Creating an Expense Budget

Creating an expense budget is an essential tool for managing your finances effectively. It allows you to gain control over your spending and ensure that you are using your money wisely. Follow these steps to create an effective expense budget.

1. Track Your Expenses: Start by tracking all of your expenses for a month. This will give you a comprehensive understanding of where your money is going and where you can make adjustments.

2. Categorize Your Expenses: Group your expenses into categories such as rent, utilities, groceries, entertainment, transportation, and debt payments. This will help you see clearly where your money is being allocated.

3. Determine Your Income: Calculate your total monthly income, including salaries, bonuses, allowances, and any other sources of revenue. It is important to have an accurate figure to work with when creating your expense budget.

4. Set Financial Goals: Determine what you want to achieve financially. Whether it is saving for a down payment on a house, paying off debt, or building an emergency fund, having specific goals will help you prioritize your spending.

5. Identify Necessary Expenses: Consider which expenses are essential and cannot be eliminated, such as rent, utilities, and groceries. These expenses should be listed as top priorities in your budget.

6. Analyze Your Discretionary Spending: Review your non-essential expenses, such as dining out, entertainment, and shopping. Look for areas where you can reduce or eliminate spending to free up more money for your financial goals.

7. Allocate Your Income: Distribute your income across your expense categories based on your priorities. Start with your necessary expenses and then allocate the remaining funds to your discretionary spending and financial goals.

8. Monitor and Adjust: Regularly review your expense budget to ensure that you are sticking to your plan and making progress towards your financial goals. Make adjustments as needed to keep your budget aligned with your priorities.

By following these steps, you can create an expense budget that helps you take control of your finances and make informed spending decisions. Remember, a well-managed budget is a powerful tool for achieving your financial aspirations.

One fundamental aspect of effective financial planning and business management is expense management. This begins with creating an expense budget. Treat your budget as a goal and regularly review and revise it to stay on track. While being on budget is important, effective management requires regular review of the timing, efficiency, and outcomes of your business expenditures.

For clarity, we can refer to it as an expense forecast or projected expenses. These terms are interchangeable, and when combined with projected sales and costs, provide the necessary information to forecast your profit or loss.

The key types of business spending include expenses, direct costs, and repayments and asset purchases. Expenses primarily consist of operating expenses such as rent, utilities, advertising, and payroll. Direct costs, also known as the costs of goods sold (COGS), refer to the expenses incurred on the products or services you sell. For example, a bookstore’s COGS would be the cost of purchasing books to sell to customers. Repaying debts and purchasing assets impact your cash flow and balance sheet but do not directly affect your profits.

Now let’s discuss your expense budget.

Creating an expense budget involves making educated guesses based on your experience, research, and common sense. It’s important to align your expense estimates with your sales, costs, and planned activities.

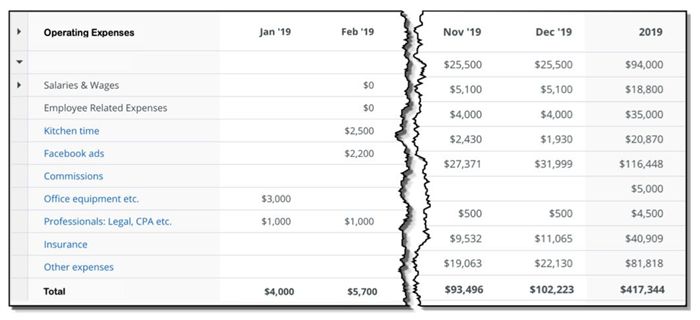

The math behind creating an expense budget is simple. The provided illustration showcases a sample expense budget from a soup delivery subscription plan. Aim to align the rows with your accounting practices as closely as possible. Set timeframes and estimate the expenses for each of the next 12 months, as well as the annual totals for the following two years.

In the example, the owners know their business. As they develop their budget, they have a good idea of the expenses for kitchen time, Facebook ads, commissions, office equipment, and more.

And if you don’t know these numbers for your business, find out. If you don’t know rents, talk to a broker, see some locations, and estimate the costs.

Do the same for utilities, insurance, and leased equipment: Make a list, call people, and make an educated guess.

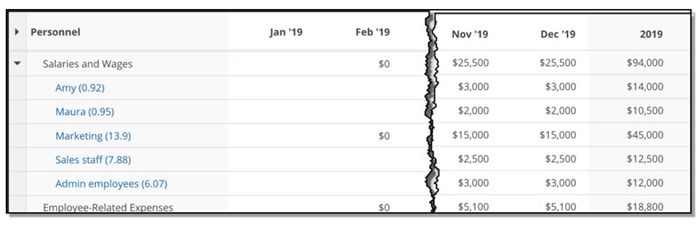

Payroll and payroll taxes are operating expenses. They also include wages and salaries, or compensation. They are worth a separate list. For payroll, they do a separate list to keep track. Payroll is a serious fixed cost and an obligation. Here is the payroll budget associated with the sample plan.

Notice that the totals from the personnel plan show up in the expense budget. And you can see the estimated expense for benefits in addition to the gross salary. Employee-related expenses include payroll taxes, health insurance, and other benefits.

Depreciation is a special case. Typically, it counts as an operating expense, but many businesses budget for it separately because it doesn’t actually cost money.

It’s a concept the tax code permits us to deduct as a business expense, in theory, to account for the gradual decline in the value of an asset or to allow money for purchasing new assets when existing ones become obsolete.

Including depreciation in the expenses provides a more accurate picture of profits. Some people separate depreciation from other expenses to calculate EBITDA, which is earnings before interest, taxes, depreciation, and amortization (similar to depreciation but for intangible assets).

Bottom line: Including or excluding it is your choice.

Because interest is also excluded from EBITDA, many people also exclude it from operating expenses. They list it separately, along with depreciation, to simplify the EBITDA calculation. Either way works, as long as you include the interest expense in your budget, because unlike depreciation, interest does cost money.

Remember the underlying goal: The budget is intended to help you make good decisions.

Set expenses to align with your strategy and tactics, so you can do what’s best for long-term progress. Match accounting categories as much as possible for easier tracking. Keep track of assumptions, so you can make quick adjustments when things don’t go according to plan (which they often do).

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!