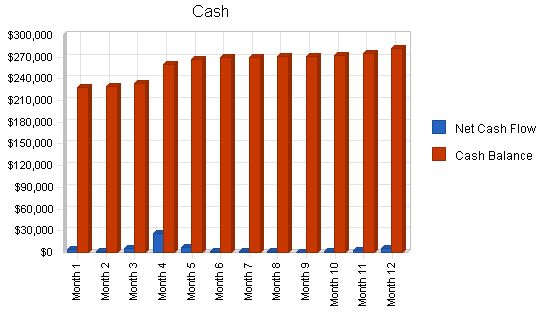

8.3 Projected Cash Flow

The Cash Flow projections are outlined below. These projections are based on our assumptions with revenue generation factors carrying the most weight. We anticipate not needing additional capital with a healthy cash flow in place.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $151,394 | $915,000 | $1,022,000 |

| Subtotal Cash from Operations | $151,394 | $915,000 | $1,022,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $151,394 | $915,000 | $1,022,000 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $2,400 | $251,000 | $266,000 |

| Bill Payments | $78,949 | $347,991 | $413,786 |

| Subtotal Spent on Operations | $81,349 | $598,991 | $679,786 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $12,000 | $30,000 | $30,000 |

| Purchase Other Current Assets | $0 | $18,000 | $21,000 |

| Purchase Long-term Assets | $0 | $20,000 | $60,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $93,349 | $666,991 | $790,786 |

| Net Cash Flow | $58,044 | $248,009 | $231,214 |

| Cash Balance | $281,627 | $529,636 | $760,850 |

Projected Balance Sheet

The following is a projected Balance Sheet showing sufficient growth and a very acceptable financial position.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $281,627 | $529,636 | $760,850 |

| Inventory | $1,199 | $3,707 | $4,697 |

| Other Current Assets | $9,827 | $27,827 | $48,827 |

| Total Current Assets | $292,653 | $561,170 | $814,373 |

| Long-term Assets | |||

| Long-term Assets | $15,206 | $35,206 | $95,206 |

| Accumulated Depreciation | $14,280 | $28,560 | $42,840 |

| Total Long-term Assets | $926 | $6,646 | $52,366 |

| Total Assets | $293,579 | $567,817 | $866,740 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $7,815 | $30,464 | $34,327 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $744 | $744 | $744 |

| Subtotal Current Liabilities | $8,559 | $31,207 | $35,071 |

| Long-term Liabilities | $220,000 | $190,000 | $160,000 |

| Total Liabilities | $228,559 | $221,207 | $195,071 |

| Paid-in Capital | $78,000 | $78,000 | $78,000 |

| Retained Earnings | ($63,175) | ($12,980) | $268,609 |

| Earnings | $50,195 | $281,589 | $325,059 |

| Total Capital | $65,020 | $346,609 | $671,668 |

| Total Liabilities and Capital | $293,579 | $567,817 | $866,740 |

| Net Worth | $65,020 | $346,609 | $671,668 |

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7011, Hotels and Motels, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 504.38% | 11.69% | 0.21% |

| Percent of Total Assets | ||||

| Inventory | 0.41% | 0.65% | 0.54% | 1.31% |

| Other Current Assets | 3.35% | 4.90% | 5.63% | 28.59% |

| Total Current Assets | 99.68% | 98.83% | 93.96% | 33.99% |

| Long-term Assets | 0.32% | 1.17% | 6.04% | 66.01% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 2.92% | 5.50% | 4.05% | 10.26% |

| Long-term Liabilities | 74.94% | 33.46% | 18.46% | 25.87% |

| Total Liabilities | 77.85% | 38.96% | 22.51% | 36.13% |

| Net Worth | 22.15% | 61.04% | 77.49% | 63.87% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 92.56% | 96.19% | 95.68% | 100.00% |

| Selling, General & Administrative Expenses | 83.02% | 65.42% | 63.87% | 70.85% |

| Advertising Expenses | 39.63% | 8.74% | 9.78% | 1.66% |

| Profit Before Interest and Taxes | 62.46% | 46.20% | 47.15% | 1.26% |

| Main Ratios | ||||

| Current | 34.19 | 17.98 | 23.22 | 1.68 |

| Quick | 34.05 | 17.86 | 23.09 | 1.29 |

| Total Debt to Total Assets | 77.85% | 38.96% | 22.51% | 50.04% |

| Pre-tax Return on Net Worth | 110.28% | 116.06% | 69.14% | 0.88% |

| Pre-tax Return on Assets | 24.43% | 70.85% | 53.58% | 1.76% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 33.16% | 30.77% | 31.81% | n.a |

| Return on Equity | 77.20% | 81.24% | 48.40% | n.a |

| Activity Ratios | ||||

| Inventory Turnover | 7.85 | 14.21 | 10.51 | n.a |

| Accounts Payable Turnover | 10.97 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 19 | 28 | n.a |

| Total Asset Turnover | 0.52 | 1.61 | 1.18 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 3.52 | 0.64 | 0.29 | n.a |

| Current Liab.

Personnel Plan: Manager: 0% Assistant Manager: 0% Cook: 0%, $0, $300 Maintenance Staff: 0% Cleaning Staff: 0%, $0, $300 Total People: 2, 5, 50 Total Payroll: $0, $600, $600, $600 Pro Forma Profit and Loss: Sales: $5,984, $7,183, $9,522, $31,350, $20,695, $11,220, $9,665, $9,400, $9,500, $10,675, $10,950, $15,250 Direct Cost of Sales: $1,365, $255, $340, $1,566, $1,315, $865, $865, $865, $915, $915, $915, $1,090 Other Production Expenses: $0 Total Cost of Sales: $1,365, $255, $340, $1,566, $1,315, $865, $865, $865, $915, $915, $915, $1,090 Gross Margin: $4,619, $6,928, $9,182, $29,784, $19,380, $10,355, $8,800, $8,535, $8,585, $9,760, $10,035, $14,160 Gross Margin %: 77.19%, 96.45%, 96.43%, 95.00%, 93.65%, 92.29%, 91.05%, 90.80%, 90.37%, 91.43%, 91.64%, 92.85% Expenses: Payroll: $0, $0, $0, $0, $0, $0, $0, $0, $600, $600, $600, $600 Sales and Marketing and Other Expenses: $0, $0, $0, $210, $85, $100, $100, $100, $125, $145, $145, $150 Depreciation: $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190, $1,190 Leased Equipment: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Utilities: $187, $168, $410, $260, $250, $350, $350, $350, $350, $350, $350, $350, $350 Insurance: $225, $225, $225, $225, $225, $225, $225, $225, $225, $225, $225, $225, $225 Lease: $1,300, $1,500, $1,500, $1,500, $1,500, $0, $0, $0, $0, $0, $0, $0 Mortgage Payment: 15%, $0, $0, $0, $0, $0, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000 Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Operating Expenses: $2,902, $3,083, $3,325, $3,385, $3,250, $3,865, $3,865, $3,865, $4,490, $4,510, $4,510, $4,515 Profit Before Interest and Taxes: $1,717, $3,845, $5,857, $26,399, $16,130, $6,490, $4,935, $4,670, $4,095, $5,250, $5,525, $9,645 EBITDA: $2,907, $5,035, $7,047, $27,589, $17,320, $7,680, $6,125, $5,860, $5,285, $6,440, $6,715, $10,835 Interest Expense: $1,933, $1,933, $1,933, $1,933, $1,933, $1,933, $1,917, $1,900, $1,883, $1,867, $1,850, $1,833 Taxes Incurred: ($65), $574, $1,177, $7,340, $4,259, $1,367, $905, $831, $664, $1,015, $1,103, $2,344 Net Profit: ($152), $1,338, $2,746, $17,126, $9,938, $3,190, $2,113, $1,939, $1,548, $2,368, $2,573, $5,468 Net Profit/Sales: -2.53%, 18.63%, 28.84%, 54.63%, 48.02%, 28.43%, 21.86%, 20.63%, 16.30%, 22.19%, 23.49%, 35.86% Pro Forma Cash Flow: Cash Received: Cash Sales: $5,984, $7,183, $9,522, $31,350, $20,695, $11,220, $9,665, $9,400, $9,500, $10,675, $10,950, $15,250 Subtotal Cash from Operations: $5,984, $7,183, $9,522, $31,350, $20,695, $11,220, $9,665, $9,400, $9,500, $10,675, $10,950, $15,250 Additional Cash Received: Sales Tax, VAT, HST/GST Received: 0.00%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 New Current Borrowing: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 New Other Liabilities (interest-free): $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 New Long-term Liabilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Sales of Other Current Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Sales of Long-term Assets: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 New Investment Received: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Subtotal Cash Received: $5,984, $7,183, $9,522, $31,350, $20,695, $11,220, $9,665, $9,400, $9,500, $10,675, $10,950, $15,250 Expenditures: Expenditures from Operations: Cash Spending: $0, $0, $0, $0, $0, $0, $0, $0, $0, $600, $600, $600, $600 Bill Payments: $1,262, $6,379, $4,428, $5,532, $13,698, $9,214, $6,959, $6,494, $6,401, $6,225, $5,637, $6,720 Subtotal Spent on Operations: $1,262, $6,379, $4,428, $5,532, $13,698, $9,214, $6,959, $6,494, $7,001, $6,825, $6,237, $7,320 Additional Cash Spent: Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Principal Repayment of Current Borrowing: $0, $0, $0, |

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!