Contents

Karate Business Plan

City Dojo, a karate school, has been a presence in its community since 1964. The dojo, owned and operated by the Shihan (head instructor) since 1975, has witnessed significant changes in both the city and the Martial Arts industry.

Currently, over five million Americans are involved in Martial Arts training, and despite the decline of the 1960s boom, new students continue to explore the industry.

Located in an area with a market of over 250,000 potential members, City Dojo has traditionally been a hub for Martial Arts training, leading to fierce competition. The dojo is at a turning point and must decide between expansion or closure. Currently, City Dojo operates part-time, providing little to no income for its owner. The following business plan was developed to identify potential opportunities in the Martial Arts marketplace, revealing that the dojo is well-positioned to not only survive but thrive in the industry.

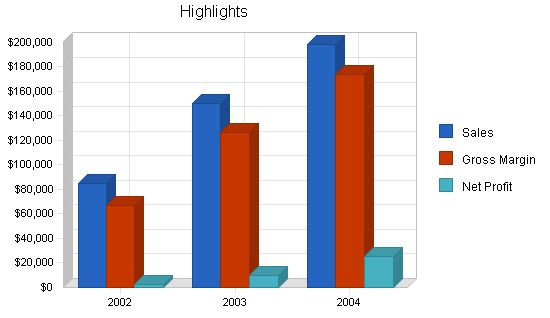

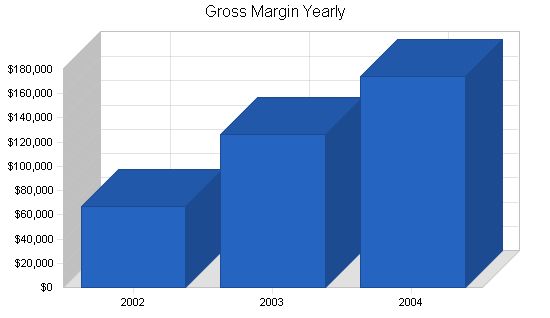

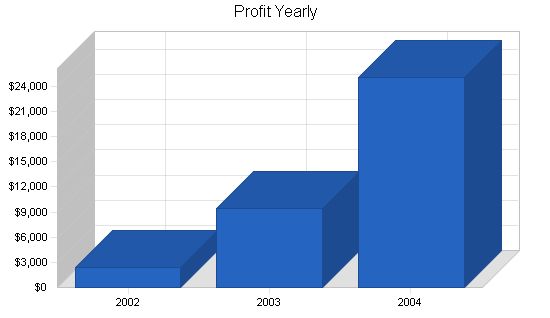

This plan outlines how City Dojo can increase its membership from the current break-even point of 65 members to 200 members (80% capacity) within three years. With an expanded membership, sales growth is projected to reach $198,000 by the end of 2004, compared to $65,000 in 2001. By operating on a full-time basis, the dojo can generate significant cash flow, offering its owner and potential investors a healthy income.

To achieve this growth, the dojo requires a $20,000 loan, to be repaid over eight years and secured by the owner’s collateral in the form of a house.

1.1 Objectives:

– Remodel and upgrade dojo by year-end 2002, including new computer, training mat, store-front, visitor area, and sauna repairs.

– Increase paid membership to 200 by year-end 2004 (80% of dojo capacity).

– Reduce membership turnover by 30% by year-end 2004.

– Develop cashflow to support future expansion.

1.2 Mission:

City Dojo was established to provide a place to learn karate, have fun, make a commitment, and use the knowledge to improve oneself, family, and community. Students will leave with a lifelong experience.

1.3 Keys to Success:

– Create a unique, modern, clean, and safe dojo environment.

– Establish and track a budget and business plan.

– Build a solid Board of Advisors for karate training and business matters.

City Dojo is an established karate school in Los Angeles County since 1964. It offers group and individual classes in karate and self-defense. The dojo is located in an outlining community near Los Angeles on a major business street with ample parking.

2.1 Company Ownership:

City Dojo was established in 1964 and later incorporated. Since 1995, it has been a sole proprietorship owned by the Shihan. The plan is to change it to a limited liability company with the Shihan as principal.

2.2 Company History:

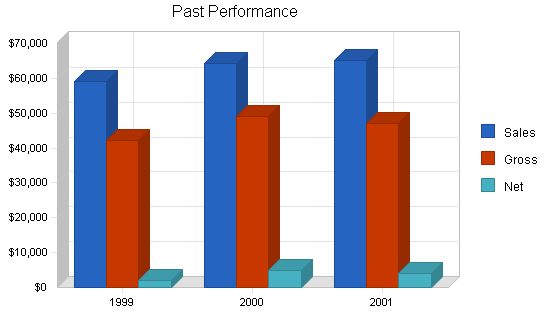

City Dojo was established in 1964 during the Martial Arts boom. At its peak, the dojo had over 300 students. Membership declined after the California Northridge Earthquake, increased competition, economic market changes, and personal family matters of the owner. Currently, membership has remained steady at 60-70. The dojo has a capacity for 250 members.

Over the past three years, the owner has operated the dojo as a part-time business, deriving income from sources outside the dojo. The dojo has provided additional income on a limited basis. The attached table reflects the dojo’s current position.

| Past Performance | |||

| 1999 | 2000 | 2001 | |

| Sales | $59,110 | $64,300 | $65,100 |

| Gross Margin | $42,184 | $49,113 | $47,095 |

| Gross Margin % | 71.37% | 76.38% | 72.34% |

| Operating Expenses | $40,960 | $44,980 | $46,300 |

| Balance Sheet | |||

| 1999 | 2000 | 2001 | |

| Current Assets | |||

| Cash | $1,000 | $1,500 | $1,500 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $1,000 | $1,500 | $1,500 |

| Long-term Assets | |||

| Long-term Assets | $25,000 | $35,000 | $40,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $25,000 | $35,000 | $40,000 |

| Total Assets | $26,000 | $36,500 | $41,500 |

| Current Liabilities | |||

| Accounts Payable | $2,500 | $3,500 | $4,500 |

| Current Borrowing | $2,500 | $14,000 | $15,000 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $5,000 | $17,500 | $19,500 |

| Long-term Liabilities | $5,000 | $14,000 | $15,000 |

| Total Liabilities | $10,000 | $31,500 | $34,500 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | $14,000 | $0 | $3,000 |

| Earnings | $2,000 | $5,000 | $4,000 |

| Total Capital | $16,000 | $5,000 | $7,000 |

| Total Capital and Liabilities | $26,000 | $36,500 | $41,500 |

| Other Inputs | |||

| Payment Days | 0 | 0 | 0 |

2.3 Company Locations and Facilities

The dojo is located in the heart of a small city near Los Angeles. It is a 3,000 square foot facility with a 1,800 square foot training area, 300 square foot viewing area with a receptionist desk, dressing areas, showers, and a sauna. There are two offices in the dojo, one used for storage, the other for the main office.

The building faces a major street and has considerable foot and drive-by traffic. There is street parking and free parking in the rear of the building, with a back entrance to the dojo. The facility has a long-term lease (25 years) with three more years remaining. A 10-year extension is available, but the current $750 monthly rental will increase with the extension.

Services

The dojo is a school where one can train in the art of traditional karate. Similar to a health or fitness club, the dojo relies on membership. The services offered are training in karate, self-defense, aerobics, and weapons training.

3.1 Service Description

Services currently provided include:

- An open training facility for members during non-class hours.

- Morning and evening classes, taught by experienced black-belt instructors.

- Private lessons for individuals and groups.

- Outside seminars on self-defense.

- Children’s ninja night (dojo sleep-over) offered once a quarter.

3.2 Competitive Comparison

Martial Arts, specifically karate instruction, is a competitive field. Various styles such as karate, judo, kung-fu, kenpo, tae-kwan-do, etc., offer similar training in traditional Martial Arts, self-defense, building self-confidence, and providing exercise to varying degrees. While we promote our dojo’s style, we understand that style is a matter of choice and no one style is truly better than another. We believe that a clean, modern facility with knowledgeable staff, at a reasonable price, sets dojos apart.

3.3 Sales Literature

The City Dojo has limited sales literature. There is a color brochure identifying the head instructors’ background, history of the dojo, and information on the association it belongs to. There is also a monthly schedule of events available to students at the dojo and a website presence.

3.4 Fulfillment

Trained black belt instructors are our #1 resource. These instructors are well versed in karate and are selected for their knowledge and ability to work with students. Instructors are members of the inner circle of the dojo and receive free membership and access to the dojo. They also receive payment for private lessons they perform on a contract basis. Instructor materials are provided free. Currently, there are five members of this inner circle of trainers.

Under the watchful eye of the head instructor, there are several students who have shown interest in training. As they move up to black belt status, they will be given the opportunity to join the inner circle.

3.5 Technology

We want to maintain a traditional sense to the dojo, but realize that technology can help us better meet our business needs. We are going to upgrade our software and computer system to improve data sharing and use Microsoft Office products.

The dojo currently uses a database software product designed for Martial Arts schools, which is utilized for membership data and billing. This software has not been fully utilized for marketing, but we believe it contains valuable data that can be used for future efforts. For example, the database has information on over 250 past members of the dojo dating back to 1999.

3.6 Future Services

The business plan is to get City Dojo up to 80% capacity and run it as a business, not a hobby. The goal is to establish a benchmark school and then replicate the business model at other dojos in need of a makeover. Many independent dojos struggle because the owners lack solid business planning, savvy, or drive.

Market Analysis Summary

There has been considerable research and marketing of sports in America, but martial arts is often overlooked. While basic figures are provided for martial arts by the U.S. Census and major research firms, there is a tremendous opportunity for growth and expansion in our field.

4.1 Market Segmentation

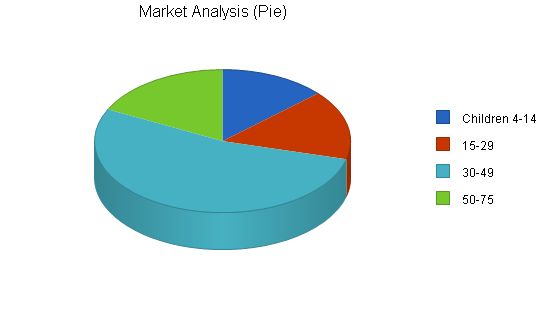

Based on three national sources, it is estimated that 10% of the U.S. population have participated in martial arts training during their lifetime. Currently, 2 to 4% of the U.S. population are actively training in martial arts.

City Dojo is located in a city with a population of 133,936. The population is 48.4% male and 51.6% female, with racial distribution of 43.7% White, 28.9% Hispanic, 12.7% African American, and 11.1% Asian. The average age is 34.5.

A national survey on martial art schools indicates that kids ages 4-14 account for 70-80% of individuals participating in martial art training. At the dojo, membership is as follows: ages 4-14 (53%), 15-29 (12%), 30-49 (28%), and 50+ (7%).

Research shows that 55% of our membership comes from three nearby zip codes within the city, with average ages ranging from 33.5 to 35.1 and family incomes ranging from $18,691 to $30,100. An additional 35% of our membership comes from nine other local zip codes, with higher family incomes. Including areas up to 5 miles away from the dojo, our potential market exceeds 600,000.

Based on our research, we believe the market is not saturated, and there is room for growth.

2002 2003 2004 2005 2006

Potential Customers

Growth CAGR

Children 4-14 2% 40,100 40,822 41,557 42,305 43,066 1.80%

15-29 2% 47,500 48,355 49,225 50,111 51,013 1.80%

30-49 3% 160,350 165,161 170,116 175,219 180,476 3.00%

50-75 1% 53,050 53,581 54,117 54,658 55,205 1.00%

Total 2.31% 301,000 307,919 315,015 322,293 329,760 2.31%

4.2 Target Market Segment Strategy

Our target market has been broken into three age segments, all within the city limits and surrounding area. The strategy is based on outside research, confirmed by our own internal survey: parents want their children to learn karate to build confidence and self-defense, adults take karate for exercise and self-defense, and seniors take karate for social aspects and exercise.

While not specifically addressed, we will emphasize the Hispanic (Latino) market where we are already a leader. We will also target ZIP codes in higher income brackets within our market, but not specifically in this plan.

Our target market breakdown is as follows:

1. Parents of kids ages 4-14: This market offers the most potential for new members. This group accounts for 50% of our current membership of which 67% are male and 33% female. The male/female breakdown corresponds with national survey results. However, our key is to grow our youth share to 60% of total membership, more in line with national figure. This group includes individuals who think karate is “cool” and enjoy physical challenge. In addition, parents desire their children to gain self-confidence and discipline, karate is one method of achieving that goal.

2. Adults 30-49: This market offers the largest base of potential students and accounts for 28% of current membership. We expect to maintain the 28% figure. Targeting this group will be to offer an alternative to health clubs and/or fitness centers. In addition, this group “controls” our number one market, their kids.

3. Adults over 50: This is our unknown market. This group only accounts for 7% of our current membership. It is felt that our traditional karate services may be too rigorous and may not meet their “social” and “exercise” needs. We are, however, approaching this market in a different manner, which will be explained later in this plan.

4.2.1 Market Needs

A needs analysis was taken of current members. Our marketing efforts will address the needs of these groups in the following order:

1. Kids 4-14(as outlined by both the kids and their parents): self-confidence, fun, exercise, discipline, self-defense, and socialization.

2. Ages 30-49: exercise, self-defense, stress reduction, and weight control.

3. Ages 50+: exercise, stress reduction, and socialization.

4.2.2 Market Trends

In the mid-1960s, there was a boom in Martial Arts studios (dojos) partially brought on by the success of Bruce Lee movies and the TV show Kung Fu. In the mid-1980s, as interest in Martial Arts waned, there was a move towards offering children’s programs. In the mid-1990s, it was estimated that 5 to 10 million Americans (2-4% of the U.S. population) are active in some form of Martial Arts training.

Recent trends, such as the popularity of the movie “Crouching Tiger, Hidden Dragon,” caused a mini-surge in the number of new applicants. In addition, Martial Arts for kids has shown a trend towards more activities and less “traditional” training. It has been noted that today’s kids have a lower level of patience, want to be involved in “movie” type karate styles (i.e., Matrix, Shanghai Noon, Karate Kid, and Power Rangers), and are more demanding of their time.

Another trend is that larger health/fitness organizations are moving into the Martial Arts field and a general consolidation is occurring. Companies such as Bally Total Fitness, 24 Hour Fitness, and Gold’s Gym are offering kick-boxing and other forms of group “soft” Martial Arts training, such as Tai Chi or Yoga.

Finally, there is a push in the health/fitness industry to attract the over 50 crowd. Fitness clubs have a difficult time applying their muscle-building, fast-paced fitness programs into this market. However, the over 50 group is expected to be marketed to more aggressively as fitness/health clubs realize the potential of the “baby boomers” and the fact that baby boomers have both the time and money to pursue outside recreational activities.

4.2.3 Market Growth

The U.S. Census (2000) shows our city, over the past 10 years, has been growing at an average annual rate of 1.8% (2.5% this last year). The central location of the city and proximity to Los Angeles is creating a boom in adults age 30 to 50 with young children, who can afford the ever-increasing cost of homes in the area.

A national survey recently taken two years ago indicated there were approximately six million Americans actively involved in Martial Arts training. The survey indicated that a 14% growth rate was expected in the upcoming years as Americans moved towards a more healthy lifestyle. This data was in part supported by data obtained from other sources. We have noted that this trend was occurring until the September 11, 2001 disaster. Data after the disaster is not yet available, but it has impacted the industry, whether that impact is permanent or temporary has yet to be determined.

Within our described market, over the past decade, the Asian community, at 11% of the population, has shown the fastest growth at 40%, followed by the Hispanic (Latino) community, representing 28.9% of the population, showing a substantial 26.5% increase. The African-American community, representing 12.7% of the population, has decreased 25% over the last ten years, and the White community, which represents 43.7% of the total population, has declined 13%. This trend towards a higher Hispanic (Latino) market mixes well into our future plans.

Two things were noted in our “over 50” market based on a study from the local newspaper, with data provided from the U.S. Census: the fastest-growing market in the city (3%) are those in their 40s to 50s; however, the market for individuals over 65 is flat and may actually be shrinking. This could be a result of the high cost of living in the area, causing many seniors on retirement income to move to more affordable locations.

The senior market, while showing little growth, has considerable potential. The senior market has not been tapped in the Martial Arts industry (only 7% of our membership). The Health Club Trend Report recently ranked seniors as the third-largest population in health clubs today at 22%. These older adults enjoy the social aspects of membership and have the time and income to participate. This group is involved in mostly “softer” exercise routines, including recumbent cycling, yoga/tai chi, and pool activities. The report goes further to state this group has "not" been aggressively marketed yet has increased 131% over the past decade.

4.3 Service Business Analysis

The business of running a dojo is similar to that of running a health/fitness club. Membership is everything. A dojo is a Japanese word defined as "a training hall where one can practice some sort of physical endeavor." Martial Arts falls under the SIC 7999 – Amusement and Recreational Services. Under this heading, we find groupings from Astrologers to Card Rooms, from Carnival Operations to Yoga. In other words, the code is too broad to provide solid analysis benefit but will be addressed in our comparative ratios analysis at the end of this plan.

To give some perspective, Martial Arts, as an industry, according to the U.S. Census, has the same approximate number of participants as:

1. Table tennis;

2. Badminton;

3. Scuba diving;

4. Mountain biking.

Martial Arts is a "pulverized" industry consisting primarily of thousands of small independent dojos (schools). Most belong to one of hundreds of loosely organized Martial Arts Associations, usually divided by style type. There is no one organization that could be called a leader in the industry; however, the International Karate Association, American Tae Kwan Do Association, American Karate Association, and U.S. Martial Arts Association are some of the largest in the United States.

Two other industries should be considered in any competitive analysis. The health and fitness club industry (Bally Total Fitness, Gold’s Gym, Bodies in Motion, 24 Hour Fitness) and the non-profits (YMCA, YWCA, and local schools) are in competition for the same group of potential customers.

4.3.1 Competition and Buying Patterns

The nature of the dojo business is to offer a facility with Martial Arts training. Membership is everything, and turnover in the industry is high. Several reports place the average turnover of a dojo at 40 to 60%. Selection of a dojo by a potential member is partly based on the style of Martial Art (karate, judo, kung-fu, or kick-boxing) the member wishes to participate in. However, selection of a dojo by a new student is more basic in nature.

A recent local survey, supported by national survey results, shows that dojo selection is based on the following (most popular first):

1. Friends/family attending;

2. Location;

3. Cost;

4. Facility environment;

5. Class schedule (times);

6. Friendliness of instructors (personal attention);

7. Class size.

Potential members are most aware of a dojo’s physical existence because:

1. Friends and family (65%);

2. Drive/walk by storefront (23%);

3. Yellow Page/media advertising (12%).

4.3.2 Main Competitors

Within our city and its surrounding area, there are 43 Martial Arts programs and 23 health and fitness clubs. We have narrowed the scope of "direct" competition to four "like" dojos in our immediate area and two health/fitness clubs.

Grade and high schools, as well as two local colleges, provide physical education classes nearby. However, they have limited Martial Arts programs and are more of a potential partner than a competitor.

4.3.3 Competing Dojos and Health Clubs

Four dojos have been identified as being the most competitive with our location. They all have a physical facility, offer traditional Martial Arts training (different styles), have competitive pricing, and are open Monday through Saturday (closed Sunday). In addition, each dojo’s Shihan (head instructor) is well versed in his/her field and well respected in the community.

Three health/fitness clubs have been identified as being the most competitive with our location. They primarily compete for the single 18 to 40 market but are moving towards offerings for the younger and older age groups, something we must watch carefully. All these clubs have national advertising programs and have a significant Yellow Page presence.

Strategy and Implementation Summary

Our overall strategy and implementation plan are based on the fact that City Dojo has never had an "on paper" business or marketing plan. Over the past five years, the dojo has not advertised its services outside internal efforts and has still been able to support a consistent flow of new members.

The dojo will focus its efforts on a broad market in a very competitive field. Considerable research was done to establish the fact that there is an opportunity in three areas: the youth market ages 4 to 14, the adult market ages 30 to 49, and the senior market ages 50+.

A large potential market is not being addressed. The ages 15 to 29 market is considered too volatile and competitive for our services at this time. While we certainly accept membership at this age, we do not plan to actively market this group.

5.1 Competitive Edge

– Dojo established for 38 years (since 1964).

– Dojo has a great location and ample lighted parking.

– Shihan is very knowledgeable (6th degree black belt) and an internationally recognized trainer.

– Shihan and Sensei have a strong desire and patience to teach.

– Shihan and most Sen sai speak Spanish.

– Competitive pricing and hours of operation.

– Solid untapped database from which to market.

– Over 300 Black Belt graduates since inception.

Challenges and Risks:

– Dojo facility needs remodeling.

– Student attrition.

– Website not competitive.

– No advertising or marketing plan.

– No budget.

– Do not offer Tai Chi (alternative “soft” Martial Arts) as most competitors do.

5.2 Sales Strategy

The overall strategy is to increase membership to 200 by year-end 2004, which is 80% of the dojo’s capacity and an aggressive three-year growth of 307%. Through marketing efforts, we will make potential customers aware of our dojo. From this awareness, we will increase the number of potential members that walk in our front door.

New potential members will be met by either the Shihan or a well-trained sales associate/receptionist who will have all sales materials, promotions, and a computer for data entry. The sales associate will be empowered to offer our promotions, however, if the potential member is interested in joining, an instructor and/or the Shihan will be made available for immediate consultation.

5.2.1 Sales Forecast

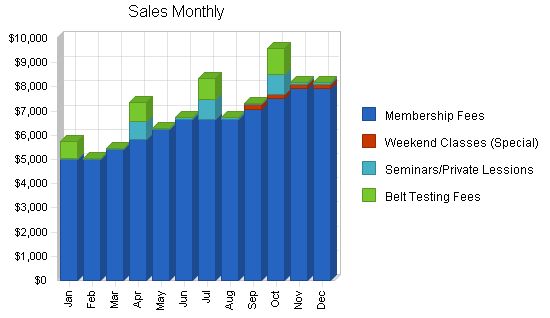

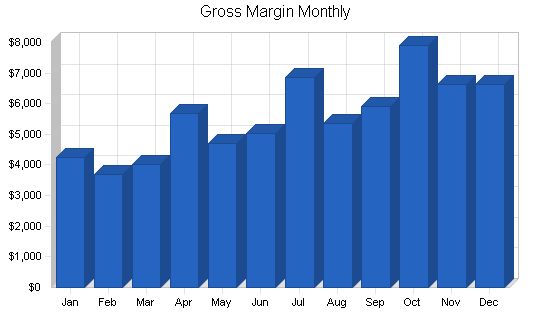

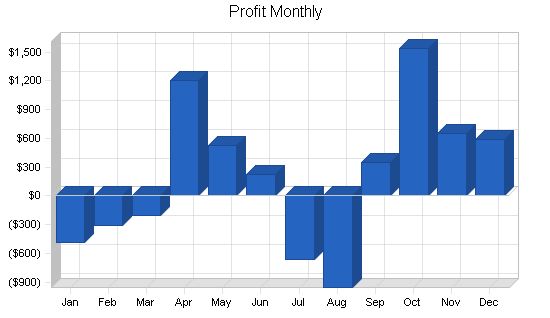

The following chart and table reflect our aggressive but obtainable sales forecast. Membership is projected to grow at a steady pace, leveling off during the summer months, our slower time of year. Membership costs are expected to decrease as we better control student turnover.

Special classes include the rent of our facilities ($200 a month) to contract instructors who are experts in Tai Chi or Yoga. This class time will consist of one-two hour class per week (four a month) on Saturday and/or Sunday when the dojo has traditionally been closed. Facility rental is projected conservatively for one group in 2002, two in 2003, and three by 2004.

Seminars are projected based on historic demand for the Shihan’s services. Belt testing is held quarterly, and fees traditionally track membership.

Sales Forecast

In the table provided, the sales forecast for the years 2002, 2003, and 2004 is displayed. The different categories of sales include membership fees, weekend classes (special), seminars/private lessons, and belt testing fees. The total sales for each year are also shown.

Direct Cost of Sales

The direct cost of sales for the years 2002, 2003, and 2004 are displayed in the table. It includes the direct costs for membership fees, weekend classes (special), seminars/private lessons, and belt testing fees. The subtotal direct cost of sales is also shown.

5.3 Milestones

The chart below illustrates the milestones anticipated for the dojo in 2002. These goals are ambitious considering the size of the business, but the individuals responsible are committed to achieving them.

Milestones

– Milestone: Start Date, End Date, Budget, Manager, Department

– Business Plan: 4/1/2002, 6/1/2002, $200, ABC, Investor

– Marketing Plan: 6/1/2002, 7/1/2002, $200, ABC, Investor

– Internal Remodeling: 8/1/2002, 11/1/2002, $9,000, ABC, Owner

– Remodeling Storefront: 8/1/2002, 10/1/2002, $1,000, ABC, Owner

– Computer Upgrade and Installation: 8/1/2002, 9/1/2002, $3,000, ABC, Investor

– Software Upgrade, Installation and Training: 8/15/2002, 9/15/2002, $1,000, ABC, Consultant

– Strategic Alliance Development: 7/1/2002, 1/1/2003, $0, ABC, Owner

– Marketing and Sales Material: 9/1/2002, 11/1/2002, $500, ABC, Investor

– Instructor Customer Service Training: 8/1/2002, 10/15/2002, $500, ABC, Instructor

– Hiring Sales Associate/Receptionist: 7/1/2002, 1/1/2003, $2,500, ABC, Owner

– Totals: $17,900

In our Marketing Strategy, our target is broad: kids 4 to 14 and adults 30 to 49. Our dojo is our "showplace" and our marketing efforts aim for potential members to judge our "book by its cover."

– Our strategy is to remodel the dojo into an "exciting," "fun," "traditional" place where members will "want to train, not have to train."

– An internal strategy is to address our attrition ratio with instructor training.

– We will utilize "paper" media for advertising our facility.

– We must address a strategy to market our newly remodeled facility for rental on weekends when the dojo is closed.

5.4.1 Promotion Strategy

– "Word of mouth" is the most successful means of promoting our dojo, followed by the storefront and advertising.

– We will offer incentives to current members who bring in new members.

5.4.2 Marketing Programs

– Our storefront will be redesigned to sell itself, attracting people to see what a dojo looks like.

– We will hold an annual "kata" tournament with a significant purse, with proceeds going to a local charity.

– Shihan will offer free karate seminars to local schools and retirement communities.

– Our website will reflect our new image.

– We will advertise in the Yellow Pages and City Weekly.

5.4.3 Positioning Statement

We offer competitive pricing, convenient hours, and quality instruction for adults who want to learn karate and build self-confidence. We have modern facilities, ample parking, and entertaining programs.

5.4.4 Pricing Strategy

We will keep our current pricing structure, offering promotional discounts to current members for bringing in new students. We will also offer introductory pricing packages.

6.1 Personnel Plan

– In August 2002, we will hire a part-time sales associate/receptionist.

– We have a Board of Advisors for instructional and business issues.

6.2 Management Team Gaps

We are building a quality management team to assist in business matters. We have gaps in the technical field.

Financial Plan

We want to become a profitable business. We expect growth in membership and sales in the next three years.

7.1 Important Assumptions

– The economy will grow steadily.

– There will be no major changes in the Martial Arts industry.

– The state will not have an impact on the unregulated Martial Arts industry.

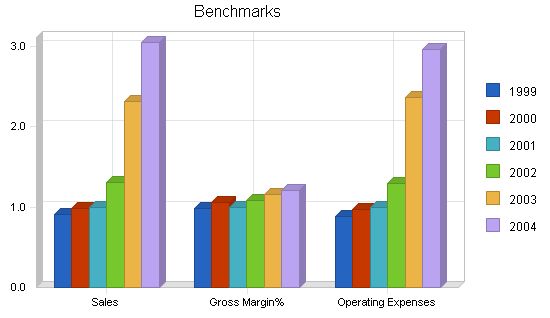

7.2 Key Financial Indicators

We expect an increase in membership and sales throughout the next three years. We will make adjustments to our business plan and explore alternatives in the future.

Monthly profit in the first year will vary as we aggressively seek improvements and begin marketing our business. However, by year two, the actions taken in year one should start to have an impact. The bottom-line profits shown in the chart can be misleading because they include a significant increase in the owner’s salary (as the dojo transitions from part-time to full-time). We anticipate that our efforts to control attrition will start to affect our cost of sales, leading to an improvement in our gross margin.

Legal fees in 2002 represent the change in legal ownership from a sole proprietorship to a limited liability company. Payroll increases in 2003 and 2004 reflect the transition from a part-time to a full-time business.

Pro Forma Profit and Loss

2002 2003 2004

Sales $84,935 $150,444 $198,452

Direct Cost of Sales $18,327 $23,010 $23,193

Other $0 $1,000 $1,000

Total Cost of Sales $18,327 $24,010 $24,193

Gross Margin $66,608 $126,434 $174,259

Gross Margin % 78.42% 84.04% 87.81%

Expenses

Payroll $12,000 $52,000 $72,000

Sales and Marketing and Other Expenses $19,404 $22,100 $25,500

Depreciation $0 $0 $0

Leased Equipment $4,800 $5,000 $5,000

Utilities $4,844 $5,000 $5,500

Telephone $3,605 $4,000 $4,500

Insurance $4,260 $4,800 $4,800

Rent $9,000 $9,000 $9,000

Payroll Taxes $1,800 $7,800 $10,800

Other $0 $0 $0

Total Operating Expenses $59,713 $109,700 $137,100

Profit Before Interest and Taxes $6,895 $16,734 $37,159

EBITDA $6,895 $16,734 $37,159

Interest Expense $3,683 $4,199 $3,560

Taxes Incurred $768 $3,134 $8,540

Net Profit $2,444 $9,401 $25,059

Net Profit/Sales 2.88% 6.25% 12.63%

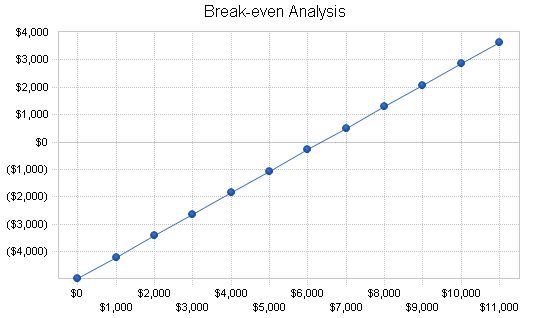

7.4 Break-even Analysis

The following table and chart show our break-even point for the next year.

Break-even Analysis

Monthly Revenue Break-even: $6,345

Assumptions:

Average Percent Variable Cost: 22%

Estimated Monthly Fixed Cost: $4,976

7.5 Projected Cash Flow

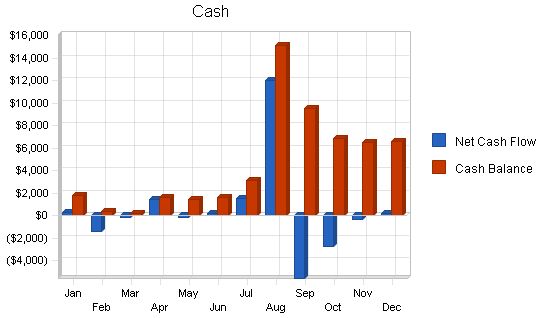

Like profit, our first-year monthly cash flow varies considerably. Current cash flow is expected to meet our needs, however, we anticipate a significant increase in cash flow due to a long-term loan ($20,000) in August 2002 for immediate remodeling and marketing efforts. This planned loan will immediately improve the dojo’s cash position in case of unexpected occurrences. Excess cash in the following years will finance our more aggressive future service plans.

Pro Forma Cash Flow

Year 2002 2003 2004

Cash Received

From Operations

Cash Sales $84,935 $150,444 $198,452

Subtotal Cash from Operations $84,935 $150,444 $198,452

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $20,000 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $104,935 $150,444 $198,452

Expenditures

Year 2002 2003 2004

Expenditures from Operations

Cash Spending $12,000 $52,000 $72,000

Bill Payments $69,112 $87,603 $100,378

Subtotal Spent on Operations $81,112 $139,603 $172,378

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $3,252 $3,252 $3,252

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $460 $2,760 $2,760

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $15,000 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $99,824 $145,615 $178,390

Net Cash Flow $5,111 $4,829 $20,062

Cash Balance $6,611 $11,439 $31,502

Projected Balance Sheet

The balance sheet below demonstrates significant activity in the first year as we implement the business plan. Long-term liabilities double in the first year due to borrowing for improvements, but remain manageable in subsequent years. Net worth is expected to increase in 2003 and 2004, driven by anticipated sales growth.

Year 2002 2003 2004

Assets

Current Assets

Cash $6,611 $11,439 $31,502

Other Current Assets $0 $0 $0

Total Current Assets $6,611 $11,439 $31,502

Long-term Assets

Long-term Assets $55,000 $55,000 $55,000

Accumulated Depreciation $0 $0 $0

Total Long-term Assets $55,000 $55,000 $55,000

Total Assets $61,611 $66,439 $86,502

Liabilities and Capital

Year 2002 2003 2004

Current Liabilities

Accounts Payable $5,879 $7,319 $8,334

Current Borrowing $11,748 $8,496 $5,244

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $17,627 $15,815 $13,578

Long-term Liabilities $34,540 $31,780 $29,020

Total Liabilities $52,167 $47,595 $42,598

Paid-in Capital $0 $0 $0

Retained Earnings $7,000 $9,444 $18,845

Earnings $2,444 $9,401 $25,059

Total Capital $9,444 $18,845 $43,904

Total Liabilities and Capital $61,611 $66,439 $86,502

Net Worth $9,444 $18,845 $43,904

As indicated in our "Service Business Analysis," the Martial Arts industry is not properly reflected in the SIC Code provided (7999). However, we have conducted preliminary business ratio comparisons using the SIC (2000 figures), which yield favorable results.

Year 2002 2003 2004 Industry Profile

Sales Growth 30.47% 77.13% 31.91% 5.73%

Percent of Total Assets

Other Current Assets 0.00% 0.00% 0.00% 33.26%

Total Current Assets 10.73% 17.22% 36.42% 43.21%

Long-term Assets 89.27% 82.78% 63.58% 56.79%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 28.61% 23.80% 15.70% 21.91%

Long-term Liabilities 56.06% 47.83% 33.55% 28.81%

Total Liabilities 84.67% 71.64% 49.25% 50.72%

Net Worth 15.33% 28.36% 50.75% 49.28%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 78.42% 84.04% 87.81% 100.00%

Selling, General & Administrative Expenses 75.58% 77.77% 75.10% 76.43%

Advertising Expenses 6.24% 4.92% 4.28% 2.77%

Profit Before Interest and Taxes 8.12% 11.12% 18.72% 1.89%

Main Ratios

Current 0.38 0.72 2.32 1.18

Quick 0.38 0.72 2.32 0.80

Total Debt to Total Assets 84.67% 71.64% 49.25% 61.12%

Pre-tax Return on Net Worth 34.01% 66.52% 76.53% 1.76%

Pre-tax Return on Assets 5.21% 18.87% 38.84% 4.52%

Additional Ratios

Year 2002 2003 2004

Net Profit Margin 2.88% 6.25% 12.63% n.a.

Return on Equity 25.88% 49.89% 57.08% n.a.

Activity Ratios

Accounts Payable Turnover 11.99 12.17 12.17 n.a.

Payment Days 29 27 28 n.a.

Total Asset Turnover 1.38 2.26 2.29 n.a.

Debt Ratios

Debt to Net Worth 5.52 2.53 0.97 n.a.

Current Liab. to Liab. 0.34 0.33 0.32 n.a.

Liquidity Ratios

Net Working Capital ($11,016) ($4,375) $17,924 n.a.

Interest Coverage 1.87 3.99 10.44 n.a.

Additional Ratios

Assets to Sales 0.73 0.44 0.44 n.a.

Current Debt/Total Assets 29% 24% 16% n.a.

Acid Test 0.38 0.72 2.32 n.a.

Sales/Net Worth 8.99 7.98 4.52 n.a.

Dividend Payout 0.00 0.00 0.00 n.a.

Appendix

Sales Forecast

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales

Membership Fees 0% $5,000 $5,000 $5,417 $5,833 $6,250 $6,667 $6,667 $6,667 $7,083 $7,500 $7,917 $7,917

Weekend Classes (Special) 0% $0 $0 $0 $0 $0 $0 $0 $0 $200 $200 $200 $200

Seminars/Private Lessons 0% $50 $35 $50 $750 $50 $50 $800 $50 $50 $800 $50 $50

Belt Testing Fees 0% $675 $0 $0 $788 $0 $0 $900 $0 $0 $1,069 $0 $0

Total Sales $5,725 $5,035 $5,467 $7,371 $6,300 $6,717 $8,367 $6,717 $7,333 $9,569 $8,167 $8,167

Direct Cost of Sales

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Membership Fees $1,300 $1,300 $1,383 $1,467 $1,550 $1,633 $1,300 $1,300 $1,363 $1,425 $1,488 $1,488

Weekend Classes (Special) $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50

Seminars/Private Lessons $10 $10 $10 $50 $10 $10 $50 $10 $10 $50 $10 $10

Belt Testing Fees $110 $0 $0 $110 $0 $0 $120 $0 $0 $150 $0 $0

Subtotal Direct Cost of Sales $1,470 $1,360 $1,443 $1,677 $1,610 $1,693 $1,520 $1,360 $1,423 $1,675 $1,548 $1,548

Personnel Plan

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Owner (Shihan) 0% $500 $500 $500 $500 $500 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Sales Associate/Receptionist 0% $0 $0 $0 $0 $0 $0 $0 $500 $500 $500 $500 $500

Total People 1 1 1 1 1 1 1 2 2 2 2 2

Total Payroll $500 $500 $500 $500 $500 $1,000 $1,000 $1,500 $1,500 $1,500 $1,500 $1,500

General Assumptions

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00% 12.00%

Long-term Interest Rate 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 9.00%

Tax Rate 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Pro Forma Profit and Loss

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales $5,725 $5,035 $5,467 $7,371 $6,300 $6,717 $8,367 $6,717 $7,333 $9,569 $8,167 $8,167

Direct Cost of Sales $1,470 $1,360 $1,443 $1,677 $1,610 $1,693 $1,520 $1,360 $1,423 $1,675 $1,548 $1,548

Other $0 $0 $0 $0 $0

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $5,725 | $5,035 | $5,467 | $7,371 | $6,300 | $6,717 | $8,367 | $6,717 | $7,333 | $9,569 | $8,167 | ||

| Subtotal Cash from Operations | $5,725 | $5,035 | $5,467 | $7,371 | $6,300 | $6,717 | $8,367 | $6,717 | $7,333 | $9,569 | $8,167 | ||

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $20,000 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $5,725 | $5,035 | $5,467 | $7,371 | $6,300 | $6,717 | $8,367 | $26,717 | $7,333 | $9,569 | $8,167 | $8,167 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $500 | $500 | $500 | $500 | $500 | $1,000 | $1,000 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| Bill Payments | $4,690 | $5,686 | $4,859 | $5,187 | $5,658 | $5,283 | $5,576 | $7,968 | $6,151 | $5,523 | $6,517 | $6,015 | |

| Subtotal Spent on Operations | $5,190 | $6,186 | $5,359 | $5,687 | $6,158 | $6,283 | $6,576 | $9,468 | $7,651 | $7,023 | $8,017 | $7,515 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $271 | $271 | $271 | $271 | $271 | $271 | $271 | $271 | $271 | $271 | $271 | $271 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $230 | $230 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $5,000 | $5,000 | $5,000 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $5,461 | $6,457 | $5,630 | $5,958 | $6,429 | $6,554 | $6,847 | $14,739 | $12,922 | $12,294 | $8,518 | $8,016 | |

| Net Cash Flow | $264 | ($1,422) | ($163) | $1,413 | ($129) | $163 | $1,520 | $11,978 | ($5,589) | ($2,725) | ($351) | $151 | |

| Cash Balance | $1,764 | $342 | $179 | $1,592 | $1,463 | $1,626 | $3,146 | $15,124 | $9,535 | $6,811 | $6,460 | $6,611 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $1,500 | $1,764 | $342 | $179 | $1,592 | $1,463 | $1,626 | $3,146 | $15,124 | $9,535 | $6,811 | $6,460 | $6,611 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $1,500 | $1,764 | $342 | $179 | $1,592 | $1,463 | $1,626 | $3,146 | $15,124 | $9,535 | $6,811 | $6,460 | $6,611 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $45,000 | $50,000 | $55,000 | $55,000 | $55,000 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $40,000 | $45,000 | $50,000 | $55,000 | $55,000 | $55,000 |

| Total Assets | $41,500 | $41,764 | $40,342 | $40,179 | $41,592 | $41,463 | $41,626 | $43,146 | $60,124 | $59,535 | $61,811 | $61,460 | $61,611 |

| Liabilities and Capital | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $4,500 | $5,524 | $4,686 | $4,998 | $5,482 | $5,100 | $5,308 | $7,762 | $5,968 | $5,305

Business Plan Outline

|

|||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!