Interior Views is a retail store that offers home decorator fabrics and complementary home accessories and resources. It has been in business for almost five years. This store specializes in fabrics designed for home decorator use, with widths of 54 inches and greater. It has over 900 fabrics available on the floor and more than 10,000 sample fabrics for custom orders. Customers can see, touch, and take the fabric home to help with their purchasing decision.

Interior Views has learned a lot from its past years of operation and is now making key decisions, such as the upcoming 5-year lease. This business plan aims to set a strategic direction for the future by addressing location, finance, product, and service issues that are crucial to the business’s success.

Currently, Interior Views has a local informational website, but it has not focused on assessing its marketing potential. The website offers information content but does little to generate revenue or enhance the business’s image.

Market research shows a growing need for the products and services offered by Interior Views, both locally and beyond. There is also an increasing role for web sales in connecting customers with sellers. However, the core target customer, women aged 35-50, are less likely to shop on the web. Shopping for decorator fabric presents an additional challenge.

The online marketing objective is to support the growth and profitability of Interior Views through the effective implementation of a cost-effective strategy. The strategy will involve using an eBay website to reach additional customers over the web and generate attention and revenue for the business. The target groups for the website will include the younger customer base (women aged 25-35) that the store currently serves, as well as out-of-area potential customers who are already shopping on the web for the products available at Interior Views. The eBay website will differentiate itself through its selection, competitive pricing, and customer service.

Objectives:

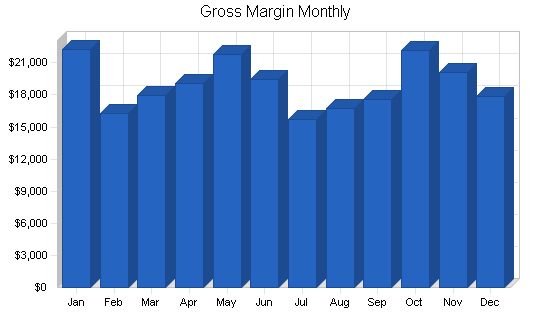

1. Maintain a healthy gross margin each month.

2. Generate sales every business day each month.

3. Achieve a modest annual growth rate this year.

4. Increase revenues through eBay-based sales to $5,700 per month by the end of the first year, with a 5% growth rate thereafter.

5. Enhance "information channels" with the established customer base to provide additional options to receive information from the store.

6. Meet the needs of customers outside the immediate serving area through eBay/Web accessibility.

Mission:

Interior Views LLC is a store for discerning, quality-conscious buyers of decorator fabrics and complementary home accessories and furniture. This store celebrates the home through the color and texture of fabric. The experience informs, inspires, and helps people transform their home into a unique and personalized expression of themselves. Interior Views aims to encourage people to imagine what can be and help make this vision a reality.

Keys to Success:

– Sell high-quality products with excellent customer support.

– Communicate with the customer base through newsletters, postcards, and the website.

– Maintain gross margins of over 45%.

– Retain customers to generate repeat purchases and referrals.

– Generate additional sales to cover all expenses related to the website as a profitable center.

Interior Views offers quality products for home decorating such as decorator fabrics, drapery hardware, pillow forms, sewing notions, home accessories, and select antiques. The store also offers classes focused on fabric use for DIY customers, and fabric fabrication and upholstery services for customers who make fabric purchases. The goal is for the store and website to be the top choice for these products and services in the market and beyond.

Interior Views is a Limited Liability Company owned by two couples: the Williams with 70% ownership and the Swansons with 30% ownership. Judy Williams serves as president with Doug Williams assisting in marketing and store layout. The Swansons have a silent partner role.

Since its opening on December 16, 1996, Interior Views has had a surprising journey. The past three years have shown a slow but steady increase in revenues, with a reduction in total revenues in year five. In-stock fabric revenues decreased, while special order fabric revenues remained stable, especially for higher-end purchases. This reduction in revenue has resulted in limited purchases and minimal expansion in new product areas. For example, the store has held back on expanding the "Oval Office Iron" line due to cash constraints.

In terms of marketing activities, we have categorized them as "Do It Again" and "Did Not Work" based on ROI from trackable sales.

"Do It Again" Marketing:

– Quarterly Newsletter with three elements: sales event, fabric-oriented classes, and events such as open houses, demonstrations, and charity fundraisers.

– Newspaper ad in the Pleasantville Herald’s Wednesday "Entree" section announcing sales events.

– Television advertising through co-sponsorship of the local broadcast of "Martha Stewart" and select sponsorship of the local broadcast of "Interior Motives."

"Do It Again" Product Development:

– Explore the use of local craftsmen, especially for the successful "Oval Office Iron" product line.

– The Antique Bureau has brought in a steady quantity of qualified customers, thanks to Teresa’s addition to the team.

"Did Not Work" Marketing:

– Advertising and sponsorship of local ballet and opera performance programs.

– Advertising in the Pleasantville Junior League Newsletter.

– Advertising in the Downtown Athletic Club Newsletter.

– Local television advertising on talk show formats, news shows, and general audience programs.

– Hilton Hotel "In-room" book advertisements.

"Did Not Work" Product Development:

– The slip-covered furniture line was too costly and lacked perceived value.

– Architectural storage and shelving pieces faced questions about their value.

In terms of hiring, it’s essential to bring on board people who understand the essence of the store and could be customers themselves. Sub-lease candidates should be screened as closely as employees.

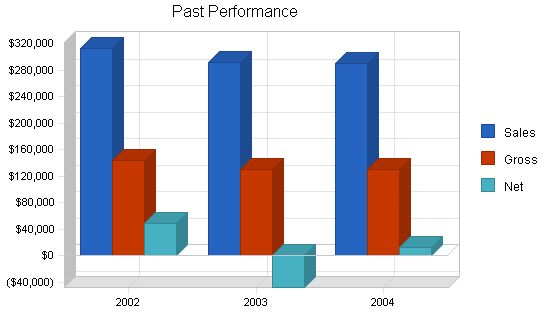

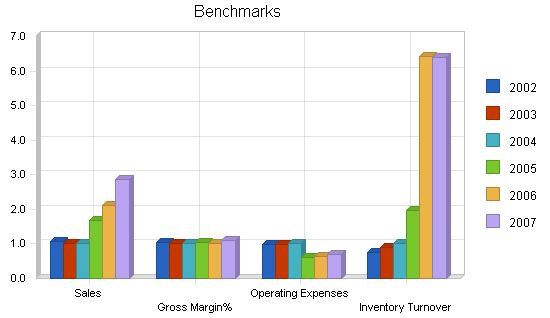

Past Performance

Year 2002 2003 2004

Sales $312,302 $291,313 $290,000

Gross Margin $143,658 $130,220 $129,520

Gross Margin % 46.00% 44.70% 44.66%

Operating Expenses $220,050 $222,660 $226,520

Inventory Turnover 1.50 1.80 2.00

Balance Sheet

Year 2002 2003 2004

Current Assets

Cash $955 $1,225 $1,200

Inventory $152,500 $150,100 $150,000

Other Current Assets $2,250 $2,350 $2,300

Total Current Assets $155,705 $153,675 $153,500

Long-term Assets

Long-term Assets $3,850 $4,140 $4,200

Accumulated Depreciation $1,850 $1,990 $2,050

Total Long-term Assets $2,000 $2,150 $2,150

Total Assets $157,705 $155,825 $155,650

Current Liabilities

Accounts Payable $102,257 $91,115 $8,000

Current Borrowing $7,200 $21,525 $22,000

Other Current Liabilities (interest free) $5,000 $940 $1,150

Total Current Liabilities $114,457 $113,580 $31,150

Long-term Liabilities

$0 $0 $0

Total Liabilities $114,457 $113,580 $31,150

Paid-in Capital $0 $0 $0

Retained Earnings ($5,172) $89,745 $112,500

Earnings $48,420 ($47,500) $12,000

Total Capital $43,248 $42,245 $124,500

Total Capital and Liabilities $157,705 $155,825 $155,650

Other Inputs

Payment Days 30 40 40

2.3 Company Locations and Facilities

Interior Views is located in Pleasantville, Ourstate. It is not situated in a typical retail location. This older, warehouse-type section of downtown continues to emerge as a retail area and does hold promise. REI is across the street, a dance and theater retail store has just recently moved next door, and a fitness center remains active around the clock. The location was selected due to the “destination” aspects of the target market – they will seek out these types of stores regardless of location as long as there is parking and it is safe. The look and feel of the street environment continues to improve with recent parking and landscape enhancements. The attractive aspect is the cost of the space and its “warehouse” charm. The challenging aspect is the lack of foot traffic and drive-by exposure.

The 5-year lease is up in December and potential relocation or reductions in the lease are both possibilities with one of the highest vacancy rates of commercial and retail space in the market the past decade.

Products

Interior Views focuses on selling decorator fabric for use in the home. It is available through the purchase of in-stock fabric and through a special order arrangement. Other fabric-related complementary products include trims, pillows, ribbon, and thread.

Additional products now available in the store include:

– Hunter Douglas products including a variety of hard window coverings.

– Interior shutters made of wood and a plastic/resin product called “polywood.”

– An in-house line of drapery hardware locally manufactured products that we design and market under the product name of “Oval Office Iron” offering wrought iron drapery hardware (We have plans to expand this to also include other metal home decor products and potentially outdoor garden products.).

– Home accessories through a “percentage” relationship with “The Window Seat” and Sarah Melvin.

– Antiques through a consignment arrangement with Joyce McMillian.

– Antiques through a sub-lease revenue arrangement with Teresa Mitchell and “The Antique Bureau.”

Initially, our eBay store will focus on fabrics and home decorating products and accessories. The size, weight, and custom dimension shipping constraints on our “Oval Office Iron” wrought iron drapery hardware will initially preclude our offering this product line on the eBay store.

3.1 Product Description

Our primary points of differentiation offer these qualities:

– The most extensive access to in-stock, first quality decorator fabrics, at affordable prices, within 100 miles of our primary geographic market.

– The largest selection of special-order fabrics, with arrangements to have most of those products shipped to the store within 10 days of placing the order.

– Personal assistance from a design-oriented staff that is qualified and capable of meeting the needs of discerning customers with high expectations.

– Complementary product offerings, including hard-covering window treatment, hardware, home accessories, made-to-order upholstered furniture, and antiques that are designed, selected, and displayed in a way to emphasize the use of fabric in home design.

Interior Views will qualify for the most attractive retail discount through these suppliers, offering greater profit margins and more competitive pricing for bolt purchases in quantities of 50 to 60 yards, or in half of that yardage with a “cutting fee” that often increases cost per yard by $.50 to $1.00 depending on the source. The primary product lines will include fabrics from the following textile sources:

– Robert Allen Fabrics

– Fabricut

– Waverly Fabrics

– Spectrum

– Art Mark

– Covington

– P/Kaufmann

Complementary accessories, including fabric trims, drapery hardware, and hard-covering window treatments, are supplied from the following sources:

– Hunter Douglas: Hard-window coverings

– Kirsh: Rods with selected window hardware and accessories

– Conso: Trims and Fabric Accessories

– Petersen-Arne: Trims and Accessories

– Graber: Selected window hardware

– Grumman: Threads

Again, we have also created a line of metal drapery hardware called “Oval Office Iron” that has replaced the Antique Drapery Rod line. A local craftsman, Mike Overman, produces these products based on our specifications and requirements.

3.2 Competitive Comparison

Our competition has changed. When we opened the store, we considered the classic fabric stores within the state to offer the greatest amount of competition. The competitors have increased primarily due to the expansion of nationally recognized businesses.

– Bed, Bath and Beyond moved into the market recently, within one mile at an excellent location.

– Discount stores including Target, Walmart, and Home Depot have expanded their fabric, bedding, pillow, and ready-made drapery selections often representing lines including Waverly and in some cases, with the same fabric.

– Norwalk continues to make purchasing “blank” furniture and making a fabric selection an attractive option to recovering furniture.

– Catalog sales continue to be a strong force with a list including Pottery Barn, Calico Corners, Ballard Design, and Eddie Bauer expanding purchasing selection.

– The list of competitors for home accessory competition includes Pier 1 and local competitors including Reed & Cross, The Shamrock, and a list of other furniture, accessory, and gift stores.

– Web sales of fabric have expanded dramatically and are easily available.

3.3 Sales Literature

Our most significant piece of literature continues to be the newsletter. This “federal-style” newsletter goes out three times each year and features:

– Sale events

– Class schedules

– Trends

– Fabric design suggestions

– “Dear Decora” with useful, but meant to be humorous, decorating advice

The newsletter is sent bulk mail, and we also send postcards to promote a special sale and/or event.

Our informational website will now display our newsletter online and have archives of previous issues. We will use our eBay customer database to send email newsletters to those who opt-in to the service.

All of our new literature and reprints of current material will include listings or active links to our home site and our eBay store site.

3.4 Sourcing

Fabric

A majority of the fabric is purchased through 12 major fabricators. Reps visit regularly, they are available by phone and are present at the four major trade shows that occur throughout the country.

Trims and Notions

There are three major sources of trim and notion providers.

Drapery and Window Treatment Goods

Hunter Douglas is the primary source of hard window coverings including duettes, vignettes, verticals, shutters, and other products. The “Oval Office Iron” line is created by a local craftsman.

Our eBay store sales will be fulfilled from Interior Views’ main inventory.

3.5 Technology

Technology has changed the industry and the business through the Internet. Information about product availability and pricing is easily available. The low cost and easy process of shipping fabric have made this more interesting.

With the establishment of its eBay store and through better utilization of its existing website, Interior Views will leverage this new retail channel to its advantage.

3.6 Future Products

Future products may include:

– Expansion of the “Oval Office Iron” line to include metal home accessories and garden-like accessories, lamp fixtures, and other metal fabricated products.

– Other furniture lines that complement fabric sold in the store.

– Patterns that enable the “do it yourselfers” to complete their project, such as the resin chair pattern.

Market Analysis Summary

The store has been well received since its opening on December 16, 1996. Marketing, combined with an optimal product offering, is critical to its continued success and future profitability. The store offers the most extensive selection of in-stock decorator fabrics, but the volume sales of special order fabric is the fastest-growing area of the store. The basic market need is to offer a good selection of decorator fabrics at reasonable prices for the “do-it-yourself” and the “buy-it-yourself” customers through a personalized retail store that offers excellent service, design assistance, and inspiration for people to redecorate their homes.

We possess valuable information about our market and know a great deal about the common attributes of our most prized and loyal customers. We will leverage this information to better understand who we serve, their specific needs, and how we can better communicate with them.

4.1 Market Segmentation

The general profile of the Interior Views customer consists of the following geographic, demographic, psychographic, and behavioral factors, with additional comments regarding the Web attributes of this customer base. It is important to understand the attributes of the current retail customer as we develop the Web customer base. We believe that the overall characteristics of our established local clientele can be extrapolated to a national level and can be reached via the Internet and our eBay store.

Geographics

– Our immediate geographic market is the Pleasantville area, with a population of 175,500.

– A 100-mile geographic area is in need of our products and services.

– The total targeted area population is estimated at 573,300.

Demographics

– Female

– Married

– Have children, but not necessarily at home

– Have attended college

– A combined annual income in excess of $75,000

– Age range of 35 to 55 years, with a median age of 42

– Own their homes, townhouses and/or condominiums valued at over $225,000.

– If they work out of the home, it’s by choice in a professional/business setting.

– Belong to one or more business, social and/or athletic organizations, which may include:

– Downtown Athletic Club.

– Pleasantville Country Club.

– Junior League of Pleasantville.

– American Business Women’s Association.

We know the following regarding the profile of the typical resident of Pleasantville:

– 67% have lived in Pleasantville for 7 years or more.

– 23% are between the ages of 35 and 44.

– 40% have completed some college.

– 24% are managers, professionals, and/or owners of a business.

– 53% are married.

– 65% have no children living at home.

– 56% own their residence.

Psychographics:

– The appearance of her home is a priority.

– Entertaining and showing her home is important.

– She perceives herself as creative, tasteful, and able, but seeks validation and support regarding her decorating ideas and choices.

– She reads one or more of the following magazines:

– Martha Stewart Living

– Country Living

– Home

– House Beautiful

– Country Home

– Metropolitan Home

– Traditional Homes

– Victoria

– Elle Decor

– She takes pride in having an active role in decorating their home.

– Her home is a form of communicating “who she is” to others.

– Comparison positioning and stature within social groups are made on an ongoing basis, but rarely discussed.

Web Attributes

We used to be concerned that this particular segment was not known to be Web-savvy. Unfortunately, the age group of these women was one of the smallest groups that look to the Internet for information and spend time there for research. This is not good for website sales in our niche industry.

However, as time has passed and the cost of computers and Internet access has plummeted, and the ease of Internet use in general, and consumer e-commerce has increased, our earlier fears have been assuaged.

We will pursue an eBay store website positioned to take advantage of the current and future potential of Internet retail. This group has become increasingly comfortable with the Web, and the “Professional Youngsters” are already using this as a resource.

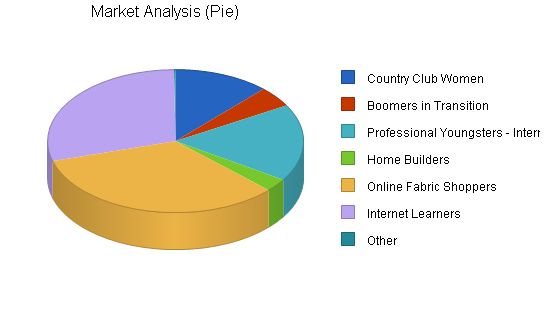

Market Analysis

The table below shows the potential customers and their growth rate from 2005 to 2009.

| Potential Customers | Growth | 2005 | 2006 | 2007 | 2008 | 2009 | CAGR |

| Country Club Women | 11% | 73,500 | 81,585 | 90,559 | 100,520 | 111,577 | 11.00% |

| Boomers in Transition | 9% | 28,500 | 31,065 | 33,861 | 36,908 | 40,230 | 9.00% |

| Professional Youngsters – Internet Savvy | 6% | 107,450 | 113,897 | 120,731 | 127,975 | 135,654 | 6.00% |

| Home Builders | 4% | 18,000 | 18,720 | 19,469 | 20,248 | 21,058 | 4.00% |

| Online Fabric Shoppers | 8% | 204,750 | 221,130 | 238,820 | 257,926 | 278,560 | 8.00% |

| Internet Learners | 3% | 180,000 | 185,400 | 190,962 | 196,691 | 202,592 | 3.00% |

| Other | 2% | 1,200 | 1,224 | 1,248 | 1,273 | 1,298 | 1.98% |

| Total | 6.56% | 613,400 | 653,021 | 695,650 | 741,541 | 790,969 | 6.56% |

4.2 Target Market Segment Strategy

Our marketing strategy is to become the resource of choice for decorator fabrics. We aim to appeal to "Country Club Women," "Boomers in Transition," "Professional Youngsters," and "Home Builders." These target markets are well-defined and accessible and are willing to invest discretionary income in their homes.

– Country Club Women: This segment consists of women aged 35-50 with a combined income of over $80,000. They own at least one home or condominium and prioritize the appearance of their homes. They are socially active and have discretionary income.

– Boomers in Transition: This group, typically aged 50-65, is going through a positive life transition. They are changing homes or remodeling due to empty nest syndrome, retirement plans, or downsizing desires. They have high discretionary income and value home decoration.

– Professional Youngsters: Couples aged 25-35 establishing their first "adult" household fall into this group. They both work and earn over $50,000 annually. They want to invest in their home and project a "successful" image to their peers.

– Home Builders: People in the building process, typically aged 40-55, are prime candidates for our products.

4.2.1 Market Needs

Interior Views aims to provide customers with the opportunity to create a personalized home environment. We offer a wide selection of current and tasteful decorator fabrics, along with convenient accessibility to our products.

4.2.2 Market Trends

The home textile market, which includes sheets, towels, draperies, carpets, blankets, and upholstery, accounts for 37% of all textile output. The industry is expected to experience steady growth in the coming years. Factors such as household formations, the need for larger homes, and the growth of the DIY market contribute to this growth.

4.2.3 Market Growth

The number of U.S. households is projected to grow by 16% to 115 million by 2010. Married couples in the 35-65 age range, which represents a growth segment, have larger incomes and choose to spend their disposable income on home amenities. The demand for home decorator fabrics is expected to increase due to new housing activity and the desire for personalized and tasteful home environments.

The decorator fabric industry is competitive and consists of various players, including traditional fabric retail stores, catalog and web-based sales, click and mortar discounters, interior designers, and individually owned stores.

– Traditional Fabric Retail Stores: These corporate stores have multiple locations and offer a broad selection of fabrics. Examples include JoAnn’s and Calico Corners.

– Catalog and Web-based Competitors: Many catalog and retail stores now have websites, and competition in this area is increasing. Calico Corners and Pottery Barn are prominent competitors.

– Click and Mortar Discounters: Discounters, including home improvement chains, offer a wide range of products and competitive prices. Home Base and Bed, Bath & Beyond are examples of such discounters.

– Interior Designers: Interior designers cater to higher-end customers and offer fabric as part of their services.

– Individually Owned Stores: These stores vary in terms of product offerings and service levels. Some have websites to serve customers.

4.3.2 Distribution Patterns

Our primary method of distribution is through our traditional retail store. However, we plan to expand our reach by establishing an eBay store and utilizing our website. The target market segments that are expected to utilize our online platforms the most are Professional Youngsters, Outsiders, Online Fabric Shoppers, and Internet Learners.

4.3.3 Competition and Buying Patterns

Competition in the decorator fabric industry comes from traditional retail stores, catalog sales, and discounters. Customers make decisions based on quality, price, and uniqueness. While competition exists online, with websites and catalogs, our local market has not been significantly impacted. We aim to leverage our internet presence to complement our store and eBay sales.

Distribution channels are shifting towards discounters, who contribute to industry growth by attracting value-oriented consumers through frequent store promotions. However, discounters are criticized for not offering quality service experience or enticing displays. They, along with specialty store chains, pose a severe threat to individually-owned specialty stores due to extensive promotions, price advantages, and vendor relationships. For example, Home Base is a discounter that includes complete decorator departments in their metropolitan stores. Although the Pleasantville Home Base store sells basic curtain rod hardware and other window treatments, there are no known plans to implement this strategy in the future. This is an important issue to monitor for competitive purposes.

In terms of our strategy and implementation summary, our primary sales and marketing strategy includes factors such as providing a premier retail store experience with impressive product displays and over-the-top customer service. We also offer other complementary products through consignment and sub-lease arrangements to create reasons for customers to visit our store. Additionally, our retail store serves as a stable financial foundation and source of inventory for our eBay store. Our website complements our fabric sales and provides access to customers who may not visit our physical retail store. We will renovate the website to provide content and a catalog of available fabrics, with direct links to our eBay store. We will also focus on good web and hardcopy marketing to drive customers to our store through search engines and links on our home website. Inventory management and prompt order fulfillment are crucial, and we will purchase additional computer hardware and software for this purpose, and hire additional staff if needed.

For our SWOT analysis, we have strong relationships with suppliers that offer credit arrangements, flexibility, and response to special product requirements. Our staff provides excellent and stable personalized customer service. Our retail space is great and offers flexibility with a positive and attractive atmosphere. We have strong merchandising and product presentation, as well as good referral relationships with complementary vendors, local realtors, and designers. Our in-store complementary products through "The Window Seat" and "Antique Bureau" add interest, stability, and revenue. We have high customer loyalty among repeat and high-dollar purchase customers. The existence of our main store provides a solid foundation for our eBay store.

Our weaknesses include limited access to additional operating capital, and unpredictable cash flow. However, we see opportunities in a growing market with a significant percentage of our target market still unaware of our existence. We can also form strategic alliances for referrals and joint marketing activities, and take advantage of new home construction and changes in design trends to generate sales. There are also increasing sales opportunities in smaller communities that have loyal customers. Additionally, we can tap into the internet potential for selling products to other markets.

As for threats, the downturn in the economy has impacted store sales, and national discount stores like Target, Walmart, and Home Depot pose a challenge in the decorator fabric space. We may also face competition from larger stores with more financing or product resources, as well as catalog resources that offer aggressively priced fabric products. Continued price pressure and dramatic changes in design can affect our inventory and margins. Finally, major fabric retailers expanding into the online market may capture customers before they reach our eBay store.

Our strategy pyramid summarizes our implementation process for the upcoming year, focusing on in-store retail revenue, expansion to non-fabric revenue sources, and web-based sales activities. Specifically, our first strategy is to generate revenue through the sale of solid margin decorator fabric in our retail store. This includes providing in-stock fabric that customers can see and buy on the spot, as well as offering special order fabric for unique customer needs. We will also provide classes on fabric fabrication and hold sales and promotional events. Our second strategy is to generate sales revenues through related non-fabric sales. This includes promoting our "Oval Office Iron" product line through newsletters, sales promotions, and cross-selling with drapery fabric purchases. We will also promote "The Window Seat" products that complement fabric sales and consignment-based sales. Lastly, our third strategy focuses on generating revenue through our home website and eBay store, targeting customers outside our retail store’s reach. This involves redesigning our website, establishing an eBay store, and integrating web-based activities into our store’s routine. We will also assess performance and set goals for email inquiries and revenue generation.

Our value proposition is that Interior Views offers high-quality decorator fabric for the home, available for immediate purchase or special order. We also offer a selection of antiques, home accessories, and complementary products. Customers have the option to be creative and customize their interior design, or work with experienced professionals who will guide them through the process. Our competitive edge lies in the quality products and excellent support we offer through our website and eBay store.

Our marketing strategy is focused on becoming the resource for people looking for decorator fabrics and home accessories. We aim to be inspiring, inviting, and motivating for both "do-it-yourself" and "buy-it-yourself" customers. Our marketing strategy revolves around product selection, product quality, and customer service. We will create awareness, interest, and appeal among our target market, encouraging repeat purchases and customer referrals.

In terms of promotion strategy, we have found success in newspaper advertisements, television advertisements on shows like "Martha Stewart" and "Interior Motives," quarterly newsletters and postcards, and in-store classes. We also have referral relationships with complementary vendors, realtors, and designers, as well as sponsorships of fundraising activities and hosting events.

Our distribution strategy primarily involves traditional retail channels, with secondary revenue generation through our home website and linked eBay store.

Finally, our positioning statement emphasizes that Interior Views is the source for selection and price for decorator fabric, customer-oriented design services, and a variety of other home accessories and furniture products. Customers have the opportunity to be creative and customize their home, or work with experienced professionals to achieve their desired look.

Our pricing strategy focuses on offering high value to customers compared to competitors, with price points within 5% of Calico Corners’ retail prices. Our sales strategy revolves around providing exceptional customer service and personalized assistance, both in-store and online. Our goal is to provide customers with all the resources, support, and guidance they need to create a unique look for their home.

In terms of online sales strategy, we aim to position Interior Views and our eBay store as a preferred source for home decorator fabrics on the internet. We will increase awareness and image through search engine optimization, leverage our existing customer base through newsletters and web-only promotions, and capitalize on upsell and cross-sell opportunities.

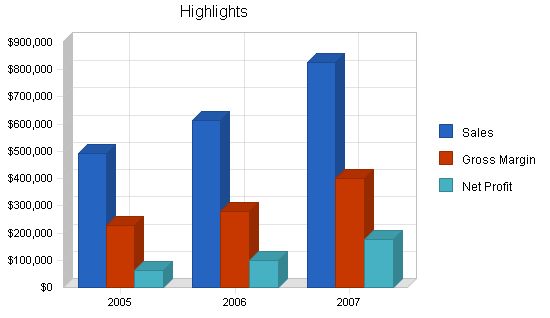

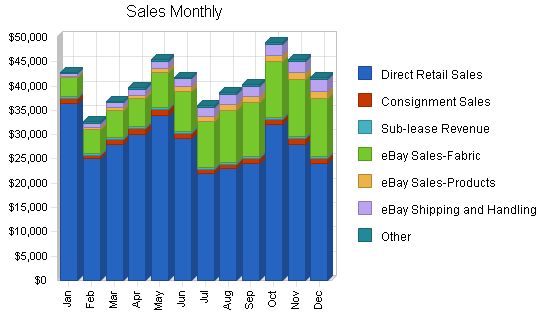

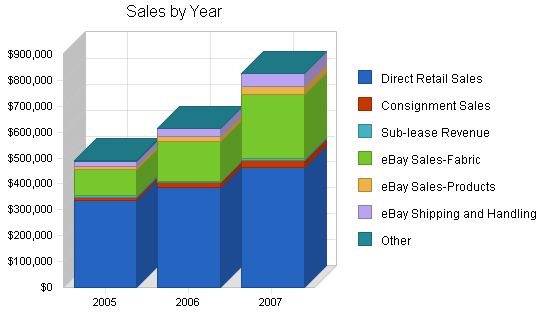

Our sales forecast is based on modest growth rates for direct sales and steady increase in eBay store sales. We project slow and steady growth in online sales, targeting existing retail customers and internet-savvy e-purchasers.

Overall, our marketing mix is comprised of pricing, distribution, advertising and promotion, and customer service strategies. We offer competitive pricing, sell through our retail store and website, advertise through various channels, and provide excellent personalized customer service.

Sales Forecast:

| Sales Forecast | |||

| 2005 | 2006 | 2007 | |

| Sales | |||

| Direct Retail Sales | $335,600 | $386,400 | $463,700 |

| Consignment Sales | $12,500 | $18,750 | $28,125 |

| Sub-lease Revenue | $5,340 | $5,600 | $6,165 |

| eBay Sales-Fabric | $101,725 | $153,370 | $246,488 |

| eBay Sales-Products | $11,050 | $18,564 | $32,487 |

| eBay Shipping and Handling | $20,070 | $30,908 | $50,576 |

| Other | $4,140 | $0 | $0 |

| Total Sales | $490,425 | $613,592 | $827,541 |

| Direct Cost of Sales | 2005 | 2006 | 2007 |

| Direct Retail Sales | $151,020 | $168,500 | $170,250 |

| Consignment Sales | $375 | $480 | $520 |

| Sub-lease Revenue | $0 | $0 | $0 |

| eBay Sales-Fabric | $50,866 | $76,685 | $123,244 |

| eBay Sales-Products | $5,548 | $9,282 | $16,244 |

| Shipping and Handling | $15,055 | $23,181 | $37,932 |

| Other | $2,070 | $4,000 | $4,250 |

| Subtotal Direct Cost of Sales | $224,934 | $282,128 | $352,440 |

5.7 Strategic Alliances:

Interior Views has dynamic alliances. A retail store, "27th Street Fabric," focuses on "dress fabric" and refers customers. There is also a beneficial relationship with "Interior Fabricators" in Lake Oswego, Oregon, and this establishment shares inventory purchases to reduce costs for both stores and to split minimum order bolts to make larger quantity purchases more affordable.

Strategic Internet Alliances:

Our use of the eBay marketplace is a major plus. It gives Interior Views access to the online retail channel without the high start-up expenses of site design, store administration, financial setup, and security programs for a self-run and hosted retail site.

We can renovate our existing website and use direct click-through links to sell through the established and secure eBay marketplace and PayPal billing systems, incurring acceptable fees.

Other strategic online alliances do not exist currently. Opportunities exist with other retailers, including expanding the relationship with "Interior Fabricators" to include online activities. This will be a focus for future development.

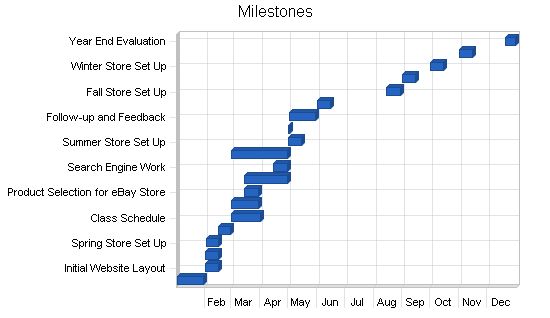

5.8 Milestones:

The milestone chart below is accompanied by a table outlining critical key activities for our success in the coming year.

Milestones:

– Milestone: Start Date, End Date, Budget, Manager, Department

– Year Buying Program: 2-Jan, 30-Jan, $560, Judy, Management

– Initial Website Layout: 1-Feb, 15-Feb, $1,850, Doug, Owner

– Establish eBay/PayPal Accounts: 1-Feb, 15-Feb, $300, Judy, Consultant

– Spring Store Set Up: 2-Feb, 15-Feb, $225, Julie, Management

– Initial eBay Site Design: 15-Feb, 28-Feb, $1,000, Doug, Owner

– Class Schedule: 1-Mar, 1-Apr, $45, Cherly/Kandi, Customer Sup.

– Fabric Selection for eBay Store: 1-Mar, 30-Mar, $0, Judy, Management

– Product Selection for eBay Store: 15-Mar, 30-Mar, $0, Julie, Sales

– Marketing Schedule: 15-Mar, 30-Apr, $0, Doug, Marketing

– Search Engine Work: 15-Apr, 30-Apr, $550, James, Consultant

– Test Home and eBay Sites: 1-Mar, 30-Apr, $0, Staff, All

– Summer Store Set Up: 1-May, 15-May, $225, Julie, Management

– Launch Sites: 1-May, 2-May, $1,200, James, Consultant

– Follow-up and Feedback: 2-May, 30-May, $0, Doug/Staff, All

– Class Schedule: 1-Jun, 15-Jun, $45, Cherly/Kandi, Customer Sup.

– Fall Store Set Up: 15-Aug, 30-Aug, $250, Julie, Customer Sup.

– Class Schedule: 1-Sep, 15-Sep, $50, Cherly/Kandi, Customer Sup.

– Winter Store Set Up: 1-Oct, 15-Oct, $250, Julie, Management

– Class Schedule: 1-Nov, 15-Nov, $50, Cherly/Kandi, Customer Sup.

– Year End Evaluation: 20-Dec, 31-Dec, $0, Judy, Management

– Totals: $6,600

Web Plan Summary:

Interior Views plans to increase sales revenues by entering the Internet retail channel through a store presence on eBay.com. The following topics discuss e-tail market trends, strategies for this channel, and development requirements and planning for our home site and eBay store.

Website Marketing Strategy:

Our strategy is to reach key groups listed in order of importance based on expected use and purchases from the site:

– Professional Youngsters: Most likely to use this resource due to high Internet use.

– Outsiders: People outside the area with Internet access who have come in contact with the physical store or learned of it through a referral or promotion.

– Online Fabric Shoppers: Mostly find the site through search engines and browse multiple sites for best buys or access to discontinued and hard-to-find fabric.

– Internet Learners: Targeted segments that are beginning to become familiar with the site and will increase their use of the Internet over time.

Website Demographic Strategy:

The target groups are divided into four primary groups:

1. Professional Youngsters: Most likely to use this resource due to high Internet use.

2. Outsiders: People outside the area with Internet access who have come in contact with the physical store or learned of it through a referral or promotion.

3. Online Fabric Shoppers: Mostly find the site through search engines, and these online decorator fabric shoppers browse multiple sites for best buys or access to discontinued or hard-to-find fabric.

4. Internet Learners: Represents all of the targeted segments that are just beginning to become familiar with the site and will increase their use of the Internet over time.

Website Demographics:

– Female.

– Married.

– Have children, but not necessarily at home.

– Have attended college.

– Combined annual income in excess of $50,000.

– Age range of 35 to 55 years, with a median age of 42.

– Owns their home, townhouse and/or condominium valued at over $125,000.

– If they work out of the home, it’s by choice in a professional/business setting.

– Belong to one or more business, social and/or athletic organizations.

Website Psychographics:

– The appearance of her home is a priority and entertaining and showing her home is important.

– She perceives herself as creative, tasteful and able, but seeks validation and support regarding her decorating ideas and choices.

– In addition to using the Internet to gather design, decorating and pricing information, she also reads the same publications as the retail shopper.

Website Behaviors:

– She takes pride in having an active role in decorating her home.

– Her home is a form of communicating “who she is” to others.

– Comparisons within social groups are made on an ongoing basis, but rarely discussed.

– Considers the Web to be a more convenient information gathering resource and potential shopping alternative.

Web Market Needs:

Customers are looking for the opportunity to create a home environment to express who they are. They desire a personalized, unique, and tasteful home that communicates a message about what is important to them. Interior Views’ website seeks to fulfill the following benefits:

– Selection: A wide choice of current and tasteful decorator fabrics with the convenience of online shopping.

– Accessibility: The buyer can visit the site and view the most popular fabrics from a vast array of suppliers. They can also communicate with the store through email or phone for additional assistance.

– Competitive Pricing: All products will be competitively priced in comparison to retail stores and other channels of distribution.

Web Market Trends:

The following trends and issues impact the success of Interior Views:

– National Economic Health: The store does better during "good times" regardless of its direct impact on the local economy.

– New Home Construction Activity: Has a significant impact on sales across all product lines.

– Shifts in Design Trends: Major changes in design trends increase sales. This offers a buying advantage for the store.

Web Market Growth:

The number of U.S. households is projected to grow by 16% to 115 million by the year 2010. Married couples in the 35 to 65 age range represent a growth segment with larger incomes. These factors contribute to an increased need for home decorator fabrics. The industry is expected to realize a steady increase over the next few years.

Development Requirements:

Tasks to be accomplished:

– Choose fabric and other product selections for site

– Establish eBay and PayPal accounts

– Purchase and install new hardware and software for sales fulfillment and shipping

– Establish database of online customers with security protocol compliance

– Prepare eBay store product pages and establish direct click-through links between home page catalog and eBay products pages

Front End:

Current elements of the site:

– URL

– Identifiable home page

– Ability to select and view popular fabrics

– Newsletter access

– Contact information

Areas that need improvement:

– Graphic design characteristics

– Speed

– Basic navigation throughout the site

– Addition of other products and select home accessories

– General information about the eBay store

– Direct click-through links to individual products on the eBay store sites

Back End:

Required features:

– Web hosting with 98% uptime

– Web Analytic statistics

– Ability for visitors to access product information, visuals, newsletter, and email system

– Full establishment of the eBay store

– Compliance with Sarbanes-Oxley security protocols

Resource Requirements:

The site is supported by a local Internet provider and a consultant. The monthly budget, including Internet access, is $65.00. Additional hardware and software will be purchased for fulfillment, shipping, inventory, and customer database.

Future Development:

Objectives of the site redesign include increased speed, enhanced navigation, and addition of additional products such as "Oval Office Iron" hardware and select home accessories. If the eBay marketplace proves successful, there may be another site renovation in the future to bring the entire online store operation in-house.

The website and eBay store will generate revenue through product sales to the targeted audience. Success will be measured based on monthly revenue compared to objectives, as well as tracking traffic and its contributions to other site objectives.

Site Positioning:

The website and eBay store will generate revenue through product sales to the targeted audience. Success will be measured based on monthly revenue compared to objectives, as well as tracking traffic and its contributions to other site objectives.

Management Summary:

Judy Williams oversees all store operations and buying activities. Julie Hanson takes on a management role, and Doug Williams handles marketing efforts. The goal is to increase Julie’s responsibilities over time. Other part-time positions fill the six-day work week.

Organizational Structure:

Judy manages all employees and professional contacts, determines staffing requirements, assigns responsibilities, and reviews employee performance.

Management Team:

Judy Williams is responsible for all managerial functions and oversees all buying activities. Julie Hanson and other staff members assist with advertising and special events. Doug Williams handles marketing efforts.

Management Team Gaps:

The team is working well at this point. The long-term goal is to have Julie take on increasing responsibilities and provide more freedom for Judy.

Personnel Plan:

Judy’s schedule is complemented by four part-time positions. Julie (24 hours per week), Kandi (20 hours per week), Cheryl (18 hours per week), and Pharis (32 hours per week) fill the six-day work week. Training will be provided for the website and eBay store roles.

Future Development:

The objectives of the site redesign include increased speed, enhanced navigation, and addition of additional products such as "Oval Office Iron" hardware and select home accessories.

The personnel plan for Interior Views eBay store is as follows:

Production Personnel

– Pharis – Sales Fulfillment: $3,360 (2005), $3,500 (2006), $3,700 (2007)

– eBay Shipper – Sales Fulfillment: $9,321 (2005), $11,186 (2006), $13,423 (2007)

– Other: $0 (2005), $0 (2006), $0 (2007)

– Subtotal: $12,681 (2005), $14,686 (2006), $17,123 (2007)

Sales and Marketing Personnel

– Kandi – Design Consultant: $7,560 (2005), $8,164 (2006), $8,820 (2007)

– Cheryl – Design Consultant: $7,200 (2005), $7,775 (2006), $8,400 (2007)

– Pharis – Design Consultant: $3,120 (2005), $3,370 (2006), $3,640 (2007)

– Doug – Online Marketing Implementation: $2,650 (2005), $3,360 (2006), $4,032 (2007)

– Other: $0 (2005), $0 (2006), $0 (2007)

– Subtotal: $20,530 (2005), $22,669 (2006), $24,892 (2007)

General and Administrative Personnel

– Judy – Owner (Draw against LLC): $24,000 (2005), $24,000 (2006), $24,000 (2007)

– Julie – Manager: $10,400 (2005), $11,330 (2006), $12,200 (2007)

– Robin – Bookkeeper: $1,440 (2005), $1,550 (2006), $1,680 (2007)

– Other: $0 (2005), $0 (2006), $0 (2007)

– Subtotal: $35,840 (2005), $36,880 (2006), $37,880 (2007)

Other Personnel

– Other: $0 (2005), $0 (2006), $0 (2007)

– Subtotal: $0 (2005), $0 (2006), $0 (2007)

Total People: 8 (2005), 8 (2006), 8 (2007)

Total Payroll: $69,051 (2005), $74,235 (2006), $79,895 (2007)

The financial plan for Interior Views eBay store includes an overview of their eBay store, website, and online marketing activities. The plan covers break-even information, sales forecasts, expense forecasts, and their link to the marketing strategy. The store expects consistent growth in online sales without extreme fluctuations. They will monitor this area and gather data and customer feedback.

The financial plan focuses on these factors:

1. Modest growth rate in sales for Year 1 and a corresponding increase in total revenues.

2. Positive sales throughout the year.

3. Substantial reduction in the existing credit line.

Potential risks include:

1. Slow sales resulting in lower cash flow than projected.

2. Unexpected cost increases compared to forecasted sales.

3. Aggressive actions by competitors that harm the business.

4. Entry of a new competitor in the market.

Worst-case scenarios may involve:

1. Business unable to sustain itself.

2. Need to liquidate inventory to repay a bank loan.

3. Difficulty finding a tenant for the leased space.

4. Loss of investor assets used as collateral.

5. Store failure and its financial and personal consequences.

Important assumptions for success:

1. Healthy economy supporting moderate market growth.

2. Ability to maintain a healthy gross margin percentage.

3. Keeping operating costs low, particularly personnel and monthly expenses.

4. Making wise inventory purchases with high turnover.

The general assumptions for the plan are as follows:

Plan Month: 1 (2005), 2 (2006), 3 (2007)

Current Interest Rate: 9.50% (2005), 9.50% (2006), 9.50% (2007)

Long-term Interest Rate: 8.50% (2005), 8.50% (2006), 8.50% (2007)

Tax Rate: 28.17% (2005), 28.00% (2006), 28.17% (2007)

Other: $0 (2005), $0 (2006), $0 (2007)

Key financial indicators:

– Marketing expenses budgeted at approximately 5% of total sales.

– Expenses tracked in major marketing categories: television advertisements, newspaper advertisements, newsletter and postcard mailings, web marketing support, printed promotional materials, public relations, and other.

Contents

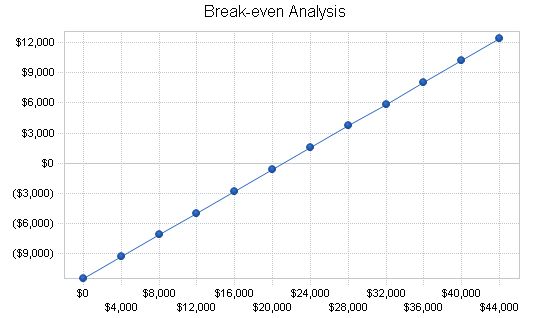

8.3 Break-even Analysis

The Break-even Analysis illustrates the sales needed to break even, based on the average sale and costs per transaction.

Break-even Analysis

Monthly Revenue Break-even: $21,130

Assumptions:

– Average Percent Variable Cost: 46%

– Estimated Monthly Fixed Cost: $11,439

Projected Profit and Loss

The following represents the Projected Profit and Loss for Interior Views based on sales and expense projections for Year 1 and beyond. We anticipate the need to invest in the business in January to address cash flow concerns.

The P&L table lists the expenses we anticipate in establishing our eBay presence and store. Legal expenses will cover initial fees with eBay, PayPal, and our business bank, as well as other legal requirements like compliance with Sarbanes-Oxley legislation.

Website development costs cover both our eBay site design and a freshening of our existing informational website.

To accommodate significant sales activity, we will purchase additional computer hardware dedicated to eBay sales fulfillment, customer database, shipping, etc.

Doug will spend time on ramp-up marketing for the eBay store and subsequent online marketing efforts. These expenses will be tracked carefully and included in the P & L table.

All products sold will be fulfilled from the overall Interior Views inventory. For accounting purposes, the value of products sold online will be transferred from the main store. For planning purposes, start-up inventory value will equal twice anticipated Month 1 sales.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Sales | $490,425 | $613,592 | $827,541 |

| Direct Cost of Sales | $224,934 | $282,128 | $352,440 |

| Production Payroll | $12,681 | $14,686 | $17,123 |

| Final Value Fees | $10,626 | $16,227 | $26,364 |

| Item Fees | $5,313 | $8,114 | $13,182 |

| PayPal Fees | $3,851 | $5,882 | $9,557 |

| Other | $6,000 | $6,600 | $7,200 |

| Total Cost of Sales | $263,405 | $333,637 | $425,866 |

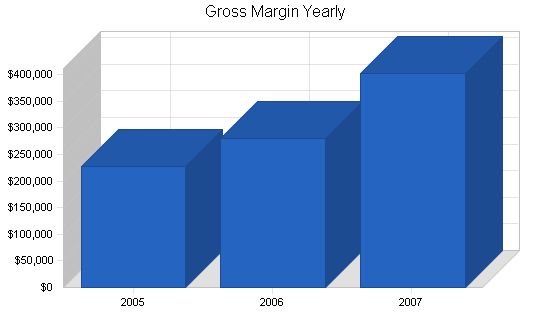

| Gross Margin | $227,020 | $279,955 | $401,675 |

| Gross Margin % | 46.29% | 45.63% | 48.54% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $20,530 | $22,669 | $24,892 |

| Advertising/Promotion | $12,300 | $15,500 | $22,000 |

| Travel | $3,050 | $3,500 | $4,000 |

| Online Ramp-up Marketing | $2,000 | $0 | $0 |

| eBay Promotion | $1,700 | $2,000 | $2,000 |

| Miscellaneous | $3,120 | $3,300 | $3,550 |

| Total Sales and Marketing Expenses | $42,700 | $46,969 | $56,442 |

| Sales and Marketing % | 8.71% | 7.65% | 6.82% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $35,840 | $36,880 | $37,880 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $2,150 | $3,000 | $3,000 |

| eBay Store Fees | $600 | $700 | $800 |

| Internet Access/Wesite Hosting | $780 | $900 | $1,200 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $2,705 | $3,000 | $3,175 |

| Insurance | $2,544 | $2,750 | $3,000 |

| Rent | $34,176 | $35,400 | $37,680 |

| Payroll Taxes | $8,058 | $8,428 | $8,811 |

| Legal Fees for eBay Store Start-up | $1,500 | $0 | $0 |

| Other General and Administrative Expenses | $0 | $0 | $0 |

| Total General and Administrative Expenses | $88,353 | $91,058 | $95,546 |

| General and Administrative % | 18.02% | 14.84% | 11.55% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants – Website Design | $5,000 | $3,000 | $3,000 |

| Contract/Consultants | $1,212 | $1,380 | $1,500 |

| Total Other Expenses | $6,212 | $4,380 | $4,500 |

| Other % | 1.27% | 0.71% | 0.54% |

| Total Operating Expenses | $137,265 | $142,407 | $156,488 |

| Profit Before Interest and Taxes | $89,755 | $137,548 | $245,187 |

| EBITDA | $91,905 | $140,548 | $248,187 |

| Interest Expense | $2,407 | $2,201 | $1,251 |

| Taxes Incurred | $24,636 | $37,897 | $68,709 |

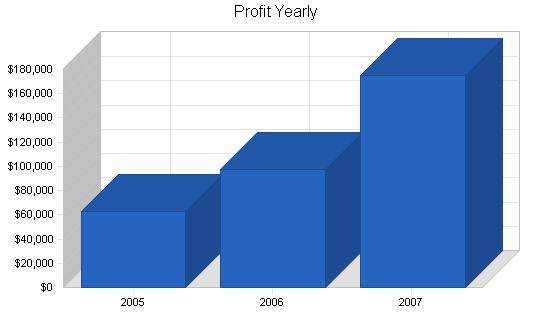

| Net Profit | $62,711 | $97,450 | $175,227 |

| Net Profit/Sales | 12.79% | 15.88% | 21.17% |

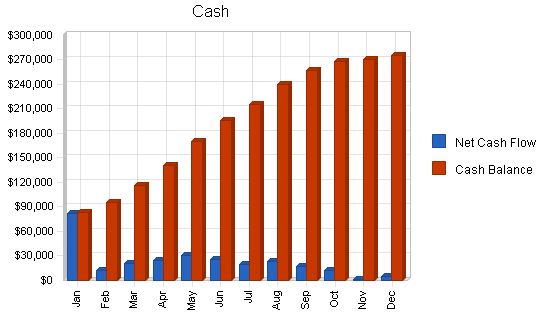

8.5 Projected Cash Flow

The cash flow projections are as follows. These projections are based on our assumptions, with revenue generation being the most significant factor. We anticipate the need for additional investment in January to address cash flow concerns.

As planned, our eBay store should generate sufficient revenue to cover its own expenses and contribute to a net increase in revenue for Interior Views. Cash flow and cash balance should be adequate. We have planned conservatively. However, other companies have experienced significant growth in sales through the eBay store retail channel and other Internet direct sales channels.

If our sales skyrocket, Interior Views may need to increase inventory purchases, site maintenance, personnel, and potentially facilities space and computer hardware.

All of this will impact expenses, cash flow, and cash balance. Interior Views may need to borrow against its bank line of credit or take out business loans until revenue from cash receivables and PayPal begins flowing into the company. Any borrowing would be documented in the eBay store business plan and accounting records. If growth is steady and incremental, we may be able to achieve the projected cash flow without borrowing.

We are investing $7,500 in new computer hardware and upgrades to support the renovation of our website and the establishment of our eBay store.

| Pro Forma Cash Flow | |||

| Pro Forma Cash Flow | |||

| 2005 | 2006 | 2007 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $490,425 | $613,592 | $827,541 |

| Subtotal Cash from Operations | $490,425 | $613,592 | $827,541 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $14,568 | $0 | $0 |

| New Other Liabilities (interest-free) | $1,224 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $59,000 | $0 | $0 |

| Subtotal Cash Received | $565,217 | $613,592 | $827,541 |

| Expenditures | 2005 | 2006 | 2007 |

| Expenditures from Operations | |||

| Cash Spending | $69,051 | $74,235 | $79,895 |

| Bill Payments | $206,171 | $435,263 | $564,703 |

| Subtotal Spent on Operations | $275,222 | $509,498 | $644,598 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $8,400 | $10,000 | $10,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $7,500 | $3,000 | $3,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $291,122 | $522,498 | $657,598 |

| Net Cash Flow | $274,095 | $91,094 | $169,943 |

| Cash Balance | $275,295 | $366,388 | $536,331 |

8.6 Projected Balance Sheet

Interior View’s balance sheet is outlined below.

This initial eBay store plan projects a modest return on the company’s internal investment, with full return in the third year. The cash balance is comfortable, revenue input into the company justifies the entry into this channel.

| Pro Forma Balance Sheet | |||

| Pro Forma Balance Sheet | |||

| 2005 | 2006 | 2007 | |

| Assets | |||

| Current Assets | |||

| Cash | $275,295 | $366,388 | $536,331 |

| Inventory | $19,531 | $24,497 | $30,602 |

| Other Current Assets | $2,300 | $2,300 | $2,300 |

| Total Current Assets | $297,126 | $393,186 | $569,234 |

| Long-term Assets | |||

| Long-term Assets | $11,700 | $14,700 | $17,700 |

| Accumulated Depreciation | $4,200 | $7,200 | $10,200 |

| Total Long-term Assets | $7,500 | $7,500 | $7,500 |

| Total Assets | $304,626 | $400,686 | $576,734 |

| Liabilities and Capital | 2005 | 2006 | 2007 |

| Current Liabilities | |||

| Accounts Payable | $27,872 | $36,483 | $47,303 |

| Current Borrowing | $28,168 | $18,168 | $8,168 |

| Other Current Liabilities | $2,374 | $2,374 | $2,374 |

| Subtotal Current Liabilities | $58,414 | $57,025 | $57,845 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $58,414 | $57,025 | $57,845 |

| Paid-in Capital | $59,000 | $59,000 | $59,000 |

| Retained Earnings | $124,500 | $187,211 | $284,661 |

| Earnings | $62,711 | $97,450 | $175,227 |

| Total Capital | $246,211 | $343,661 | $518,888 |

| Total Liabilities and Capital | $304,626 | $400,686 | $576,734 |

| Net Worth | $246,211 | $343,661 | $518,888 |

8.7 Business Ratios

Business Ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 5949, Sewing, Needlework, and Piece Goods, are shown for comparison.

The following will enable us to keep on track. If we fail in any of these areas, we will need to re-evaluate our business model:

- Gross margins at or above 42%.

- Month-to-month annual comparisons indicate an increase of 12% or greater.

- Do not depend on the credit line to meet cash requirements.

- Continue to pay down the credit line at a minimum of $24,000 per year.

| Ratio Analysis | ||||

| 2005 | 2006 | 2007 | Industry Profile | |

| Sales Growth | 69.11% | 25.11% | 34.87% | 5.27% |

| Percent of Total Assets | ||||

| Inventory | 6.41% | 6.11% | 5.31% | 38.70% |

| Other Current Assets | 0.76% | 0.57% | 0.40% | 28.89% |

| Total Current Assets | 97.54% | 98.13% | 98.70% | 90.95% |

| Long-term Assets | 2.46% | 1.87% | 1.30% | 9.05% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 19.18% | 14.23% | 10.03% | 27.10% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 4.25% |

| Total Liabilities | 19.18% | 14.23% | 10.03% | 31.35% |

| Net Worth | 80.82% | 85.77% | 89.97% | 68.65% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 46.29% | 45.63% | 48.54% | 20.33% |

| Selling, General & Administrative Expenses | 40.69% | 39.47% | 39.16% | 8.95% |

| Advertising Expenses | 3.40% | 3.76% | 4.40% | 1.10% |

| Profit Before Interest and Taxes | 18.30% | 22.42% | 29.63% | 2.03% |

| Main Ratios | ||||

| Current | 5.09 | 6.89 | 9.84 | 2.90 |

| Quick | 4.75 | 6.47 | 9.31 | 1.20 |

| Total Debt to Total Assets | 19.18% | 14.23% | 10.03% | 37.

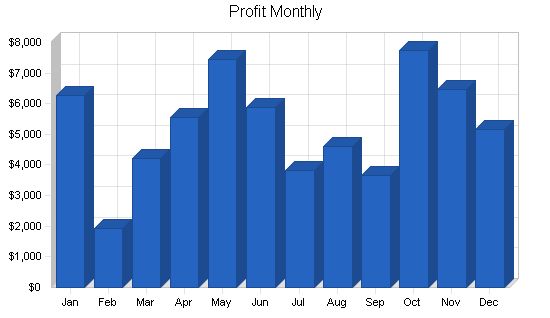

General Assumptions: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1 2 3 4 5 6 7 8 9 10 11 12 Plan Month Current Interest Rate 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% 9.50% Long-term Interest Rate 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% Tax Rate 30.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% 28.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Sales $42,895 $32,615 $36,880 $39,635 $45,400 $41,840 $36,045 $38,635 $40,355 $48,900 $45,500 $41,725 Direct Cost of Sales $19,130 $14,705 $16,571 $17,846 $20,597 $19,141 $16,768 $18,068 $18,790 $22,647 $21,140 $19,531 Production Payroll $260 $260 $760 $1,060 $1,100 $1,142 $1,226 $1,272 $1,321 $1,372 $1,426 $1,482 Final Value Fees 8.00% $388 $492 $566 $618 $758 $862 $990 $1,116 $1,154 $1,190 $1,228 $1,264 Item Fees $0.04 $194 $246 $283 $309 $379 $431 $495 $558 $577 $595 $614 $632 PayPal Fees 2.90% $141 $178 $205 $224 $275 $312 $359 $405 $418 $431 $445 $458 Other $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Total Cost of Sales $20,613 $16,381 $18,885 $20,557 $23,609 $22,388 $20,338 $21,919 $22,760 $26,735 $25,353 $23,867 Gross Margin $22,282 $16,234 $17,995 $19,078 $21,791 $19,452 $15,707 $16,716 $17,595 $22,165 $20,147 $17,858 Gross Margin % 51.95% 49.77% 48.79% 48.13% 48.00% 46.49% 43.58% 43.27% 43.60% 45.33% 44.28% 42.80% Operating Expenses: Sales and Marketing Expenses Sales and Marketing Payroll $1,690 $1,690 $1,790 $1,840 $1,690 $1,690 $1,690 $1,690 $1,690 $1,690 $1,690 $1,690 Advertising/Promotion $250 $2,150 $750 $750 $1,950 $750 $750 $750 $1,950 $750 $750 $750 Travel $0 $0 $1,250 $0 $0 $0 $0 $0 $900 $800 $100 Online Ramp-up Marketing $1,000 $1,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 eBay Promotion $100 $100 $150 $200 $100 $100 $100 $150 $150 $200 $200 $150 Miscellaneous $340 $220 $220 $340 $220 $220 $340 $220 $220 $340 $220 $220 Total Sales and Marketing Expenses $3,380 $5,160 $4,160 $3,130 $3,960 $2,760 $2,880 $2,810 $4,010 $3,880 $3,660 $2,910 Sales and Marketing % 7.88% 15.82% 11.28% 7.90% 8.72% 6.60% 7.99% 7.27% 9.94% 7.93% 8.04% 6.97% General and Administrative Expenses General and Administrative Payroll $2,960 $2,920 $2,980 $2,980 $2,980 $3,020 $3,020 $3,020 $3,000 $3,000 $3,000 $2,960 Sales and Marketing and Other Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Depreciation $195 $195 $195 $195 $195 $195 $195 $195 $195 $195 $5 eBay Store Fees $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 Internet Access/Website Hosting $65 $65 $65 $65 $65 $65 $65 $65 $65 $65 $65 $65 Leased Equipment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Utilities $240 $235 $230 $225 $220 $215 $215 $215 $220 $225 $230 $235 Insurance $212 $212 $212 $212 $212 $212 $212 $212 $212 $212 $212 $212 Rent $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 $2,848 Payroll Taxes 15% $668 $662 $671 $671 $671 $677 $677 $677 $674 $674 $674 Legal Fees for eBay Store Start-up $1,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Other General and Administrative Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total General and Administrative Expenses $8,738 $7,187 $7,251 $7,246 $7,241 $7,282 $7,282 $7,282 $7,264 $7,269 $7,274 $7,043 General and Administrative % 20.37% 22.03% 19.66% 18.28% 15.95% 17.40% 20.20% 18.85% 18.00% 14.86% 15.99% 16.88% Other Expenses: Other Payroll $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Consultants – Website Design $1,000 $1,000 $500 $0 $0 $1,000 $0 $0 $1,000 $0 $0 $500 Contract/Consultants $36 $36 $36 $816 $36 $36 $36 $36 $36 $36 $36 $36 Total Other Expenses $1,036 $1,036 $536 $816 $36 $1,036 $36 $36 $1,036 $36 $36 $536 Other % 2.42% 3.18% 1.45% 2.06% 0.08% 2.48% 0.10% 0.09% 2.57% 0.07% 0.08% 1.28% Total Operating Expenses $13,154 $13,383 $11,947 $11,192 $11,237 $11,078 $10,198 $10,128 $12,310 $11,185 $10,970 $10,489 Profit Before Interest and Taxes $9,129 $2,852 $6,049 $7,887 $10,555 $8,375 $5,510 $6,589 $5,286 $10,981 $9,178 $7,370 EBITDA $9,324 $3,047 $6,244 $8,082 $10,750 $8,570 $5,705 $6,784 $5,481 $11,176 $9,373 $7,375 Interest Expense $178 $182 $186 $190 $195 $199 $203 $207 $211 $215 $219 $223 Taxes Incurred $2,685 $747 $1,641 $2,155 $2,901 $2,289 $1,486 $1,787 $1,421 $3,014 $2,508 $2,001 Net Profit $6,265 $1,922 $4,221 $5,541 $7,459 $5,887 $3,821 $4,595 $3,654 $7,751 $6,450 $5,145 Net Profit/Sales 14.61% 5.89% 11.44% 13.98% 16.43% 14.07% 10.60% 11.89% 9.05% 15.85% 14.18% 12.33% Pro Forma Cash Flow |

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $42,895 | $32,615 | $36,880 | $39,635 | $45,400 | $41,840 | $36,045 | $38,635 | $40,355 | $48,900 | $45,500 | $41,725 | |

| Subtotal Cash from Operations | $42,895 | $32,615 | $36,880 | $39,635 | $45,400 | $41,840 | $36,045 | $38,635 | $40,355 | $48,900 | $45,500 | $41,725 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | $1,214 | |

| New Other Liabilities (interest-free) | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 | $102 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $59,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $103,211 | $33,931 | $38,196 | $40,951 | $46,716 | $43,156 | $37,361 | $39,951 | $41,671 | $50,216 | $46,816 | $43,041 | |

| Expenditures | |||||||||||||

| Expenditures from Operations | |||||||||||||

| Cash Spending | $4,910 | $4,870 | $5,530 | $5,880 | $5,770 | $5,852 | $5,936 | $5,982 | $6,011 | $6,062 | $6,116 | $6,132 | |

| Bill Payments | $8,530 | $15,729 | $10,905 | $10,357 | $10,213 | $11,358 | $10,717 | $9,587 | $17,657 | $31,468 | $38,498 | $31,152 | |

| Subtotal Spent on Operations | $13,440 | $20,599 | $16,435 | $16,237 | $15,983 | $17,210 | $16,653 | $15,569 | $23,668 | $37,530 | $44,614 | $37,284 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | $700 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $7,500 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $21,640 | $21,299 | $17,135 | $16,937 | $16,683 | $17,910 | $17,353 | $16,269 | $24,368 | $38,230 | $45,314 | $37,984 | |

| Net Cash Flow | $81,571 | $12,632 | $21,061 | $24,014 | $30,033 | $25,246 | $20,008 | $23,682 | $17,303 | $11,986 | $1,502 | $5,057 | |

| Cash Balance | $82,771 | $95,403 | $116,465 | $140,479 | $170,512 | $195,757 | $215,765 | $239,447 | $256,750 | $268,736 | $270,238 | $275,295 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $1,200 | $82,771 | $95,403 | $116,465 | $140,479 | $170,512 | $195,757 | $215,765 | $239,447 | $256,750 | $268,736 | $270,238 | $275,295 |

| Inventory | $150,000 | $134,370 | $119,665 | $103,094 | $85,248 | $64,651 | $45,510 | $28,742 | $18,068 | $18,790 | $22,647 | $21,140 | $19,531 |

| Other Current Assets | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 | $2,300 |

| Total Current Assets | $153,500 | $219,441 | $217,368 | $221,859 | $228,027 | $237,463 | $243,567 | $246,807 | $259,815 | $277,840 | $293,683 | $293,678 | $297,126 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $4,200 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 | $11,700 |

| Accumulated Depreciation | $2,050 | ||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!