Catering and Ballroom Rental Business Plan

Sumptuous Cuisine Catering is a local catering company serving business and private clients in Doeuvreville and surrounding towns within a ten mile radius. Established in 2005, the business specializes in full-service catering and event planning for upscale events. Services include event management, staff, a variety of cuisine for breakfasts, lunches, dinners, and appetizers, beverage service, floral and space design, musicians and DJs, event equipment and furniture rentals, and other event services.

Sumptuous Cuisine Catering aims to expand its operations to a dedicated venue, The Sumptuous Ballroom, located in Doeuvreville. To fund this expansion, the company will secure a mortgage on the space, use its own cash reserves, and issue convertible debt to angel investors.

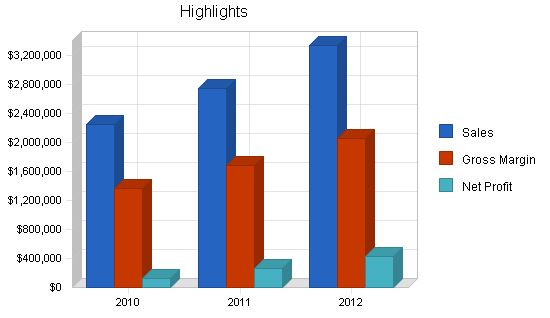

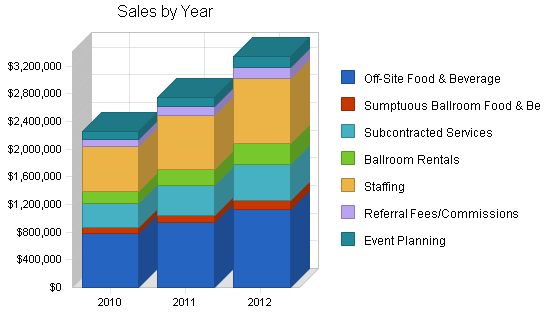

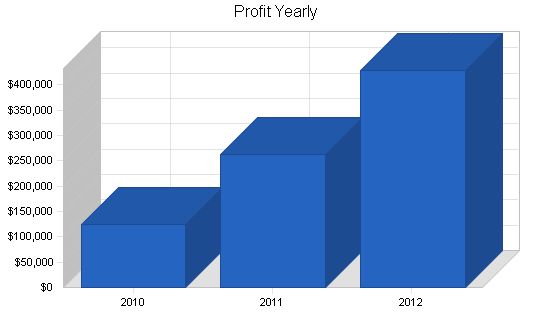

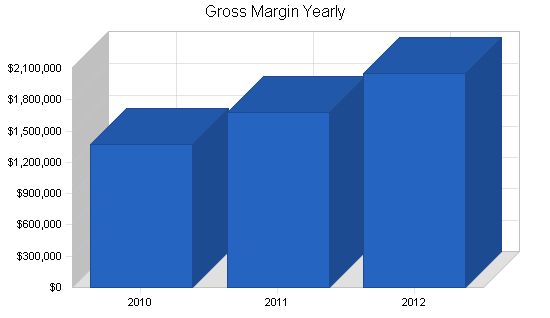

The addition of The Sumptuous Ballroom will increase gross margins, surpassing previous levels and industry averages due to high gross margins from space rentals. Both new and existing clients will be interested in using this space and the additional services provided. Top line sales will more than double from 2009 to 2012, while net profits will triple from 2010 to 2012, even with expected increases in operating expenses. Sumptuous Cuisine Catering plans to maximize space utilization, aiming for at least 40% occupancy by the end of year 3 to achieve these results.

Contents

Objectives

Sumptuous Cuisine Catering has set the following objectives for the first three years of its ballroom launch:

- Renovate and upgrade the ballroom’s interior

- Hire and retain a facilities manager to run logistics

- Earn a positive return on investment by the end of the second year

- Utilize the ballroom on 40% of days by the end of the third year

Mission

Sumptuous Cuisine Catering offers top-class event experiences with flawless execution for business and private clients in the Doeuvreville area. With Sumptuous Cuisine Catering, the food will be delicious, the service will be excellent, and the guests will be wowed.

Keys to Success

Keys to success in the catering and event business include:

- Manage and exceed client expectations

- Balance expert opinions and advice with client’s preferences and vision

- Exhibit professional showmanship on the day of the event

- Protect the client’s interests and liability even when it requires unpopular decisions

Sumptuous Cuisine Catering keeps these keys in mind for all events they manage and cater, and will continue to do so when they open their own catering venue.

Company Summary

Sumptuous Cuisine Catering is a local catering company serving business and private clients in Doeuvreville and surrounding towns within a ten-mile radius. Established in 2005, the business specializes in full-service catering and event planning for upscale events in the region at client sites and event spaces. The business became the in-house caterer at Corporate Hall, a corporate meeting space, in Doeuvreville in 2008, and has expertise in managing client events and event planning. Sumptuous Cuisine Catering provides referrals to additional vendors, manages rental equipment needs, and provides event management expertise for most events.

Company Ownership

Sumptuous Cuisine Catering was founded by partners Rudy Electrum and Tosca Cabrini. Rudy owns 49% of the business, and Tosca owns 51%. The business is established as an LLC.

10% of shares will be given to angel investors who purchase $270,000 in convertible debt to finance the expansion. This will dilute Electrum’s shares to 44% and Cabrini’s shares to 46%.

Company History

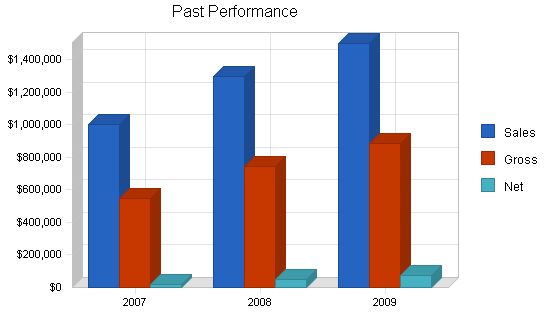

Over the past three years, Sumptuous Cuisine Catering has developed its core business significantly after two years of slow growth. Gross and operating margins have improved, and the business has invested in kitchen, delivery equipment, and some event furniture.

Sales have grown due to increasing partnerships with venues and event planners, which account for 75% of growth in the past three years. Corporate Hall alone accounted for 15% of sales in 2009. The remaining growth is from new client acquisition through marketing and referrals.

Inventory includes raw materials for food, beverages, and liquor, which are accounted for as inventory and attributed to cost of sales. Cost of sales also includes hourly wages, fuel for delivery, and supplies for events. Vendor subcontractors are paid by the client through Sumptuous Cuisine Catering. Sumptuous Cuisine Catering recommends clients contract directly with audio-visual and lighting providers.

Operating expenses have dropped from 45% to 40% of sales over the previous three years, while growing by $150,000.

Past Performance

Sales: $1,000,000 (2007), $1,300,000 (2008), $1,500,000 (2009)

Gross Margin: $550,000 (2007), $741,000 (2008), $885,000 (2009)

Gross Margin %: 55.00% (2007), 57.00% (2008), 59.00% (2009)

Operating Expenses: $450,000 (2007), $552,500 (2008), $600,000 (2009)

Collection Period (days): 51 (2007), 58 (2008), 78 (2009)

Inventory Turnover: 32.14 (2007), 38.55 (2008), 39.68 (2009)

Balance Sheet

Current Assets:

Cash: $150,000 (2007), $200,000 (2008), $300,000 (2009)

Accounts Receivable: $41,667 (2007), $83,333 (2008), $108,333 (2009)

Inventory: $14,000 (2007), $15,000 (2008), $16,000 (2009)

Other Current Assets: $2,500 (2007), $2,500 (2008), $2,500 (2009)

Total Current Assets: $208,167 (2007), $300,833 (2008), $426,833 (2009)

Long-term Assets:

Long-term Assets: $75,000 (2007), $85,000 (2008), $90,000 (2009)

Accumulated Depreciation: $20,000 (2007), $27,500 (2008), $40,000 (2009)

Total Long-term Assets: $55,000 (2007), $57,500 (2008), $50,000 (2009)

Total Assets: $263,167 (2007), $358,333 (2008), $476,833 (2009)

Current Liabilities:

Accounts Payable: $37,500 (2007), $46,042 (2008), $50,000 (2009)

Current Borrowing: $0 (2007), $0 (2008), $0 (2009)

Other Current Liabilities (interest free): $0 (2007), $0 (2008), $0 (2009)

Total Current Liabilities: $37,500 (2007), $46,042 (2008), $50,000 (2009)

Long-term Liabilities: $5,000 (2007), $2,500 (2008), $0 (2009)

Total Liabilities: $42,500 (2007), $48,542 (2008), $50,000 (2009)

Paid-in Capital: $200,000 (2007), $200,000 (2008), $200,000 (2009)

Retained Earnings: $667 (2007), $59,792 (2008), $151,833 (2009)

Earnings: $20,000 (2007), $50,000 (2008), $75,000 (2009)

Total Capital: $220,667 (2007), $309,792 (2008), $426,833 (2009)

Total Capital and Liabilities: $263,167 (2007), $358,333 (2008), $476,833 (2009)

Other Inputs

Payment Days: 30

Sales on Credit: $300,000 (2007), $390,000 (2008), $450,000 (2009)

Receivables Turnover: 7.20 (2007), 4.68 (2008), 4.15 (2009)

Products and Services

Sumptuous Cuisine Catering currently offers:

– Event management

– Coat-check, door check, and restroom attendants

– A variety of cuisine for breakfasts, lunches, dinners, and appetizers

– Non-alcoholic, wine, beer, and liquor beverage service

– Wait service

Through subcontractors, Sumptuous Cuisine Catering offers:

– Floral design

– Space design and decor

– Musicians and DJs

– Event equipment and furniture rentals

– Cakes

Through referrals, Sumptuous Cuisine Catering offers:

– Lighting

– Audio-visual rentals and support

– Event security

– Valet service

Future plans include the following additions with the opening of The Sumptuous Ballroom:

– Ballroom rentals for half-day or full-day timespans

– Space rental with a per-head full-service catering fee or as a fee separate from catering and beverage

– Facility management service

Market Analysis Summary

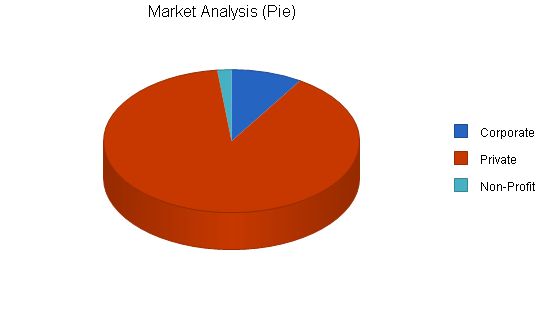

The catering industry serves private, corporate, and non-profit events with food, drinks, event management, and other services. Events are held to celebrate, communicate, or both.

The U.S. market for caterers was estimated at $6.9 billion in 2008 by IBISWorld. The market is prone to economic cycles, as events, especially corporate events, are one of the first expenses cut during a downturn. Celebratory events may be scaled back but are generally not canceled during a downturn. The industry contracted by 1.5% in 2008 due to the economic downturn, and a similar decline is apparent for 2009. In 2010, the industry is expected to return to positive growth. The industry is relatively mature, with 33,000 catering companies serving the U.S.

There is a movement towards horizontal integration in the event industry, with full-service event providers growing to provide entertainment, audio-visual technology, catering, rentals, decor, venues, and more. With the opening of The Sumptuous Ballroom, Sumptuous Cuisine Catering will become part of this integration movement.

Market Segmentation

The Doeuvreville area in a radius of ten miles is considered for the market analysis.

The corporate market includes businesses that hold at least one off-site event each year. Businesses often have A/V and public relations needs in concert with their events. The private market includes households with a combined household income of over $80,000 per year. This group puts pressure on caterers and requires added attention. The non-profit market is defined as non-profit organizations which hold at least one off-site event each year. The non-profit market is very price-conscious and looks for in-kind donations and discounted services whenever possible.

Market Analysis:

– Table: Market Analysis by Potential Customers, Growth, and CAGR

– Sumptuous Cuisine Catering focuses on private and corporate markets primarily. Private clients can be charged higher rates and help to "recession-proof" the business.

– Corporate clients can lead to repeat engagements and are more valuable as clients.

– Non-profit clients generally seek lower cost providers and venues, and Sumptuous Cuisine Catering will choose specific non-profits to sponsor events for strategic purposes or based on the owners’ charitable interests.

Service Business Analysis:

– The catering industry is highly fragmented, with 33,000 companies in the United States.

– Customers find caterers through referrals, online searches, Yellow Pages, and from restaurants they are already familiar with.

– Some businesses and private clients hire event planners or producers to handle the details and act as a buffer between the client and the caterer.

Competition and Buying Patterns:

– Key competitors of Sumptuous Cuisine Catering include Fancy Fetes, Food For Thought, and Pandora’s.

– Customers choose caterers based on cuisine options, quality, added services, and price.

– Sumptuous Cuisine Catering offers a range of cuisine options, high quality, added services, but does not compete on price.

Strategy and Implementation Summary:

– Sumptuous Cuisine Catering intends to open The Sumptuous Ballroom in Doeuvreville, purchased from the city.

– The ballroom will create synergy with the catering business and bring in current and future clients.

– Sumptuous Cuisine Catering will target private and corporate clients, have dedicated facility management and salespeople for The Sumptuous Ballroom, and use various marketing tactics to promote the space.

Competitive Edge:

– Sumptuous Cuisine Catering will become a true "one-stop-shop" for all-inclusive events with The Sumptuous Ballroom.

– Currently, competitors in the area do not offer the same combination of upscale catering, track record, flexibility of cuisine, and a beautiful venue.

– Sumptuous Cuisine Catering will focus its marketing for The Sumptuous Ballroom on corporate and private upscale event markets.

– The business will advertise in Doeuvreville Magazine, develop a separate but linked website for the ballroom, promote through search engine optimization and marketing, revise brochures, and conduct an email campaign.

– They will also create a press kit, a featured listing on BizBash.com, promote introductory rates, promote at local fairs, and sponsor non-profit events.

Sales Strategy:

– The sales strategy will be spearheaded by Rudy Electrum and two account managers.

– Additional salespeople will field inquiries about The Sumptuous Ballroom rentals.

– Salespeople will be added over the first three years of operation as business grows.

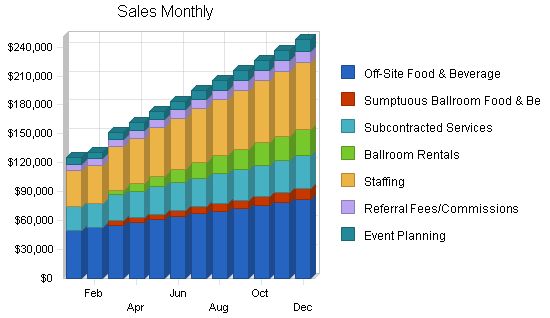

– The Sumptuous Ballroom revenues will scale up sharply in the first year and decline in years 2 and 3 due to varying demand.

– Sumptuous Cuisine Catering expects that existing business events at Corporate Hall will continue, as they host smaller meetings.

Overall, Sumptuous Cuisine Catering focuses on the private and corporate markets, offers a range of cuisine options and added services, and will open The Sumptuous Ballroom for synergy and expanded services. They plan to target high net-worth clients, utilize marketing tactics, and provide a competitive edge as a one-stop-shop for events. Sales will be spearheaded by Rudy Electrum and additional staff. Revenues for The Sumptuous Ballroom are projected to grow sharply initially and level off in subsequent years.

Sales Forecast:

| Sales Forecast | |||

| 2010 | 2011 | 2012 | |

| Sales | |||

| Off-Site Food & Beverage | $784,537 | $941,444 | $1,129,733 |

| Sumptuous Ballroom Food & Beverage | $79,687 | $103,593 | $134,671 |

| Subcontracted Services | $354,801 | $425,761 | $510,913 |

| Ballroom Rentals | $168,750 | $236,250 | $307,125 |

| Staffing | $648,168 | $783,778 | $948,303 |

| Referral Fees/Commissions | $108,028 | $130,630 | $158,051 |

| Event Planning | $108,028 | $130,630 | $158,051 |

| Total Sales | $2,251,998 | $2,752,086 | $3,346,846 |

| Direct Cost of Sales | 2010 | 2011 | 2012 |

| Food and Beverage Cost | $216,056 | $261,259 | $316,101 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $216,056 | $261,259 | $316,101 |

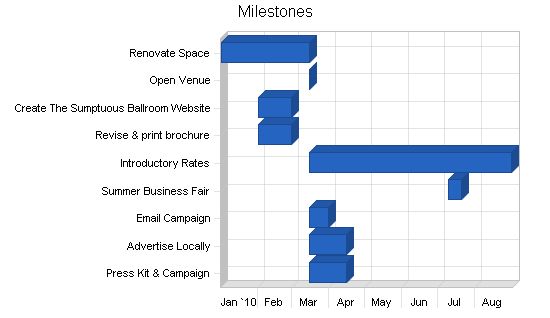

Milestones:

Milestones

The listed milestones are the key steps to launch The Sumptuous Ballroom.

CEO Tosca Cabrini will lead the space renovation with feedback from staff. A renovations contractor will manage subcontracted work for electricians, plumbers, painters, and floor specialists.

Antero MacDougal, Sumptuous Cuisine Catering’s marketing director, will oversee the other activities under the marketing umbrella. The preparations will occur during the venue’s renovation period, with photos of the completed space available once the renovation is finished.

Introductory rates will discount the rate for the first 100 events by $500 to encourage initial ballroom rentals.

Milestones:

Renovate Space:

1/1/2010 – 3/15/2010

Budget: $100,000

Manager: TC

Department: Operations

Open Venue:

3/15/2010 – 3/15/2010

Budget: $0

Manager: TC

Department: Operations

Create The Sumptuous Ballroom Website:

2/1/2010 – 2/28/2010

Budget: $10,000

Manager: JR

Department: Marketing

Revise & print brochure:

2/1/2010 – 2/28/2010

Budget: $5,000

Manager: JR

Department: Marketing

Introductory Rates:

3/15/2010 – 8/31/2010

Budget: $50,000

Manager: JR

Department: Marketing

Summer Business Fair:

7/9/2010 – 7/20/2010

Budget: $5,000

Manager: JR

Department: Marketing

Email Campaign:

3/15/2010 – 3/31/2010

Budget: $500

Manager: JR

Department: Marketing

Advertise Locally:

3/15/2010 – 4/15/2010

Budget: $10,000

Manager: JR

Department: Marketing

Press Kit & Campaign:

3/15/2010 – 4/15/2010

Budget: $2,000

Manager: JR

Department: Marketing

Totals:

Budget: $182,500

Management Summary:

Sumptuous Cuisine Catering is directed by CEO Rudy Electrum. COO Tosca Cabrini is second-in-command.

Electrum heads sales and strategy for the business, in close consultation with Cabrini, who manages the kitchen operations, human resources, and finances.

Marketing is directed and executed by Antero MacDougal, who also serves as the liaison to outside marketing service firms. MacDougal reports to the CEO.

The Facility Manager will be hired to manage the hall. They will provide information to vendors, oversee client access, handle maintenance and repairs, contract vendors, and schedule cleanings. The Facility Manager will work during the daytime and report to the COO. Event managers from the catering staff will be present during events.

Personnel Plan:

The personnel table shows full-time personnel only.

A full-time administrative assistant handles bookkeeping, accounts receivable, and accounts payable.

Sales staff, managed by the CEO, will add one salesperson in year 2 and another in year 3. These salespeople will focus on sales for The Sumptuous Ballroom, earning a salary plus a 3% commission.

The kitchen is staffed by a salaried head cook and an hourly assistant cook.

Events are staffed by a roster of 30 event managers, cater-waiters, bartenders, and other staff. Most staff are cross-trained.

2010 2011 2012

CEO $84,000 $87,360 $90,854

COO $72,000 $74,880 $77,875

Marketing Director $60,000 $62,400 $64,896

Salespeople $48,000 $97,440 $149,083

Admin Assistant $48,000 $49,920 $51,917

Head Cook $60,000 $62,400 $64,896

Assistant Cooks $48,000 $49,920 $51,917

Facility Manager $54,000 $56,160 $58,406

Total People 8 9 10

Total Payroll: $474,000 $540,480 $609,845

Sumptuous Cuisine Catering will fund its expansion through its cash reserves and a loan for the purchase of The Sumptuous Ballroom.

Funds needed:

– $2 million for purchase

– $100,000 for improvements

– $50,000 for equipment

– $82,500 for marketing

Sources of funds:

– $1.6 million mortgage

– $270,000 in convertible debt from investors (10% equity stake)

– $300,000 from cash reserves

– Cash flow surpluses in the second half of 2010

The business expects stronger profits and gross margins after the acquisition.

Important Assumptions:

The table below presents the assumptions used in the financial calculations of this business plan.

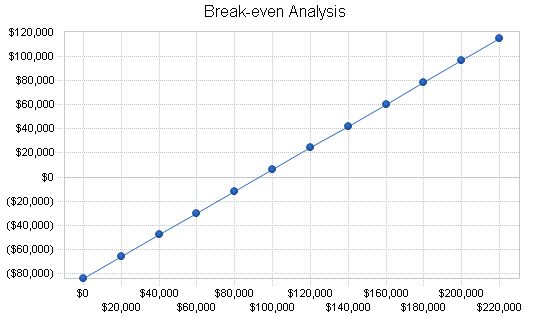

Break-even Analysis:

Due to the high fixed costs of the venue, the monthly break-even point is high. Approximately 9-10 events at $10,000 per event are needed to cover costs. Revenue from The Sumptuous Ballroom events is higher due to the rental fee and additional services provided to clients.

Break-even Analysis

Monthly Revenue Break-even: $93,206

Assumptions:

– Average Percent Variable Cost: 10%

– Estimated Monthly Fixed Cost: $84,264

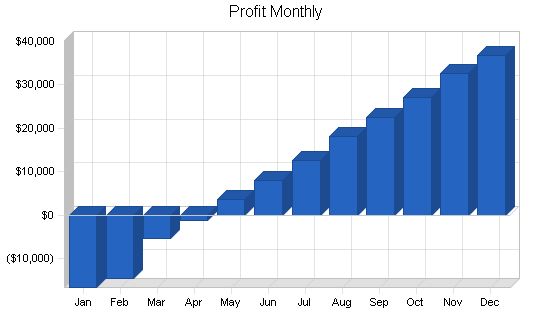

Projected Profit and Loss

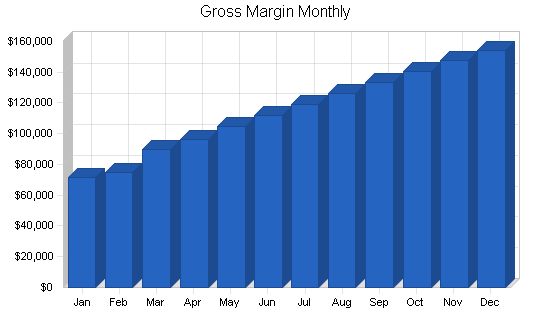

Gross margins will improve as ballroom rentals become a revenue stream for the business. Facility rentals do not have a direct cost of sales, although higher fixed costs are associated with The Sumptuous Ballroom than with the core business.

Subcontracted services are the other major cost of sales category, incurring a higher cost of sales at 80% compared to other categories. These services (such as floral design and rental furniture) are discounted by vendors due to their relationship with Sumptuous Cuisine Catering. Sumptuous Cuisine Catering bills these services to clients at the vendor’s advertised rates and earns a 20% margin on those revenues.

Marketing expenses will be higher in the first year to accommodate additional marketing activities described in the marketing strategy and milestones table. Depreciation expenses will cover existing equipment in the catering kitchen and the installed sound and networking equipment in the venue.

Rent is for the catering kitchen and office only, as the ballroom will be purchased by the business. Utilities will be significantly higher than before due to the high electric, heating, and air conditioning costs of the new space compared to the kitchen and office alone. Insurance must also increase significantly to provide general liability coverage for the space and guests.

Payroll taxes amount to 15% of payroll, which includes the event staff cost of sales. Employee benefits, including health insurance and 401K contributions for employees with tenure over 2 years, vacation and sick pay, make up 10% of payroll and event staff costs.

Office expenses cover computer equipment maintenance and sundry supplies for the office. Facility cleaning and maintenance includes a budget of $200 for maintenance and an estimate for cleaning, which will increase as the use of the ballroom scales up. Cleaning services will be provided by an outside vendor and managed by the Facility Manager.

Pro Forma Profit and Loss

Sales

– 2010: $2,251,998

– 2011: $2,752,086

– 2012: $3,346,846

Direct Cost of Sales

– 2010: $216,056

– 2011: $261,259

– 2012: $316,101

Event Staff

– 2010: $382,840

– 2011: $467,855

– 2012: $568,964

Subcontracted Services

– 2010: $283,841

– 2011: $340,609

– 2012: $408,730

Total Cost of Sales

– 2010: $882,736

– 2011: $1,069,723

– 2012: $1,293,795

Gross Margin

– 2010: $1,369,262

– 2011: $1,682,363

– 2012: $2,053,051

Gross Margin %

– 2010: 60.80%

– 2011: 61.13%

– 2012: 61.34%

Expenses

Payroll

– 2010: $474,000

– 2011: $540,480

– 2012: $609,845

Marketing/Promotion

– 2010: $106,000

– 2011: $100,000

– 2012: $100,000

Depreciation

– 2010: $28,000

– 2011: $28,000

– 2012: $28,000

Rent

– 2010: $24,000

– 2011: $25,200

– 2012: $26,460

Utilities

– 2010: $7,959

– 2011: $9,000

– 2012: $10,000

Insurance

– 2010: $36,000

– 2011: $37,440

– 2012: $38,938

Payroll Taxes

– 2010: $128,526

– 2011: $151,250

– 2012: $176,821

Employee Benefits

– 2010: $85,684

– 2011: $100,833

– 2012: $117,881

Office Expenses

– 2010: $6,000

– 2011: $6,500

– 2012: $7,000

Facility Cleaning & Maintenance

– 2010: $115,000

– 2011: $137,804

– 2012: $167,542

Total Operating Expenses

– 2010: $1,011,168

– 2011: $1,136,508

– 2012: $1,282,487

Profit Before Interest and Taxes

– 2010: $358,094

– 2011: $545,855

– 2012: $770,564

EBITDA

– 2010: $386,094

– 2011: $573,855

– 2012: $798,564

Interest Expense

– 2010: $181,222

– 2011: $171,000

– 2012: $160,333

Taxes Incurred

– 2010: $53,061

– 2011: $112,457

– 2012: $183,069

Net Profit

– 2010: $123,810

– 2011: $262,399

– 2012: $427,162

Net Profit/Sales

– 2010: 5.50%

– 2011: 9.53%

– 2012: 12.76%

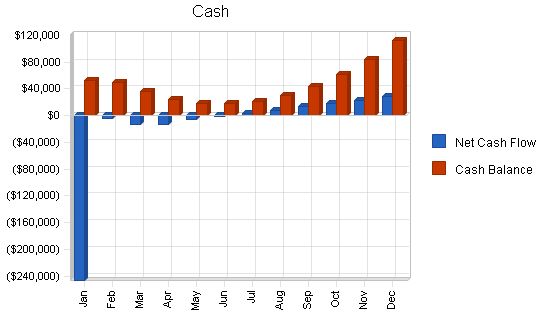

Projected Cash Flow

The projected cash flow table and chart illustrate the business’s investment in The Sumptuous Ballroom, a $2 million purchase. The asset will be acquired with 20% down and a $1.6 million 15-year mortgage. An additional $270,000 in convertible debt will be raised at 10% interest for three years.

In addition to this investment, $50,000 in depreciable assets will be purchased (sound system, office setup for the facility). Small investments in replacing and augmenting these assets strategically will be made in future years. Current assets ($100,000) purchased will include signage and venue improvements.

The business will reach cash flow break-even in July 2010.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 2010 | 2011 | 2012 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $1,125,999 | $1,376,043 | $1,673,423 |

| Cash from Receivables | $1,055,339 | $1,336,295 | $1,626,150 |

| Subtotal Cash from Operations | $2,181,338 | $2,712,337 | $3,299,573 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $180,160 | $220,167 | $267,748 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $1,870,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $4,231,498 | $2,932,504 | $3,567,321 |

| Expenditures | 2010 | 2011 | 2012 |

| Expenditures from Operations | |||

| Cash Spending | $474,000 | $540,480 | $609,845 |

| Bill Payments | $1,508,109 | $1,928,419 | $2,254,866 |

| Subtotal Spent on Operations | $1,982,109 | $2,468,899 | $2,864,711 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $180,160 | $220,167 | $267,748 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $106,668 | $106,668 | $106,668 |

| Purchase Other Current Assets | $100,000 | $0 | $0 |

| Purchase Long-term Assets | $2,050,000 | $5,000 | $5,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $4,418,937 | $2,800,734 | $3,244,127 |

| Net Cash Flow | ($187,439) | $131,771 | $323,194 |

| Cash Balance | $112,561 | $244,331 | $567,526 |

Projected Balance Sheet

The balance sheet shows the increasing strength of the business as its mortgage is paid off and profits are earned from the expansion of the business. Accounts payable will rise significantly from previous levels due to the added expenses taken on by the business when The Sumptuous Ballroom opens.

| Pro Forma Balance Sheet | |||

| 2010 | 2011 | 2012 | |

| Assets | |||

| Current Assets | |||

| Cash | $112,561 | $244,331 | $567,526 |

| Accounts Receivable | $178,994 | $218,742 | $266,015 |

| Inventory | $11,664 | $13,163 | $15,936 |

| Other Current Assets | $102,500 | $102,500 | $102,500 |

| Total Current Assets | $405,719 | $578,737 | $951,976 |

| Long-term Assets | |||

| Long-term Assets | $2,140,000 | $2,145,000 | $2,150,000 |

| Accumulated Depreciation | $68,000 | $96,000 | $124,000 |

| Total Long-term Assets | $2,072,000 | $2,049,000 | $2,026,000 |

| Total Assets | $2,477,719 | $2,627,737 | $2,977,976 |

| Liabilities and Capital | 2010 | 2011 | 2012 |

| Current Liabilities | |||

| Accounts Payable | $163,743 | $158,031 | $187,776 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $163,743 | $158,031 | $187,776 |

| Long-term Liabilities | $1,763,332 | $1,656,664 | $1,549,996 |

| Total Liabilities | $1,927,075 | $1,814,695 | $1,737,772 |

| Paid-in Capital | $200,000 | $200,000 | $200,000 |

| Retained Earnings | $226,833 | $350,643 | $613,042 |

| Earnings | $123,810 | $262,399 | $427,162 |

| Total Capital | $550,643 | $813,042 | $1,240,204 |

| Total Liabilities and Capital | $2,477,719 | $2,627,737 | $2,977,976 |

| Net Worth | $550,643 | $813,042 | $1,240,204 |

The table compares the business ratios of Sumptuous Cuisine Catering to caterers in the $1 million to $5 million revenue category. Caterers with banquet halls are covered by NAICS industry code 722320, or SIC code 5812.

| Ratio Analysis | ||||

| 2010 | 2011 | 2012 | ||

| Sales Growth | 50.13% | 22.21% | 21.61% | 1.65% |

| Percent of Total Assets | ||||

| Accounts Receivable | 7.22% | 8.32% | 8.93% | 3.53% |

| Inventory | 0.47% | 0.50% | 0.54% | 6.34% |

| Other Current Assets | 4.14% | 3.90% | 3.44% | 43.25% |

| Total Current Assets | 16.37% | 22.02% | 31.97% | |

| Personnel Plan | ||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| CEO | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 |

| COO | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| Marketing Director | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Salespeople | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Administrative Assistant | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Head Cook | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Assistant Cooks | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 | $4,000 |

| Facility Manager | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 | $4,500 |

| Total People | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| Total Payroll | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 |

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | $125,000 | $130,750 | $151,773 | $161,581 | $173,038 | $183,670 | $194,752 | $204,972 | $215,580 | $226,599 | $236,806 | $247,478 | |

| Direct Cost of Sales | $12,500 | $13,125 | $15,031 | $15,845 | $16,706 | $17,617 | $18,581 | $19,434 | $20,333 | $21,279 | $22,276 | $23,328 | |

| Event Staff | 17% | $21,250 | $22,228 | $25,801 | $27,469 | $29,417 | $31,224 | $33,108 | $34,845 | $36,649 | $38,522 | $40,257 | $42,071 |

| Subcontracted Services | $20,000 | $20,600 | $21,218 | $21,855 | $22,510 | $23,185 | $23,881 | $24,597 | $25,335 | $26,095 | $26,878 | $27,685 | |

| Total Cost of Sales | $53,750 | $55,953 | $62,051 | $65,169 | $68,633 | $72,027 | $75,570 | $78,877 | $82,316 | $85,896 | $89,411 | $93,084 | |

| Gross Margin | $71,250 | $74,798 | $89,722 | $96,412 | $104,405 | $111,643 | $119,182 | $126,095 | $133,263 | $140,703 | $147,395 | $154,395 | |

| Gross Margin % | 57.00% | 57.21% | 59.12% | 59.67% | 60.34% | 60.78% | 61.20% | 61.52% | 61.82% | 62.09% | 62.24% | 62.39% | |

| Expenses | |||||||||||||

| Payroll | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | |

| Marketing/Promotion | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $8,000 | $8,000 | $8,000 | $6,000 | $6,000 | |

| Depreciation | $50,000 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 | $2,333 |

| Rent | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |

| Utilities | $500 | $525 | $551 | $579 | $608 | $638 | $670 | $704 | $739 | $776 | $814 | $855 | |

| Insurance | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Payroll Taxes | 15% | $9,113 | $9,259 | $9,795 | $10,045 | $10,337 | $10,609 | $10,891 | $11,152 |

| Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash Sales | $62,500 | $65,375 | $75,886 | $80,790 | $86,519 | $91,835 | $97,376 | $102,486 | $107,790 | $113,300 | $118,403 | $123,739 | |

| Cash from Receivables | $72,222 | $69,444 | $64,033 | $70,981 | $78,502 | $83,846 | $89,354 | $94,790 | $100,101 | $105,315 | $110,728 | $116,021 | |

| Subtotal Cash from Operations | $134,722 | $134,819 | $139,920 | $151,771 | $165,021 | $175,681 | $186,730 | $197,276 | $207,891 | $218,614 | $229,131 | $239,761 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 8.00% | $10,000 | $10,460 | $12,142 | $12,926 | $13,843 | $14,694 | $15,580 | $16,398 | $17,246 | $18,128 | $18,944 | $19,798 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $1,870,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $2,014,722 | $145,279 | $152,061 | $164,698 | $178,864 | $190,374 | $202,310 | $213,674 | $225,137 | $236,742 | $248,076 | $259,559 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | $39,500 | |

| Bill Payments | $53,001 | $90,483 | $104,113 | $116,411 | $121,640 | $128,225 | $134,482 | $140,936 | $145,552 | $151,832 | $158,297 | $163,138 | |

| Subtotal Spent on Operations | $92,501 | $129,983 | $143,613 | $155,911 | $161,140 | $167,725 | $173,982 | $180,436 | $185,052 | $191,332 | $197,797 | $202,638 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $10,000 | $10,460 | $12,142 | $12,926 | $13,843 | $14,694 | $15,580 | $16,398 | $17,246 | $18,128 | $18,944 | $19,798 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $8,889 | $8,889 | $8,889 | $8,889 | $8,889 | $8,889 | $8,889 | ||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!