Contents

Feed and Farm Supply Business Plan

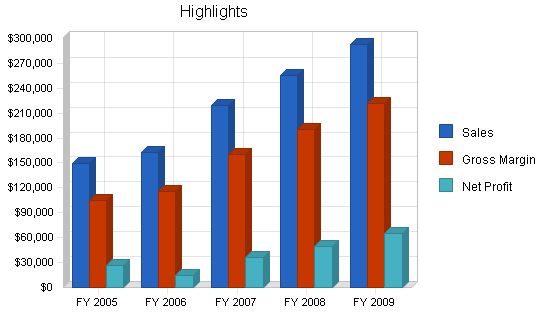

This plan is based on 16 years of experience, is highly focused, and promises prosperity for its owners and staff. It is based on conservative sales figures, and actual sales may be higher. The projections are authentic and will be used as the business budget. Latheethen Feeds, Inc. will show an immediate profit and increase sales and profits each year.

Latheethen Feeds, Inc. is a well-established custom feed store. The company produces custom livestock feeds, bird feed, deer feed, and other animal products. Latheethen Feeds, Inc. has expanded its production facility and is well-positioned to market its products beyond its current client base. The company is dedicated to providing high-quality customer service, meeting delivery dates, and keeping sales prices controlled. The focus of this plan is to identify target clients, explain the marketing strategy, improve internal procedures, increase profitability, and obtain funding to expand the business.

Latheethen Feeds, Inc. is located in Pleasantville, Michigan. The company has been operating privately for nearly 16 years. The previous owners live next door and plan on moving to their retirement home in Northern Michigan after the business transaction is completed. However, since the current and new owners are family, the current owners will be available if needed and to visit bi-weekly.

The six counties surrounding Latheethen Feeds have an estimated 14,695 livestock farms and 20,434 hunters. However, the entire state is an open market once delivery to customers is an option. Latheethen’s can compete for the business of 53,315 farms in the state. USDA records show that farms in Michigan spend a quarter of a billion dollars annually on feed. The company’s estimated market share is less than 1%. The owners have established an estimated $140,000 of the state total annually without any advertisement or outside sales. The new owners aim to grow the business and gain a greater share, $260,000 annually, of the state total.

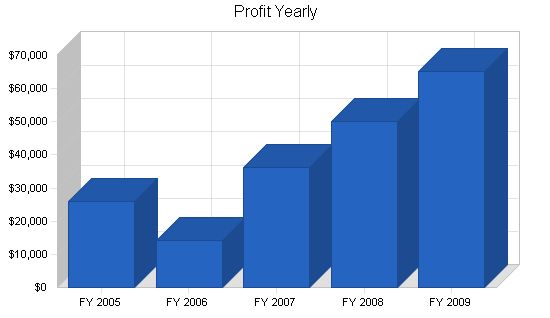

The marketing research and tailored strategy in this plan will result in after-tax profits of $22,806 in Year 1, increasing to nearly $30,000 within three years, despite new advertising and renovation expenses.

To achieve these goals, Latheethen Feeds needs funding for two expansion phases. We are seeking a $15,000 short-term loan, repaid within two years, to purchase a delivery truck. In early Year 2, we will need a second, long-term loan of $135,000 to build the area’s premier equine boarding stable. The addition of “Mid-Town Meadows” will not only be another source of revenue but also feed sales. Mid-Town Meadows will be a comfortable, inviting equine resort designed to make customers and their horses feel they are enjoying VIP services in a world all to themselves. The decor and theme will be rustic yet formal, with a log exterior walls and a private club house overlooking the enclosed arena. The feed store is located at the main entrance, next to a cascading water fountain and company signs.

1.1 Objectives

Latheethen Feeds has five primary objectives:

- Maintain 100% of existing customer base through consistent customer service.

- Expand customer base through direct referrals and aggressive direct sales.

- Gradually expand product line based on customer requests.

- Expand the custom feed mill to meet growing sales market.

- Expand the types of services offered to customers based on their desires.

1.2 Mission

Latheethen Feeds is a family owned and operated company dedicated to providing customers the best premium products and services. Our commitment to customer service and satisfaction ensures 100% customer satisfaction.

1.3 Keys to Success

The primary keys to the success of Latheethen Feeds are:

- Product freshness and quality.

- Variety and price.

- Constant research of industry to stay knowledgeable of market needs.

- Managing budgets, including on-time product delivery and professional customer service.

- Constant evaluation of strengths and weaknesses with adjustments as warranted.

Company Summary

Latheethen Feeds is a mid-Michigan based farm and feed store dedicated to providing professional services and high quality feed products. Latheethen’s offers the best feed and products in the industry, including custom made feed. Our mill enables us to provide quality products that are always fresh. Our primary focus is on customer satisfaction through professional service, competitive pricing, and a knowledgeable staff.

Latheethen’s was founded in 1989 by Chris and Steve Latheethen and is now one of the area’s premier feed stores specializing in custom-made feed.

The future of Latheethen’s looks bright with younger family members taking over ownership. Our focus is on core products, with sales and promotions emphasizing our history and reputation for quality and customer service. With new energy and enthusiasm, we will increase sales and the bottom line. Our commitment and pride in protecting and growing the business will be our greatest asset.

Latheethen’s will continue to expand in the future, becoming not only a larger provider of quality feeds, but also a boarding stable and resource for customers with inquiries about all areas of pet care.

2.1 Company Ownership

Latheethen Feeds, Inc. is a privately-held Michigan corporation owned by Chris and Steve Latheethen. The new owners, Dennis Latheethen and Kay Latheethen, will share 50/50 ownership.

2.2 Company History

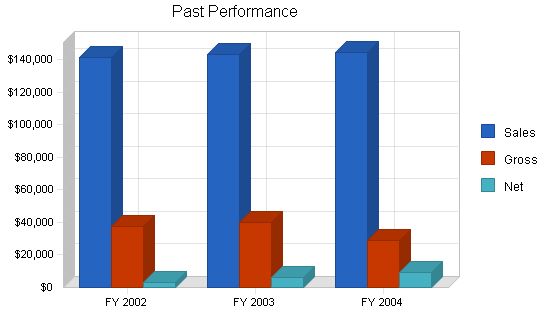

Latheethen Feeds was founded in 1989 by Chris and Steve Latheethen as a retail company selling feed and supplies to local customers. Recognizing the need for more variety and competitive pricing, they added a feed mill to produce custom feeds, which became their best seller. The past performance shows an increase in sales over the past three years. The business will implement a point of sale inventory and accounting system to better track sales categories and increase net revenue.

The recent increase in the value of assets is due to the contribution of the acreage on which the business stands and the purchase of the point of sale system to track orders.

Past Performance:

FY 2002: Sales – $141,550 | Gross Margin – $37,314 | Gross Margin % – 26.36% | Operating Expenses – $34,497 | Inventory Turnover – 0.00

FY 2003: Sales – $143,200 | Gross Margin – $39,930 | Gross Margin % – 27.88% | Operating Expenses – $33,896 | Inventory Turnover – 0.00

FY 2004: Sales – $144,522 | Gross Margin – $28,695 | Gross Margin % – 19.86% | Operating Expenses – $28,940 | Inventory Turnover – 23.66

Balance Sheet:

FY 2002: Current Assets – Cash: $1,179 | Inventory: $2,198 | Other Current Assets: $0 | Total Current Assets: $3,377

FY 2003: Current Assets – Cash: $1,378 | Inventory: $2,198 | Other Current Assets: $0 | Total Current Assets: $3,576

FY 2004: Current Assets – Cash: $527 | Inventory: $8,904 | Other Current Assets: $75,463 | Total Current Assets: $84,894

FY 2002: Long-term Assets: Long-term Assets: $39,625 | Accumulated Depreciation: $38,603 | Total Long-term Assets: $1,022

FY 2003: Long-term Assets: Long-term Assets: $39,625 | Accumulated Depreciation: $38,603 | Total Long-term Assets: $1,022

FY 2004: Long-term Assets: Long-term Assets: $170,000 | Accumulated Depreciation: $39,089 | Total Long-term Assets: $130,911

FY 2002: Total Assets – $4,399

FY 2003: Total Assets – $4,598

FY 2004: Total Assets – $215,805

Current Liabilities:

FY 2002 – Total Current Liabilities: $0

FY 2003 – Total Current Liabilities: $0

FY 2004 – Total Current Liabilities: $0

Total Liabilities:

FY 2002 – Total Liabilities: $0

FY 2003 – Total Liabilities: $0

FY 2004 – Total Liabilities: $0

Paid-in Capital – $1,000

Retained Earnings – FY 2002: $584 | FY 2003: ($2,436) | FY 2004: $205,465

Earnings – FY 2002: $2,815 | FY 2003: $6,034 | FY 2004: $9,340

Total Capital – FY 2002: $4,399 | FY 2003: $4,598 | FY 2004: $215,805

Total Capital and Liabilities: FY 2002: $4,399 | FY 2003: $4,598 | FY 2004: $215,805

Other Inputs:

Payment Days – FY 2002: 0 | FY 2003: 0 | FY 2004: 0

Services:

Latheethen Feeds, Inc. offers products and supplies (Feed, Wormer, Treats, Beading, etc.) for various animals including Birds (Caged and Wild), Cats and Dogs (Household Pets), Cattle, Chickens, Deer and Elk, Horses, Fish (Pond), Goats, Pigs, Llamas, Lambs, Rabbits, Sheep, and Turkeys. Additionally, they provide Custom Made Feeds and Delivery (Selective).

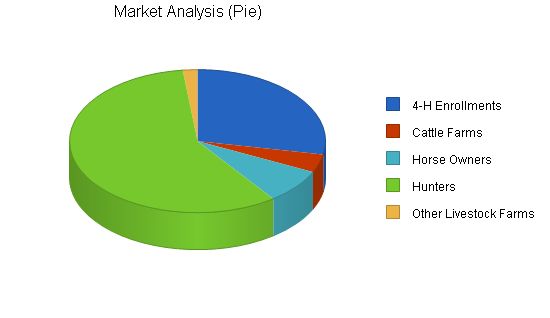

Market Analysis Summary:

Latheethen Feeds is the only custom feed manufacturer in the Midland, Michigan area and surrounding 50 mile radius. Market analysis suggests potential growth by marketing their custom feeds to other direct feed stores outside of this radius. They have a strong customer base consisting of local organizations such as 4-H and Future Farmers of America (FFA), as well as farms and ranches. Despite not having a direct sales force or significant advertising, the business has been successful in creating high-quality, cost-contained custom feed formulas for over sixteen years. They now have the opportunity for further growth by targeting the 4-H enrollments market segment, which offers exposure to a variety of animals and potential sales of all their feed products.

Market Analysis

The provided chart displays market growth for potential customers from 2004 to 2008.

The chart shows the growth of potential customers in the following categories:

– 4-H Enrollments: 5% growth from 2004 to 2008, with a compound annual growth rate (CAGR) of 5.00%.

– Cattle Farms: 2% growth from 2004 to 2008, with a CAGR of 2.00%.

– Horse Owners: 5% growth from 2004 to 2008, with a CAGR of 5.00%.

– Hunters: 8% growth from 2004 to 2008, with a CAGR of 8.00%.

– Other Livestock Farms: 3% growth from 2004 to 2008, with a CAGR of 3.00%.

– Total: 6.63% growth from 2004 to 2008, with a CAGR of 6.63%.

4.2 Target Market Segment Strategy

Strategically targeting 4-H enrollments near our business aligns with our marketing plan and style of feed store. The 4-H youth are our future and value exceptional service, low prices, and high-quality feed. Our marketing plan focuses on supporting the 4-H kids and their community.

Cattle Farms, our second-tier market group, appreciates great service, quality feed, and fresh products delivered directly to their farms. This market is smaller but has a larger number of cattle to feed on each farm.

Horse Owners will find value in our special blend of oats, grains, and high-quality minerals, resulting in premium feed at an affordable cost. We must target the right avenues to gain industry share in this expanding market.

Hunters represent the largest group in terms of individual purchasers. They are mostly seasonal customers, with higher numbers between September and December. We projected a low 30% of the total available market for our hunting products.

Other Livestock Farms have a high number of feed users. With our custom feed mill, we can manufacture any type of animal feed, providing high-quality feed at the lowest cost possible. We have no competitors within a 125 mile radius.

The data for our market analysis was acquired from the Department of Natural Resources, the 4-H Council, and the USDA National Agricultural Statistics Service.

All projections are based on real-life numbers. We have forecasted conservatively to show the actual amount of business we can easily obtain through advertisements and direct marketing.

4.3 Service Business Analysis

Latheethen Feeds, Inc. manufactures and retails custom feed and related products. We straddle two industries – feed manufacturers and retailers. With 16 years of success, our custom feed industry experience is a strong foundation for continued growth.

There are over 7,000 farm product raw materials businesses in the United States. Only 843 of them sell poultry and livestock feeds mixed on location. Our sales of $8,141,368 reflect the fact that most custom-feed mixers are small operations. We have expanded our product line with snacks, and wild and exotic animal feed. By becoming a full-service custom-feed store and prioritizing service and quality, we have surpassed industry standards for revenue.

Our products are purchased from wholesale suppliers and sold to retail consumers. Our custom feed competes with other retail products. The lower raw goods and manufacturing costs allow us to offer quality feeds at a lower price. We rely on direct referrals and word-of-mouth advertising for growth.

Within a 50-mile radius, there are no competitors for custom feed for the wide variety of animals we provide for. Our tasks include encouraging referrals, implementing direct marketing to groups like the 4-H and FFA, and introducing our company and custom feeds to ranches and livestock farms.

Our existing customer base is strong, and most have been doing business with us for several years. Customer relationships, quality products, and competitive prices contribute to our success. We plan to gain new customers through delivery services and focused marketing.

4.3.1 Competition and Buying Patterns

In the feed and farm supply industry, businesses compete on price, quality, customer service, and delivery. Trust in suppliers for consistent quality and service is crucial for customers.

Our existing customers have routine buying patterns. They come at the same time and schedule deliveries with the same volumes each time. Customers use our products because they are good for their animals and reasonably priced.

We believe that offering delivery services will attract new customers. We will leverage existing customer relationships and implement focused marketing to gain recognition and grow.

4.4 Sales Strategy

Starting in October and November, we will approach members of our target markets via phone and direct visits. We will ask existing customers for introductions or referrals. We will present our products and services, listen to their needs, and create personalized sales proposals. The proposals will be presented as written agreements ready for signature to begin doing business.

Order details will be entered into our customer database. We will adjust raw goods shipments to include fresh products necessary for new orders. Deliveries will be scheduled using our point of sale/delivery database. Each order will be reviewed by an owner to ensure quality and accuracy. Payment terms will be COD, and invoices will be sent prior to delivery.

We will follow up with each customer within 24 hours of delivery to ensure satisfaction. Any issues will be addressed promptly by an owner.

Our focus is on keeping existing customers happy while introducing new products and services. We will always prioritize our loyal repeat customers and use their referrals to sustain growth.

4.4.1 Sales Forecast

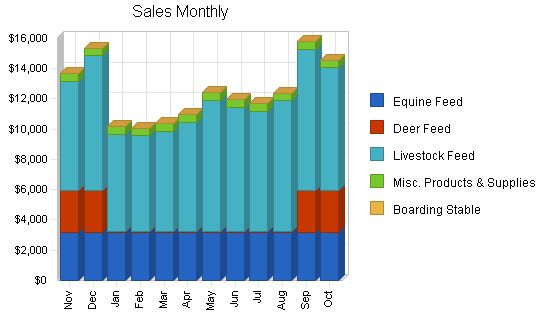

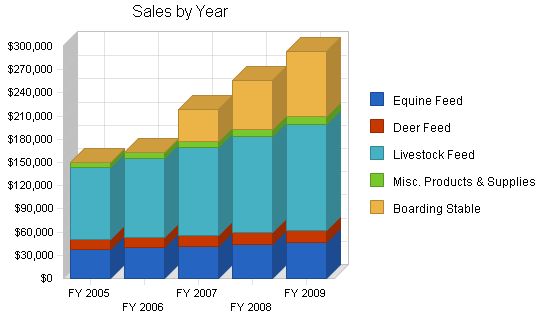

The sales forecast includes all varieties of feed, non-feed supplies, and future boarding stable revenue.

The annual growth rates fluctuate as follows:

– 2005: 3.37%

– 2006: 8.83%

– 2007: 34.63%

– 2008: 16.68%

– 2009: 14.81%

The initial dramatic increase in sales is due to accurate reporting, tracking, and growth generated through direct sales and advertising. In 2007, 2008, and 2009, sales are forecasted to significantly increase with the opening of the boarding stable. We anticipate it will take three years to book all of our stalls.

For 2009, we forecast a modest increase of 12.84% based on feed sales and stable services alone. We also plan to bring back rodeos and livestock shows to attract more customers.

Sales Forecast

| Sales Forecast | |||||

| FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | |

| Sales | |||||

| Equine Feed | $38,040 | $39,942 | $41,939 | $44,036 | $46,238 |

| Deer Feed | $12,000 | $12,960 | $13,997 | $15,117 | $16,326 |

| Livestock Feed | $93,346 | $102,680 | $112,948 | $124,243 | $136,668 |

| Misc. Products & Supplies | $6,000 | $7,000 | $8,000 | $9,000 | $10,000 |

| Boarding Stable | $0 | $0 | $42,000 | $63,000 | $84,000 |

| Total Sales | $149,386 | $162,582 | $218,884 | $255,396 | $293,232 |

| Direct Cost of Sales | FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 |

| Corn, Oats, Molasses, Other Ingredients | $40,400 | $42,258 | $44,202 | $46,236 | $48,362 |

| Misc. Products & Supplies | $3,000 | $3,500 | $4,000 | $4,500 | $5,000 |

| Boarding Stable | $0 | $0 | $8,400 | $12,600 | $16,800 |

| Bags, Ties, Pallets, Labels | $1,440 | $1,506 | $1,575 | $1,648 | $1,724 |

| Subtotal Direct Cost of Sales | $44,840 | $47,264 | $58,177 | $64,984 | $71,886 |

Strategy and Implementation Summary

Emphasize customer service

Differentiate ourselves with exceptional customer service. Establish our business as a viable alternative to competitors known for limited offerings and lack of delivery options.

Customer service is paramount. Accomplish this goal by training employees and providing encouragement.

A happy workforce enhances customer satisfaction. Clean facilities and well-maintained equipment also contribute to customer happiness.

Establish community involvement programs. Demonstrate the business’s contribution to a better community life.

Build a relationship-oriented business

Cultivate long-term relationships with customers. Become their preferred feed dealer. Educate them on the value of the relationship.

Focus on target markets

Concentrate offerings on specific population groups. Aim to attract informed, quality-conscious customers.

Competitive Edge

Latheethen Feeds, Inc. possesses a sought-after competitive edge in the feed industry. The company has its own feed mill capable of producing custom feeds. By avoiding the middleman and producing feed at a lower cost, the company can offer high-quality products at competitive prices.

Word-of-mouth advertising has been successful for the company since its opening in 1989. In the future, targeted marketing strategies will be employed to attract new customers and expand the business.

An advantage over competitors is the ability to offer delivery services to a wider area. This differentiates Latheethen Feeds, Inc. and allows for greater convenience for customers.

The company’s strength lies in its status as a family-owned and operated business, with deep knowledge of the feed industry. With dedicated resources, youthful energy, business acumen, and a focus on customer service, the potential for growth is substantial.

Marketing Strategy

Latheethen Feeds, Inc. will implement the following marketing strategies:

- Direct Marketing: Personally sell products to various feed stores, stables, boarding facilities, farms, clubs, and race tracks. This approach is projected to significantly increase business within the first two years under new ownership.

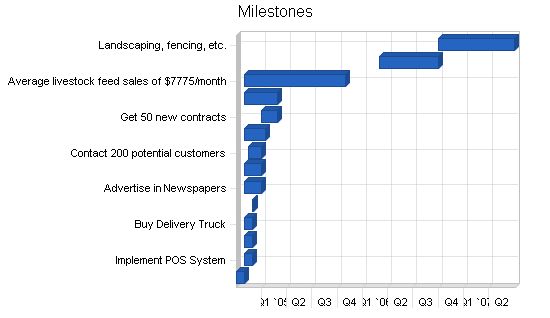

Milestones

The following milestone table identifies key points for our company takeover, growth, and development, along with corresponding budgets and selected vendors:

Milestones:

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Title Transfer | 10/4/2004 | 10/31/2004 | $0 | Chris | Department |

| Implement POS System | 11/1/2004 | 11/30/2004 | $6,000 | Dennis | Department |

| Print Product Catalogs | 11/1/2004 | 11/30/2004 | $250 | Dennis | Department |

| Buy Delivery Truck | 11/1/2004 | 12/1/2004 | $15,000 | Dennis | Department |

| Begin Delivery Service | 12/1/2004 | 12/5/2004 | $0 | Dennis | Department |

| Advertise in Newspapers | 11/1/2004 | 12/31/2004 | $1,000 | Dennis | Department |

| Affiliate with related website | 11/1/2004 | 12/31/2004 | $400 | Dennis | Department |

| Contact 200 potential customers | 11/15/2004 | 1/1/2005 | $0 | Dennis & Kay | Department |

| Build Web Site | 11/1/2004 | 1/15/2005 | $1,500 | Dennis | Department |

| Get 50 new contracts | 1/1/2005 | 3/1/2005 | $0 | Dennis & Kay | Department |

| Track hunter snack preferences | 11/1/2004 | 3/1/2005 | $0 | Dennis | Department |

| Average livestock feed sales of $7775/month | 11/1/2004 | 10/31/2005 | $0 | Dennis | Department |

| Renovate Boarding Stable | 3/1/2006 | 10/1/2006 | $100,000 | Dennis | Department |

| Landscaping, fencing, etc. | 10/1/2006 | 7/1/2007 | $25,000 | Dennis | Department |

| Totals | $149,150 |

Web Plan Summary:

Latheethen Feeds, Inc.’s website will offer current information on special sales, promos, new product releases, events, and public service announcements. We will utilize the Web to sell and market our products and services. An e-store will be implemented into our web design, allowing customers to place orders for the feed they need on our website. We will accept and process check and credit card orders immediately online. Customers will also have the options of paying by cash, check or money order.

Website Marketing Strategy:

Our website will be promoted through sponsor listings and affiliate memberships [confidential and proprietary information removed]. Our site will be registered with major search engines. We will share links with our distributors and manufacturers.

Development Requirements:

Latheethen Feeds, Inc.’s website will be initially developed with few internal technical resources. IPowerWeb will host the site and provide the technical back end. MX-Productions will produce the graphics, logos, artwork, and flash media as they will develop our website from scratch. Our site will be maintained by one of the owners.

Management Summary:

Latheethen Feeds, Inc. is currently made up of three employees. The two owners and one mill operator put in approximately 75 hours a week. As the new business ownership takes effect and marketing plans are implemented, the product volume will increase. There is sufficient room in the production mill to expand and produce more feed daily. The two new owners will oversee the production and day to day business practices.

We will also contract a new outside CPA to handle the corporate bookkeeping and business accounts (listed in the Profit and Loss table). Proper accounting and reporting of all sales activities are important to the successful growth of a company. Accurate accounting will verify business growth and ensure the security of this family business.

Personnel Plan:

Latheethen Feeds, Inc. is currently run and operated by one person in the mill and one person in the store. As we implement our marketing plan, we will hire an additional person to assist in the mill, possibly another person to assist Kay in the store, and a delivery person in 2005. When the business expands with new customers and larger feed orders, Dennis will assist Kay with inspecting the orders prior to delivery to ensure quality and accuracy. Other family members or employees may be brought in as the business grows. We will also hire independent contractors to best suit our company’s size and needs.

| Personnel Plan | |||||

| FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | |

| Dennis | $12,000 | $18,000 | $20,000 | $25,000 | $25,000 |

| Kay | $12,000 | $15,000 | $15,000 | $15,000 | $15,000 |

| Extra Mill Operator | $7,000 | $12,000 | $18,000 | $18,000 | $24,000 |

| Extra Store Help | $0 | $0 | $10,000 | $15,000 | $18,000 |

| Total People | 3 | 3 | 4 | 4 | 4 |

| Total Payroll | $31,000 | $45,000 | $63,000 | $73,000 | $82,000 |

The financial plan is to borrow $15,000 as a short-term loan from Citizens Bank, at an interest rate of 7%, to buy a delivery truck suitable to our needs. We will repay this loan within two years from the cash flow of the business. This truck will allow us to expand our services to include delivery, giving us a further edge over the local competition and enabling us to further expand into our target market, while increasing recognition of our name and services.

The second phase of the plan is to borrow $135,000 in long-term loans from the bank in early 2006, to fund the renovation of the existing property’s barn and outbuilding into a structurally-sound, attractive, and livable horse boarding stable, and to install fencing and landscaping suitable to that purpose. This renovation will be completed within 7 months, although final landscaping and fencing is not expected to be finished until early 2007. We will repay this loan over 10 years. We will secure this loan with our equity in the value of the existing property. The boarding stable will open up a new revenue stream for the business, and attract new steady customers.

With aggressive target marketing and the sales strategies outlined above, we will increase sales over 3% in the first year. We expect a bigger increase in year two, with the extensive renovation generating some free publicity and with existing customers making referrals, but the largest expansion is planned for 2008, when we can first realize a full year’s revenue from the boarding stable.

From the very start, the new owners of Latheethen’s will build the business and take it to the highest level. The new owners have bright futures ahead of themselves, as does Latheethen Feeds, Inc. The small, unknown feed store will be transformed into the area’s premier livestock feed store and equine boarding facility. The new Latheethen Feeds will be capable of hosting large scale rodeos and other livestock shows by the end of 2009.

8.1 Important Assumptions

This business plan assumes steady growth from good management. It assumes an adequate loan amount for initial implementation of plans. It assumes competition and buying patterns remain similar to those used for forecasting. It assumes the existing customer base will be maintained. It assumes market research is on target and current. It assumes new customers will be gained through direct sales and advertising. It assumes the long-term interest rate will be no more than 7%. It assumes an income tax rate of 30% and a sales tax rate of 6%.

| General Assumptions | |||||

| FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | |

| Plan Month | 1 | 2 | 3 | 4 | 5 |

| Current Interest Rate | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% |

| Long-term Interest Rate | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 |

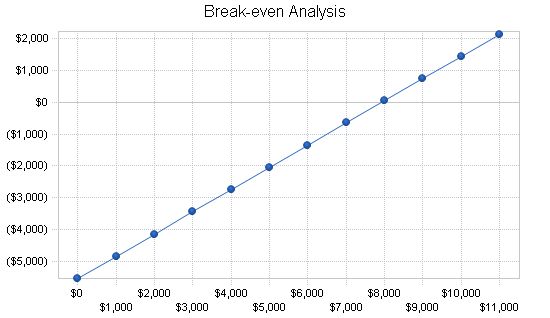

8.2 Break-even Analysis

Break-even is based on fixed costs of approximately $5,900 including loan repayment, insurance, maintenance and labor. Controllable expenses such as service labor, payroll taxes, property taxes, advertising and legal/professional fees are also included.

The following chart shows that we need to produce approximately $8,500 in sales per month to break-even. This is less than what the previous owners have accomplished in previous years. We believe we will succeed and provide handsome returns for our company and its owners.

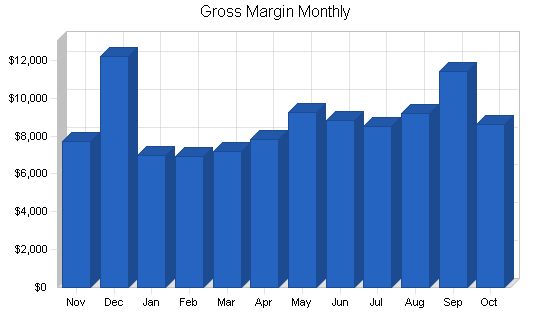

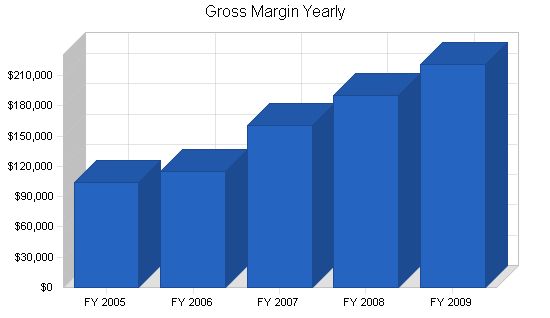

Margins are harder to assume. Our FY 2005 gross margin is forecasted at 69.98%. In the following years, our gross margin will continue to grow beyond our starting point because of the continued growth in total product sales and the release of our new equine boarding stable. The products manufactured in the mill cost about $3.50 for 50 pounds of feed on average. The lowest sale price on those products is $5.50 with the highest coming in at $10.75. The majority of our gross profit on feed products is made directly as a result of having our own custom mill.

Not only will we serve a much higher number of customers monthly than required by this break-even chart, we believe that we are going to possibly double the amount projected in our cash flow charts in this business plan, because we are going to be the only facility of its kind within a 150 mile radius. As advertising and direct sales follow suit from outside areas, our delivery service will prove to be valuable to our company and our customers.

Break-even Analysis

Monthly Revenue Break-even: $7,929

Assumptions:

Average Percent Variable Cost: 30%

Estimated Monthly Fixed Cost: $5,549

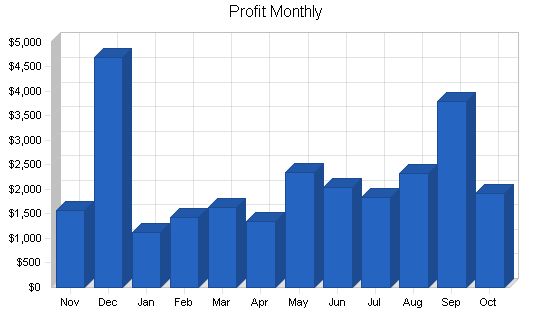

8.3 Projected Profit and Loss

Outlined below, in the table and chart, are the intrinsic facets of the projected profit and loss for Latheethen Feeds, Inc.

Cost of sales reflects our manufacturing and purchasing costs. Gross margin will rise steadily throughout the forecasted years.

Payroll expenses include income for the owners. Additional employees will be hired as needed. More details are available in our Personnel table.

Advertising and marketing expenses will increase as net profits and positive results are achieved from the same marketing and advertising. All sales and marketing are handled by Dennis. No commissions are paid to him as he is a major owner.

Depreciation includes normal wear and maintenance on trucks, tractors, and equipment in the mill.

Fuel costs will grow with sales that require delivery. This includes fuel for trucks and tractors.

Utilities will increase annually. Market prices for utilities will change over time. We have accounted for an annual $100 increase.

Insurance: Latheethen’s quoted insurance premium is $1,200/month, which includes liability, property, theft, fire, and personal insurance. The equipment is also covered in the premium.

Payroll taxes include social security, unemployment, and workers compensation. Feed dealer’s permit and state sales tax license will be paid annually in January. Sales taxes will be paid monthly, and income tax quarterly as required by law.

All website expenses are listed below, from initial development to hosting and account management for e-commerce transactions.

Boarding Stable: The expenses for barn renovations in year two are shown as an operating expense. The remaining $125,000 represents the increased value of the property after renovation and is shown as a purchase of new long-term assets in the Cash Flow table.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||

| FY 2005 | FY 2006 | FY 2007 | FY 2008 | FY 2009 | |

| Sales | $149,386 | $162,582 | $218,884 | $255,396 | $293,232 |

| Direct Cost of Sales | $44,840 | $47,264 | $58,177 | $64,984 | $71,886 |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $44,840 | $47,264 | $58,177 | $64,984 | $71,886 |

| Gross Margin | $104,546 | $115,318 | $160,707 | $190,412 | $221,346 |

| Gross Margin % | 69.98% | 70.93% | 73.42% | 74.56% | 75.48% |

| Expenses | |||||

| Payroll | $31,000 | $45,000 | $63,000 | $73,000 | $82,000 |

| Advertising & Marketing | $1,110 | $1,500 | $1,800 | $2,100 | $2,400 |

| Depreciation | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 |

| Fuel | $7,185 | $7,490 | $7,822 | $9,000 | $9,600 |

| Maintenance of Delivery Truck | $3,000 | $3,500 | $3,500 | $3,500 | $3,600 |

| Utilities | $3,072 | $3,400 | $3,600 | $3,600 | $3,600 |

| Insurance | $14,400 | $14,400 | $15,400 | $15,400 | $15,400 |

| Payroll Taxes | $0 | $0 | $0 | $0 | $0 |

| Postage | $180 | $180 | $190 | $190 | $210 |

| Bank Charges | $240 | $240 | $240 | $240 | $240 |

| Stable Renovation Expenses | $0 | $10,000 | $0 | $0 | $0 |

| Accounting & Legal | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Feed Dealers Permit | $15 | $15 | $15 | $15 | $15 |

| Website Development | $1,500 | $0 | $300 | $0 | $200 |

| Website hosting | $300 | $300 | $300 | $300 | $300 |

| Online Payment Account Mgmt | $360 | $360 | $380 | $380 | $400 |

| Sales Tax License | $25 | $25 | $25 | $25 | $25 |

| Total Operating Expenses | $66,587 | $90,610 | $100,772 | $111,950 | $122,190 |

| Profit Before Interest and Taxes | $37,959 | $24,708 | $59,935 | $78,462 | $99,156 |

| EBITDA | $40,959 | $27,708 | $62,935 | $81,462 | $102,156 |

| Interest Expense | $729 | $4,457 | $8,033 | $7,088 | $6,143 |

| Taxes Incurred | $11,169 | $6,076 | $15,571 | $21,412 | $27,904 |

| Net Profit | $26,061 | $14,176 | $36,332 | $49,962 | $65,109 |

| Net Profit/Sales | 17.45% | 8.72% | 16.60% | 19.56% | 22.20% |

8.4 Projected Cash Flow

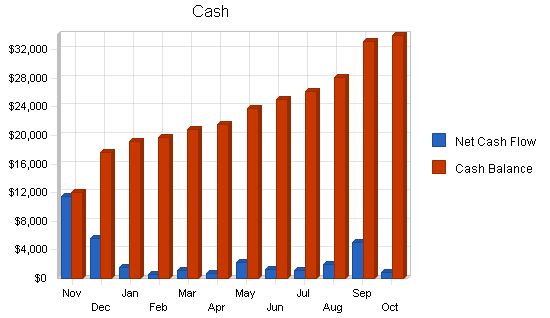

The cash flow projection for Latheethen Feeds, Inc. shows that provisions for ongoing expenses are adequate to meet the needs of the company. The business generates sufficient cash flow to support operations and future expansions.

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month and the other representing the monthly balance. The annual cash flow figures are included here and in our Cash Flow table. Detailed monthly numbers are included in the Appendix.

Cash Flow shows the purchase of long-term assets as follows:

$15,000 for a delivery truck

The table also shows the new loans required and the projected repayment schedules.

Pro Forma Cash Flow

We will review our business plan while implementing changes to ensure accuracy and stability. Our goal is to take over and protect this business, nurturing it and enabling its growth in a professional atmosphere.

Sales:

FY 2005 – $149,386

FY 2006 – $162,582

FY 2007 – $218,884

FY 2008 – $255,396

FY 2009 – $293,232

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Cost of Sales:

FY 2005 – $44,840

FY 2006 – $47,264

FY 2007 – $58,177

FY 2008 – $64,984

FY 2009 – $71,886

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Gross Margin:

FY 2005 – $104,546

FY 2006 – $115,318

FY 2007 – $160,707

FY 2008 – $190,412

FY 2009 – $221,346

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Gross Margin %:

FY 2005 – 69.98%

FY 2006 – 70.93%

FY 2007 – 73.42%

FY 2008 – 74.56%

FY 2009 – 75.48%

FY 2010 – 0.00%

FY 2011 – 0.00%

FY 2012 – 0.00%

FY 2013 – 0.00%

FY 2014 – 0.00%

Operating Expenses:

FY 2005 – $66,587

FY 2006 – $90,610

FY 2007 – $100,772

FY 2008 – $111,950

FY 2009 – $122,190

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Operating Income:

FY 2005 – $37,959

FY 2006 – $24,708

FY 2007 – $59,935

FY 2008 – $78,462

FY 2009 – $99,156

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Net Income:

FY 2005 – $26,061

FY 2006 – $14,176

FY 2007 – $36,332

FY 2008 – $49,962

FY 2009 – $65,109

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Current Assets:

FY 2005 – $115,409

FY 2006 – $120,910

FY 2007 – $148,162

FY 2008 – $168,670

FY 2009 – $204,408

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Long-term Assets:

FY 2005 – $142,911

FY 2006 – $264,911

FY 2007 – $261,911

FY 2008 – $258,911

FY 2009 – $255,911

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Current Liabilities:

FY 2005 – $16,453

FY 2006 – $8,279

FY 2007 – $9,699

FY 2008 – $10,745

FY 2009 – $11,874

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Long-term Liabilities:

FY 2005 – $0

FY 2006 – $121,500

FY 2007 – $108,000

FY 2008 – $94,500

FY 2009 – $81,000

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Equity:

FY 2005 – $241,866

FY 2006 – $256,042

FY 2007 – $292,374

FY 2008 – $322,336

FY 2009 – $367,446

FY 2010 – $0

FY 2011 – $0

FY 2012 – $0

FY 2013 – $0

FY 2014 – $0

Appendix

Sales Forecast:

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Equine Feed $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170

Deer Feed $2,800 $2,800 $100 $100 $100 $100 $100 $100 $100 $100 $100 $2,800

Livestock Feed $7,200 $8,900 $6,400 $6,300 $6,600 $7,200 $8,654 $8,200 $7,900 $8,600 $9,300 $8,092

Misc. Products & Supplies $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Boarding Stable $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Sales $13,670 $15,370 $10,170 $10,070 $10,370 $10,970 $12,424 $11,970 $11,670 $12,370 $15,770 $14,562

Direct Cost of Sales:

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Corn, Oats, Molasses, Other Ingredients $5,600 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $2,800 $4,000 $5,600

Misc. Products & Supplies $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250

Boarding Stable $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $5,970 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $4,370 $5,970

Personnel Plan:

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Dennis 0% $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Kay 0% $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Extra Mill Operator 0% $0 $0 $0 $0 $0 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Extra Store Help 0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total People 3 3 3 3 3 3 3 3 3 3 3 3

Total Payroll $2,000 $2,000 $2,000 $2,000 $2,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

General Assumptions:

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00%

Long-term Interest Rate 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 7.00%

Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss:

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

Sales $13,670 $15,370 $10,170 $10,070 $10,370 $10,970 $12,424 $11,970 $11,670 $12,370 $15,770 $14,562

Direct Cost of Sales $5,970 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $4,370 $5,970

Other Costs of Goods $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $5,970 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $3,170 $4,370 $5,970

Gross Margin $7,700 $12,200 $7,000 $6,900 $7,200 $7,800 $9,254 $8,800 $8,500 $9,200 $11,400 $8,592

Gross Margin % 56.33% 79.38% 68.83% 68.52% 69.43% 71.10% 74.48% 73.52% 72.84% 74.37% 72.29% 59.00%

Expenses

Payroll $2,000 $2,000 $2,000 $2,000 $2,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Advertising & Marketing $100 $100 $100 $100 $100 $100 $100 $100 $100 $

Pro Forma Cash Flow

| Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $13,670 | $15,370 | $10,170 | $10,070 | $10,370 | $10,970 | $12,424 | $11,970 | $11,670 | $12,370 | $15,770 | $14,562 | |

| Subtotal Cash from Operations | $13,670 | $15,370 | $10,170 | $10,070 | $10,370 | $10,970 | $12,424 | $11,970 | $11,670 | $12,370 | $15,770 | $14,562 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $15,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $28,670 | $15,370 | $10,170 | $10,070 | $10,370 | $10,970 | $12,424 | $11,970 | $11,670 | $12,370 | $15,770 | $14,562 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,000 | $2,000 | $2,000 | $2,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | ||

| Bill Payments | $231 | $6,881 | $5,791 | $6,664 | $6,394 | $6,479 | $6,385 | $6,823 | $6,677 | $6,589 | $6,904 | $9,952 | |

| Subtotal Spent on Operations | $2,231 | $8,881 | $7,791 | $8,664 | $8,394 | $9,479 | $9,385 | $9,823 | $9,677 | $9,589 | $9,904 | $12,952 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $833 | $833 | $833 | $833 | $833 | $833 | $834 | $834 | $834 | $834 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $15,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $17,231 | $9,714 | $8,624 | $9,497 | $9,227 | $10,312 | $10,218 | $10,656 | $10,511 | $10,423 | $10,738 | $13,786 | |

| Net Cash Flow | $11,439 | $5,656 | $1,546 | $573 | $1,143 | $658 | $2,206 | $1,314 | $1,159 | $1,947 | $5,032 | $776 | |

| Cash Balance | $11,966 | $17,622 | $19,168 | $19,741 | $20,884 | $21,542 | $23,748 | $25,062 | $26,221 | $28,168 | $33,200 | $33,976 |

Pro Forma Balance Sheet

| Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct |

| Starting Balances |

| Inventory Detail | |||||||||||||

| Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | ||

| Months of Inventory On-hand | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | ||

| Minimum Inventory Purchase | $500 | ||||||||||||

| Inventory Balance | |||||||||||||

| Beginning Inventory Balance | $8,904 | $5,970 | $3,300 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $4,370 | ||

| Less Inventory Used as COGS | $5,970 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $4,370 | $5,970 | ||

| Plus Inventory Purchase | $3,036 | $500 | $3,040 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $5,570 | $7,570 | ||

| Ending Inventory Balance | $5,970 | $3,300 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $3,170 | $4,370 | $5,970 | ||

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!