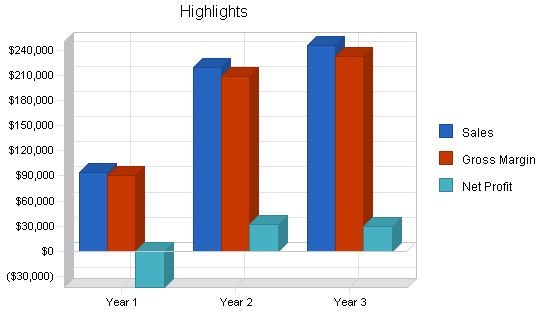

PRfect Greens is an environmental PR firm based in Eugene, Ore. They specialize in crisis management, image creation, and managing publicity events for companies with sensitive environmental concerns. Their clients include mining, natural gas extraction, and lumber companies who want to improve their public environmental image. PRfect Greens differentiates itself from other PR firms through its specialized skill set and flexibility. With two industry professionals at its helm, PRfect Greens aims to achieve profitability by month 10 and generate significant revenues by year three.

1.1 Mission

PRfect Greens’ mission is to provide the highest quality environmental PR consultancy. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customer expectations.

1.2 Keys to Success

The keys to success are attention to detail, thinking outside the box, professionalism, and results.

1.3 Objectives

The objectives for the first three years include:

1. To create a start-up company whose primary goal is to exceed customer expectations.

2. To increase the number of clients served by at least 20% per year through superior performance and referrals.

3. To develop a sustainable business that can survive off its own cash flow.

PRfect Greens is an environmental PR consultancy firm that specializes in working with companies perceived as anti-environmental.

PRfect Greens is a partnership of two industry PR veterans, Birk Grunola and Arbor Hugger.

PRfect Greens will provide PR services to local and regional firms in need of immediate reactionary help and long-term management.

2.1 Company Ownership

PRfect Greens is a private partnership owned equally by Birk Grunola and Arbor Hugger.

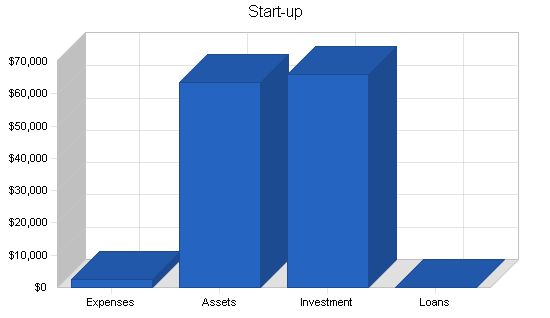

2.2 Start-up Summary

The following equipment will be needed. Please note that items considered assets to be used for more than a year will be labeled long-term assets and will be depreciated using the GAAP-approved straight-line depreciation method.

– Two desks and chairs.

– Two file cabinets.

– Two computer systems including one license of QuickBooks Pro, two licenses of Microsoft Office, a CD-RW, printer, digital camera, and a DSL connection.

– Burrelle’s media directory.

– Subscription to LexisNexis researching tools.

– Website development.

Start-up Requirements:

– Legal: $1,000

– Stationery etc.: $50

– Brochures: $100

– Website development: $1,000

– Lexis Nexus subscription: $300

– Total Start-up Expenses: $2,450

Start-up Assets:

– Cash Required: $59,850

– Other Current Assets: $0

– Long-term Assets: $3,700

– Total Assets: $63,550

Total Requirements: $66,000

Start-up Funding:

– Start-up Expenses to Fund: $2,450

– Start-up Assets to Fund: $63,550

– Total Funding Required: $66,000

Assets:

– Non-cash Assets from Start-up: $3,700

– Cash Requirements from Start-up: $59,850

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $59,850

– Total Assets: $63,550

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

Capital:

– Planned Investment:

– Arbor: $33,000

– Birk: $33,000

– Additional Investment Requirement: $0

– Total Planned Investment: $66,000

Loss at Start-up (Start-up Expenses): ($2,450)

Total Capital: $63,550

Total Capital and Liabilities: $63,550

Total Funding: $66,000

Services:

PRfect Greens offers environmental PR services. These services cater to gas, mining, and lumber companies aiming to enhance their environmental image or handle crises. The main services provided are:

– Crisis management: Reactive/proactive assistance in managing crises or situations that may negatively impact the public image of environmentally sensitive companies.

Market Analysis Summary:

PRfect Greens will mainly target gas, mining, and lumber companies within the environmental PR space. These industries have significant business activity and have struggled with maintaining a favorable public image. The company will utilize tailored advertising campaigns and networking activities for each industry.

Market Segmentation:

PRfect Greens has three customer groups:

– Gas companies: Engaged in subterranean drilling for natural gas reserves. They may seek PRfect Greens’ assistance in strengthening their image as environmentally friendly energy providers. Additionally, they may require crisis management services or promotional activities.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5

Potential Customers Growth CAGR

Gas companies 15 16 17 18 19 6.09%

Mining companies 44 48 52 57 62 8.95%

Lumber companies 38 41 44 47 50 7.10%

Total 97 105 113 122 131 7.80%

4.2 Target Market Segment Strategy

The selected customer segments will be targeted in an advertising and networking campaign.

Advertising: This campaign will target prospective customers through industry trade journals. It will highlight PRfect Greens as a specialized environmental PR firm that provides proactive and reactive PR services. The advertisements will also showcase the founders’ expertise and the services provided by PRfect Greens.

4.3 Service Business Analysis

The PR industry in Eugene has various competitors. However, few possess the specialized skills required for environmental PR work. Competitors include general communication firms, small local PR firms, and large national firms.

PRfect Greens will gain market share by leveraging their competitive edges, which include their specialized skill set for environmental PR and their flexibility in addressing client needs.

4.3.1 Competition and Buying Patterns

Competition exists in the form of general communication firms, which offer a wide range of communication services. Buying patterns for companies typically involve RFPs for larger companies and informal referrals/networking for smaller clients.

Strategy and Implementation Summary

PRfect Greens’ marketing and sales strategies aim to establish visibility and communicate their unmatched service offering. They emphasize their specialized skill set and flexibility in serving clients.

5.1 Competitive Edge

PRfect Greens’ competitive edge lies in their specialized skill set. This allows them to provide valuable insight into the customer’s industry and its relationship with public relations.

PRfect Greens will use targeted advertising and networking to generate visibility and communicate their message as the premier environmental PR firm. Advertising will focus on specific industry journals, chosen to reach a specific demographic. Networking activities will leverage existing relationships established by Birk and Arbor.

5.3 Sales Strategy

The sales strategy focuses on turning prospective customers into long-term clients. It involves a presentation outlining PRfect Greens’ services, personalized attention, past client portfolio, and creative thinking. The portfolio itself will showcase PRfect Greens’ creativity and competence.

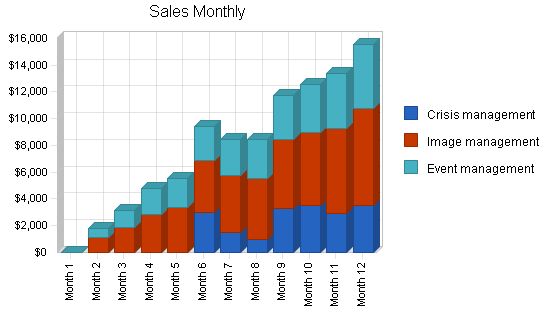

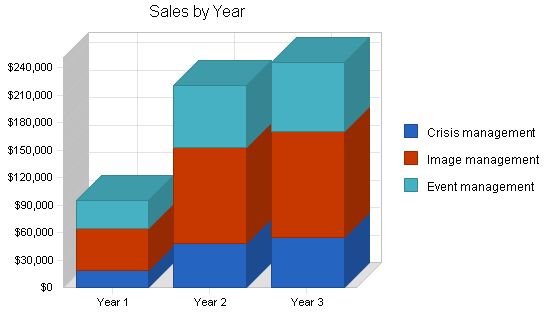

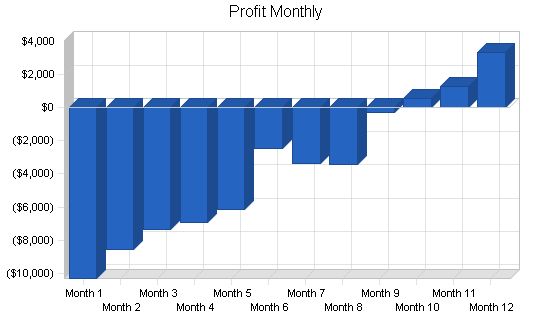

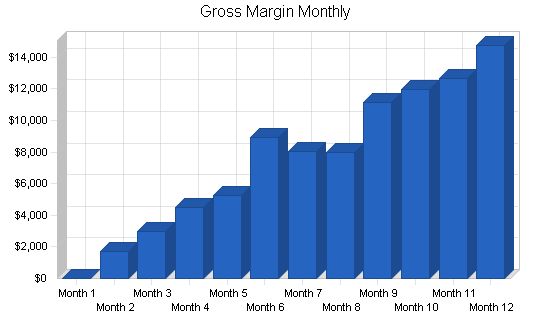

5.3.1 Sales Forecast

The first month will be dedicated to setting up the office and devising the marketing campaign, with no sales activity. The second month will see a small amount of activity with limited duration projects.

By month three and four, visibility will have increased, leading to a growing number of inquiries and projects.

Sales will steadily increase, reaching profitability by month 10, and continuing to increase through the end of year three.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Crisis management | $18,700 | $48,000 | $55,000 |

| Image management | $46,069 | $104,556 | $115,676 |

| Event management | $29,945 | $67,961 | $75,189 |

| Total Sales | $94,714 | $220,517 | $245,865 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Crisis management | $935 | $2,400 | $2,750 |

| Image management | $2,303 | $5,228 | $5,784 |

| Event management | $1,497 | $3,398 | $3,759 |

| Subtotal Direct Cost of Sales | $4,736 | $11,026 | $12,293 |

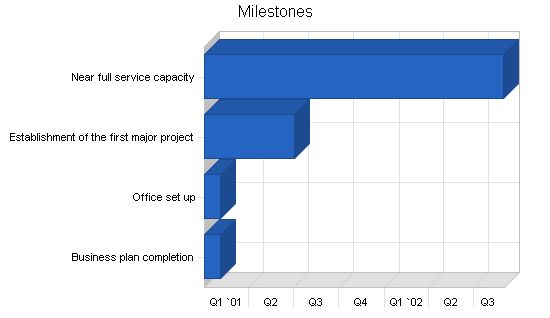

5.4 Milestones

PRfect Greens will have several milestones early on:

- Business plan completion. Business plans are typically created to secure capital, but PRfect Greens will use the plan to develop a strategic focus and track adherence to the plan at multiple intervals.

- Office set up.

- Establishment of the first major project.

- Near full service capacity.

Milestones:

| Business plan completion | 1/1/2001 | 2/1/2001 | $0 | Arbor | Marketing |

| Office set up | 1/1/2001 | 2/1/2001 | $0 | Birk | Department |

| Establishment of the first major project | 1/1/2001 | 7/1/2001 | $0 | Arbor & Birk | Department |

| Near full service capacity | 1/1/2001 | 8/30/2002 | $0 | Everyone | Department |

| Totals | $0 |

Web Plan Summary:

The website will serve as a resource for developing visibility, disseminating information such as a portfolio of past projects and case studies, and providing a way for prospective customers to contact PRfect Greens.

Website Marketing Strategy:

The marketing of the website will include the following actions:

– Search engine submission for prospective customers using the Internet for research. PRfect Greens will submit their site to popular search engines to appear at the top of the search list.

– Advertising the site through written materials distributed to prospective customers.

Development Requirements:

The website development will be done by a University of Oregon computer science graduate student. The student will be chosen for their technical competence and below-market rates.

Management Summary:

Birk Grunola:

Birk received a BS in communications and environmental science from the University of Oregon. He worked for the Weyerhauser corporation in their marketing department and eventually became the head of the in-house staff for external communications. After five years in this position, Birk wanted more flexibility and autonomy.

Arbor Hugger:

Arbor received a biology degree from American University. He worked for the Environmental Protection Industry (EPA) in Washington D.C., progressing to a managerial role in external communications. After 10 years at the EPA, Arbor sought a more progressive organization and became the PR director for the National Gas Exploration Association. After three years, Arbor wanted more flexibility. Arbor and Birk, who remained in contact since high school, decided to start their own firm after realizing they were both unhappy in their current jobs.

Personnel Plan:

Birk and Arbor are the firm’s principals. They will hire a part-time administrative assistant by month four.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Arbor | $48,000 | $60,000 | $70,000 |

| Birk | $48,000 | $60,000 | $70,000 |

| Administrative assistant | $8,640 | $11,520 | $15,000 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $104,640 | $131,520 | $155,000 |

This section will outline important financial information.

Important Assumptions:

The following table details important financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

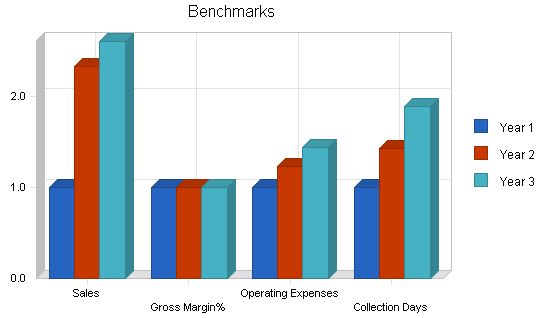

Key Financial Indicators:

The following table outlines the key financial indicators.

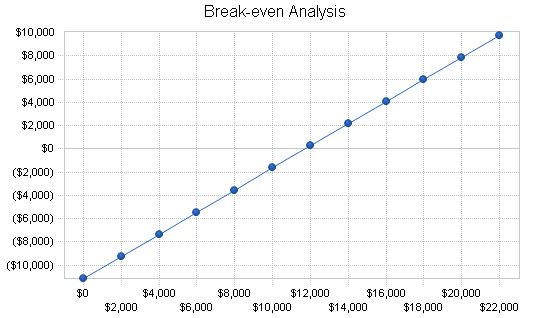

Break-even Analysis determines the monthly revenue required to reach the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $11,725 |

| Assumptions: | |

| Average Percent Variable Cost | 5% |

| Estimated Monthly Fixed Cost | $11,139 |

Contents

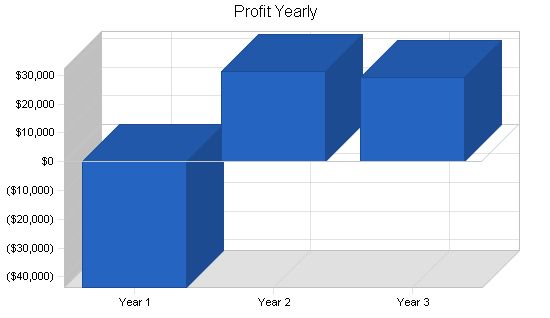

8.4 Projected Profit and Loss

The table below shows projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $94,714 | $220,517 | $245,865 |

| Direct Cost of Sales | $4,736 | $11,026 | $12,293 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $4,736 | $11,026 | $12,293 |

| Gross Margin | $89,978 | $209,492 | $233,572 |

| Gross Margin % | 95.00% | 95.00% | 95.00% |

| Expenses | |||

| Payroll | $104,640 | $131,520 | $155,000 |

| Sales and Marketing and Other Expenses | $4,200 | $4,200 | $4,200 |

| Depreciation | $732 | $732 | $732 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,200 | $1,200 | $1,200 |

| Insurance | $1,200 | $1,200 | $1,200 |

| Rent | $6,000 | $6,000 | $6,000 |

| Payroll Taxes | $15,696 | $19,728 | $23,250 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $133,668 | $164,580 | $191,582 |

| Profit Before Interest and Taxes | ($43,690) | $44,912 | $41,990 |

| EBITDA | ($42,958) | $45,644 | $42,722 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $13,473 | $12,597 |

| Net Profit | ($43,690) | $31,438 | $29,393 |

| Net Profit/Sales | -46.13% | 14.26% | 11.95% |

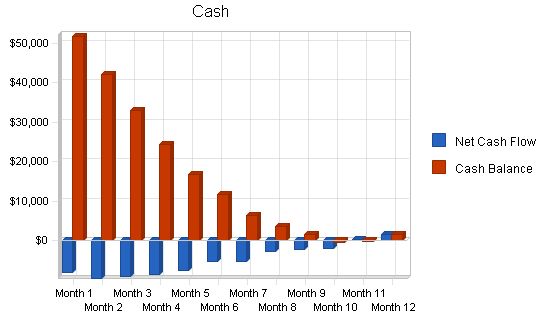

Projected Cash Flow

The chart and table below show projected cash flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $33,150 | $77,181 | $86,053 |

| Cash from Receivables | $43,071 | $118,773 | $154,863 |

| Subtotal Cash from Operations | $76,221 | $195,954 | $240,916 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $76,221 | $195,954 | $240,916 |

Projected Balance Sheet

The following table indicates the projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $1,465 | $10,676 | $36,174 |

| Accounts Receivable | $18,493 | $43,057 | $48,006 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $19,958 | $53,733 | $84,180 |

| Long-term Assets | |||

| Long-term Assets | $3,700 | $3,700 | $3,700 |

| Accumulated Depreciation | $732 | $1,464 | $2,196 |

| Total Long-term Assets | $2,968 | $2,236 | $1,504 |

| Total Assets | $22,926 | $55,969 | $85,684 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $3,066 | $4,671 | $4,992 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $3,066 | $4,671 | $4,992 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $3,066 | $4,671 | $4,992 |

Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8743, Public Relations Service, are shown for comparison.

| Ratio Analysis | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales Growth | 0.00% | 132.82% | 11.49% | 8.60% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percent of Total Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Receivable | 80.67% | 76.93% | 56.03% | 24.20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 44.30% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Current Assets | 87.05% | 96.00% | 98.24% | 72.50% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term Assets | 12.95% | 4.00% | 1.76% | 27.50% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Payable | 13.37% | 8.35% | 5.83% | 45.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 17.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 13.37% | 8.35% | 5.83% | 62.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Worth | 86.63% | 91.65% | 94.17% | 38.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Percent of Sales | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross Margin | 95.00% | 95.00% | 95.00% | 0.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selling, General & Administrative Expenses | 141.13% | 80.74% | 83.05% | 79.40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Advertising Expenses | 2.53% | 1.09% | 0.98% | 1.20% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Profit Before Interest and Taxes | -46.13% | 20.37% | 17.08% | 2.40% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Main Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current | 6.51 | 11.50 | 16.86 | 1.71 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quick | 6.51 | 11.50 | 16.86 | 1.36 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt to Total Assets | 13.37% | 8.35% | 5.83% | 62.00% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax Return on Net Worth | -219.99% | 87.55% | 52.04% | 5.10% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-tax Return on Assets | -190.57% | 80.24% | 49.01% | 13.50% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Ratios | Year 1 | Year 2 | Year 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Profit Margin | -46.13% | 14.26% | 11.95% | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on Equity | -219.99% | 61.28% | 36.43% | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Activity Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Receivable Turnover | 3.33 | 3.33 | 3.33 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Collection Days | 55 | 78 | 104 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accounts Payable Turnover | 10.78 | 12.17 | 12.17 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Days | 27 | 25 | 29 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Asset Turnover | 4.13 | 3.94 | 2.87 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt to Net Worth | 0.15 | 0.09 | 0.06 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Liquidity Ratios | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Working Capital | $16,892 | $49,062 | $79,187 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Additional Ratios | Year 1 | Year 2 | Year 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets to Sales | 0.24 | 0.25 | 0.35 | n.a | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

READ MORE Formwork Construction Business Plan Example

Pro Forma Profit and Loss:

Pro Forma Cash Flow Cash Received – Cash from Operations – Cash Sales – Cash from Receivables Subtotal Cash from Operations Additional Cash Received – Sales Tax, VAT, HST/GST Received – New Current Borrowing – New Other Liabilities (interest-free) – New Long-term Liabilities – Sales of Other Current Assets – Sales of Long-term Assets – New Investment Received Subtotal Cash Received Expenditures – Expenditures from Operations – Cash Spending – Bill Payments Subtotal Spent on Operations Additional Cash Spent – Sales Tax, VAT, HST/GST Paid Out – Principal Repayment of Current Borrowing – Other Liabilities Principal Repayment – Long-term Liabilities Principal Repayment – Purchase Other Current Assets – Purchase Long-term Assets – Dividends Subtotal Cash Spent Net Cash Flow Cash Balance Pro Forma Balance Sheet Assets – Current Assets – Cash – Accounts Receivable – Other Current Assets – Total Current Assets Long-term Assets – Long-term Assets – Accumulated Depreciation – Total Long-term Assets Total Assets Liabilities and Capital – Current Liabilities – Accounts Payable – Current Borrowing – Other Current Liabilities – Subtotal Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth

Business Plan Outline

“> Hello! I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com. My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals. Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success! | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||