This plan provides investor information and the strategic business plan necessary for establishing and operating JTB Products and Services, Inc., a division of JTB Technologies, Inc., in Richfield, Louisiana. JTB’s Products and Services Division will manufacture custom tools for the Automotive, Auto Body Repair, Sports Service, and Commercial Drilling Industries. Additionally, the division will provide re-conditioning services using our quality products from the JTB product line. The management team consists of Mitchell R. Jeremy, Rachel L. Jeremy, and a staff of 3. A CPA firm will handle financial matters. JTB Products and Services, Inc. has the potential to generate $348,000 in sales within the first eighteen months of operation. The projected ratios at the end of Fiscal Year 2 are solid. The equity for each investor will be based on their investment. Primary markets include the Auto Repair, Automotive, Commercial and Private Utility Contracting, Sporting Goods, Metalworking, and Manufacturing industries. To minimize risk factors, JTB Products and Services, Inc. will obtain sufficient capital, maintain low overhead, build a customer base, and engage in community involvement projects.

1.1 Objectives:

– Integrate products and services into the Industrial Distribution market.

– Direct-market product lines to over 100,000 potential clients throughout the U.S.

– Utilize Business Technology Software to gain market share.

– Provide clients with quality products and services while maintaining high profitability.

For many years, we have helped businesses with their production processes, external job costing, and expediting services. These services are handled in a one-on-one fashion. The clients’ process for using the products is reviewed, and a recommendation is made to either scrap, rebuild, or replace the items. We can also recommend one of our distributor partner products as a substitute.

JTB Products and Services, Inc. will be a partner in the JTB network and will use this network to promote its products and services throughout industrial distribution partners.

1.2 Mission:

JTB will develop and offer the highest quality products and services.

– Our products will reduce customers’ costs and have a longer life than competitors’ products.

– Our re-manufacturing services will offer the client a solid, value-based purchase backed by a 100% quality commitment and effort by our employees and management.

Using JTB own manufacturing facility as a model and test bed, JTB will provide the mid-sized corporate market with cost-effective ways to manage all external transactions, yielding continual savings. Our manufacturing partners will also add value to our offering of services, allowing JTB to grow into a high-quality, long-term growth corporation.

1.3 Keys to Success:

– Seasoned management with over twenty years of business experience in Industrial Distribution and Metalworking.

– Focused and well-defined long-range goals for longevity.

– Strong project-management staffing with extensive prior Engineering experience, providing clients with product and service support in an industrial setting.

– Strong marketing goals with niche products and services; targeted services and products delivered with unique marketing approaches.

– Very low internal development costs at startup. Management is well-suited to oversee and develop all projects described in this business plan, limiting pre-production expenses by utilizing industry partnerships to lower the initial costs.

– Previous base of high-quality external support vendors available to build on, with over twenty years of industry contacts to work with, in both purchasing quality products and marketing our own products.

– Previous successful business plans and experience to draw from. Management’s previous business plan helped in closing an SBA package valued at $240,000 for the acquisition of C.N.C manufacturing equipment. Management will implement and perfect all aspects of the business plan, expecting that creativity, positive attitude, and energy will be brought into all the required projects.

JTB Products and Services is one of the three sub-divisions of JTB Technologies, Inc.

JTB Technologies, Inc. will be located in Richfield, Louisiana, close to the I-82 corridor, providing excellent access to the Mississippi, Arkansas, and Texas industrial markets. JTB management acquired its roots in the industrial marketplace while managing RL&I Tool and Machine, Inc., a privately held corporation that operated in Missouri for over twenty-five years.

Further experience was acquired while managing RL&I’s industrial supply division. Eventually, the Missouri corporation was closed, and the management relocated to Louisiana. Prior to leaving Missouri, Technical Marketing Technologies LLC, a spin-off of the Missouri-based corporation, was established and operates as a sole proprietorship in Louisiana. With our roots firmly planted in the Industrial marketplace, JTB will provide Industrial and Commercial Tools, Safety Products, and Engineered Sales expertise.

The primary partners in this plan are responsible for all phases of business and product development with special emphasis on bringing the latest Machining and Computer design into the business. JTB will provide Industrial and Commercial Tools, Re-manufacturing Services, and engineering expertise acquired over the last twenty-five years while working with the following business types:

1. Automotive – Automotive repair and Auto body industry.

2. Automotive – Auto Makers and their support industries.

3. Primary Metals – Machining Industry – Turbine, Valve, Specialty Manufacturers, and Machining industries.

4. Sporting Goods Industry – Sporting Goods manufacturers and Services industries.

5. Mining and Contractor Industry – Hole drilling and Utility service providers

In addition to providing these clients with industrial products, JTB will also provide technical expertise, engineering assistance, and all types of outsourced industrial services.

2.1 Company Ownership:

JTB will be a privately held corporation co-owned by Rachel L. Jeremy and her husband, Mitchell R. Jeremy. Rachel Jeremy has 10 years of experience in production management and customer services acquired while working with RL&I Tool and Machine, Inc., where she was also the Secretary for that corporation. Rachel will also add a large percentage to the minority-owned shares, allowing the firm to participate in larger contracts requiring minority involvement.

Mitchell R. Jeremy owns and operates Technical Marketing Technologies LLC, a technology and marketing consulting firm. Mr. Jeremy is an innovator with over 25 years of technical experience in the Industrial market with an additional 15 years of integrating computers and other technologies into the manufacturing and distribution of industrial products. Mr. Jeremy has a proven track record of success in launching new business projects and directing operations for a previous Missouri-based corporation as President of RL&I Tool and Machine.

To achieve our objectives, Mr. Jeremy is seeking $230,000 in investment and $45,000 in long-term loans for JTB Products and Services. A percentage of the stock and royalties of its products will be offered to the initial investors.

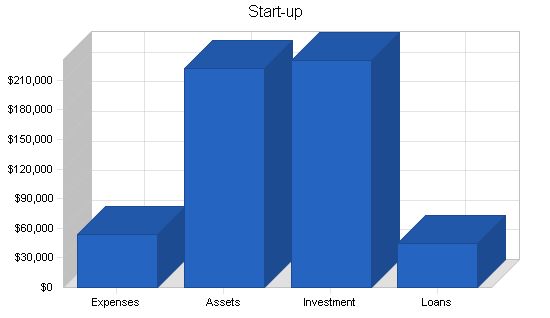

2.2 Start-up Summary:

Initial startup will consist of setting up the equipment, shipping area, and inventory areas in the 2,500 sq. ft. of production space described, with provisions for further expansion when needed.

Once established, Mr. Jeremy will utilize all of his previous business contacts to develop JTB’s products for immediate resale. This will include several custom catalog offerings with over 50,000 products each. As many of the customers require similar products sold by the Industrial Sales Division, a stock list will also be compiled of the major items to be offered, adding more customer support value to the business.

In the production area, we will add approximately $45,000 of machinery, allowing the firm to produce its products and services. Further leased equipment will be added starting in the first month of the plan. This equipment will be both manually operated and computer-controlled, depending on availability. The machine tool market currently has excess available equipment, which is driving the costs to purchase these items down considerably. Included in this amount is $30,000 of specialty prototyping equipment, allowing us to solicit specialty prototype work.

We intend to add 3 Service Team Members to be trained on the equipment and handle order processing with our intended local customer base. Rachel Jeremy will oversee the production and shipping aspects. Mr. Jeremy will oversee training and make personal contact with all potential clients to develop long-term solid relationships.

During this time, several developers will be hired as part of the JTB Integrated Technologies Division, located in the same facility as Industrial Sales, to begin development of the software to later drive the inventory-sharing and customer-interactivity aspects of the business. (Payroll and income figures related to these portions of the plan can be found in the JTB IT Division business plan.)

Start-up Funding

Start-up Expenses to Fund: $53,350

Start-up Assets to Fund: $221,650

Total Funding Required: $275,000

Assets

Non-cash Assets from Start-up: $51,000

Cash Requirements from Start-up: $170,650

Additional Cash Raised: $0

Cash Balance on Starting Date: $170,650

Total Assets: $221,650

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $45,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $45,000

Capital

Planned Investment

Investor 1: $230,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $230,000

Loss at Start-up (Start-up Expenses): ($53,350)

Total Capital: $176,650

Total Capital and Liabilities: $221,650

Total Funding: $275,000

Products and Services

JTB Products and Services will provide the following:

– Manufacturing of patented products from the JTB line of Automotive tool products.

– Manufacturing of patented JTB – Commcut-commercial waterline hole tools.

– Manufacturing of patented JTB – Sportcut drill system for the sports industry.

– Providing reconditioning for the Commcut commercial waterline tools.

– Providing reconditioning for the Sportcut drill system for the sports industry.

– Providing reconditioning of industrial tools sold by JTB Industrial Sales.

– Prototype building from clients’ CAD drawings.

With the proper equipment, JTB can work as both a manufacturer and a service provider, repairing its own products and its competitors’ products. Additionally, the equipment gives the business an opportunity to sell itself to clients at the production managers level and at the shop level, forging solid ties with production and engineering managers.

Our prototype services will be handled via the Internet: a client sends a CAD file to our secure dedicated servers, we download the CAD file into the 3-D software, and the process of developing a tangible prototype begins. Including this type of technology will bring JTB closer to the Aerospace and Automotive industries. This process can also help JTB develop additional products for different markets. Related engineering technology will consist of 3-D Computer Aided Design where applicable in the prototype work.

The mix of JTB’s Industrial Sales and Products and Services Division makes the actual sale, as the business can respond to clients in any way needed. Our ability to share information about order status and offer products and services from our distributor partners will allow for even more opportunity with clients, as they are always looking for ways to reduce purchasing costs.

3.1 Competitive Comparison

Why should industrial buyers work with JTB Products and Services?

JTB’s products are developed to perform better than the competition. Our products are developed with the goal of providing our clients a value-based purchase that will help them be more profitable in their day-to-day operations. Our commitment to high quality and consistency in our products and services sets us apart from others.

Our services also combine a value-based approach, while still providing quality. Our attention to customer detail is critical in our customer service area. Our custom sales software allows our staff to keep detailed, accurate notes on our customers’ requirements, allowing us to fulfill orders to their preferences. This commitment to consistency allows the customer to feel confident when they ship orders in for service.

3.2 Future Products and Services

JTB will methodically seek out additional products to match our customers’ requirements while working closely on applications to provide our clients with a better overall result in their manufacturing process.

In particular, we will add products to our own lines, and develop a sales strategy around each product. The additional products and services will likely come from our distributor partners, allowing us to develop quality product and service offerings. Our distributor partners can also produce private label products for us.

Further development on this strategy will come from our engineering software applications. These applications will allow us to work one-on-one with plant application engineers to fine-tune products to maximize the product’s life, yielding the best possible results.

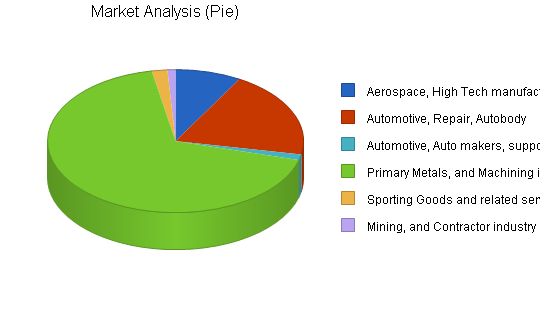

Market Analysis Summary

National Market Description consists of 314,555 potential clients in the following categories:

1. Aerospace Industry – High Tech Manufacturers, and supporting sub-industries

2. Automotive – Automotive repair, and Auto body industry.

3. Automotive – Auto Makers, and their support industries.

4. Primary Metals – Machining Industry – Turbine, Valve, Specialty Manufacturers, and Machining industries.

5. Sporting Industry – Sporting Goods manufacturers, and Services industries.

6. Mining and Contractor Industry – Hole drilling and Utility service providers

The Louisiana Market consists of 4,553 potential clients in the same categories.

Our sales goal is to integrate our Industrial Products and Services into the above markets. Our sales approach is simple, utilizing a well-trained inside sales staff to approach new clients, and to respond to well-placed ads in industrial publications. Our software applications will make it possible for these businesses to interact closely with JTB and its distributor partners.

4.1 Market Segmentation

Our customers are seeking cost reduction in their daily operations. As JTB will function as a distributor and a service provider, we can deliver custom specialty products faster, with fair, competitive prices.

Market Analysis

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Growth | CAGR | ||||||

| Aerospace, High Tech manufacturing | 3% | 25,587 | 26,355 | 27,146 | 27,960 | 28,799 | 3.00% |

| Automotive, Repair, Autobody | 9% | 61,228 | 66,739 | 72,746 | 79,293 | 86,429 | 9.00% |

| Automotive, Auto makers, support sub-industry | 2% | 4,000 | 4,080 | 4,162 | 4,245 | 4,330 | 2.00% |

| Primary Metals, and Machining industry | 7% | 210,000 | 224,700 | 240,429 | 257,259 | 275,267 | 7.00% |

| Sporting Goods and related services | 7% | 6,058 | 6,482 | 6,936 | 7,422 | 7,942 | 7.00% |

| Mining, and Contractor industry | 9% | 3,149 | 3,432 | 3,741 | 4,078 | 4,445 | 9.00% |

| Total | 7.06% | 310,022 | 331,788 | 355,160 | 380,257 | 407,212 | 7.06% |

4.2 Target Market Segment Strategy

Our marketing strategy for each target market segment will vary slightly. We will focus our direct marketing efforts on the Aerospace, Automotive, and Primary Metals and Machining industries, introducing these clients to our products and services. In particular, our combination of over 300,000 catalog items and our industrial services will allow us to sell ourselves in different ways. Additionally, our base of sub-contract service providers will allow us to offer various programs through our distributorship.

When order management and inventory systems are completed by the Integrated Technologies Division, they will make it faster and easier to place repeat orders. Special incentives will be given to businesses using the system, further reducing our costs.

4.3 Service Business Analysis

JTB products and services focus on unique markets, supported by niche providers all over the U.S.

Industry by count:

- Auto Body clients available: 62,361

- Commercial utilities and drilling services available: 3,200

- Sporting Good Service Centers: 6,164

- Metalworking and Manufacturing: 238,764

The above client numbers are based on data from Hugo Dunhill Mailing Lists, Inc. Larger firms like Peoplesoftware, Profit2100, Dimasystems, and Net2soft have developed expensive software and netware packages starting at $10,000 – $50,000. Our cost analysis has shown that there are many cost competitive options available for businesses to choose from. As a service business that utilizes our own products, we can market and demo our products simultaneously, reducing our costs per solicitation.

4.3.1 Competition and Buying Patterns

Automotive clients: These clients are individual auto repair businesses. They purchase supplies via local suppliers and catalogs. Our products for this market will be marketed as specialized time savers. Also, our industrial sales division can sell directly to these clients through catalogs and our online sales process. Commercial Utilities and Drilling clients: These clients are commercial service providers and contractors providing hole drilling services. Our process for re-manufacturing their drilling units will improve OEM’s efforts to make and sell a quality tool. Competition in this marketplace is developed as commercial plumbing supply houses. Our unique cost-saving rebuild process will be directly marketed to them. Sporting Good Service Centers: These clients are bowling suppliers. Our patented products will out-perform any available products, creating a large re-conditioning market for JTB. Competition in this marketplace is not strong. Our Max-Drill product line re-defines the process, providing technical help, good service, and a cost-effective process. Metalworking and Manufacturing: These clients are machine shops, aerospace manufacturers, and other specialty manufacturers requiring industrial products and services. Our services department will add value and services to Rachel industrial sales division. Competition is strong, but JTB’s mix of industrial sales and industrial services provides an added edge.

4.3.2 Distributing a Service

JTB’s primary goal is to develop one-on-one business relations during the first four years of the business plan. We may consider working through distribution for additional business after that, as long as it represents a major addition to the business and maintains our projected profits.

Strategy and Implementation Summary

Our strategy and implementation will extend our products and services to potential clients through cost-effective approaches. Our combined services offering allows for more profitability while staying ahead of other industrial distributors and service providers in terms of delivery and pricing. The combination of our distributorship’s solid inventory and the service area’s ability to provide quick re-conditioning and special services allows for faster shipments with fewer logistical problems, resulting in lower costs for our customers.

Presently, local industrial suppliers and service providers do not provide an effective combination of supplying a cost-effective service strategy that yields any real savings to the customers. The local distributors heavily rely on outsourcing for many of their services, driving up shipping costs dramatically. This business plan allows for low-cost implementation of Internet-based customer access and direct marketing. The plan also focuses on the needs of our clients, working efficiently within particular parameters.

5.1 Competitive Edge

Our competitive edge is our combined services, products, and engineering skills required to properly interact with our customers and vendors. Our mix of inventory, industrial distribution, and service capabilities will make JTB a respected vendor in the industry.

JTB’s competitive edge incorporates an overall approach to market our goods and services to many different industries. Our unique approach of developing our own branded sales and marketing applications will strengthen our ties to our distributor partners and direct clients. Our overall goal is to utilize our own applications and developed software to integrate our distributor partners’ services. When completed, JTB will be able to offer much larger clients an extremely large variety of products and services drawing from our distributor partners’ services and products. All of the JTB divisions will benefit from the marketing, strategic ad placements, and the direct marketing products offered by every other JTB division.

Key goals to our marketing strategy are as follows:

- Develop a high-profile sales environment to bring our products to new and existing clients.

- Develop new ways to market our products to potential clients through our branded applications and software.

- Develop channel partnerships utilizing our own applications, drawing from these partners’ services and products to develop a large base of products and services to be offered to larger clients.

- Develop and maintain a quality customer service and follow-up program for all of the JTB divisions.

- Develop and utilize an ongoing automated marketing system to contact potential clients.

- Carefully target marketing expenditures to maximize returns on the campaigns.

5.2.1 Marketing Programs

JTB’s marketing programs will directly target our intended customer base, utilizing many different avenues of marketing. Initially, we will mass-market introductory offers and letters of introduction indexed against our customer database. Further secondary marketing will be through our Internet-based marketing systems. Additional follow-up work will be done by our staff.

JTB’s customer databases will overlap as they are similar. Every opportunity will be explored as each branch solicits new business, allowing for additional cost-effective introduction of our other products and services. JTB will also develop Internet marketplaces where our products and services can be marketed as well, taking full advantage of the very low costs offered by developing and managing our own sites.

5.3 Sales Strategy

JTB’s sales strategy will rely on a straightforward approach of developing the company’s long-term sales goal of providing quality engineered products and services tailored to the customer. Our overall goal will be to pay close attention to details gathered regarding other vendors and how they interact with the clients, constantly fine-tuning our transaction process until it is almost effortless for the clients to do business with us.

Customer access to our sales staff is critical, as we intend to offer phone, fax, and Internet-based inventory access and order processing. Further Internet access on our main site will let clients develop budgets and gather engineering information about the products we offer. Our sales staff will have a tremendous source of information available to act as an advisor to our clients.

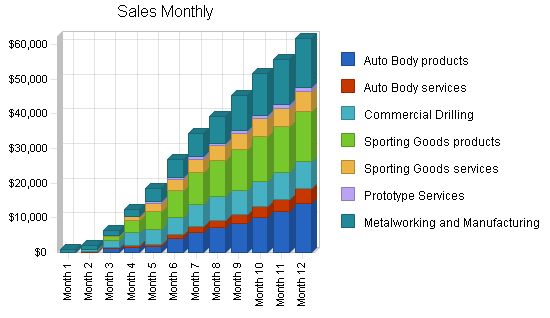

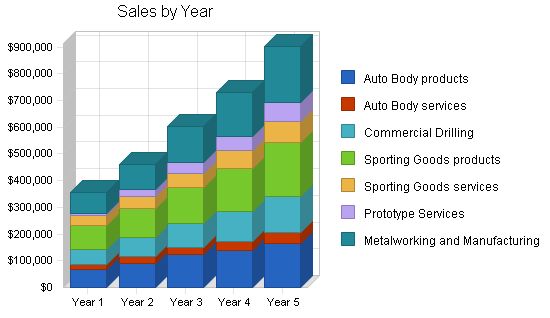

5.3.1 Sales Forecast

Our sales forecast table uses the following assumptions:

- Auto Body Products average growth rate of 34% annually.

- Auto Body Services average growth rate of 14% annually.

- Commercial Drilling average growth rate of 22% annually.

- Sporting Goods Products average growth rate of 19% annually.

- Sporting Goods Services average growth rate of 17% annually.

- Metalworking and Manufacturing growth rate of 18% annually.

- Industry Analysis Compounded Annual Growth Rate of 7.02%

The sales growth is controlled by several factors, including our ability to find quality service associates to train and the length of the training process. Limitations in actual shop time available, such as constraints in available work area and personnel, also play a role.

Many of the services provided are billable hourly at nearly $60 per hour for service work. Some products manufactured internally will need to be at a lower shop rate to provide more competitive pricing. We will work to have many of the patented products manufactured externally, allowing our equipment to be utilized for more profitable work. Contingencies need to be in place to backup all products and services offered in the event of personnel issues or equipment failure. Direct costs in the Sales Forecast table reflect these outsourced manufacturing costs, after initial design.

Sales Forecast:

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | |||||

| Auto Body products | $66,000 | $90,520 | $122,234 | $139,846 | $166,212 |

| Auto Body services | $20,205 | $23,842 | $28,133 | $33,197 | $39,173 |

| Commercial Drilling | $57,880 | $71,771 | $88,996 | $110,355 | $136,841 |

| Sporting Goods products | $89,800 | $109,556 | $133,658 | $163,063 | $198,937 |

| Sporting Goods services | $35,820 | $43,700 | $53,314 | $65,044 | $79,353 |

| Prototype Services | $7,200 | $28,800 | $43,200 | $54,000 | $72,000 |

| Metalworking and Manufacturing | $77,800 | $93,360 | $132,032 | $164,438 | $210,326 |

| Total Sales | $354,705 | $461,550 | $601,569 | $729,944 | $902,842 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Auto body products and Services | $43,546 | $48,635 | $55,751 | $69,849 | $86,067 |

| Commercial Drilling | $37,939 | $39,267 | $50,020 | $58,800 | $74,633 |

| Sporting Goods | $62,388 | $73,440 | $89,520 | $110,880 | $133,920 |

| Prototype Services | $1,908 | $7,632 | $11,448 | $14,310 | $19,080 |

| Metalworking and Manufacturing | $53,270 | $61,000 | $73,000 | $89,000 | $106,000 |

| Subtotal Direct Cost of Sales | $199,051 | $229,974 | $279,739 | $342,839 | $419,700 |

5.4 Strategic Alliances

JTB will develop and implement strategic alliances to build its product and services offering. Alliances to manufacture our high-volume products will control costs and enable growth through channel partners’ production capabilities. Purchasing on a contractual basis will also lock in pricing. Distributor partnerships will expand our product and service range, reducing the need for additional staff and equipment while maximizing profits.

5.5 Milestones

Secure Leasing, Banking, and Attorney Arrangements – Long-term arrangements for equipment financing, banking relations, and general and patent attorney needs.

Set up JTB’s Industrial Services Location – Prepare working area for equipment, wiring, shipping and receiving areas, networked accounting systems, and develop a workflow methodology for the entire shop.

Complete equipment selections and installation – Select equipment from various machine tool dealers in the U.S., inspecting for quality and working within budget.

Manager selections and training begins – Look for individuals with a background in engineering, preferably with QC and machining experience.

Contractor selection for outsourced manufacturing – Competing contract manufacturers will provide sample parts and quotations for our products, particularly for Automotive and Sporting Goods lines.

JTB Industrial Services Marketing Campaign – Initially target the local Louisiana market with a letter to key personnel in target businesses, introducing the JTB Industrial Sales Division. The Industrial Sales Division’s sales team will follow up on these accounts.

JTB outsourced product line development – Once contractor selection is complete, place orders from suppliers for components, packaging, and replacement parts.

JTB services development – JTB’s service area will begin servicing clients as soon as core machine tools are in place. Specialty equipment may take several months to locate. Management will handle most of the work during the first year.

JTB Service associate selection and training – Service Associates will be from a production background, familiar with manufacturing and general machining. Training will be ongoing for at least 1 year. Management will work with these individuals on a one-on-one basis to minimize training costs while fulfilling orders.

Milestones:

Milestone Start Date End Date Budget Manager Department

Secure Leasing and Banking Arrangements 2/1/2005 2/15/2005 $1,500 M. Jeremy Corporate Management

Setup JTB’s Industrial services location 2/1/2005 3/1/2005 $6,500 M. Jeremy Corporate Management

Contractor selections for services and products 2/15/2005 3/15/2005 $3,500 M. Jeremy Media development

Manager selections and training begin 2/1/2005 4/15/2005 $12,000 R. Jeremy Corporate Management

Complete equipment selections and installations 2/1/2004 6/15/2005 $125,000 M. Jeremy Corporate Management

JTB outsourced Product line development 3/15/2005 6/15/2005 $18,000 M. Jeremy Products and Services

JTB Service Associate selection and training 3/10/2005 10/1/2005 $15,000 R. Jeremy Products and Services

JTB Services development 4/15/2005 1/1/2006 $7,500 R. Jeremy Products and services

JTB Industrial Services Marketing campaign 3/1/2005 1/30/2006 $3,500 R. Jeremy Marketing

Totals: $192,500

Web Plan Summary

JTB’s Web-based marketing plan is the same for all divisions, with each division targeting its own clients. We will gather information and feedback through paid ads in trade magazines and other websites. The plan is to link our products and services with as many affiliate sites as possible.

Each division will have a dedicated website under the JTB logo. With a customer database available at all times, we can easily track our marketing expenditures and customer demographics.

Website Marketing Strategy

JTB will develop and manage industrial marketplaces, and embed itself into other sites using search engine technology, affiliate marketing programs, and paid banner ads. As our Integrated Technologies Division will develop the sites and software applications, this will be done at a lower cost than our competitors.

Management Summary

Operations Manager Mitchell R. Jeremy

Mitchell will oversee the development of all projects, develop procedures and techniques for all products and services, and provide hands-on training to all employees.

Service and Production Manager Rachel L. Jeremy

Rachel will act as the Service Team Manager, oversee order processing, scheduling, and act as the general business manager. After year one, the service team members and manager will handle the day-to-day workload. Rachel will continue to maintain the work schedule, track billing issues, and stay in contact with clients.

Personnel Plan

Service Team Manager

Initially, Rachel Jeremy will fill this role while undergoing training. The service team manager will answer directly to the Operations Manager.

Service Team Member

TBA. Service Associates will perform the manual labor required in the service and production department.

Sales and Marketing Associate

TBA. This is a shared position, with costs and responsibilities distributed among all divisions.

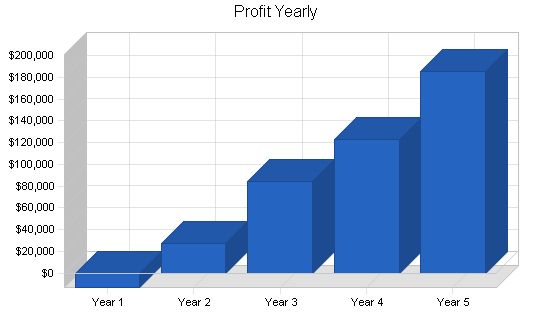

JTB’s financial plan is based on raising $230,000 in private equity and securing a $45,000 loan to cover initial equipment costs. We expect the Product and Service Division to achieve a small net profit in just over two years.

By year three, we expect to begin paying dividends to investors and secure lines of credit for equipment and expansion.

Important Assumptions

The plan assumes current business and economic stability, strong customer buying trends, projected growth in operating and outsourced costs, and continued growth in internet buying trends.

Note 8.1.1: We have selected a high-quality accounting system that allows for multiple businesses and full consolidation, with budgeting capabilities.

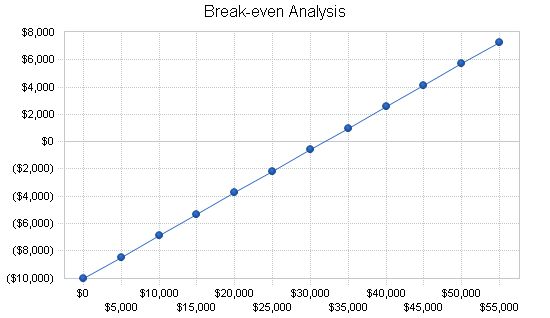

Break-even Analysis

JTB’s break-even analysis is difficult to project due to the mix of labor-charged hourly services and outsourced manufactured goods. The goal is to bring manufactured product lines to market within 60 days and offer service-based orders immediately. The aim is to build a solid base while developing distribution and secondary services business.

| Break-even Analysis | |

| Monthly Revenue Break-even | $31,884 |

| Assumptions: | |

| Average Percent Variable Cost | 69% |

| Estimated Monthly Fixed Cost | $10,036 |

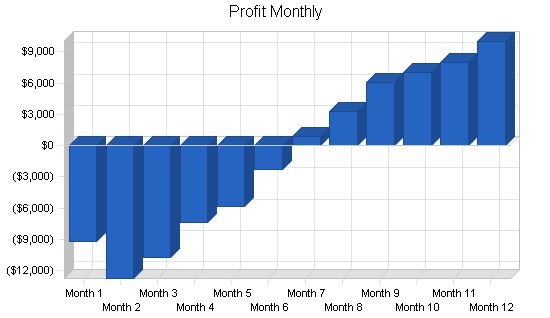

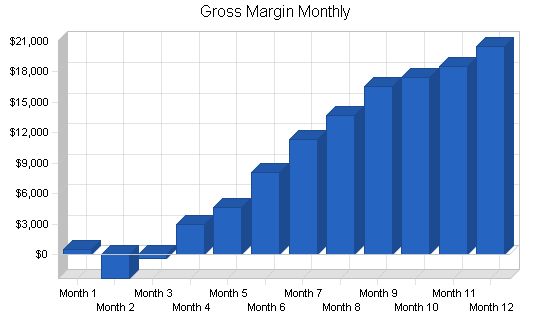

8.3 Projected Profit and Loss

Please read the note in the Important Assumptions section regarding our Accounting system and methodology.

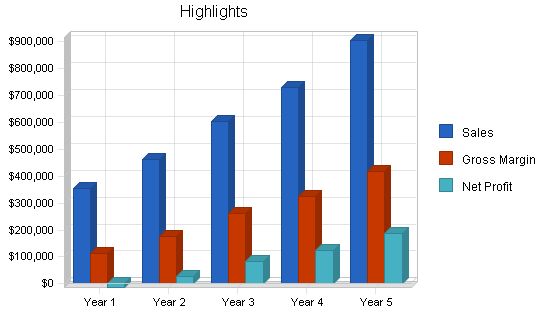

The Projected Profit and Loss table considers all basic operating costs for the Products and Services Division only. This division will reach the break-even point late in the first year and become increasingly profitable thereafter. At full capacity in later years, we expect net profit margins between 12% and 19%.

The Profit and Loss in this business plan also includes a full depreciation schedule. Management’s goal is to work with a leasing company that will provide a construction-type loan/lease situation, allowing us time to hand-select the best possible equipment while minimizing cash outlay during this process. For this plan and a conservative approach, we have bought some starting equipment as long-term assets in the start-up table. We will add leased equipment as initial equipment depreciates.

The Profit and Loss table in this plan does not reflect the burden of management, and management’s output-related personnel costs can be found in the plan for the holding company, JTB Technologies, Inc. Please remember when reviewing the P&L, the 3 JTB divisions will be operating under one roof. As such, overhead is low, and management’s role will be to fill in all areas of production as needed to complete orders.

Management’s operating schedule will also be overlapped to “keep our doors open” more operating hours than any other 9 to 5 operations. Management anticipates running at least 50 hours per week to develop more business on the west coast.

Pro Forma Profit and Loss

Sales:

Year 1: $354,705

Year 2: $461,550

Year 3: $601,569

Year 4: $729,944

Year 5: $902,842

Direct Cost of Sales:

Year 1: $199,051

Year 2: $229,974

Year 3: $279,739

Year 4: $342,839

Year 5: $419,700

Production Payroll:

Year 1: $44,000

Year 2: $57,000

Year 3: $59,000

Year 4: $63,000

Year 5: $66,000

Other Costs of Goods:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Total Cost of Sales:

Year 1: $243,051

Year 2: $286,974

Year 3: $338,739

Year 4: $405,839

Year 5: $485,700

Gross Margin:

Year 1: $111,654

Year 2: $174,576

Year 3: $262,830

Year 4: $324,105

Year 5: $417,142

Gross Margin %:

Year 1: 31.48%

Year 2: 37.82%

Year 3: 43.69%

Year 4: 44.40%

Year 5: 46.20%

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll:

Year 1: $2,750

Year 2: $4,000

Year 3: $6,000

Year 4: $8,000

Year 5: $10,000

Advertising/Promotion:

Year 1: $4,950

Year 2: $6,000

Year 3: $7,500

Year 4: $8,500

Year 5: $9,500

Other Sales and Marketing Expenses:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Total Sales and Marketing Expenses:

Year 1: $7,700

Year 2: $10,000

Year 3: $13,500

Year 4: $16,500

Year 5: $19,500

Sales and Marketing %:

Year 1: 2.17%

Year 2: 2.17%

Year 3: 2.24%

Year 4: 2.26%

Year 5: 2.16%

General and Administrative Expenses:

General and Administrative Payroll:

Year 1: $43,200

Year 2: $43,500

Year 3: $44,000

Year 4: $45,000

Year 5: $45,000

Sales and Marketing and Other Expenses:

Year 1: $5,400

Year 2: $7,200

Year 3: $8,500

Year 4: $9,500

Year 5: $10,200

Depreciation:

Year 1: $7,750

Year 2: $7,750

Year 3: $7,750

Year 4: $7,750

Year 5: $7,750

Rent:

Year 1: $8,400

Year 2: $8,400

Year 3: $8,400

Year 4: $8,400

Year 5: $8,400

Equipment Lease:

Year 1: $35,988

Year 2: $35,988

Year 3: $35,988

Year 4: $35,988

Year 5: $35,988

Utilities:

Year 1: $7,200

Year 2: $7,200

Year 3: $7,200

Year 4: $7,200

Year 5: $7,200

Insurance:

Year 1: $4,800

Year 2: $5,400

Year 3: $7,200

Year 4: $9,000

Year 5: $9,600

Payroll Taxes:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Other General and Administrative Expenses:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Total General and Administrative Expenses:

Year 1: $112,738

Year 2: $115,438

Year 3: $119,038

Year 4: $122,838

Year 5: $124,138

General and Administrative %:

Year 1: 31.78%

Year 2: 25.01%

Year 3: 19.79%

Year 4: 16.83%

Year 5: 13.75%

Other Expenses:

Other Payroll:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Consultants:

Year 1: $0

Year 2: $6,000

Year 3: $6,000

Year 4: $6,000

Year 5: $6,000

Other Other Expenses:

Year 1: $0

Year 2: $0

Year 3: $0

Year 4: $0

Year 5: $0

Total Other Expenses:

Year 1: $0

Year 2: $6,000

Year 3: $6,000

Year 4: $6,000

Year 5: $6,000

Other %:

Year 1: 0.00%

Year 2: 1.30%

Year 3: 1.00%

Year 4: 0.82%

Year 5: 0.66%

Total Operating Expenses:

Year 1: $120,438

Year 2: $131,438

Year 3: $138,538

Year 4: $145,338

Year 5: $149,638

Profit Before Interest and Taxes:

Year 1: ($8,784)

Year 2: $43,138

Year 3: $124,292

Year 4: $178,767

Year 5: $267,504

EBITDA:

Year 1: ($1,034)

Year 2: $50,888

Year 3: $132,042

Year 4: $186,517

Year 5: $275,254

Interest Expense:

Year 1: $4,297

Year 2: $3,938

Year 3: $3,563

Year 4: $3,188

Year 5: $2,813

Taxes Incurred:

Year 1: $0

Year 2: $11,760

Year 3: $36,219

Year 4: $52,674

Year 5: $79,408

Net Profit:

Year 1: ($13,081)

Year 2: $27,440

Year 3: $84,511

Year 4: $122,906

Year 5: $185,284

Net Profit/Sales:

Year 1: -3.69%

Year 2: 5.95%

Year 3: 14.05%

Year 4: 16.84%

Year 5: 20.52%

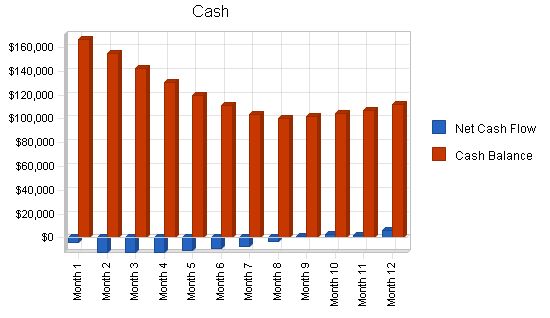

8.4 Projected Cash Flow

JTB’s projected cash flow reflects the business’ cash position. Please note that this table is for the Products and Services Division only. The table shows the planned repayment of the 12-year loan and dividends to investors starting in year 3.

When reviewing the projected cash flow, it is important to consider that the largest sales growth comes from outsourced manufacturing, which is not specifically segmented in this review. Additional segmentation information can be found in the market segmentation table in section 4.1.

Outsourced manufacturing allows the company to have the desired product line while utilizing its internal personnel for the more profitable services. The outsourced products operate under fixed costs, while the services area primarily works on cost plus projects, which have a higher shop rate. As the cash flow projection only includes the base products described in the business plan, it is highly probable that JTB will be involved with more outsourced products in years two through five, further increasing our potential profitability.

For a better understanding of the projected cash flow, please refer to section 8.1, which discusses the important assumptions.

The Pro Forma Cash Flow table displays cash received and cash from operations over a five-year period. It includes categories such as Cash Sales and Cash from Receivables. The subtotal cash from operations is then calculated. Additional cash received is also listed, including Sales Tax, VAT, HST/GST Received and New Current Borrowing. The table concludes with the subtotal cash received.

Moving on to the Projected Balance Sheet, it demonstrates the cash development capability of JTB Products and Services over the five-year plan. It assumes fixed costs and reveals the growth of cash and net worth. The division is a manufacturing setting, resulting in the accumulation of hard assets. A full depreciation schedule and payment schedule are provided.

The text mentions that inventory requirements may change and reflects the goal of keeping inventory levels reasonable. The division is service-oriented, creating multiple income streams tied to product lines. Fine details of labor and materials breakdown are not shown.

Lastly, the Business Ratios section provides standard ratios for the plan years and compares them to the Manufacturing Industries industry. JTB’s Products and Services Division demonstrates strong growth in Gross Margins. Long-term assets decline as equipment is paid off, and overall Debt to Asset ratios are better than the industry average. General and Administrative ratios are higher due to the essential role of personnel in the company’s growth and outsourcing goals.

Ratio Analysis:

Sales Growth: 0.00%, 30.12%, 30.34%, 21.34%, 23.69%, -0.33%

Percent of Total Assets:

– Accounts Receivable: 23.49%, 29.98%, 30.91%, 30.35%, 29.40%, 23.08%

– Inventory: 14.78%, 16.76%, 16.12%, 15.83%, 15.33%, 15.97%

– Other Current Assets: 2.00%, 1.96%, 1.55%, 1.25%, 0.98%, 34.94%

– Total Current Assets: 85.14%, 88.45%, 93.26%, 96.49%, 98.77%, 73.99%

– Long-term Assets: 14.86%, 11.55%, 6.74%, 3.51%, 1.23%, 26.01%

– Total Assets: 100.00%, 100.00%, 100.00%, 100.00%, 100.00%, 100.00%

Current Liabilities: 18.27%, 10.54%, 10.42%, 10.18%, 9.74%, 23.82%

Long-term Liabilities: 16.46%, 14.68%, 10.45%, 7.52%, 5.15%, 17.66%

Total Liabilities: 34.73%, 25.22%, 20.88%, 17.70%, 14.89%, 41.48%

Net Worth: 65.27%, 74.78%, 79.12%, 82.30%, 85.11%, 58.52%

Percent of Sales:

– Sales: 100.00%, 100.00%, 100.00%, 100.00%, 100.00%, 100.00%

– Gross Margin: 31.48%, 37.82%, 43.69%, 44.40%, 46.20%, 36.34%

– Selling, General & Administrative Expenses: 39.96%, 31.88%, 29.64%, 27.56%, 25.68%, 17.49%

– Advertising Expenses: 2.22%, 2.31%, 2.42%, 2.44%, 2.35%, 1.27%

– Profit Before Interest and Taxes: -2.48%, 9.35%, 20.66%, 24.49%, 29.63%, 3.23%

Main Ratios:

– Current: 4.66, 8.39, 8.95, 9.48, 10.14, 2.18

– Quick: 3.85, 6.80, 7.40, 7.92, 8.57, 1.33

– Total Debt to Total Assets: 34.73%, 25.22%, 20.88%, 17.70%, 14.89%, 50.82%

– Pre-tax Return on Net Worth: -8.00%, 20.52%, 47.25%, 53.46%, 61.03%, 7.44%

– Pre-tax Return on Assets: -5.22%, 15.35%, 37.39%, 44.00%, 51.94%, 15.13%

Additional Ratios:

– Net Profit Margin: -3.69%, 5.95%, 14.05%, 16.84%, 20.52%, n.a

– Return on Equity: -8.00%, 14.37%, 33.07%, 37.42%, 42.72%, n.a

Activity Ratios:

– Accounts Receivable Turnover: 4.52, 4.52, 4.52, 4.52, 4.52, n.a

– Collection Days: 38, 71, 71, 74, 73, n.a

– Inventory Turnover: 12.00, 5.76, 5.90, 5.95, 5.94, n.a

– Accounts Payable Turnover: 6.69, 12.17, 12.17, 12.17, 12.17, n.a

– Payment Days: 27, 41, 27, 27, 27, n.a

– Total Asset Turnover: 1.42, 1.81, 1.86, 1.83, 1.77, n.a

Debt Ratios:

– Debt to Net Worth: 0.53, 0.34, 0.26, 0.22, 0.17, n.a

– Current Liab. to Liab.: 0.53, 0.42, 0.50, 0.58, 0.65, n.a

Liquidity Ratios:

– Net Working Capital: $167,569, $199,010, $267,520, $344,426, $453,710, n.a

– Interest Coverage: -2.04, 10.96, 34.89, 56.08, 95.11, n.a

Additional Ratios: (Year 1 – Year 5)

– Assets to Sales: 0.71, 0.55, 0.54, 0.55, 0.56, n.a

– Current Debt/Total Assets: 18%, 11%, 10%, 10%, 10%, n.a

– Acid Test: 2.57, 3.96, 4.44, 4.94, 5.55, n.a

– Sales/Net Worth: 2.17, 2.42, 2.35, 2.22, 2.08, n.a

– Dividend Payout: 0.00, 0.00, 0.24, 0.41, 0.43, n.a

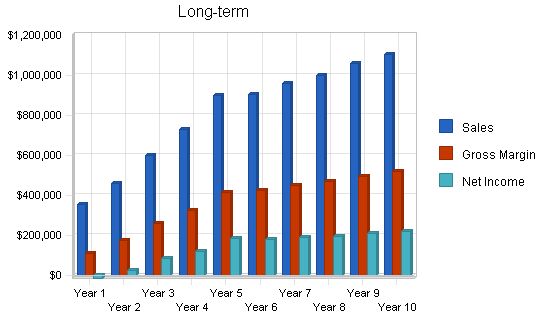

8.7 Long-term Plan:

JTB’s Product and Services Division has projected a 10-year plan to showcase long-term results and the potential of distributor partnerships. The plan also includes cash positions for years 4 and 5 for payout analysis and provides a clearer equity picture.

Gross Sales: Over $900,000 by year 6.

Gross Margins: Over $450,000 by year 5.

Net Income: Over $160,000 by year 6.

Current Assets: Over $600,000 by year 6.

Equity: Over $600,000 by year 7.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!