Contents

Conducting Market Analysis in a Crisis

Market analysis in a crisis presents serious challenges. Our steady assumptions have changed. Businesses are closed and unemployment has skyrocketed. The duration of the crisis is uncertain.

However, as business owners, we are still making critical decisions. Some must be made immediately while others rely on market analysis.

We cannot simply accept the impossibility of the situation. We must understand and adapt to the new circumstances. This is even more crucial during a crisis when so much has changed.

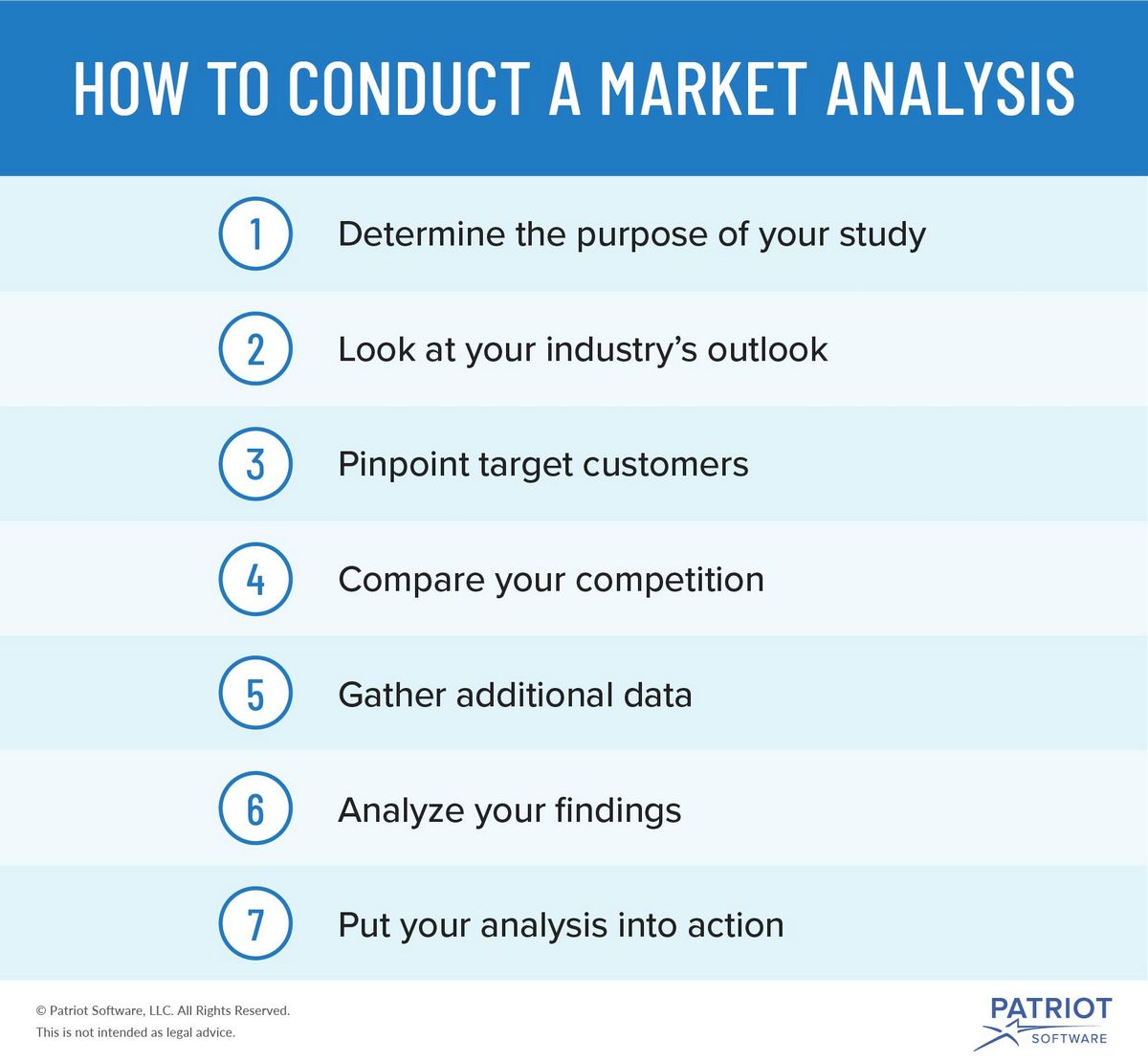

Start with the fundamentals of market analysis

Despite the crisis, the fundamentals of market analysis still apply. You need to estimate the total potential market, potential market value, reachable market, and the most important market segments. Additionally, identify the target market segments and distribution channels you specifically target. If you need a refresher on the basics, you can start with the following:

- How to Develop a Market Analysis for Your Business Plan

- How to Write a Market Analysis

- TAM, SAM, and SOM explained

During a crisis, most of the information we gather for market analysis is about the recent past. We collect census information, economic database information, and publicly available financial information. We also consider data from published research, interviews, and market reports. In some cases, we supplement with our own experience or primary research.

However, it mainly focuses on what has been true in the recent past. At times, we compare short and long-term trends. We also make guesses about the future, but these guesses are only relevant during or after the crisis. The goal is to establish a current market landscape and gather as much useful information as possible.

Crisis market analysis

A crisis disrupts everything. For example, as of May 2020, many businesses such as restaurants, taxis, and retail stores face significant challenges. At first glance, previous data seems irrelevant and market research appears impossible. However, we must look beyond the obvious.

We rely on a combination of past data and reasonable assumptions. To analyze restaurants, for instance, we can start with the existing demographics in the county from the last economic census. Then, we assume a percentage of closures and a percentage of establishments offering takeout and delivery. We also estimate the revenue generated from these services.

If time and budget permit, we can conduct primary research by contacting restaurant owners. This gives us better inputs to inform our assumptions. However, in reality, we may have to work with estimates.

Generally, we need to understand what the market was initially, and then make educated guesses based on specific research or assumptions to determine how it has changed and will recover over time.

Has your total addressable market (TAM) changed?

The crisis may impact the long-term total market for goods and services. However, this remains uncertain. In the short-term, some establishments have closed or switched to takeout and delivery. Less competition might be observed at present, but will this trend continue?

Economists speculate that suppressed demand will surge after the crisis ends. However, long-term changes depend on behaviors throughout the crisis. As a business, you need to estimate these changes or invest in primary research to inform your assumptions.

For instance, after the crisis, people might return to restaurants more frequently or opt to cook at home more. Restaurants might face capacity limits due to social distancing guidelines. Additionally, consumers might be hesitant to gather in public places until a vaccine is widely available. These are all factors to consider.

We might see a rise in remote work and online meetings in the long-term. The crisis has shown the benefits of online tools, and this trend may persist. Conversely, the economic impact of unemployment may decrease the market for consumer goods. Ultimately, these are educated guesses, and ongoing tracking and scenario planning are essential.

Has your serviceable available market (SAM) changed?

The crisis affects the portion of the market that you can acquire (SAM) and requires business-by-business analysis. Restrictions on brick and mortar businesses may necessitate a shift to online platforms, increasing the SAM for some.

Less certainty, more educated guessing

Business decisions cannot be put on hold during a crisis. We must use our judgment and common sense, making reasonable assumptions. Although uncertainty is higher in times of crisis, we still need to track results and revise our plans over time.

For more information on tracking results, learn how to run an effective plan review meeting.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!