NALB Creative Center (NCC) is a specialty retail store that offers artists’ materials, crafters’ needs, a gallery, and an education center. NCC aims to inspire and support amateurs, professionals, and crafters in the Big Island art community. In addition to providing a wide variety of products, NALB will sponsor art shows, competitions, and craft fairs, as well as offer scholarships for artists to continue their formal education. NCC will also facilitate creative workshops and classes in various techniques and media.

NALB is unique in the market, as it is the only art supply store on the island owned and operated exclusively by artists. Unlike the two existing stores on the island, NALB will offer education and hands-on opportunities, as well as provide exceptional customer support. NALB will cater to the growing number of professional artists in West Hawaii and also target the retiree population that has been attracted to Kona because of its thriving art community. Furthermore, NALB will actively market to teachers and students in the public and private education systems.

Customer satisfaction is a top priority for NALB Creative Center. The owners are practicing artists themselves and understand the importance of exceeding customer expectations. NCC will actively participate in the local art scene to maintain a presence within the art and craft community and build close relationships with customers. The staff will receive training on current trends and products, and the owners will set consumer trends in creative work.

NALB will be located in a 3,000 square foot store in the commercial business park between Costco and Home Depot. The store’s size allows for a wide variety of art and craft supplies, and direct purchasing from manufacturers will help avoid middle man mark-ups. Regular customers will be eligible for discounts, and orders of $300 or more will qualify for free delivery in North Kona. Additionally, NALB will offer Artist’s Oasis holidays to travelers, providing local accommodations, equipment rental, supplies, and maps/guides.

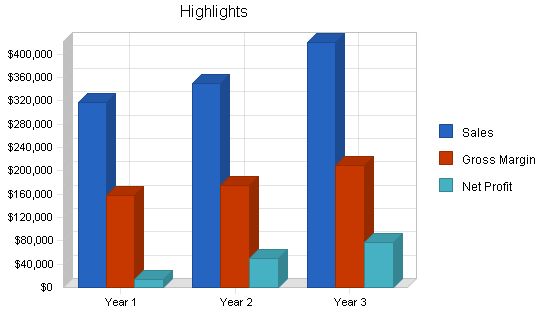

NALB expects to generate modest profit from the first month of operation, with projected margins at 50% due to wholesale purchasing. Sales in the first year are estimated to be slightly over $300,000, with a conservative growth rate of 5% for the first three years and 20% thereafter. Despite existing art supply stores reporting growth of over 30%, NALB takes a conservative approach to budgeting while maintaining a strong vision for the future.

1.1 Objectives

– Customer Satisfaction: To create a shopping environment that caters to the needs of the art and craft community of the Big Island by offering knowledgeable and professional customer service. Customer satisfaction will be measured through repeat business and multiple sales.

– Earn 80% market share and become the number one art and craft supplier on the island.

– Achieve a 50% profit margin within the first year.

– Be an active and vocal member in the community and provide continual re-investment through sponsorship of community activities and celebrations, including supporting art and craft events, hosting classes, providing scholarships.

– Develop Artist’s Oasis of Hawaii in year two and three, arranging local accommodations and materials rental for visiting/vacationing artists.

1.2 Keys to Success

– Provide for the satisfaction of all our customers and vendors.

– Advertise and promote in areas where our target customer base will learn about our store.

– Continuously review our inventory and adjust levels accordingly.

– Sell reliable and quality products, offering as many or more premium products than our competition. Offer promotions that bring customers into the store to buy goods and explore our services.

– Be an active member of the community.

– Provide in-store classes, demonstrations, and events.

1.3 Mission

– NALB Creative Center’s mission is to support and contribute to the community of artists and crafters by offering quality, name brand supplies, hosting and supporting shows, events, classes, and contests, and promoting the island as an artist’s oasis and destination.

– We will strive to supply what the consumer is asking for and provide new products and services to the areas of need. We will maintain NALB as a place for artists to gather.

– Success will be measured by customers choosing us because of their belief in our ability to meet or exceed their expectations of price, service, and selection.

– NALB Creative Center is a start-up business that will offer a large variety of art and craft supplies, focusing on items currently unavailable on this island. We will also offer classes in the use of new materials and techniques.

– We will build an Artist’s Oasis tour program, providing accommodations, plein-air sites, easels and materials rental, and shipping completed work to clients.

– We will expand the store into an art center, including a fine art gallery, musical instruments/studio space, classrooms for art/music lessons, art/music books, a live music/coffee bar, and do-it-yourself crafts.

2.1 Company Ownership

– NALB Creative Center is a subsidiary of NALB LLC, a limited liability corporation equally owned and operated by Callie Graff and VanDyke Brown. Additional subsidiaries include NALB Design, NALB Fine Art, and NALB Music.

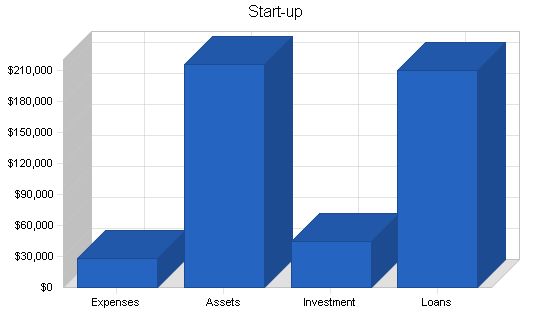

2.2 Start-up Summary

– NALB Creative Center’s start-up costs include inventory, liability umbrella, rent, interior design costs, and opening day promotions.

– Current assets acquired during interior build-out, shelving, slotwall, fixtures, signage, display cases, etc., total $26,000.

– The operating capital cash on hand balance will be $31,050.

– The purpose of this business plan is to drive the company direction in accord with its vision and secure a $210,000 loan. Other financing includes the owner’s investment of $45,000 and a short-term revolving line-of-credit for inventory replenishment.

– Successful operation and building a loyal customer base will allow NALB Creative Center to be self-sufficient and profitable in the first year.

Start-up Requirements

– Legal: $500

– Stationery etc.: $200

– Insurance: $3,200

– Rent and Deposit: $10,000

– Travel: Trade Show: $3,500

– Set-up Banking: $50

– POS System: $2,000

– Security System: $1,500

– Advertising: $1,000

– Phone System: $1,000

– Computers: $5,000

– Other: $0

– Total Start-up Expenses: $27,950

Start-up Assets

– Cash Required: $20,000

– Start-up Inventory: $130,000

– Other Current Assets: $26,000

– Long-term Assets: $40,000

– Total Assets: $216,000

Total Requirements: $243,950

Services

NALB Creative Center provides a wide variety of products for artists and crafters. Our wholesale suppliers include Grumbacher, Liquitex, Windsor and Newton, Mabef Easels, Duncan, PrismaColor, Speedball, Masterpiece, Fredrix, Holbein, Rembrandt, and Strathmore. Vendors include MacPherson and Herr’s. We offer many unusual or new products, as well as the basics that every artist needs. Our product lines include bargain, mid-range, and professional quality products.

Management relies on customer feedback, suggestions, and daily sales reports to introduce or eliminate certain brands or products.

In year two, we will market our Artist’s Oasis tour packages and art/craft equipment rental. Rentals will include bulky or expensive equipment that is used only periodically and may not be suitable for purchase by the average artist or crafter, such as a Giclee Printer.

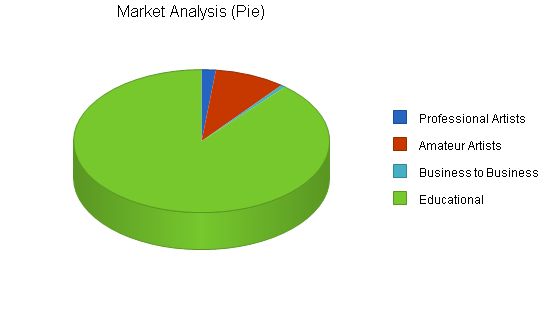

Market Analysis Summary

In West Hawaii, the mauka community of Holualoa in Kona, Kealakekua and South Kona, as well as Waimea and Hawi in Kohala, have large artist populations and galleries. The Holualoa Foundation for Arts and Culture, the Society for Kona’s Education and Art, the Kailua Village Artists, the Kona Arts Center, the Waimea Arts Center, and other non-profit groups offer arts classes and instruction year-round to children and adults.

NALB Creative Center targets four primary customers:

1. Professional artists.

2. Amateur artists and crafters, including hobbyists.

3. Businesses, such as architects, graphic designers, interior designers, or direct mail advertisers.

4. Teachers and students.

Market Segmentation

Average household income has steadily grown, with 36 percent of Big Island households reporting incomes of $25,000 – $50,000 and another 36 percent in the $50,000 – $75,000 range. Predictions for West Hawaii include population growth, economic growth, and business opportunity.

1. Professional artists: There are currently at least 39 Fine Art Galleries on the west side of Hawaii, representing several artists each.

2. Amateur artists and crafters, including hobbyists: Many of the amateurs are retirees with high disposable income levels.

3. Businesses: Architects (36 companies on the island), technical drawing, interior/graphic design (18 companies on the island), advertising/direct mail companies (12 companies on the island).

4. Teachers and students: This group includes K-12 teachers and students, as well as those attending art classes at the store (25,000 public school students).

*The total population of Hawaii County has grown by about 20 percent in the past decade. The older segments, such as those aged 45-54 and those 55 and older, have increased at rates of 100 percent and 64 percent respectively.

Market Analysis:

– Year 1:

Potential Customers:

– Professional Artists: Growth – 20%; 200, 240, 288, 346, 415; CAGR – 20.02%

– Amateur Artists: Growth – 40%; 1,000, 1,400, 1,960, 2,744, 3,842; CAGR – 40.00%

– Business to Business: Growth – 10%; 66, 73, 80, 88, 97; CAGR – 10.10%

– Educational: Growth – 20%; 10,000, 12,000, 14,400, 17,280, 20,736; CAGR – 20.00%

– Total: 22.16%; 11,266, 13,713, 16,728, 20,458, 25,090; CAGR – 22.16%

4.2 Target Market Segment Strategy:

1. Professional Artists: With only one existing art supply store, if customer service is not met, they will use the Internet and mainland stores. We can impact this segment by having products in-store for artists to manipulate and study.

2. Amateur artists and crafters: This segment has the same needs as professional artists. Some will purchase lower and mid-priced product lines, but many appreciate and use professional quality materials.

3. Businesses: Currently not served on the west side of the island. Most purchasing is done online.

4. Teachers and students: Currently neglected on the island. We plan to have a store big enough to accommodate the art supply needs of the education community.

4.3 Service Business Analysis:

NALB Creative Center fills an underserved niche market on the island. Existing outlets for art products offer limited selections and poor customer service satisfaction.

4.3.1 Competition and Buying Patterns:

Art Supply of Hawaii is the closest competitor to NALB. Many artists refuse to shop there due to dissatisfaction with customer service. They currently shop online and in mainland stores. Customers in the educational segment buy at discount stores. NALB will provide better selection, customer service, and hands-on access to materials.

Strategy and Implementation Summary:

NALB’s goal is to provide products, service, and education to the underserved creative community on the island. Our intention is to gain 80% of the market share by focusing on customer service, niche positioning, and becoming a gathering place for artists.

5.1 Competitive Edge:

NALB’s competitive edge involves customer service, location, being an art education center, being a gathering place for artists, and providing percentage discounts for repeat customers.

5.2 Marketing Strategy:

Our marketing strategy will focus on customer service, sales promotion, and niche positioning. We will advertise in local and regional magazines, use direct mail postcards, utilize website marketing, make direct calls on professional artists, and rely on word of mouth and in-store events.

5.3 Sales Strategy:

NALB will approach sales from a relationship basis. We will gather customer information, target marketing efforts effectively, develop product offers and services, increase awareness of NCC, and seek future sales opportunities. We will make direct sales calls, utilize POS software for customer information, offer a generous return/exchange policy, and focus on educating and filling customer needs.

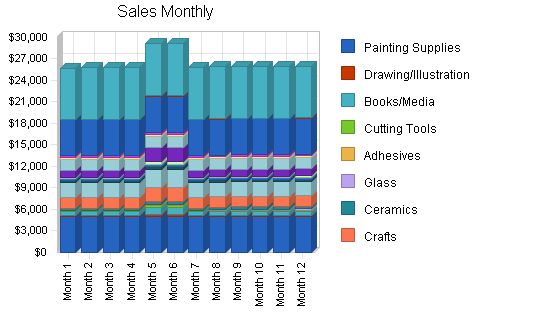

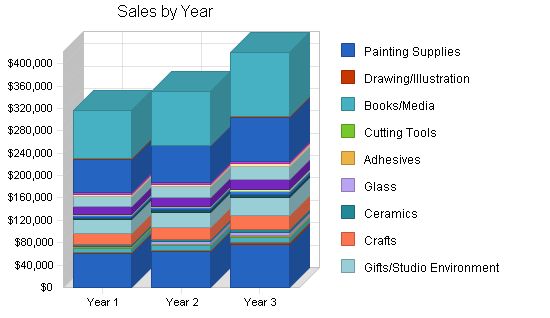

5.3.1 Sales Forecast:

Sales are expected to start off conservatively and increase during the holiday season and the months of July and August. Growth rates for the first three years are projected at 5%, 10%, and 20% respectively.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Painting Supplies | $60,000 | $64,200 | $77,040 |

| Drawing/Illustration | $2,600 | $2,782 | $3,338 |

| Books/Media | $7,000 | $7,490 | $8,988 |

| Cutting Tools | $1,400 | $1,498 | $1,798 |

| Adhesives | $1,400 | $1,540 | $1,848 |

| Glass | $750 | $4,000 | $5,000 |

| Ceramics | $3,800 | $4,180 | $5,016 |

| Crafts | $19,000 | $20,900 | $25,080 |

| Gifts/Studio Environment | $25,000 | $27,500 | $33,000 |

| Print Making | $4,300 | $4,730 | $5,676 |

| Sculpture | $3,100 | $3,410 | $4,092 |

| Portfolios/Transporting | $2,800 | $3,080 | $3,696 |

| Gallery Sales | $14,000 | $15,400 | $18,480 |

| Fabrics/Yarn | $18,000 | $19,800 | $23,760 |

| Equipment | $3,600 | $3,960 | $4,752 |

| Clothing/Accessories | $2,600 | $2,860 | $3,432 |

| Paper/Boards | $60,000 | $66,000 | $79,200 |

| Classes | $1,050 | $1,155 | $1,386 |

| Canvas/Surfaces | $86,400 | $95,040 | $114,048 |

| Total Sales | $316,800 | $349,525 | $419,630 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Inventory | $158,400 | $174,763 | $209,815 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $158,400 | $174,763 | $209,815 |

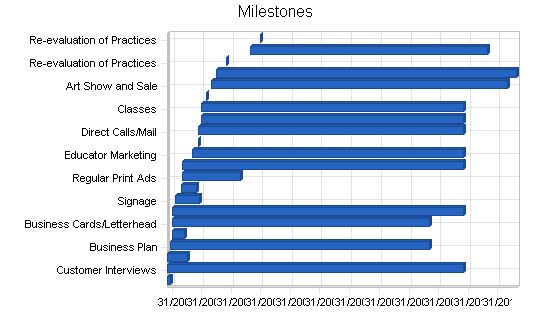

5.4 Milestones

The milestone chart highlights our plan with specific dates. This schedule reflects our commitment to organization and detail. During the 6-month and 12-month evaluation period, we will complete a detailed evaluation of all aspects of the business:

- Financials/Bottom Line

- Sales

- Customer satisfaction

- Goals for next period

We will have a "Plan-B" for implementation if the evaluation shows it is ill-advised to continue. Product diversification, location, advertising, and new markets will be considered if NALB needs to be more liquid.

Milestones:

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Corporate Identity | 1/3/2005 | 1/18/2005 | $100 | CG | Department |

| Customer Interviews | 1/3/2005 | 1/3/2010 | $0 | CG/VB | Department |

| Site Improvements and Design | 1/3/2005 | 5/5/2005 | $0 | CG/VB | Department |

| Business Plan | 1/20/2005 | 6/6/2009 | $50 | VB | Department |

| Website Development | 2/1/2005 | 4/18/2005 | $50 | CG | Department |

| Business Cards/Letterhead | 2/1/2005 | 6/6/2009 | $300 | CG | Department |

| Yellow Pages Ads | 2/1/2005 | 1/3/2010 | $200 | CG/VB | Department |

| Signage | 2/18/2005 | 7/18/2005 | $2,000 | CG/VB | Department |

| Print Ad. “Ticklers” | 4/1/2005 | 6/30/2005 | $600 | CG/VB | Department |

| Regular Print Ads | 4/5/2005 | 3/30/2006 | $3,000 | CG/VB | Department |

| Radio Advertising | 4/5/2005 | 1/3/2010 | $1,000 | CG/VB | Department |

| Educator Marketing | 6/5/2005 | 1/3/2010 | $150 | CG/VB | Department |

| Grand Opening | 7/10/2005 | 7/10/2005 | $500 | CG/VB | Department |

| Direct Calls/Mail | 7/15/2005 | 1/3/2010 | $250 | CG | Department |

| Promotional Events | 8/1/2005 | 1/3/2010 | $500 | CG/VB | Department |

| Classes | 8/1/2005 | 1/3/2010 | $0 | CG/VB | Department |

| Follow-up Surveys | 9/1/2005 | 9/1/2005 | $0 | CG/VB | Department |

| Art Show and Sale | 10/1/2005 | 10/1/2010 | $0 | CG/VB | Department |

| Music Jam Sessions | 11/1/2005 | 11/25/2010 | $0 | CG/VB | Department |

| Re-evaluation of Practices | 12/30/2005 | 12/30/2005 | $0 | CG/VB | Department |

| Artist Oasis Web Tours | 6/1/2006 | 6/1/2010 | $0 | CG/VB | Department |

| Re-evaluation of Practices | 7/30/2006 | 7/30/2006 | $0 | CG/VB | Department |

| Totals | – | – | $8,700 | – | – |

Web Plan Summary:

NALB’s Web presence will be informational and educational with a contact form for requesting additional information. Our URL will be on all print items from the store (advertising, sales promotion sheets, letterhead).

- Customers can search our inventory and place orders.

- Customers can access a calendar of educational opportunities and sign up online.

- Customers can use the website for art-related research: technical, historical, and local.

- Customers can view and print coupons.

- Off-island customers can read about our tour packages and request additional information.

- Customers can view our online art gallery.

Website Marketing Strategy:

We will direct customers to our website in the following ways:

- Direct email through voluntarily provided addresses.

- Printing our URL on all store items (letterhead, business cards, direct mail, shopping bags and wrapping paper, promotional items, print advertising).

- Links from local business pages and Hawaii Tourism portals.

- Links to and from national art resource pages.

- Advertising on all company vehicles.

Development Requirements:

Our parent company website is already in place. Through NALB Design, we have trained staff, domain names, and software to build a web presence for NALB Creative Center at a nominal cost.

Management Summary:

NALB Creative Center is managed by the owners/founders.

- We will open with the two owners operating the store.

- As our business expands, we will hire additional employees. Our projections include six employees, with the owners managing the store and cold-call selling.

- Employees will work within their creative, physical, and intellectual boundaries.

- All duties will be divided and delegated based on strengths and weaknesses.

- We expect a high degree of customer service skills and personality from our employees as it is essential to our success.

Personnel Plan:

NCC will be operated in the first few years by the owners. Additional part-time help will be provided by family members.

As NALB grows over the next years, we will need two additional full-time sales clerks and two part-time clerks. This will free the owners to concentrate on building the business and expanding into other areas of NALB’s vision (tours, competitions, music, gallery, special events, etc.).

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Owners | $66,000 | $68,000 | $71,400 |

| Other | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total People | 3 | 3 | 3 |

| Total Payroll | $66,000 | $68,000 | $71,400 |

- The growth of NALB will be moderate and the cash balance will always be positive.

- We will not be selling on credit. We accept cash, checks, Visa, and MasterCard.

- Marketing and advertising will remain at or below 5% of sales.

- We will finance growth mainly through cash flow. Profits will be reinvested in inventory and debt payments until debt is fully paid.

Start-up Funding:

NALB’s start-up funds:

- $210,000 SBA loan

- $20,000 short-term/credit card

- $45,000 owner investment

The additional capital is needed to fund salaries, inventory lags, and other costs during the first months of the business year.

| Start-up Funding | |

| Start-up Expenses to Fund | $27,950 |

| Start-up Assets to Fund | $216,000 |

| Total Funding Required | $243,950 |

| Assets | |

| Non-cash Assets from Start-up | $196,000 |

| Cash Requirements from Start-up | $20,000 |

| Additional Cash Raised | $11,050 |

| Cash Balance on Starting Date | $31,050 |

| Total Assets | $227,050 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $210,000 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $210,000 |

| Capital | |

| Planned Investment | |

| Owner | $45,000 |

| Investor | $0 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $45,000 |

| Loss at Start-up (Start-up Expenses) | ($27,950) |

| Total Capital | $17,050 |

| Total Capital and Liabilities | $227,050 |

| Total Funding | $255,000 |

Important Assumptions:

The financial plan depends on important assumptions, most of which are shown in the following table. The key underlying assumptions are:

- We do not sell anything on credit. We accept cash, checks, debit cards, Visa, MasterCard.

- A slow-growth economy/customer base, without major recession.

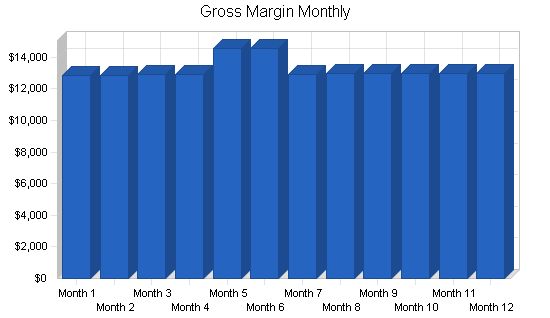

- Monthly sales are the largest indicator for this business. There are some seasonal variations, with the months October through January being the highest sales months.

- We assume access to sufficient capital and financing to maintain our financial plan as shown in the tables.

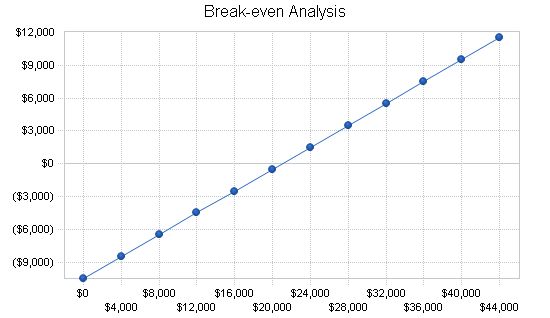

Break-even Analysis

Monthly Revenue Break-even: $21,000

Assumptions:

– Average Percent Variable Cost: 50%

– Estimated Monthly Fixed Cost: $10,500

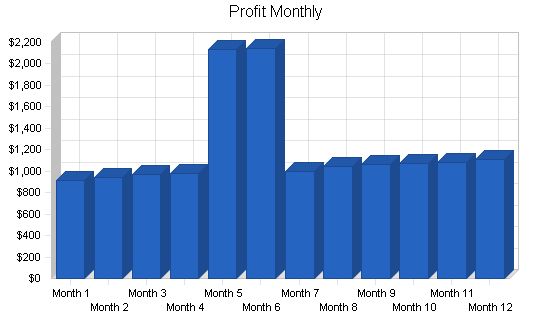

8.4 Projected Profit and Loss

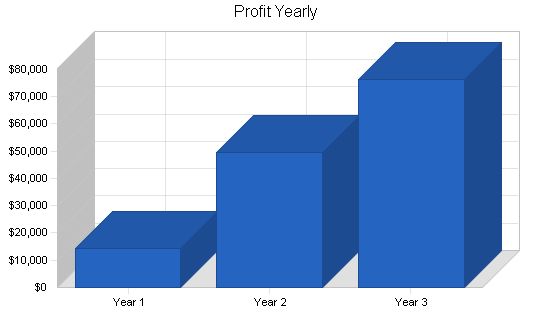

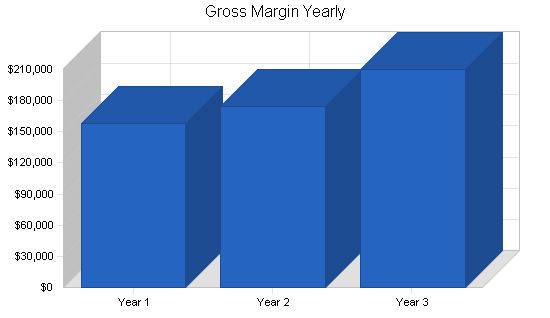

We predict that in the second year of operation, our high customer service level and strong assortment will generate around 5% profit. This is faster than the usual start-up retailer’s two to three year period. Our sales projections are conservative. If sales increase as expected, the profit-to-sales ratio could reach 10% by the end of year three.

Please refer to the chart and table below for projected profit and loss.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $316,800 | $349,525 | $419,630 |

| Direct Cost of Sales | $158,400 | $174,763 | $209,815 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $158,400 | $174,763 | $209,815 |

| Gross Margin | $158,400 | $174,763 | $209,815 |

| Gross Margin % | 50.00% | 50.00% | 50.00% |

| Expenses | |||

| Payroll | $66,000 | $68,000 | $71,400 |

| Marketing/Promotion | $2,400 | $2,520 | $2,646 |

| Depreciation | $0 | $0 | $0 |

| Rent | $42,000 | $12,600 | $7,056 |

| Utilities | $12,000 | $6,720 | $7,056 |

| Insurance | $3,600 | $3,780 | $3,969 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $126,000 | $93,620 | $92,127 |

| Profit Before Interest and Taxes | $32,400 | $81,143 | $117,688 |

| EBITDA | $32,400 | $81,143 | $117,688 |

| Interest Expense | $11,747 | $10,238 | $8,663 |

| Taxes Incurred | $6,196 | $21,272 | $32,708 |

| Net Profit | $14,457 | $49,634 | $76,318 |

| Net Profit/Sales | 4.56% | 14.20% | 18.19% |

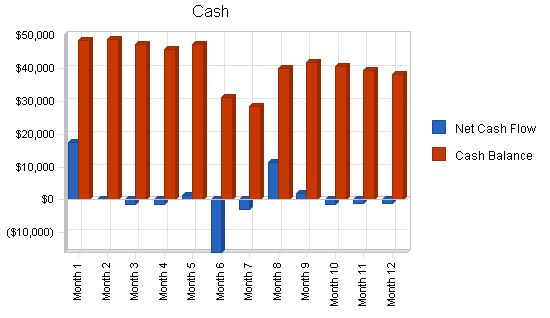

8.5 Projected Cash Flow

Our projected cash flow is outlined in the following chart and table.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash Sales | $316,800 | $349,525 | $419,630 |

| Subtotal Cash from Operations | $316,800 | $349,525 | $419,630 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $316,800 | $349,525 | $419,630 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $66,000 | $68,000 | $71,400 |

| Bill Payments | $217,354 | $244,145 | $296,130 |

| Subtotal Spent on Operations | $283,354 | $312,145 | $367,530 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $26,250 | $26,250 | $26,250 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $309,604 | $338,395 | $393,780 |

| Net Cash Flow | $7,196 | $11,130 | $25,850 |

| Cash Balance | $38,246 | $49,375 | $75,225 |

8.6 Projected Balance Sheet

The table shows the annual balance sheet results with a conservative projected increase in net worth. Detailed monthly projections are in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $38,246 | $49,375 | $75,225 |

| Inventory | $130,000 | $143,429 | $172,197 |

| Other Current Assets | $26,000 | $26,000 | $26,000 |

| Total Current Assets | $194,246 | $218,804 | $273,422 |

| Long-term Assets | |||

| Long-term Assets | $40,000 | $40,000 | $40,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $40,000 | $40,000 | $40,000 |

| Total Assets | $234,246 | $258,804 | $313,422 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $18,988 | $20,163 | $24,713 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $18,988 | $20,163 | $24,713 |

| Long-term Liabilities | $183,750 | $157,500 | $131,250 |

| Total Liabilities | $202,738 | $177,663 | $155,963 |

| Paid-in Capital | $45,000 | $45,000 | $45,000 |

| Retained Earnings | ($27,950) | ($13,493) | $36,141 |

| Earnings | $14,457 | $49,634 | $76,318 |

| Total Capital | $31,507 | $81,141 | $157,459 |

| Total Liabilities and Capital | $234,246 | $258,804 | $313,422 |

| Net Worth | $31,507 | $81,141 | $157,459 |

8.7 Business Ratios

Business ratios for the years of this plan are shown below. The industry profile is from 2003, based on the Standard Industrial Classification (SIC) code 5092.9901 for the Arts and crafts equipment and supplies industry.

| Ratio Analysis | ||||||||||||||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |||||||||||||

| Sales Growth | 0.00% | 10.33% | 20.06% | 2.44% | ||||||||||||

| Percent of Total Assets | ||||||||||||||||

| Inventory | 55.50% | 55.42% | 54.94% | 28.77% | ||||||||||||

| Other Current Assets | 11.10% | 10.05% | 8.30% | 26.58% | ||||||||||||

| Total Current Assets | 82.92% | 84.54% | 87.24% | 87.58% | ||||||||||||

| Long-term Assets | 17.08% | 15.46% | 12.76% | 12.42% | ||||||||||||

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% | ||||||||||||

| Current Liabilities | ||||||||||||||||

| Accounts Payable | 8.11% | 7.79% | 7.89% | 41.17% | ||||||||||||

| Long-term Liabilities | 78.44% | 60.86% | 41.88% | 9.71% | ||||||||||||

| Total Liabilities | 86.55% | 68.65% | 49.76% | 50.88% | ||||||||||||

| Net Worth | 13.45% | 31.35% | 50.24% | 49.12% | ||||||||||||

| Percent of Sales | ||||||||||||||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% | ||||||||||||

| Gross Margin | 50.00% | 50.00% | 50.00% | 30.58% | ||||||||||||

| Selling, General & Administrative Expenses | 45.44% | 35.80% | 31.81% | 16.83% | ||||||||||||

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.21% | ||||||||||||

| Profit Before Interest and Taxes | 10.23% | 23.22% | 28.05% | 1.02% | ||||||||||||

| Main Ratios | ||||||||||||||||

| Current | 10.23 | 10.85 | 11.06 | 1.84 | ||||||||||||

| Quick | 3.38 | 3.74 | 4.10 | 1.00 | ||||||||||||

| Total Debt to Total Assets | 86.55% | 68.65% | 49.76% | 55.33% | ||||||||||||

| Pre-tax Return on Net Worth | 65.55% | 87.39% | 69.24% | 2.27% | ||||||||||||

| Pre-tax Return on Assets | 8.82% | 27.40% | 34.79% | 5.08% | ||||||||||||

| Additional Ratios | Year 1 | Sales Forecast | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||||

| Sales | ||||||||||||||||

| Painting Supplies | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |||

| Drawing/Illustration | 0% | $200 | $200 | $200 | $200 | $300 | $300 | $200 | $200 | $200 | $200 | $200 | $200 | |||

| Books/Media | 0% | $500 | $500 | $500 | $500 | $1,000 | $1,000 | $500 | $500 | $500 | $500 | $500 | $500 | |||

| Cutting Tools | 0% | $100 | $100 | $100 | $100 | $200 | $200 | $100 | $100 | $100 | $100 | $100 | $100 | |||

| Adhesives | 0% | $100 | $100 | $100 | $100 | $200 | $200 | $100 | $100 | $100 | $100 | $100 | $100 | |||

| Glass | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $100 | $150 | $150 | $150 | $200 | |||

| Ceramics | 0% | $300 | $300 | $300 | $300 | $400 | $400 | $300 | $300 | $300 | $300 | $300 | $300 | |||

| Crafts | 0% | $1,500 | $1,500 | $1,500 | $1,500 | $2,000 | $2,000 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |||

| Gifts/Studio Environment | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,500 | $2,500 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | |||

| Print Making | 0% | $350 | $350 | $350 | $350 | $400 | $400 | $350 | $350 | $350 | $350 | $350 | $350 | |||

| Sculpture | 0% | $250 | $250 | $250 | $250 | $300 | $300 | $250 | $250 | $250 | $250 | $250 | $250 | |||

| Portfolios/Transporting | 0% | $200 | $200 | $200 | $200 | $400 | $400 | $200 | $200 | $200 | $200 | $200 | $200 | |||

| Gallery Sales | 0% | $1,000 | $1,000 | $1,000 | $1,000 | $2,000 | $2,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | |||

| Fabrics/Yarn | 0% | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |||

| Equipment | 0% | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | $300 | |||

| Clothing/Accessories | 0% | $200 | $200 | $200 | $200 | $300 | $300 | $200 | $200 | $200 | $200 | $200 | $200 | |||

| Paper/Boards | 0% | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |||

| Classes | 0% | $0 | $50 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | |||

| Canvas/Surfaces | 0% | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | |||

| Total Sales | $25,700 | $25,750 | $25,800 | $25,800 | $29,100 | $29,100 | $25,800 | $25,900 | $25,950 | $25,950 | $25,950 | $26,000 | ||||

| Personnel Plan | ||||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | |||||||

| Pro Forma Cash Flow | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Cash Received | ||||||||||||||

| Cash from Operations | ||||||||||||||

| Cash Sales | $25,700 | $25,750 | $25,800 | $25,800 | $29,100 | $29,100 | $25,800 | $25,900 | $25,950 | $25,950 | $25,950 | $26,000 | ||

| Subtotal Cash from Operations | $25,700 | $25,750 | $25,800 | $25,800 | $29,100 | $29,100 | $25,800 | $25,900 | $25,950 | $25,950 | $25,950 | $26,000 | ||

| Additional Cash Received | ||||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| Subtotal Cash Received | $25,700 | $25,750 | $25,800 | $25,800 | $29,100 | $29,100 | $25,800 | $25,900 | $25,950 | $25,950 | $25,950 | $26,000 | ||

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Expenditures from Operations | ||||||||||||||

| Cash Spending | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | $5,500 | ||

| Bill Payments | $593 | $17,842 | $19,558 | $19,573 | $19,946 | $37,411 | $20,952 | $6,730 | $16,371 | $19,625 | $19,376 | $19,377 | ||

| Subtotal Spent on Operations | $6,093 | $23,342 | $25,058 | $25,073 | $25,446 | $42,911 | $26,452 | $12,230 | $21,871 | $25,125 | $24,876 | $24,877 | ||

| Additional Cash Spent | ||||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!