Commercial Catalog Sales Business Plan

This plan provides investor information and includes the strategic business plan necessary for establishing and operating JTB’s Industrial Sales Division. The following sub-plan outlines all aspects of the Industrial Sales Division. JTB Industrial Sales, Inc. is a sub-corporation of JTB Technologies, Inc., a holding company. It will be formed in February of this year in Richfield, Louisiana as a corporation under the Laws of the Commonwealth of Louisiana.

JTB’s Industrial Sales Division will distribute top-quality Industrial-related products and services to local and national clients in the Automotive and Aerospace Industries, Primary Metals and Machining Industries, Mining and Contractor Industries, and in the Military and Governmental procurement sector. JTB Industrial will partner with manufacturers throughout the U.S to bring our clients additional support services and specialty products. JTB Industrial Sales will be located with other JTB divisions, providing access to our Industrial Products and Services Division’s equipment and staff to service our clients’ needs.

The management team responsible for the Industrial Sales Division’s development and daily operations are Mitchell and Rachel Jeremy. In addition, a staff of 3 will support the management team. JTB Industrial Sales, Inc. will retain the services of a CPA firm to perform company audits, prepare taxes and payroll, and serve as a business consultant to assist in setting achievable long-range strategic goals.

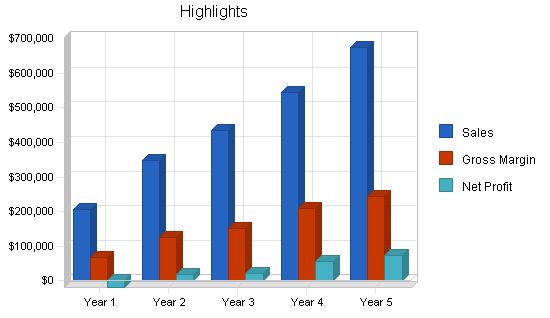

Based on current prices in the industrial distribution market, JTB Industrial Sales has the potential of making $325,000 within the first eighteen months of operations. With good management, a revenue growth of approximately 24% is expected. The projected ratios at the end of Fiscal Year 2 are solid.

The equity for each investor will be based on their investment. An in-depth look at ratios can be found in the Financial Plan section.

Ways to minimize risk factors to JTB’s Industrial Sales Division success include:

- Obtaining sufficient capital to fund the project.

- Maintaining lower overhead for increased profits. Multi-skilled personnel will be employed, and a continual training program will ensure consistent service and customer satisfaction.

- Building a customer base. An excellent location has been determined, and an aggressive marketing program will ensure desired results.

- Establishing community involvement to contribute to a better quality of life. Community projects using company facilities will be developed to help civic groups obtain their financial goals.

JTB Industrial Sales specializes in distributing and supporting the highest quality products and services. Our mission is to establish strong business relationships in the Louisiana and national markets. Today’s market demands cost-effective alternatives without compromising on quality. At JTB, we cater to the Automotive, Aerospace, and Industrial sectors.

Our objectives for the target markets are as follows:

1. Integrate our products and services into the industrial distribution market.

2. Resell products and services offered by our manufacturing partners as an industrial distributor.

3. Gain market share by utilizing technology software and websites.

For years, we have excelled in helping businesses with production processes, external job costing, and expediting the purchasing of industrial supplies. Our personalized approach involves reviewing clients’ criteria, providing recommendations, and quotations.

JTB’s Industrial Sales Division, a base partner in the JTB network, will leverage this network to promote our products and services. Our custom marketing and order processing systems enhance order placement and information processing. This technology facilitates tasks such as placing requests to vendors and accepting requests from customers simultaneously. Additionally, JTB will extend inventory, order tracking, and engineering information to larger clients.

Keys to our success:

1. Seasoned management with extensive experience in the Industrial Distribution and Tooling industries.

2. Focused long-range goals for longevity, allowing flexibility and growth.

3. Strong project management staffing with prior Engineering experience.

4. Unique marketing approaches for niche products and services.

5. Low internal development costs at startup.

6. Existing base of quality external support vendors and industry contacts.

JTB’s Industrial Sales Division will be located in Richfield, Louisiana, offering excellent access to industrial markets in Mississippi, Arkansas, and Texas. Our management team has extensive experience in the industrial marketplace. We provide Industrial and Commercial Tools, Safety Products, and Engineered Sales expertise.

We cater to the following business types:

– Aerospace and Military

– Turbine and Valve manufacturers

– General Manufacturing, Fabricators, and Precision Machine Shops

– Specialty Machine Manufacturers

– Governmental procurement and Military

In addition to industrial products, we offer technical expertise, engineering assistance, and outsourced industrial services through our industrial services division.

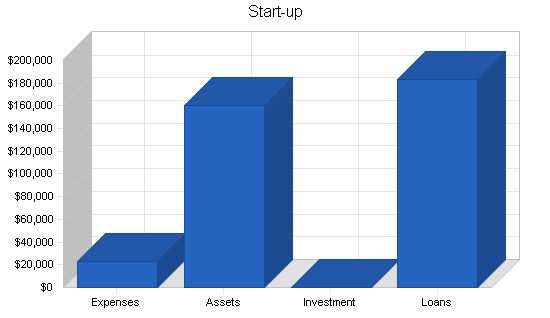

Our startup plan involves relocating Technical Marketing Technologies LLC to a nearby 3,500 sq. ft. commercial facility. This will provide 1,000 sq. ft. of sales office area and 2,500 sq. ft. of production space. We will leverage our existing business contacts to offer a wide range of products, including catalog offerings. We will also train sales associates to handle order processing and develop relationships with local customers. Mr. Jeremy, our sales and marketing associate, will focus on new client research and development.

JTB will be a privately held corporation co-owned by Rachel L Jeremy and her husband Mitchell R. Jeremy, both of whom have extensive experience in production management and customer services. Rachel Jeremy has worked at RL&I Tool and Machine, Inc where she also served as the Secretary. Mitchell R. Jeremy owns and operates Technical Marketing Technologies LLC, a technology and marketing consulting firm. He has over 25 years of technical experience in the Industrial tool market and has successfully launched new business projects in the past. To fund the Industrial Sales Division’s portion of the business plan, Mr. Jeremy is seeking a loan of $181,000, which will be secured by the company’s assets and backed by the owners’ guarantees.

JTB’s Industrial Sales Division will provide industrial, commercial, military, and governmental procurement clients with specialty and general industrial products and services. Our unique selling point is our ability to work closely with clients’ engineering needs while also providing outsourced services to reduce production, maintenance, and safety costs. The division will offer tools, specialty made-to-order items, safety products, raw materials, and maintenance repair items.

To achieve our goals, we will:

1. Provide quality industrial products to fulfill production needs

2. Offer expertise and become a trusted source of quality products

3. Market nearly 300,000 products through an extensive catalog

4. Stock essential items to fulfill client needs

5. Extend business hours to process late orders

6. Maintain detailed records for repeat orders

7. Provide post-sales services

8. Seek out specialty products and services to differentiate ourselves from competitors

JTB’s Industrial Sales Division will purchase goods and services for resale from various sources throughout the US. We have strong distributor relationships with quality suppliers and will bring our years of machining and engineering background to the sales process. Additionally, we have manufacturing partners who can fulfill specialty product requests. We will develop our own PC-based sales and marketing systems and utilize web-based applications to enhance customer relations and sales processes.

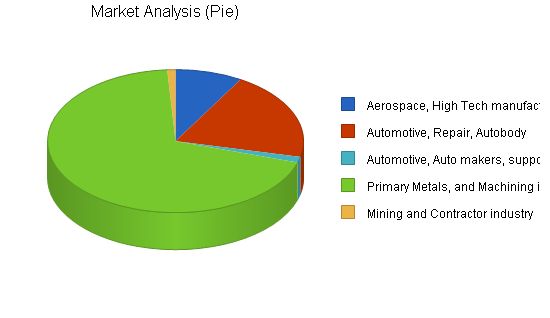

JTB’s potential market includes aerospace, automotive, primary metals and machining, mining and contracting industries, as well as military and governmental procurement clients. These clients currently purchase from specialty catalog companies, industrial distributors, and online platforms. Cost reduction and longer product life are key factors for these markets, and JTB’s ability to provide faster and competitively priced specialty products will meet their needs. The majority of the potential client base can benefit from our product and service offerings, which will significantly reduce customer acquisition costs.

In summary, JTB Industrial Sales Division aims to be a leading provider of industrial products and services by offering quality, cost-effective solutions to meet the unique needs of our clients.

The table below shows the potential customers and their growth over a span of five years. The CAGR (Compound Annual Growth Rate) for each industry is also provided.

+———————–+——–+———+———+———+———+——-+

| Potential Customers | Growth | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | CAGR |

+———————–+——–+———+———+———+———+——-+

| Aerospace, High Tech manufacturing | 3% | 25,587 | 26,355 | 27,146 | 27,960 | 28,799 | 3.00% |

| Automotive, Repair, Autobody | 9% | 61,228 | 66,739 | 72,746 | 79,293 | 86,429 | 9.00% |

| Automotive, Auto makers, support sub-industry | 2% | 4,000 | 4,080 | 4,162 | 4,245 | 4,330 | 2.00% |

| Primary Metals, and Machining industry | 7% | 210,000 | 224,700 | 240,429 | 257,259 | 275,267 | 7.00% |

| Mining and Contractor industry | 9% | 3,149 | 3,432 | 3,741 | 4,078 | 4,445 | 9.00% |

| Total | 7.06% | 303,964 | 325,306 | 348,224 | 372,835 | 399,270 | 7.06% |

+———————–+——–+———+———+———+———+——-+

Target Market Segment Strategy:

We will focus on national and regional market strategies for the following industries:

1. Aerospace Industry – High Tech Manufacturers and supporting sub-industries.

2. Automotive – Automotive repair and Auto Body industry.

3. Automotive – Auto Makers and their support industries.

4. Primary Metals and Machining Industry – Turbine, Valve, Specialty Manufacturers, and Machining industries.

5. Mining and Contractor Industry – Hole drilling and Utility service providers.

6. Military and Government Procurement.

Our marketing strategy will primarily use direct marketing and leverage the owners’ contacts in these industries. Our interactive software systems will enhance our integration into the market, making it easier to place repeat orders.

Service Business Analysis:

JTB’s Industrial Sales Division specializes in helping manufacturers and distributors select catalog products, parts, and service conditions. In this fragmented market, we will compete with other small, local businesses. Buyers often stick with unsatisfactory local options due to a lack of industry standards and a desire to avoid learning new systems.

Our division will provide a variety of industrial products from top manufacturers and offer commissions as a distributor and service provider. Our strong emphasis on providing the right product the first time comes from our 25 years of experience in CAD design and C.N.C. machining. We’ve rectified problems resulting from bad product choices and salvaged relationships with clients by making better and more cost-effective recommendations.

Our unique addition of interactive online marketing and easy customer access, along with a commitment to quality service, sets us apart in the industry.

Competition and Buying Patterns:

We face competition from local established distributors and three nationally established catalog style distributors. Local distributors supply the market with a range of industrial products, often based on the products they supply. A lack of planning by buyers leads to rush order scenarios, giving local distributors large margins.

Customers have diverse buying habits, including small dollar orders, large blanket purchase orders, systems contracts, rush orders, and other procurement types. Each competition tries to fulfill these requests without standardization, forcing customers to adapt to different sales and order placement methods.

Strategy and Implementation Summary:

Our strategy for the Industrial Sales Division is aligned with other JTB divisions. We strive to distribute quality products and services while minimizing overhead. Buyers often seek external help for technical issues, which we can provide.

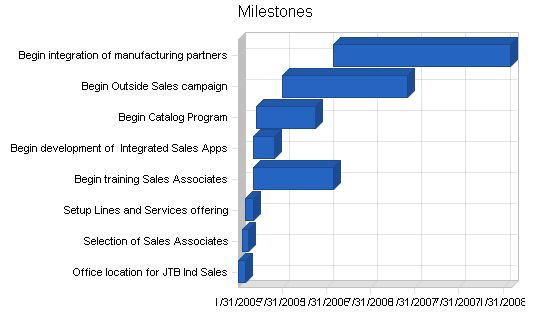

Milestones:

– Office location for JTB Ind Sales: 2/1/2005 – 2/28/2005; $4,500 budget; Manager: M.Jeremy; Department: Sales

– Selection of Sales Associates: 2/15/2005 – 3/15/2005; $2,000 budget; Manager: M.Jeremy; Department: Sales

– Setup Lines and Services offering: 3/1/2005 – 4/1/2005; $1,500 budget; Manager: M.Jeremy; Department: Sales

– Begin training Sales Associates: 4/1/2005 – 3/1/2006; $8,500 budget; Manager: M.Jeremy; Department: Sales

– Begin development of Integrated Sales Apps: 4/1/2005 – 6/30/2005; $5,000 budget; Manager: M.Jeremy; Department: Web

– Begin Catalog Program: 4/15/2005 – 12/15/2005; $4,500 budget; Manager: M.Jeremy; Department: Sales

– Begin Outside Sales campaign: 8/1/2005 – 12/30/2006; $12,000 budget; Manager: M.Jeremy; Department: Sales

– Begin integration of manufacturing partners: 3/1/2006 – 3/1/2008; $12,000 budget; Manager: M.Jeremy; Department: Sales

– Totals: $50,000 budget

Sales Strategy:

JTB’s Industrial Sales Division’s strategy is Marketing, Engineering, and Sales. Our marketing environments provide customers with cost-free access to products and services via Phone, Fax, EDI, and the Internet. The marketing environment is integrated with sales capabilities. Customers can access their accounts via the Internet to review purchases, request quotes, and place orders.

Pre-sales engineering is available for client consultation. JTB will develop online databases about the products we represent, which our staff can use to converse with clients about projects. Engineering software will address potential issues before ordering. After the pre-sale process, the staff will generate a formal quote in the client’s preferred format.

The prominent components of our sales process are ease of use and a knowledgeable staff to fulfill orders promptly. Having purchased from various businesses, including tool manufacturers, industrial distributors, and catalog houses, JTB will blend the best features into a customer-oriented purchasing environment.

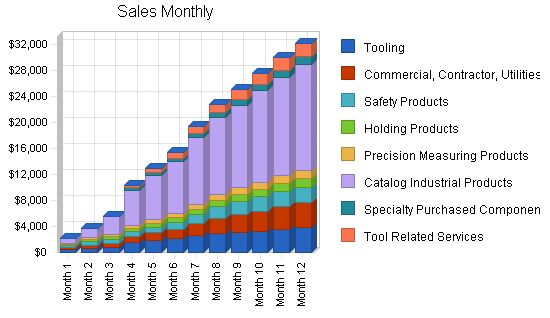

Our sales forecast assumptions are as follows:

1. Tooling average growth rate of sales: 29.5% annually.

2. Commercial, Contractor, Utilities average growth rate of sales: 25% annually.

3. Safety Products average growth rate of sales: 66% annually.

4. Holding Products average growth rate of sales: 49.3% annually.

5. Precision Measuring Products average growth rate of sales: 49.3% annually.

6. Catalog Industrial Products average growth rate of sales: 34.3% annually.

7. Specialty Purchased Components average growth rate of sales: 66.7%.

8. Tool related Services average growth rate of sales: 34.5% annually.

The sales growth is affected by various factors, including:

1. JTB’s ability to develop its internal sales staff quickly.

2. JTB’s ability to rapidly redevelop management’s previous industry relations channels.

3. The development of JTB’s Products and Services Division’s services.

4. The development of JTB’s Integrated Technologies Division’s marketing products.

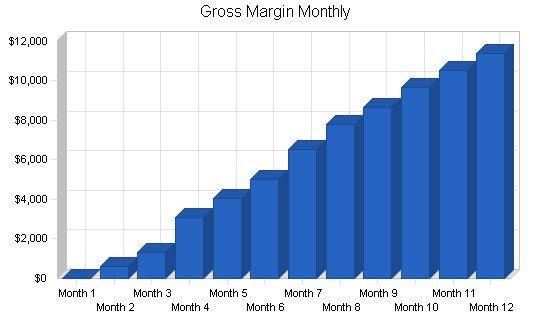

JTB’s Industrial Sales Division’s forecast highlights the key products to be initially offered. Management will seek additional avenues of business to develop, adding further sales capability. We aim to establish a strong local customer base in Louisiana for quick growth and cash flow. Additionally, we anticipate better margins as we become direct distributors for many of the lines initially offered.

Our sales forecast has an average margin of 36%. As an established direct or stocking distributor, we previously had discount arrangements of up to 68% off list pricing. These changes would result in an additional 15–30% reduction in our direct costs of goods.

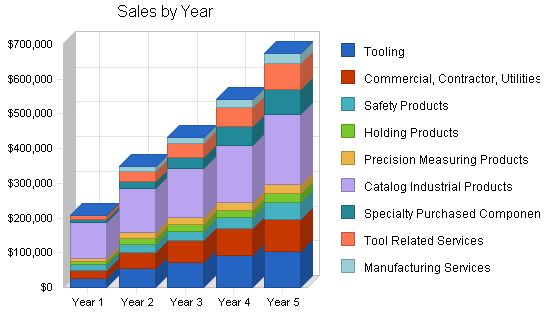

Sales Forecast

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

Tooling $26,320 $54,000 $72,000 $93,000 $103,456

Commercial, Contractor, Utilities $22,300 $48,000 $64,800 $76,400 $93,208

Safety Products $16,330 $21,200 $24,000 $32,156 $48,234

Holding Products $9,050 $17,800 $19,900 $21,300 $26,000

Precision Measuring Products $9,050 $17,800 $19,900 $21,300 $26,000

Catalog Industrial Products $105,200 $126,300 $141,500 $164,375 $200,537

Specialty Purchased Components $6,975 $21,400 $33,000 $56,000 $73,600

Tool Related Services $11,300 $28,800 $40,320 $54,432 $73,483

Manufacturing Services $0 $12,000 $18,000 $24,000 $30,000

Manufacturing Partners $0 $0 $0 $0 $0

Military and Governmental $0 $0 $0 $0 $0

Total Sales $206,525 $347,300 $433,420 $542,963 $674,518

Direct Cost of Sales

Year 1 Year 2 Year 3 Year 4 Year 5

Metal Cutting Tools $15,792 $32,400 $43,200 $50,880 $62,074

Commercial, Contractor, Utilities $13,380 $28,800 $38,880 $45,840 $55,925

Safety Products $9,798 $12,720 $14,400 $19,299 $28,940

Work Holding Products $5,430 $10,680 $11,940 $12,780 $15,600

Precision Measuring Products $5,430 $10,680 $11,940 $12,780 $15,600

Catalog Industrial Products $68,380 $82,095 $91,975 $106,843 $130,349

Specialty Purchased Components $3,834 $11,770 $18,150 $22,660 $40,480

Cutting Tool Related Services $6,215 $15,840 $22,176 $29,938 $40,415

Channel Partner Services $0 $7,200 $10,800 $14,400 $18,000

Internet Distributorships $0 $0 $0 $0 $0

Military and Governmental $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $128,259 $212,185 $263,461 $315,420 $407,383

Web Plan Summary

JTB’s Web-based marketing plan is the same for all divisions, with each division targeting its clients. JTB will receive information and feedback from paid ads in trade magazines and other websites. The plan is to link products and services with as many affiliate sites as possible.

When established, marketplaces and affiliate sites will serve as cost effective marketing tools for all divisions. Each division will have dedicated websites under the JTB logo. With a client database available via servers, JTB can show others the benefits of its products and services.

Website Marketing Strategy

JTB will develop and manage industrial marketplaces, utilizing search engine technology, affiliate marketing programs, and paid banner ads to drive customers to its sites.

Management Summary

Sales Manager, Mitchell R. Jeremy, will train staff and act as project manager. Staff will be trained on the technical aspects of products and the use of the corporate Intranet. Mr. Jeremy will develop internal and external sales and marketing programs.

New products and programs will be added as they are developed. The Intranet will be continually developed. Key training goals for staff include making associates self-sufficient on base inventory. Standardized product lists and promotions will expedite the training process.

Management Team

Sales and Operations Manager, Mitchell R. Jeremy, will oversee inside sales, train sales staff, and develop new customers. Sales Team Leaders will work in sales and marketing roles, providing customer support and training on new products and services.

Personnel Plan

Sales Associates will work in sales roles, providing customer support and training on new products and services. Shipping and Receiving will be a part-time position in the first two years, with potential for full-time in year 3.

Total People Year 1 Year 2 Year 3 Year 4 Year 5

Production Personnel 0 0 0 0 0

Shipping and Receiving $9,600 $9,600 $18,800 $18,800 $22,500

Name or Title or Group 0 0 0 0 0

Subtotal $9,600 $9,600 $18,800 $18,800 $22,500

Sales and Marketing Personnel

Sales Team Leader $30,000 $30,000 $31,000 $31,000 $31,000

Sales Associate $9,000 $14,000 $16,500 $19,000 $22,500

Sales and Marketing Associate (shared) $0 $0 $12,000 $16,000 $18,000

Subtotal $39,000 $44,000 $59,500 $66,000 $71,500

General and Administrative Personnel

Sales Manager $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0

Other Personnel

Name or Title $0 $0 $0 $0 $0

Other $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0

Total Payroll $48,600 $53,600 $78,300 $84,800 $94,000

Financial Plan

JTB’s financial plan is based on raising $181,000 in long-term loans for the Industrial Sales Division. The division will also develop P.C.-based Industrial Sales applications. The goal is to speed the quotation and purchasing process for the 300,000 industrial products offered in JTB’s catalogs. The division will implement a large-scale Internet and catalog-based marketing program to develop its client base.

Important Assumptions

The plan assumes stable business, banking, and economic trends. It assumes customer buying trends and orders remain strong and that overhead and external costs grow as projected. It also assumes Internet buying trends continue to grow in the industrial sector.

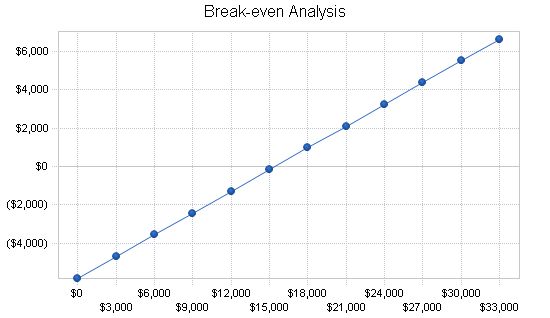

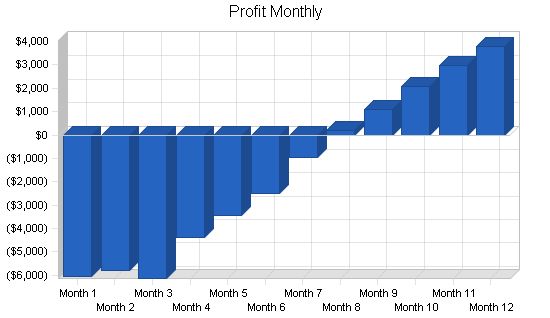

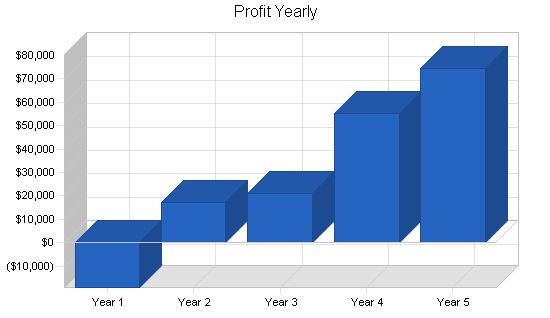

JTB will pass the break-even point in late in the first year and make increasing profits thereafter. The goal is to establish a solid base for the corporation and develop distribution software.

The financial tables in this plan only include projections for the Industrial Sales Division. Each plan should be reviewed, as each is different.

General Assumptions

Year 1 Year 2 Year 3 Year 4 Year 5

Plan Month 1 2 3 4 5

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 0.00% 30.00% 30.00% 30.00% 30.00%

Other 0 0 0 0 0

Note 8.1.1: A high-quality, networked accounting system with project management capabilities and budgeting will be implemented. The plan includes a budgeted approach for projects while adjusting costs in JTB’s favor.

All financial tables in this plan include only the projections for the Industrial Sales Division. Each plan should be reviewed, as each is different.

Break-even Analysis

Monthly Revenue Break-even: $15,441

Assumptions:

– Average Percent Variable Cost: 62%

– Estimated Monthly Fixed Cost: $5,852

Projected Profit and Loss

Please refer to note 8.1.1 in the Important Assumptions section regarding our Accounting system and methodology. The Projected Profit and Loss table considers all basic operating expenses for the Industrial Sales Division only.

When creating the table, we based our sales model on discount structures previously received while operating our previous distributorship. This distributorship represented and stocked many lines. For the sales portion of the P&L in the business plan, we calculated direct cost of goods sold using historical discount information. As we cannot predict our actual discount schedules from each vendor, we believe we can further reduce our direct costs of goods sold by an additional 15% – 20% once established as a direct distributor.

The projected table shows an average Gross Margin of 36%, but we expect to negotiate better terms. The long-term goal remains unchanged and is reflected in years 2006 and 2007. Please note the significant increase in sales for 2006, which is due to a large development of catalog clients. Taking note of 8.1.1, management believes that combining all elements of the business plan will result in a more robust corporation.

Other considerations that are partially factored into the P&L include management’s payroll and output. The holding company’s plan accounts for upper management’s payroll, and work will be distributed across the three divisions. Please remember, when reviewing the Profit and Loss statement, that the three JTB divisions will operate under one roof. Thus, management will fill in all sales and production areas as needed to fulfill orders.

Management’s operating schedule will also overlap to provide more operating hours than our 9 to 5 competitors. We anticipate running at least 50 hours per week, allowing us to expand business on the west coast.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | $206,525 | $347,300 | $433,420 | $542,963 | $674,518 |

| Direct Cost of Sales | $128,259 | $212,185 | $263,461 | $315,420 | $407,383 |

| Production Payroll | $9,600 | $9,600 | $18,800 | $18,800 | $22,500 |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $137,859 | $221,785 | $282,261 | $334,220 | $429,883 |

| Gross Margin | $68,666 | $125,515 | $151,159 | $208,743 | $244,635 |

| Gross Margin % | 33.25% | 36.14% | 34.88% | 38.45% | 36.27% |

| Operating Expenses | |||||

| Sales and Marketing Expenses | |||||

| Sales and Marketing Payroll | $39,000 | $44,000 | $59,500 | $66,000 | $71,500 |

| Advertising/Promotion | $3,000 | $4,800 | $4,800 | $4,800 | $4,800 |

| Other Sales and Marketing Expenses | $0 | $0 | $0 | $0 | $0 |

| Total Sales and Marketing Expenses | $42,000 | $48,800 | $64,300 | $70,800 | $76,300 |

| Sales and Marketing % | 20.34% | 14.05% | 14.84% | 13.04% | 11.31% |

| General and Administrative Expenses | |||||

| General and Administrative Payroll | $0 | $0 | $0 | $0 | $0 |

| Sales and Marketing and Other Expenses | $0 | $2,500 | $3,000 | $3,500 | $4,000 |

| Depreciation | $1,950 | $1,950 | $1,950 | $1,950 | $1,950 |

| Rent | $9,000 | $9,000 | $9,000 | $9,000 | $9,000 |

| Utilities | $4,100 | $4,800 | $5,600 | $6,000 | $6,500 |

| Insurance | $3,000 | $4,000 | $5,000 | $6,000 | $7,000 |

| Payroll Taxes | $6,570 | $9,405 | $12,750 | $14,400 | $16,200 |

| CPA – Accounting and Payroll | $3,600 | $3,800 | $4,000 | $4,000 | $4,000 |

| Other | $0 | $0 | $0 | $0 | $0 |

| Total General and Administrative Expenses | $28,220 | $35,455 | $41,300 | $44,850 | $48,650 |

| General and Administrative % | 13.66% | 10.21% | 9.53% | 8.26% | 7.21% |

| Other Expenses: | |||||

| Other Payroll | $0 | $0 | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 | $0 | $0 |

| Other Other Expenses | $0 | $0 | $0 | $0 | $0 |

| Total Other Expenses | $0 | $0 | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $70,220 | $84,255 | $105,600 | $115,650 | $124,950 |

| Profit Before Interest and Taxes | ($1,554) | $41,260 | $45,559 | $93,093 | $119,685 |

| EBITDA | $396 | $43,210 | $47,509 | $95,043 | $121,635 |

| Interest Expense | $17,536 | $16,538 | $15,496 | $14,454 | $13,413 |

| Taxes Incurred | $0 | $7,417 | $9,019 | $23,592 | $31,882 |

| Net Profit | ($19,090) | $17,306 | $21,044 | $55,047 | $74,391 |

| Net Profit/Sales | -9.24% | 4.98% | 4.86% | 10.14% | 11.03% |

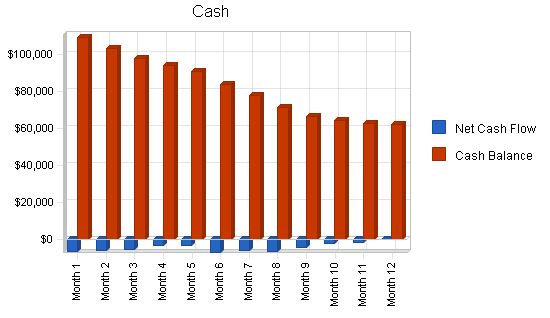

8.4 Projected Cash Flow

JTB’s projected cash flow reflects a strong balance throughout the plan. Please note that this table is for the Industrial Sales Division only.

When reviewing the projected cash flow, note that the largest sales growth is from our catalog sales program, which is not segmented for review. Additional segmentation information can be found in the market segmentation table in section 4.1 and in the milestones section 5.6.

Purchasing operates on a cost-plus scenario, marking up services to be re-sold, similar to the services area of our Industrial Products and Services Division. As the cash flow projects only the base products described in the business plan, it is highly probable JTB will be involved with more outsourced products and manufacturer partnering in years 2 through 5, furthering our potential profitability.

Pro Forma Cash Flow

Year 1 Year 2 Year 3 Year 4 Year 5

Cash Received

Cash from Operations

Cash Sales $20,653 $34,730 $43,342 $54,296 $67,452

Cash from Receivables $147,150 $286,175 $373,931 $468,128 $582,400

Subtotal Cash from Operations $167,802 $320,905 $417,273 $522,424 $649,852

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0 $0 $0

New Current Borrowing $0 $0 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $0 $0

Subtotal Cash Received $167,802 $320,905 $417,273 $522,424 $649,852

Expenditures

Year 1 Year 2 Year 3 Year 4 Year 5

Expenditures from Operations

Cash Spending $48,600 $53,600 $78,300 $84,800 $94,000

Bill Payments $162,310 $287,556 $337,505 $408,226 $511,084

Subtotal Spent on Operations $210,910 $341,156 $415,805 $493,026 $605,084

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0 $0 $0

Long-term Liabilities Principal Repayment $10,416 $10,416 $10,416 $10,416 $10,416

Purchase Other Current Assets $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $0 $0 $0 $0

Dividends $0 $0 $0 $0 $0

Subtotal Cash Spent $221,326 $351,572 $426,221 $503,442 $615,500

Net Cash Flow ($53,524) ($30,667) ($8,948) $18,982 $34,351

Cash Balance $62,076 $31,408 $22,460 $41,442 $75,794

8.5 Projected Balance Sheet

JTB’s projected balance sheet shows strong cash development capability over the projected 5 year plan. The balance sheet assumes the business remains at its startup location for the first five years, keeping costs relatively fixed. Management believes it can achieve an even stronger financial position than projected.

JTB’s Industrial Sales Division will maintain a stable cash position while developing positive net worth. As the division operates in an office setting, there is no need for large assets other than what is necessary at startup. Inventory requirements may change as different purchasing options are offered to clients. Any differences in cash flow and inventory would indicate that cash is tied up in inventory. Efforts will be made to keep inventory levels reasonable.

Pro Forma Balance Sheet

Year 1 Year 2 Year 3 Year 4 Year 5

Assets

Current Assets

Cash $62,076 $31,408 $22,460 $41,442 $75,794

Accounts Receivable $38,723 $65,118 $81,265 $101,804 $126,471

Inventory $29,852 $41,361 $51,356 $64,336 $79,924

Other Current Assets $5,500 $5,500 $5,500 $5,500 $5,500

Total Current Assets $136,150 $143,387 $160,582 $213,082 $287,688

Long-term Assets

Long-term Assets $19,500 $19,500 $19,500 $19,500 $19,500

Accumulated Depreciation $1,950 $3,900 $5,850 $7,800 $9,750

Total Long-term Assets $17,550 $15,600 $13,650 $11,700 $9,750

Total Assets $153,700 $158,987 $174,232 $224,782 $297,438

Liabilities and Capital

Year 1 Year 2 Year 3 Year 4 Year 5

Current Liabilities

Accounts Payable $25,106 $23,503 $28,120 $34,039 $42,720

Current Borrowing $0 $0 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0

Subtotal Current Liabilities $25,106 $23,503 $28,120 $34,039 $42,720

Long-term Liabilities $170,584 $160,168 $149,752 $139,336 $128,920

Total Liabilities $195,690 $183,671 $177,872 $173,375 $171,640

Paid-in Capital $0 $0 $0 $0 $0

Retained Earnings ($22,900) ($41,990) ($24,684) ($3,640) $51,407

Earnings ($19,090) $17,306 $21,044 $55,047 $74,391

Total Capital ($41,990) ($24,684) ($3,640) $51,407 $125,798

Total Liabilities and Capital $153,700 $158,987 $174,232 $224,782 $297,438

Net Worth ($41,990) ($24,684) ($3,640) $51,407 $125,798

8.6 Business Ratios

Business ratios for the years of this plan are shown below. These ratios are compared to industry profile ratios based on the Standard Industrial Classification (SIC) code 5961.9905, Catalog Sales.

JTB’s ratios differ in some areas as the industry profile ratios likely reflect a complete business with full overhead. JTB’s ratios are lighter in overhead and assets due to the heavy assets being in the Industrial Products and Services Division, which is not reflected in this division’s balance sheet.

JTB’s sales growth is substantially greater due to adding new products and services each year. The gross average margins of 36% are in line with the industry profile. Overall, JTB’s ratios are better than the industry as marketing budgets and avenues have been maximized while keeping costs in check. Sales staff are trained to maintain profit per order levels when processing orders, resulting in streamlined repeat ordering and efficient order processing, reducing internal costs.

Ratio Analysis

Sales Growth

Year 1: 0.00%

Year 2: 68.16%

Year 3: 24.80%

Year 4: 25.27%

Year 5: 24.23%

Industry Profile: 2.88%

Percent of Total Assets

Accounts Receivable: 25.19%

Inventory: 19.42%

Other Current Assets: 3.58%

Total Current Assets: 88.58%

Long-term Assets: 11.42%

Total Assets: 100.00%

Current Liabilities: 16.33%

Long-term Liabilities: 110.99%

Total Liabilities: 127.32%

Net Worth: -27.32%

Percent of Sales

Sales: 100.00%

Gross Margin: 33.25%

Selling, General & Administrative Expenses: 10.98%

Advertising Expenses: 12.20%

Profit Before Interest and Taxes: -0.75%

Main Ratios

Current: 5.42

Quick: 4.23

Total Debt to Total Assets: 127.32%

Pre-tax Return on Net Worth: 45.46%

Pre-tax Return on Assets: -12.42%

Additional Ratios

Net Profit Margin: -9.24%

Return on Equity: 0.00%

Activity Ratios

Accounts Receivable Turnover: 4.80

Collection Days: 40

Inventory Turnover: 6.70

Accounts Payable Turnover: 7.37

Payment Days: 28

Total Asset Turnover: 1.34

Debt Ratios

Debt to Net Worth: 0.00

Current Liab. to Liab.: 0.13

Liquidity Ratios

Net Working Capital: $111,044

Interest Coverage: -0.09

Additional Ratios

Assets to Sales: 0.74

Current Debt/Total Assets: 16%

Acid Test: 2.69

Sales/Net Worth: 0.00

Dividend Payout: 0.00

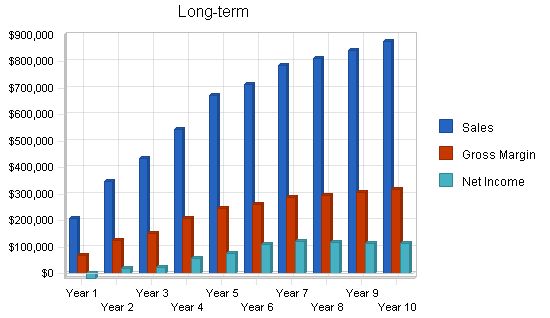

8.7 Long-term Plan

JTB’s Industrial Sales Division has projected a 10-year plan to showcase the business’s long-term results and the potential of manufacturing partnerships.

Goals for the long-term plan include:

1. Achieving gross sales exceeding $800,000 by year 8.

2. Attaining gross margins surpassing $280,000 by year 7.

3. Generating net income of over $100,000 by year 5.

4. Reaching current assets totaling more than $390,000 by year 5.

5. Establishing equity exceeding $360,000 by year 7.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!