Contents

Financial Holding Company Business Plan

Domino Comptech Holdings (DCH) formed as a diversified financial holding company to facilitate the acquisition of existing companies and provide additional capital to increase their volume and profitability.

The overall business model of DCH creates a complete solution platform of unlimited marketing opportunities. This platform combines natural relationship marketing synergies and enables the combined companies to provide a wide variety of technology solutions at cost savings to clients.

Acquire an Internet Service Provider:

Domino Comptech acquired ZumoNet, an Internet Service Provider (ISP) company from Lynx Caracal in exchange for 1,500,000 shares of common stock of DCH. The company plans to expand ZumoNet’s customer base and increase recurring revenue. Expanding the marketing base will yield increased profits as the revenue stream increases and expenses are minimized through consolidation.

Acquire a Technology company that manufactures White Box computers and provides networking services and support:

Domino Comptech has entered into an agreement to acquire Kettle-Moraine Computers, Inc. (KMCI) in exchange for 20,000,000 shares of common stock of DCH and a loan of $5,000,000. The agreement allows Domino Comptech to immediately acquire and control 100% of KMCI, including its revenue stream. KMCI aims to become a full-service technology provider, with marketing inroads into state and federal government contracts.

Acquire a Software company with a first-class management software program:

DCH has identified a software company that develops and markets a strategic software program to help businesses manage and increase profitability. The software company can be purchased for approximately $87,000,000, with significant annual revenue and assets.

Acquire a Technology Services company specializing in data storage, telephony, and security:

KMCI offers service, wiring, and network solutions and plans to expand into data storage, telephony, and security. Domino Comptech has begun acquisition discussions with service providers specializing in these areas. This acquisition would further leverage the synergies created by the software company, KMCI, and ZumoNet, providing a total technology, management, and security solution.

DCH has completed first-round funding of $1,000,000 and is considering extending Phase II funding through a private placement offering.

1.1 Objectives

- Acquire a Technology company that manufactures White Box computers and provides networking services and support.

1.2 Mission

Domino Comptech Holdings facilitates the acquisition of existing companies and provides additional capital to increase their volume and profitability. The company creates a complete business solution platform of unlimited marketing opportunities, combining marketing synergies to provide cost-effective technology solutions.

1.3 About This Plan

Form Follows Function

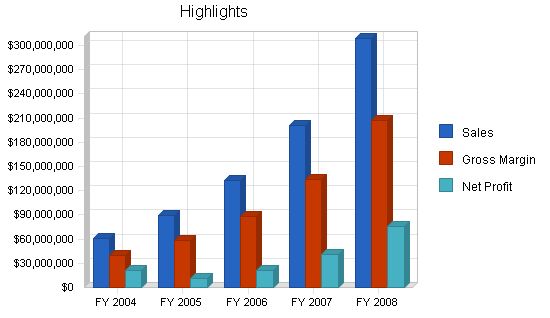

This is the business plan for Domino Comptech Holdings. For key points, the plan highlights the numbers expected from the KMCI division, the main revenue-generator.

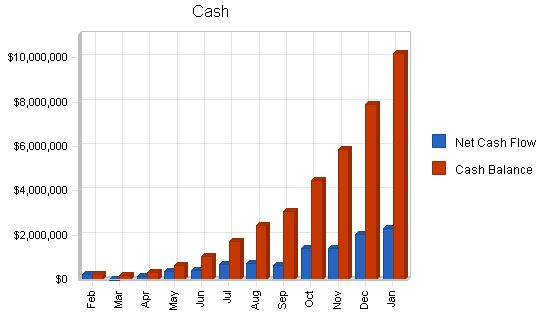

- The Sales Forecast table indicates the actual and projected sales from the KMCI division.

- The Personnel Plan table shows only the principals in the holding company, with other personnel costs appearing as a summary item in the projected Profit and Loss.

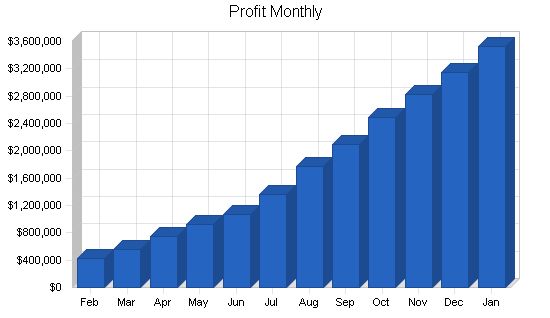

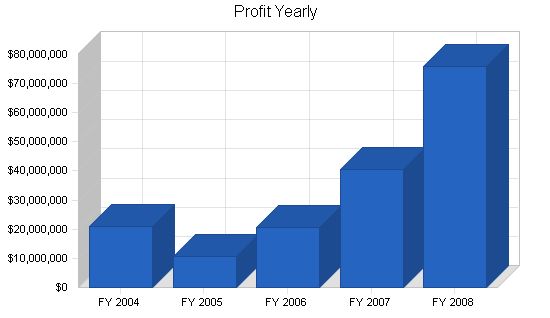

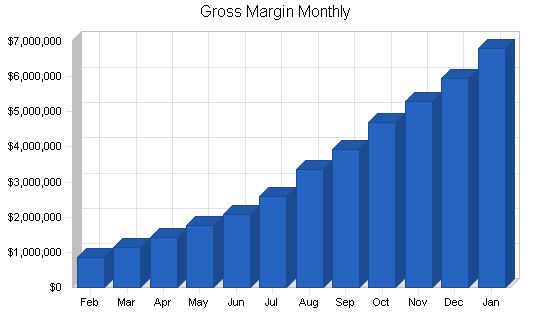

- The Profit and Loss table includes summarized projections of the divisions, focusing on the sales and costs of the main division.

- The Cash Flow table presents a summarized and consolidated general cash flow, including the assumed cash flow of the divisions in aggregate and summary form.

- Many discussions focus on the holding company operations only, excluding detailed personnel of the separate divisions.

1.4 Keys to Success

The keys to success in this business are:

- Maintain and increase product quality by keeping the total product failure rate of KMCI at or below the current level of five percent.

- Successfully market the S.E.A.T. management program.

- Successfully acquire an existing software company with positive cash flow, existing assets, and a top-notch management team.

Company Summary

Domino Comptech Holdings (DCH) is a diversified financial holding company formed under the laws of the State of Gulfstate. Its purpose is to acquire existing companies and provide additional capital to increase their volume and profitability.

2.1 Company History

Domino Comptech Holdings, a financial holding company, was incorporated as a Gulfstate corporation in 2002. DCH has purchased revenue-producing companies with a history of strong revenue production, existing assets, employees, and a minimum of 10 years of profitable business.

Kettle-Moraine Computers, Inc.

Last year, DCH purchased Kettle-Moraine Computers, Inc. (KMCI), a Gulfstate corporation established in 1990. Under the leadership of Lynx Caracal, KMCI has become a full-service provider of computer hardware and services. Apart from assembling and selling PCs, servers, and laptops, KMCI is an authorized reseller or service provider for industry leaders such as Compaq, Dell, Gateway, Okidata, Enterasys, World Wide Technology, Structure Wise, Lexmark, Hewlett-Packard, Novell, Panasonic, Cisco, IBM, and Nortel Networks.

To offer quality services, KMCI employs skilled professionals with certifications including A+, Microsoft Certified Professional (MCP), ASE, Microsoft Certified System Engineer (MCSE), Novell CNA and CNE, ACT Compaq, Cisco, CCNA, IBM, Lexmark, Hewlett-Packard, Network +, and Networking Essentials. These professionals successfully fulfill statewide hardware and maintenance contracts, providing on-site service for computers across Gulfstate and in parts of Plainsstate and Hillystate.

ZumoNet

In Q4 last year, Domino Comptech purchased ZumoNet, an Internet Service Provider (ISP). ZumoNet was wholly owned by Lynx Caracal and was merged via a stock swap. DCH acquired 100% of the ISP’s shares in exchange for 1,500,000 shares of DCH common stock. In addition to the ISP’s customer base, DCH receives an annual revenue stream of $20,000. The total expenses of the ISP are only $3,600, resulting in a total annual profit of $16,400. ZumoNet offers a 56K dial-up connection for a monthly fee of $20 for unlimited access. The service price varies based on billing type, such as a bi-annual fee of $100 or an annual fee of $100. There is also a one-time sign-up fee of $5. DCH is currently evaluating the most cost-effective way to expand the ISP’s service to include DSL, T-1, and T-4. However, with Sprint shutting down its ISP service, DCH is carefully considering the ISP business model to ensure competitiveness and profitability. Therefore, no expansion of services is expected within the next year.

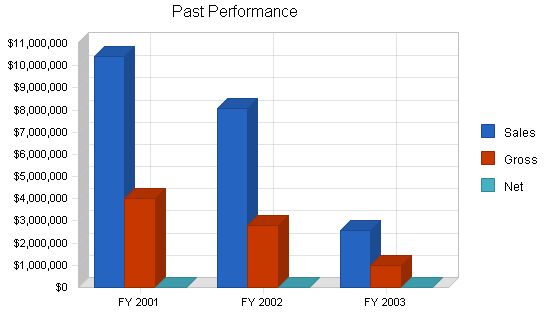

Past Performance

Our past performance reflects the overall decline in the technology sector over the past three years. In Year 1, we experienced a significant increase in orders placed through our sales department. This increase is attributed to:

- The resumption of purchasing new hardware and software by companies and entities, particularly the state of Gulfstate, which had previously frozen their budgets.

- An executive order signed by the Governor of the state of Gulfstate, requiring all state offices to purchase equipment and services from Gulfstate-based companies. DCH is headquartered in Central City, the capital of Gulfstate.

- The implementation of the S.E.A.T.* Management program in business and educational institutions.

- The expansion of the S.E.A.T. Management program to surrounding states.

*S.E.A.T. (Shrinking Expenses Advancing Technology) Management is a combined product/service offering where institutions can outsource their full IT needs to us on a three-year renewable contract. This is discussed further under Products and Services.

Past Performance

FY 2001, FY 2002, FY 2003

Sales

– $10,392,811

– $8,090,275

– $2,557,055

Gross Margin

– $4,019,873

– $2,814,145

– $977,387

Gross Margin %

– 38.68%

– 34.78%

– 38.22%

Operating Expenses

– $3,975,828

– $3,622,506

– $1,288,385

Collection Period (days)

– 33

– 41

– 102

Inventory Turnover

– 8.76

– 8.19

– 3.01

Balance Sheet

FY 2001, FY 2002, FY 2003

Current Assets

Cash

– $24,045

– $13,239

– $7,709

Accounts Receivable

– $940,059

– $857,610

– $572,109

Inventory

– $727,207

– $561,143

– $487,587

Other Current Assets

– $385,915

– $190,731

– $193,429

Total Current Assets

– $2,077,226

– $1,622,723

– $1,260,834

Long-term Assets

Long-term Assets

– $1,396,982

– $1,464,032

– $1,479,498

Accumulated Depreciation

– $952,728

– $1,087,047

– $166,002

Total Long-term Assets

– $444,254

– $376,985

– $1,313,496

Total Assets

– $2,521,480

– $1,999,708

– $2,574,330

Current Liabilities

Accounts Payable

– $663,740

– $509,665

– $166,002

Current Borrowing

– $0

– $0

– $370,126

Other Current Liabilities (interest free)

– $246,210

– $637,873

– $335,462

Total Current Liabilities

– $909,950

– $1,147,538

– $871,590

Long-term Liabilities

– $2,221,869

– $2,091,938

– $1,973,421

Total Liabilities

– $3,131,819

– $3,239,476

– $2,845,011

Paid-in Capital

– $676,193

– $676,193

– $676,193

Retained Earnings

– ($1,286,532)

– ($1,915,961)

– ($946,874)

Earnings

– $0

– $0

– $0

Total Capital

– ($610,339)

– ($1,239,768)

– ($270,681)

Total Capital and Liabilities

– $2,521,480

– $1,999,708

– $2,574,330

Other Inputs

Payment Days

– 38

– 35

– 38

Sales on Credit

– $10,392,811

– $8,090,275

– $2,557,055

Receivables Turnover

– 11.06

– 9.43

– 4.47

Company Ownership

The company is a privately-held C corporation owned by its founders, officers, and directors. Thirteen shareholders hold a total of 33,258,080 common shares. The major shareholders are:

– Lynx Caracal: 19,733,040 shares

– Kit Puma: 9,000,000 shares

– Neve Palenque: 1,500,000 shares

– Minerva Astarte: 1,204,800 shares

Company Locations and Facilities

DCH is located in Central City, Gulfstate, within the corporate administrative offices of Kettle-Moraine Computers. We have separate offices and a shared conference room with KMCI. KMCI leases approximately 1,338 square feet of office space divided into three locations within the property. The retail space is located at street level, across from the Capital Mall. KMCI also owns a 100,000 square foot building for the computer production facility.

Products and Services

DCH provides management, marketing, and financial expertise to acquired companies. KMCI focuses on providing network systems and services to businesses, including LAN systems and server-based systems. Services include design, installation, training, and support. KMCI’s production department assembles servers, workstations, and laptops.

Product and Service Description

Hardware provided includes servers, workstations, laptops, and network hardware. KMCI’s production department assembles servers, workstations, and laptops following an ISO 9001:2000 Quality Management System. KMCI holds certifications from various industry leaders. Services include LAN and WAN solutions, server installations, network engineering, and infrastructure services.

Competitive Comparison

DCH does not compete with any other companies in or around Central City. KMCI competes with IBM, Gateway, Dell, and Compaq, as well as other OEMs. KMCI’s advantages include selling directly from its own facilities, maintaining a low failure rate, and implementing S.E.A.T. Management.

Sales Literature

DCH is a holding company and does not use sales literature. However, the companies owned by DCH do utilize sales literature.

Future Products and Services

DCH plans to acquire a software company and introduce the S.E.A.T. Management concept to new and existing software customers. DCH also plans to acquire a storage, telephony, and security company to expand its services and customer base. The acquisitions will result in various outcomes, including the launch of new products, business consultation, and increased deployment.

Technology

The technology industry experienced a decline in hardware and software purchasing. KMCI developed the S.E.A.T. Management program in response to this trend, offering a new approach to purchasing and servicing information technology assets. The program provides state-of-the-art technology, installation, problem resolution, and equipment updates. S.E.A.T. Management offers benefits such as staying current with technology and outsourcing.

Note: The provided text has been edited for clarity and conciseness without altering the original meaning.

- Eliminates technology maintenance tasks and reduces staffing requirements.

- Eliminates responsibility for information technology hardware removal and disposal.

- Eliminates the need for large up-front capital expenditures.

- Reduces the need for grant funding or proposal of new bond issues.

- Reduces the time and resources spent on costly bid processes.

- Eliminates Microsoft licensing issues.

- Offers accounting advantages in expense write-off versus depreciation of hardware.

- Allows technology products and services to become part of the customer’s recurring monthly expense budget.

- Offers a convenient single bill per month for information technology products and services.

KMCI is currently signing up dealers and customers at a 50% close rate on the first call.

3.6 Fulfillment

DCH acquires businesses that produce, market, and service their own products. This eliminates the middleman and allows us to keep our products competitively priced compared to the competition.

KMCI owns a 100,000 square foot manufacturing facility (the plant), which is completely paid for. In addition, KMCI builds every product to customers’ specifications, eliminating the need for hardware inventory (computer and servers) that may or may not sell. KMCI delivers every order on time (or before the promised delivery date) while maintaining a 5% or lower failure rate on every product.

To hold costs down, we only order specific supplies needed to complete paid orders. This eliminates the problem of non-current technology (computer parts) sitting in a warehouse. Our business strategy is to provide the most current technology, combined with outstanding service, making it easy for customers to purchase from us. Additionally, we are a value-added reseller (VAR) for Perpetual Systems, IBM, Compaq, Hewlett-Packard, Lexmark, and Cisco, among others.

Service and installation is a major and highly profitable part of our business. KMCI has hardware, software, wiring, backbone infrastructure, maintenance, and consulting capabilities. This eliminates customers’ frustration in dealing with multiple vendors.

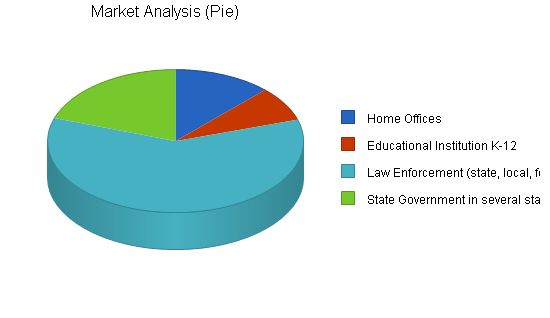

Market Analysis Summary

Domino Comptech Holdings’ computer division, Kettle-Moraine Computers, has focused on institutional clients such as the government of the state of Gulfstate, law enforcement, and educational institutions. With the implementation of the S.E.A.T. Management program, we can now expand our target market to all state governments, law enforcement agencies (municipal, county, and federal), educational institutions, and private and public companies across the United States.

Our market analysis uses figures from the United States Census website, the SBA business research website, individual state business censuses, and the United States Business Census.

4.1 Market Segmentation

Kettle-Moraine Computers has penetrated target markets in education, law enforcement, government, and small business. Domino Comptech plans to use KMCI’s brand recognition among large state institutions to broaden national coverage. Products and services are promoted through standard channels such as print, radio, television, and direct mail, as well as seminars, product fairs, and industry conferences.

KMCI’s major advantages in the market include:

- KMCI is a value-added reseller (VAR) with a broad range of products.

- KMCI has the capability for hardware, software, wiring, backbone infrastructure, maintenance, and consulting, eliminating the frustration of dealing with multiple vendors.

- KMCI has numerous Blue Chip contracts, providing name recognition and credibility.

- KMCI has developed strong strategic relationships with companies like IBM, Microsoft, Intel, Cisco, and others.

KMCI uses internal and external sales representatives with competitive compensation packages. ISO approved marketing and sales procedures ensure efficiency and customer satisfaction throughout the purchase process.

Market Analysis

Potential Customers | Growth | 2003 | 2004 | 2005 | 2006 | 2007 | CAGR

Home Offices | 15% | 200,000 | 230,000 | 264,500 | 304,175 | 349,801 | 15.00%

Educational Institution K-12 | 1% | 128,484 | 129,769 | 131,067 | 132,378 | 133,702 | 1.00%

Law Enforcement (state, local, federal) | 6% | 983,412 | 1,042,417 | 1,104,962 | 1,171,260 | 1,241,536 | 6.00%

State Government in several states | 7% | 322,419 | 344,988 | 369,137 | 394,977 | 422,625 | 7.00%

Total | 7.07% | 1,634,315 | 1,747,174 | 1,869,666 | 2,002,790 | 2,147,664 | 7.07%

4.2 Target Market Segment Strategy

Our choice of target markets is strategic and reflects our strengths and weaknesses. Quality is our primary focus. Currently, we operate with 100% on-time delivery and an equipment failure rate

We do not want to compete at the low end of the market, as most buyers in that segment look for low prices and do not value quality. This market is better served by chain stores and office stores.

In the small business target market segment, we focus on businesses that need at least five networked units. We provide network servers, installation, maintenance, and software support. Many of our target market customers have their own in-house IT department, but we can offer additional support. For those without an IT staff, we provide service on a contractual basis.

We are listed as a preferred provider with all members of our primary target market, and we have expanded our marketing efforts to include companies on the fringe of our established target market. Additionally, our new program, S.E.A.T. Management, allows companies to shift the purchase of new hardware and software from a capital expense to a monthly line item expense through leasing. KMCI will maintain the equipment and software and replace them with new ones in three years, generating a new sale.

4.2.1 Market Growth

At the time of acquisition by Domino Comptech Holdings, Kettle-Moraine Computers experienced three years of declining profits. The decline was mainly due to the general decline of the US economy. Businesses, particularly state governments and educational institutions, stopped purchasing computer hardware and software unless absolutely necessary. Every target market KMCI had established experienced spending cutbacks simultaneously. To secure contracts, KMCI had to submit bids with lower profit margins.

Since the acquisition by DCH, KMCI has broadened its target market to include surrounding states. We have also refocused our sales efforts to penetrate further into small, medium, and large public and private corporations.

In a 1999 profile by the Small Business Administration, it was reported that the number of small businesses with employees increased by 2.6%. 37.1% of all self-employment nationwide was attributed to women-owned businesses. Additionally, 52% of all businesses in the United States were small businesses with fewer than 500 employees. KMCI has begun aggressively marketing to these new potential market segments while maintaining existing relationships with state and local governments and law enforcement.

4.2.2 Market Trends

The most significant trend in the market is declining prices. Major brand-name manufacturers are offering systems with more power, speed, memory, and disk storage at competitive prices. This has led to a decrease in brand loyalty, especially in the home, student, and home office user segment. Buyers in this segment are more price-sensitive and tend to be more do-it-yourself when it comes to upgrading or replacing computer components.

Another trend is the increasing popularity of computers as throw-away appliances. Buyers find it cheaper to buy completely new systems rather than upgrading their existing ones. This trend is driven by the increasing power and storage of sub-$1,000 systems.

Connectivity is also a growing trend, with more people wanting to connect to the internet and small offices requiring LAN and internet connections.

With our S.E.A.T. program, we have bypassed the trend of purchasing cheaper equipment and instead offer an affordable solution that includes the latest technology and best service. By providing leasing options and regularly updating equipment and software, we offer a more reliable and convenient option for our target market.

4.2.3 Market Needs

Since our target market consists of service seekers, the most important market needs are support, service, training, and installation, in that order. We must focus on target segments that understand and value these needs and are willing to pay for them.

All personal computer users require support and service. While some users may handle these needs themselves, many companies are downsizing their in-house IT departments and relying on consultants. This is particularly true for state government offices, educational institutions, and law enforcement agencies that have experienced budget cuts. These organizations often use old equipment that requires ongoing service and upgrades.

Our customers rely on their systems and need the assurance that they can find help when needed. KMCI has established a strong reputation within our target markets and is increasing market share by providing excellent service and support.

4.3 Service Business Analysis

In the computer manufacturing and reselling business, there are several types of businesses:

1. Large manufacturers such as IBM, Dell, Compaq, and Gateway are our direct competitors. While they have a national image and high volume, they often have a high product failure rate and reduced service compared to KMCI.

2. Computer dealers are small storefront retailers that focus on specific hardware brands and offer variable amounts of service and support. They typically have higher prices and lower quality service compared to larger stores.

3. Chain stores and computer superstores, including CompUSA, Computer City, and Future Shop, have warehouse-like locations with aggressive pricing but limited service.

4. Mail order and online businesses offer aggressive pricing and boxed products but lack service.

We also have smaller local computer stores that are not direct competitors. Many of them carry our private labeled products, and we maintain their service contracts.

4.3.1 Distribution Patterns

Our target market buyers are used to vendors visiting their offices to make sales. We have established relationships with our clients based on this type of selling. We have assigned exclusive sales areas to our representatives, who are responsible for ongoing sales, service, and prospecting for new business.

Home office buyers often turn to superstores and mail-order options for the best prices without considering the value we offer. To reduce this, we have implemented the S.E.A.T. Management program, which has received a strong response from our existing and new target markets. Under this program, we have contracted smaller computer dealerships, IT consulting firms, and individual IT consultants to sell S.E.A.T. Management to their customers and receive a commission. This approach effectively expands our sales force without the burden of salaries and benefits.

4.3.2 Competition and Buying Patterns

Kettle-Moraine Computers (KMCI) operates as the computer manufacturing division of Domino Comptech Holdings. Our target markets include state and local governments, educational institutions, and law enforcement agencies. These markets rely on personal relationships with sales representatives and often make buying decisions based on factors such as reputation, timely service, and minimal downtime. KMCI has a strong reputation within the state of Gulfstate and is expanding into neighboring states.

Dell Computer, one of our competitors, has reduced face-to-face contact and shifted to a call center and help desk support for service. While this approach is cost-effective, it doesn’t align with the preferences of many business clients who value after-sales support at reasonable prices.

4.3.3 Main Competitors

We compete with major manufacturers such as IBM, Compaq, Lexmark, Hewlett-Packard, Dell, and Gateway. These companies have national reach and strong brand names but lack personalized company representation. KMCI offers personalized service and low failure rates compared to our competitors.

We also compete with local computer stores, but many of them carry our products and rely on us for service contracts.

4.3.4 Industry Participants

National chains such as CompUSA, Computer City, and Sears have a growing presence in the computer industry. They benefit from national advertising and economies of scale but face challenges such as rapid product obsolescence.

Local computer stores are threatened by competition from larger chains and often struggle with undercapitalization and lower-quality service.

Strategy and Implementation Summary

Emphasize service and support, building a relationship-oriented business focused on long-term relationships with clients. We aim to differentiate ourselves from box pushers by delivering on our promises and offering high-quality products and services.

Our strategy is to focus on small, medium, and large businesses, particularly those needing networked units. We also target the high-end home office market. Our emphasis on service and support sets us apart from competitors.

Our marketing strategy revolves around emphasizing service and support, building relationships, maintaining and expanding our existing client base, and focusing on small businesses and high-end home offices.

We rely on word-of-mouth advertising and direct contact by our sales representatives to reach new buyers. Direct contact involves cold calling and office visits. We have also formed strategic relationships with IT staffing companies and consulting groups to sell our services to their clients.

Our promotional strategy includes direct contact, sales literature, advertising, and direct mail. We are continuously finding new ways to promote ourselves and attract new clients.

Competitive Edge

Our competitive edge lies in positioning ourselves as strategic allies to our clients, focusing on long-standing relationships and delivering on our promises. We have the advantage of offering personalized service, low failure rates, and customization options.

Marketing and positioning KMCI as a viable and reliable alternative to price-focused competitors will further strengthen our competitive edge.

Marketing and promotion will emphasize our service and support, building a relationship business, and attracting new clients while maintaining existing ones.

Promotion Strategy

Our primary promotion strategy involves direct contact by our sales department, including cold calling and office visits. We also utilize sales literature, advertising, and direct mail to reach potential buyers and maintain regular contact with existing clients.

We will also leverage strategic partnerships with IT staffing companies and consulting groups to expand our reach and attract new clients.

This marketing and promotion strategy aligns with our emphasis on service and support, building relationships, and focusing on specific target markets.

An online quoting system enables sales representatives to make a complete presentation and offer an immediate quote, facilitating a one-call close and a signed contract.

Domino Comptech Holding’s computer division, KMCI, focuses on customized and differentiated computer hardware, software, and networking requirements. Products are built entirely to the clients’ specifications. Customers are acquired through the VAR channel, which emphasizes customization and personalized service. VARs are seen as direct extensions of the company, and the goal is to provide the best equipment at a reasonable price with superior quality control.

The company also maintains a presence in high-volume channels, recognizing the longer sales cycle but being able to offer competitive pricing due to owning its own manufacturing plant.

DCH and KMCI currently lack a Marketing Director and are in the process of filling this gap. In the meantime, they are implementing the marketing plan created by the former Marketing Director. The S.E.A.T. program has already shown a favorable response, resulting in a large increase in sales. KMCI aims to capture the market by establishing strategic alliances with companies and individuals who already have a "book of business."

To match the high-end and high-quality service and support they offer, KMCI must charge appropriately. Service and support revenue cannot be included in the product price, as the market cannot bear higher prices. However, KMCI does provide help desk and on-site services to their S.E.A.T. Management clients, as the cost per unit spread over a three-year period is minimal.

KMCI’s positioning statement highlights their commitment to reliable computer systems, trained staff, and minimal downtime. Unlike chain retail stores and other competitors, KMCI’s sales and service staff know their customers, provide proactive support, and offer on-site assistance, training, and installation.

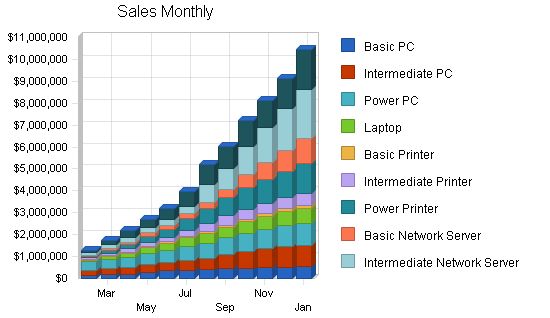

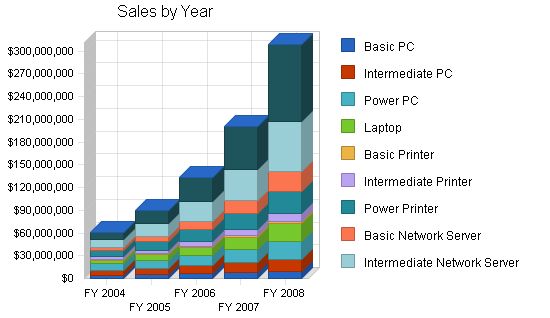

DCH’s different divisions are responsible for their individual sales strategies. It is important to sell the company, KMCI, rather than specific products or brands. The sales table and charts indicate KMCI’s projected sales and their plan to increase them. They have expanded their sales force by signing up dealers to sell S.E.A.T. Management on their behalf, while also hiring more in-house sales representatives. Both dealers and in-house salespersons are paid the same commission rate.

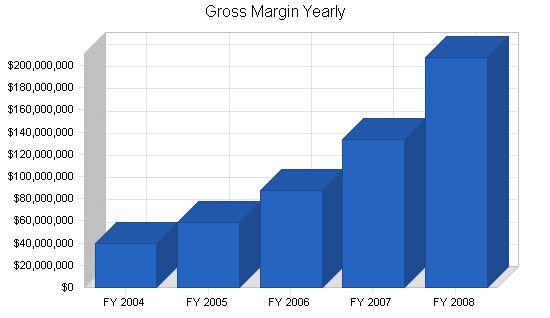

| Sales Forecast | |||||

| FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 | |

| Unit Sales | |||||

| Basic PC | 2,685 | 3,222 | 3,866 | 4,640 | 5,568 |

| Intermediate PC | 2,630 | 3,288 | 4,109 | 5,137 | 6,421 |

| Power PC | 2,550 | 3,315 | 4,310 | 5,602 | 7,283 |

| Laptop | 1,915 | 2,873 | 4,309 | 6,463 | 9,695 |

| Basic Printer | 2,130 | 2,663 | 3,328 | 4,160 | 5,200 |

| Intermediate Printer | 2,705 | 3,517 | 4,571 | 5,943 | 7,726 |

| Power Printer | 2,275 | 3,185 | 4,459 | 6,243 | 8,740 |

| Basic Network Server | 1,290 | 1,935 | 2,903 | 4,354 | 6,531 |

| Intermediate Network Server | 1,600 | 2,560 | 4,096 | 6,554 | 10,486 |

| Power Network Server | 1,015 | 1,827 | 3,289 | 5,919 | 10,655 |

| Other | 0 | 0 | 0 | 0 | 0 |

| Total Unit Sales | 20,795 | 28,383 | 39,240 | 55,014 | 78,303 |

| Unit Prices | FY 2004 | FY 2005 | FY 2006 | FY 2007 | FY 2008 |

| Basic PC | $1,634.00 | $1,634.00 | $1,634.00 | $1,634.00 | $1,634.00 |

| Intermediate PC | $2,523.00 | $2,523.00 | $2,523.00 | $2,523.00 | $2,523.00 |

| Power PC | $3,212.00 | $3,212.00 | $3,212.00 | $3,212.00 | $3,212.00 |

| Laptop | $2,483.00 | $2,483.00 | $2,483.00 | $2,483.00 | $2,483.00 |

| Basic Printer | $465.00 | $465.00 | $465.00 | $465.00 | $465.00 |

| Intermediate Printer | $1,393.00 | $1,393.00 | $1,393.00 | $1,393.00 | $1,393.00 |

| Power Printer | $3,368.00 | $3,368.00 | $3,368.00 | $3,368.00 | $3,368.00 |

| Basic Network Server | $3,883.00 | $3,883.00 | $3,883.00 | $3,883.00 | $3,883.00 |

| Intermediate Network Server | $6,351.00 | $6,351.00 | $6,351.00 | $6,351.00 | $6,351.00 |

| Power Network Server | $9,573.00 | $9,573.00 | $9,573.00 | $9,573.00 | $9,573.00 |

| Other | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Sales | |||||

| Basic PC | $4,387,290 | $5,264,748 | $6,317,698 | $7,581,237 | $9,097,485 |

| Intermediate PC | $6,635,490 | $8,294,363 | $10,367,953 | $12,959,941 | $16,199,927 |

| Power PC | $8,190,600 | $10,647,780 | $13,842,114 | $17,994,748 | $23,393,173 |

| Laptop | $4,754,945 | $7,132,418 | $10,698,626 | $16,047,939 | $24,071,909 |

| Basic Printer | $990,450 | $1,238,063 | $1,547,578 | $1,934,473 | $2,418,091 |

| Intermediate Printer | $3,768,065 | $4,898,485 | $6,368,030 | $8,278,439 | $10,761,970 |

| Power Printer | $7,662,200 | $10,727,080 | $15,017,912 | $21,025,077 | $29,435,108 |

| Basic Network Server | $5,009,070 | $7,513,605 | $11,270,408 | $16,905,611 | $25,358,417 |

| Intermediate Network Server | $10,161,600 | $16,258,560 | $26,013,696 | $41,621,914 | $66,595,062 |

| Power Network Server | $9,716,595 | ||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!