Cash is crucial. But do you understand its true meaning?

I initially learned about cash flow in business school, but it didn’t resonate until I faced financial challenges while building my own business. As my sales and profits grew, my cash flow declined. What was once an academic exercise now became a real-life struggle, jeopardizing my ability to meet payroll despite apparent success.

Unfortunately, many of us fall into this same trap: we focus on profits while disregarding cash. Our culture encourages this mindset, emphasizing the idea of selling something for more than it costs to make. In theory, this should be sufficient, but reality often proves otherwise.

So, the lesson here is this: learn from my mistakes. Prioritize cash flow. Don’t confuse profits with cash. I managed to overcome my temporary cash flow problem, but it required extra mortgages and heavy credit card debt.

Let’s delve into the distinctions between cash, profits, and revenue.

What are profits?

Profits are the result of deducting expenses from sales. Whether you’ve been paid by your customer or cleared your bills is inconsequential. Sales are recorded when you send an invoice, while expenses can be recorded before payment.

What is revenue?

Revenue is the money flowing into the business. In accounting and financial analysis contexts, it’s synonymous with sales. However, it can also include sales of assets, loans, and investments.

What is cash?

Cash refers to the actual funds available to pay your bills — the money you have on hand or in your bank account.

The discrepancy between cash and profits stems from financial and accounting standards deeply rooted in Western business practices. The profit and loss statement, also known as an income statement, is the foundation of these practices. It presents a business’s performance over a specific period, typically a month, quarter, or year.

The statement begins with sales, followed by direct costs (or costs of goods sold, COGS). Subtracting direct costs from sales yields the gross margin. Next, expenses (including fixed expenses like rent and payroll, as well as discretionary expenses like marketing) are listed. While interest and taxes are technically expenses, they often appear separately. Finally, the profit is determined by subtracting all expenses (including interest and taxes) from the gross margin.

This accounting cornerstone sets the tone for many business discussions and shapes our vocabulary — sales are referred to as "the top line," while profits are "the bottom line."

However, here’s the catch: while the profit and loss statement seems to encapsulate a business’s overall health, it doesn’t provide the full picture.

Let’s explore how receiving payment for sales impacts profits and cash.

In business-to-business transactions, an invoice is delivered alongside the goods or services, while the payment follows later. While this is common, it means that the amount on the invoice is considered sales for the month, contributing to profits, but it isn’t actual cash in the bank.

Instead, that amount is classified as accounts receivable until the check arrives and is deposited. The time between invoicing and payment is known as the collection period. The problem arises when businesses have a substantial amount tied up in accounts receivable but little in their bank accounts, as they struggle to receive timely payments. Although these sales appear in profits, they cannot be spent. Thus, profitable businesses can fail due to excessive accounts receivable.

Inventory management poses a similar challenge. Most product-based businesses, like stores and manufacturers, must purchase products and materials before selling them. This can create significant cash flow problems. Money spent on inventory doesn’t impact profits until the items are sold, yet the funds are depleted when the purchase is made. Effective inventory management is crucial for maintaining cash flow, as money tied up in stagnant inventory does not contribute to profit and loss statements.

Accounts payable, on the other hand, refers to the money a business owes its vendors. Prolonging payment terms (e.g., paying invoices after 30 days or more) benefits cash flow. Every dollar in accounts payable counts as an expense, reducing profits. However, until the payment is made, that dollar remains in the business’s bank account.

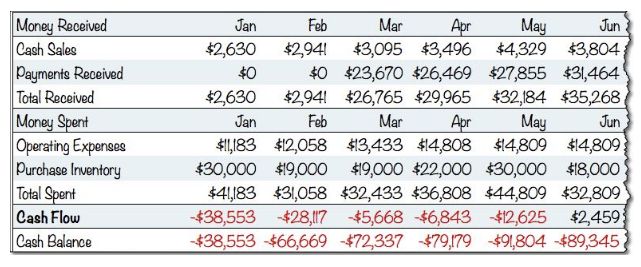

To illustrate the disparity between cash and profits, let’s consider a case study. Garrett’s Bike Shop, a medium-sized retailer, generates annual sales of around $400,000. The following chart highlights key financial data over several months:

[chart]

Now, let’s compare this to a cash flow projection. Assuming the store derives 90% of its sales via credit (net-60) and customers take two months to pay, we can anticipate different cash flow outcomes. Additionally, let’s assume Garrett maintains approximately one month’s worth of sales as inventory. The following illustration demonstrates the stark contrast between cash flow and profits:

[illustration]

The difference between profits and cash here exceeds $90,000 for a business selling approximately $30,000 monthly. Despite being profitable, the business would face bankruptcy due to a lack of cash.

The change between the two scenarios solely lies in cash flow, with no impact on sales, cost of sales, or expenses. There are no alterations to prices, no hiring of new employees, and no changes in salary.

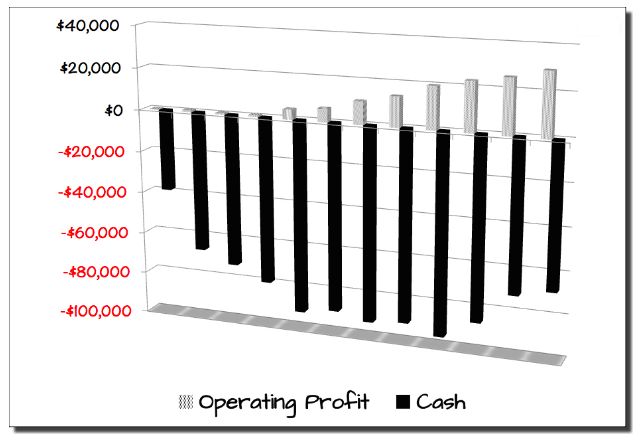

Here is a graphical representation of this difference.

Mind the cash flow: The real bottom line

The phrase “the bottom line” refers to profits, which are recorded in the profit and loss statement. However, it has evolved to mean a conclusion or the most important result. For business owners, the true bottom line is cash flow, not just profits.

A profitable company can still face financial difficulties if it lacks sufficient cash flow. Therefore, it is essential for business owners to prioritize cash flow management rather than focusing solely on profits.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!