Grassroots Wireless is an innovative start-up that provides wireless broadband Internet connections in Chicago. By using Wi-fi technology and proprietary antennas and repeaters, Grassroots can serve a large area with broadband Internet.

Steve Teche, the founder of Grassroots, has an MBA and an undergraduate Computer Science degree, giving him the skills to execute this well-researched business plan. Steve’s experience in the Peace Corps also gave him project management skills and confidence to venture into business.

The market for wireless broadband Internet is growing rapidly, surpassing forecasts. The wireless market is especially exciting due to its low delivery infrastructure costs. As Grassroots’ customer base grows, costs decrease, making the business even more compelling.

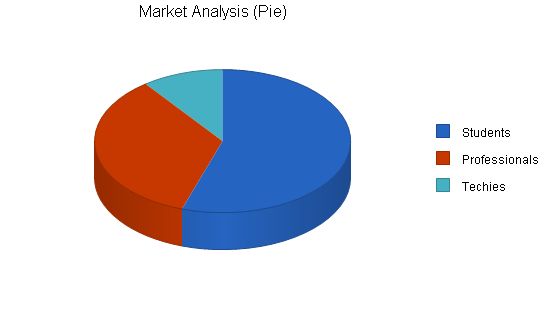

Grassroots has targeted three groups: students, professionals, and techies. These groups have high expectations for internet speed and are heavy internet users.

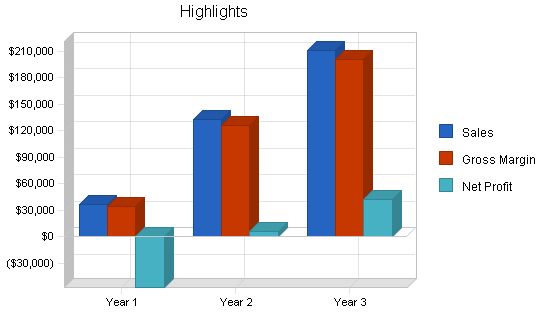

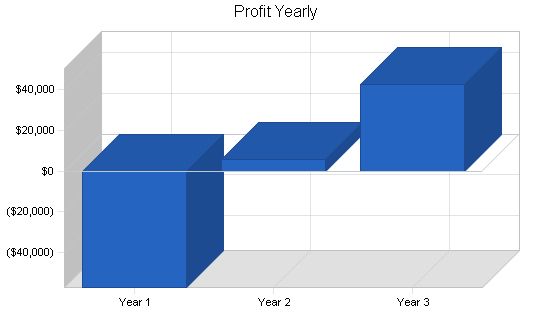

Grassroots leverages technology and proprietary tools to offer below-market prices for a market need. As the customer base grows, the business will earn higher margins and increase profits. Year two and year three are expected to have significant profit growth.

Overall, Grassroots Wireless offers a compelling and exciting business opportunity with great potential for success under Steve Teche’s leadership.

Grassroots Wireless is dedicated to providing fast, affordable wireless Internet access. Our primary goal is ensuring customer satisfaction.

To achieve success, we will focus on disciplined growth, aiming for profitability within two years. Additionally, we will prioritize meeting customer needs and maintaining a 90% retention rate.

Our objectives include delivering fast, reliable wireless Internet access and treating customers with utmost respect. We aim to achieve profitability within two years.

Grassroots Wireless, established in 2003, offers affordable wireless broadband Internet as an alternative to DSL or cable. Utilizing Wi-Fi technology, we can easily set up neighborhood networks. Steve Teche, the company’s founder, relies on outside investors for initial funding.

Grassroots Wireless is an Illinois L.L.C., with Steve Teche as the principal and majority owner.

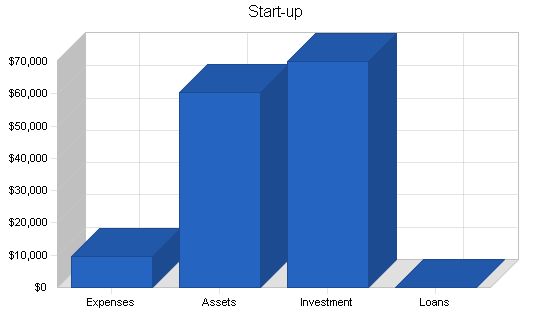

The necessary equipment includes three computer workstations, a wireless access point, five repeaters, five antennas, and various office supplies.

Startup Funding

Start-up Expenses to Fund: $9,500

Start-up Assets to Fund: $60,500

Total Funding Required: $70,000

Assets

Non-cash Assets from Start-up: $5,000

Cash Requirements from Start-up: $55,500

Additional Cash Raised: $0

Cash Balance on Starting Date: $55,500

Total Assets: $60,500

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Investor 1: $15,000

Investor 2: $55,000

Additional Investment Requirement: $0

Total Planned Investment: $70,000

Loss at Start-up (Start-up Expenses): ($9,500)

Total Capital: $60,500

Total Capital and Liabilities: $60,500

Total Funding: $70,000

Start-up Requirements

Start-up Expenses

Legal: $2,000

Stationery etc.: $100

Consultants: $1,000

Insurance: $200

Rent: $200

Research and Development: $1,000

Expensed Equipment: $5,000

Total Start-up Expenses: $9,500

Start-up Assets

Cash Required: $55,500

Other Current Assets: $0

Long-term Assets: $5,000

Total Assets: $60,500

Total Requirements: $70,000

Services

Grassroots offers wireless broadband Internet access. The service offers DSL speed and requires only a Wi-fi card for customers within range of the signal, covering a thirty block radius. The coverage area will expand as more customers sign up.

Wi-fi technology uses 2.4 mhz spectrum wireless transmissions. The Internet signals are broadcasted through the neighborhood using the same wave lengths as some cordless phones. With a supplied password and a Wi-fi receiver in each customer’s computer, customers can have fast, wireless Internet connections.

Market Analysis Summary

In the past three years, the popularity of broadband Internet connections has increased. With fast connections at work, people no longer want to deal with dial-up connections at home. Wi-fi technology allows for a fast connection without the need for expensive cables, as the signal is transmitted via radio waves. The targeted market segments are students, professionals, and techies.

Market Segmentation

The market can be divided into three groups:

– Students: These individuals are in academia and are accustomed to fast connections. They use the Internet frequently for trading MP3s and downloading videos.

– Professionals: This group conducts business over the Internet for banking, e-commerce, and communications.

– Techies: Tech-savvy individuals who enjoy challenging themselves with technology and its complexity.

Grassroots’ customers, except for students, are generally affluent (household income of $50,000 or more) and invest in technology offerings such as digital cable, cellular service, or broadband Internet connections. The target customers are also well-educated, with 65% having a college degree and 20% holding a graduate degree. Combining various demographic factors, Grassroots has identified the following primary customer profile:

– Spends 10 hours a week on the Internet outside of home.

– Has made a purchase from a website within the past two months.

– Has at least some undergraduate coursework.

– Household income of $50,000 or more.

Market Analysis:

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth

Students 9% 54,000 58,860 64,157 69,931 76,225 9.00%

Professionals 8% 34,000 36,720 39,658 42,831 46,257 8.00%

Techies 11% 10,000 11,100 12,321 13,676 15,180 11.00%

Total 8.87% 98,000 106,680 116,136 126,438 137,662 8.87%

4.2 Target Market Segment Strategy:

Grassroots has chosen these target markets because they adopt broadband Internet technology. These groups are most likely to use and pay for a fast connection.

4.3 Service Business Analysis:

The consumer broadband Internet market has three main participants:

– DSL (digital subscriber line): Uses the copper phone lines for transmission.

– Cable: Uses cable TV wiring for transmission.

– Satellite connections: Uses satellites for "cable" TV and Internet connections.

4.3.1 Competition and Buying Patterns:

DSL, cable, and satellite access are competitors in the broadband market. Consumer buying patterns depend on availability and convenience in terms of outlet cords and location.

Strategy and Implementation Summary:

Grassroots’ strategy is to offer a service demanded by customers at a price that undercuts the competition. This will be achieved by leveraging technology to reduce costs. Grassroots will generate awareness among the target segments.

5.1 Competitive Edge:

Grassroots’ competitive edge lies in its effective and efficient use of Wi-Fi technology. The company has developed a proprietary antenna that allows for long-distance signal transmission with less loss. Grassroots has also reduced administrative costs by utilizing the Internet for marketing, sales, and service details.

5.2 Marketing Strategy:

Grassroots will use a grassroots approach for developing awareness. This includes advertising/postings with local retailers and commercial businesses, targeted mailings to local residents, and leveraging the website for marketing and sales information.

5.3 Sales Strategy:

The sales strategy focuses on positioning Grassroots’ service as a viable alternative to Cable and DSL. The message highlights the ability to receive broadband speed connections anywhere at a fraction of the competitors’ price. Grassroots will use targeted advertising, mailings, and a website for marketing, sales, and administrative purposes.

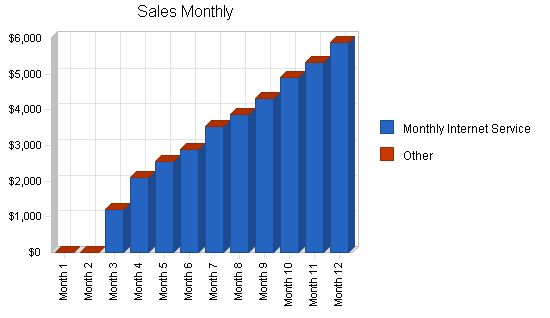

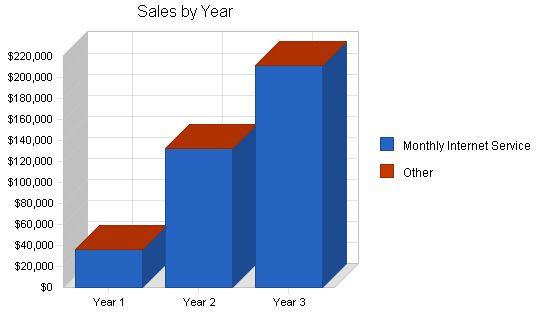

5.3.1 Sales Forecast:

Grassroots has developed a conservative sales forecast to minimize the impact of external variables. The company expects steady adoption rates and extensive growth due to the general adoption of broadband connections and the offering of a less expensive alternative.

Sales Forecast

Sales

Year 1 Year 2 Year 3

$36,584 $132,665 $211,443

Monthly Internet Service

$36,584 $132,665 $211,443

Other

$0 $0 $0

Total Sales

$36,584 $132,665 $211,443

Direct Cost of Sales

Year 1 Year 2 Year 3

Administrative costs

$1,829 $6,633 $10,572

Other

$0 $0 $0

Subtotal Direct Cost of Sales

$1,829 $6,633 $10,572

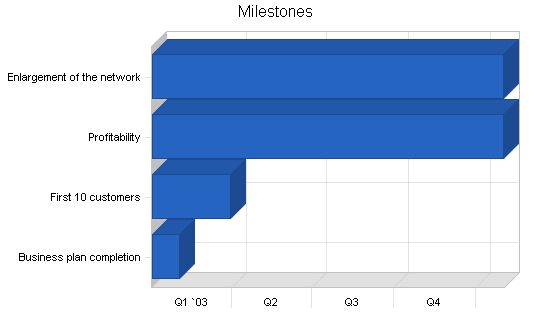

5.4 Milestones

Milestones are important in a business plan. They provide achievable goals that the business must concentrate on. By targeting lofty goals, Grassroots aims high and is more likely to achieve more. The chosen milestones are specific to the company and will be embraced by all employees.

Milestones:

– Business plan completion: 1/1/2003 – 2/1/2003, $0 Budget, Manager: Steve, Department: Management

– First 10 customers: 1/1/2003 – 3/30/2003, $0 Budget, Manager: Steve, Department: Sales

– Profitability: 1/1/2003 – 2/1/2004, $0 Budget, Manager: Steve, Department: Operations

– Enlargement of the network: 1/1/2003 – 2/1/2004, $0 Budget, Manager: Steve, Department: Operations

– Totals: $0 Budget

Web Plan Summary:

The website will be used for:

– Marketing/sales

– Administrative functions

6.1 Website Marketing Strategy:

– All of Grassroots’ marketing information will be present on the website for viewing and for downloading/printing.

– Awareness regarding the website will be accomplished by inclusion of the website address on all printed materials.

– The website will have a comprehensive submission procedure to all of the popular search engines.

6.2 Development Requirements:

The website will be developed in-house by leveraging interns.

Management Summary:

Steve Teche, founder and president will be the anchor of the management team.

– Steve received his undergraduate degree in computer science from Loyola University.

– While Steve enjoyed the coursework, he recognized that it was not something he was interested in pursuing as a career.

– Steve decided that it would be in his best interest to study for an MBA. However, he was not immediately ready to do this.

– So Steve headed off to Ghana with the Peace Corps to develop community-based trading systems.

– Steve’s Peace Corps experience provided him with extensive project management experience and confidence in his abilities.

– After getting back to the States, Steve began the MBA program at the University of Chicago.

– Steve’s course of study concentrated on entrepreneurial ventures, recognizing his desire to start his own business.

– Near the end of his second year, Steve began to hear about Wi-fi technology.

– He became interested in what he saw was a strong market need for inexpensive broadband Internet connections transmitted wirelessly, thereby significantly decreasing delivery costs.

– Steve formed Grassroots Wireless to fulfill this market need.

7.1 Personnel Plan:

The two main employees beyond Steve are:

– Technician: responsible for the smooth operation of the wireless network and the website.

– Administration: a general customer service position, assisting in sales and support.

Personnel Plan:

– President: Year 1 – $24,000, Year 2 – $36,000, Year 3 – $48,000

– Technician: Year 1 – $19,800, Year 2 – $21,600, Year 3 – $21,600

– Administration: Year 1 – $15,000, Year 2 – $18,000, Year 3 – $18,000

– Total People: 3

– Total Payroll: Year 1 – $58,800, Year 2 – $75,600, Year 3 – $87,600

The following sections outline important financial information.

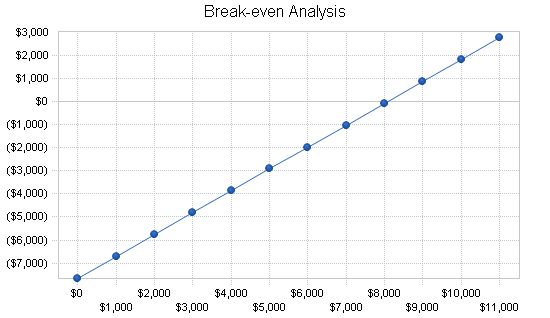

8.1 Break-even Analysis:

– Average per-unit revenue: based on the $20 monthly access fee.

– Average per-unit variable cost: costs based on infrastructure and administrative costs.

– Estimated monthly fixed costs: Internet connection costs.

Break-even Analysis:

Monthly Revenue Break-even: $8,072.

Assumptions:

– Average Percent Variable Cost: 5%.

– Estimated Monthly Fixed Cost: $7,668.

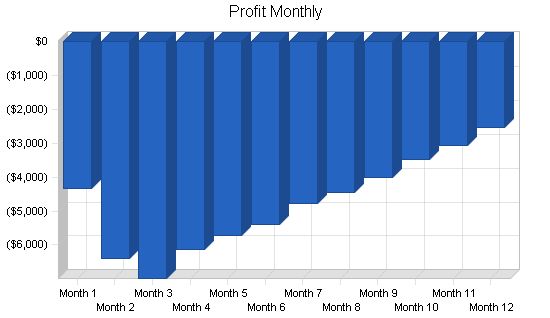

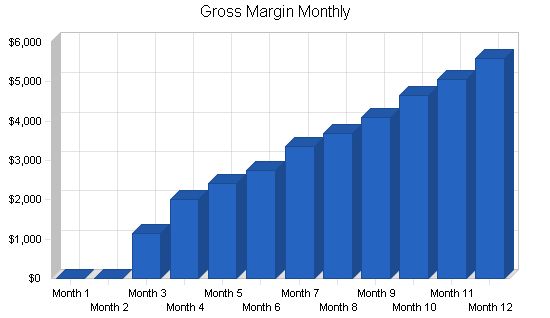

Projected Profit and Loss:

The table and charts below display the Projected Profit and Loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $36,584 | $132,665 | $211,443 |

| Direct Cost of Sales | $1,829 | $6,633 | $10,572 |

| Other Costs of Sales | $0 | $0 | $0 |

| Total Cost of Sales | $1,829 | $6,633 | $10,572 |

| Gross Margin | $34,755 | $126,032 | $200,871 |

| Gross Margin % | 95.00% | 95.00% | 95.00% |

| Expenses | |||

| Payroll | $58,800 | $75,600 | $87,600 |

| Sales and Marketing and Other Expenses | $2,400 | $5,600 | $12,000 |

| Depreciation | $996 | $1,002 | $1,002 |

| Rent | $2,400 | $2,400 | $2,400 |

| Utilities | $9,600 | $13,000 | $15,000 |

| Insurance | $3,000 | $3,000 | $3,000 |

| Payroll Taxes | $8,820 | $11,340 | $13,140 |

| Other | $6,000 | $6,000 | $6,000 |

| Total Operating Expenses | $92,016 | $117,942 | $140,142 |

| Profit Before Interest and Taxes | ($57,261) | $8,090 | $60,729 |

| EBITDA | ($56,265) | $9,092 | $61,731 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $2,427 | $18,219 |

| Net Profit | ($57,261) | $5,663 | $42,510 |

| Net Profit/Sales | -156.52% | 4.27% | 20.10% |

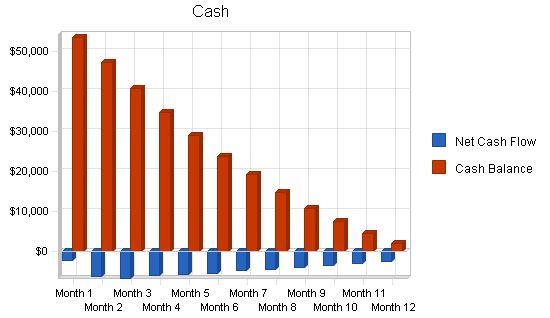

8.3 Projected Cash Flow

The following table and chart display the Projected Cash Flow.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $36,584 | $132,665 | $211,443 |

| Subtotal Cash from Operations | $36,584 | $132,665 | $211,443 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $36,584 | $132,665 | $211,443 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $58,800 | $75,600 | $87,600 |

| Bill Payments | $31,112 | $49,195 | $77,871 |

| Subtotal Spent on Operations | $89,912 | $124,795 | $165,471 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $89,912 | $124,795 | $165,471 |

| Net Cash Flow | ($53,328) | $7,870 | $45,972 |

| Cash Balance | $2,172 | $10,042 | $56,014 |

8.4 Projected Balance Sheet

The following table presents the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $2,172 | $10,042 | $56,014 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $2,172 | $10,042 | $56,014 |

| Long-term Assets | |||

| Long-term Assets | $5,000 | $5,000 | $5,000 |

| Accumulated Depreciation | $996 | $1,998 | $3,000 |

| Total Long-term Assets | $4,004 | $3,002 | $2,000 |

| Total Assets | $6,176 | $13,044 | $58,014 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $2,938 | $4,142 | $6,603 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $2,938 | $4,142 | $6,603 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $2,938 | $4,142 | $6,603 |

| Paid-in Capital | $70,000 | $70,000 | $70,000 |

| Retained Earnings | ($9,500) | ($66,761) | ($61,098) |

| Earnings | ($57,261) | $5,663 | $42,510 |

| Total Capital | $3,239 | $8,902 | $51,412 |

| Total Liabilities and Capital | $6,176 | $13,044 | $58,014 |

| Net Worth | $3,239 | $8,902 | $51,412 |

8.5 Business Ratios

The following table illustrates the different Business Ratios, based on NAICS code 518111, Internet Service Providers.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 262.63% | 59.38% | 15.97% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.00% | 0.00% | 0.00% | 56.35% |

| Total Current Assets | 35.17% | 76.99% | 96.55% | 87.48% |

| Long-term Assets | 64.83% | 23.01% | 3.45% | 12.52% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 47.56% | 31.76% | 11.38% | 30.66% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 23.07% |

| Total Liabilities | 47.56% | 31.76% | 11.38% | 53.73% |

| Net Worth | 52.44% | 68.24% | 88.62% | 46.27% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 95.00% | 95.00% | 95.00% | 100.00% |

| Selling, General & Administrative Expenses | 251.52% | 90.73% | 74.90% | 73.80% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.37% |

| Profit Before Interest and Taxes | -156.52% | 6.10% | 28.72% | 1.03% |

| Main Ratios | ||||

| Current | 0.74 | 2.42 | 8.48 | 1.97 |

| Quick | 0.74 | 2.42 | 8.48 | 1.50 |

| Total Debt to Total Assets | 47.56% | 31.76% | 11.38% | 59.78% |

| Pre-tax Return on Net Worth | -1767.98% | 90.88% | 118.12% | 2.93% |

| Pre-tax Return on Assets | -927.10% | 62.02% | 104.68% | 7.28% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -156.52% | 4.27% | 20.10% | n.a |

| Return on Equity | -1767.98

General Assumptions: Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Plan Month 1 2 3 4 5 6 7 8 9 10 11 12 Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% Tax Rate 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% Other 0 0 0 0 0 0 0 0 0 0 0 0 Pro Forma Profit and Loss: Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Sales $0 $0 $1,200 $2,112 $2,544 $2,887 $3,543 $3,877 $4,322 $4,899 $5,323 $5,877 Direct Cost of Sales $0 $0 $60 $106 $127 $144 $177 $194 $216 $245 $266 $294 Other Costs of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Cost of Sales $0 $0 $60 $106 $127 $144 $177 $194 $216 $245 $266 $294 Gross Margin $0 $0 $1,140 $2,006 $2,417 $2,743 $3,366 $3,683 $4,106 $4,654 $5,057 $5,583 Gross Margin % 0.00% 0.00% 95.00% 95.00% 95.00% 95.00% 95.00% 95.00% 95.00% 95.00% 95.00% 95.00% Expenses Payroll $2,000 $3,800 $5,300 $5,300 $5,300 $5,300 $5,300 $5,300 $5,300 $5,300 $5,300 $5,300 Sales and Marketing and Other Expenses $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Depreciation $83 $83 $83 $83 $83 $83 $83 $83 $83 $83 $83 $83 Rent $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 Utilities $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 $800 Insurance $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 Payroll Taxes 15% $300 $570 $795 $795 $795 $795 $795 $795 $795 $795 $795 $795 Other $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 Total Operating Expenses $4,333 $6,403 $8,128 $8,128 $8,128 $8,128 $8,128 $8,128 $8,128 $8,128 $8,128 $8,128 Profit Before Interest and Taxes ($4,333) ($6,403) ($6,988) ($6,122) ($5,711) ($5,385) ($4,762) ($4,445) ($4,022) ($3,474) ($3,071) ($2,545) EBITDA ($4,250) ($6,320) ($6,905) ($6,039) ($5,628) ($5,302) ($4,679) ($4,362) ($3,939) ($3,391) ($2,988) ($2,462) Interest Expense $0 $0 $0 $0 $0 $0 $0 $0 Pro Forma Balance Sheet |

|||

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $55,500 | $53,425 | $47,366 | $40,737 | $34,742 | $29,135 | $23,849 | $19,201 | $14,856 | $10,938 | $7,575 | $4,607 | $2,172 |

| Other Current Assets | $0 | ||||||||||||

| Total Current Assets | $55,500 | $53,425 | $47,366 | $40,737 | $34,742 | $29,135 | $23,849 | $19,201 | $14,856 | $10,938 | $7,575 | $4,607 | $2,172 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 |

| Accumulated Depreciation | $0 | $83 | $166 | $249 | $332 | $415 | $498 | $581 | $664 | $747 | $830 | $913 | $996 |

| Total Long-term Assets | $5,000 | $4,917 | $4,834 | $4,751 | $4,668 | $4,585 | $4,502 | $4,419 | $4,336 | $4,253 | $4,170 | $4,087 | $4,004 |

| Total Assets | $60,500 | $58,342 | $52,200 | $45,488 | $39,410 | $33,720 | $28,351 | $23,620 | $19,192 | $15,191 | $11,745 | $8,694 | $6,176 |

| Liabilities and Capital | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $2,175 | $2,436 | $2,712 | $2,756 | $2,776 | $2,793 | $2,825 | $2,841 | $2,862 | $2,890 | $2,911 | $2,938 |

| Current Borrowing | $0 | ||||||||||||

| Other Current Liabilities | $0 | ||||||||||||

| Subtotal Current Liabilities | $0 | $2,175 | $2,436 | $2,712 | $2,756 | $2,776 | $2,793 | $2,825 | $2,841 | $2,862 | $2,890 | $2,911 | $2,938 |

| Long-term Liabilities | $0 | ||||||||||||

| Total Liabilities | $0 | $2,175 | $2,436 | $2,712 | $2,756 | $2,776 | $2,793 | $2,825 | $2,841 | $2,862 | $2,890 | $2,911 | $2,938 |

| Paid-in Capital | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 | $70,000 |

| Retained Earnings | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) | ($9,500) |

| Earnings | $0 | ($4,333) | ($10,736) | ($17,724) | ($23,846) | ($29,557) | ($34,942) | ($39,704) | ($44,149) | ($48,171) | ($51,645) | ($54,716) | ($57,261) |

| Total Capital | $60,500 | $56,167 | $49,764 | $42,776 | $36,654 | $30,943 | $25,558 | $20,796 | $16,351 | $12,329 | $8,855 | $5,784 | $3,239 |

| Total Liabilities and Capital | $60,500 | $58,342 | $52,200 | $45,488 | $39,410 | $33,720 | $28,351 | $23,620 | $19,192 | $15,191 | $11,745 | $8,694 | $6,176 |

| Net Worth | $60,500 | $56,167 | $49,764 | $42,776 | $36,654 | $30,943 | $25,558 | $20,796 | $16,351 | $12,329 | $8,855 | $5,784 | $3,239 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Web Plan Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!