Artemide Auditing & Consulting AG (Artemide AC) is a sole proprietorship owned and operated by Sandor Artemide AC, a spinoff of Daten Riffwald-Ennetmoos AG. The plan serves as a guide for managing the business under the new company, as well as the basis for marketing proposals. The objectives of Artemide AC are to generate a profit and grow at a challenging and manageable rate.

The mission of Artemide AC is to provide fast and reliable auditing and consulting services to SMBs, individuals, and other organizations.

The keys to success for Artemide AC are visibility, networking, responsiveness, and quality.

The initial primary service offered will be auditing, with potential growth in specialized fields.

The overall objective is to specialize in analyses, investigations, startups, and become a leader in this niche in the Luzern area. The company projects a 10% growth in sales in the next three years.

The most important keys to success for Artemide AC are developing visibility, focusing on client relationships, and delivering high-quality services.

The cooperation between Daten Riffwald-Ennetmoos and Artemide AC is flexible, with the ability to adapt quickly to market demands.

Artemide AC was founded in 1996 and is located in Luzern, separate from Daten Riffwald-Ennetmoos AG.

Competition in the fiduciary business in Switzerland includes individual proprietors, small and medium fiduciary and accounting offices, medium fiduciary offices with 6 to 25 employees, large auditing and consulting companies, banks, assurances, and other financial consultants.

Technology is essential for the success of Artemide AC, and the company will allocate a reasonable portion of annual revenues to upgrade equipment and software.

Artemide AC will adopt a focused market strategy, targeting individuals, investors, small businesses, medium businesses, large businesses, and authorities and public organizations. The company considers individual persons, investors, small and medium businesses crucial for further development.

Artemide AC has numerous competitors in a vast market but aims to create and expand a niche in the chosen market fields. The general market is estimated to grow between 5% and 10% annually.

The primary opportunities in the fiduciary business are bookkeeping and other services related to financial management, consulting and special mandates, and legal auditing.

The primary market trends in the business are rapid growth in business complexity, increased litigation, and the growth of outsourced financial consulting.

Artemide AC has a competitive edge due to Sandor Artemide’s well-established reputation and the company’s ability to focus on this niche market.

The sales strategy will focus on building long-term customer relationships. The company projects revenues of approximately $232,000 by Year 3, with no debt financing and no anticipated cash flow problems.

Sandor Artemide will assume strategic management functions, and Brigitte Artemide will be in charge of market research and customer support. No major increases in personnel are expected in the next three years.

1.1 Mission

Artemide AC’s mission is to provide complete, reliable, and high-quality services to SMBs, individuals, lawyers, and authorities. Services must deliver solutions and results!

1.2 Keys to Success

The keys to success for Artemide AC are:

- Developing visibility to generate new business leads.

- Building relationships with clients and potential clients.

- Marketing/strategy and networking with professionals.

- Collaborating with Daten Riffwald-Ennetmoos AG for fiduciary services and IT services.

- Being responsive to clients’ special problems.

- Ensuring quality reporting.

- Fulfilling the promise with excellence.

- Being open to creating interregional and international contacts.

1.3 Objectives

The objectives of this business plan are:

- To provide a strategic framework for developing a comprehensive tactical marketing philosophy.

- This plan is purely for internal improvements.

- To provide detailed monthly projections for the current plan year, as well as yearly summaries for the following two years.

The objectives of Artemide Auditing & Consulting are:

- To focus the activities towards specialized services and become a leader in this niche in the Luzern area.

- To generate sufficient cash flow to finance future growth and development, and to provide the resources needed to achieve the other objectives of the company and its owners.

- To expand the business at a challenging and manageable rate, serving the market with innovation and adaptability (Growth projected at 10% of sales in the next three years.)

Company Summary

Artemide AC will be an ongoing company from the sole proprietorship company Sandor Artemide dipl. Wirtschaftsprüfer with the following characteristics:

- The goal will be to continue the activities on a larger personal and organizational basis, still with no debt financing.

- Artemide AC will assume operations of one of the Daten Riffwald-Ennetmoos AG’s divisions.

- There will be a 25% cross-participation between the owners of Daten Riffwald-Ennetmoos and Artemide AC.

- The cooperation between Daten Riffwald-Ennetmoos and Artemide AC is flexible, with the objective to change rapidly if the market demands.

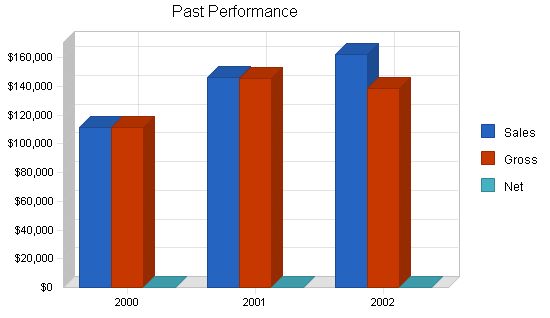

2.1 Company History

The sole proprietorship company “Sandor Artemide dipl. Wirtschaftsprüfer” was founded on March 8, 1996. In the first 10-month period, the company generated sales of $50,000.

During a period of general recession between 1996 and 2000, the owner created and assured his independent existence. The name Artemide became known, and he established a good professional reputation in Luzern.

Before starting his own business, Sandor Artemide gained extensive professional experience listed below:

- 5 years at ATAG Graff & Altern in Geneva, Switzerland.

- 3 years at Ziegfeld in Bern, Switzerland.

- 4 years at KUGN in Bienne, Switzerland.

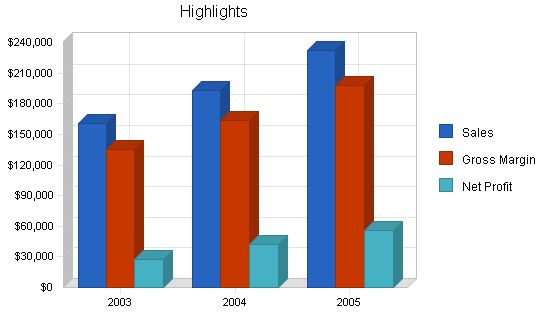

Past Performance

[table]

[tr]

[td]Year[/td] [td]Sales[/td] [td]Gross Margin[/td] [td]Gross Margin %[/td] [td]Operating Expenses[/td] [td]Collection Period (days)[/td]

[/tr]

[tr]

[td]2000[/td] [td]$111,182[/td] [td]$111,182[/td] [td]100.00%[/td] [td]$43,430[/td] [td]27[/td]

[/tr]

[tr]

[td]2001[/td] [td]$146,505[/td] [td]$145,347[/td] [td]99.21%[/td] [td]$46,325[/td] [td]17[/td]

[/tr]

[tr]

[td]2002[/td] [td]$162,140[/td] [td]$138,977[/td] [td]85.71%[/td] [td]$49,221[/td] [td]19[/td]

[/tr]

[/table]

Balance Sheet

[table]

[tr]

[td]Year[/td] [td]Current Assets[/td] [td]Long-term Assets[/td] [td]Total Assets[/td] [td]Current Liabilities[/td] [td]Long-term Liabilities[/td] [td]Paid-in Capital[/td] [td]Retained Earnings[/td] [td]Earnings[/td] [td]Total Capital[/td] [td]Total Capital and Liabilities[/td] [td]Other Inputs[/td] [td]Payment Days[/td] [td]Sales on Credit[/td] [td]Receivables Turnover[/td]

[/tr]

[tr]

[td]2000[/td] [td]$13,897[/td] [td]$5,211[/td] [td]$19,108[/td] [td]$13,309[/td] [td]$0[/td] [td]$5,000[/td] [td]$799[/td] [td]$0[/td] [td]$5,799[/td] [td]$19,108[/td] [td]N/A[/td] [td]45[/td] [td]$111,182[/td] [td]13.71[/td]

[/tr]

[tr]

[td]2001[/td] [td]$28,952[/td] [td]$5,211[/td] [td]$34,163[/td] [td]$11,002[/td] [td]$0[/td] [td]$5,000[/td] [td]$18,161[/td] [td]$0[/td] [td]$23,161[/td] [td]$34,163[/td] [td]N/A[/td] [td]45[/td] [td]$146,505[/td] [td]28.11[/td]

[/tr]

[tr]

[td]2002[/td] [td]$105,390[/td] [td]$6,948[/td] [td]$112,338[/td] [td]$14,476[/td] [td]$0[/td] [td]$5,000[/td] [td]$92,862[/td] [td]$0[/td] [td]$97,862[/td] [td]$112,338[/td] [td]N/A[/td] [td]45[/td] [td]$162,140[/td] [td]14.00[/td]

[/tr]

[/table]

Company Ownership

Artemide Auditing & Consulting AG will be incorporated in Luzern by Sandor Artemide, who will be the majority owner. Twenty-five percent of the company will be owned by Daten Riffwald-Ennetmoos AG, the parent company.

Company Locations and Facilities

Artemide AC is established in a separate office in Luzern, with secretary and telephone response services provided by Daten Riffwald-Ennetmoos. ATO Geistesblitz is also established in the same building, on the first level, for SMB software sales and consulting. The current structure satisfies the needs of both companies, but there are plans to optimize the office location in the future.

Services

Artemide AC will be the top company in Luzern for specialized and investigative services in the business environment. The company also offers auditing, consulting, and investigation services.

– Artemide AC offers three main services: Auditing, Consulting, and Investigation.

– There are four main classes of competition, as discussed in section 3.2.

– Sandor Artemide and other qualified professionals will provide the services.

– Staying up-to-date with classic and special business software is essential.

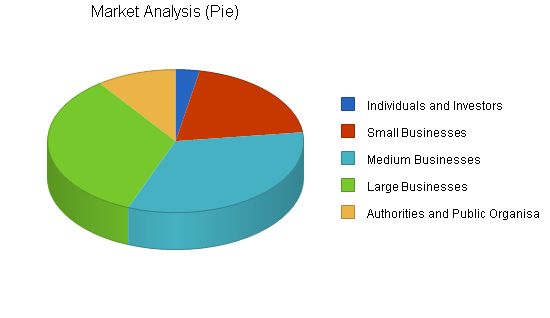

Market Analysis Summary

Artemide Auditing & Consulting AG will implement a focused market strategy.

– The market is segmented into Individuals, Investors, Small Businesses, Medium Businesses, Large Businesses, and Authorities and Public Organizations.

– The main target markets currently are small and medium businesses.

– Artemide AC does not have direct competitors in its chosen market fields.

– The general market is estimated to grow between 5% and 10% annually.

Market Segmentation

The estimated market segmentation and growth for this business are as follows:

– Individual persons and Investors

– Small Businesses – Businesses with 1 to 24 employees, the second largest and fastest growing segment in the region.

– Medium Businesses – Businesses with 25 to 499 employees.

– Large Businesses – Businesses with 500 or more employees.

– Authorities and Public Organizations

Market Analysis:

- Potential Customers: Growth in Individuals and Investors segment:

– 2003: 3

– 2004: 4

– 2005: 5

– 2006: 6

– 2007: 7

– CAGR: 23.59%

– 2003: 20

– 2004: 22

– 2005: 24

– 2006: 26

– 2007: 29

– CAGR: 9.73%

– 2003: 33

– 2004: 36

– 2005: 40

– 2006: 44

– 2007: 48

– CAGR: 9.82%

– 2003: 34

– 2004: 36

– 2005: 38

– 2006: 40

– 2007: 42

– CAGR: 5.42%

– 2003: 10

– 2004: 11

– 2005: 12

– 2006: 13

– 2007: 14

– CAGR: 8.78%

– 2003: 100

– 2004: 109

– 2005: 119

– 2006: 129

– 2007: 140

– CAGR: 8.78%

4.2 Target Market Segment Strategy

We consider the following market segments to be important for our further development:

- Individuals and Investors

- Small and Medium Businesses

Artemide AC will primarily focus its marketing strategy on these segments.

4.2.1 Market Needs

There are three major opportunities in the fiduciary business over the next years:

- Bookkeeping and other services related to financial management (payroll, cost-accounting, accounting for pension funds, etc.).

- Consulting and special mandates, including Financial-Planning, Business-Planning, Business-Evaluation, Merger & Acquisition, Startup-Planning, Restructuring, Business Succession-Planning, Coaching in Financial-Managing, Recovery, Special Audits, Reviews, Analyses, Investigation, and Forensic Services.

- Legal Auditing (incl. IAS and other standards) as an independent and responsible institution.

We believe that the need for consulting and specialized services has a strong growth potential.

4.2.2 Market Trends

Three primary market trends are important in our business:

- Trend 1 – Rapid growth in complexity of business in an ever-changing market and competitive environment needs continuous and rapid adaptation in both strategy and structures of companies. Economically, it is more expedient to acquire specialized services from a consulting firm that has its own specialized employees.

4.2.3 Market Growth

Several factors are predicted to continue well into the next decade, including an estimated annual market growth rate between 5% and 10%.

4.3 Service Business Analysis

The fiduciary and consulting business for the local area is already well established, yet still allows ample opportunity for us. This is supported by the following points:

- A large number of firms already exist, with most small and medium firms operating in a limited spectrum of traditional fiduciary services (accounting and tax). They do not have enough knowledge or time to enter the field of specialized services. New participants like banks, assurances, lawyers, and others are entering the market.

- We believe our business is in a period of grand change. Competitors must be generalists and specialists at the same time. For small and medium fiduciary businesses, a focus on one primary segment of business is necessary. In the core business, the company must be current with the services, while having the capacity to innovate (like new accounting services related to the Internet).

- We do not have main competitors, but rather many competitors in diversified services. More important than the competitors is the need to get established in the right market and to develop this market with a strong and flexible strategy.

4.3.1 Competition and Buying Patterns

Competition in the field of business consulting in the Luzern area is quite intense. Artemide Auditing & Consulting AG considers competition in our focus market niche of small and medium businesses to be modest. Customers in this segment strongly rely on the consultant’s professional qualifications and the ability to come up with viable solutions in a time- and cost-effective manner.

Strategy and Implementation Summary

Artemide AC will offer auditing, consulting, and investigation services to small and medium businesses in the Luzern area. The company will focus on providing excellent customer service, which will generate favorable client referrals and increase customer retention.

5.1 Competitive Edge

Artemide Auditing & Consulting’s competitive edge lies in the well-established reputation of Sandor Artemide, who has been in the consulting business for over a decade. Combining his professional expertise with the financial, marketing, and technical support of Daten Riffwald-Ennetmoos AG, the company is positioned to further entrench itself in the growing market of small and medium business consulting in the Luzern area.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

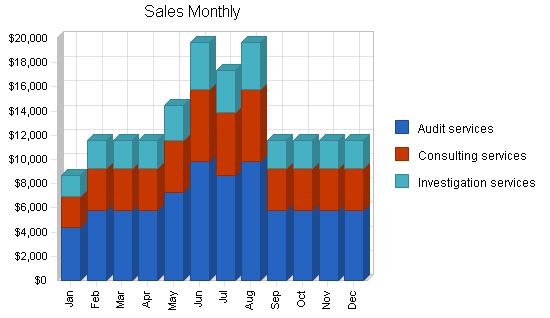

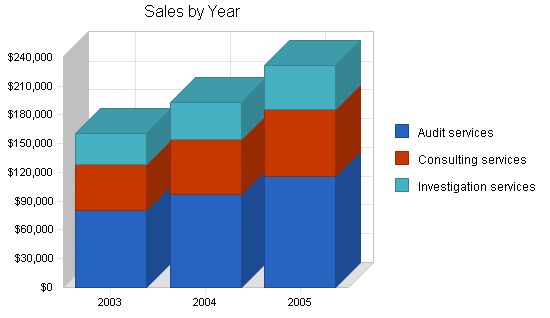

5.2 Sales Strategy

The company’s sales strategy will be based on building long-term customer relationships, which will result in repeat sales. Customer service and ‘face time’ with clients will aim to maintain a high level of customer retention. The charts and table below outline the Sales Forecast for the next three years.

Sales Forecast:

Sales

Audit services

2003, $80,492

2004, $96,590

2005, $115,908

Consulting services

2003, $48,291

2004, $57,949

2005, $69,539

Investigation services

2003, $32,194

2004, $38,633

2005, $46,359

Total Sales

2003, $160,977

2004, $193,172

2005, $231,807

Direct Cost of Sales

Audit services

2003, $12,077

2004, $13,889

2005, $15,972

Consulting services

2003, $7,243

2004, $8,329

2005, $9,579

Investigation services

2003, $6,438

2004, $7,404

2005, $8,514

Subtotal Direct Cost of Sales

2003, $25,758

2004, $29,622

2005, $34,065

Management Summary:

Sandor Artemide, majority owner of Artemide AC, will assume strategic management functions. Brigitte Artemide will be in charge of market research and customer support. No significant personnel increases are expected in the next three years.

6.1 Personnel Plan:

Personnel Plan:

Sandor Artemide

2003, $48,000

2004, $51,000

2005, $56,000

Brigitte Artemide

2003, $24,000

2004, $26,000

2005, $30,000

Total People: 2

Total Payroll:

2003, $72,000

2004, $77,000

2005, $86,000

The following sections include the annual estimates for the standard set of financial tables. Detailed monthly pro-forma tables are included in the appendix.

7.1 Important Assumptions:

General Assumptions:

Plan Month, 2003: 1, 2004: 2, 2005: 3

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 25.00%

Other: 0

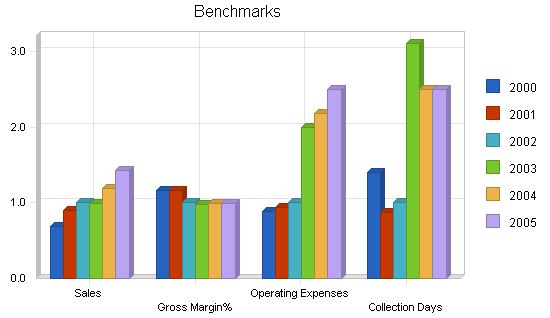

7.2 Key Financial Indicators:

The Benchmark chart below uses index values to compare past and future financial indicators. The bars show relative change, not absolute values.

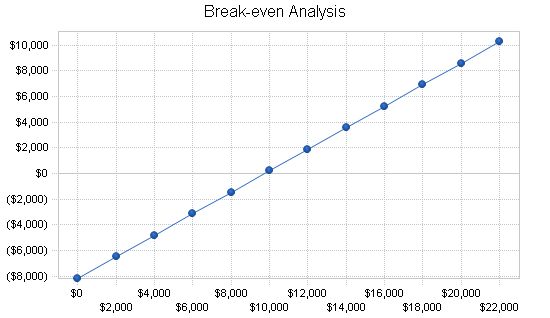

7.3 Break-even Analysis

Artemide will consistently surpass break-even throughout the next year, considering our average monthly fixed costs.

Break-even Analysis

Monthly Revenue Break-even: $9,744

Assumptions:

– Average Percent Variable Cost: 16%

– Estimated Monthly Fixed Cost: $8,185

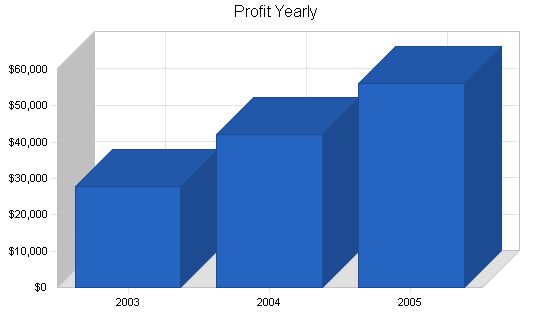

Projected Profit and Loss:

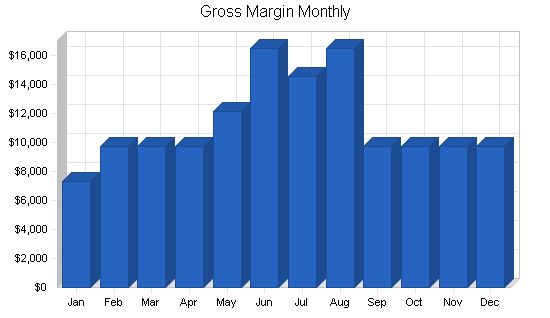

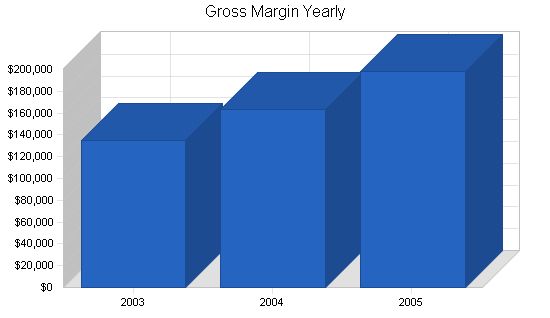

The projected profit and loss information is presented in the table and charts below.

Pro Forma Profit and Loss

Year | 2003 | 2004 | 2005

— | — | — | —

Sales | $160,977 | $193,172 | $231,807

Direct Cost of Sales | $25,758 | $29,622 | $34,065

Other | $0 | $0 | $0

Total Cost of Sales | $25,758 | $29,622 | $34,065

Gross Margin | $135,219 | $163,551 | $197,742

Gross Margin % | 84.00% | 84.67% | 85.30%

Expenses | | |

Payroll | $72,000 | $77,000 | $86,000

Sales and Marketing and Other Expenses | $6,897 | $9,500 | $13,000

Depreciation | $2,400 | $2,500 | $2,500

Leased Equipment (incl. office rental) | $2,400 | $2,500 | $3,000

Utilities (incl. office furniture, etc.) | $1,800 | $2,000 | $2,500

Insurance | $1,200 | $1,500 | $2,000

Rent | $0 | $0 | $0

Payroll Taxes | $11,520 | $12,320 | $13,760

Other | $0 | $0 | $0

Total Operating Expenses | $98,217 | $107,320 | $122,760

Profit Before Interest and Taxes | $37,003 | $56,231 | $74,982

EBITDA | $39,403 | $58,731 | $77,482

Interest Expense | $0 | $0 | $0

Taxes Incurred | $9,251 | $14,058 | $18,745

Net Profit | $27,752 | $42,173 | $56,236

Net Profit/Sales | 17.24% | 21.83% | 24.26%

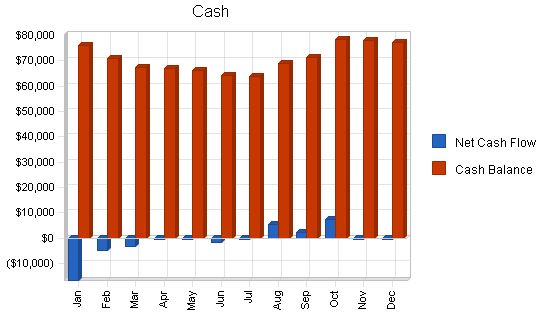

7.5 Projected Cash Flow

The projected cash flow and cash balance information is presented in the chart and table below.

Pro Forma Cash Flow

| | 2003 | 2004 | 2005 |

| — | ——- | ——- | ——- |

| | | | |

| Cash Received | | | |

| Cash from Operations | | | |

| Cash Sales | $0 | $0 | $0 |

| Cash from Receivables | $149,782 | $188,617 | $226,341 |

| Subtotal Cash from Operations | $149,782 | $188,617 | $226,341 |

| Additional Cash Received | | | |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $149,782 | $188,617 | $226,341 |

| | | | |

| Expenditures | 2003 | 2004 | 2005 |

| | | | |

| Expenditures from Operations | | | |

| Cash Spending | $72,000 | $77,000 | $86,000 |

| Bill Payments | $66,312 | $69,717 | $85,791 |

| Subtotal Spent on Operations | $138,312 | $146,717 | $171,791 |

| Additional Cash Spent | | | |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $2,895 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $24,000 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $165,207 | $146,717 | $171,791 |

| Net Cash Flow | ($15,425) | $41,901 | $54,550 |

| Cash Balance | $77,226 | $119,126 | $173,676 |

7.6 Projected Balance Sheet

The projected balance sheet information is presented in the table below.

| | 2003 | 2004 | 2005 |

| ——— | ——- | ——- | ——- |

| Assets | | | |

| | | | |

| Current Assets | | | |

| Cash | $77,226 | $119,126 | $173,676 |

| Accounts Receivable | $22,776 | $27,331 | $32,797 |

| Other Current Assets | $1,158 | $1,158 | $1,158 |

| Total Current Assets | $101,160 | $147,616 | $207,632 |

| | | | |

| Long-term Assets | | | |

| Long-term Assets | $30,948 | $30,948 | $30,948 |

| Accumulated Depreciation | $2,400 | $4,900 | $7,400 |

| Total Long-term Assets | $28,548 | $26,048 | $23,548 |

| Total Assets | $129,708 | $173,664 | $231,180 |

| | | | |

| Liabilities and Capital | 2003 | 2004 | 2005 |

| | | | |

| Current Liabilities | | | |

| Accounts Payable | $4,094 | $5,877 | $7,156 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,094 | $5,877 | $7,156 |

| | | | |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $4,094 | $5,877 | $7,156 |

| | | | |

| Paid-in Capital | $5,000 | $5,000 | $5,000 |

| Retained Earnings | $92,862 | $120,614 | $162,787 |

| Earnings | $27,752 | $42,173 | $56,236 |

| Total Capital | $125,614 | $167,787 | $224,023 |

| Total Liabilities and Capital | $129,708 | $173,664 | $231,180 |

7.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8721.01 – Auditing services, are shown for comparison.

| Ratio Analysis | 2003 | 2004 | 2005 | Industry Profile |

| ————– | —- | —- | —- | —————- |

| Sales Growth | -0.72% | 20.00% | 20.00% | 8.60% |

| Percent of Total Assets | | | | |

| Accounts Receivable | 17.56% | 15.74% | 14.19% | 24.40% |

| Other Current Assets | 0.89% | 0.67% | 0.50% | 46.70% |

| Total Current Assets | 77.99% | 85.00% | 89.81% | 74.90% |

| Long-term Assets | 22.01% | 15.00% | 10.19% | 25.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | | | | |

| Accounts Payable | 3.16% | 3.38% | 3.10% | 42.80% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 17.20% |

| Total Liabilities | 3.16% | 3.38% | 3.10% | 60.00% |

| Net Worth | 96.84% | 96.62% | 96.90% | 40.00% |

| Percent of Sales | | | | |

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 84.00% | 84.67% | 85.30% | 0.00% |

| Selling, General & Administrative Expenses | 66.89% | 62.95% | 61.14% | 83.50% |

| Advertising Expenses | 2.05% | 2.07% | 2.59% | 1.20% |

| Profit Before Interest and Taxes | 22.99% | 29.11% | 32.35% | 2.60% |

| Main Ratios | | | | |

| Current | 24.71 | 25.12 | 29.01 | 1.59 |

| Quick | 24.71 | 25.12 | 29.01 | 1.26 |

| Total Debt to Total Assets | 3.16% | 3.38% | 3.10% | 60.00% |

| Pre-tax Return on Net Worth | 29.46% | 33.51% | 33.47% | 4.40% |

| Pre-tax Return on Assets | 28.53% | 32.38% | 32.43% | 10.90% |

| Net Profit Margin | 17.24% | 21.83% | 24.26% | n.a |

| Return on Equity | 22.09% | 25.13% | 25.10% | n.a |

| Activity Ratios | | | | |

| Accounts Receivable Turnover | 7.07 | 7.07 | 7.07 | n.a |

| Collection Days | 59 | 47 | 47 | n.a |

| Accounts Payable Turnover | 14.37 | 12.17 | 12.17 | n.a |

| Payment Days | 33 | 25 | 27 | n.a |

| Total Asset Turnover | 1.24 | 1.11 | 1.00 | n.a |

| Debt Ratios | | | | |

| Debt to Net Worth | 0.03 | 0.04 | 0.03 | n.a |

| Current Liab. To Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | | | | |

| Net Working Capital | $97,066 | $141,739 | $200,475 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | 2003 | 2004 | 2005 | |

| Assets to Sales | 0.81 | 0.90 | 1.00 | n.a |

| Current Debt/Total Assets | 3% | 3% | 3% | n.a |

| Acid Test | 19.15 | 20.47 | 24.43 | n.a |

| Sales/Net Worth | 1.28 | 1.15 | 1.03 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

Sales Forecast

| | 2003 | 2004 | 2005 |

| ————– | ——– | ——– | ——– |

| | | | |

| Sales | | | |

| Audit services | $8,686 | $11,581 | $11,581 |

| Consulting services | $2,606 | $3,474 | $3,474 |

| Investigation services | $1,737 | $2,316 | $2,316 |

| Total Sales | $12,029 | $17,371 | $17,371 |

Personnel Plan

| | 2003 | 2004 | 2005 |

| ———– | —– | —– | —– |

| | | | |

| Sandor Artemide | $4,000 | $4,000 | $4,000 |

| Brigitte Artemide | $2,000 | $2,000 | $2,000 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $6,000 | $6,000 | $6,000 |

General Assumptions:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Pro Forma Profit and Loss:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| $8,686 | $11,581 | $11,581 | $11,581 | $14,476 | $19,688 | $17,372 | $19,688 | $11,581 | $11,581 | $11,581 | $11,581 |

| $1,389 | $1,853 | $1,853 | $1,853 | $2,316 | $3,151 | $2,780 | $3,151 | $1,853 | $1,853 | $1,853 | $1,853 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $1,389 | $1,853 | $1,853 | $1,853 | $2,316 | $3,151 | $2,780 | $3,151 | $1,853 | $1,853 | $1,853 | $1,853 |

| $7,297 | $9,728 | $9,728 | $9,728 | $12,160 | $16,537 | $14,592 | $16,537 | $9,728 | $9,728 | $9,728 | $9,728 |

| 84.01% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% | 84.00% |

Pro Forma Cash Flow:

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| $5,791 | $6,080 | $8,783 | $11,581 | $11,581 | $11,678 | $14,650 | $19,611 | $17,449 | $19,418 | $11,581 | $11,581 |

Pro Forma Balance Sheet

[table]

[tr]

[td]Jan[/td] [td]Feb[/td] [td]Mar[/td] [td]Apr[/td] [td]May[/td] [td]Jun[/td] [td]Jul[/td] [td]Aug[/td] [td]Sep[/td] [td]Oct[/td] [td]Nov[/td] [td]Dec[/td]

[/tr]

[tr]

[td]Assets[/td] [td]Starting Balances[/td]

[/tr]

[tr]

[td]Cash[/td] [td]$92,651[/td] [td]$75,865[/td] [td]$70,884[/td] [td]$67,431[/td] [td]$66,777[/td] [td]$66,087[/td] [td]$64,395[/td] [td]$63,832[/td] [td]$69,036[/td] [td]$71,351[/td] [td]$78,534[/td] [td]$77,880[/td] [td]$77,226[/td]

[/tr]

[tr]

[td]Accounts Receivable[/td] [td]$11,581[/td] [td]$14,477[/td] [td]$19,977[/td] [td]$22,776[/td] [td]$22,776[/td] [td]$25,671[/td] [td]$33,681[/td] [td]$36,404[/td] [td]$36,481[/td] [td]$30,613[/td] [td]$22,776[/td] [td]$22,776[/td] [td]$22,776[/td]

[/tr]

[tr]

[td]Other Current Assets[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td] [td]$1,158[/td]

[/tr]

[tr]

[td]Total Current Assets[/td] [td]$105,390[/td] [td]$91,499[/td] [td]$92,019[/td] [td]$91,365[/td] [td]$90,711[/td] [td]$92,916[/td] [td]$99,234[/td] [td]$101,393[/td] [td]$106,675[/td] [td]$103,121[/td] [td]$102,468[/td] [td]$101,814[/td] [td]$101,160[/td]

[/tr]

[tr]

[td]Long-term Assets[/td]

[/tr]

[tr]

[td]Long-term Assets[/td] [td]$6,948[/td] [td]$8,948[/td] [td]$10,948[/td] [td]$12,948[/td] [td]$14,948[/td] [td]$16,948[/td] [td]$18,948[/td] [td]$20,948[/td] [td]$22,948[/td] [td]$24,948[/td] [td]$26,948[/td] [td]$28,948[/td] [td]$30,948[/td]

[/tr]

[tr]

[td]Accumulated Depreciation[/td] [td]$0[/td] [td]$200[/td] [td]$400[/td] [td]$600[/td] [td]$800[/td] [td]$1,000[/td] [td]$1,200[/td] [td]$1,400[/td] [td]$1,600[/td] [td]$1,800[/td] [td]$2,000[/td] [td]$2,200[/td] [td]$2,400[/td]

[/tr]

[tr]

[td]Total Long-term Assets[/td] [td]$6,948[/td] [td]$8,748[/td] [td]$10,548[/td] [td]$12,348[/td] [td]$14,148[/td] [td]$15,948[/td] [td]$17,748[/td] [td]$19,548[/td] [td]$21,348[/td] [td]$23,148[/td] [td]$24,948[/td] [td]$26,748[/td] [td]$28,548[/td]

[/tr]

[tr]

[td]Total Assets[/td] [td]$112,338[/td] [td]$100,247[/td] [td]$102,567[/td] [td]$103,713[/td] [td]$104,859[/td] [td]$108,864[/td] [td]$116,982[/td] [td]$120,941[/td] [td]$128,023[/td] [td]$126,269[/td] [td]$127,416[/td] [td]$128,562[/td] [td]$129,708[/td]

[/tr]

[tr]

[td]Liabilities and Capital[/td]

[/tr]

[tr]

[td]Current Liabilities[/td]

[/tr]

[tr]

[td]Accounts Payable[/td] [td]$11,581[/td] [td]$2,920[/td] [td>$4,094

[/tr]

[tr]

[td]Current Borrowing[/td] [td>$2,895$0$0$0$0$0$0$0$0$0$0$0$0

[/tr]

[tr]

[td]Other Current Liabilities[/td] [td>$0$0$0$0$0$0$0$0$0$0$0$0$0

[/tr]

[tr]

[td]Subtotal Current Liabilities[/td] [td>$14,476$2,920$4,094$4,094$4,094$5,129$7,000$6,165$6,994$4,093$4,094$4,094$4,094

[/tr]

[tr]

[td]Long-term Liabilities[/td] [td>$0$0$0$0$0$0$0$0$0$0$0$0$0

[/tr]

[tr]

[td]Total Liabilities[/td] [td>$14,476$2,920$4,094$4,094$4,094$5,129 [td>$7,000$6,165$6,994$4,093$4,094$4,094$4,094

[/tr]

[tr]

[td]Paid-in Capital[/td] [td>$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000$5,000

[/tr]

[tr]

[td]Retained Earnings[/td] [td>$92,862$92,862$92,862$92,862 [td>$92,862$92,862$92,862$92,862$92,862] [td>$92,862$92,862$92,862$92,862

[/tr]

[tr]

[td]Earnings[/td] [td>$0($535)$611$1,757$2,903$5,874$12,120$16,914$23,168$24,314$25,460$26,606$27,752

[/tr]

[tr]

[td]Total Capital[/td] [td>$97,862$97,327$98,473$99,619$100,765$103,736$109,982$114,776$121,030$122,176$123,322$124,468$125,614

[/tr]

[tr]

[/tr]

[tr][td]Net Worth [td>$97,862$97,327 [td>$98,473 [td>$99,619 [td>$100,765 [td>$103,736 [td>$109,982$114,776$121,030 [td>$122,176$123,322$124,468$125,614

[/table]

Business Plan Outline

– Services

– Market Analysis Summary

– Strategy and Implementation Summary

– Management Summary

– Financial Plan

– Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!