Computer Hardware Reseller Business Plan

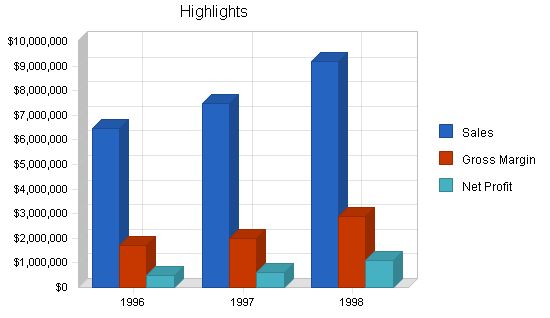

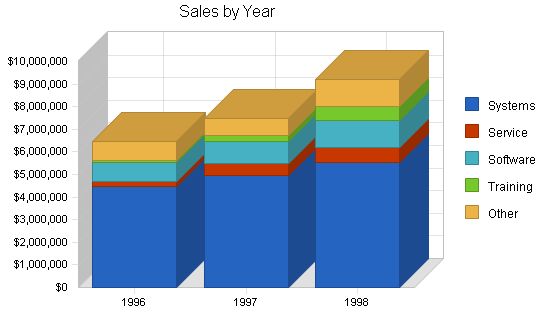

By focusing on strengths, key customers, and their underlying values, American Management Technology (AMT) will increase sales to over $9 million in three years, while improving the gross margin on sales and cash management.

This business plan renews our strategic focus: adding value to the small business and high-end home office users in our local market. It also provides a step-by-step plan for improving sales, gross margin, and profitability. To implement these changes and improve profitability, we plan to borrow an additional $100,000 long-term this year, which aligns with the balance sheet capabilities.

AMT operates under the assumption that managing information technology for businesses is not a do-it-yourself prospect. Smart business people who aren’t computer hobbyists need quality vendors of reliable hardware, software, service, and support. AMT aims to fulfill these needs and become the leader in business technology for its region.

AMT provides computer products and services for small businesses, with a focus on network systems. These systems include PC-based LAN systems and minicomputer server-based systems. Services offered include network system design, installation, training, and support.

The keys to success for AMT over the next three years are:

– Differentiating from price-oriented businesses by offering and delivering service and support.

– Increasing gross margin to more than 30%.

– Increasing non-hardware sales to 20% of total sales by the third year.

AMT was founded as a consulting-oriented value-added reseller and is emphasizing service and support to differentiate itself from competitors focused solely on price.

AMT currently operates from a 7,000 square foot store in a suburban shopping center. The store includes a training area, service department, offices, and showroom.

AMT is a privately-held C corporation majority-owned by its founder and president, Ralph Jones. There are six part owners, including four investors and two past employees. The firm employs 21 individuals across sales, marketing, service, and administration. Currently, AMT lacks technical capabilities in managing database marketing programs and upgraded service and support for cross-platform networks. The company also needs to find a training manager.

Recent changes in the computer reseller market have adversely affected AMT, including margin squeezes, longer collection periods, and lower inventory turnovers. These concerns reflect the general trend affecting computer resellers worldwide.

To effectively differentiate itself, AMT aims to be an information technology ally to its clients. The company offers support services such as training, upgrade offers, installation services, network configuration services, etc. AMT will aggressively pursue new opportunities.

AMT focuses on local markets, specifically small businesses and home offices, with a special emphasis on high-end home offices and small businesses with 5-20 units.

While retail sales are growing at 5% per year, web sales and direct sales are growing at 25-30%.

Within the computer retail industry, AMT’s competitors include computer dealers, chain stores and superstores, and mail order businesses. None of these competitors provide the customization and service that small businesses truly need.

Small business buyers are used to vendors visiting their offices. Many turn to large stores or mail order for the best price without considering a better option that offers ongoing service and support. AMT aims to overcome the idea that computers are plug-in appliances and educate buyers about the benefits of a long-term vendor providing quality service and support.

AMT currently relies on newspaper advertising to reach new buyers. As the company changes strategies, promotional efforts will shift to radio, cable TV, sales brochures, direct mailers, and newspapers. The focus will be on selling the company rather than specific product brands.

The Yearly Total Sales chart summarizes the ambitious sales forecast, projecting sales to increase from $5.3 million to over $6 million next year and exceed $9 million in the final year of this plan.

1.1 Objectives:

– Increase sales to over $9 million by the third year.

– Raise gross margin to above 30% and maintain that level.

– Generate $1.5 million in service, support, and training sales by 1998.

– Improve inventory turnover to 6 turns by 1998.

1.2 Keys to Success:

– Differentiate from price-oriented businesses by offering and delivering service and support, and charging for it.

– Achieve a gross margin of more than 30%.

– Increase non-hardware sales to 20% of total sales by the third year.

1.3 Mission:

AMT operates under the premise that managing business information technology is akin to seeking professional advice in other fields such as law, accounting, and graphic arts. Non-technical business professionals require reputable vendors for reliable hardware, software, service, and support. AMT aims to serve as a trusted ally to its clients, offering the same loyalty as a business partner, and the economic benefits of an external supplier. We ensure that our clients have the necessary tools to operate their businesses with maximum efficiency and reliability. As many of our applications are mission critical, we provide our clients with the assurance that we will be available when they need us.

AMT is a computer reseller located in the Uptown area. Initially founded as a consulting-oriented VAR, it pivoted to become a reseller to address the demand for personal computers. The company focuses on differentiating itself from larger, price-focused national chains through its emphasis on service and support.

2.1 Company History:

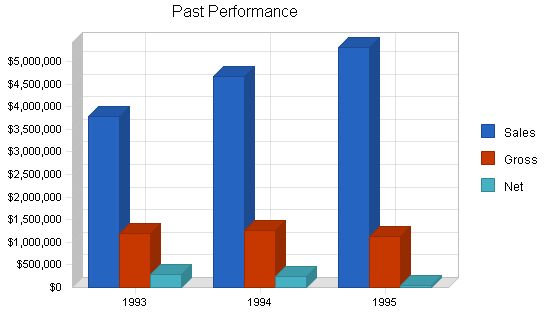

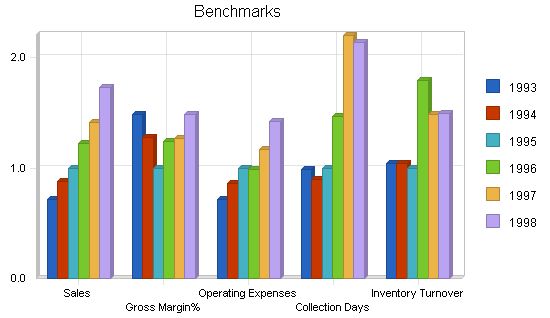

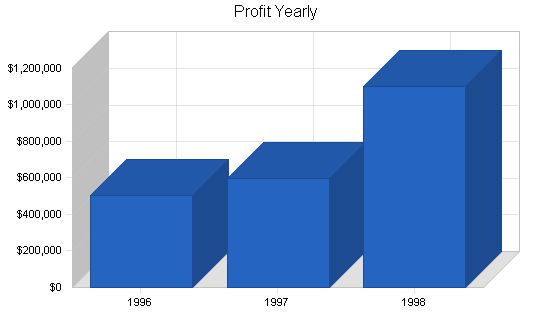

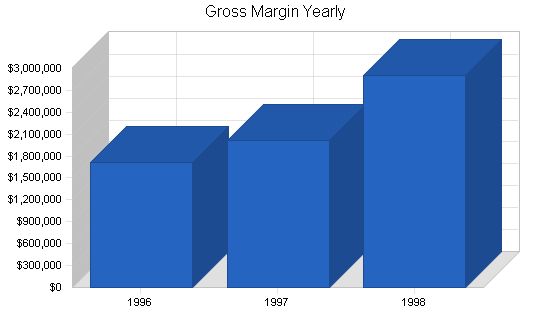

AMT, like computer resellers globally, has been impacted by margin squeezes. Although the Past Financial Performance chart indicates healthy sales growth, it also reveals a decline in gross margin and profits. Additional numbers in the Past Performance table highlight other worrisome indicators, such as the consistent decline in gross margin percentage, increased collection days, and worsening inventory turnover. These concerns reflect the broader trend affecting computer resellers worldwide. The margin squeeze is pervasive in the computer industry.

| Past Performance | |||

| 1993 | 1994 | 1995 | |

| Sales | $3,773,889 | $4,661,902 | $5,301,059 |

| Gross Margin | $1,189,495 | $1,269,261 | $1,127,568 |

| Gross Margin % | 31.52% | 27.23% | 21.27% |

| Operating Expenses | $752,083 | $902,500 | $1,052,917 |

| Collection Period (days) | 39 | 35 | 39 |

| Inventory Turnover | 6.22 | 6.19 | 5.96 |

| Balance Sheet | |||

| 1993 | 1994 | 1995 | |

| Current Assets | |||

| Cash | $43,023 | $47,650 | $55,432 |

| Accounts Receivable | $281,282 | $347,468 | $395,107 |

| Inventory | $573,159 | $708,026 | $805,098 |

| Other Current Assets | $15,000 | $20,000 | $25,000 |

| Total Current Assets | $912,464 | $1,123,144 | $1,280,637 |

| Long-term Assets | |||

| 1993 | 1994 | 1995 | |

| Long-term Assets | $250,000 | $300,000 | $350,000 |

| Accumulated Depreciation | $5,000 | $20,000 | $50,000 |

| Total Long-term Assets | $245,000 | $280,000 | $300,000 |

| Total Assets | $1,157,464 | $1,403,144 | $1,580,637 |

| Current Liabilities | |||

| Accounts Payable | $159,395 | $196,901 | $223,897 |

| Current Borrowing | $64,072 | $79,149 | $90,000 |

| Other Current Liabilities (interest free) | $10,679 | $13,191 | $15,000 |

| Total Current Liabilities | $234,146 | $289,241 | $328,897 |

| Long-term Liabilities | $202,797 | $250,516 | $284,862 |

| Total Liabilities | $436,943 | $539,757 | $613,759 |

| Paid-in Capital | $250,000 | $350,000 | $500,000 |

| Retained Earnings | $186,203 | $274,992 | $418,355 |

| Earnings | $284,318 | $238,395 | $48,523 |

| Total Capital | $720,521 | $863,387 | $966,878 |

| Total Capital and Liabilities | $1,157,464 | $1,403,144 | $1,580,637 |

| Other Inputs | |||

| Payment Days | 30 | 30 | 30 |

| Sales on Credit | $2,641,722 | $3,263,331 | $3,445,688 |

| Receivables Turnover | 9.39 | 9.39 | 8.72 |

2.2 Company Ownership

AMT is a privately-held C corporation majority owned by founder and president Ralph Jones. There are six part owners, including four investors and two past employees. The largest owners are Frank Dudley, our attorney, and Paul Karots, our public relations consultant. Neither owns more than 15%, but both are active participants in management decisions.

2.3 Company Locations and Facilities

We have one location – a 7,000 square foot store in a suburban shopping center near downtown. It includes a training area, service department, offices, and showroom.

Products and Services

AMT provides computer products and services for small businesses, with a focus on network systems. We offer both PC-based LAN systems and minicomputer server-based systems. Our services include network system design, installation, training, and support.

3.1 Product and Service Description

We support three main lines of personal computers:

The Super Home is our smallest and least expensive line, used as a cheap workstation for small business installations.

The Power User is our main upscale line, designed for high-end home and small business workstations.

The Business Special is an intermediate system, used to fill the gap in our product offerings.

We also carry a complete line of peripherals, accessories, and other hardware.

In addition, we offer a range of service and support options, including walk-in or depot service, maintenance contracts, and on-site guarantees.

We also provide software and training services.

3.2 Competitive Comparison

We differentiate ourselves by being an information technology ally to our clients. We offer not only products, but also confidence, reliability, and prompt support.

Our competitors only sell the products themselves, lacking the knowledge and experience to provide comprehensive solutions.

We cannot sell the products at a higher price just because of our services; we have to sell the services separately.

3.3 Sales Literature

Copies of our brochure and advertisements are provided as appendices. Our literature emphasizes selling the company rather than the product.

3.4 Fulfillment

We concentrate our purchasing with Hauser, which offers 30-day net terms and overnight shipping from their Dayton warehouse. Our goal is to hold costs down and negotiate better prices through volume.

In accessories and add-ons, we can still achieve decent margins.

3.5 Technology

We have supported both Windows and Macintosh technology for CPUs over the years. We also support Novell, Banyon, and Microsoft networking, Xbase database software, and Claris application products.

3.6 Future Products and Services

We must stay ahead of new technologies, focusing on cross-platform technologies, direct-connect internet, and integrated technologies for fax, copier, printer, and voice mail systems.

3.7 Service and Support

Our strategy relies on excellent service and support. We aim to differentiate ourselves in this area and deliver outstanding service to our customers.

- Training: details omitted

- Upgrade offers: details omitted

- Our own internal training: details omitted

- Installation services: details omitted

- Custom software services: details omitted

- Network configuration services: details omitted

Market Analysis Summary

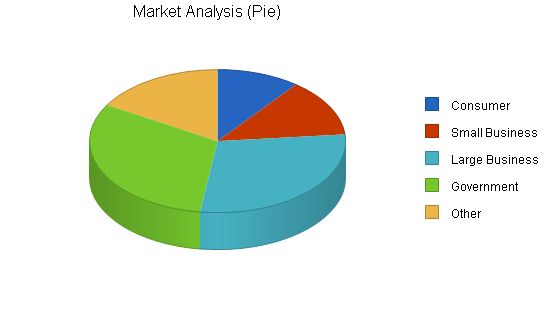

AMT focuses on local markets, specifically small businesses and home offices, with a particular emphasis on the high-end home office and small business offices with 5-20 employees.

4.1 Market Segmentation

Our target market consists of small-medium sized businesses that need high-quality information technology management but lack a separate computer management staff. Our high-end home office market includes businesses that prioritize the quality of their information technology management and have both the budget and needs that align with our services.

table

Market Analysis

h3

Service Business Analysis

p

We are part of the computer reselling business, which includes several kinds of businesses:

ol

Computer dealers: storefront computer resellers, usually less than 5,000 square feet, often focused on a few main brands of hardware, usually offering only a minimum of software, and variable amounts of service and support. These are usually old-fashioned computer stores and they offer relatively few reasons for buyers to shop with them. Their service and support is not usually very good and their prices are usually higher than the larger stores.

h3

Competition and Buying Patterns

p

The small business buyers understand the concept of service and support, and are more likely to pay for it when the offering is clearly stated.

p

We compete more against all the box pushers than against other service providers. We need to compete against the idea that businesses should buy computers as plug-in appliances that don’t need ongoing service, support, and training.

p

Our focus group sessions indicated that our target Home Offices think about price but would buy based on quality service if the offering were properly presented. They think about price because that’s all they ever see. We have indications that many would rather pay 10-20% more for a relationship with a long-term vendor providing back-up and quality service and support; they end up in the box-pusher channels because they aren’t aware of the alternatives.

p

Availability is also important. The Home Office buyers tend to want immediate, local solutions to problems.

h3

Main Competitors

p

Chain stores:

We have Store 1 and Store 2 already within the valley, and Store 3 is expected by the end of next year. If our strategy works, we will have differentiated ourselves sufficiently to not have to compete against these stores.

p

Strengths: national image, high volume, aggressive pricing, economies of scale.

p

Weaknesses: lack of product, service, and support knowledge, lack of personal attention.

p

Other local computer stores:

Store 4 and Store 5 are both in the downtown area. They are both competing against the chains in an attempt to match prices. When asked, the owners will complain that margins are squeezed by the chains and customers buy on price only. They say they tried offering services and that buyers didn’t care, instead preferring lower prices. We think the problem is also that they didn’t really offer good service, and also that they didn’t differentiate from the chains.

h3

Business Participants

ol

The national chains are a growing presence. CompUSA, Computer City, Incredible Universe, Babbages, Egghead, and others. They benefit from national advertising, economies of scale, volume buying, and a general trend toward name-brand loyalty for buying in the channels as well as for products.

h3

Distributing a Service

p

Small Business buyers are accustomed to buying from vendors who visit their offices. They expect the copy machine vendors, office products vendors, and office furniture vendors, as well as the local graphic artists, freelance writers, or whomever, to visit their office to make their sales.

p

There is usually a lot of leakage in ad-hoc purchasing through local chain stores and mail order. Often the administrators try to discourage this, but are only partially successful.

p

Unfortunately our Home Office target buyers may not expect to buy from us. Many of them turn immediately to the superstores and mail order to look for the best price, without realizing that there is a better option for them at only a little bit more.

h3

Target Market Segment Strategy

p

We are part of the computer reselling business, which includes several kinds of businesses:

ol

Computer dealers: storefront computer resellers, usually less than 5,000 square feet, often focused on a few main brands of hardware, usually offering only a minimum of software, and variable amounts of service and support. These are usually old-fashioned computer stores and they offer relatively few reasons for buyers to shop with them. Their service and support is not usually very good and their prices are usually higher than the larger stores.

h3

Market Needs

p

Since our target market is the service seeker, the most important market needs are support, service, training, and installation, in that order. One of the key points of our strategy is the focus on target segments that know and understand these needs and are willing to pay to have them filled.

p

All personal computer users need support and service. The self-reliant ones, however, supply those needs themselves. In home offices, these are the knowledgeable computer users who like to do it themselves. Among the businesses, these are businesses that have people on staff.

h3

Market Trends

p

The most obvious and important trend in the market is declining prices. This has been true for years, but the trend seems to be accelerating. We see the major brand-name manufacturers putting systems together with amazing specs at amazing prices. The major chain shops are selling brand-name powerful computers for less than $1,000.

p

This may be related to a second trend, which is the computer as throw-away appliance. By the time a system needs upgrading, it is cheaper to buy completely new. The increasing power and storage of a sub-$1000 system means buyers are asking for less service.

p

A third trend is ever greater connectivity. Everybody wants onto the internet, and every small office wants a LAN. A lot of small offices want their LAN connected to the internet.

h3

Market Growth

p

As prices fall, unit sales increase. The published market research on sales of personal computers is astounding, as the United States market alone is absorbing more than 30 million units per year, and sales are growing at more than 20 percent per year.

p

Where growth is not as obvious is the retail market. A report in CRW says Dell is now selling $5 million monthly over the web, and we assume Gateway and Micron are both close to that. Direct mail has given way to the web, but catalogs are still powerful, and the non-retail sale is more accepted every day. The last study we saw published has retail sales growing at 5% per year, while web sales and direct sales are growing at 25% or 30%.

h2

Strategy and Implementation Summary

p

The home offices in Tintown are an important growing market segment. Nationally, there are approximately 30 million home offices, and the number is growing at 10% per year. Our estimate in this plan for the home offices in our market service area is based on an analysis published four months ago in the local newspaper.

p

Home offices include several types. The most important, for our plan’s focus, are the home offices that are the only offices of real businesses, from which people make their primary living. These are likely to be professional services such as graphic artists, writers, and consultants, some accountants and the occasional lawyer, doctor, or dentist. There are also part-time home offices with people who are employed during the day but work at home at night, people who work at home to provide themselves with a part-time income, or people who maintain home offices relating to their hobbies; we will not be focusing on this segment.

p

Small business within our market includes virtually any business with a retail, office, professional, or industrial location outside of someone’s home, and fewer than 30 employees. We estimate 45,000 such businesses in our market area.

p

The 30-employee cutoff is arbitrary. We find that the larger companies turn to other vendors, but we can sell to departments of larger companies, and we shouldn’t be giving up leads when we get them.

h3

Strategy Pyramid

p

For placing emphasis on service and support, our main tactics are networking expertise, excellent training, and developing our own proprietary software/network administrative system. Our specific programs for networking include mailers and internal training. Specific programs for training include direct mail promotion, and train-the-trainers programs. For developing our own proprietary systems, our programs are company direct mail marketing, and working with VARs.

p

Our second strategy is emphasizing relationships. The tactics are marketing the company, more regular contacts with the customer, and increasing sales per customer. Programs for marketing the company include new sales literature, revised ad strategy, and direct mail. Programs for more regular contacts include call-backs after installation, direct mail, and sales management. Programs for increasing sales per customer include upgrade mailings and sales training.

p

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

h3

p

Our value proposition has to be different from the standard box-oriented retail chain. We offer our target customer, who is service seeking and not self-reliant, a vendor who acts as a strategic ally, at a premium price that reflects the value of reassurance that systems will work.

h3

Competitive Edge

p

Our competitive edge is our positioning as strategic ally with our clients, who are clients more than customers. By building a business based on long-standing relationships with satisfied clients, we simultaneously build defenses against competition. The longer the relationship stands, the more we help our clients understand what we offer them and why they need it.

h3

Sales Strategy

ol

We need to sell the company, not the product. We sell AMT, not Apple, IBM, Hewlett-Packard, or Compaq, or any of our software brand names.

ol

We have to sell our service and support. The hardware is like the razor, and the support, service, software services, training, and seminars are the razor blades. We need to serve our customers with what they really need.

ol

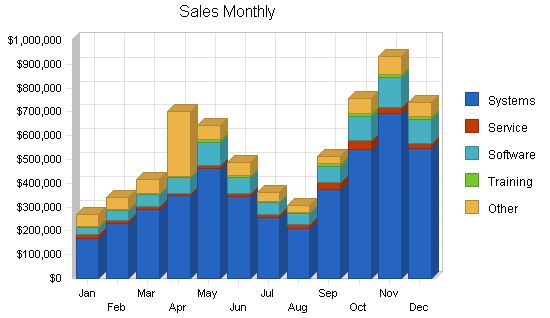

The Yearly Total Sales chart summarizes our ambitious sales forecast. We expect sales to increase from $5.3 million last year to more than $6 million next year and to more than $9 million in the last year of this plan.

h3

Sales Forecast

p

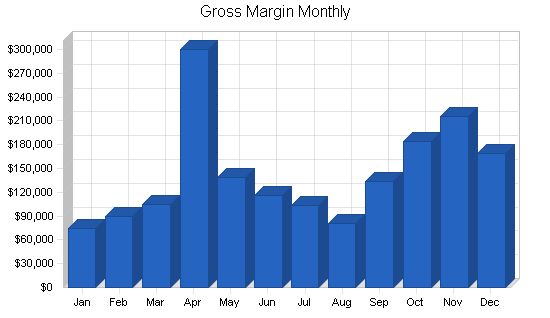

The important elements of the sales forecast are shown in the Total Sales by Month in Year 1 table. The non-hardware sales increase to over $2 million total in the third year.

Sales Forecast:

| Sales Forecast | |||

| 1996 | 1997 | 1998 | |

| Unit Sales | |||

| Systems | 2,255 | 2,500 | 2,800 |

| Service | 3,128 | 6,000 | 7,500 |

| Software | 3,980 | 5,000 | 6,500 |

| Training | 2,230 | 4,000 | 8,000 |

| Other | 2,122 | 2,500 | 3,000 |

| Total Unit Sales | 13,715 | 20,000 | 27,800 |

| Unit Prices | 1996 | 1997 | 1998 |

| Systems | $1,980.80 | $1,984.50 | $1,980.80 |

| Service | $68.54 | $84.00 | $87.00 |

| Software | $212.87 | $195.00 | $180.00 |

| Training | $46.54 | $72.00 | $79.00 |

| Other | $394.21 | $300.00 | $394.00 |

| Sales | |||

| Systems | $4,466,711 | $4,961,250 | $5,546,240 |

| Service | $214,388 | $504,000 | $652,500 |

| Software | $847,220 | $975,000 | $1,170,000 |

| Training | $103,795 | $288,000 | $632,000 |

| Other | $836,520 | $750,000 | $1,182,000 |

| Total Sales | $6,468,634 | $7,478,250 | $9,182,740 |

| Direct Unit Costs | 1996 | 1997 | 1998 |

| Systems | $1,700.00 | $1,686.82 | $1,683.68 |

| Service | $30.00 | $30.00 | $30.00 |

| Software | $120.00 | $120.00 | $120.00 |

| Training | $11.10 | $11.10 | $11.10 |

| Other | $90.00 | $90.00 | $90.00 |

| Direct Cost of Sales | |||

| Systems | $3,833,500 | $4,217,050 | $4,714,304 |

| Service | $93,840 | $180,000 | $225,000 |

| Software | $477,600 | $600,000 | $780,000 |

| Training | $24,753 | $44,400 | $88,800 |

| Other | $190,980 | $225,000 | $270,000 |

| Subtotal Direct Cost of Sales | $4,620,673 | $5,266,450 | $6,078,104 |

5.4.2 Sales Programs

- Direct mail: Describe your company’s programs here.

- Seminars: Describe your company’s programs here.

5.4.3 Distribution Strategy

Our most important marketing program is [specifics omitted]. Leslie Doe will be responsible, with a budget of $XX,XXX and milestone date of May 15. This program is intended to [objectives omitted]. Achievement should be measured by [specific concrete measurement].

Another key marketing program is [specifics omitted]. [Name] will be responsible, with a budget of $XX,XXX and milestone date of [date]. This program is intended to [objectives omitted]. Achievement should be measured by [specific concrete measurement].

5.5 Marketing Strategy

The marketing strategy is the core of the main strategy:

- Emphasize service and support.

- Build a relationship business.

- Focus on small business and high-end home office as key target markets.

5.5.1 Promotion Strategy

We depend on newspaper advertising as our main way to reach new buyers. As we change strategies, however, we need to change the way we promote ourselves:

Advertising: We’ll be developing our core positioning message: "24 Hour On-Site Service – 365 Days a Year With No Extra Charges" to differentiate our service from the competition. We will be using local newspaper advertising, radio, and cable TV to launch the initial campaign.

Sales Brochure: Our collaterals have to sell the store, and visiting the store, not the specific book or discount pricing.

Direct Mail: We must radically improve our direct mail efforts, reaching our established customers with training, support services, upgrades, and seminars.

Local Media: It’s time to work more closely with the local media. We could offer the local radio a regular talk show on technology for small business, as one example.

5.5.2 Pricing Strategy

We must charge appropriately for the high-end, high-quality service and support we offer. Our revenue structure has to match our cost structure, so the salaries we pay to assure good service and support must be balanced by the revenue we charge.

We cannot build the service and support revenue into the price of products. The market can’t bear the higher prices and the buyer feels ill-used when they see the same product priced lower at the chains. Despite the logic behind this, the market doesn’t support this concept.

Therefore, we must make sure that we deliver and charge for service and support. Training, service, installation, networking support–all of this must be readily available and priced to sell and deliver revenue.

5.5.3 Positioning Statement

For businesspeople who want to be sure their computer systems are always working reliably, AMT is a vendor and trusted strategic ally who makes sure their systems work, their people are trained, and their downtime is minimal. Unlike the chain retail stores, it knows the customer and goes to their site when needed, and offers proactive support, service, training, and installation.

5.6 Milestones

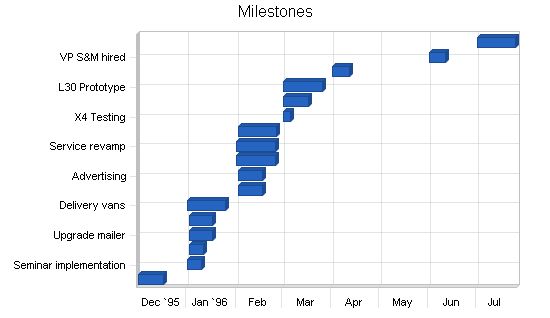

Our important milestones are shown in the following table. They track the need to follow up on strategy with specific activities. Most of the activities on the list can be easily tied to our strategic goals of selling more service and enhancing the relationship with the customer.

Management Summary:

Our management philosophy is based on responsibility and mutual respect. People who work at AMT are drawn to our environment that encourages creativity and achievement.

6.1 Organizational Structure:

The team includes 21 employees, under a president and four managers. Our main divisions are sales, marketing, service, and administration. Service handles support, training, and development.

6.2 Management Team:

Ralph Jones, President: 46 years old, founded AMT in 1984. He has a degree in computer science and 15 years of experience with Large Computer Company, Inc. Sabrina Benson, VP Marketing: 36 years old, joined us last year following a successful career with Continental Computers. She managed the VAR marketing division. Gary Andrews, VP Service and Support: 48 years old, 18 years with Large Computers, Inc. in programming and service-related positions, 7 years with AMT. Laura Dannis, VP Sales: 32, former teacher, joined AMT part-time in 1991. John Peters, Director of Administration: 43, started with AMT as a part-time bookkeeper in 1987.

6.3 Management Team Gaps:

Presently, we need to strengthen our technical capabilities for managing database marketing programs and upgraded service and support, especially with cross-platform networks. We also need to find a training manager.

6.4 Personnel Plan:

Our total headcount should increase to 26 in the first year and 31 by the third year. Detailed monthly projections are included in the appendix.

6.5 Other Management Considerations:

Our attorney, Frank Dudley, is also a co-founder. Paul Karots, a public relations consultant, is also a co-founder and co-owner.

Financial Plan:

The critical need in our financial plan is to improve inventory turnover and develop better inventory management to bring the turnover back up to 6 turns by the third year. This should be achieved through a shift in focus towards service revenues in addition to hardware revenues.

7.1 Important Assumptions:

We assume a slow-growth economy without major recession. We also assume that there are no unforeseen changes in technology that would make our products immediately obsolete.

7.2 Key Financial Indicators:

The Benchmark Comparison chart highlights our plans to correct declining gross margin and inventory turnover. These plans are based on reasonable sales increases that we have achieved in the recent past.

7.3 Break-even Analysis

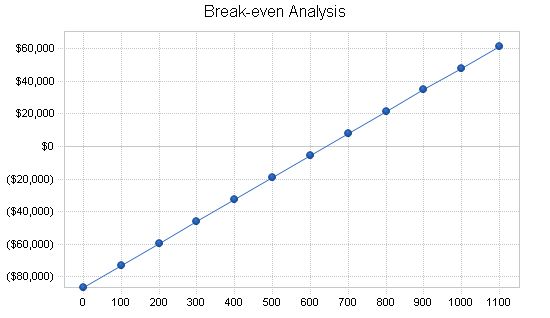

In our break-even analysis, we account for running costs, such as payroll, rent, utilities, and other expenses. Currently, our payroll expenses amount to approximately $55,000. Projecting margins is more challenging, as they vary. Our average margin is based on future projections, and we aim to achieve higher margins.

The chart illustrates the monthly sales required to reach the break-even point based on these assumptions.

Break-even Analysis

Monthly Units Break-even: 642

Monthly Revenue Break-even: $302,979

Assumptions:

– Average Per-Unit Revenue: $471.65

– Average Per-Unit Variable Cost: $336.91

– Estimated Monthly Fixed Cost: $86,555

Projected Profit and Loss

The most important assumption in the Projected Profit and Loss statement is the gross margin. It is expected to increase from 21% last year. This increase is based on changing our sales mix and is critical. Month-by-month profit and loss assumptions are included in the appendix.

Pro Forma Profit and Loss:

1996 1997 1998

Sales: $6,468,634 $7,478,250 $9,182,740

Direct Cost of Sales: $4,620,673 $5,266,450 $6,078,104

Production Payroll: $139,000 $202,500 $203,500

Other Costs of Sales: $0 $0 $0

Total Cost of Sales: $4,759,673 $5,468,950 $6,281,604

Gross Margin: $1,708,961 $2,009,300 $2,901,136

Gross Margin %: 26.42% 26.87% 31.59%

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll: $344,000 $422,000 $486,000

Ads: $125,000 $140,000 $175,000

Catalog: $25,000 $19,039 $19,991

Mailing: $113,300 $120,000 $150,000

Promo: $16,000 $20,000 $25,000

Shows: $20,200 $25,000 $30,000

Literature: $7,000 $10,000 $12,500

PR: $1,000 $1,250 $1,500

Seminar: $31,000 $45,000 $60,000

Service: $10,250 $12,000 $15,000

Training: $5,400 $7,000 $15,000

Total Sales and Marketing Expenses: $698,150 $821,289 $989,991

Sales and Marketing %: 10.79% 10.98% 10.78%

General and Administrative Expenses:

General and Administrative Payroll: $155,000 $179,000 $234,000

Marketing/Promotion: $0 $0 $0

Depreciation: $12,681 $13,315 $13,981

Leased Equipment: $30,000 $31,500 $33,075

Rent: $84,000 $88,200 $92,610

Utilities: $9,000 $9,450 $9,923

Insurance: $6,000 $6,300 $6,615

Payroll Taxes: $0 $0 $0

Other General and Administrative Expenses: $6,331 $6,648 $6,980

Total General and Administrative Expenses: $303,012 $334,413 $397,184

General and Administrative %: 4.68% 4.47% 4.33%

Other Expenses:

Other Payroll: $36,000 $70,000 $77,000

Contract/Consultants: $1,500 $5,000 $30,000

Other Expenses: $0 $0 $0

Total Other Expenses: $37,500 $75,000 $107,000

Other %: 0.58% 1.00% 1.17%

Total Operating Expenses: $1,038,662 $1,230,702 $1,494,175

Profit Before Interest and Taxes: $670,299 $778,598 $1,406,961

EBITDA: $682,980 $791,913 $1,420,942

Interest Expense: $35,568 $31,710 $25,557

Taxes Incurred: $128,111 $150,748 $278,816

Net Profit: $506,619 $596,140 $1,102,588

Net Profit/Sales: 7.83% 7.97% 12.01%

7.5 Projected Cash Flow

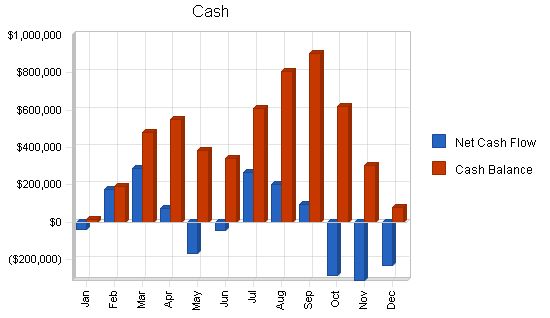

The cash flow depends on assumptions for inventory turnover, payment days, and accounts receivable management. Our projected 60-day collection days is not ideal, but it is realistic in this market, and hard for us to effectively change. We need significant new financing in March to get through a cash flow dip as we build up for mid-year sales.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 1996 | 1997 | 1998 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $970,295 | $1,121,738 | $1,377,411 |

| Cash from Receivables | $4,496,795 | $6,138,525 | $7,437,311 |

| Subtotal Cash from Operations | $5,467,090 | $7,260,263 | $8,814,722 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $100,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $5,567,090 | $7,260,263 | $8,814,722 |

Projected Balance Sheet

The Projected Balance Sheet is quite solid. We do not project any real trouble meeting our debt obligations–as long as we can achieve our specific objectives.

| Pro Forma Balance Sheet | |||

| 1996 | 1997 | 1998 | |

| Assets | |||

| Current Assets | |||

| Cash | $77,893 | $375,137 | $1,039,509 |

| Accounts Receivable | $1,396,650 | $1,614,638 | $1,982,656 |

| Inventory | $556,810 | $634,629 | $732,436 |

| Other Current Assets | $25,000 | $25,000 | $25,000 |

| Total Current Assets | $2,056,353 | $2,649,403 | $3,779,602 |

| Long-term Assets | |||

| Long-term Assets | $350,000 | $350,000 | $350,000 |

| Accumulated Depreciation | $62,681 | $75,996 | $89,977 |

| Total Long-term Assets | $287,319 | $274,004 | $260,023 |

| Total Assets | $2,343,672 | $2,923,407 | $4,039,625 |

| Liabilities and Capital | 1996 | 1997 | 1998 |

| Current Liabilities | |||

| Accounts Payable | $443,022 | $499,160 | $588,779 |

| Current Borrowing | $64,000 | $32,000 | $0 |

| Other Current Liabilities | $15,000 | $15,000 | $15,000 |

| Subtotal Current Liabilities | $522,022 | $546,160 | $603,779 |

| Long-term Liabilities | $348,153 | $307,610 | $263,621 |

| Total Liabilities | $870,175 | $853,770 | $867,400 |

| Paid-in Capital | $500,000 | $500,000 | $500,000 |

| Retained Earnings | $466,878 | $973,497 | $1,569,637 |

| Earnings | $506,619 | $596,140 | $1,102,588 |

| Total Capital | $1,473,497 | $2,069,637 | $3,172,225 |

| Total Liabilities and Capital | $2,343,672 | $2,923,407 | $4,039,625 |

| Net Worth | $1,473,497 | $2,069,637 | $3,172,225 |

The table follows with our main business ratios. We do intend to improve gross margin, collection days, and inventory turnover. The industry standards are taken for industry classification 5734 in the SIC code. We assume that the difference between our results and the standards is that the standards include

| Ratio Analysis | ||||

| 1996 | 1997 | 1998 | Industry Profile | |

| Sales Growth | 22.03% | 15.61% | 22.79% | 10.50% |

| Percent of Total Assets | ||||

| Accounts Receivable | 59.59% | 55.23% | 49.08% | 19.20% |

| Inventory | 23.76% | 21.71% | 18.13% | 38.00% |

| Other Current Assets | 1.07% | 0.86% | 0.62% | 20.80% |

| Total Current Assets | 87.74% | 90.63% | 93.56% | 78.00% |

| Long-term Assets | 12.26% | 9.37% | 6.44% | 22.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 22.27% | 18.68% | 14.95% | 44.60% |

| Long-term Liabilities | 14.86% | 10.52% | 6.53% | 14.10% |

| Total Liabilities | 37.13% | 29.20% | 21.47% | 58.70% |

| Net Worth | 62.87% | 70.80% | 78.53% | 41.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 26.42% | 26.87% | 31.59% | 37.20% |

| Selling, General & Administrative Expenses | 18.59% | 18.90% | 19.59% | 22.30% |

| Advertising Expenses | 1.93% | 1.87% | 1.91% | 4.10% |

| Profit Before Interest and Taxes | 10.36% | 10.41% | 15.32% | 1.50% |

| Main Ratios | ||||

| Current | 3.94 | 4.85 | 6.26 | 1.78 |

| Quick | 2.87 | 3.69 | 5.05 | 0.75 |

| Total Debt to Total Assets | 37.13% | 29.20% | 21.47% | 58.70% |

| Pre-tax Return on Net Worth | 43.08% | 36.09% | 43.55% | 3.80% |

| Pre-tax Return on Assets | 27.08% | 25.55% | 34.20% | 9.30% |

| Additional Ratios | 1996 | 1997 | 1998 | |

| Net Profit Margin | 7.83% | 7.97% | 12.01% | n.a |

| Return on Equity | 34.38% | 28.80% | 34.76% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.94 | 3.94 | 3.94 | n.a |

| Collection Days | 58 | 86 | 84 | n.a |

| Inventory Turnover | 10.68 | 8.84 | 8.89 | n.a |

| Accounts Payable Turnover | 11.35 | 12.17 | 12.17 | n.a |

| Payment Days | 28 | 28 | 28 | n.a |

| Total Asset Turnover | 2.76 | 2.56 | 2.27 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.59 | 0.41 | 0.27 | n.a |

| Current Liab. to Liab. | 0.60 | 0.64 | 0.70 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $1,534,331 | $2,103,243 | $3,175,823 | n.a |

| Interest Coverage | 18.85 | 24.55 | 55.05 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.36 | 0.39 | 0.44 | n.a |

| Current Debt/Total Assets | 22% | 19% | 15% | n.a |

| Acid Test | 0

Sales Forecast |

|||

| Sales Forecast | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unit Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Systems | 0% | 85 | 115 | 145 | 190 | 245 | 175 | 120 | 100 | 180 | 275 | 350 | 275 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service | 0% | 200 | 200 | 200 | 200 | 244 | 256 | 269 | 282 | 296 | 311 | 327 | 343 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software | 0% | 150 | 200 | 250 | 330 | 430 | 310 | 210 | 180 | 320 | 490 | 620 | 490 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Training | 0% | 145 | 155 | 165 | 170 | 225 | 200 | 150 | 150 | 200 | 220 | 250 | 200 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 0% | 160 | 176 | 192 | 240 | 200 | 175 | 125 | 100 | 104 | 200 | 250 | 200 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Unit Sales | 740 | 846 | 952 | 1,130 | 1,344 | 1,116 | 874 | 812 | 1,100 | 1,496 | 1,797 | 1,508 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unit Prices | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Systems | $2,000.00 | $2,000.00 | $2,000.00 | $1,828.95 | $1,890.63 | $1,966.17 | $2,131.58 | $2,115.38 | $2,083.33 | $1,966.40 | $1,980.29 | $1,984.50 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service | $75.00 | $69.00 | $58.00 | $46.00 | $50.00 | $47.00 | $50.00 | $50.00 | $91.00 | $124.00 | $75.00 | $67.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software | $200.00 | $200.00 | $200.00 | $200.00 | $223.00 | $217.00 | $242.00 | $253.00 | $220.00 | $211.00 | $204.00 | $207.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Training | $37.00 | $35.00 | $39.00 | $41.00 | $56.00 | $50.00 | $33.00 | $33.00 | $50.00 | $55.00 | $60.00 | $50.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $300.00 | $300.00 | $300.00 | $1,133.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | $300.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Systems | $170,000 | $230,000 | $290,000 | $347,501 | $463,204 | $344,080 | $255,790 | $211,538 | $374,999 | $540,760 | $693,102 | $545,738 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service | $15,000 | $13,800 | $11,600 | $9,200 | $12,200 | $12,032 | $13,450 | $14,100 | $26,936 | $38,564 | $24,525 | $22,981 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software | $30,000 | $40,000 | $50,000 | $66,000 | $95,890 | $67,270 | $50,820 | $45,540 | $70,400 | $103,390 | $126,480 | $101,430 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Training | $5,365 | $5,425 | $6,435 | $6,970 | $12,600 | $10,000 | $4,950 | $4,950 | $10,000 | $12,100 | $15,000 | $10,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $48,000 | $52,800 | $57,600 | $271,920 | $60,000 | $52,500 | $37,500 | $30,000 | $31,200 | $60,000 | $75,000 | $60,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Sales | $268,365 | $342,025 | $415,635 | $701,591 | $643,894 | $485,882 | $362,510 | $306,128 | $513,535 | $754,814 | $934,107 | $740,149 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct Unit Costs | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Systems | 0.00% | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | $1,700.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Service | 0.00% | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Software | 0.00% | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | $120.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Training | 0.00% | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | $11.10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 0.00% | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | $90.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

READ MORE Teachers Employment Agency Business Plan Example

Pro Forma Balance Sheet:

Hello! I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com. My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals. Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success! | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||