A Small Business Administration (SBA) loan application typically requires a business plan. However, there’s no specific SBA loan business plan format that guarantees approval. The SBA states that you should choose a format that works for you. While I agree with this sentiment, I’ve found that entrepreneurs who explain how they will use funds and repay the loan tend to be more successful.

Luckily, our SBA-lender-approved business plan format covers these details. In this article, I’ll go over the structure and sections that the SBA prioritizes, so you can maximize your chances of getting funded. You can also download a free SBA-lender-approved business plan template to fill out as you read.

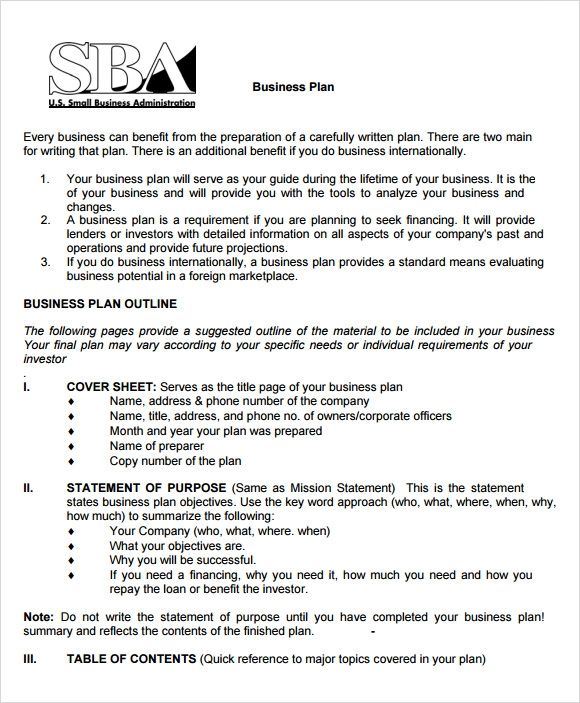

Here’s why you need a business plan for SBA loans:

SBA loans require documentation of your business and personal finances, including tax returns, bank statements, and application forms. The bank issuing the loan will also want to know the future of your business and if you can afford loan payments. Writing an SBA business plan not only describes your business but also includes financial projections.

Here’s what your business plan should include, according to the SBA:

A short overview of your business highlighting the business opportunity, team, financial forecast, and the amount you want to borrow.

2. Company description:

Explains your business opportunity, including the problem you solve, who you’re solving it for, and what makes your solution better. Include information about the product life cycle, intellectual property filings, and research and development if applicable.

3. Market analysis:

Describes your target market, providing specific demographic and psychographic information. Also includes an industry overview and a competitive analysis to demonstrate how your business is unique.

4. Organization and management:

Describes your legal structure, history, and team. Focus on leadership positions and provide detailed resumes for each team member. Also mention key positions you plan to fill as you grow.

5. Sales and marketing plan:

Summarizes how you will attract, retain, and sell to your customers. Provide examples of marketing messaging, visuals, and promotions. Include any research or results that support your strategy.

6. Financial projections:

Include the loan in your financial projections, showing it as a liability on your balance sheet, cash flow payments, and interest expenses on your profit and loss statement. First-year projections should be monthly, while annual summaries are usually sufficient.

7. Appendix:

Provides additional documents that support your business plan, such as employee resumes, licenses, permits, financial statements, and credit histories.

To improve your chances of being approved for an SBA loan, make sure your financial plan includes:

– Funding request: Clearly state how much money you are asking for.

– Use of funds: Describe how you plan to use the loan and which aspects of the business you want to invest in.

– Cash flow forecast: Show how the loan will impact your finances and include loan payments for the life of the loan.

– Balance sheet: Show the loan as a liability, while the cash received is an asset.

– Profit & Loss forecast: Include interest expenses and demonstrate how the interest will impact your profitability.

The length of an SBA business plan isn’t officially recommended, but it’s best to keep it short and concise. The written portion should be between 10-15 pages, with additional pages for financial forecasts.

If you’re struggling to keep it short, consider starting with a one-page business plan that provides a brief overview of your business. You can later expand on the ideas to develop your complete business plan.

To help you write an SBA business plan, you can download our SBA-lender-approved business plan template. If you need a more powerful tool, LivePlan offers AI-powered recommendations, step-by-step instructions, automatic financials, and a built-in pitch presentation.

Whether you use a template, LivePlan, or write the plan yourself, following the structure and tips from this article will improve your chances of getting an SBA-backed loan. For more SBA-focused resources, check out our guide on how to get an SBA loan.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!