Contents

Office Supplies Retail Business Plan

Green Office addresses the market need for environmentally-friendly office supplies. It has been formed as an Illinois Corporation with Stan Cooksey as the main shareholder. Green Office will serve a wide range of customers, including corporations and government agencies.

Products

Green Office will sell eco-friendly products that use recycled materials, “recharged” parts, or non-toxic alternatives. This includes recycled paper (notepads, envelopes, copier paper), laser toner, inkjet cartridges, and common office supplies like correction fluid.

Customers

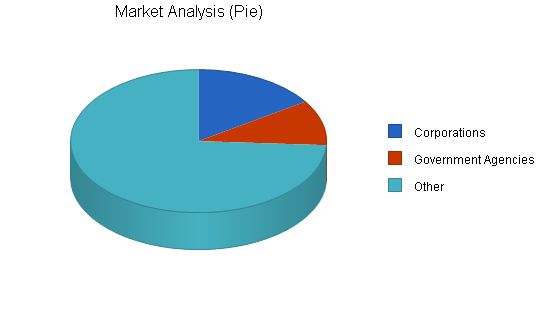

Green Office has identified three market segments: corporations, government agencies, and assorted customers. Corporations have an 8% growth rate and 12,000 potential customers. Government agencies have an 11% growth rate and 7,886 possible customers. Assorted customers have a 7% growth rate and 56,888 potential customers.

Competitive Edge

Green Office will offer a complete range of office supplies, becoming a one-stop shopping destination. It will also provide exceptional customer attention to foster long-term relationships.

Management

Green Office will be led by Stan Cooksey, who holds an undergraduate degree from the University of Chicago and has experience as the Regional Sales Manager for the Government Agency Unit at Symantec Software. Stan also earned an Executive MBA while working at Symantec.

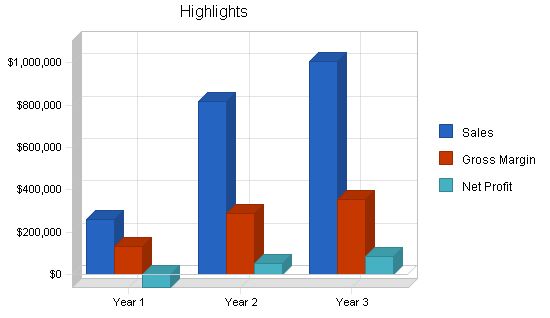

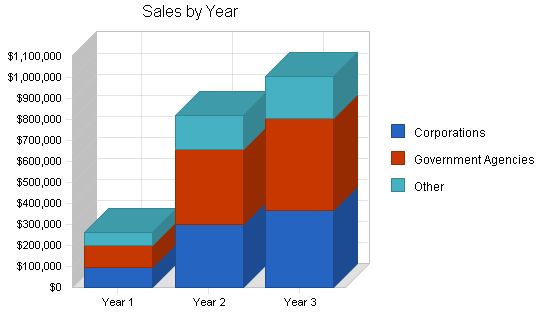

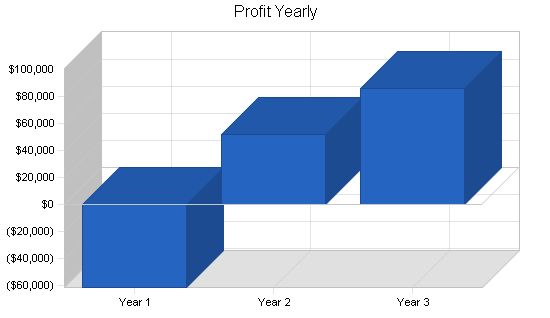

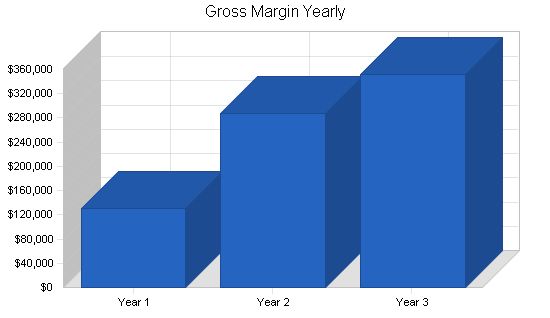

Green Office is supported by a proven business model, carefully identified market segments, and a top-notch management team. Sales are projected to reach $818,000 in year two and $1,004,000 in year three, with profitability expected in the second year.

1.1 Objectives:

– Become the premier source of eco-friendly office supplies.

– Offer green office supplies at the same or lower prices compared to non-eco-friendly supplies.

– Achieve significant growth and profitability within the first two years.

1.2 Mission:

Green Office aims to be the leading vendor of eco-friendly office supplies, providing a wide selection at competitive prices and exceptional customer service.

1.3 Keys to Success:

– Provide competitively priced eco-friendly office supplies.

– Secure major contracts with corporations and government agencies.

– Maintain fiscal efficiency through strict financial controls.

Green Office is an Illinois corporation founded by Stan Cooksey.

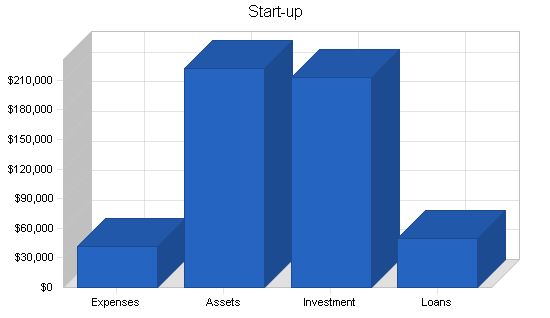

2.1 Start-up Summary:

Green Office’s start-up expenses include:

– Office desk sets, chairs, and supplies (6).

– Workstations, a central file server, two laser printers, and an Internet connection (6).

– Copier and fax machine.

– Assorted office furniture.

– Assorted shipping material.

– Unit phone system with an answering service (7).

– Shelving units for storage.

– Used forklift.

– Intercom system.

– Warehouse build-out.

Start-up funds will mainly come from equity investment, with Stan obtaining a $50,000 SBA-backed loan to help purchase start-up inventory.

Start-up

Requirements

Start-up Expenses

Legal: $3,000

Stationery: $500

Brochures: $500

Insurance: $300

Web Site Development: $5,000

Research and Development: $2,000

Other: $30,000

Total Start-up Expenses: $41,300

Start-up Assets

Cash Required: $128,700

Start-up Inventory: $46,000

Other Current Assets: $3,500

Long-term Assets: $43,500

Total Assets: $221,700

Total Requirements: $263,000

Start-up Funding

Start-up Expenses to Fund: $41,300

Start-up Assets to Fund: $221,700

Total Funding Required: $263,000

Assets

Non-cash Assets from Start-up: $93,000

Cash Requirements from Start-up: $128,700

Additional Cash Raised: $0

Cash Balance on Starting Date: $128,700

Total Assets: $221,700

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $50,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $50,000

Capital

Planned Investment

Investor 1: $95,000

Investor 2: $68,000

Other: $50,000

Additional Investment Requirement: $0

Total Planned Investment: $213,000

Loss at Start-up (Start-up Expenses): ($41,300)

Total Capital: $171,700

Total Capital and Liabilities: $221,700

Total Funding: $263,000

2.2 Company Ownership

Green Office is a privately held corporation owned by Stan Cooksey. Green Office has been incorporated in Illinois.

Products

Green Office offers environmentally friendly office supplies, including:

– Recycled clip boards

– Non-toxic correction fluid

– Recycled note pads (small and legal size)

– Recycled paper clips

– Recycled copier and printer paper

– Recycled envelopes

– Erasable boards

– Reusable coffee filters

– Recycled, refillable laser toner cartridges and inkjet cartridges

– Solar calculators

– Refillable pens and pencils made out of recyclable materials

– And many other items

Market Analysis Summary

Green Office believes it faces significant demand and many opportunities in the office supply industry. Its main customer segments are corporations, government agencies, and others.

Corporations: This customer group consists of companies with at least 35 employees. They purchase supplies for the entire organization, sometimes individually by different groups within the organization. These customers are interested in environmentally-friendly supplies due to personal/corporate belief reasons or as part of a PR program that showcases their commitment to the environment.

Government Agencies: This segment is expanding due to legislation such as Former President Clinton’s Executive Order 13101, which requires federal government agencies to buy environmentally-friendly products. Similar legislation exists in the majority of states for their governmental agencies, creating a large market for Green Office.

Other: This segment includes small companies, individuals, school districts, and more.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Corporations | 8% | 12,009 | 12,970 | 14,008 | 15,129 | 16,339 | 8.00% |

| Government Agencies | 3% | 7,886 | 8,123 | 8,367 | 8,618 | 8,877 | 3.00% |

| Other | 7% | 56,888 | 60,870 | 65,131 | 69,690 | 74,568 | 7.00% |

| Total | 6.77% | 76,783 | 81,963 | 87,506 | 93,437 | 99,784 | 6.77% |

4.2 Target Market Segment Strategy

As mentioned previously in the Market Segmentation section, three customer groups have been identified. Two of these, corporations and government agencies, are attractive customer segments. The third is used as a “catch all” category. The strategy will be a targeted sales campaign using specific sales agents, each responsible for a customer group.

The hiring process for these sales agents will be done with the specific group in mind. The agent responsible for government agencies will be chosen based on experience and proficiency in selling to government agencies if possible. Green Office will provide each experienced salesperson with an exclusive territory to achieve high sales marks for the respective customer group.

Green Office competes in the office supplies industry. Within that industry, several market leaders are Staples, OfficeMax, and Office Depot. These companies offer local retail stores and mail order/Internet sales. They have a combined 59% market share. The remaining players in the market include mail order/Internet competitors and local retailers. Within this market is a newly developed niche of environmentally-friendly suppliers, primarily mail order/Internet based.

4.3.1 Competition and Buying Patterns

Competition comes from two sources: direct and indirect competitors. Direct competitors offer similar lines of environmentally-friendly products, such as Ecomall, EcoProducts, and The Good Humans. Indirect competitors are companies within the office supplies industry that offer eco supplies but do not primarily focus on these products. Customers’ buying patterns are based on the price comparison to standard office supplies and eco-friendly ones, as well as convenience in ordering, shipping schedule, and variety of products.

Strategy and Implementation Summary

Green Office aims to become a major vendor of environmentally-friendly office supplies. They will leverage their competitive edge of a wide selection of green office supplies and a strong customer service-oriented organization. The marketing strategy seeks to develop awareness of Green Office and its ability to offer a wide selection of eco-friendly office products. The sales strategy focuses on converting qualified sales leads into paying customers through excellent customer service and creating long-term relationships.

5.1 Competitive Edge

Green Office’s competitive edge is twofold. They offer a wide selection of office supplies, making it a convenient one-stop shopping place. They also prioritize customer service and aim to provide the finest service to build a loyal customer base.

5.2 Marketing Strategy

The marketing strategy will communicate Green Office’s competitive edges of selection and customer service. They will undertake a marketing campaign primarily through print advertising to develop awareness among targeted customers.

5.3 Sales Strategy

Green Office’s sales strategy focuses on converting qualified sales leads into paying customers by providing exceptional customer service. Each customer will be assigned a specific account manager/sales agent based on their customer type. Account managers will be incentivized to develop long-term customer relationships.

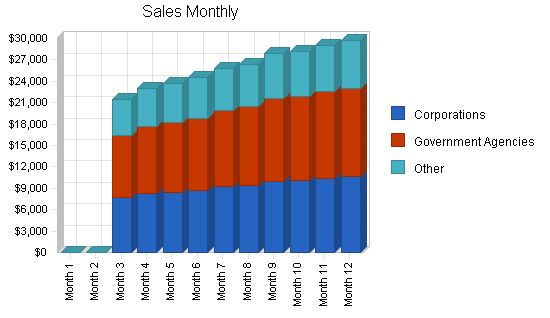

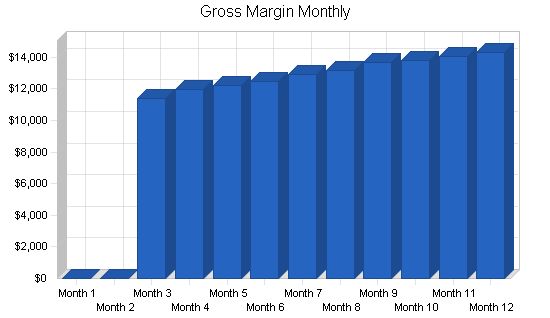

5.3.1 Sales Forecast

Green Office has adopted a conservative sales forecast to ensure financial stability as a start-up organization. The forecast predicts sales to increase at a steady rate over time.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Corporations | $92,892 | $298,887 | $366,544 |

| Government Agencies | $107,470 | $358,664 | $439,853 |

| Other | $59,362 | $161,399 | $197,934 |

| Total Sales | $259,724 | $818,950 | $1,004,331 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Corporations | $47,380 | $194,277 | $238,254 |

| Government Agencies | $56,856 | $233,132 | $285,904 |

| Other | $25,585 | $104,909 | $128,657 |

| Subtotal Direct Cost of Sales | $129,821 | $532,318 | $652,815 |

5.4 Milestones

Green Office has identified four specific milestones as goals to achieve. While the milestones are qualitative and have a deadline, they are achievable.

- Business plan completion.

- First major government agency account.

- $200K in sales.

- Profitability.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2004 | 2/15/2004 | $0 | Stan | Business Development |

| First major government agency account | 1/1/2004 | 4/1/2004 | $0 | Sales Manager | Sales |

| $200K in sales | 1/1/2004 | 2/15/2005 | $0 | Sales Manager | Sales |

| Profitability | 1/1/2004 | 6/1/2005 | $0 | Stan | Entire company |

| Totals | $0 | ||||

Web Plan Summary

The website will offer customers a product catalog for online orders. The design philosophy of the site is ease of use. Green Office aims to make placing an order easy and fast, encouraging increased sales. Special features include a section for each customer to easily purchase repeat items, speeding up the ordering process. This ease-of-use feature will help increase sales as customers become familiar with the site and appreciate its simplicity.

6.1 Website Marketing Strategy

The marketing strategy for the website will include search engine submissions and the use of pay-per-clicks, where the company pays the search engine for each click to the Green Office site.

6.2 Development Requirements

Green Office has secured a start-up website design company for the development and maintenance of the site at a favorable rate.

Management Summary

Green Office is led by Stan Cooksey, who has an undergraduate degree in business from the University of Chicago. Stan has extensive experience in sales and management. He started Green Office after achieving a vice president position at Symantec.

7.1 Personnel Plan

- Stan: Operations, business development, finance, and accounting.

- Willma (Stan’s wife): Procurement and marketing.

- Sales: Account manager functions.

- Accounting: Part-time accounting clerk.

- Shipping: Responsible for order filling.

- Administrative/customer support.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Stan | $20,000 | $22,000 | $24,200 |

| Willma | $20,000 | $22,000 | $24,200 |

| Sales | $15,000 | $16,500 | $18,150 |

| Sales | $12,000 | $13,200 | $14,520 |

| Sales | $9,000 | $9,900 | $10,890 |

| Accounting | $6,400 | $7,040 | $7,744 |

| Shipping | $15,000 | $16,500 | $18,150 |

| Shipping | $12,000 | $13,200 | $14,520 |

| Shipping | $7,000 | $7,700 | $8,470 |

| Admin/customer support | $10,000 | $11,000 | $12,100 |

| Admin/customer support | $4,800 | $5,280 | $5,808 |

| Total People | 11 | 11 | 11 |

| Total Payroll | $131,200 | $144,320 | $158,752 |

Financial Plan

The following sections outline important financial information.

8.1 Important Assumptions

The following table details important Financial Assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 9.00% | 9.00% | 9.00% |

| Long-term Interest Rate | 8.00% | 8.00% | 8.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

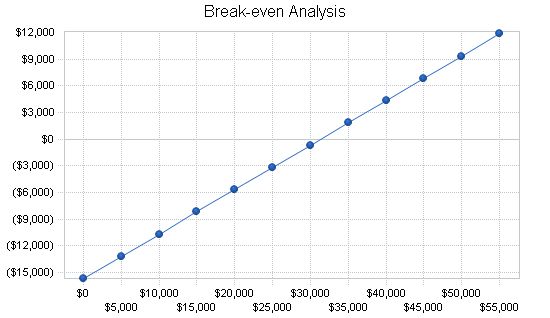

8.2 Break-even Analysis

The following table and chart show our break-even analysis.

Break-even Analysis

Monthly Revenue Break-even: $31,303

Assumptions:

– Average Percent Variable Cost: 50%

– Estimated Monthly Fixed Cost: $15,657

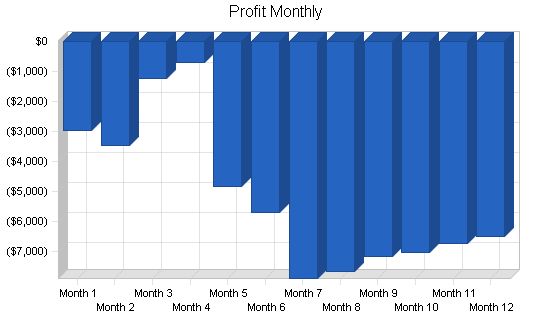

8.3 Projected Profit and Loss

The table below shows the Projected Profit and Loss.

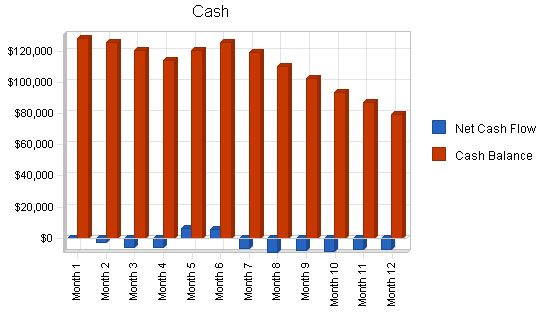

Projected Cash Flow:

The chart and table below show the Projected Cash Flow.

Chart:

Year 1 Year 2 Year 3

$0 $0 $0

Table:

Sales $1,004,331

Direct Cost of Sales $652,815

Other Costs of Goods $0

Total Cost of Sales $652,815

Gross Margin $351,516

Gross Margin % 35.00%

Expenses:

Payroll $158,752

Sales and Marketing and Other Expenses $2,400

Depreciation $8,700

Rent $12,000

Utilities $6,000

Insurance $2,400

Payroll Taxes $28,080

Website Maintenance $7,500

Total Operating Expenses $225,832

Profit Before Interest and Taxes $125,684

EBITDA $134,384

Interest Expense $3,500

Taxes Incurred $36,655

Net Profit $85,528

Net Profit/Sales 8.52%

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | $64,931 | $204,738 | $251,083 |

| Cash from Receivables | $151,445 | $520,877 | $722,308 |

| Subtotal Cash from Operations | $216,376 | $725,615 | $973,390 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $3,000 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $36,000 | $0 |

| Subtotal Cash Received | $216,376 | $764,615 | $973,390 |

Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $79,527 | $95,062 | $155,369 |

| Other Current Assets | $3,500 | $3,500 | $3,500 |

| Total Current Assets | $141,788 | $269,506 | $368,509 |

| Long-term Assets | |||

| Long-term Assets | $43,500 | $43,500 | $43,500 |

| Accumulated Depreciation | $8,700 | $17,400 | $26,100 |

| Total Long-term Assets | $34,800 | $26,100 | $17,400 |

| Total Assets | $176,588 | $295,606 | $385,909 |

| Liabilities and Capital | |||

| Total Liabilities | $66,719 | $98,356 | $103,131 |

| Paid-in Capital | $213,000 | $249,000 | $249,000 |

| Retained Earnings | ($41,300) | ($103,131) | ($51,750) |

| Earnings | ($61,831) | $51,381 | $85,528 |

| Total Capital | $109,869 | $197,250 | $282,779 |

| Total Liabilities and Capital | $176,588 | $295,606 | $385,909 |

| Net Worth | $109,869 | $197,250 | $282,779 |

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 215.32% | 22.64% | 1.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 24.55% | 46.24% | 43.44% | 38.65% |

| Inventory | 8.73% | 11.59% | 10.89% | 28.15% |

| Other Current Assets | 1.98% | 1.18% | 0.91% | 18.82% |

| Total Current Assets | 80.29% | 91.17% | 95.49% | 85.62% |

| Long-term Assets | 19.71% | 8.83% | 4.51% | 14.38% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 11.39% | 18.63% | 16.37% | 43.40% |

| Long-term Liabilities | 26.39% | 14.65% | 10.36% | 11.10% |

| Total Liabilities | 37.78% | 33.27% | 26.72% | 54.50% |

| Net Worth | 62.22% | 66.73% | 73.28% | 45.50% |

| Percent of Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 50.02% | 35.00% | 35.00% | 22.64% |

| Selling, General & Administrative Expenses | 96.00% | 31.88% | 28.47% | 13.42% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 0.26% |

| Profit Before Interest and Taxes | -22.32% | 9.42% | 12.51% | 1.70% |

| Main Ratios | ||||

| Current | 7.05 | 4.89 | 5.83 | 1.77 |

| Quick | 6.28 | 4.27 | 5.17 | 1.07 |

| Total Debt to Total Assets | 37.78% | 33.27% | 26.72% | 5.52% |

| Pre-tax Return on Net Worth | -56.28% | 37.21% | 43.21% | 59.64% |

| Pre-tax Return on Assets | -35.01% | 24.83% | 31.66% | 13.69% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -23.81% | 6.27% | 8.52% | n.a |

| Return on Equity | -56.28% | 26.05% | 30.25% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.49 | 4.49 | 4.49 | n.a |

| Collection Days | 56 | 53 | 74 | n.a |

| Inventory Turnover | 5.91 | 21.43 | 17.12 | n.a |

| Accounts Payable Turnover | 7.51 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 21 | 28 | n.a |

| Total Asset Turnover | 1.47 | 2.77 | 2.60 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.61 | 0.50 | 0.36 | n.a |

| Current Liab. to Liab. | 0.30 | 0.56 | 0.61 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $121,666 | $214,446 | $305,351 | n.a |

| Interest Coverage | -15.04 | 20.67 | 35.91 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.68 | 0.36 | 0.38 | n.a |

| Current Debt/Total Assets | 11% | 19% | 16% | n.a |

| Acid Test | 4.13 | 1.79 | 2.52 | n.a |

| Sales/Net Worth | 2.36 | 4.15 | 3.55 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Corporations | $0 | $0 | $7,645 | $8,212 | $8,455 | $8,747 | $9,212 | $9,454

Personnel Plan: Stan 0% $0 $0 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 Willma 0% $0 $0 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 Sales 0% $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Sales 0% $0 $0 $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Sales 0% $0 $0 $0 $0 $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Accounting 0% $0 $0 $0 $0 $800 $800 $800 $800 $800 $800 $800 $800 $800 Shipping 0% $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Shipping 0% $0 $0 $0 $0 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Shipping 0% $0 $0 $0 $0 $0 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Admin/customer support 0% $0 $0 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Admin/customer support 0% $0 $0 $0 $0 $0 $0 $800 $800 $800 $800 $800 $800 $800 Total People 0 0 5 5 8 9 11 11 11 11 11 11 11 Total Payroll $0 $0 $8,000 $8,000 $11,800 $12,800 $15,100 $15,100 $15,100 $15,100 $15,100 $15,100 $15,100 General Assumptions: Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% Long-term Interest Rate 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% 8.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Sales $0 $0 $21,467 $23,021 $23,687 $24,487 $25,761 $26,424 $27,884 $28,227 $29,054 $29,712 Direct Cost of Sales $0 $0 $10,054 $11,064 $11,496 $12,016 $12,845 $13,276 $14,225 $14,447 $14,985 $15,413 Other Costs of Goods $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $0 $10,054 $11,064 $11,496 $12,016 $12,845 $13,276 $14,225 $14,447 $14,985 $15,413 Gross Margin $0 $0 $11,414 $11,957 $12,190 $12,470 $12,916 $13,148 $13,660 $13,779 $14,069 $14,299 Gross Margin % 0.00% 0.00% 53.17% 51.94% 51.46% 50.93% 50.14% 49.76% 48.99% 48.82% 48.42% 48.13% Expenses Payroll $0 $0 $8,000 $8,000 $11,800 $12,800 $15,100 $15,100 $15, Pro Forma Cash Flow |

|||||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $5,367 | $5,755 | $5,922 | $6,122 | $6,440 | $6,606 | $6,971 | $7,057 | $7,264 | $7,428 | |

| Cash from Receivables | $0 | $0 | $0 | $537 | $16,139 | $17,282 | $17,785 | $18,397 | $19,337 | $19,854 | $20,922 | $21,191 | |

| Subtotal Cash from Operations | $0 | $0 | $5,367 | $6,292 | $22,061 | $23,404 | $24,225 | $25,003 | $26,308 | $26,911 | $28,185 | $28,619 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $5,367 | $6,292 | $22,061 | $23,404 | $24,225 | $25,003 | $26,308 | $26,911 | $28,185 | $28,619 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $0 | $0 | $8,000 | $8,000 | $11,800 | $12,800 | $15,100 | $15,100 | $15,100 | $15,100 | $15,100 | $15,100 | |

| Bill Payments | $74 | $2,248 | $2,770 | $3,928 | $3,945 | $4,854 | $15,401 | $18,659 | $18,739 | $20,139 | $19,678 | $20,511 | |

| Subtotal Spent on Operations | $74 | $2,248 | $10,770 | $11,928 | $15,745 | $17,654 | $30,501 | $33,759 | $33,839 | $35,239 | $34,778 | $35,611 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $273 | $275 | $277 | $279 | $281 | $283 | $284 | $286 | $288 | $290 | $292 | $294 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!