Group Publishing, Inc. is the publisher of “Artists In Business” magazine. The magazine, which printed its initial issue in July/August 1996, targets artists of all business levels in the United States. Group Publishing aims to reach a total circulation of 206,000 in year one and increase it to 310,000 by the end of year three. The magazine will be published bi-monthly, with larger press runs during the first three years. They will distribute sample copies, sell to organizations, and use direct mail to build subscriptions.

Additionally, Group Publishing will market books through direct marketing and established artist distribution channels. They will leverage their magazine readership base for the direct marketing of their books.

Publishing is a highly profitable business, with high profit margins. Successful marketing is essential for success. Group Publishing has a focused and multi-dimensional sales and marketing plan to quickly build their circulation base. They used the same channels and methods to establish a circulation of 500,000 in the first year for the Visionary Artist’s periodical.

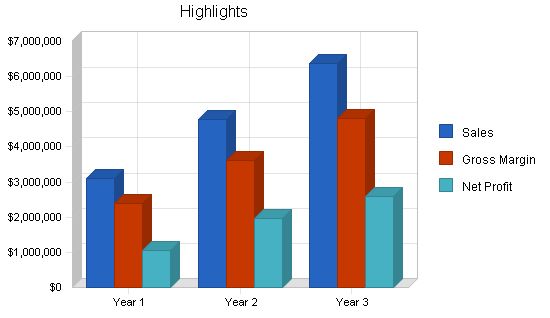

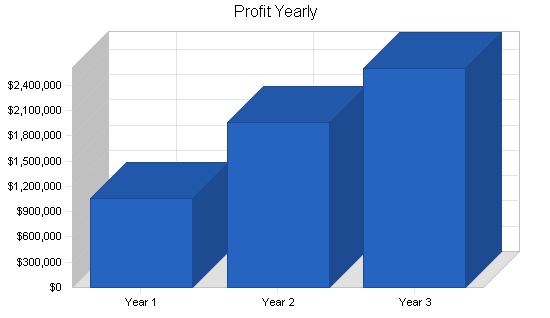

The execution of Group’s plan is projected to generate sales revenues of $3.1 million in year one, $4.8 million in year two, and $6.4 million in year three. Net profit will steadily increase over the next three years.

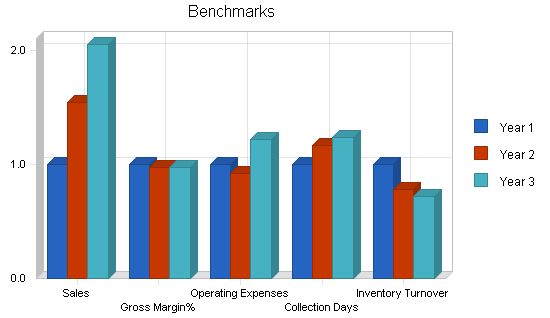

The chart below illustrates the highlights of the business plan, showing the growth in sales, margins, and net profit each year. The lowest margins occur in year one due to the marketing costs of building the circulation base.

1.1 Objectives

The initial objectives of Group Publishing are as follows:

1. Raise seed capital of $150,000 to ensure publication by month two and establish a cash reserve for subscription marketing.

2. Reach 90,000 subscribers by the end of year one through direct sampling and marketing.

3. Gain an additional 50,000 subscribers by the end of year one through organizational sales.

4. Sell 10,000 more two-year subscriptions.

5. Publish two 36-page issues initially with press runs of 50,000 promotional copies each.

6. Increase to 48 pages by issue number three and raise press runs to 75,000 promotional copies.

7. Increase to 100,000 promotional copies in issues five and six.

8. Increase the average ad page cost from $1,819 to $2,618 by the end of the first year.

9. Sell an average of 17.5 ad pages per issue throughout year one.

1.2 Mission

“Artists In Business” magazine is for artists at any level. It serves as a platform to profile artists who represent artistic vision in the marketplace and can serve as role models to others. Group Publishing, through its magazine, books, and editorial content, aims to inform artists about artistic principles in everyday business and encourage interaction among artists as business people. Their mission is to promote the concept of “community” in the workplace.

1.3 Keys to Success

The keys to success are:

– Attaining targeted circulation levels.

– Controlling costs while maximizing subscription marketing in year one.

– Carefully monitoring response rates of all media executions.

– Follow-on marketing of two to four book titles in the first year.

– Achieving targeted advertising sales revenues.

– Providing quality editorial content in each issue.

– Meeting all production and distribution deadlines for each issue.

Group Publishing, Inc. started as a joint concept between two artists, Red Brushwielder, an advertising executive, and Thallos Green, a former insurance executive and owner of the "Artists In Business" name. Mr. Green is licensing the "Artists In Business" name to The Group Publishing, Inc. for $1. He will also receive one page of advertising at no charge and one page of editorial in each issue as the founder of the magazine. The radio show produced by Mr. Green is expected to be a powerful promotional vehicle for the magazine.

Group Publishing will have exclusive rights to "Artists In Business" for all print media, electronic media, catalog business, and possible seminars and workshops for artistic business people.

Equity investment in the company is now available to outside investors for the first time to raise the "seed" capital needed to launch the magazine. An initial Private Placement offering of $150K to $375K is in progress. The minimum amount would be enough to publish the first new issue in 1997. Extra funds will enable full-scale sampling and marketing of subscriptions. There may be a need for additional capital in the future, and it’s not guaranteed that sufficient capital will be available to continue publication.

The company anticipates buying back the outside investment in year three for $1.5 million.

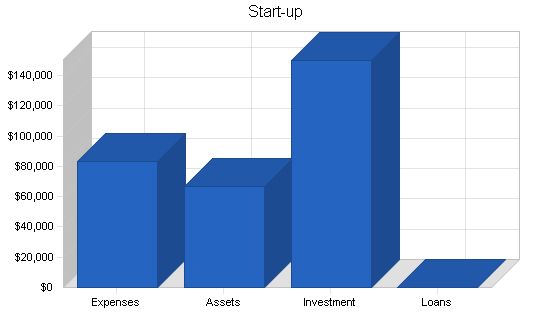

Start-up Funding:

Start-up Expenses to Fund: $83,000

Start-up Assets to Fund: $67,000

Total Funding Required: $150,000

Assets:

Non-cash Assets from Start-up: $0

Cash Requirements from Start-up: $67,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $67,000

Total Assets: $67,000

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital:

Planned Investment:

Private Placement ’96: $150,000

Investor: $0

Additional Investment Requirement: $0

Total Planned Investment: $150,000

Loss at Start-up (Start-up Expenses): ($83,000)

Total Capital: $67,000

Total Capital and Liabilities: $67,000

Total Funding: $150,000

Start-up Requirements:

Start-up Expenses:

Legal: $7,500

Stationery, etc.: $2,500

Brochures: $5,000

Consultants: $12,500

Development Advisory Fee: $8,000

Rent: $7,500

1st Issue Total: $40,000

Total Start-up Expenses: $83,000

Start-up Assets:

Cash Required: $67,000

Start-up Inventory: $0

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $67,000

Total Requirements: $150,000

Company Ownership

Red Brushwielder is the founder of The Group Publishing, Inc., a newly formed Southwest "C" corporation. He currently owns all its stock.

Company Locations and Facilities

The Group Publishing, Inc. has current offices at 1234 Main Street, Anytown, GA. 30000. The office is fully equipped and functional. Expanded facilities are not anticipated for the first few years of the plan. All business, management, and editorial functions will be performed there. All printing, mailing, warehousing, and fulfillment are outsourced.

Products

The Group Publishing will publish "Artists In Business" magazine, a high gloss, 48-page contemporary magazine with a focus on quality art content. The magazine aims to be entertaining, newsworthy, and thought-provoking, appealing to a broad artist readership. It offers a unique reading experience not available in any other existing magazine.

The Group Publishing will also publish softcover and hardcover books. Some titles will be published in softcover "trade" size, while others will be similar to "paperback" size. The themes of the books will revolve around contemporary arts, specifically addressing the challenges faced by artists in today’s business climate.

Market Analysis Summary

The target market includes artist business persons at all levels in any organization. Market segments are defined by organizational affiliation. Media strategy and execution may vary by segment.

Strategy and Implementation Summary

The strategy of The Group Publishing is to serve a clearly defined niche market effectively by capitalizing on the passions and loyalty of committed artists. The initial issue of "Artists In Business," published in late summer of 1996, received excellent reviews and was well-received at bookseller and distributor conventions. To reach and inform the target market, the strategy involves sampling, direct mail, and group membership solicitation to build circulation through subscriptions and newsstand distribution. Multi-channel distribution principles will be utilized to maximize the magazine’s reach.

New subscriptions will be obtained through sampling to known arts organization members and artist mailing lists. The magazine has access to a list of 100,000 artist business leaders, all of whom will receive a magazine sample. Sampling programs will vary in size, starting from 50,000 issues and gradually increasing to 100,000 issues. Print media, such as arts publications and general interest media, will be used in alternate months to attract new subscribers. Sales through arts supply and retail bookstores will also be pursued, with key distributors already expressing interest in the publication.

Distribution Strategy

Magazine and book distribution through retail channels will be projected at retail less 60%. Subscriptions through organizations will be projected at list less 50%. Direct sales will be billed at full revenue, with the cost of the product deducted for six issues per year. Fulfillment costs will be expensed. The magazine will also be promoted through direct sales of books, with future sales planned directly over the internet from the AIB website.

Strategic Alliances

The strategic alliance with Thallos Green and his AIB radio broadcasts holds great potential. Thallos plans to syndicate the broadcasts on Arts News radio stations across the U.S.

Promotion Strategy

In addition to advertising, direct mail, and media executions, public relations exposure will significantly benefit magazine circulation. Red Brushwielder has already appeared and been interviewed on Arts News radio programs multiple times, generating high interest and subscription requests. Red has also been asked to tape programs on artists in the workplace for an Anytown radio station. Promotion strategy for sales through organizations includes revenue sharing with the selling organization in the first year of subscription.

Pricing Strategy

"Artists In Business" magazine will be priced at $3.95 per single issue on the newsstand. One-year subscriptions will cost $16.95, while two-year subscriptions will cost $29.95. Softcover "trade" books will be priced at $14.95, and paperback-sized "booklets" will be priced at $7.95. Future hardcover books, not projected in this three-year plan, will be priced between $19.95 and $22.95.

Sales Strategy

The combined sales strategy of sampling, direct mail, and organizations aims to achieve the following first-year sales goals:

– 90,000 one-year subscriptions

– 50,000 one-year subscriptions through organizations

– 10,000 two-year subscriptions

Sales of four book titles are also factored into the second half of the year, with modest sales goals.

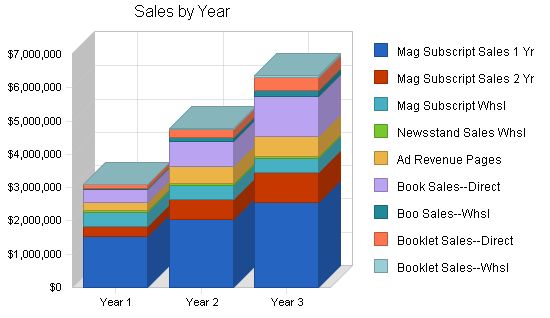

These sales efforts are projected to generate annual revenue of $3.1 million in the first year, $4.8 million in the second year, and $6.4 million in the third year.

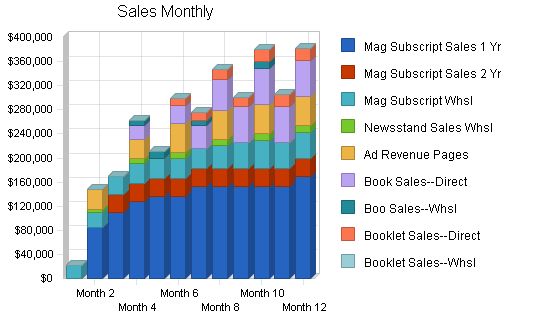

The following table and chart present specific sales forecasts by product and month for the first year of sales. The sales projections incorporate unit cost and margin differences to reflect discounts, commissions, and revenue splits. Ad revenue will be subject to a 15% discount for agency commission and 20% for sales commission.

All product costs for subscriptions are based on $0.40 per issue for six issues in one year and 12 issues in two years. Author royalties on book sales, expected to be 15%, are included as an expense item in the P&L statement.

Sales Forecast

Sales

– Mag Subscript Sales 1 Yr: 90,000 (Year 1), 120,000 (Year 2), 150,000 (Year 3)

– Mag Subscript Sales 2 Yr: 10,000 (Year 1), 20,000 (Year 2), 30,000 (Year 3)

– Mag Subscript Whsl: 50,000 (Year 1-3)

– Newsstand Sales Whsl: 56,500 (Year 1), 72,000 (Year 2), 80,000 (Year 3)

– Ad Revenue Pages: 118 (Year 1), 150 (Year 2-3)

– Book Sales–Direct: 25,500 (Year 1), 50,000 (Year 2), 80,000 (Year 3)

– Boo Sales–Whsl: 7,000 (Year 1), 20,000 (Year 2), 30,000 (Year 3)

– Booklet Sales–Direct: 14,500 (Year 1), 30,000 (Year 2), 50,000 (Year 3)

– Booklet Sales–Whsl: 0 (Year 1), 15,000 (Year 2), 20,000 (Year 3)

– Total Unit Sales: 253,618 (Year 1), 377,150 (Year 2), 490,150 (Year 3)

Unit Prices

– Mag Subscript Sales 1 Yr: $16.95 (Year 1-3)

– Mag Subscript Sales 2 Yr: $29.95 (Year 1-3)

– Mag Subscript Whsl: $8.50 (Year 1-3)

– Newsstand Sales Whsl: $0.99 (Year 1-3)

– Ad Revenue Pages: $2,182.00 (Year 1), $3,365.00 (Year 2), $3,976.00 (Year 3)

– Book Sales–Direct: $14.95 (Year 1-3)

– Boo Sales–Whsl: $5.98 (Year 1-3)

– Booklet Sales–Direct: $7.95 (Year 1-3)

– Booklet Sales–Whsl: $0.00 (Year 1), $3.18 (Year 2-3)

Sales

– Mag Subscript Sales 1 Yr: $1,525,500 (Year 1), $2,034,000 (Year 2), $2,542,500 (Year 3)

– Mag Subscript Sales 2 Yr: $299,500 (Year 1), $599,000 (Year 2), $898,500 (Year 3)

– Mag Subscript Whsl: $425,000 (Year 1-3)

– Newsstand Sales Whsl: $55,935 (Year 1), $71,280 (Year 2), $79,200 (Year 3)

– Ad Revenue Pages: $257,476 (Year 1), $504,750 (Year 2), $596,400 (Year 3)

– Book Sales–Direct: $381,225 (Year 1), $747,500 (Year 2), $1,196,000 (Year 3)

– Boo Sales–Whsl: $41,860 (Year 1), $119,600 (Year 2), $179,400 (Year 3)

– Booklet Sales–Direct: $115,275 (Year 1), $238,500 (Year 2), $397,500 (Year 3)

– Booklet Sales–Whsl: $0 (Year 1), $47,700 (Year 2), $63,600 (Year 3)

– Total Sales: $3,101,771 (Year 1), $4,787,330 (Year 2), $6,378,100 (Year 3)

Direct Unit Costs

– Mag Subscript Sales 1 Yr: $2.40 (Year 1-3)

– Mag Subscript Sales 2 Yr: $4.80 (Year 1-3)

– Mag Subscript Whsl: $2.40 (Year 1-3)

– Newsstand Sales Whsl: $0.40 (Year 1-3)

– Ad Revenue Pages: $788.02 (Year 1), $1,178.00 (Year 2), $1,392.00 (Year 3)

– Book Sales–Direct: $2.99 (Year 1-3)

– Boo Sales–Whsl: $2.99 (Year 1-3)

– Booklet Sales–Direct: $1.59 (Year 1-3)

– Booklet Sales–Whsl: $0.00 (Year 1), $1.59 (Year 2-3)

Direct Cost of Sales

– Mag Subscript Sales 1 Yr: $216,000 (Year 1), $288,000 (Year 2), $360,000 (Year 3)

– Mag Subscript Sales 2 Yr: $48,000 (Year 1), $96,000 (Year 2), $144,000 (Year 3)

– Mag Subscript Whsl: $120,000 (Year 1-3)

– Newsstand Sales Whsl: $22,600 (Year 1), $28,800 (Year 2), $32,000 (Year 3)

– Ad Revenue Pages: $92,986 (Year 1), $176,700 (Year 2), $208,800 (Year 3)

– Book Sales–Direct: $76,245 (Year 1), $149,500 (Year 2), $239,200 (Year 3)

– Boo Sales–Whsl: $20,930 (Year 1), $59,800 (Year 2), $89,700 (Year 3)

– Booklet Sales–Direct: $23,055 (Year 1), $47,700 (Year 2), $79,500 (Year 3)

– Booklet Sales–Whsl: $0 (Year 1), $23,850 (Year 2), $31,800 (Year 3)

– Subtotal Direct Cost of Sales: $619,816 (Year 1), $990,350 (Year 2), $1,305,000 (Year 3)

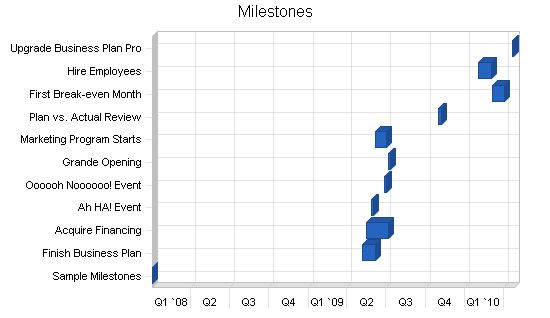

5.3 Milestones

Important milestones are:

– Raising “seed” capital.

– Publishing magazine by February.

– Launching subscription marketing programs.

– Achieving subscription goals.

Milestones

Milestone Start Date End Date Budget Manager Department

Sample Milestones 1/4/2008 1/4/2008 $0 ABC Department

Finish Business Plan 5/7/2009 6/6/2009 $100 Dude LeGrande Fromage

Acquire Financing 5/17/2009 7/6/2009 $200 Dudette Legumers

Ah HA! Event 5/27/2009 6/1/2009 $60 Marianne Bosses

Oooooh Noooooo! Event 6/26/2009 7/1/2009 $250 Marionette Chèvre deBlâme

Grande Opening 7/6/2009 7/11/2009 $500 Gloworm Nobs

Marketing Program Starts 6/6/2009 7/1/2009 $1,000 Glower Marketeers

Plan vs. Actual Review 11/1/2009 11/8/2009 $0 Galore Alles

First Break-even Month 3/5/2010 4/4/2010 $0 Bouys Salers

Hire Employees 2/1/2010 3/3/2010 $150 Gulls HRM

Upgrade Business Plan Pro 4/22/2010 4/24/2010 $100 Brass Bossies

Totals $2,360

Management Summary

With production and fulfillment services outsourced, The Group Publishing, Inc. requires management, editorial, artistic, sales & marketing, and financial expertise.

6.1 Management Team

Red Brushwielder (44), President & CEO, Publisher & Editor

Mr. Brushwielder founded and grew an advertising agency over thirteen years. He specializes in publishing and direct marketing. His major clients include Payne’s Gray Publishers, Inc., a NASDAQ public company and art book publisher.

Mr. Brushwielder has 20 years of experience in advertising and publishing. His advertising clients include American Express, Steinway & Sons Piano Company, Peachtree Software, Parisian Department Stores, and ADP Payroll Services. Red Brushwielder attended the University of South Carolina.

Ochre & Sienna Burnt, Asst. Editors

Ochre (50) and Sienna (48) founded Painting Restoration, specializing in restoring old family portraits. They are accomplished authors, credited with "Restoring the Early Portrait" and "Demolishing Portrait Forgeries". Ochre served in the U.S. Navy as a helicopter pilot in Viet Nam.

Ochre holds a BA in Economics from the University of Connecticut, an MBA from California Lutheran College, and a Master’s of Art Education from School of Hard Knocks. Sienna holds a BS in Education from the University of Connecticut.

John Crimson (50), Interim CFO

Mr. Crimson was previously VP and Treasurer for Holiday Inn Worldwide. He was also President of a $30 million dollar credit union. John has a BA in Finance from the College of Wooster in Ohio and an MBA in Finance from Emory University.

Timothy Clark (48), VP of Corporate Development

Mr. Clark has successfully raised capital for both public and private companies. He has written and executed strategic growth plans in executive and consulting roles. He has held positions with three growth stage companies and was part of a turn-around team for a failed venture-backed start-up. In his early career, he held sales and marketing management positions with Lever Brothers Company and the LCR Division of Squibb, Inc. in Chicago and New York. He specializes in Strategic Planning and Capital Formation. Mr. Clark holds a BA in Marketing from the University of Notre Dame.

6.2 Management Team Gaps

An art director and freelance artists are needed.

Ad sales manager and circulation manager will be hired as required.

6.3 Personnel Plan

The following table shows the personnel plan and projected salaries for key individuals.

Personnel Plan

Year 1 Year 2 Year 3

Production Personnel $0 $0 $0

Name or Title or Group $0 $0 $0

Name or Title or Group $0 $0 $0

Subtotal $0 $0 $0

Sales and Marketing Personnel

Ad Sales Mgr. $36,000 $40,000 $44,000

Subscription Mgr. $15,000 $30,000 $33,000

Subtotal $51,000 $70,000 $77,000

General and Administrative Personnel

Red Brushwielder, CEO $60,000 $66,000 $72,000

Ochre & Sienna Burnt, Exec. Editors $52,800 $60,000 $66,000

John Crimson, CFO $12,000 $52,000 $60,000

Exec. Asst. $18,000 $22,000 $24,000

Timothy Clark, VP Corp. Dev. $18,000 $36,000 $48,000

Subtotal $160,800 $236,000 $270,000

Other Personnel

Art Director $52,800 $60,000 $66,000

Freelance Artist $6,000 $6,000 $6,000

Bookkeeper $5,400 $0 $0

Subtotal $64,200 $66,000 $72,000

Total People 10 11 11

Total Payroll $276,000 $372,000 $419,000

After initial capitalization, growth can be financed through internal cash flow if subscription targets are met. In the event of a sales shortfall, marketing can be temporarily reduced to preserve cash. Alternatively, additional investment may be sought to fund growth.

The company will generate cash once the subscription base reaches critical mass.

7.1 Important Assumptions

The following table shows the financial assumptions used in this plan. The key assumption is six inventory turns per year, reflecting the magazine’s issues and ad revenue. Subscriptions are paid in advance, and only 10% of receivables are collected within 30 days, primarily from wholesale accounts.

General Assumptions

Year 1 Year 2 Year 3

Plan Month 1 2 3

Current Interest Rate 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00%

Tax Rate 30.00% 30.00% 30.00%

Other 0 0 0

7.2 Key Financial Indicators

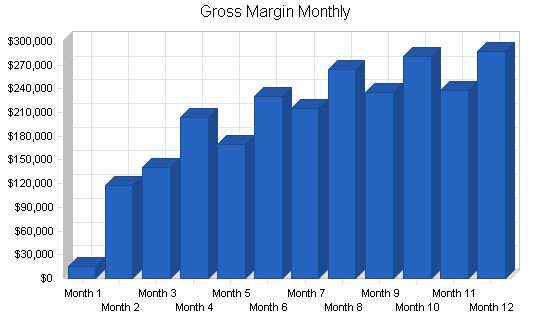

The chart below shows changes in critical profit variables. Margins and expenses are consistently controlled, resulting in increased net profit. Inventory turns slow down in the third year due to higher inventories for increasing book sales.

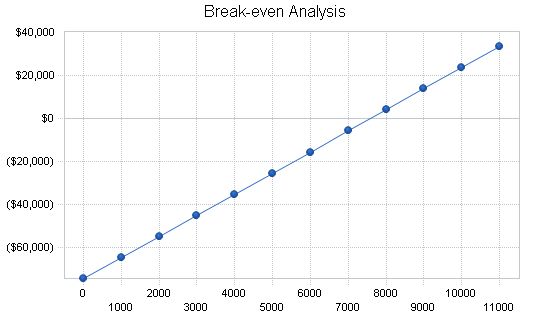

This break-even analysis applies specifically to the early 1997 time frame. Fixed costs are the primary expenses before marketing plans accelerate. So, if subscriptions don’t come in as expected, this is the point where the company can survive without increasing marketing efforts. In this case, management can buy time to raise more capital.

Break-even Analysis:

Monthly Units Break-even: 7,584

Monthly Revenue Break-even: $92,759

Assumptions:

Average Per-Unit Revenue: $12.23

Average Per-Unit Variable Cost: $2.44

Estimated Monthly Fixed Cost: $74,223

Projected Profit and Loss:

We expect net income to reach $1 million in year one and $2.4 million in year three. Net profit margins will improve as subscriptions mature and marketing costs decrease.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $3,101,771 | $4,787,330 | $6,378,100 |

| Direct Cost of Sales | $619,816 | $990,350 | $1,305,000 |

| Production Payroll | $0 | $0 | $0 |

| Author’s Royalties: 15% | $80,754 | $172,995 | $275,475 |

| Total Cost of Sales | $700,570 | $1,163,345 | $1,580,475 |

| Gross Margin | $2,401,201 | $3,623,985 | $4,797,625 |

| Gross Margin % | 77.41% | 75.70% | 75.22% |

| Operating Expenses | |||

| Sales and Marketing Payroll | $51,000 | $70,000 | $77,000 |

| Advertising/Promotion | $386,176 | $72,000 | $90,000 |

| Travel | $7,500 | $9,000 | $11,000 |

| Entertainment & Meals | $2,400 | $3,000 | $3,600 |

| Miscellaneous | $12,000 | $15,000 | $18,000 |

| Total Sales and Marketing Expenses | $459,076 | $169,000 | $199,600 |

| Sales and Marketing % | 14.80% | 3.53% | 3.13% |

| General and Administrative Payroll | $160,800 | $236,000 | $270,000 |

| Leased Equipment | $10,200 | $12,500 | $14,000 |

| Telephone | $7,200 | $7,500 | $7,800 |

| Postage | $138,200 | $279,000 | $465,000 |

| Rent | $30,000 | $30,000 | $36,000 |

| Utilities | $9,000 | $10,000 | $10,500 |

| Insurance | $12,000 | $12,000 | $14,000 |

| Total General and Administrative Expenses | $367,400 | $587,000 | $817,300 |

| General and Administrative % | 11.84% | 12.26% | 12.81% |

| Other Payroll | $64,200 | $66,000 | $72,000 |

| Total Other Expenses | $64,200 | $66,000 | $72,000 |

| Other % | 2.07% | 1.38% | 1.13% |

| Total Operating Expenses | $890,676 | $822,000 | $1,088,900 |

| Profit Before Interest and Taxes | $1,510,525 | $2,801,985 | $3,708,725 |

| EBITDA | $1,510,525 | $2,801,985 | $3,708,725 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $453,157 | $840,596 | $1,112,618 |

| Net Profit | $1,057,368 | $1,961,390 | $2,596,108 |

| Net Profit/Sales | 34.09% | 40.97% | 40.70% |

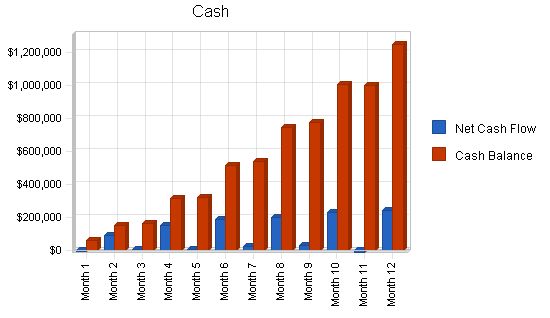

7.5 Projected Cash Flow

The table below illustrates cash accumulation from the initial assumption of $150K capital infusion. The company never runs out of cash. We expect to buy back the initial outside investment in year three.

The chart illustrates the critical cash flow in year one. Note that early contributions on a monthly basis are minimal and only gain momentum in the second half of the year. If shortfalls occur early on, more capital may be required.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $2,791,594 | $4,308,597 | $5,740,290 |

| Cash from Receivables | $242,574 | $441,996 | $603,139 |

| Subtotal Cash from Operations | $3,034,168 | $4,750,593 | $6,343,429 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $3,034,168 | $4,750,593 | $6,343,429 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $276,000 | $372,000 | $419,000 |

| Bill Payments | $1,582,258 | $2,577,550 | $3,334,557 |

| Subtotal Spent on Operations | $1,858,258 | $2,949,550 | $3,753,557 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $1,500,000 |

| Subtotal Cash Spent | $1,858,258 | $2,949,550 | $5,253,557 |

| Net Cash Flow | $1,175,910 | $1,801,044 | $1,089,872 |

| Cash Balance | $1,242,910 | $3,043,954 | $4,133,826 |

7.6 Projected Balance Sheet

We project a strong growth in net worth over the next several years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $1,242,910 | $3,043,954 | $4,133,826 |

| Accounts Receivable | $67,603 | $104,339 | $139,010 |

| Inventory | $89,856 | $143,573 | $189,188 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $1,400,369 | $3,291,866 | $4,462,024 |

| Long-term Assets | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $1,400,369 | $3,291,866 | $4,462,024 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $276,001 | $206,109 | $280,160 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $276,001 | $206,109 | $280,160 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $276,001 | $206,109 | $280,160 |

| Paid-in Capital | $150,000 | $150,000 | $150,000 |

| Retained Earnings | ($83,000) | $974,368 | $1,435,757 |

| Earnings | $1,057,368 | $1,961,390 | $2,596,108 |

| Total Capital | $1,124,368 | $3,085,757 | $4,181,865 |

| Total Liabilities and Capital | $1,400,369 | $3,291,866 | $4,462,024 |

| Net Worth | $1,124,367 | $3,085,757 | $4,181,864 |

7.7 Business Ratios

These business ratios are limited in value since the company projects no debt. This will also be an advantage if debt capital is desired later without dilution to shareholders. Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 2721, Periodicals, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 54.34% | 33.23% | -1.70% |

| Percent of Total Assets | ||||

| Accounts Receivable | 4.83% | 3.17% | 3.12% | 25.50% |

| Inventory | 6.42% | 4.36% | 4.24% | 5.40% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 54.10% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 85.00% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 15.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 19.71% | 6.26% | 6.28% | 42.30% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 12.30% |

| Total Liabilities | 19.71% | 6.26% | 6.28% | 54.60% |

| Net Worth | 80.29% | 93.74% | 93.72% | 45.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 77.41% | 75.70% | 75.22% | 56.10% |

| Selling, General & Administrative Expenses | 43.32% | 34.73% | 34.52% | 39.70% |

| Advertising Expenses | 12.45% | 1.50% | 1.41% | 1.90% |

| Profit Before Interest and Taxes | 48.70% | 58.53% | 58.15% | 4.20% |

| Main Ratios | ||||

| Current | 5.07 | 15.97 | 15.93 | 2.16 |

| Quick | 4.75 | 15.27 | 15.25 | 1.71 |

| Total Debt to Total Assets | 19.71% | 6.26% | 6.28% | 54.60% |

| Pre-tax Return on Net Worth | 134.34% | 90.80% | 88.69% | 7.40% |

| Pre-tax Return on Assets | 107.87% | 85.12% | 83.12% | 16.20% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 34.09% | 40.97% | 40.70% | n.a |

| Return on Equity | 94.04% | 63.56% | 62.08% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 4.59 | 4.59 | 4.59 | n.a |

| Collection Days | 56 | 66 | 70 | n.a |

| Inventory Turnover | 10.91 | 8.49 | 7.84 | n.a |

| Accounts Payable Turnover | 6.73 | 12.17 | 12.17 | n.a |

| Payment Days |

Review: Sales Forecast Sales – Mag Subscript Sales 1 Yr: $0, $84,750, $110,175, $127,125, $135,600, $135,600, $152,550, $152,550, $152,550, $152,550, $152,550, $169,500 – Mag Subscript Sales 2 Yr: $0, $0, $29,950, $29,950, $29,950, $29,950, $29,950, $29,950, $29,950, $29,950, $29,950, $29,950 – Mag Subscript Whsl: $21,250, $25,500, $29,750, $34,000, $34,000, $34,000, $34,000, $38,250, $42,500, $46,750, $42,500, $42,500 – Newsstand Sales Whsl: $0, $4,950, $0, $7,425, $0, $9,900, $0, $9,900, $0, $11,880, $0, $11,880 – Ad Revenue Pages: $0, $32,730, $0, $32,730, $0, $48,004, $0, $48,004, $0, $48,004, $0, $48,004 – Book Sales–Direct: $0, $0, $0, $22,425, $0, $29,900, $37,375, $52,325, $59,800, $59,800, $59,800, $59,800 – Boo Sales–Whsl: $0, $0, $0, $8,970, $11,960, $0, $8,970, $0, $0, $11,960, $0, $0 – Booklet Sales–Direct: $0, $0, $0, $0, $0, $11,925, $11,925, $15,900, $15,900, $19,875, $19,875, $19,875 – Booklet Sales–Whsl: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Total Sales: $21,250, $147,930, $169,875, $262,625, $211,510, $299,279, $274,770, $346,879, $300,700, $380,769, $304,675, $381,509 Direct Unit Costs – Mag Subscript Sales 1 Yr: 0%, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40 – Mag Subscript Sales 2 Yr: 0%, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80, $4.80 – Mag Subscript Whsl: 0%, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40, $2.40 – Newsstand Sales Whsl: 0%, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40, $0.40 – Ad Revenue Pages: 0%, $637.00, $637.00, $637.00, $637.00, $763.00, $763.00, $763.00, $763.00, $916.00, $916.00, $916.00, $916.00 – Book Sales–Direct: 0%, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99 – Boo Sales–Whsl: 0%, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99, $2.99 – Booklet Sales–Direct: 0%, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59 – Booklet Sales–Whsl: 0%, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59, $1.59 – Subtotal Direct Cost of Sales: $6,000, $30,755, $28,800, $53,925, $39,580, $62,751, $50,345, $71,631, $53,540, $86,467, $54,335, $81,687 Note: The provided table displays sales forecasts and related unit prices for various products over a twelve-month period. The information has been condensed to eliminate redundancy and improve readability. Personnel Plan Production Personnel Name or Title or Group Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Subtotal $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Sales and Marketing Personnel Ad Sales Mgr. $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 Subscription Mgr. $0 $0 $0 $0 $0 $0 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 Subtotal $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $5,500 $5,500 $5,500 $5,500 $5,500 $5,500 General and Administrative Personnel Red Brushwielder, CEO $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 Ochre & Sienna Burnt, Exec. Editors $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 John Crimson, CFO $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 Exec. Asst. $0 $0 $0 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 Timothy Clark, VP Corp. Dev. $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 $1,500 Subtotal $11,900 $11,900 $11,900 $13,900 $13,900 $13,900 $13,900 $13,900 $13,900 $13,900 $13,900 $13,900 Other Personnel Art Director $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 $4,400 Freelance Artist $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Bookkeeper $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 $450 Subtotal $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 $5,350 Total People 8 8 8 8 9 9 10 10 10 10 10 10 Total Payroll $20,250 $20,250 $20,250 $22,250 $22,250 $22,250 $24,750 $24,750 $24,750 $24,750 $24,750 $24,750 Pro Forma Profit and Loss Sales: – Month 1: $21,250 – Month 2: $147,930 – Month 3: $169,875 – Month 4: $262,625 – Month 5: $211,510 – Month 6: $299,279 – Month 7: $274,770 – Month 8: $346,879 – Month 9: $300,700 – Month 10: $380,769 – Month 11: $304,675 – Month 12: $381,509 Direct Cost of Sales: – Month 1: $6,000 – Month 2: $30,755 – Month 3: $28,800 – Month 4: $53,925 – Month 5: $39,580 – Month 6: $62,751 – Month 7: $50,345 – Month 8: $71,631 – Month 9: $53,540 – Month 10: $86,467 – Month 11: $54,335 – Month 12: $81,687 Production Payroll: – Month 1 to Month 12: $0 Author’s Royalties: 15% – Month 1 to Month 12: $0 – Month 4: $4,709 – Month 5: $1,794 – Month 6: $6,274 – Month 7: $8,741 – Month 8: $10,234 – Month 9: $11,355 – Month 10: $13,745 – Month 11: $11,951 – Month 12: $11,951 Total Cost of Sales: – Month 1: $6,000 – Month 2: $30,755 – Month 3: $28,800 – Month 4: $58,634 – Month 5: $41,374 – Month 6: $69,025 – Month 7: $59,086 – Month 8: $81,865 – Month 9: $64,895 – Month 10: $100,212 – Month 11: $66,286 – Month 12: $93,638 Gross Margin: – Month 1: $15,250 – Month 2: $117,175 – Month 3: $141,075 – Month 4: $203,991 – Month 5: $170,136 – Month 6: $230,254 – Month 7: $215,685 – Month 8: $265,014 – Month 9: $235,805 – Month 10: $280,557 – Month 11: $238,389 – Month 12: $287,871 Gross Margin %: – Month 1: 71.76% – Month 2: 79.21% – Month 3: 83.05% – Month 4: 77.67% – Month 5: 80.44% – Month 6: 76.94% – Month 7: 78.50% – Month 8: 76.40% – Month 9: 78.42% – Month 10: 73.68% – Month 11: 78.24% – Month 12: 75.46% Operating Expenses: Sales and Marketing Expenses: – Month 1 to Month 12: $7,700 – Month 2: $43,424 – Month 4: $43,424 – Month 6: $67,647 – Month 8: $70,397 – Month 10: $87,167 Sales and Marketing Payroll: – Month 1 to Month 12: $3,000 – Month 7 to Month 12: $5,500 Advertising/Promotion: – Month 2: $38,724 – Month 4: $38,724 – Month 6: $62,947 – Month 8: $62,947 – Month 10: $79,717 Travel: – Month 1 to Month 12: $500 – Month 7 to Month 12: $750 Entertainment & Meals: – Month 1 to Month 12: $200 Miscellaneous: – Month 1 to Month 12: $1,000 Total Sales and Marketing Expenses: – Month 1: $7,700 – Month 2: $43,424 – Month 4: $43,424 – Month 6: $67,647 – Month 8: $70,397 – Month 10: $87,167 Sales and Marketing %: – Month 1: 36.24% – Month 2: 29.35% – Month 3: 4.53% – Month 4: 16.53% – Month 5: 3.64% – Month 6: 22.60% – Month 7: 4.46% – Month 8: 20.29% – Month 9: 4.07% – Month 10: 22.89% – Month 11: 4.02% – Month 12: 22.85% General and Administrative Expenses: General and Administrative Payroll: – Month 1 to Month 12: $11,900 Leased Equipment: – Month 1 to Month 12: $850 Telephone: – Month 1 to Month 12: $600 Postage: – Month 2: $13,950 – Month 4: $13,950 – Month 6: $23,250 – Month 8: $23,250 – Month 10: $31,000 Rent: – Month 1 to Month 12: $2,500 Utilities: – Month 1 to Month 12: $750 Insurance: – Month 1 to Month 12: $1,000 Payroll Taxes: 20% – Month 1 to Month 12: $0 Total General and Administrative Expenses: – Month 1: $17,900 – Month 2: $31,550 – Month 4: $33,550 – Month 6: $42,850 – Month 8: $42,850 – Month 10: $50,600 General and Administrative %: – Month 1: 84.24% – Month 2: 21.33% – Month 3: 10.54% – Month 4: 12.77% – Month 5: 9.41% – Month 6: 14.32% – Month 7: 7.24% – Month 8: 12.35% – Month 9: 6.62% – Month 10: 13.29% – Month 11: 6.53% – Month 12: 13.26% Other Expenses: Other Payroll: – Month 1 to Month 12: $5,350 Total Other Expenses: – Month 1 to Month 12: $5,350 Other %: – Month 1: 25.18% – Month 2: 3.62% – Month 3: 3.15% – Month 4: 2.04% – Month 5: 2.53% – Month 6: 1.79% – Month 7: 1.95% – Month 8: 1.54% – Month 9: 1.78% – Month 10: 1.41% – Month 11: 1.76% – Month 12: 1.40% Total Operating Expenses: – Month 1: $30,950 – Month 2: $80,324 – Month 4: $82,324 – Month 6: $115,847 – Month 8: $118,597 – Month 10: $143,117 Profit Before Interest and Taxes: – Month 1: ($15,700) – Month 2: $36,851 – Month 3: $110,125 – Month 4: $121,667 – Month 5: $137,186 – Month 6: $114,407 – Month 7: $178,185 – Month 8: $146,417 – Month 9: $198,305 – Month 10: $137,440 – Month 11: $200,889 – Month 12: $144,754 EBITDA: – Month 1: ($15,700) – Month 2: $36,851 – Month 3: $110,125 – Month 4: $121,667 – Month 5: $137,186 – Month 6: $114,407 – Month 7: $178,185 – Month 8: $146,417 – Month 9: $198,305 – Month 10: $137,440 – Month 11: $200,889 – Month 12: $144,754 Interest Expense: – Month 1 to Month 12: $0 Taxes Incurred: – Month 1: ($4,710) – Month 2: $11,055 – Month 3: $33,038 – Month 4: $36,500 – Month 5: $41,156 – Month 6: $34,322 – Month 7: $53,455 – Month 8: $43,925 – Month 9: $59,492 – Month 10: $41,232 – Month 11: $60,267 – Month 12: $43,426 Net Profit: – Month 1: ($10,990) – Month 2: $25,796 – Month 3: $77,088 – Month 4: $85,167 – Month 5: $96,030 – Month 6: $80,085 – Month 7: $124,729 – Month 8: $102,492 – Month 9: $138,814 – Month 10: $96,208 – Month 11: $140,622 – Month 12: $101,328 Net Profit/Sales: – Month 1: -51.72% – Month 2: 17.44% – Month 3: 45.38% – Month 4: 32.43% – Month 5: 45.40% – Month 6: 26.76% – Month 7: 45.39% – Month 8: 29.55% – Month 9: 46.16% – Month 10: 25.27% – Month 11: 46.15% – Month 12: 26.56% Pro Forma Cash Flow |

|||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $19,125 | $133,137 | $152,888 | $236,363 | $190,359 | $269,351 | $247,293 | $312,191 | $270,630 | $342,692 | $274,208 | $343,358 | |

| Cash from Receivables | $0 | $71 | $2,547 | $14,866 | $17,297 | $26,092 | $21,444 | $29,846 | $27,717 | $34,534 | $30,337 | $37,823 | |

| Subtotal Cash from Operations | $19,125 | $133,208 | $155,435 | $251,229 | $207,656 | $295,443 | $268,737 | $342,037 | $298,347 | $377,226 | $304,544 | $381,181 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $19,125 | $133,208 | $155,435 | $251,229 | $207,656 | $295,443 | $268,737 | $342,037 | $298,347 | $377,226 | $304,544 | $381,181 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $20,250 | $20,250 | $20,250 | $22,250 | $22,250 | $22,250 | $24,750 | $24,750 | $24,750 | $24,750 | $24,750 | $24,750 | |

| Bill Payments | $620 | $22,274 | $127,157 | $74,136 | $179,333 | $82,283 | $218,739 | $116,024 | $238,858 | $123,196 | $289,628 | $110,010 | |

| Subtotal Spent on Operations | $20,870 | $42,524 | $147,407 | $96,386 | $201,583 | $104,533 | $243,489 | $140,774 | $263,608 | $147,946 | $314,378 | $134,760 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $20,870 | $42,524 | $147,407 | $96,386 | $201,583 | $104,533 | $243,489 | $140,774 | $263,608 | $147,946 | $314,378 | $134,760 | |

| Net Cash Flow | ($1,745) | $90,684 | $8,028 | $154,843 | $6,073 | $190,910 | $25,247 | $201,263 | $34,740 | $229,280 | ($9,834) | $246,422 | |

| Cash Balance | $65,255 | $155,939 | $163,967 | $318,810 | $324,883 | $515,793 | |||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!