D.A.P. Exports exports automobile parts and auto lubricants to Jamaica, Venezuela, Columbia, and Ecuador. The company combines American-made products with foreign parts, repackaging and labeling them as necessary.

The auto part sales industry in Latin America and the Caribbean is currently worth $100 million. Most of the automobiles in these countries were manufactured in the 1980s, making it difficult to find replacement parts. Auto makers primarily focus on cars produced in the last ten years.

D.A.P. Exports has an extensive network of customer contacts in the region. James Dunn, the owner, has twenty years of experience selling consumer products in Latin America and the Caribbean. He has worked for Axiom Food Products, Klymor Manufacturing, and Dudley Food Products.

During his previous years in the region, James used taxi services and noticed the high demand for auto parts and lubricants. He also discovered the most effective distribution system for these products through local taxi companies.

D.A.P. Exports will partner with the region’s taxi companies to offer wholesale auto parts and lubricants. The taxi companies can use the parts to repair their vehicles or sell them directly to consumers. Additionally, D.A.P. Exports will sell auto parts to stores in the region.

D.A.P. Exports has the following objectives:

– Achieve high sales revenues in the first year.

– Establish a customer base of 100 taxi companies in the region.

– Gradually increase sales in the second year.

The mission of D.A.P. Exports is to be the preferred auto parts provider for taxi companies in the region.

D.A.P. Exports exports automobile parts and auto lubricants to various countries, including Jamaica, Venezuela, Columbia, and Ecuador. The company combines American-made products with foreign parts, repackaging and labeling as needed.

The company is organized as a limited liability partnership.

D.A.P. Exports operates from an 8,000 square foot facility in Monroe, Florida, strategically located near South Florida’s transportation hub, ensuring cost control and efficient access to key markets.

The company is owned by James Dunn and a silent partner.

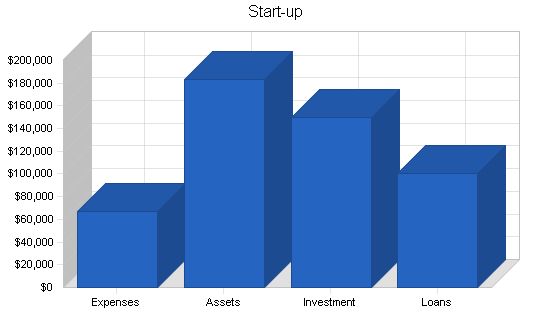

The start-up expenses for D.A.P. Exports mainly involve inventory and repackaging equipment. James Dunn will personally invest in the company, and additional funds will be contributed by the silent partner. Dunn will also secure a long-term loan.

Start-up Requirements:

Legal: $10,000

Stationery etc.: $1,000

Brochures: $2,000

Insurance: $2,000

Rent: $2,000

Expensed Equipment: $50,000

Total Start-up Expenses: $67,000

Start-up Assets:

Cash Required: $83,000

Start-up Inventory: $100,000

Other Current Assets: $0

Long-term Assets: $0

Total Assets: $183,000

Total Requirements: $250,000

Start-up Funding:

Start-up Expenses to Fund: $67,000

Start-up Assets to Fund: $183,000

Total Funding Required: $250,000

Assets:

Non-cash Assets from Start-up: $100,000

Cash Requirements from Start-up: $83,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $83,000

Total Assets: $183,000

Liabilities and Capital:

Liabilities:

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital:

Planned Investment:

James Dunn: $50,000

Silent Partner: $100,000

Additional Investment Requirement: $0

Total Planned Investment: $150,000

Loss at Start-up (Start-up Expenses): ($67,000)

Total Capital: $83,000

Total Capital and Liabilities: $183,000

Total Funding: $250,000

Products:

D.A.P. Exports offers the following products:

– Transmission parts

– Engine parts

– Electrical parts

– Engine lubricants

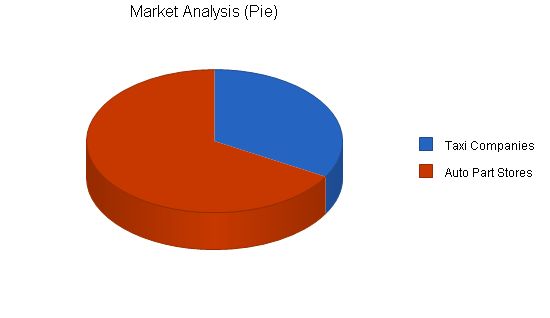

Market Analysis Summary:

The auto part sales industry in Latin America and the Caribbean is valued at $100 million. Most of the automobiles in these countries were manufactured in the 1980s, making it challenging to find replacement parts. Auto makers mainly focus on newer cars, leaving a limited supply of parts for older vehicles. The market is underserved, with few stores and high prices for auto parts. However, D.A.P. Exports aims to tap into this market by targeting taxi companies, in addition to traditional auto part stores. Taxi companies are the largest buyers of auto parts in the region, and D.A.P. Exports has established strong connections with them.

Market Segmentation:

D.A.P. Exports will primarily target the following customers:

– Taxi companies

– Auto part stores

Individuals may also purchase from D.A.P., but stores and taxi services are more attractive customers due to their repeat business, lower price sensitivity, and larger volume per order.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth

Taxi Companies 10% 2,000 2,200 2,420 2,662 2,928 10.00%

Auto Part Stores 8% 4,000 4,320 4,666 5,039 5,442 8.00%

Total 8.68% 6,000 6,520 7,086 7,701 8,370 8.68%

Currently, the markets are too small to attract many competitors. The auto parts shops in the region are not expanding to meet the demand for parts for older cars. They are instead focusing on newer cars imported by wealthy individuals.

Utilizing taxi services as a distribution network and primary customers is an excellent strategy to capture market share in a segment currently ignored by bigger players.

4.3 Target Market Segment Strategy

There are estimated to be over 25,000 vehicles in the region used by taxi services, and that number is growing.

Taxi firms are excellent target customers for D.A.P. Export products. First, they represent the largest buying block in our target countries. Additionally, there is no established channel for them to purchase parts for their cars at this time.

By buying directly from D.A.P. Export, taxi firms can reduce the cost of parts and receive exactly what they need quickly.

Although many taxi drivers work independently or for small companies, the informal network within this group is extensive. There is a lot of downtime in this business, where drivers are waiting for fares. They will chat with friends and colleagues about their cars and work. Word-of-mouth recommendations will benefit us.

4.4 Competition and Buying Patterns

Without much competition, the key to maintaining the customer base is to provide the right parts at a reasonable price, delivered quickly. As D.A.P. Exports meets customer demand in a timely manner, sales will grow. The company will be able to strengthen critical business relationships for when competition does emerge.

Strategy and Implementation Summary

D.A.P. Exports will offer a 15% discount on all purchases of $1,000 or more. We will also have two salespeople based in Latin America and the Caribbean. Our focus will be establishing a strong relationship with the region’s taxi services.

James has established export contacts in Latin America and the Caribbean, making the process of developing an export channel for car parts much easier. In these countries, much business is done through a handshake and word of mouth, rather than formal contracts. His experience and contacts will be invaluable in this environment.

5.1 Competitive Edge

The products D.A.P. is selling are made for older cars. The trend in this country is towards newer cars, so domestic demand for these parts is falling. James will be able to negotiate excellent prices on these products and order in bulk, further increasing his negotiating leverage.

Another competitive edge of D.A.P. Exports is the ability to assemble a product package that exactly fits a customer’s needs. When taxi services buy directly from D.A.P. Exports, they receive the highest quality product at the lowest price. Previously, car owners had to spend time shopping around for parts due to the lack of an organized, established channel. This resulted in their cars being off the road for longer periods, costing them more lost revenue.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

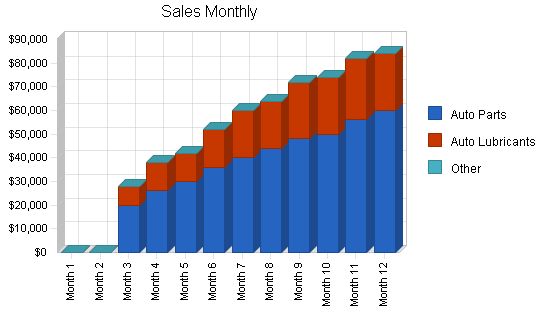

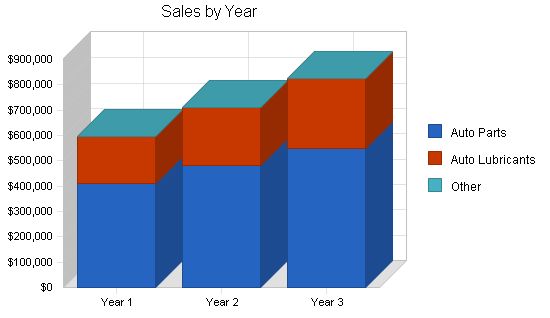

5.2 Sales Forecast

The following is the sales forecast for three years.

Sales Forecast:

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Auto Parts | $410,000 | $480,000 | $550,000 |

| Auto Lubricants | $186,000 | $230,000 | $274,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $596,000 | $710,000 | $824,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Auto Parts | $200,000 | $240,000 | $275,000 |

| Auto Lubricants | $93,000 | $115,000 | $137,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $293,000 | $355,000 | $412,000 |

Contents

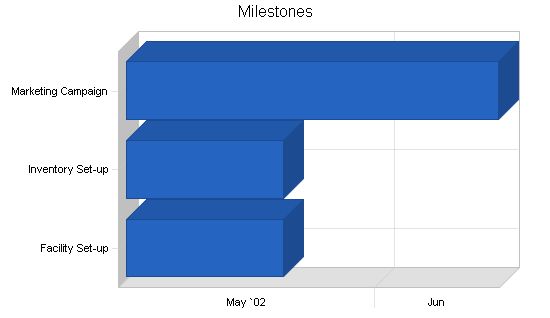

5.3 Milestones

The accompanying chart and table provide important program milestones, with dates, managers in charge, and budgets. The milestone schedule emphasizes planning for implementation.

Milestones:

| Facility Set-up | 5/1/2002 | 5/20/2002 | $20,000 | James Dunn | Marketing |

| Inventory Set-up | 5/1/2002 | 5/20/2002 | $100,000 | James Dunn | Department |

| Marketing Campaign | 5/1/2002 | 6/15/2002 | $20,000 | James Dunn | Department |

| Totals | $140,000 |

5.4 Marketing Strategy

In May and June, regional salespeople will deliver presentations to taxi firms and auto parts stores in the region. D.A.P. Export will offer a 15% discount on all purchases over $1,000.

The key to the marketing strategy is continuous follow-up with customers to anticipate future parts inventory needs.

Management Summary

James Dunn, owner of D.A.P Exports, will manage the business. With twenty years of experience selling consumer products in Latin America and the Caribbean, he has extensive knowledge of the region and culture. He has contacts with people and businesses gained from years of living or working in the country. James has been a salesperson for Axiom Food Products, Klymor Manufacturing, and Dudley Food Products, and traveled to the Caribbean and Latin America at least three times a year.

James has excellent management skills. In his last position, he managed a sales staff of five people, beating the sales quota by more than 10% each year. He successfully motivated each staff member to perform their best

James also has experience running a small business. He and his wife have successfully run a small catering business in their hometown for the past four years. James’ wife will continue to run this business while he focuses on launching D.A.P. Exports.

6.1 Personnel Plan

D.A.P. Exports’ personnel:

- James Dunn

- 4 Facility Staff

- 2 Sales Staff

| Total People | Year 1 | Year 2 | Year 3 |

| James Dunn | $36,000 | $39,000 | $42,000 |

| 4 Facility Staff | $86,400 | $94,000 | $102,000 |

| 2 Sales Staff | $72,000 | $80,000 | $88,000 |

| Total People | 7 | 7 | 7 |

| Total Payroll | $194,400 | $213,000 | $232,000 |

Financial Plan

Here is the financial plan for D.A.P. Exports.

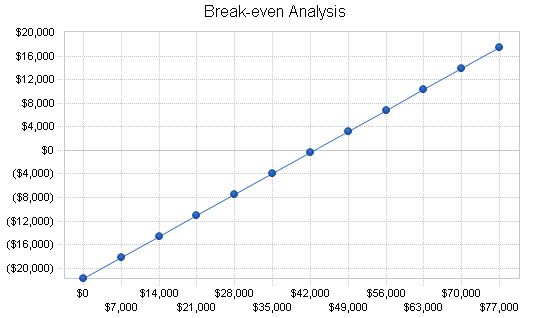

7.1 Break-even Analysis

The monthly break-even point, based on average monthly running costs and estimated variable costs of sales, is shown below.

| Break-even Analysis | |

| Monthly Revenue Break-even | $42,743 |

| Assumptions: | |

| Average Percent Variable Cost | 49% |

| Estimated Monthly Fixed Cost | $21,730 |

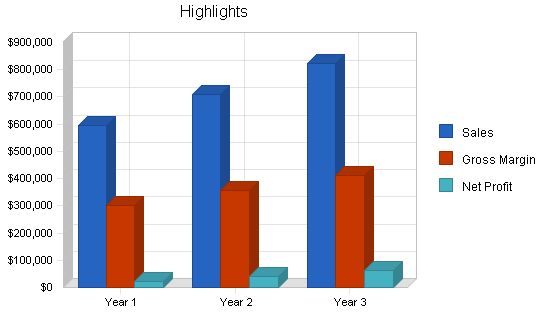

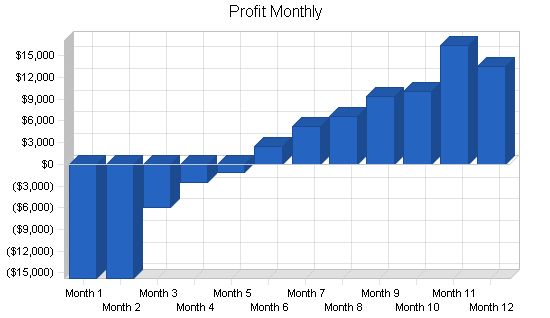

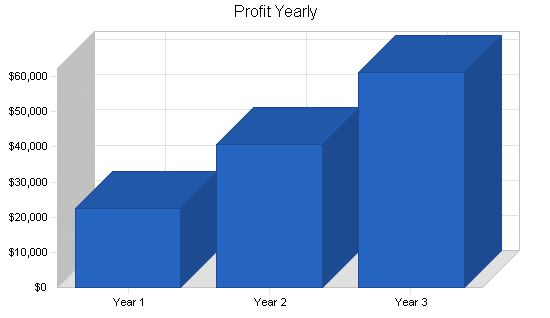

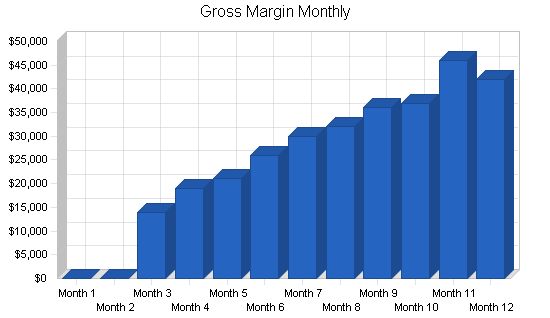

7.2 Projected Profit and Loss

The table and charts below show the projected profit and loss for three years.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $596,000 $710,000 $824,000

Direct Cost of Sales $293,000 $355,000 $412,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $293,000 $355,000 $412,000

Gross Margin $303,000 $355,000 $412,000

Gross Margin % 50.84% 50.00% 50.00%

Expenses

Payroll $194,400 $213,000 $232,000

Sales and Marketing and Other Expenses $6,000 $10,000 $15,000

Depreciation $0 $0 $0

Leased Equipment $0 $0 $0

Utilities $7,200 $8,000 $9,000

Insurance $0 $0 $0

Rent $24,000 $24,000 $24,000

Payroll Taxes $29,160 $31,950 $34,800

Other $0 $0 $0

Total Operating Expenses $260,760 $286,950 $314,800

Profit Before Interest and Taxes $42,240 $68,050 $97,200

EBITDA $42,240 $68,050 $97,200

Interest Expense $10,000 $10,000 $10,000

Taxes Incurred $9,672 $17,415 $26,160

Net Profit $22,568 $40,635 $61,040

Net Profit/Sales 3.79% 5.72% 7.41%

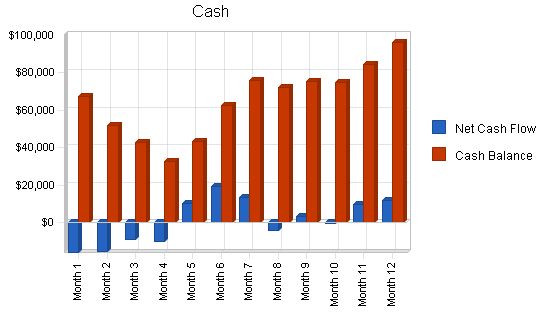

7.3 Projected Cash Flow

The following table and chart highlight the projected cash flow for three years.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $149,000 | $177,500 | $206,000 |

| Cash from Receivables | $324,550 | $509,078 | $594,578 |

| Subtotal Cash from Operations | $473,550 | $686,578 | $800,578 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $473,550 | $686,578 | $800,578 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $194,400 | $213,000 | $232,000 |

| Bill Payments | $265,680 | $487,380 | $533,881 |

| Subtotal Spent on Operations | $460,080 | $700,380 | $765,881 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $460,080 | $700,380 | $765,881 |

| Net Cash Flow | $13,470 | ($13,802) | $34,697 |

| Cash Balance | $96,470 | $82,668 | $117,365 |

7.4 Projected Balance Sheet

The following table highlights the projected balance sheet for three years.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $96,470 | $82,668 | $117,365 |

| Accounts Receivable | $122,450 | $145,872 | $169,293 |

| Inventory | $46,200 | $55,976 | $64,964 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $265,120 | $284,516 | $351,622 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $265,120 | $284,516 | $351,622 |

| Liabilities and Capital | |||

| Year 1 | Year 2 | Year 3 | |

| Current Liabilities | |||

| Accounts Payable | $59,552 | $38,313 | $44,379 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $59,552 | $38,313 | $44,379 |

| Long-term Liabilities | |||

| $100,000 | $100,000 | $100,000 | |

| Total Liabilities | $159,552 | $138,313 | $144,379 |

| Paid-in Capital | $150,000 | $150,000 | $150,000 |

| Retained Earnings | ($67,000) | ($44,432) | ($3,797) |

| Earnings | $22,568 | $40,635 | $61,040 |

| Total Capital | $105,568 | $146,203 | $207,243 |

| Total Liabilities and Capital | $265,120 | $284,516 | $351,622 |

| Net Worth | $105,568 | $146,203 | $207,243 |

7.5 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5013, Motor Vehicles Supplies and New Parts, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 19.13% | 16.06% | 12.20% |

| Percent of Total Assets | ||||

| Accounts Receivable | 46.19% | 51.27% | 48.15% | 25.10% |

| Inventory | 17.43% | 19.67% | 18.48% | 46.10% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 15.10% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 86.30% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 13.70% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 22.46% | 13.47% | 12.62% | 46.60% |

| Long-term Liabilities | 37.72% | 35.15% | 28.44% | 11.50% |

| Total Liabilities | 60.18% | 48.61% | 41.06% | 58.10% |

| Net Worth | 39.82% | 51.39% | 58.94% | 41.90% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 50.84% | 50.00% | 50.00% | 21.70% |

| Selling, General & Administrative Expenses | 47.05% | 44.28% | 42.59% | 13.20% |

| Advertising Expenses | 1.01% | 1.41% | 1.82% | 0.70% |

| Profit Before Interest and Taxes | 7.09% | 9.58% | 11.80% | 1.40% |

| Main Ratios | ||||

| Current | 4.45 | 7.43 | 7.92 | 1.98 |

| Quick | 3.68 | 5.97 | 6.46 | 0.78 |

| Total Debt to Total Assets | 60.18% | 48.61% | 41.06% | 58.10% |

| Pre-tax Return on Net Worth | 30.54% | 39.71% | 42.08% | 3.80% |

| Pre-tax Return on Assets | 12.16% | 20.40% | 24.80% | 9.00% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 3.79% | 5.72% | 7.41% | n.a |

| Return on Equity | 21.38% | 27.79% | 29.45% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.65 | 3.65 | 3.65 | n.a |

| Collection Days | 56 | 92 | 93 | n.a |

| Inventory Turnover | 5.31 | 6.95 | 6.81 | n.a |

| Accounts Payable Turnover | 5.46 | 12.17 | 12.17 | n.a |

| Payment Days | 28 | 38 | 28 | n.a |

| Total Asset Turnover | 2.25 | 2.50 | 2.34 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 1.51 | 0.95 | 0.70 | n.a |

| Current Liab. to Liab. | 0.37 | 0.28 | 0.31 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| James Dunn | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| 4 Facility Staff | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | $7,200 | |

| 2 Sales Staff | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Total People | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | |

| Total Payroll | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $28,000 | $38,000 | $42,000 | $52,000 | $60,000 | $64,000 | $72,000 | $74,000 | $82,000 | $84,000 | |

| Direct Cost of Sales | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $36,000 | $42,000 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $36,000 | $42,000 | |

| Gross Margin | $0 | $0 | $14,000 | $19,000 | $21,000 | $26,000 | $30,000 | $32,000 | $36,000 | $37,000 | $46,000 | $42,000 | |

| Gross Margin % | 0.00% | 0.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 50.00% | 56.10% | 50.00% | |

| Expenses | |||||||||||||

| Payroll | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | $16,200 | |||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!