Contents

Independent Video Store Business Plan

Independent Choice Flicks (ICF) is a unique video rental store in Eugene, Ore. ICF offers a variety of movies that are not commonly found in larger chains, including film festival movies, independent releases, foreign films, and other "arts" films. Eugene is an ideal market for these types of films, given its demographics (liberal, educated, college town) and the success of the Bijou Arts Cinema, a first-run movie theater that specializes in this genre.

The dominant stores in Eugene have overlooked this market. While they may have a few films that fit these descriptions, they are generally scarce. Large corporations find it challenging to cater to this specific segment, especially with their current business model, which focuses on placing stores in all cities and prioritizing mainstream commercial releases.

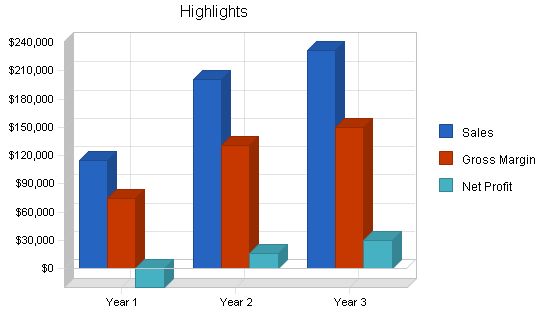

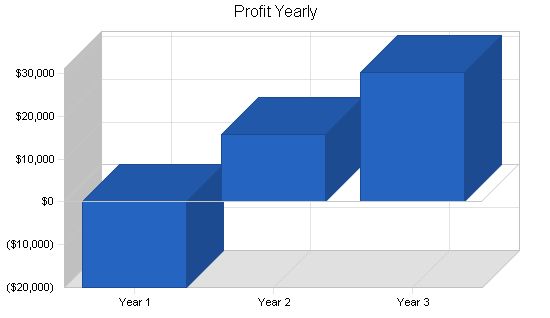

ICF’s key competitive advantage lies in its dedication to customers. By providing exceptional customer service and knowledgeable assistance, ICF will steadily grow and become profitable. Furthermore, ICF will meet the demand for movies in Eugene that other players have neglected, assuming it is only for a niche audience. However, in Eugene, this "fringe" population represents a significant portion of the general population. ICF expects to achieve profitability within the first year and projected revenues of over $230,000 by year three.

1.1 Objectives

The objectives for the first three years include:

- Create a movie rental store that exceeds customers’ expectations.

- Develop an alternative to traditional franchise movie rental stores.

- Increase the number of clients by 20% per year through superior selection and customer service.

1.2 Mission

The Independent Choice Flick’s mission is to provide customers with independent, non-commercial movies. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall into place. Our services will exceed customers’ expectations.

Company Summary

ICF will be based in Eugene, Oregon, offering an alternative to traditional franchise movie rental stores. ICF’s selections will include non-commercial releases, independent films, foreign films, and films present at international film festivals, including the Sundance Film Festival.

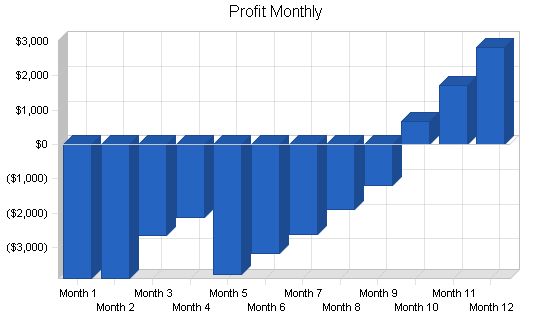

ICF will offer flexible business hours and exceptional customer service. ICF will be willing to special order movies within its stocked genres. The business will be located in a high-traffic area in Eugene and will have five employees by the end of year one. ICF is forecasted to reach profitability by month nine with $32,000 in profit by year three.

2.1 Company Ownership

ICF will be owned by Janet Sinemma.

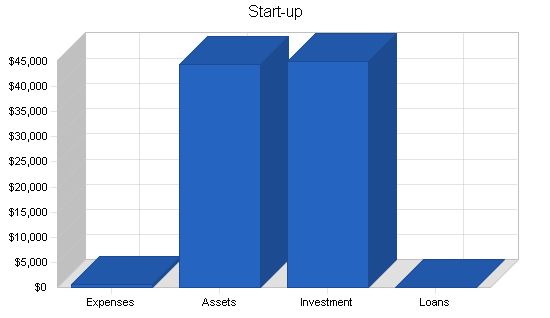

2.2 Start-up Summary

ICF will have the following start-up costs, and any long-term assets will be depreciated using the straight-line method:

- Legal fees: business formation and contract generation and review.

- Advertising costs: advertisements in the Register Guard, Eugene Weekly, and Bijou Arts Cinema.

- Display shelves (purchased used).

- Cash register with bar code printer, scanner, and inventory tracking software.

- Video cassette cases.

- Back office computer with printer, CD-RW, and Internet connection.

- Back office furniture.

- Phone lines (2).

- Fax machine and copier.

- Movies (listed as long-term assets).

Start-up

Requirements

Start-up Expenses

Legal -$300

Stationery etc. -$200

Rent -$0

Other -$0

Total Start-up Expenses -$500

Start-up Assets

Cash Required -$28,800

Start-up Inventory -$0

Other Current Assets -$0

Long-term Assets -$15,700

Total Assets -$44,500

Total Requirements -$45,000

Start-up Funding

Start-up Expenses to Fund -$500

Start-up Assets to Fund -$44,500

Total Funding Required -$45,000

Assets

Non-cash Assets from Start-up -$15,700

Cash Requirements from Start-up -$28,800

Additional Cash Raised -$0

Cash Balance on Starting Date -$28,800

Total Assets -$44,500

Liabilities and Capital

Liabilities

Current Borrowing -$0

Long-term Liabilities -$0

Accounts Payable (Outstanding Bills) -$0

Other Current Liabilities (interest-free) -$0

Total Liabilities -$0

Capital

Planned Investment

Janet -$45,000

Other -$0

Additional Investment Requirement -$0

Total Planned Investment -$45,000

Loss at Start-up (Start-up Expenses) -($500)

Total Capital -$44,500

Total Capital and Liabilities -$44,500

Total Funding -$45,000

Services

ICF will provide Eugene with an alternative movie rental store, a service not yet offered in Eugene. Typical rental stores currently focus on popular, commercial releases. However, there is a market for alternative releases, as shown by the success of the Bijou Arts Cinema, which shows movies of this genre in a first-run movie theater format. In essence, ICF will be an extension of the Bijou, but in the comfort of customers’ homes.

Market Analysis Summary

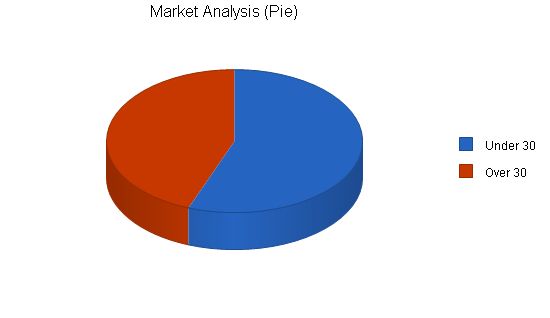

ICF will target two distinct groups that use movie rental stores: a younger group and an older group. Although both groups enjoy non-commercial releases, their tastes in movies are not being met by the current offerings of corporate movie stores.

4.1 Market Segmentation

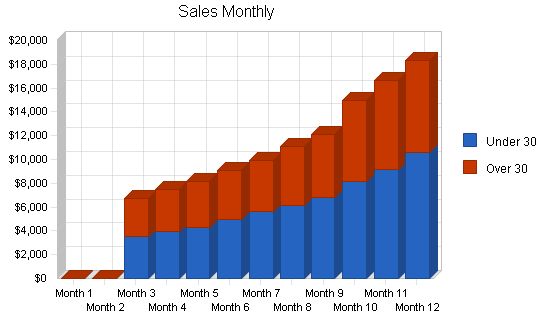

ICF’s customer base can be divided into two general groups: those under 30 and those over 30.

– Under 30: This segment has diverse interests, including action, violence, drugs, and sex. Although the movies are not solely about these subjects, they may resonate more with individuals under 30.

– Over 30: This segment has more mature tastes and appreciates sophisticated humor. They are more likely to enjoy foreign films compared to the under 30 group. The movie topics will generally reflect experiences and issues that this group is familiar with.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| 36,000 | 40,320 | 45,158 | 50,577 | 56,646 | 12.00% | ||

| 28,500 | 31,065 | 33,861 | 36,908 | 40,230 | 9.00% | ||

| 64,500 | 71,385 | 79,019 | 87,485 | 96,876 | 10.70% | ||

4.2 Target Market Segment Strategy

ICF focuses on underserved groups in Eugene. Currently, Hollywood Video and Blockbuster dominate the market. To be successful, ICF must concentrate on the middle market and use economies of scale to reduce operating costs. However, the fringes are largely unaddressed by ICF.

While the term fringe market may sound derogatory, it is thriving in Eugene. The alternative market appeals to the highly educated population in Eugene, who prefer movies with thematic and cultural value. ICF will target this market through advertising and word-of-mouth referrals.

4.3 Service Business Analysis

ICF competes in the movie rental business alongside Hollywood Video and Blockbuster. These two corporate rental chains target the mainstream market, leaving the alternative movie rental market unaddressed by them. ICF’s customers value thematic quality rather than popularity or new releases.

4.3.1 Competition and Buying Patterns

In Eugene, there are two types of competitors: the industry gorillas (Hollywood Video and Blockbuster) and local video rentals. The industry gorillas focus on new releases, while local video rentals cater to convenience.

Strategy and Implementation Summary

ICF recognizes the unaddressed alternative film rental market in Eugene, which is supported by demographics and the success of similar genre first run movie theaters. By marketing through local publications and partnering with the Bijou Arts Cinema, ICF will reach their target market. Additionally, ICF will prioritize superior customer service to build long-term relationships and achieve steady growth.

5.1 Competitive Edge

ICF’s competitive edge lies in their attention to customer needs in Eugene. They fill a specific need in the market, making them distinct from larger corporate chains. ICF offers a selection of difficult-to-find videos, fostering loyalty among their smaller user base.

5.2 Sales Strategy

ICF’s sales strategy focuses on targeted selection and personalized service. They offer genres of films that are currently unavailable in Eugene and employ knowledgeable staff who are passionate about these movies. They also provide customer-oriented service, including ordering films for customers.

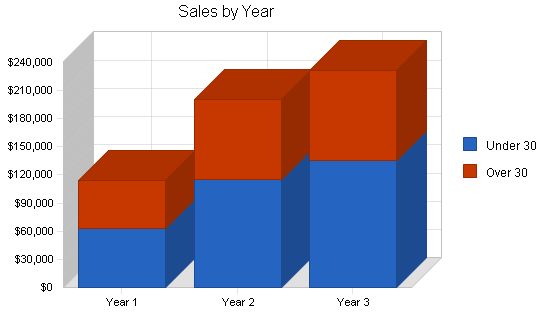

5.2.1 Sales Forecast

In the first two months, ICF will set up the store and order inventory. Sales activity will begin in the third month. By the fifth month, sales will steadily increase, necessitating the hiring of a full-time employee. Janet, along with three part-time employees, will drive the monthly sales growth pattern.

[table]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Sales[/td]

[td][/td]

[td][/td]

[td][/td]

[/tr]

[tr]

[td]Under 30[/td]

[td]$63,293[/td]

[td]$115,476[/td]

[td]$135,214[/td]

[/tr]

[tr]

[td]Over 30[/td]

[td]$51,190[/td]

[td]$85,475[/td]

[td]$95,878[/td]

[/tr]

[tr]

[td]Total Sales[/td]

[td]$114,483[/td]

[td]$200,951[/td]

[td]$231,092[/td]

[/tr]

[tr]

[td]Direct Cost of Sales[/td]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Under 30[/td]

[td]$22,153[/td]

[td]$40,417[/td]

[td]$47,325[/td]

[/tr]

[tr]

[td]Over 30[/td]

[td]$17,917[/td]

[td]$29,916[/td]

[td]$33,557[/td]

[/tr]

[tr]

[td]Subtotal Direct Cost of Sales[/td]

[td]$40,069[/td]

[td]$70,333[/td]

[td]$80,882[/td]

[/tr]

[/table]

5.3 Milestones:

ICF will have several milestones early on:

1. Business plan completion.

2. Set up the store.

3. Revenues of $50,000.

4. Achieve 55% rental usage per day.

[table]

[tr]

[td]Milestone[/td]

[td]Start Date[/td]

[td]End Date[/td]

[td]Budget[/td]

[td]Manager[/td]

[td]Department[/td]

[/tr]

[tr]

[td]Business plan completion[/td]

[td]1/1/2001[/td]

[td]1/1/2001[/td]

[td]$0[/td]

[td]ABC[/td]

[td]Janet[/td]

[/tr]

[tr]

[td]Set up the store[/td]

[td]1/1/2001[/td]

[td]3/1/2001[/td]

[td]$0[/td]

[td]ABC[/td]

[td]Janet[/td]

[/tr]

[tr]

[td]Revenues of $50,000[/td]

[td]1/1/2001[/td]

[td]11/30/2001[/td]

[td]$0[/td]

[td]ABC[/td]

[td]everyone[/td]

[/tr]

[tr]

[td]Achieve 55% rental usage per day[/td]

[td]1/1/2001[/td]

[td]12/31/2001[/td]

[td]$0[/td]

[td]ABC[/td]

[td]everyone[/td]

[/tr]

[tr]

[td]Totals[/td]

[td][/td]

[td][/td]

[td]$0[/td]

[td][/td]

[td][/td]

[/tr]

[/table]

Management Summary:

Independent Choice Flicks is owned and operated by Janet Sinemma, who has a degree in marketing from the University of Michigan. Janet worked at a local video rental store while studying, gaining valuable industry experience. After working for Hollywood Video’s corporate headquarters, she decided to open her own store in Eugene. Her goal is to provide quality movies that address an unmet demand.

6.1 Personnel Plan:

The staff will consist of Janet working full-time initially. By month three, three part-time employees will be hired. A full-time employee will be brought on board in month five. The employees will be selected based on their people skills and their knowledge of the genre of movies that ICF rents.

[table]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Janet[/td]

[td]$24,000[/td]

[td]$24,000[/td]

[td]$24,000[/td]

[/tr]

[tr]

[td]Part-time employee[/td]

[td]$9,000[/td]

[td]$11,000[/td]

[td]$11,000[/td]

[/tr]

[tr]

[td]Part-time employee[/td]

[td]$9,000[/td]

[td]$11,000[/td]

[td]$11,000[/td]

[/tr]

[tr]

[td]Part-time employee[/td]

[td]$9,000[/td]

[td]$11,000[/td]

[td]$11,000[/td]

[/tr]

[tr]

[td]Full-time employee[/td]

[td]$14,400[/td]

[td]$21,600[/td]

[td]$21,600[/td]

[/tr]

[tr]

[td]Total People[/td]

[td]5[/td]

[td]5[/td]

[td]5[/td]

[/tr]

[tr]

[td]Total Payroll[/td]

[td]$65,400[/td]

[td]$78,600[/td]

[td]$78,600[/td]

[/tr]

[/table]

The following section provides important financial information.

7.1 Important Assumptions:

[table]

[tr]

[td]Year 1[/td]

[td]Year 2[/td]

[td]Year 3[/td]

[/tr]

[tr]

[td]Plan Month[/td]

[td]1[/td]

[td]2[/td>

[td>3

[/tr]

[tr]

[td]Current Interest Rate[/td]

[td>10.00%

][td>10.00%

[td>10.00%

[/tr]

[tr]

[td]Long-term Interest Rate[/td>

[td>10.00%

[td>10.00%

[td>10.00%

[/tr]

[tr]

[td]Tax Rate[/td]

[td>25.42%

[td>25.00%

[td>25.42%

[/tr]

[tr]

[td]Other[/td>

[td>0

[td>0

[td>0

[/tr]

[/table]

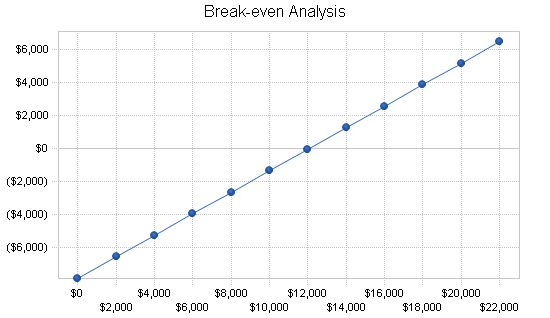

7.2 Break-even Analysis:

The Break-even Analysis is shown below.

Break-even Analysis

Monthly Revenue Break-even: $12,113

Assumptions:

– Average Percent Variable Cost: 35%

– Estimated Monthly Fixed Cost: $7,874

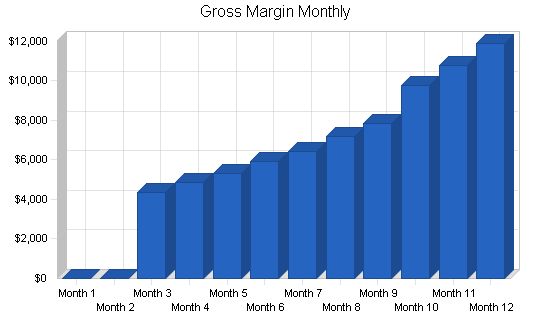

Projected Profit and Loss:

The table below presents the projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Sales | $114,483 | $200,951 | $231,092 |

| Direct Cost of Sales | $40,069 | $70,333 | $80,882 |

| Total Cost of Sales | $40,069 | $70,333 | $80,882 |

| Gross Margin | $74,414 | $130,618 | $150,210 |

| Gross Margin % | 65.00% | 65.00% | 65.00% |

| Expenses | |||

| Payroll | $65,400 | $78,600 | $78,600 |

| Sales and Marketing and Other Expenses | $2,400 | $2,400 | $2,400 |

| Depreciation | $3,072 | $3,072 | $3,072 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $1,800 | $1,800 | $1,800 |

| Insurance | $1,800 | $1,800 | $1,800 |

| Rent | $10,200 | $10,200 | $10,200 |

| Payroll Taxes | $9,810 | $11,790 | $11,790 |

| Total Operating Expenses | $94,482 | $109,662 | $109,662 |

| Profit Before Interest and Taxes | ($20,068) | $20,956 | $40,548 |

| EBITDA | ($16,996) | $24,028 | $43,620 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $5,239 | $10,306 |

| Net Profit | ($20,068) | $15,717 | $30,242 |

| Net Profit/Sales | -17.53% | 7.82% | 13.09% |

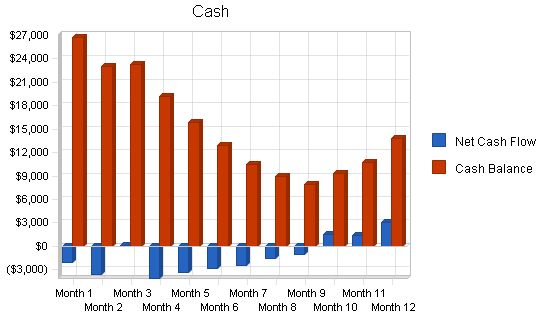

Projected Cash Flow:

7.4 Projected Cash Flow

The following chart and table display projected cash flow.

Pro Forma Cash Flow

| Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Operations | |||

| Cash Sales | $114,483 | $200,951 | $231,092 |

| Total Cash from Operations | $114,483 | $200,951 | $231,092 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Total Additional Cash Received | $0 | $0 | $0 |

| Total Cash Inflow | $114,483 | $200,951 | $231,092 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $65,400 | $78,600 | $78,600 |

| Bill Payments | $64,059 | $109,005 | $120,035 |

| Total Spent on Operations | $129,459 | $187,605 | $198,635 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Total Additional Cash Spent | $0 | $0 | $0 |

| Net Cash Flow | ($14,976) | $13,346 | $32,457 |

| Cash Balance | $13,824 | $27,170 | $59,627 |

Projected Balance Sheet

7.5 Projected Balance Sheet

The following table shows the projected balance sheet.

| Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $13,824 | $27,170 | $59,627 |

| Inventory | $7,049 | $12,372 | $14,228 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $20,873 | $39,543 | $73,855 |

| Long-term Assets | |||

| Long-term Assets | $15,700 | $15,700 | $15,700 |

| Accumulated Depreciation | $3,072 | $6,144 | $9,216 |

| Total Long-term Assets | $12,628 | $9,556 | $6,484 |

| Total Assets | $33,501 | $49,099 | $80,339 |

7.6 Business Ratios

The following table presents business ratios for the years of the plan, with industry profile ratios for comparison based on the SIC code 7841, Video Tape Rental.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 75.53% | 15.00% | 11.90% |

| Percent of Total Assets | ||||

| Inventory | 21.04% | 25.20% | 17.71% | 4.10% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 42.90% |

| Total Current Assets | 62.31% | 80.54% | 91.93% | 54.80% |

| Long-term Assets | 37.69% | 19.46% | 8.07% | 45.20% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 9.069% | 8.950% | 9.948% | 37.70% |

| Current Borrowing | $0 | $0 | $0 | 23.20% |

| Total Current Liabilities | 9.069% | 8.950% | 9.948% | 60.90% |

| Long-term Liabilities | $0 | $0 | $0 | n/a |

| Total Liabilities | 9.069% | 8.950% | 9.948% | 60.90% |

| Paid-in Capital | $45,000 | $45,000 | $45,000 | n/a |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $28,800 | $26,745 | $23,095 | $23,267 | $19,160 | $15,813 | $12,949 | $10,512 | $8,929 | $7,898 | $9,371 | $10,805 | $13,824 |

| Inventory | $0 | $0 | $0 | $2,580 | $2,890 | $3,142 | $3,497 | $3,823 | $4,258 | $4,663 | $5,775 | $6,400 | $7,049 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $28,800 | $26,745 | $23,095 | $25,847 | $22,050 | $18,955 | $16,446 | $14,335 | $13,187 | $12,561 | $15,145 | $17,205 | $20,873 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 | $15,700 |

| Accumulated Depreciation | $0 | $256 | $512 | $768 | $1,024 | $1,280 | $1,536 | $1,792 | $2,048 | $2,304 | $2,560 | $2,816 | $3,072 |

| Total Long-term Assets | $15,700 | $15,444 | $15,188 | $14,932 | $14,676 | $14,420 | $14,164 | $13,908 | $13,652 | $13,396 | $13,140 | $12,884 | $12,628 |

| Total Assets | $44,500 | $42,189 | $38,283 | $40,779 | $36,726 | $33,375 | $30,610 | $28,243 | $26,839 | $25,957 | $28,285 | $30,089 | $33,501 |

| Liabilities and Capital | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $1,595 | $1,595 | $6,747 | $4,826 | $5,252 | $5,664 | $5,923 | $6,410 | $6,737 | $8,397 | $8,476 | $9,069 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $1,595 | $1,595 | $6,747 | $4,826 | $5,252 | $5,664 | $5,923 | $6,410 | $6,737 | $8,397 | $8,476 | $9,069 |

| Long-term Liabilities | |||||||||||||

| Total Liabilities | $0 | $1,595 | $1,595 | $6,747 | $4,826 | $5,252 | $5,664 | $5,923 | $6,410 | $6,737 | $8,397 | $8,476 | $9,069 |

| Paid-in Capital | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 | $45,000 |

| Retained Earnings | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) | ($500) |

| Earnings | $0 | ($3,906) | ($7,812) | ($10,468) | ($12,600) | ($16,377) | ($19,554) | ($22,180) | ($24,071) | ($25,280) | ($24,611) | ($22,887) | ($20,068) |

| Total Capital | $44,500 | $40,594 | $36,688 | $34,032 | $31,900 | $28,123 | $24,946 | $22,320 | $20,429 | $19,220 | $19,889 | $21,613 | $24,432 |

| Total Liabilities and Capital | $44,500 | $42,189 | $38,283 | $40,779 | $36,726 | $33,375 | $30,610 | $28,243 | $26,839 | $25,957 | $28,285 | $30,089 | $33,501 |

| Net Worth | $44,500 | $40,594 | $36,688 | $34,032 | $31,900 | $28,123 | $24,946 | $22,320 | $20,429 | $19,220 | $19,889 | $21,613 | $24,432 |

Business Plan Outline

- Executive Summary

- Company Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!