Contents

Ready for Equity Based Crowdfunding?

Are you an emerging entrepreneur with an underfunded venture? Could your business flourish with money and hype? The Securities and Exchange Commission’s proposed equity crowdfunding rules may be the solution for you.

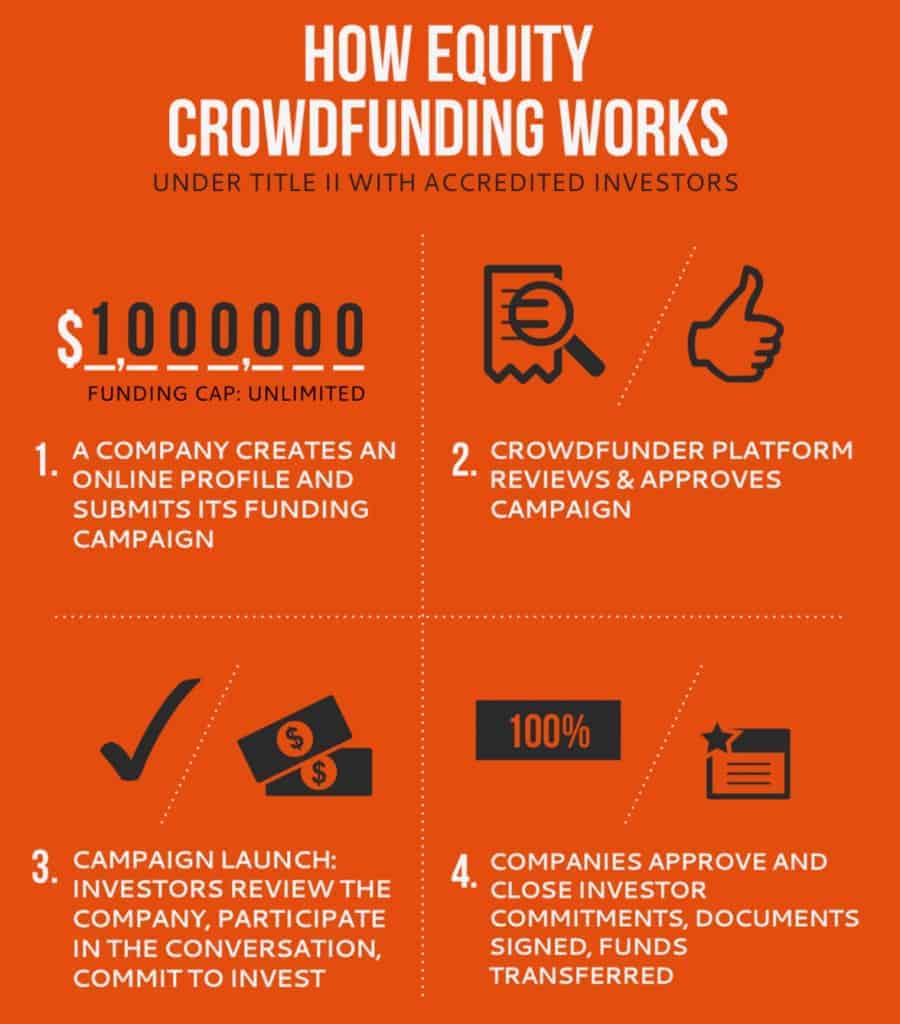

The proposed rules (mandated by the JOBS Act of 2012) amend existing acts to allow the offer and sale of securities through an internet crowdfunding campaign, similar to donation crowdfunding campaigns on Kickstarter and Indiegogo.

Both donation and equity crowdfunding appeal to the public’s desire to participate in fulfilling others’ entrepreneurial visions.

Whether launching the next internet sensation, filming a sci-fi fantasy, mass producing savory barbecue sauce, or creating a must-have tech gadget, entrepreneurs will witness this spirited support—not only from funding, but also from subsequent purchases of the products they help create.

If your business needs financing, consider equity crowdfunding. It lures investors desiring investment returns and investor protection, in addition to the goodwill generated by their support.

Equity crowdfunding vs. donation crowdfunding

Equity crowdfunding differs from donation crowdfunding in two major ways. Unlike donation crowdfunding, which allows nominal consideration for donations, equity crowdfunding involves the offer and sale of debt or equity securities in exchange for financial support.

In addition, businesses offering and selling securities must comply with SEC regulations. The proposed equity crowdfunding rules regulate:

- Your business (the securities issuer)

- The intermediary facilitating your business’ securities offering (the broker-dealer or funding portal)

- The investors

How to prepare for equity based crowdfunding

This article discusses six actions you can take now (plus one to avoid) to optimize your readiness for equity crowdfunding when these rules become effective.

Compliance obligations increase once your business starts offering securities to potential investors—so start early.

1. Set a Fundraising Goal

The proposed equity crowdfunding rules allow businesses to fundraise up to $1 million per 12 month period. However, this may not supply all the funding your business needs, so equity crowdfunding should be seen as one of many tools in your business’s funding arsenal.

Before rushing to fundraise any amount for your business, answer two pivotal questions:

- Is this a strategic amount for my business to fundraise?

- Does my business have the necessary resources to conduct this equity crowdfunding campaign?

Select a Strategic Target Amount:

Let’s say you own a craft brewery that needs financing to brew a new line of specialty beers. You set a minimum amount to fundraise and a deadline date to fundraise this amount. If your brewery fails to meet the target amount by the deadline date, it collects nothing.

Your brewery determines it needs $250,000 to get its beers in various markets and sets a fundraising deadline to ensure its first special project will be ready by the start of the season. The following scenarios illustrate the results of different tactics to fundraise $250,000:

Scenario 1: Your business sets a deadline date of 4/30/16 to fundraise its target amount of $250,000. As of 2/25/16, your business has already fundraised $250,000. Congratulations!

Scenario 2: Your business sets a deadline date of 4/30/16 to fundraise its target amount of $250,000. As of the deadline date, your business has only fundraised $225,000. Unfortunately, your business cannot collect anything and all committed funds will be returned to investors. You are forced to postpone your brewery’s new product line.

To prevent failure, you should tactically lower your brewery’s optimal target amount and simultaneously declare a maximum offering amount. The maximum offering amount equals the target amount plus any additional amount your business seeks to raise after meeting its target amount.

Now let’s see what happens when your brewery uses this tactic to fundraise $250,000:

Scenario 3: Your business sets a deadline date of 4/30/16 to fundraise its lowered target amount of $150,000. As of 2/25/16, your business has fundraised $150,000 (which it will collect). Your business then aims to fundraise an additional $100,000. As of the deadline date, your business has only fundraised $75,000 of the additional requested $100,000. Even though your business failed to raise its entire maximum offering amount, it still collects an impressive $225,000. Success! Plus, most (if not all) of your brewery’s plans will be funded.

One rule dominates the equity crowdfunding realm—your business must fundraise its target amount at minimum to collect any funds. But as the scenario above shows, your business can still collect funds even if it fails to reach its maximum offering amount.

Using the cautious maximum offering amount approach will generally reap the most long-term success, as the target amount could be reached at a lower dollar amount.

Evaluate Your Business:

Your business’s success in collecting equity crowdfunding proceeds determines the worthiness of its campaign. A successful campaign collects enough proceeds to justify your business costs and satisfy your key business needs. When setting an appropriate target amount, use the following checklist:

- Develop an internal spending plan for your prospective equity crowdfunding proceeds

- Itemize and prioritize needs to select a worthwhile minimum target amount (and maximum offering amount)

- Assess your business’s finances, administrative capabilities, compliance capabilities, regulatory obligations, and other business obligations

- Evaluate the amount your business can reasonably collect

- Evaluate the administrative and financial costs of running the campaign

To reiterate, costs can comprise a significant part of your business’s equity crowdfunding budget. The intermediary fee—one of the heftier mandatory costs—may consume 15% of the securities offering, by the SEC’s estimate. Other costs, including legal, promoter, and accounting costs, can also add up.

Understand Your Business’s Value:

Set your business’s strategic funding goals in conjunction with your business’s valuation and share price.

What is your business worth? Examine your business’s value from an analysis of its financial documents and the viewpoint of the likely investor. Your business’s intrinsic value or potential investors’ perception of your business’s value matters—what share value or price prompts them to buy?

You must also consider what you are selling to investors—is it a portion of your business or a portion of your business’s specific assets? Select your business’s methodology for pricing shares and consider the ideal number of investors for your business to manage.

Your notion of this value is intertwined in your business’s securities offering statement, which describes to potential investors the terms of their crowdfunding securities. Material terms will include the securities type, cancellation and reconfirmation rights, share class, securities resales, purchase price, and voting rights.

Finalize the Equity Crowdfunding Spending Plan:

Equity crowdfunding campaigns trigger disclosure obligations linked to your business’s maximum fundraising goals. Along with establishing a target amount, the proposed rules require your business to provide potential investors with a full understanding of any potential equity crowdfunding proceeds.

Your final equity crowdfunding spending plan will help your business defend any funding request. Consider the costs involved and the purpose of the funds you raise.

2. Develop Your Business Plan

The public convenes to weigh the value of your business’s securities offering. To enable prospective investors to have an informed discussion, the proposed equity crowdfunding rules require your business to release its business plan.

Your business must submit a description of its project, idea, or business for the public to probe.

When drafting your crowdfunding business plan, comply with crowdfunding regulations and sell sufficient amounts of crowdfunding securities. Include the following:

Specify Permissible Reasons for Needing Funding:

Almost every business, idea, or project is fair game. You just need to specify one. Detailing plans for mergers or acquisitions with unspecified companies disqualifies your business from offering crowdfunding securities.

Brand Your Business with a Pithy Mission Statement:

Communicate your business’s value in a few captivating sentences. An impressive mission statement inspires the public to buy your business’s vision.

Tout Your Business’s Strengths:

Showcase your management and creative prowess, product innovation or usefulness, business or technology development talents, and demonstrated interest from relevant parties. Superiority in business skills excites prospective investors about your business’s crowdfunding campaign.

For many small and emerging businesses, minimal information exists to assist a securities buying decision. When information is thin, a call to pathos can work wonders.

Omit Proprietary and Confidential Information:

The SEC does not require inclusion of proprietary and confidential information in a crowdfunding business plan. You must refrain from divulging such information to satisfy the public’s quest.

3. Grow Your Network

Get a Network:

Your business’s equity crowdfunding campaign success largely depends on the power of your business’s network. Strive to develop a vast business network that will both buy crowdfunding securities and promote your campaign to others.

For a small network of affluent individuals, your business may not need to develop a vast network. However, for most businesses, a large network is necessary as investment limits apply.

Engage Your Network:

Developing an impassioned network that bankrolls your business’s crowdfunding securities offering is essential. Generate and spread news about your business to keep people engaged.

Most of your network’s retention and growth will come through interactions and networking on social media platforms, such as Facebook, Google Hangout, and Twitter. Build relationships and circulate information through these platforms.

The intermediary’s communication channel will serve as the primary place for discussing your business’s crowdfunding securities under the proposed rules. Use this platform to inform your network that they may purchase and discuss those securities.

4. Perform Background Checks

Evaluate your business for red flags to save investors from fraud and misconduct. The proposed rules require intermediaries to conduct background and securities enforcement regulatory history checks on some of your business’s covered persons.

Rethink your business’s equity crowdfunding if its adverse background will prevent or deter the public from buying its securities. Launch a plan to address any potential fallout from the background check.

To clear any hurdles, answer three questions:

- Has anyone in my business committed misconduct?

- Will this misconduct endanger my business’s securities offering?

- How would I handle any history of misconduct in my business?

Identify Persons Subject to Background Checks:

Entities and titled persons who are covered persons under the proposed rules include your business, its directors, officers, beneficial owners, promoters, and compensated solicitors.

Only the past behavior of certain covered persons, especially your business and its officers, directors, and beneficial owners, will impact your business’s securities offering. However, the past behavior of your business’s other covered persons could also impact your business’s offering.

Identify Adverse Backgrounds:

Vet your business’s covered persons through a background and securities history check to uncover any history of misconduct and judge its impact on your business’s crowdfunding campaign.

Disqualifying events include certain criminal convictions, court injunctions, regulatory orders, false representation orders, and disciplinary actions. Review a broader list of disqualifying events on the SEC’s website.

Past misconduct may not disqualify your business, but the intermediary and the public may view it negatively. Prepare to respond civilly to any judgments raised by the intermediary or the public about your business.

Understand the Risks of Adverse Backgrounds:

The intermediary and the public have the power to impact your business’s crowdfunding campaign. The intermediary may remove your offering based on a belief, reasonable or not, that it is fraudulent or lacks commitment to investor protection. The public may hesitate to buy your business’s securities or criticize your offering on the intermediary’s platform. Be prepared to respond civilly to any negative judgments.

Overcome Problematic History:

Identifying covered persons with a problematic history allows you to strategize a favorable outcome. Construct a winning narrative that supports your business and showcases integrity and commitment to compliance. Reject past misconduct and demonstrate your business’s values. This will rally the public around your business’s securities offering.

1. Exclude affected persons from covered roles by restructuring share ownership to less than 20% beneficial ownership, changing their job responsibilities to non-covered functions within the business, or terminating them.

If the intermediary is unswayed by your business’s enhanced dedication to compliance, refine your pitch and select an intermediary receptive to your business’s securities offering (which includes your business’s adverse background).

5. Hire Attorneys and Accountants

Securities regulatory compliance plus rising profits equals long term equity crowdfunding success. Acquire assistance with the compliance requirements from attorneys and accountants with a securities regulatory purview. Applying this legal and accounting advice should demonstrate your conscientiousness in preparing a credible securities offering. Vitally, prioritizing legal issues helps your business reduce the prospect of SEC investigations, sanctions, investor dissatisfaction, and intermediary disputes—the three primary legal risks in securities offerings.

Ensure Understanding of the Securities Laws:

The SEC, in its investor protection mission, imposes obligations and restrictions on your business and its securities offering. Your business’s primary securities obligations comprise disclosing and reporting required information about your business’s securities offering, background, operations, plans, and finances, and filing that required information on various versions of Form C (the offering statement that crowdfunding securities issuers must use to disclose required information).

Additional crowdfunding regulations include limits on securities offering advertisements, and promoter compensation and activities. Managing investor expectations through transparent and complete disclosure limits investor dissatisfaction; although, non-existent investment returns or a non-existent/uncertain secondary securities market predictably escalates such dissatisfaction.

"Managing investor expectations—through transparent and complete disclosure—limit investor dissatisfaction"

Sufficiently increasing your comprehension of crowdfunding regulations substantially diminishes your business’s likelihood of non-compliance. Still, navigating the unknown landscape of new equity crowdfunding regulations will be tricky and time-consuming, especially for the inexperienced entrepreneur.

Determine Terms of the Intermediary Agreement:

Your business’s choice of registered intermediary will be one of the principal decisions of your business’s crowdfunding campaign. Numerous broker-dealers and funding portals will compete to be each business’s sole permissible intermediary.

The intermediary will, among other things, facilitate the securities offering, host discussion of the crowdfunding offering, and assess each business’s worthiness to issue securities. Leverage your options to get the most favorable intermediary agreement.

The intermediary agreement primarily covers the intermediary’s internet-based platform to conduct the securities offering and online communication channels to discuss the securities offering. Some issues you’ll want to review with the intermediary are:

– Facilitation of the securities offering

– Collection of investment proceeds

– Intermediary fees

– Provision of issuer disclosures

– Termination of securities offering

– Availability of communication channels

– Promotion of the intermediary

Consider that securities regulations disallow funding portals from offering all of the services normally provided by broker-dealers; both, though, may sell document preparation assistance, disclosure templates, securities regulatory consultations, and so on. Determine if your business needs the securities offering services provided by a broker-dealer.

Retain an Accountant:

Your business’s choice of accountant and disclosure of financial information may influence prospective investors’ assessments of your business’s credibility, viability, and securities buying decision.

When your business hires accountants, establish whether they are independent or non-independent, and that your business’s financial statements are prepared using U.S. GAAP standards.

Under the proposed equity crowdfunding rules, elements of your financial disclosure (including the independence status of your accountant and accounting services required) are tied to your business’s maximum funding goals.

Fundraising Goal:

Obligations:

– Hire an independent auditor to audit financial statements

– Disclose audited financial statements

Fundraising Goal:

– Over $100,000 up to $500,000

Obligations:

– Hire an independent public accountant to review financial statements

– Disclose reviewed financial statements

Fundraising Goal:

Obligations:

– Hire an independent or non-independent accountant

– Disclose your business’ income tax returns and financial statements certified by one of your business’ principal executive officers

Importantly, make sure you comprehend your business’s financial statements. When the public questions the numbers in your business’s financial statements in the intermediary’s communication channel (and they will), can you respond capably?

Additionally, the proposed rules require your business to describe its financial condition, including your business’s historical results of operations, liquidity, and capital resources (as necessary).

If your business has no operating history, describe its financial milestones and operational liquidity and other challenges.

If your business has an operating history, describe whether the historical results and cash flows are indicative of future results.

Moreover, your business must include the effect the crowdfunding proceeds (and any other pending sources of capital) will have on its financial condition. For example, is this crowdfunding campaign “do or die” for the success of your business? Accountants can help navigate the instructions to these questions, ensuring you provide a transparent and material overview of your business’s prospects.

6. Cover Upfront Costs for Equity Crowdfunding Offering

Frankly, it’s going to take a sweet sum of money upfront to finance your business vision with equity crowdfunding. Moreover, the bigger the securities offering, the higher the upfront costs—although, some costs are fixed.

And, many of the huge crowdfunding bills—like accounting and legal services—will be due before your business collects one equity crowdfunding dollar. Fortunately, some bills can be delayed and paid for with crowdfunding proceeds (like intermediary services), so disclose these in your equity crowdfunding spending plan. Prioritize upfront costs based on both your budget and compliance needs.

Finally—Don’t Sell Securities to the Crowd, Yet:

Even if you forego acting on any suggested “do,” here is one “don’t” you must observe. Don’t attempt to sell crowdfunding securities before the crowdfunding regulations go into effect. Selling unregistered crowdfunding securities to the public will result in SEC repercussions that could undermine your business financing goals.

Disclaimer: This article is intended to be general information only. Nothing in this article constitutes legal advice. Please consult with an attorney before making any legal decisions.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!