Carpet and Upholstery Cleaning Services

Like New Carpet Cleaners is a local carpet-cleaning service in Fairfield County, Connecticut. Established in June 2009, Like New Carpet Cleaners was founded by Fred and Rebecca Smith, who operate the business from their home office in Danbury, CT.

Company Ownership

Fred and Rebecca Smith founded Like New Carpet Cleaners as an LLC in June 2009, each owning 50% of the company.

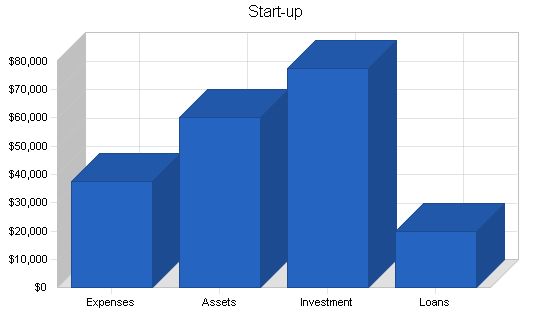

Start-up Summary

The startup expenses for the business primarily include:

- Website: Developing and testing a website with functionality for online ordering, scheduling, rescheduling, and customer support. ($30,000 estimate)

- Delivery Van: Purchasing a van to transport cleaning staff and equipment to customer homes. One van will suffice for multiple cleaning crews during initial operations. ($15,000 estimate)

- Cleaning Equipment: Acquiring 3 portable extractors and additional specialized equipment for cleanings. ($15,000 estimate)

The business will be based out of a home office, minimizing initial rent and overhead costs.

Start-up

Requirements

Start-up Expenses

Legal – $1,500

Stationery etc. – $1,000

Insurance – $2,000

Rent – $1,000

Website – $30,000

Other – $2,000

Total Start-up Expenses – $37,500

Start-up Assets

Cash Required – $30,000

Other Current Assets – $0

Long-term Assets – $30,000

Total Assets – $60,000

Total Requirements – $97,500

Services

Like New Carpet Cleaners services and products will include:

– Regular Carpet Cleaning

– Spot Treatment for Carpets

– Furniture Cleaning

– Leather Furniture Cleaning

– Area Rugs

– Gift Certificates

The company will focus on cleaning carpets, rugs, and upholstered items and will seek to build and maintain its expertise in this area. Its services will not include hardwood floors or other home-cleaning services.

Through its website, the company will offer the service of easy scheduling and the set-up of automated recurring appointments for its regular customers.

Market Analysis Summary

The U.S. carpet and upholstery cleaning service sector was estimated at $5.3 billion in 2006 by Marketdata Enterprises. The market is broken into residential and commercial services. Moderate growth is estimated for the next five years, but the national market is highly competitive.

The initial market for Like New Carpet Cleaners is residential services in Fairfield County, CT, within a five-mile radius of Danbury, CT. Fairfield County has a population of approximately 895,000, with 225,000 owner-occupied condos and homes. It is estimated that 40,000 of these owner-occupied homes and condos are within the five-mile radius. These 40,000 owners spend an estimated $4 million per year on carpet, upholstery, and other floor-cleaning services. This is why we have chosen this as our initial market.

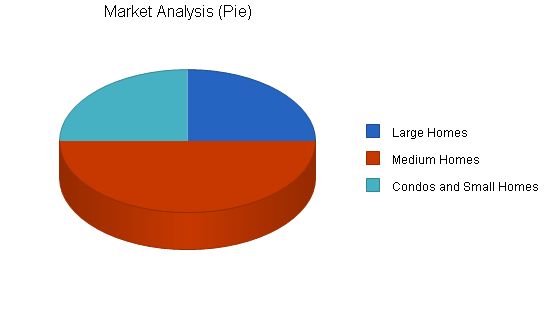

Market Segmentation

Customers for this industry are divided into the following targets:

– Residences (including individuals, families, and landlords)

– Businesses (including small businesses, larger businesses, insurance companies, and commercial landlords)

Residences require a higher level of customer support, pay higher rates on average, and often include additional opportunities to sell related services to homeowners.

Businesses require less customer support and service, pay lower rates on average, and generally seek ongoing services that can repeat the same tasks without much room for upselling.

Market Analysis:

– Year 1

– Year 2

– Year 3

– Year 4

– Year 5

Potential Customers:

– Growth

– CAGR (Compound Annual Growth Rate)

Large Homes:

– 25%

– 10,000

– 12,500

– 15,625

– 19,531

– 24,414

– 25.00%

Medium Homes:

– 25%

– 20,000

– 25,000

– 31,250

– 39,063

– 48,829

– 25.00%

Condos and Small Homes:

– 25%

– 10,000

– 12,500

– 15,625

– 19,531

– 24,414

– 25.00%

Total:

– 25.00%

– 40,000

– 50,000

– 62,500

– 78,125

– 97,657

– 25.00%

Target Market Segment Strategy:

Like New Carpet Cleaners will focus on residential cleaning services. The market is divided into:

– Large homes (over 5,000 square feet)

– Medium homes (2000 to 5000 square feet)

– Small homes and condos (under 2000 square feet)

Service Business Analysis:

The carpet-cleaning business is characterized by multiple local businesses and some national franchises. Each town can have from ten to twenty businesses. Services are generally ordered by phone. On-site consultations are given for large homes.

Competition and Buying Patterns:

The carpet and upholstery industry is comprised of 40,000 mostly small companies. The top ten franchises make up only 22% of the market. Customers choose between competitors based on brand name, positive references, and price.

Web Plan Summary:

The website for Like New Carpet Cleaners will convert Web users to ordering cleaning services because of its simplicity, customization, and ability to identify inquiries which require additional attention. The website will include graphics, tutorials, client testimonials, pricing explanations, services list, FAQs, and "About us" page. For current customers, the website will also allow scheduling and rescheduling cleanings, and setting up recurring appointments.

Website Marketing Strategy:

The website will be marketed through search engine marketing and search engine optimization, using Google Adwords. Like New Carpet Cleaners will retain the services of a search engine marketing firm to optimize its Google Adwords account. Search engine optimization will be based on the initial design of the website and building links to increase its Google ranking.

Development Requirements:

The front end of the website will require the previously mentioned pages, and the back end will include the ability to adjust pricing and service options, integration with accounting and calendar systems, and customer data storage.

Strategy and Implementation Summary:

The strategy is to expand rapidly within Fairfield County, CT, targeting residential customers only. Priorities include ensuring high-quality, moderately-priced service, keeping overhead low, and building the brand around making carpets look "like new."

Competitive Edge:

The website will offer complete sales, service, and scheduling applications online, reducing operating costs and providing a good customer experience. Customers can sign up for services any time, day or night.

Marketing Strategy:

The marketing strategy is to promote and build a base of residential customers within a five-mile radius of Danbury, CT. This includes a direct mail campaign, poster advertising, and web advertising via search engine marketing and search engine optimization.

Sales Strategy:

Sales will be automated through the website. 75% of sales in the first year will be conducted entirely on the website, increasing to 90% by the fifth year. Specific client queries will be handled by the owners through personal attention.

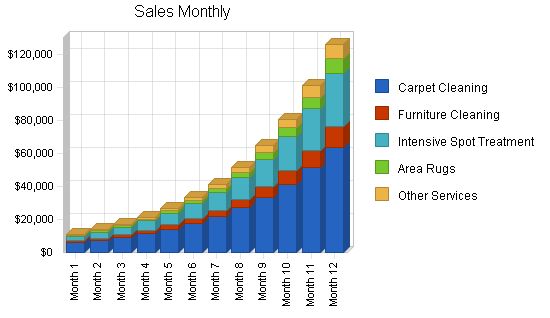

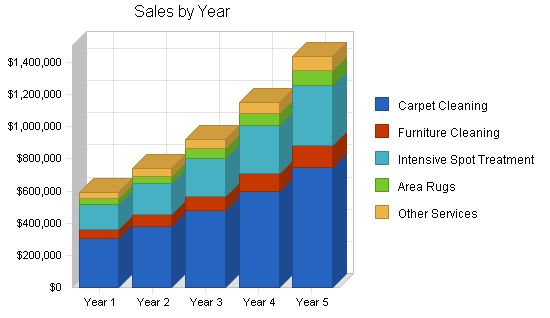

The primary revenue streams will be carpet cleaning and spot treatments. Average services are defined, and cost of sales is expected to be 35% for labor. Rapid growth is anticipated, with a 25% annual growth estimated.

Sales Forecast

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Unit Sales | |||||

| Carpet Cleaning | 3,054 | 3,817 | 4,772 | 5,965 | 7,456 |

| Furniture Cleaning | 2,310 | 2,888 | 3,609 | 4,512 | 5,640 |

| Intensive Spot Treatment | 3,054 | 3,817 | 4,772 | 5,964 | 7,456 |

| Area Rugs | 1,486 | 1,857 | 2,322 | 2,902 | 3,628 |

| Other Services | 1,486 | 1,857 | 2,322 | 2,902 | 3,628 |

| Total Unit Sales | 11,390 | 14,237 | 17,796 | 22,245 | 27,806 |

| Unit Prices | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Carpet Cleaning | $100.00 | $100.00 | $100.00 | $100.00 | $100.00 |

| Furniture Cleaning | $25.00 | $25.00 | $25.00 | $25.00 | $25.00 |

| Intensive Spot Treatment | $50.00 | $50.00 | $50.00 | $50.00 | $50.00 |

| Area Rugs | $25.00 | $25.00 | $25.00 | $25.00 | $25.00 |

| Other Services | $25.00 | $25.00 | $25.00 | $25.00 | $25.00 |

| Sales | |||||

| Carpet Cleaning | $305,395 | $381,744 | $477,180 | $596,475 | $745,593 |

| Furniture Cleaning | $57,750 | $72,188 | $90,234 | $112,793 | $140,991 |

| Intensive Spot Treatment | $152,691 | $190,864 | $238,580 | $298,225 | $372,781 |

| Area Rugs | $37,147 | $46,434 | $58,042 | $72,553 | $90,691 |

| Other Services | $37,147 | $46,434 | $58,042 | $72,553 | $90,691 |

| Total Sales | $590,130 | $737,663 | $922,078 | $1,152,598 | $1,440,747 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Carpet Cleaning | $30.00 | $30.00 | $30.00 | $30.00 | $30.00 |

| Furniture Cleaning | $7.50 | $7.50 | $7.50 | $7.50 | $7.50 |

| Intensive Spot Treatment | $22.50 | $22.50 | $22.50 | $22.50 | $22.50 |

| Area Rugs | $9.75 | $9.75 | $9.75 | $9.75 | $9.75 |

| Other Services | $11.25 | $11.25 | $11.25 | $11.25 | $11.25 |

| Direct Cost of Sales | |||||

| Carpet Cleaning | $91,619 | $114,523 | $143,154 | $178,942 | $223,678 |

| Furniture Cleaning | $17,325 | $21,656 | $27,070 | $33,838 | $42,297 |

| Intensive Spot Treatment | $68,711 | $85,889 | $107,361 | $134,201 | $167,751 |

| Area Rugs | $14,487 | $18,109 | $22,636 | $28,296 | $35,369 |

| Other Services | $16,716 | $20,895 | $26,119 | $32,649 | $40,811 |

| Subtotal Direct Cost of Sales | $208,858 | $261,072 | $326,341 | $407,926 | $509,907 |

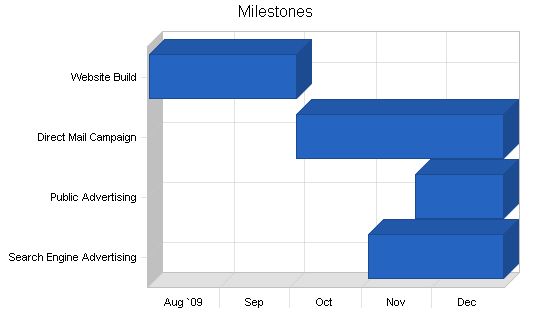

Milestones

The marketing program depends on timely completion of key tasks. Before public marketing begins, the website service must undergo comprehensive testing over a two-month period. Once this work is completed, direct mail and poster/movie screen advertising will start simultaneously, aiming to inform thousands of local residents about the new business and its value. Web advertising will follow, targeting locals searching for carpet cleaning to increase sales.

Milestones:

Website Build: 8/1/2009 – 10/3/2009, $30,000 budget, managed by RS, Operations

Direct Mail Campaign: 10/3/2009 – 12/31/2009, $10,000 budget, managed by FS, Marketing

Public Advertising: 11/23/2009 – 12/31/2009, $20,000 budget, managed by FS, Marketing

Search Engine Advertising: 11/3/2009 – 12/31/2009, $10,000 budget, managed by FS, Marketing

Totals: $70,000 budget

Management Summary:

The business will be managed by the owners, Fred and Rebecca Smith. Fred Smith, CEO, will handle sales and marketing. Rebecca Smith, COO, will handle operations and finances. She will also oversee the development of the website and sales work as needed. In the fourth year, experienced managers will be hired to take over the CEO and COO positions.

Personnel Plan:

After six months, a full-time administrative assistant will be hired to handle bookkeeping, accounts payable, and support sales and marketing. This will allow Fred and Rebecca Smith to focus on strategic endeavors. After two years, another administrative assistant will be hired.

Like New Carpet Cleaning will add a new local base each year, financed by cash generated from existing locations and debt. Start-up funding will come from owner investment, investor funding, and a small amount of debt.

Start-up Funding:

Start-up funding will come from owner investment, investor funding, and a small amount of debt. The owners will contribute $20,000, and investors will contribute $57,500 for a 30% share of the company.

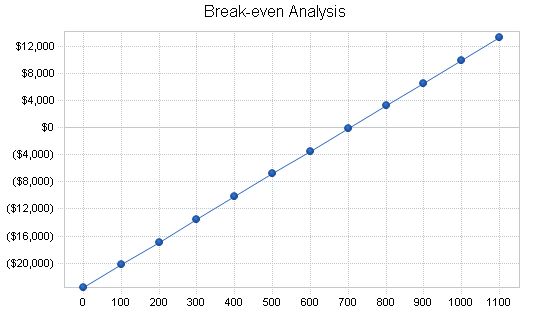

Break-even Analysis:

The business will have a low monthly break-even point due to most costs being assigned directly to the cleaning service and the use of Like New’s website to reduce administrative costs.

Break-even Analysis:

Monthly Units Break-even: 705

Monthly Revenue Break-even: $36,506

Assumptions:

– Average Per-Unit Revenue: $51.81

– Average Per-Unit Variable Cost: $18.34

– Estimated Monthly Fixed Cost: $23,586

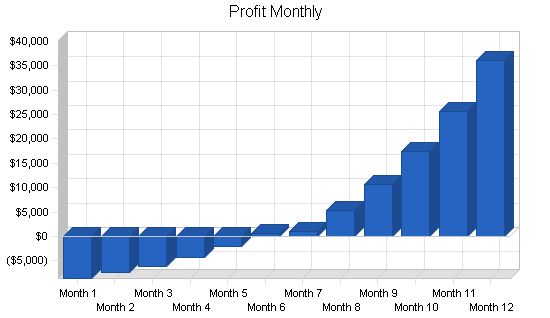

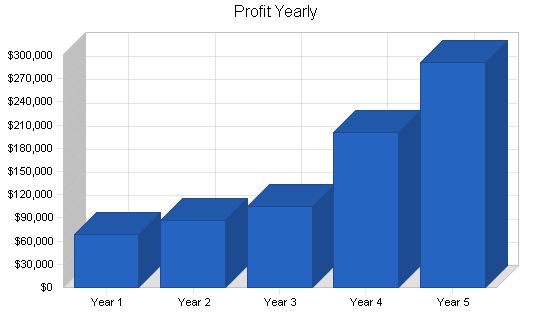

Projected Profit and Loss:

The business will experience modest profits for its first three years of operation. This is because the organization’s operations will scale up over a larger geographic region. In the fourth and fifth years of operation, this will result in healthy profits, demonstrating the viability of the business model for franchise or statewide expansion.

Direct labor accounts for about 35% of sales revenue, with the actual cleaning representing a markup of approximately 280% of the labor cost. Direct labor is included in the cost of sales.

Pro Forma Profit and Loss:

Sales:

Year 1: $590,130

Year 2: $737,663

Year 3: $922,078

Year 4: $1,152,598

Year 5: $1,440,747

Direct Cost of Sales:

Year 1: $208,858

Year 2: $261,072

Year 3: $326,341

Year 4: $407,926

Year 5: $509,907

Other Costs of Sales:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Total Cost of Sales:

Year 1: $208,858

Year 2: $261,072

Year 3: $326,341

Year 4: $407,926

Year 5: $509,907

Gross Margin:

Year 1: $381,272

Year 2: $476,590

Year 3: $595,738

Year 4: $744,672

Year 5: $930,840

Gross Margin %:

Year 1: 64.61%

Year 2: 64.61%

Year 3: 64.61%

Year 4: 64.61%

Year 5: 64.61%

Expenses:

Payroll:

Year 1: $138,000

Year 2: $160,000

Year 3: $210,000

Year 4: $237,000

Year 5: $255,000

Marketing/Promotion:

Year 1: $60,000

Year 2: $70,000

Year 3: $80,000

Year 4: $90,000

Year 5: $100,000

Depreciation:

Year 1: $6,000

Year 2: $10,000

Year 3: $12,000

Year 4: $18,000

Year 5: $30,000

Rent:

Year 1: $10,200

Year 2: $30,000

Year 3: $40,000

Year 4: $50,000

Year 5: $60,000

Utilities:

Year 1: $1,200

Year 2: $2,000

Year 3: $2,500

Year 4: $3,000

Year 5: $3,500

Insurance:

Year 1: $3,600

Year 2: $4,000

Year 3: $5,000

Year 4: $6,500

Year 5: $8,000

Payroll Taxes:

Year 1: $52,029

Year 2: $63,161

Year 3: $80,451

Year 4: $35,550

Year 5: $38,250

Website Maintenance/Hosting:

Year 1: $6,000

Year 2: $7,000

Year 3: $8,000

Year 4: $9,000

Year 5: $10,000

Other:

Year 1: $6,000

Year 2: $7,000

Year 3: $8,000

Year 4: $9,000

Year 5: $10,000

Total Operating Expenses:

Year 1: $283,029

Year 2: $353,161

Year 3: $445,951

Year 4: $458,050

Year 5: $514,750

Profit Before Interest and Taxes:

Year 1: $98,243

Year 2: $123,429

Year 3: $149,787

Year 4: $286,622

Year 5: $416,090

EBITDA:

Year 1: $104,243

Year 2: $133,429

Year 3: $161,787

Year 4: $304,622

Year 5: $446,090

Interest Expense:

Year 1: $688

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Taxes Incurred:

Year 1: $29,267

Year 2: $37,029

Year 3: $44,936

Year 4: $85,987

Year 5: $124,827

Net Profit:

Year 1: $68,289

Year 2: $86,400

Year 3: $104,851

Year 4: $200,635

Year 5: $291,263

Net Profit/Sales:

Year 1: 11.57%

Year 2: 11.71%

Year 3: 11.37%

Year 4: 17.41%

Year 5: 20.22%

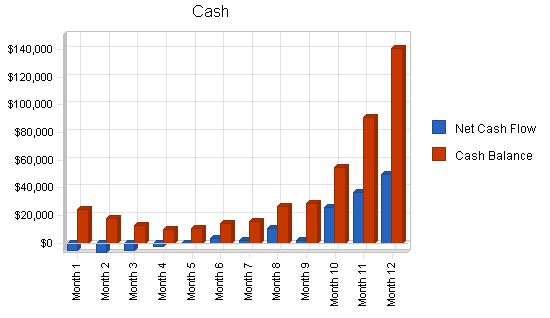

Projected Cash Flow:

In the first year, cash flow will be supported by start-up funding and full prepayment by customers. Company vans will be purchased with auto loans. When the business expands to new offices, additional vans and cleaning equipment will be financed through debt, including a company credit line.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Sales | $590,130 | $737,663 | $922,078 | $1,152,598 | $1,440,747 |

| Subtotal Cash from Operations | $590,130 | $737,663 | $922,078 | $1,152,598 | $1,440,747 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $590,130 | $737,663 | $922,078 | $1,152,598 | $1,440,747 |

| Cash Spending | $138,000 | $160,000 | $210,000 | $237,000 | $255,000 |

| Bill Payments | $308,546 | $516,001 | $585,861 | $688,600 | $850,715 |

| Subtotal Spent on Operations | $446,546 | $676,001 | $795,861 | $925,600 | $1,105,715 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $15,000 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $18,000 | $30,000 | $30,000 | $30,000 | $30,000 |

| Subtotal Cash Spent | $479,546 | $706,001 | $825,861 | $955,600 | $1,135,715 |

| Net Cash Flow | $110,584 | $31,662 | $96,218 | $196,997 | $305,032 |

| Cash Balance | $140,584 | $172,245 | $268,463 | $465,460 | $770,492 |

Projected Balance Sheet

The net worth of the business will show healthy growth, even while liabilities increase due to business growth and the need for additional assets. Liabilities will decrease in the second year as accounts payable from the first expansion are paid off. After that, growth will be more even. A cash balance will be built up to finance further expansion.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash | $140,584 | $172,245 | $268,463 | $465,460 | $770,492 |

| Total Current Assets | $140,584 | $172,245 | $268,463 | $465,460 | $770,492 |

| Long-term Assets | $42,000 | $62,000 | $80,000 | $92,000 | $92,000 |

| Total Assets | $182,584 | $234,245 | $348,463 | $557,460 | $862,492 |

| Total Liabilities | $74,295 | $39,556 | $48,923 | $57,285 | $71,053 |

| Total Capital | $108,289 | $194,690 | $299,540 | $500,176 | $791,439 |

| Total Liabilities and Capital | $182,584 | $234,245 | $348,463 | $557,460 | $862,492 |

| Net Worth | $108,289 | $194,690 | $299,540 | $500,176 | $791,439 |

The business will have higher SGA expenses as a ratio of sales compared to the carpet and upholstery cleaning industry due to the need for a professional, senior-level staff during its early years. These years are crucial for establishing systems and procedures that can be scaled for expansion. SGA as a percentage of sales will decrease to below the industry average after this expansion due to the reduction in staff and office overhead allowed by its Web-based sales model. Savings from this will be allocated to advertising to support the rapid growth of the business.

| Ratio Analysis | ||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Industry Profile | |

| Gross Margin | 64.61% | 64.61% | 64.61% | 64.61% | 64.61% | 59.56% |

| SG&A Expenses | 53.04% | 52.90% | 53.24% | 47.20% | 44.39% | 28.35% |

| Advertising Expenses | 10.17% | 9.49% | 8.68% | 7.81% | 6.94% | 1.21% |

| Pre-tax Return on Net Worth | 90.09% | 63.40% | 50.01% | 57.30% | 52.57% | 696.24% |

| Pre-tax Return on Assets | 53.43% | 52.69% | 42.98% | 51.42% | 48.24% | 52.41% |

| Net Profit Margin | 11.57% | 11.71% | 11.37% | 17.41% | 20.22% | n.a |

| Return on Equity | 63.06% | 44.38% | 35.00% | 40.11% | 36.80% | n.a |

Long-term Plan

The business’s financial strategy is to grow rapidly until it can demonstrate that its investment in its website and infrastructure generates much greater revenue than its competitors’ more traditional approach. At that point, the business will seek a second round of equity financing to expand regionally and then statewide. This will provide an opportunity for initial investors to cash out of the business.

Appendix

Sales Forecast

Unit Sales

Carpet Cleaning: 60, 74, 92, 114, 142, 176, 218, 270, 335, 416, 516, 639

Furniture Cleaning: 40, 50, 64, 80, 101, 127, 160, 202, 254, 320, 404, 508

Intensive Spot Treatment: 60, 74, 92, 114, 142, 176, 218, 270, 335, 416, 516, 639

Area Rugs: 20, 26, 34, 44, 57, 74, 96, 125, 163, 212, 276, 358

Other Services: 20, 26, 34, 44, 57, 74, 96, 125, 163, 212, 276, 358

Total Unit Sales: 200, 251, 316, 397, 499, 627, 789, 994, 1,251, 1,576, 1,986, 2,504

Unit Prices

Carpet Cleaning: $100.00

Furniture Cleaning: $25.00

Intensive Spot Treatment: $50.00

Area Rugs: $25.00

Other Services: $25.00

Sales

Carpet Cleaning: $6,000, $7,440, $9,226, $11,440, $14,186, $17,591, $21,813, $27,048, $33,540, $41,590, $51,572, $63,949

Furniture Cleaning: $1,000, $1,260, $1,588, $2,001, $2,521, $3,176, $4,002, $5,043, $6,354, $8,006, $10,088, $12,711

Intensive Spot Treatment: $3,000, $3,720, $4,613, $5,720, $7,093, $8,795, $10,906, $13,523, $16,769, $20,794, $25,785, $31,973

Area Rugs: $500, $650, $845, $1,098, $1,427, $1,855, $2,412, $3,136, $4,077, $5,300, $6,890, $8,957

Other Services: $500, $650, $845, $1,098, $1,427, $1,855, $2,412, $3,136, $4,077, $5,300, $6,890, $8,957

Total Sales: $11,000, $13,720, $17,117, $21,357, $26,654, $33,272, $41,545, $51,886, $64,817, $80,990, $101,225, $126,547

Direct Unit Costs

Carpet Cleaning: 30.00%

Furniture Cleaning: 30.00%

Intensive Spot Treatment: 45.00%

Area Rugs: 39.00%

Other Services: 45.00%

Direct Cost of Sales

Carpet Cleaning: $1,800, $2,232, $2,768, $3,432, $4,256, $5,277, $6,544, $8,114, $10,062, $12,477, $15,472, $19,185

Furniture Cleaning: $300, $378, $476, $600, $756, $953, $1,201, $1,513, $1,906, $2,402, $3,026, $3,813

Intensive Spot Treatment: $1,350, $1,674, $2,076, $2,574, $3,192, $3,958, $4,908, $6,085, $7,546, $9,357, $11,603, $14,388

Area Rugs: $195, $254, $330, $428, $557, $723, $941, $1,223, $1,590, $2,067, $2,687, $3,493

Other Services: $225, $293, $380, $494, $642, $835, $1,085, $1,411, $1,835, $2,385, $3,101, $4,031

Subtotal Direct Cost of Sales: $3,870, $4,830, $6,030, $7,529, $9,403, $11,746, $14,678, $18,347, $22,939, $28,688, $35,889, $44,910

Personnel Plan

CEO: $5,000

COO: $5,000

Administrative Assistant/Manager: $0, $0, $0, $0, $0, $0, $3,000, $3,000, $3,000, $3,000, $3,000, $3,000

Administrative Assistant 2: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total People: 2, 2, 2, 2, 2, 2, 3, 3, 3, 3, 3, 3

Total Payroll: $10,000, $10,000, $10,000, $10,000, $10,000, $10,000, $13,000, $13,000, $13,000, $13,000, $13,000, $13,000

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||||||||||||

| Sales | $11,000 | $13,720 | $17,117 | $21,357 | $26,654 | $33,272 | $41,545 | $51,886 | $64,817 | $80,990 | $101,225 | $126,547 | |

| Direct Cost of Sales | $3,870 | $4,830 | $6,030 | $7,529 | $9,403 | $11,746 | $14,678 | $18,347 | $22,939 | $28,688 | $35,889 | $44,910 | |

| Other Costs of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $3,870 | $4,830 | $6,030 | $7,529 | $9,403 | $11,746 | $14,678 | $18,347 | $22,939 | $28,688 | $35,889 | $44,910 | |

| Gross Margin | $7,130 | $8,890 | $11,087 | $13,828 | $17,251 | $21,526 | $26,867 | $33,539 | $41,878 | $52,302 | $65,336 | $81,637 | |

| Gross Margin % | 64.82% | 64.80% | 64.77% | 64.75% | 64.72% | 64.70% | 64.67% | 64.64% | 64.61% | 64.58% | 64.55% | 64.51% | |

| Expenses | |||||||||||||

| Payroll | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | |

| Marketing/Promotion | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Depreciation | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Rent | $500 | $500 | $500 | $500 | $500 | $500 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| Utilities | $50 | $50 | $50 | $50 | $50 | $50 | $150 | $150 | $150 | $150 | $150 | $150 | |

| Insurance | $200 | $200 | $200 | $200 | $200 | $200 | $400 | $400 | $400 | $400 | $400 | $400 | |

| Payroll Taxes | 15% | $2,081 | $2,225 | $2,404 | $2,629 | $2,910 | $3,262 | $4,152 | $4,702 | $5,391 | $6,253 | $7,333 | $8,686 |

| Website Maintenance/Hosting | 15% | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 |

| Other | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Total Operating Expenses | $19,331 | $19,475 | $19,654 | $19,879 | $20,160 | $20,512 | $25,402 | $25,952 | $26,641 | $27,503 | $28,583 | $29,936 | |

| Profit Before Interest and Taxes | ($12,201) | ($10,585) | ($8,567) | ($6,051) | ($2,909) | $1,014 | $1,465 | $7,587 | $15,237 | $24,799 | $36,753 | $51,701 | |

| EBITDA | ($11,701) | ($10,085) | ($8,067) | ($5,551) | ($2,409) | $1,514 | $1,965 | $8,087 | $15,737 | $25,299 | $37,253 | $52,201 | |

| Interest Expense | $115 | $104 | $94 | $83 | $73 | $63 | $52 | $42 | $31 | $21 | $10 | $0 | |

| Taxes Incurred | ($3,695) | ($3,207) | ($2,598) | ($1,840) | ($895) | $285 | $424 | $2,264 | $4,562 | $7,433 | $11,023 | $15,510 | |

| Net Profit | ($8,621) | ($7,482) | ($6,063) | ($4,294) | ($2,087) | $666 | $989 | $5,282 | $10,644 | $17,344 | $25,720 | $36,191 | |

| Net Profit/Sales | -78.37% | -54.53% | -35.42% | -20.11% | -7.83% | 2.00% | 2.38% | 10.18% | 16.42% | 21.42% | 25.41% | 28.60% | |

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||||||||||||

| Cash Received | |||||||||||||

| Cash from Operations | $11,000 | $13,720 | $17,117 | $21,357 | $26,654 | $33,272 | $41,545 | $51,886 | $64,817 | $80,990 | $101,225 | $126,547 | |

| Subtotal Cash from Operations | $11,000 | $13,720 | $17,117 | $21,357 | $26,654 | $33,272 | $41,545 | $51,886 | $64,817 | $80,990 | $101,225 | $126,547 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $11,000 | $13,720 | $17,117 | $21,357 | $26,654 | $33,272 | $41,545 | $51,886 | $64,817 | $80,990 | $101,225 | $126,547 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | $13,000 | |

| Bill Payments | $5,304 | $9,173 | $10,768 | $12,762 | $15,254 | $18,370 | $22,271 | $27,258 | $33,356 | $40,989 | $50,541 | $62,500 | |

| Subtotal Spent on Operations | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!