CorbelArch Real Estate Inspectors specializes in thorough, unbiased real estate and building inspections. Our services include residential and commercial properties, new construction, condos, manufactured homes, 11th month inspections, and pre-listing inspections.

Our inspectors are professionally trained and stay up-to-date on the latest building components and inspection techniques.

We offer flexible scheduling, accommodating clients 7 days a week.

CorbelArch is fully licensed, bonded, and insured. We hold Professional Real Estate licenses through the Ourstate Realty Commission and national institutions. We have $1,000,000 in Errors and Omissions and General Liability Insurance.

Our inspections meet or exceed industry standards set by the American Society of Home Inspectors and the ORC.

CorbelArch reports are computerized and provide a checklist and narrative format with summary pages and color photos. Reports are emailed and posted securely for retrieval on our web hosting service. Printed or faxed hard copies are available upon request.

We utilize state-of-the-art equipment, including gas detection meters, moisture meters, circuit testers, and infrared thermometers.

Our inspectors are professional and courteous, prioritizing effective communication, appearance, and professionalism.

CorbelArch’s objective is to become the top property services company in the Niceburg metro area.

Our goals include achieving a 10% market share in the first year, increasing gross margins by 15% in the second year, and growing market share by at least 10% each year for the first five years.

CorbelArch aims to establish itself as the leader in the property services industry by entering the marketplace first and setting quality standards.

We understand the impact we have on the community and strive for the approval and support of key professionals.

CorbelArch’s mission is to build a financially solid and profitable company while providing market-leading service based on professionalism, integrity, and personalized customer service.

Keys to our success include maintaining an untarnished reputation, offering high-quality client-sensitive service, competitive pricing, flexible hours, excellence in fulfilling our promises, and generating new business leads.

Company Summary

CorbelArch Real Estate Inspectors is an S corporation with two principal officers and two employees, collectively possessing 45 years of industry experience. The company was established to capitalize on the perceived weaknesses and shortcomings of other regional companies in terms of quality and customer satisfaction. CorbelArch Real Estate Inspectors has actively promoted its name thus far, with the company’s principals investing significant personal capital and seeking additional funding for startup costs and future growth.

Located at 5296 Plinth Hwy in Niceburg, CorbelArch Real Estate Inspectors operates out of a standalone building that is leased and houses offices for the principals, a storage area for tools and marketing supplies, and an employee lounge.

The company plans to utilize its existing contacts gained through previous web marketing, direct mail campaigns, personal connections, and printed publications to secure short-term residential contracts. Its long-term profitability will depend on current commercial contracts with national property services companies, as well as future commercial contracts obtained through strategic alliances and a comprehensive marketing program.

2.1 Company Ownership

CorbelArch Real Estate Inspectors is an established S corporation co-owned by Mason Corbel and Rocky Arch.

2.2 Company History

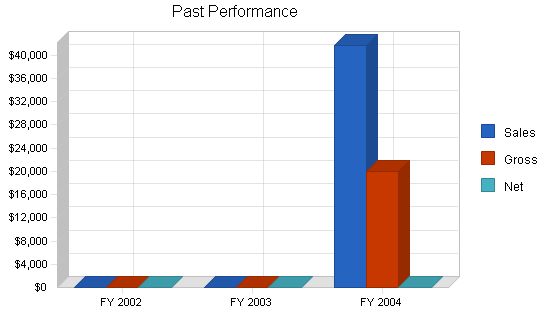

CorbelArch Real Estate Inspectors was incorporated as an S corporation in Ourstate in FY 2004. The company provided services for only a portion of the year and currently holds a substantial amount of Accounts Receivable, along with a modest cash balance. The principals each invested $15,000 in the company’s startup and secured short-term loans.

Past Performance:

FY 2002 FY 2003 FY 2004

Sales $0 $0 $41,639

Gross Margin $0 $0 $20,000

Gross Margin % 0.00% 0.00% 48.03%

Operating Expenses $0 $0 $5,800

Collection Period (days) 0 0 135

Balance Sheet:

FY 2002 FY 2003 FY 2004

Current Assets:

Cash $0 $0 $3,000

Accounts Receivable $0 $0 $21,639

Other Current Assets $0 $0 $25,000

Total Current Assets $0 $0 $49,639

Long-term Assets:

Long-term Assets $0 $0 $15,000

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $0 $0 $15,000

Total Assets $0 $0 $64,639

Current Liabilities:

Accounts Payable $0 $0 $2,000

Current Borrowing $0 $0 $9,827

Other Current Liabilities (interest free) $0 $0 $0

Total Current Liabilities $0 $0 $11,827

Long-term Liabilities $0 $0 $0

Total Liabilities $0 $0 $11,827

Paid-in Capital $0 $0 $30,000

Retained Earnings $0 $0 $22,812

Earnings $0 $0 $0

Total Capital $0 $0 $52,812

Total Capital and Liabilities $0 $0 $64,639

Other Inputs:

Payment Days 0 0 30

Sales on Credit $0 $0 $29,147

Receivables Turnover 0.00 0.00 1.35

Services:

CorbelArch Real Estate Inspectors provides comprehensive property inspection and preservation services to the residential and commercial markets.

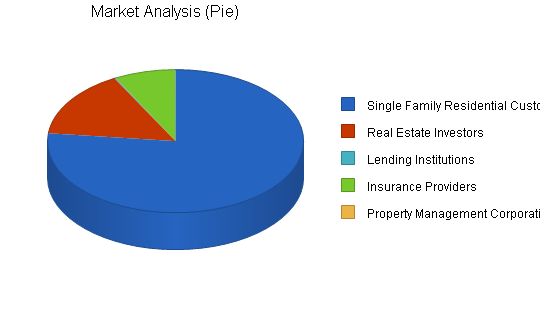

Market Analysis Summary:

CorbelArch Real Estate Inspectors will focus on two markets within the industry, the residential segment (including apartment buildings) and the commercial segment (including buildings used for professional purposes).

The commercial market participants currently need competent inspection firms to provide services to themselves or their clients. Our inspection findings can significantly impact a business’ profitability, so accuracy and completeness are crucial.

In the residential segment, quality and meeting the individual needs/wants of the client while maintaining the Realtor’s transaction come first. The inspector must be flexible, willing to listen, and work directly with the client.

Several new trends have been observed in the industry over the past decade, including steady growth of the local economy, an increased percentage of property transactions requiring inspections, and the requirement and escalation of credentials needed for inspections.

Market Segmentation:

CorbelArch Real Estate Inspectors will focus on two markets within the industry, the residential segment (including apartment buildings) and the commercial segment (buildings used for professional purposes). The company can handle any size building that needs inspection or management services. The goal is to eventually have approximately one-third of all business coming from the commercial segment, which generates the greatest cash flow and has the lowest percentage of variable costs. The residential segment is considered the company’s cash cow. Even during slow winter months, the company can expect several residential contracts.

Market Analysis

| Potential Customers | 2004 | 2005 | 2006 | 2007 | 2008 | CAGR | |

| Single Family Residential Customers | 10% | 50,000 | 55,000 | 60,500 | 66,550 | 73,205 | 10.00% |

| Real Estate Investors | 10% | 10,000 | 11,000 | 12,100 | 13,310 | 14,641 | 10.00% |

| Lending Institutions | 0% | 100 | 100 | 100 | 100 | 100 | 0.00% |

| Insurance Providers | 0% | 5,000 | 5,000 | 5,000 | 5,000 | 5,000 | 0.00% |

| Property Management Corporations | 50% | 30 | 45 | 68 | 102 | 153 | 50.28% |

| Total | 9.34% | 65,130 | 71,145 | 77,768 | 85,062 | 93,099 | 9.34% |

4.2 Target Market Segment Strategy

Currently, there is limited competition in the commercial inspection services industry. We plan to target our marketing to gain share in this growing business.

4.3 Service Business Analysis

Most of the industry analysis is contained in the Competitive Comparison section to give the reader an idea of the industry’s competitive nature, opportunities and threats, and the company’s flexibility in pricing. CorbelArch Real Estate Inspectors exists in a purely competitive market that faces unlimited competition and high demand. The company can differentiate its services or enter a niche market. The company will engage in strong leadership principles, aggressive sales, and high quality.

4.3.1 Competition and Buying Patterns

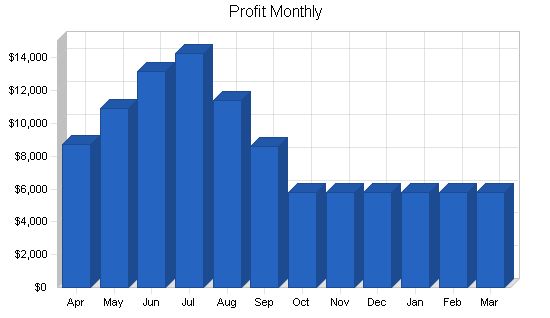

This industry is somewhat seasonal. The busiest times are during the summer months, where a company can become so engaged that it must turn down opportunities. During the winter months, businesses must focus on service diversification and marketing to maintain a consistent level of work.

Strategy and Implementation Summary

As stated before, the company will focus on greater service through better scheduling, project management, and personnel alignment by providing profit sharing. The company is utilizing the most up-to-date communications, scheduling, reporting technology available.

The company is also carrying out an aggressive marketing plan throughout the region. This includes Web listings, direct mailings, literature, and strategic alliances with key industry professionals.

5.1 Competitive Edge

CorbelArch Real Estate Inspectors seeks to establish a competitive edge in its new target market segment by increasing the level of customer contact and service. Additionally, CorbelArch Real Estate Inspectors possesses the necessary skills to produce high-quality services needed in this field. The establishment of work processes that ensure greater service will strengthen contacts that promote word-of-mouth marketing and networking.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

CorbelArch Real Estate Inspectors is currently utilizing several avenues to promote the company and its services, including but not limited to: website, multiple trade Web listings, brochure placements, phone directory advertisement, direct mail advertisement, target service mailings, and word of mouth among key industry professionals.

The website will be promoted on all marketing publications and promo pieces. We will link to various trade and government sites. We are currently listed at the top of several of the most utilized search engines.

5.3 Sales Strategy

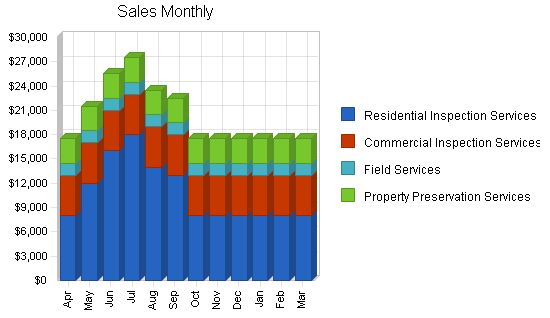

Sales forecast is based on the existing client base of the two principal officers of the company and the ability of their two relatively new employees to generate new sales based on these contacts. By bringing together the experience (which includes significant sales) of the existing owners and new employees, the company will be able to generate sales on an escalating basis. Furthermore, the company’s growing marketing program will generate the growth the company needs to excel.

5.3.1 Sales Forecast

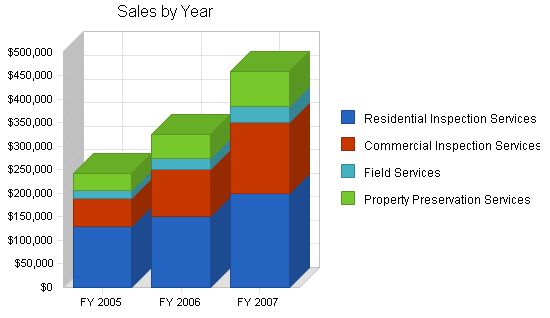

The table and chart below, along with the first-year monthly breakdown in the appendix, present the Sales and Cost of Sales forecast.

Sales Forecast

| Sales Forecast | |||

| FY 2005 | FY 2006 | FY 2007 | |

| Sales | |||

| Residential Inspection Services | $129,000 | $150,000 | $200,000 |

| Commercial Inspection Services | $60,000 | $100,000 | $150,000 |

| Field Services | $18,000 | $25,000 | $35,000 |

| Property Preservation Services | $36,000 | $50,000 | $75,000 |

| Total Sales | $243,000 | $325,000 | $460,000 |

| Direct Cost of Sales | FY 2005 | FY 2006 | FY 2007 |

| Mileage | $35,235 | $47,125 | $66,700 |

| Report Materials | $14,580 | $19,500 | $27,600 |

| Subtotal Direct Cost of Sales | $49,815 | $66,625 | $94,300 |

Management Summary

Our company philosophy is based on mutual respect for all contributors and we value suggestions from everyone regardless of their position. CorbelArch Real Estate Inspectors aims to create a partnership environment where teamwork is appreciated and rewarded.

CorbelArch Real Estate Inspectors is committed to community involvement programs that improve the quality of community life. We offer our services to schools, churches, and other groups for mutual benefit.

6.1 Personnel Plan

Customer service is of utmost importance in our business plan. The management team will target trainable employees and provide encouragement and incentives. CorbelArch Real Estate Inspectors will outsource bookkeeping/HR functions initially, with plans to hire a full-time bookkeeper in year three.

In year one, we will have four personnel. In year two, we will hire two more people. By year three, our total personnel count will be seven.

As the business becomes more profitable, CorbelArch intends to provide the following benefits for owners and employees:

– Health care insurance

– Dental care insurance

– Life insurance

– Vacation time

– Up sell incentive programs

– 401k retirement plans

Personnel Plan

| Personnel Plan | |||

| FY 2005 | FY 2006 | FY 2007 | |

| Owner\Founders | $14,000 | $64,000 | $74,000 |

| Employees | $7,000 | $100,000 | $125,000 |

| Total People | 0 | 6 | 7 |

| Total Payroll | $21,000 | $164,000 | $199,000 |

The financial plan for CorbelArch Real Estate Inspectors includes a Break-even Analysis, Cash Flow, P & L, and a Balance Sheet.

7.1 Important Assumptions

We assume steady growth with good management, barring any unforeseen local or national disasters such as the economic slowdown after the September 11th, 2001 tragedies.

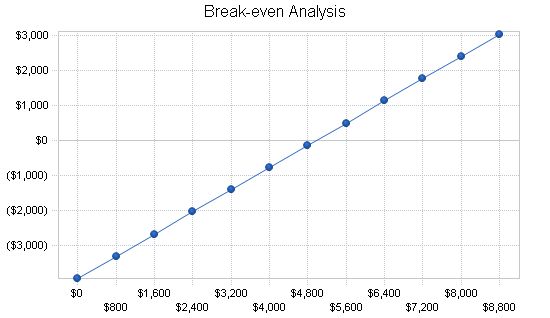

7.2 Break-even Analysis

The break-even analysis is based on our average monthly expenses. The total expenses for the 12-month plan period were divided by twelve to establish the monthly average. The table below shows our monthly revenue target. We understand that our actual revenue and expenses will vary each month.

Break-even Analysis:

Monthly Revenue Break-even: $4,963.

Assumptions:

– Average Percent Variable Cost: 21%.

– Estimated Monthly Fixed Cost: $3,946.

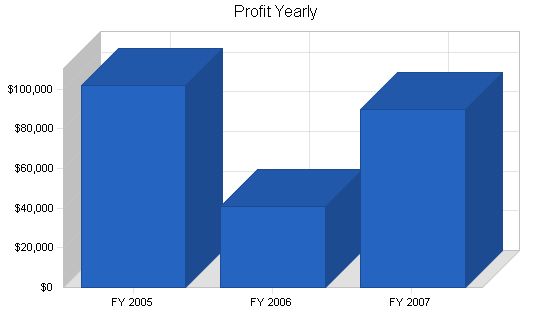

Projected Profit and Loss:

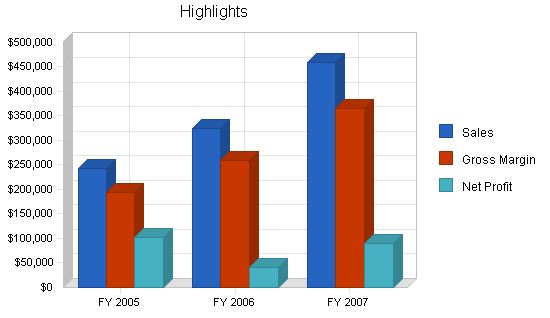

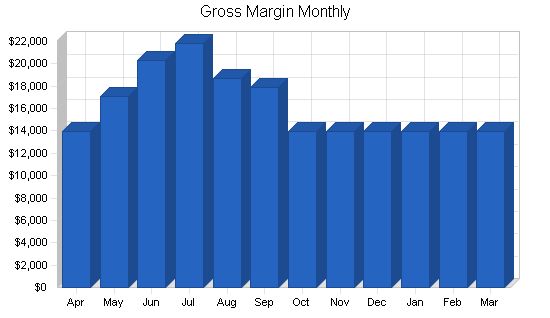

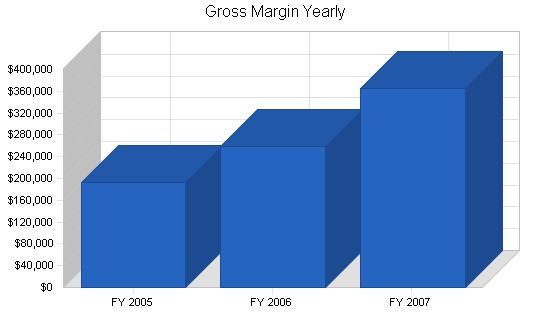

According to the Profit and Loss table, the company anticipates sustained profitability growth over the next three years of operations.

Projected Profit and Loss:

FY 2005 FY 2006 FY 2007

Sales $243,000 $325,000 $460,000

Direct Cost of Sales $49,815 $66,625 $94,300

Other Costs of Sales $0 $0 $0

Total Cost of Sales $49,815 $66,625 $94,300

Gross Margin $193,185 $258,375 $365,700

Gross Margin % 79.50% 79.50% 79.50%

Expenses:

Payroll $21,000 $164,000 $199,000

Marketing/Promotion $3,000 $4,000 $8,000

Depreciation $0 $0 $0

Rent $6,000 $9,000 $9,000

Utilities $1,200 $2,000 $2,400

Insurance $9,000 $12,000 $16,000

Website Hosting and Maintenance $2,400 $2,800 $3,000

Bookkeeping Service $4,750 $6,000 $0

Payroll Taxes $0 $0 $0

Total Operating Expenses $47,350 $199,800 $237,400

Profit Before Interest and Taxes $145,835 $58,575 $128,300

EBITDA $145,835 $58,575 $128,300

Interest Expense $533 $436 $335

Taxes Incurred $43,591 $17,442 $38,389

Net Profit $101,711 $40,697 $89,575

Net Profit/Sales 41.86% 12.52% 19.47%

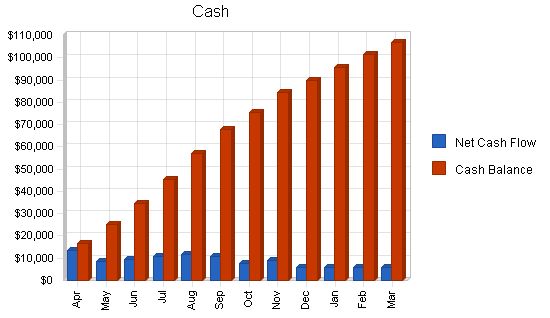

Projected Cash Flow:

In years two and three, we will purchase company vehicles. In year two, we anticipate distributing profit sharing as dividends to all owners and employees.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| FY 2005 | FY 2006 | FY 2007 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $72,900 | $97,500 | $138,000 |

| Cash from Receivables | $167,647 | $219,370 | $308,616 |

| Subtotal Cash from Operations | $240,547 | $316,870 | $446,616 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $240,547 | $316,870 | $446,616 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $21,000 | $164,000 | $199,000 |

| Bill Payments | $113,869 | $118,834 | $167,223 |

| Subtotal Spent on Operations | $134,869 | $282,834 | $366,223 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $1,740 | $1,635 | $1,736 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $30,000 | $45,000 |

| Dividends | $0 | $30,000 | $60,000 |

| Subtotal Cash Spent | $136,609 | $344,469 | $472,959 |

| Net Cash Flow | $103,938 | ($27,599) | ($26,343) |

| Cash Balance | $106,938 | $79,339 | $52,996 |

7.5 Projected Balance Sheet

The balance sheet shows healthy growth of net worth and a strong financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| FY 2005 | FY 2006 | FY 2007 | |

| Assets | |||

| Current Assets | |||

| Cash | $106,938 | $79,339 | $52,996 |

| Accounts Receivable | $24,092 | $32,221 | $45,606 |

| Other Current Assets | $25,000 | $25,000 | $25,000 |

| Total Current Assets | $156,030 | $136,560 | $123,602 |

| Long-term Assets | |||

| Long-term Assets | $15,000 | $45,000 | $90,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $15,000 | $45,000 | $90,000 |

| Total Assets | $171,030 | $181,560 | $213,602 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $8,419 | $9,888 | $14,090 |

| Current Borrowing | $8,087 | $6,452 | $4,716 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $16,506 | $16,340 | $18,806 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $16,506 | $16,340 | $18,806 |

| Paid-in Capital | $30,000 | $30,000 | $30,000 |

| Retained Earnings | $22,812 | $94,523 | $75,221 |

| Earnings | $101,711 | $40,697 | $89,575 |

| Total Capital | $154,523 | $165,221 | $194,796 |

| Total Liabilities and Capital | $171,030 | $181,560 | $213,602 |

| Net Worth | $154,523 | $165,221 | $194,796 |

7.6 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7389.0203, Building Inspection Services, are shown for comparison.

| Ratio Analysis | ||||

| FY 2005 | FY 2006 | FY 2007 | Industry Profile | |

| Sales Growth | 483.59% | 33.74% | 41.54% | 2.53% |

| Percent of Total Assets | ||||

| Accounts Receivable | 14.09% | 17.75% | 21.35% | 23.12% |

| Other Current Assets | 14.62% | 13.77% | 11.70% | 47.86% |

| Total Current Assets | 91.23% | 75.21% | 57.87% | 73.23% |

| Long-term Assets | 8.77% | 24.79% | 42.13% | 26.77% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 9.65% | 9.00% | 8.80% | 34.95% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 11.17% |

| Total Liabilities | 9.65% | 9.00% | 8.80% | 46.12% |

| Net Worth | 90.35% | 91.00% | 91.20% | 53.88% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 79.50% | 79.50% | 79.50% | 100.00% |

| Selling, General & Administrative Expenses | 37.64% | 66.98% | 60.03% | 81.44% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.41% |

| Profit Before Interest and Taxes | 60.01% | 18.02% | 27.89% | 2.40% |

| Main Ratios | ||||

| Current | 9.45 | 8.36 | 6.57 | 1.54 |

| Quick | 9.45 | 8.36 | 6.57 | 1.23 |

| Total Debt to Total Assets | 9.65% | 9.00% | 8.80% | 56.68% |

| Pre-tax Return on Net Worth | 94.03% | 35.19% | 65.69% | 5.58% |

| Pre-tax Return on Assets | 84.96% | 32.02% | 59.91% | 12.87% |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!