High-Tech Marketing Business Plan

Acme Consulting is a specialized marketing consulting company for high-technology products in international markets. We provide high-tech manufacturers with reliable and high-quality alternatives for business development, market development, and channel development.

Acme Consulting is a California C corporation based in Santa Clara County’s "Silicon Valley," owned by its principal investors and operators. Our initial office will be in A-quality office space in the Santa Clara County area, the heart of the U.S. high tech industry.

Our target market consists of large manufacturer corporations such as HP, IBM & Microsoft within the US and European high tech industry. We will also focus on medium-sized companies in high growth areas like multimedia and software. Acme’s challenge is to establish itself as a legitimate consulting company, offering a relatively risk-free corporate purchase.

Competition in the industry comes from companies that choose to handle business development and market research internally. There are also well-known generalist management consulting firms like Arthur Anderson and Boston Consulting Group, as well as market research companies such as Dataquest and Stanford Research Institute. Acme Consulting’s advantage is the ability to provide high-level consulting that integrates market research data with the company’s goals.

Acme Consulting’s pricing is at the higher end of the market, competing with established consultants. This pricing aligns with our positioning as providers of high-level expertise.

The founders of Acme Consulting have extensive experience in marketing consulting services, personal computers, and market research in international markets. They established Acme to formalize their consulting services. The company will be managed by working partners in a structure based on Smith Partners, initially with 3-5 partners.

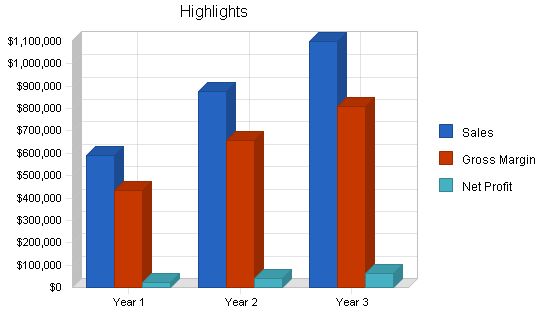

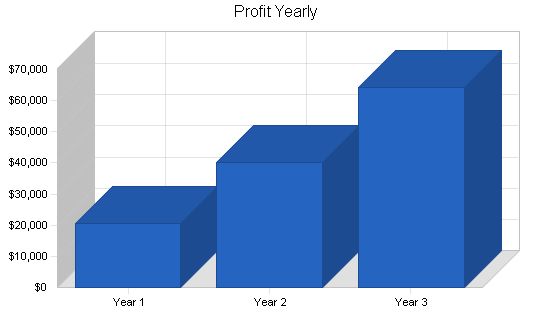

By Year 3, Acme Consulting estimates profits of approximately $65,000 with a net profit margin of 6%. The company plans to take on $130,000 in current debt and raise an additional $50,000 in long-term debt for long-term assets. Cash flow problems are not anticipated.

1.1 Objectives:

– Achieve sales of $550,000 in Year 1 and $1 million by Year 3.

– Maintain a gross margin higher than 70%.

– Attain a net income that is more than 5% of sales by Year 3.

1.2 Mission:

Acme Consulting offers high-tech manufacturers a reliable and high-quality alternative to in-house resources for international business development, market development, and channel development. Acme provides practical experience, know-how, contacts, and confidentiality, making it a professional and less risky option for clients to develop new areas. Acme charges a high value for its services but delivers even higher value to its clients. The initial focus will be on developing the European and Latin American markets, as well as serving European clients in the United States market.

1.3 Keys to Success:

– Excellence in fulfilling the promise of complete confidentiality, reliability, trustworthiness, expertise, and information.

– Develop visibility to generate new business leads.

– Leverage expertise for multiple revenue generation opportunities, including retainer consulting, project consulting, market research, and published reports.

Acme Consulting is a new company specializing in international high-tech business development, channel development, distribution strategies, and marketing of high-tech products. The company’s initial focus is on providing development services to United States clients targeting European and Latin American markets, as well as European clients targeting the United States and Latin American markets. Acme Consulting aims to expand into other markets, such as the rest of Latin America and the Far East, and explore brokerage and representation positions to hold percentage stakes in product results.

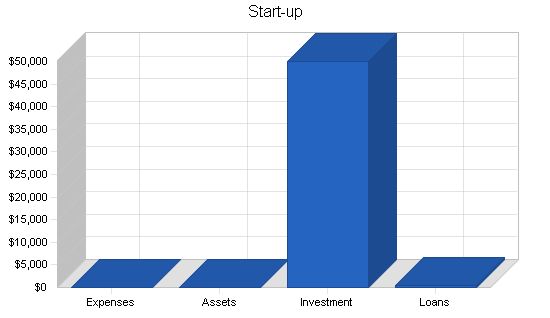

2.1 Start-up Summary:

The total start-up expense, including legal costs, logo design, stationery, and related expenses, amounts to $18,350. Start-up assets required are $7,000 for short-term assets (office furniture, etc.) and $25,000 in initial cash to cover the first few months of consulting operations while waiting for sales and accounts receivable to generate cash flow. Details are provided below.

Start-up Funding

Start-up Expenses: $0

Start-up Assets: $0

Total Funding Required: $0

Assets

Non-cash Assets from Start-up: $0

Cash Requirements from Start-up: $0

Additional Cash Raised: $50,350

Cash Balance on Starting Date: $50,350

Total Assets: $50,350

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $350

Other Current Liabilities (interest-free): $0

Total Liabilities: $350

Capital

Planned Investment

Investor 1: $20,000

Investor 2: $20,000

Other: $10,000

Total Planned Investment: $50,000

Loss at Start-up (Start-up Expenses): $0

Total Capital: $50,000

Total Capital and Liabilities: $50,350

Total Funding: $50,350

Start-up

Requirements

Start-up Expenses

Legal: $0

Stationery etc.: $0

Brochures: $0

Consultants: $0

Insurance: $0

Expensed equipment: $0

Other: $0

Total Start-up Expenses: $0

Start-up Assets

Cash Required: $0

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $0

Total Requirements: $0

Company Locations and Facilities

The initial office will be established in A-quality office space in the Santa Clara County "Silicon Valley" area of California, the heart of the U.S. high tech industry.

Company Ownership

Acme Consulting will be created as a California C corporation based in Santa Clara County, owned by its principal investors and principal operators. It has not been chartered yet and is still considering alternatives of legal formation.

Services

Acme offers the expertise a high-technology company needs to develop new product distribution and new market segments. This can be high-level retainer consulting, market research reports, or project-based consulting.

Service Description

1. Retainer consulting: We represent a client company as an extension of its business development and market development functions. This begins with complete understanding of the client company’s situation, objectives, and constraints. We then represent the client company quietly and confidentially, sifting through new market developments and new opportunities as is appropriate to the client, representing the client in initial talks with possible allies, vendors, and channels.

2. Project consulting: Proposed and billed on a per-project and per-milestone basis, project consulting offers a client company a way to harness our specific qualities and use our expertise to solve specific problems, develop and/or implement plans, and develop specific information.

3. Market research: Group studies available to selected clients at $5,000 per unit. A group study is a packaged and published complete study of a specific market, channel, or topic. Examples might be studies of developing consumer channels in Japan or Mexico, or implications of changing margins in software.

Competitive Comparison

The competition comes in several forms:

1. No consulting: Companies choosing to do business development, channel development, and market research in-house. Our advantage is that managers are already overloaded with responsibilities and don’t have time for additional responsibilities in new market development or new channel development. Also, Acme can approach alliances, vendors, and channels on a confidential basis, gathering information and making initial contacts in ways that corporate managers can’t.

2. Prestige management consulting: McKinsey, Bain, Arthur Anderson, Boston Consulting Group, etc. These are generalists who take their name-brand management consulting into specialty areas. Our advantage is that we compete against them as experts in our specific fields, with top-level people doing the actual work.

3. International market research companies: International Data Corporation (IDC), Dataquest, Stanford Research Institute, etc. These companies are formidable competitors for published market research and market forums, but cannot provide the high-level consulting that Acme will provide.

4. Market-specific smaller houses: For example, Nomura Research in Japan, Select S.A. de C.V. in Mexico (now affiliated with IDC).

5. Sales representation, brokering, and deal catalysts are an ad-hoc business form that will be defined by the specific nature of each individual case.

Sales Literature

The business will begin with a general corporate brochure establishing the positioning. This brochure will be developed as part of the start-up expenses. Literature and mailings for the initial market forums will be important.

Fulfillment

1. The key fulfillment and delivery will be provided by the principals of the business. The real core value is professional expertise, provided by a combination of experience, hard work, and education (in that order).

2. Qualified professionals will be turned to for freelance back-up in market research and presentation and report development, which are areas that can be sub-contracted without risking the core values provided to the clients.

Technology

Acme Consulting will maintain the latest Windows and Macintosh capabilities including:

1. Complete e-mail facilities on the Internet, Compuserve, America-Online, and Applelink, for working with clients directly through e-mail delivery of drafts and information.

2. Complete presentation facilities for preparation and delivery of multimedia presentations on Macintosh or Windows machines, in formats including on-disk presentation, live presentation, or video presentation.

3. Complete desktop publishing facilities for delivery of regular retainer reports, project output reports, marketing materials, and market research reports.

Future Services

In the future, Acme will broaden the coverage by expanding into coverage of additional markets (e.g., all of Latin America, Far East, Western Europe) and additional product areas (e.g., telecommunications and technology integration). There is also the possibility of newsletter or electronic newsletter services, or perhaps special on-topic reports.

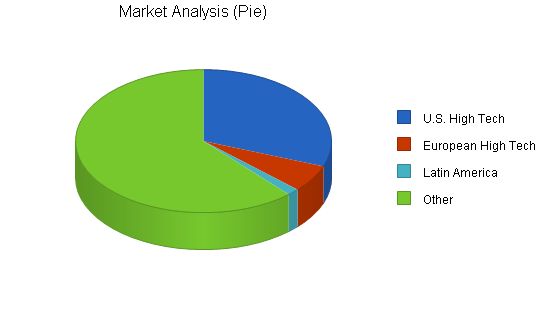

Market Analysis Summary

Acme will be focusing on high-technology manufacturers of computer hardware and software, services, and networking, who want to sell into markets in the United States, Europe, and Latin America. Our most important group of potential customers are executives in larger corporations, such as marketing managers, general managers, and sales managers. They are very sensitive to risking their company’s name and reputation.

Market Segmentation

Large manufacturer corporations: Our most important market segment is the large manufacturer of high-technology products, such as Apple, Hewlett-Packard, IBM, Microsoft, Siemens, or Olivetti. These companies will be calling on Acme for development functions that are better spun off than managed in-house, for market research, and for market forums.

Medium-sized growth companies: particularly in software, multimedia, and related high-growth fields, Acme will offer an attractive development alternative to companies that are management constrained and unable to address opportunities in new markets and new market segments.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR U.S. High Tech 10% 5,000 5,500 6,050 6,655 7,321 10.00% European High Tech 15% 1,000 1,150 1,323 1,521 1,749 15.00% Latin America 35% 250 338 456 616 832 35.07% Other 2% 10,000 10,200 10,404 10,612 10,824 2.00% Total 6.27% 16,250 17,188 18,233 19,404 20,726 6.27%

4.2 Target Market Segment Strategy

As shown in the previous table and Illustration, we need to focus on a few thousand carefully chosen potential customers in the United States, Europe, and Latin America. These high-tech manufacturing companies are the key customers for Acme.

4.3 Service Business Analysis

The consulting industry is fragmented, with numerous smaller consulting organizations and individuals for every well-known company. Consulting participants range from major international consultants to thousands of individuals. Acme’s challenge will be establishing itself as a legitimate consulting company, positioned as a safe corporate purchase.

4.3.1 Competition and Buying Patterns

Trust in the professional reputation and reliability of the consulting firm is the key factor in purchase decisions made by Acme’s clients.

4.3.2 Main Competitors

1. The high-level prestige management consulting:

Strengths: International locations, owner-partners with a deep understanding of general business. Enviable reputation makes consulting an easy decision for managers, despite high prices.

Weaknesses: Limited expertise in high-technology markets and products, high fees, work done by junior-level consultants.

2. The international market research company:

Strengths: International offices, specific market knowledge, permanent staff dedicated to market research.

Weaknesses: Market numbers not equivalent to business understanding at a high level.

3. Market or function specific experts:

Strengths: Expertise in specific areas.

Weaknesses: Limited scope, lack of overall management expertise.

4. Companies with in-house research and development:

Strengths: No incremental cost, work done by responsible individuals.

Weaknesses: Overburdened managers, additional risk, limited reach.

4.3.3 Business Participants

At the highest level are major names in management consulting, often organized as partnerships. Some evolved from accounting companies and others from management consulting. They charge high rates and have high overhead structures.

At an intermediate level are function-specific or market-specific consultants, such as market research and channel development firms.

Some consulting is provided by individuals between jobs.

4.3.4 Distributing a Service

Consulting is mainly sold and purchased through word-of-mouth, with relationships and previous experience being the most important factor. Name-brand consulting firms leverage their business through various associations. Medium-level firms have more limited distribution abilities.

Strategy and Implementation Summary

Acme will primarily focus on the United States, Europe, and Latin America, targeting personal computers, software, networks, telecommunications, personal organizers, and technology integration products. The target customers are typically managers in larger corporations or owners/presidents of medium-sized high-growth corporations.

5.1 Pricing Strategy

Acme Consulting will be priced competitively with name-brand consultants at the upper edge of the market. The pricing aligns with Acme’s positioning as a provider of high-level expertise. Project consulting is priced at $5,000 per day, market research at $2,000 per day, and retainer consulting starts at $10,000 per month. Market research reports are priced at $5,000 per report, ensuring high quality and relevance.

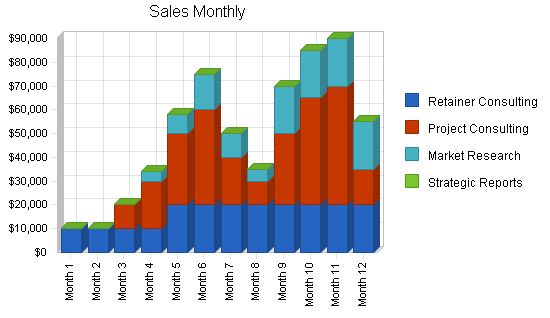

5.2 Sales Strategy

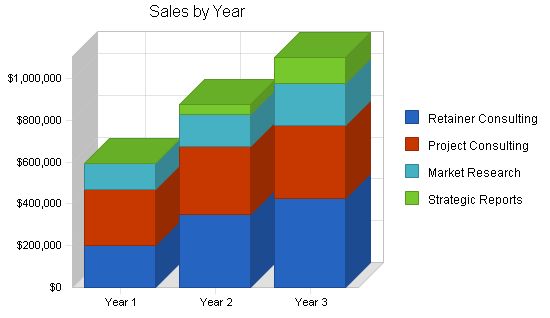

The monthly sales forecast is included in the appendix, while the annual projections are summarized in Table 5.2.

Sales Forecast

Year 1 Year 2 Year 3

Sales

Retainer Consulting $200,000 $350,000 $425,000

Project Consulting $270,000 $325,000 $350,000

Market Research $122,000 $150,000 $200,000

Strategic Reports $0 $50,000 $125,000

Total Sales $592,000 $875,000 $1,100,000

Direct Cost of Sales

Year 1 Year 2 Year 3

Retainer Consulting $30,000 $38,000 $48,000

Project Consulting $45,000 $56,000 $70,000

Market Research $84,000 $105,000 $131,000

Strategic Reports $0 $20,000 $40,000

Subtotal Direct Cost of Sales $159,000 $219,000 $289,000

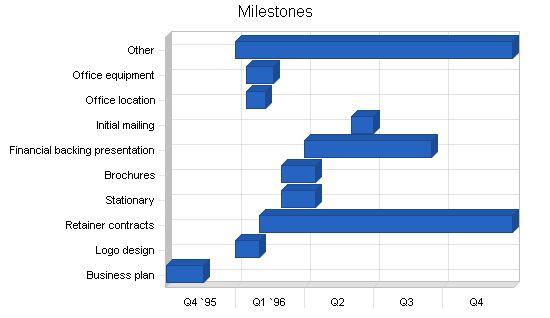

5.3 Milestones

Our milestones are listed in the table and chart below. The associated budgets are included in the projected Profit and Loss statement, found in Chapter 7 of this plan.

Milestones:

– Milestone: Start Date – End Date, Budget: $Amount, Manager: Name, Department: Name

– Business plan: 10/1/1995 – 11/19/1995, $5,000, HM, Devpt

– Logo design: 1/1/1996 – 2/1/1996, $2,000, TAJ, Marketing

– Retainer contracts: 2/1/1996 – 12/31/1996, $10,000, HM, Sales

– Stationary: 3/1/1996 – 4/15/1996, $500, JD, G&A

– Brochures: 3/1/1996 – 4/15/1996, $2,500, TAJ, Marketing

– Financial backing presentation: 4/1/1996 – 9/15/1996, $10,000, HM, Devpt

– Initial mailing: 6/1/1996 – 7/1/1996, $5,000, HM, Sales

– Office location: 1/15/1996 – 2/9/1996, $5,000, JD, G&A

– Office equipment: 1/15/1996 – 2/19/1996, $12,500, JD, G&A

– Other: 1/1/1996 – 12/31/1996, $10,000, ABC, Department

– Totals: $62,500

5.4 Strategic Alliances:

– Currently, strategic alliances with Smith and Jones are possibilities, based on existing discussions.

– Prospective partners include European companies like Siemens, Olivetti, and others, as well as United States companies related to Apple Computer.

– Printaform is a key local high-technology vendor in Latin America.

Management Summary:

– The initial management team relies on the founders themselves, with little backup.

– As the company grows, additional consulting help, graphic/editorial, sales, and marketing staff will be added.

6.1 Organizational Structure:

– Acme should be managed by working partners, following a structure primarily based on Smith Partners.

– In the beginning, there will be 3-5 partners.

– The organization will have a flat structure, with each founder responsible for their own work and management.

6.2 Management Team:

– The Acme team requires a high level of international experience and expertise.

– Partners will also be involved in the fulfillment of the core business proposition, providing expertise to clients.

– The initial team includes 3-5 partners, 1-3 consultants, 1 editorial/graphic person with staff support, 1 marketing person, 1 office manager, and 1 secretary.

– Additional partners, consultants, and sales staff will be added later.

6.3 Personnel Plan:

– The detailed monthly personnel plan for the first year is included in the appendix.

– The annual personnel estimates are as follows:

Personnel Plan:

– Year 1:

– Partners: $144,000

– Consultants: $0

– Editorial/graphic: $18,000

– VP Marketing: $20,000

– Sales people: $0

– Office Manager: $7,500

– Secretarial: $5,250

– Total People: 7

– Total Payroll: $194,750

– Year 2:

– Partners: $175,000

– Consultants: $50,000

– Editorial/graphic: $22,000

– VP Marketing: $50,000

– Sales people: $30,000

– Office Manager: $30,000

– Secretarial: $20,000

– Total People: 14

– Total Payroll: $377,000

– Year 3:

– Partners: $200,000

– Consultants: $63,000

– Editorial/graphic: $26,000

– VP Marketing: $55,000

– Sales people: $33,000

– Office Manager: $33,000

– Secretarial: $22,000

– Total People: 20

– Total Payroll: $432,000

– The financial plan is based on conservative estimates and assumptions.

– Initial investment will be necessary to make the financials work.

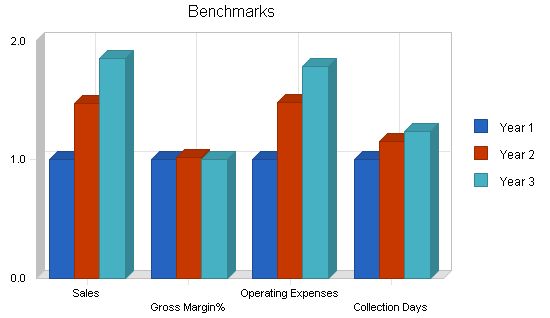

7.1 Key Financial Indicators:

– The following chart indicates the key financial indicators for the first three years.

– Sales and operating expenses are projected to experience significant growth.

– Collection days may increase as the business expands.

7.2 Important Assumptions

Table 7.1 summarizes financial assumptions, including a 45-day average collection period, sales on invoice basis, expenses on net 30 basis, and current interest rates.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Interest Rates | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

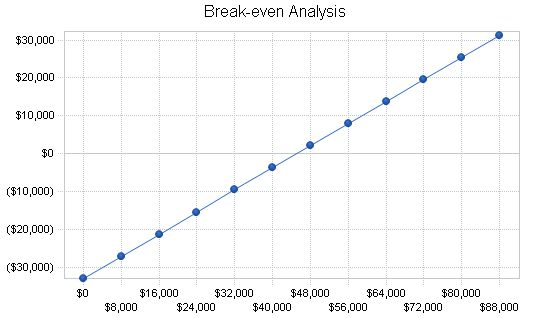

7.3 Break-even Analysis

Table 7.3 summarizes the break-even analysis, including monthly sales break-even points.

Break-even Analysis:

Monthly Revenue Break-even: $45,158

Assumptions:

– Average Percent Variable Cost: 27%

– Estimated Monthly Fixed Cost: $33,029

7.4 Projected Profit and Loss:

In the appendix, you can find the detailed monthly pro-forma income statement for the first year. The annual estimates are also included here.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales $592,000 $875,000 $1,100,000

Direct Cost of Sales $159,000 $219,000 $289,000

Other Costs of Sales $0 $0 $0

Total Cost of Sales $159,000 $219,000 $289,000

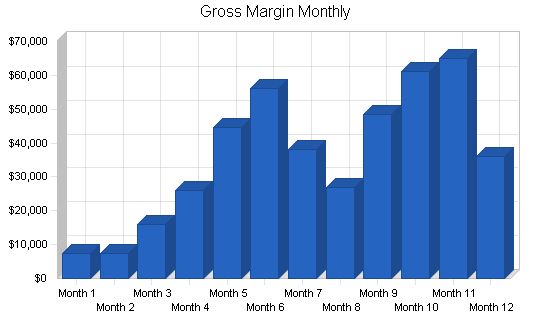

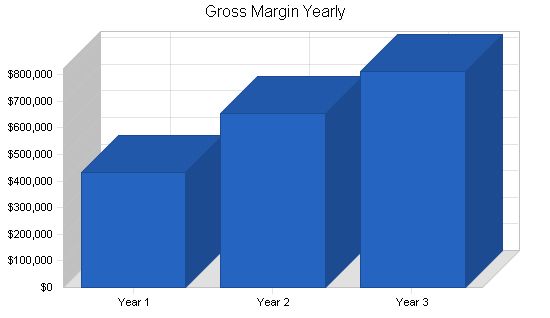

Gross Margin $433,000 $656,000 $811,000

Gross Margin % 73.14% 74.97% 73.73%

Expenses:

Payroll $194,750 $377,000 $432,000

Marketing/Promotion $162,000 $137,000 $195,000

Depreciation $0 $0 $0

Leased Equipment $6,000 $7,000 $7,000

Utilities $12,000 $12,000 $12,000

Insurance $3,600 $2,000 $2,000

Rent $18,000 $52,780 $60,480

Payroll Taxes $0 $0 $0

Other $0 $0 $0

Total Operating Expenses $396,350 $587,780 $708,480

Profit Before Interest and Taxes $36,650 $68,220 $102,520

EBITDA $36,650 $68,220 $102,520

Interest Expense $7,222 $10,940 $10,940

Taxes Incurred $8,828 $17,184 $27,474

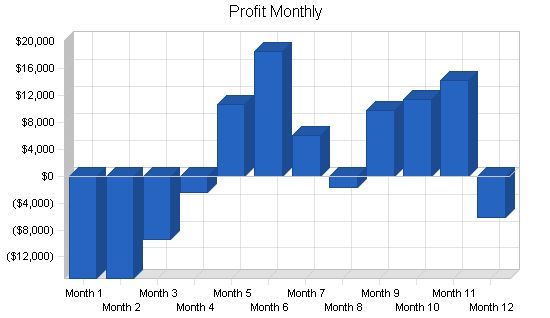

Net Profit $20,600 $40,096 $64,106

Net Profit/Sales 3.48% 4.58% 5.83%

7.5 Projected Cash Flow:

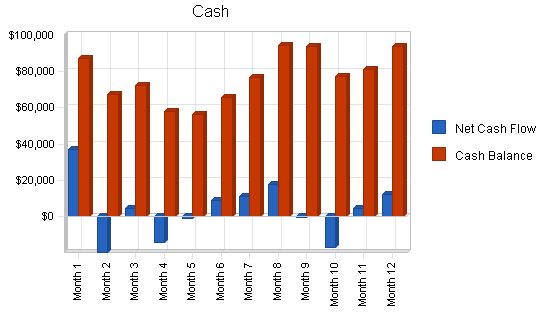

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included in Table 7.5. Detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $0 $0 $0

Cash from Receivables $495,000 $828,630 $1,063,133

Subtotal Cash from Operations $495,000 $828,630 $1,063,133

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $30,000 $100,000 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $50,000 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $8,000 $0 $0

Subtotal Cash Received $583,000 $928,630 $1,063,133

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $194,750 $377,000 $432,000

Bill Payments $344,281 $452,988 $591,895

Subtotal Spent on Operations $539,031 $829,988 $1,023,895

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $30,000 $50,000

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $600 $10,000 $10,000

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $539,631 $869,988 $1,083,895

Net Cash Flow $43,369 $58,642 ($20,761)

Cash Balance $93,719 $152,362 $131,600

7.6 Projected Balance Sheet

The balance sheet shows healthy growth of net worth and a strong financial position. The monthly estimates are in the appendix.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3

Assets

Current Assets

Cash $93,719 $152,362 $131,600

Accounts Receivable $97,000 $143,370 $180,236

Other Current Assets $0 $0 $0

Total Current Assets $190,719 $295,731 $311,837

Long-term Assets

Long-term Assets $0 $0 $0

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $0

Total Assets $190,719 $295,731 $311,837

Liabilities and Capital

Year 1 Year 2 Year 3

Current Liabilities

Accounts Payable $32,720 $37,636 $49,635

Current Borrowing $30,000 $100,000 $50,000

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $62,720 $137,636 $99,635

Long-term Liabilities $49,400 $39,400 $29,400

Total Liabilities $112,120 $177,036 $129,035

Paid-in Capital $58,000 $58,000 $58,000

Retained Earnings $0 $20,600 $60,696

Earnings $20,600 $40,096 $64,106

Total Capital $78,600 $118,696 $182,802

Total Liabilities and Capital $190,719 $295,731 $311,837

Net Worth $78,600 $118,696 $182,802

7.7 Business Ratios

The following table shows the projected business ratios. We expect to maintain healthy ratios for profitability, risk, and return. The industry comparisons are for SIC 8742, management consulting services.

Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

Sales Growth 0.00% 47.80% 25.71% 6.98%

Percent of Total Assets

Accounts Receivable 50.86% 48.48% 57.80% 26.80%

Other Current Assets 0.00% 0.00% 0.00% 48.96%

Total Current Assets 100.00% 100.00% 100.00% 75.76%

Long-term Assets 0.00% 0.00% 0.00% 24.24%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 32.89% 46.54% 31.95% 31.78%

Long-term Liabilities 25.90% 13.32% 9.43% 17.26%

Total Liabilities 58.79% 59.86% 41.38% 49.04%

Net Worth 41.21% 40.14% 58.62% 50.96%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 73.14% 74.97% 73.73% 100.00%

Selling, General & Administrative Expenses 69.66% 70.39% 67.90% 85.31%

Advertising Expenses 0.00% 0.00% 0.00% 1.02%

Profit Before Interest and Taxes 6.19% 7.80% 9.32% 1.90%

Main Ratios

Current 3.04 2.15 3.13 1.88

Quick 3.04 2.15 3.13 1.48

Total Debt to Total Assets 58.79% 59.86% 41.38% 3.41%

Pre-tax Return on Net Worth 37.44% 48.26% 50.10% 55.78%

Pre-tax Return on Assets 15.43% 19.37% 29.37% 7.72%

Additional Ratios

Year 1 Year 2 Year 3

Net Profit Margin 3.48% 4.58% 5.83% n.a

Return on Equity 26.21% 33.78% 35.07% n.a

Activity Ratios

Accounts Receivable Turnover 6.10 6.10 6.10 n.a

Collection Days 43 50 54 n.a

Accounts Payable Turnover 11.51 12.17 12.17 n.a

Payment Days 27 28 26 n.a

Total Asset Turnover 3.10 2.96 3.53 n.a

Debt Ratios

Debt to Net Worth 1.43 1.49 0.71 n.a

Current Liab. to Liab. 0.56 0.78 0.77 n.a

Liquidity Ratios

Net Working Capital $128,000 $158,096 $212,202 n.a

Interest Coverage 5.07 6.24 9.37 n.a

Additional Ratios

Year 1 Year 2 Year 3

Assets to Sales 0.32 0.34 0.28 n.a

Current Debt/Total Assets 33% 47% 32% n.a

Acid Test 1.49 1.11 1.32 n.a

Sales/Net Worth 7.53 7.37 6.02 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales

Retainer Consulting $10,000 $10,000 $10,000 $10,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000

Project Consulting $0 $0 $10,000 $20,000 $30,000 $40,000 $20,000 $10,000 $30,000 $45,000 $50,000 $15,000

Market Research $0 $0 $0 $4,000 $8,000 $15,000 $10,000 $5,000 $20,000 $20,000 $20,000 $20,000

Strategic Reports $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Sales $10,000 $10,000 $20,000 $34,000 $58,000 $75,000 $50,000 $35,000 $70,000 $85,000 $90,000 $55,000

Direct Cost of Sales

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Retainer Consulting $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Project Consulting $0 $0 $1,500 $3,500 $5,000 $6,500 $3,500 $1,500 $5,000 $7,500 $8,500 $2,500

Market Research $0 $0 $0 $2,000 $6,000 $10,000 $6,000 $4,000 $14,000 $14,000 $14,000 $14,000

Strategic Reports $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $2,500 $2,500 $4,000 $8,000 $13,500 $19,000 $12,000 $8,000 $21,500 $24,000 $25,000 $19,000

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Partners | 140% | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 |

| Consultants | 125% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Editorial/graphic | 120% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $6,000 | $6,000 | $6,000 |

| VP Marketing | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $5,000 | $5,000 | $5,000 |

| Sales people | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Office Manager | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $2,500 | $2,500 | $2,500 |

| Secretarial | 110% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,750 | $1,750 | $1,750 |

| Total People | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 5 | 7 | 7 | 7 | |

| Total Payroll | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $17,000 | $27,250 | $27,250 | $27,250 | ||

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $10,000 | $10,000 | $20,000 | $34,000 | $58,000 | $75,000 | $50,000 | $35,000 | $70,000 | $85,000 | $90,000 | $55,000 | |

| Direct Cost of Sales | $2,500 | $2,500 | $4,000 | $8,000 | $13,500 | $19,000 | $12,000 | $8,000 | $21,500 | $24,000 | $25,000 | $19,000 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $2,500 | $2,500 | $4,000 | $8,000 | $13,500 | $19,000 | $12,000 | $8,000 | $21,500 | $24,000 | $25,000 | $19,000 | |

| Gross Margin | $7,500 | $7,500 | $16,000 | $26,000 | $44,500 | $56,000 | $38,000 | $27,000 | $48,500 | $61,000 | $65,000 | $36,000 | |

| Gross Margin % | 75.00% | 75.00% | 80.00% | 76.47% | 76.72% | 74.67% | 76.00% | 77.14% | 69.29% | 71.76% | 72.22% | 65.45% | |

| Expenses | |||||||||||||

| Payroll | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $12,000 | $17,000 | $27,250 | $27,250 | $27,250 | ||

| Marketing/Promotion | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Utilities | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |

| Insurance | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |

| Rent | 0% | $1,500 | $1,

Pro Forma Cash Flow: Cash Received Cash from Operations Cash Sales Cash from Receivables Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Principal Repayment of Current Borrowing Other Liabilities Principal Repayment Long-term Liabilities Principal Repayment Purchase Other Current Assets Purchase Long-term Assets Dividends Subtotal Cash Spent Net Cash Flow Cash Balance Pro Forma Balance Sheet: Assets Starting Balances Current Assets Cash Accounts Receivable Other Current Assets Total Current Assets Long-term Assets Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Subtotal Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth |

||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!