Home Interior Design Business Plan

The city of Claremont has been growing at a rate of 6% annually for the past five years. Currently, the population is 700,000, with the greatest increase happening in southwest Claremont, the city’s most affluent area. Southwest Claremont has seen a 20% population growth in the past two years. The area, with 80,000 residents, boasts an average income of $200,000 and an average home value of $350,000. The new construction in this area alone is expected to generate $600 million in home sales next year. Additionally, the growth has led to an increase in remodeling projects for existing homes, with last year’s projects showing a 20% increase compared to the previous year, resulting in $20 million spent on remodeling services.

The demand for interior design services has significantly increased with the building and remodeling occurring in southwest Claremont. Residential interior design companies in the greater Claremont area generated $4 million in sales last year, and predictions for next year indicate an 11% increase in sales.

At Hamlin and Park Design, we offer a wide range of interior design services to cater to the needs of our clients in southwest Claremont. These services include on-site consultations, project survey & analysis, space planning & furniture arrangement, design concepts, finishes & furnishings, custom designs, purchasing, delivery, & installation, and project coordination & management.

Courtney Hamlin and Katherine Park, with ten years of experience working with the top interior design firms in the city, have established a strong client base that will refer new business to our designers.

Hamlin and Park Design, located in southwest Claremont, specializes in a wide range of interior design services. Our firm’s main objectives are to exceed customer expectations, increase our client base by 15% annually through exceptional performance, and establish a profitable and sustainable startup business.

Our mission at Hamlin and Park Design is to ensure superior customer service by maintaining open communication with clients, discussing the pros and cons of various design options, involving clients in every stage of the design process, surpassing customer expectations, and staying updated with the latest developments and innovations in the field of interior design.

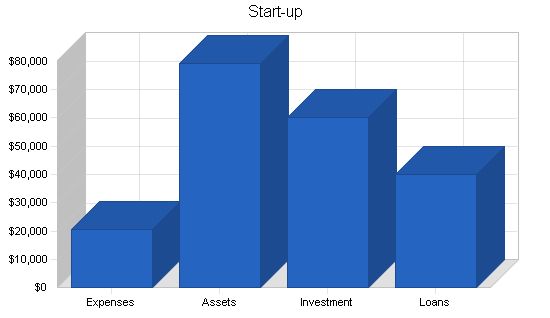

Courtney Hamlin and Katherine Park, the owners and designers of Hamlin and Park Design, are investing $60,000 in the company. Additionally, they have secured a $50,000 loan to support the startup.

With a high level of expertise in interior design, Hamlin and Park Design takes pride in the fact that 50% of their business comes from repeat clients and referrals. As professional interior designers, our responsibility is to use our skills and resources to surpass client expectations in terms of service, value, functionality, and beauty.

Start-up Funding

Start-up Expenses to Fund: $20,550

Start-up Assets to Fund: $79,450

Total Funding Required: $100,000

Assets

Non-cash Assets from Start-up: $20,000

Cash Requirements from Start-up: $59,450

Additional Cash Raised: $0

Cash Balance on Starting Date: $59,450

Total Assets: $79,450

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $30,000

Accounts Payable (Outstanding Bills): $10,000

Other Current Liabilities (interest-free): $0

Total Liabilities: $40,000

Capital

Planned Investment

Investor 1: $30,000

Investor 2: $30,000

Additional Investment Requirement: $0

Total Planned Investment: $60,000

Loss at Start-up (Start-up Expenses): ($20,550)

Total Capital: $39,450

Total Capital and Liabilities: $79,450

Total Funding: $100,000

Services

Hamlin and Park Design offers a wide range of interior design services in southwest Claremont, including:

– On-site Consultations: Convenient consultations at the home or office, providing all necessary product samples for review.

– Project Survey and Analysis: In-depth site inspections and client interviews to determine project requirements and analyze for design concepts.

– Design Concepts: Creating the desired look and feel based on client preferences, using unique selections of fabrics, furniture, and finishes.

– Finishes and Furnishings: Assisting clients in selecting furniture and finishes, applying creativity in the process.

– Custom Designs: Offering custom furniture, built-ins, and window treatments with detailed drawings to visualize the finished piece.

– Purchasing, Delivery, & Installation: Coordinating the purchasing, delivery, and installation of the entire project.

– Project Coordination & Management: Managing all aspects of projects to ensure smooth transitions and successful completion.

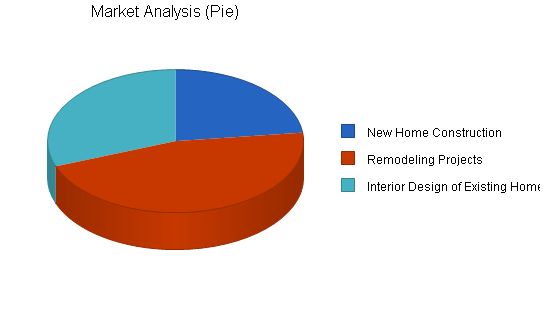

Market Analysis Summary

Due to the strengthening economy in southwest Claremont, more homeowners are seeking interior design services. Last year, residential interior design companies generated $4 million in sales in the greater Claremont area, with 75% of the sales concentrated in southwest Claremont. Sales are expected to increase by 11% next year, presenting a significant opportunity for Hamlin and Park Design to establish itself as a recognized and profitable entity in the city’s interior design market.

Market Segmentation

Hamlin and Park Design will serve three customer groups:

– New Home Construction: Providing interior design services for new homes, including strategic planning, master planning, and lighting, floor, or carpet design.

– Remodeling Projects: Offering consulting services to builders and greater control over all aspects of the project.

– Interior Design of Existing Home: Managing all aspects of interior design projects for existing homes.

Market Analysis:

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Growth | – | 5.99% | 10.00% | 8.01% | 8.50% | ||

| Potential Customers | – | 1,500 | 1,590 | 1,685 | 1,786 | 1,893 | |

| Remodeling Projects | 3,000 | 3,300 | 3,630 | 3,993 | 4,392 | ||

| Interior Design of Existing Home | 2,000 | 2,160 | 2,333 | 2,520 | 2,722 | ||

| Total | 6,500 | 7,050 | 7,648 | 8,299 | 9,007 | ||

4.2 Competitive Edge

Hamlin and Park Design has a competitive edge as highly successful interior designers with a loyal customer base. Courtney Hamlin has been a Project Manager with Sullivan and Associates for five years, establishing strong relationships with builders and vendors. Katherine Park has worked as a Design Consultant for Jonathan Miller for six years. Together, Courtney and Katherine have the skills, resources, and experience to build on a base of 1,000 satisfied customers.

Strategy and Implementation Summary

Hamlin and Park will focus on interior design needs in the southwest section of the city, targeting affluent residents.

5.1 Sales Strategy

Hamlin and Park Design will employ the following sales strategy for the three target customer groups:

- New Home Construction/Remodeling Projects: Courtney Hamlin already has a strong professional relationship with dominant builders/remodelers in southwest Claremont. She will directly meet with them and pitch the consulting services of Hamlin and Park Design.

- Interior Design of Existing Home: Visibility with the customer base is crucial for marketing Hamlin and Park Design. Southwest Claremont has five homeowner associations that meet regularly. Courtney and Katherine have previously made presentations on interior design issues, and they will continue this service to raise the visibility of Hamlin and Park Design.

To develop effective business strategies, perform a SWOT analysis of your business. Learn how to perform a SWOT analysis with our free guide and template.

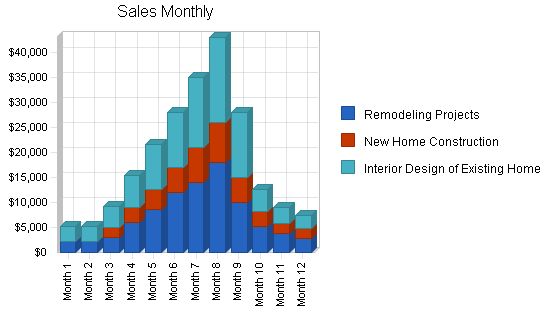

5.1.1 Sales Forecast

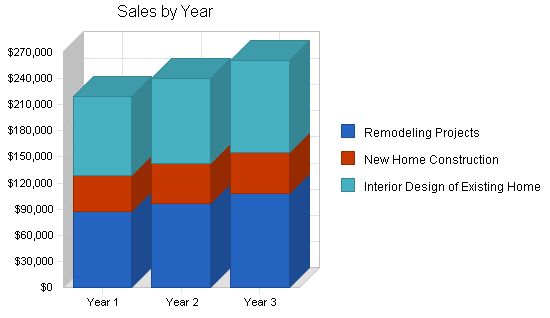

The following table and chart forecast sales for the next three years.

"Sales Forecast"

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Remodeling Projects | $87,672 | $96,685 | $108,200 |

| New Home Construction | $41,000 | $45,280 | $47,300 |

| Interior Design of Existing Home | $90,739 | $97,800 | $105,000 |

| Total Sales | $219,411 | $239,765 | $260,500 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Remodeling Projects | $8,634 | $9,500 | $10,000 |

| New Home Construction | $5,500 | $6,300 | $7,000 |

| Interior Design of Existing Home | $9,091 | $10,000 | $10,000 |

| Subtotal Direct Cost of Sales | $23,225 | $25,800 | $27,000 |

Contents

Management Summary

Hamlin and Park is a two-member interior design firm. Both designers are equal partners in the firm.

- Courtney Hamlin began her passion for the arts at a young age. After graduating from State University, Courtney worked as an office manager at a local interior design firm. She oversaw all aspects of design projects, from proposal preparation to project coordination. After five years, Courtney pursued her Associates Degree in Interior Design. Following the completion of her degree, she became a designer and project manager for Sullivan and Associates.

- Katherine Park received a B.A. in Art from State University and obtained a degree in Interior Design from the Art Institute of Monroe. She has worked as a Design Consultant for Jonathan Miller, a successful interior designer in Claremont.

6.1 Personnel Plan

The staff of Hamlin and Park Design will consist of co-owners Courtney Hamlin and Katherine Park.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Courtney Hamlin | $48,000 | $54,000 | $60,000 |

| Katherine Park | $48,000 | $54,000 | $60,000 |

| Total People | 2 | 2 | 2 |

| Total Payroll | $96,000 | $108,000 | $120,000 |

Financial Plan

The following is the financial plan for Hamlin and Park Design.

7.1 Important Assumptions

The financial plan depends on certain important assumptions, most of which are shown in the following table as annual assumptions. Monthly assumptions are included in the appendix. We understand that collection days are critical, but not easily influenced. Nevertheless, we have planned for this challenge. Interest rates, tax rates, and personnel burden are based on conservative assumptions. Some of the key underlying assumptions are:

- We assume a strong economy with no major recession.

- We assume no unforeseen changes in the economy that would affect our estimations.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

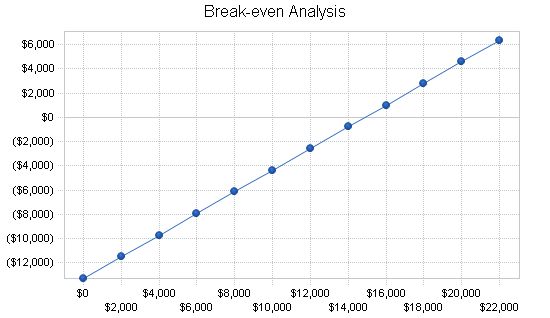

7.2 Break-even Analysis

The following table and chart summarize our break-even analysis. The monthly break-even point is approximately $14,800.

Break-even Analysis

Monthly Revenue Break-even: $14,874

Assumptions:

– Average Percent Variable Cost: 11%

– Estimated Monthly Fixed Cost: $13,300

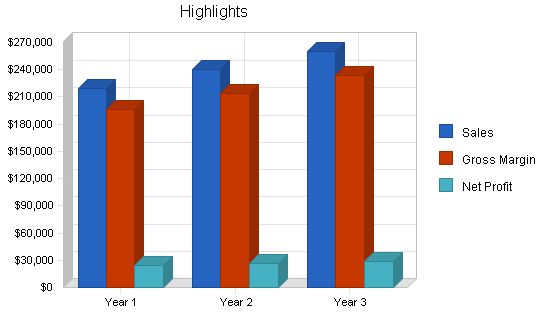

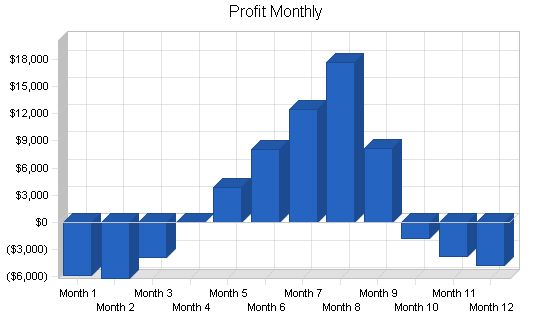

Projected Profit and Loss:

Our projected profit and loss is displayed in the table and charts below.

Pro Forma Profit and Loss:

Sales:

Year 1: $219,411

Year 2: $239,765

Year 3: $260,500

Direct Cost of Sales:

Year 1: $23,225

Year 2: $25,800

Year 3: $27,000

Other Production Expenses:

$0

Total Cost of Sales:

Year 1: $23,225

Year 2: $25,800

Year 3: $27,000

Gross Margin:

Year 1: $196,186

Year 2: $213,965

Year 3: $233,500

Gross Margin %:

Year 1: 89.41%

Year 2: 89.24%

Year 3: 89.64%

Expenses:

Payroll:

Year 1: $96,000

Year 2: $108,000

Year 3: $120,000

Sales and Marketing and Other Expenses:

Year 1: $6,000

Year 2: $7,000

Year 3: $10,000

Depreciation:

$0

Leased Equipment:

Year 1: $2,400

Year 2: $2,400

Year 3: $2,400

Utilities:

Year 1: $2,400

Year 2: $2,400

Year 3: $2,400

Insurance:

Year 1: $2,400

Year 2: $2,400

Year 3: $2,400

Rent:

Year 1: $36,000

Year 2: $36,000

Year 3: $36,000

Payroll Taxes:

Year 1: $14,400

Year 2: $16,200

Year 3: $18,000

Other:

$0

Total Operating Expenses:

Year 1: $159,600

Year 2: $174,400

Year 3: $191,200

Profit Before Interest and Taxes:

Year 1: $36,586

Year 2: $39,565

Year 3: $42,300

EBITDA:

Year 1: $36,586

Year 2: $39,565

Year 3: $42,300

Interest Expense:

Year 1: $2,643

Year 2: $2,010

Year 3: $1,350

Taxes Incurred:

Year 1: $10,183

Year 2: $11,267

Year 3: $12,285

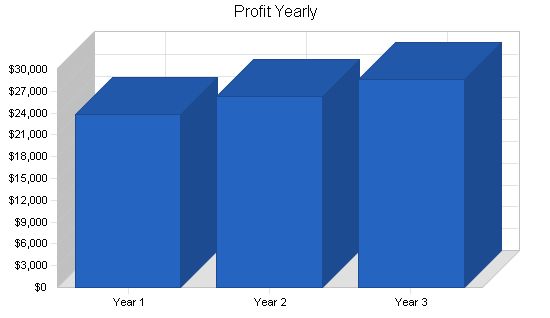

Net Profit:

Year 1: $23,760

Year 2: $26,289

Year 3: $28,665

Net Profit/Sales:

Year 1: 10.83%

Year 2: 10.96%

Year 3: 11.00%

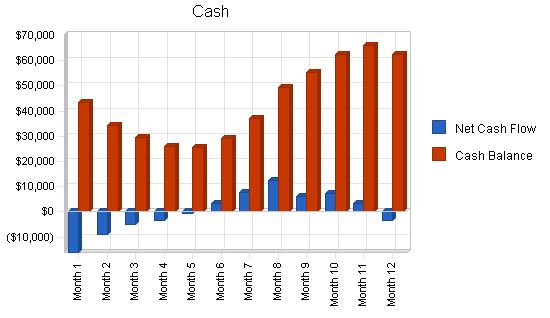

7.4 Projected Cash Flow:

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing the cash flow per month, and the other the monthly balance. The annual cash flow figures are included here and the more important detailed monthly numbers are included in the appendix.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $109,706 | $119,883 | $130,250 |

| Cash from Receivables | $101,608 | $119,131 | $129,485 |

| Subtotal Cash from Operations | $211,313 | $239,014 | $259,735 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $211,313 | $239,014 | $259,735 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $96,000 | $108,000 | $120,000 |

| Bill Payments | $105,544 | $100,914 | $111,312 |

| Subtotal Spent on Operations | $201,544 | $208,914 | $231,312 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $6,600 | $6,600 | $6,600 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $208,144 | $215,514 | $237,912 |

| Net Cash Flow | $3,170 | $23,500 | $21,822 |

| Cash Balance | $62,620 | $86,119 | $107,942 |

7.5 Projected Balance Sheet

The balance sheet in the following table shows managed but sufficient growth of net worth and a healthy financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $62,620 | $86,119 | $107,942 |

| Accounts Receivable | $8,098 | $8,849 | $9,614 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $90,717 | $114,968 | $137,556 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $90,717 | $114,968 | $137,556 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $4,107 | $8,669 | $9,192 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $4,107 | $8,669 | $9,192 |

| Long-term Liabilities | $23,400 | $16,800 | $10,200 |

| Total Liabilities | $27,507 | $25,469 | $19,392 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($20,550) | $3,210 | $29,499 |

| Earnings | $23,760 | $26,289 | $28,665 |

| Total Capital | $63,210 | $89,499 | $118,164 |

| Total Liabilities and Capital | $90,717 | $114,968 | $137,556 |

| Net Worth | $63,210 | $89,499 | $118,164 |

7.6 Business Ratios

The following table provides important ratios for the real estate industry, as determined by the Standard Industry Classification (SIC) Index, 8999, Services.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 |

General Assumptions: |

|

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Pro Forma Profit and Loss:

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $5,100 | $5,200 | $9,260 | $15,300 | $21,500 | $28,000 | $35,000 | $43,000 | $28,022 | $12,532 | $9,042 | $7,455 | |

| Direct Cost of Sales | $0 | $550 | $1,323 | $1,830 | $2,452 | $3,003 | $3,659 | $4,250 | $2,850 | $1,520 | $980 | $808 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $550 | $1,323 | $1,830 | $2,452 | $3,003 | $3,659 | $4,250 | $2,850 | $1,520 | $980 | $808 | |

| Gross Margin | $5,100 | $4,650 | $7,937 | $13,470 | $19,048 | $24,997 | $31,341 | $38,750 | $25,172 | $11,012 | $8,062 | $6,647 | |

| Gross Margin % | 100.00% | 89.42% | 85.71% | 88.04% | 88.60% | 89.28% | 89.55% | 90.12% | 89.83% | 87.87% | 89.16% | 89.16% | |

| Expenses | |||||||||||||

| Payroll | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Sales and Marketing and Other Expenses | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Leased Equipment | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Utilities | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Insurance | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Rent | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | $3,000 | |

| Payroll Taxes | 15% | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | $13,300 | |

| Profit Before Interest and Taxes | ($8,200) |

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Received | ||||||||||||

| Cash from Operations | $2,550 | $2,600 | $4,630 | $7,650 | $10,750 | $14,000 | $17,500 | $21,500 | $14,011 | $6,266 | $4,521 | $3,728 |

| Cash from Receivables | $0 | $85 | $2,552 | $2,668 | $4,731 | $7,753 | $10,858 | $14,117 | $17,633 | $21,250 | $13,753 | $6,208 |

| Subtotal Cash from Operations | $2,550 | $2,685 | $7,182 | $10,318 | $15,481 | $21,753 | $28,358 | $35,617 | $31,644 | $27,516 | $18,274 | $9,935 |

| Additional Cash Received | ||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $2,550 | $2,685 | $7,182 | $10,318 | $15,481 | $21,753 | $28,358 | $35,617 | $31,644 | $27,516 | $18,274 | $9,935 |

| Expenditures | ||||||||||||

| Expenditures from Operations | ||||||||||||

| Cash Spending | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 |

| Bill Payments | $10,100 | $3,026 | $3,482 | $5,252 | $7,420 | $9,713 | $12,053 | $14,618 | $17,152 | $11,672 | $6,229 | $4,828 |

| Subtotal Spent on Operations | $18,100 | $11,026 | $11,482 | $13,252 | $15,420 | $17,713 | $20,053 | $22,618 | $25,152 | $19,672 | $14,229 | $12,828 |

| Additional Cash Spent | ||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $550 | $550 | $550 | $550 | $550 | $550 | $550 | $550 | $550 | $550 | $550 | $550 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $18,650 | $11,576 | $12,032 | $13,802 | $15,970 | $18,263 | $20,603 | $23,168 | $25,702 | $20,222 | $14,779 | $13,378 |

| Net Cash Flow | ($16,100) | ($8,891) | ($4,850) | ($3,484) | ($489) | $3,490 | $7,755 | $12,449 | $5,943 | $7,295 | $3,495 | ($3,443) |

| Cash Balance | $43,350 | $34,459 | $29,609 | $26,125 | $25,636 | $29,126 | $36,881 | $49,330 | $55,273 | $62,568 | $66,063 | $62,620 |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | |||||||||||||

| Cash | $59,450 | $43,350 | $34,459 | $29,609 | $26,125 | $25,636 | $29,126 | $36,881 | $49,330 | $55,273 | $62,568 | $66,063 | $62,620 |

| Accounts Receivable | $0 | $2,550 | $5,065 | $7,143 | $12,126 | $18,145 | $24,392 | $31,033 | $38,417 | $34,794 | $19,810 | $10,578 | $8,098 |

| Other Current Assets | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $79,450 | $65,900 | $59,524 | $56,752 | $58,250 | $63,781 | $73,518 | $87,915 | $107,747 | $110,067 | $102,378 | $96,641 | $90,717 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $79,450 | $65,900 | $59,524 | $56,752 | $58,250 | $63,781 | $73,518 | $87,915 | $107, | ||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!