Holding Company Business Plan

JTB Technologies, Inc. is a holding company consisting of three sub-corporations with distinct products, services, markets, and opportunities. This business plan combines the three sub-divisions of the JTB business plan to offer high-quality customer service, branded industrial products, and specialty products and services that complement each division’s efforts. JTB will commence operations within 45 days of funding as a corporation under the Laws of the Commonwealth of Louisiana. The plan involves opening each subcorporation and the holding company in the same location for employee and management training, accounting procedures, and inventory management.

JTB Industrial Sales Division will distribute high-quality industrial products and services to local and national clients in the Automotive and Aerospace Industries, Primary Metals and Machining Industries, Mining and Contractor Industries, and the Military and Governmental procurement sector.

JTB Products and Services Division will design custom tools for the Automotive, Auto Repair, Sports Service, and Commercial Drilling Industries. Additionally, this division will provide re-conditioning services using our quality products. To maximize efficiency, this division will be situated within the same building as the other divisions.

JTB Integrated Technologies Division will develop and support a full line of P.C. and Internet-based business applications. Additionally, JTB will develop and support ad-based Internet marketplaces, online magazines, custom-developed commercial websites, and other hosted business products for the Industrial marketplace.

To maximize profitability, JTB Technologies, Inc. will consolidate all operations into one location in Richfield, Louisiana. This location provides excellent access to the Mississippi, Arkansas, and Texas industrial markets. JTB’s management gained experience in the industrial marketplace while managing RL&I Tool and Machine, Inc., a privately held corporation operating in Missouri for over 25 years.

Special interest points about this corporation:

- A high percentage of minority ownership allows the business to participate in special-interest contract bids, employee-training grant procurement, and state-offered business development bond offerings.

- The management has the ability to develop other avenues of business, including Military and other governmental procurement fulfillment.

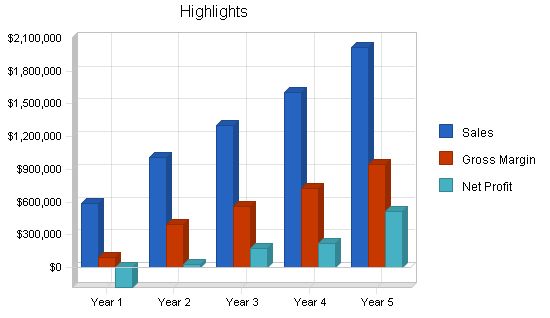

Based on current prices in the Industrial Products and Services market, JTB Technologies, Inc. has the potential to achieve sales of $1,008,798 by year two of the plan. With good management, a 29% annual revenue growth is expected.

The equity for each investor will be based on their investment.

JTB will offer high-quality products and services. Our products will reduce customers’ costs and have a longer life than competitors’ products. Our re-manufacturing services will offer clients a solid, value-based purchase with a 100% quality commitment.

Using JTB’s own manufacturing facility as a model, we will provide cost-effective management of external vendor and customer transactions, yielding continual savings for our users. Our manufacturing partners will add value to our services, allowing JTB to grow into a high-quality, long-term growth corporation.

The keys to our success are our seasoned management with over twenty years of business experience in Industrial Distribution and Metalworking.

Our primary objectives are to integrate our products and services into desired marketplaces, gain market share with our technology products, resell this technology and its support services, and provide high-quality products and services while maintaining high profitability.

JTB Technologies is a holding company for three sub-corporations: JTB Industrial Sales Division, JTB Products and Services Division, and JTB Integrated Technologies.

JTB Technologies, Inc. will be located in Richfield, Louisiana, close to the I-82 corridor, providing excellent access to industrial markets in Mississippi, Arkansas, and Texas. JTB’s management acquired experience while managing RL&I Tool and Machine, Inc.

In addition to providing industrial products, JTB’s sub-divisions will provide technical expertise, engineering assistance, and outsourced industrial services. JTB’s services division will be utilized for these services.

Initial startup will consist of moving Technical Marketing Technologies, LLC to a nearby 3,500 sq. ft. commercial facility with sales office and production space.

Mr. Jeremy will re-establish industrial business contacts to offer a well-rounded product selection for resale.

Approximately $125,000 of machinery will be added to the production area.

Within the initial 60 days of startup, contract-based developers will begin developing internet-based software for inventory-sharing and customer-interactivity aspects.

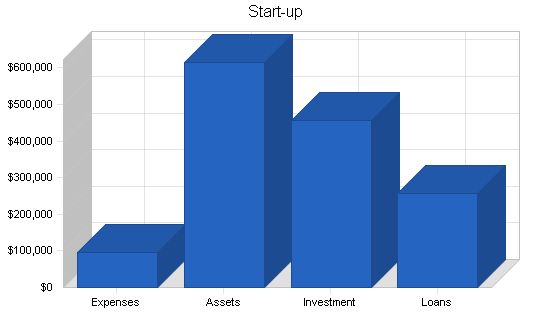

We are seeking $253,150 in loan financing and an additional $455,000 of investment to achieve our objectives.

Start-up Expenses:

– Legal: $5,400

– Stationery etc.: $1,600

– Brochures: $11,500

– Headhunter Fees (IT Div.): $2,000

– Consultants: $9,000

– Insurance: $2,250

– Rent: $2,250

– Research and Development: $18,000

– Patent Process: $18,000

– Computers, Office Equipment, Software: $18,700

– Accounting System: $3,500

– Demo Models: $1,200

– Office Supplies: $2,500

– Total Start-up Expenses: $95,900

Start-up Assets:

– Cash Required: $496,250

– Start-up Inventory: $22,000

– Other Current Assets: $17,000

– Long-term Assets: $79,500

– Total Assets: $614,750

Total Requirements: $710,650

Start-up Funding:

– Start-up Expenses to Fund: $95,900

– Start-up Assets to Fund: $614,750

– Total Funding Required: $710,650

Assets:

– Non-cash Assets from Start-up: $118,500

– Cash Requirements from Start-up: $496,250

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $496,250

– Total Assets: $614,750

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $253,150

– Accounts Payable (Outstanding Bills): $2,500

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $255,650

– Capital:

– Planned Investment:

– Investment- Industrial Sales Div: $0

– Investment- Ind Products and Services Div: $230,000

– Investment- Integrated Tech Div: $225,000

– Additional Investment Requirement: $0

– Total Planned Investment: $455,000

– Loss at Start-up (Start-up Expenses): ($95,900)

– Total Capital: $359,100

– Total Capital and Liabilities: $614,750

Total Funding: $710,650

Company Locations and Facilities:

JTB will initially work from its Richfield, Louisiana location. After year 5, it may open 3 additional marketing and support offices in the U.S as SOHO businesses to expand its services and product support. These offices will provide low costs of operations for JTB while supporting their products. Additional opportunity may arise for individuals to sell JTB services and build customer bases, allowing manufacturing and distribution divisions to pursue new clients.

Company Ownership:

JTB will be a privately held corporation co-owned by Rachel L. Jeremy and Mitchell R. Jeremy. Rachel Jeremy has 10 years of experience in production management and customer services. Mitchell R. Jeremy owns and operates Technical Marketing Technologies LLC. Both co-owners bring unique skills and experience to JTB.

Products and Services:

Over the last five years, Rachel and Mitchell Jeremy have been focusing on customer relation management issues for small- to medium-sized industrial distributors, manufacturers, and service related industries. They aim to develop PC-based marketing and order processing systems for their clients, allowing sales and order processing to be available online. JTB Technologies is a holding company for three sub-corporations:

A. JTB Industrial Sales Division (Sales and Distribution)

– Specialty technical services

– Industrial products reselling

– Contract Bid services and Contract Servicing

B. JTB Products and Services Division (Engineering and Manufacturing)

– Manufacturing patented products

– Providing reconditioning services

– JTB’s Max-Drill line of cutting tools

C. JTB Integrated Technologies (Marketing Technologies)

– Developing purchasing and vendor management software

– Web portal and industrial website development

– Data management applications

Product and Service Description:

A. JTB Industrial Sales Division (Sales and Distribution)

– Industrial and Commercial Tools

– Resale program for up to 300,000 products

– Safety products, raw materials, and MRO maintenance repair items

– Specialty made-to-print items

B. JTB Products and Services Division (Engineering and Manufacturing)

– Manufacturing patented products

– JTB’s Max-Drill line of cutting tools

– Providing reconditioning services

C. JTB Integrated Technologies (Marketing Technologies)

– Web content development

– Industra – Industrial and commercial website system

– Industrial search engine technology

– Web development, hosting, and marketing support

– Data management applications

Competitive Comparison:

JTB stands out in the market with its unique combination of IT, distribution, and manufacturing expertise. Its industrial sales division has strong distributor relationships and offers expertise in manufacturing and outsourcing. JTB’s internally manufactured products are known for their high quality and consistency.

Fulfillment:

JTB fulfills orders by reselling products and providing secondary services. It also develops its own media to support web-based products and offers hardware and software installation services.

Technology:

JTB utilizes computer-controlled equipment for manufacturing and service repairs. PC-based business applications and extensive web development capabilities are part of their technology strategy. They also utilize 3-D prototype technology to develop tangible prototypes of customer’s intended parts.

Future Products and Services:

JTB plans to expand its product offering by seeking out additional products that complement their existing lines and meet customer requirements. They will also develop sales strategies around each product and work with application engineers to further fine-tune products.

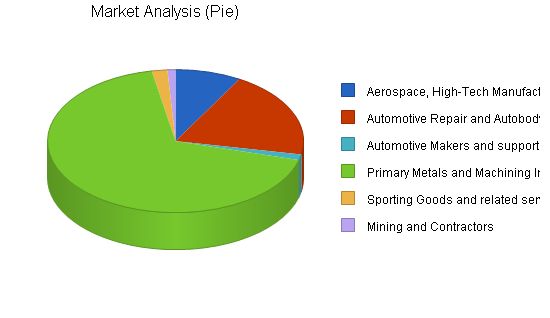

Market Analysis Summary:

JTB’s national market consists of 314,555 potential clients in industries such as aerospace, automotive, primary metals, sporting, mining, and contracting. In Louisiana, there are 4,553 potential clients in the same industries. JTB aims to integrate its industrial products and services into these markets by utilizing a well-trained sales staff and PC-based server applications.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth

Aerospace, High-Tech Manufacturing 3% 25,587 26,355 27,146 27,960 28,799 3.00%

Automotive Repair and Autobody 9% 61,228 66,739 72,746 79,293 86,429 9.00%

Automotive Makers and support 2% 4,000 4,080 4,162 4,245 4,330 2.00%

Primary Metals and Machining Industry 7% 210,000 224,700 240,429 257,259 275,267 7.00%

Sporting Goods and related services 7% 6,058 6,482 6,936 7,422 7,942 7.00%

Mining and Contractors 9% 3,149 3,149 3,149 3,149 3,149 0.00%

Total 6.97% 310,022 331,505 354,568 379,328 405,916 6.97%

4.2 Target Market Segment Strategy

Our marketing strategy for each target market segment will vary slightly. We will focus our direct marketing efforts on the Aerospace, Automotive, and Primary Metals and Machining industries, introducing these clients to our products and services. Our combination of over 300,000 catalog items and industrial services will allow us to sell ourselves in many different ways. Our base of sub-contract service providers will also allow us to offer various programs through our distributorship.

4.2.1 Market Trends

Online use in our market has changed over the last five years. Business sites are becoming more informational, as search engines analyze site content for ranking. Trade magazine ads now often include a business’ web address. Larger manufacturers’ sites have advanced features that smaller businesses lack. Our target market is small to mid-sized corporations. Larger firms have developed expensive software and netware packages. We have worked to develop cost-effective software solutions with similar features. JTB aims to bring these products to market at a fraction of the cost, while offering paid support services.

4.2.2 Market Needs

JTB’s market is serviced by various media, marketing, and business applications development companies. JTB aims to provide customized business growth and customer services solutions using web technologies. Our view is simple: the market consists of businesses looking for work, businesses wanting to sell or distribute products, and a large offering of web-based sites backed by trade magazines. Many small to mid-sized manufacturers are using low-end marketing and are unhappy with their web development aspects. JTB aims to replace outdated websites with interactive, web-based products and collaborate with businesses’ existing sites.

4.3 Service Business Analysis

JTB products and services focus on unique markets supported by niche providers all over the U.S.

Industry by count:

– Auto Body clients available: 62,361

– Commercial utilities and drilling services available: 3,200

– Sporting Good Service Centers: 6,164

– Metalworking and Manufacturing: 238,764

The above client numbers are based on data from Hugo Dunhill Mailing Lists, Inc. Larger firms have developed expensive software packages. JTB’s cost analysis has identified many cost-competitive options available to businesses that they may not be aware of. As a service business, we can offer our own products, market and demo them simultaneously, and reduce costs per solicitation.

JTB’s integrated technologies services business develops customized solutions for small to mid-sized corporations. With most work done online, we offer distributed software products and support services. Our industrial sales division will sell our products to potential clients, and our services division will add value and provide clients with custom solutions.

4.3.1 Distributing a Service

JTB’s integrated technologies division distributes our services online. We also have plans for 3 additional satellite offices to further grow our business.

4.3.2 Competition and Buying Patterns

– Automotive clients: They purchase supplies via local suppliers and catalogs. Our specialized time savers will be marketed directly to them.

– Commercial Utilities and Drilling clients: Our re-manufacturing process for their drilling units will offer better quality at a lower cost. Commercial plumbing supply houses currently provide limited technical help. Our unique rebuild process will be marketed directly to them.

– Sporting Good Service Centers: Our patented products will outperform any available products and create a re-conditioning market. There is currently no competition in this market.

– Metalworking and Manufacturing: Clients work with local suppliers and catalog companies. JTB’s mix of industrial sales and services will help acquire clients.

4.3.3 Main Competitors

JTB Technologies, Inc. is a holding corporation with sub-divisions that have competition locally and nationally. Local competitors are well-established industrial distributorships that outsource most of their services. JTB’s business concept is more beneficial, cost-effective, and expeditious for clients. There are also mega catalog distributorships with sales up to 50 Million annually.

Strategy and Implementation Summary

Our strategy is to extend our products and services to potential clients through every cost-effective approach possible. Our combined services offering allows for more profitability and faster shipments with fewer logistical problems. Presently, local industrial suppliers and service providers do not effectively provide cost-effective services. Our business plan includes low-cost implementation of Internet-based customer access and direct marketing. We focus on the needs of our clients and target marketing expenditures to maximize returns.

JTB’s value proposition is simple: providing quality and service that meets customers’ requirements. When accomplished in-house, the value turns into a quality product or service for a reduced overall cost to the customer.

5.2 Competitive Edge

JTB’s combined competitive edge is our overall approach to marketing our goods and services. Our own branded sales and marketing applications strengthen our ties to manufacturing partners and direct clients. Our computer networking expertise allows us to offer solid, network-based sales and marketing tools. By utilizing our own applications and credibility, we can offer larger clients a wide variety of products and services through a Web-based purchasing system.

Key goals of our marketing plans:

1. Develop a high-profile sales environment to bring our products to new and existing clients.

2. Develop new ways to market our products to potential clients through our branded applications and credibility.

3. Develop manufacturing partnerships utilizing our web-based applications.

4. Develop and maintain a high-quality customer service and follow-up program for all divisions.

5. Utilize an ongoing automated marketing system to contact potential clients.

6. Target marketing expenditures to maximize returns on campaigns.

5.3.1 Pricing Strategy

JTB’s industrial sales division will benchmark pricing against well-known industrial product catalogs. Catalog prices serve as a reference for clients to make comparisons when they purchase from us. Our pricing will not give away the house, but what sets us apart is the services offered following the sale. Additional revenues will be generated through servicing the distributed products.

5.3.2 Promotion Strategy

JTB’s Industrial Sales Division will promote sales and specials via the Internet, faxing, mailed sales literature, and printed media sent with boxed shipments. Our integrated marketing systems will email buyers about current promotions, tailoring them to their previous purchases. We will also offer trial and demonstration arrangements for our media marketing products and custom-developed applications.

5.3.3 Distribution Strategy

JTB will implement a distribution system developed by our Integrated Technologies Division, allowing real-time sharing of inventory online with other suppliers and customers. We will work closely with manufacturing partners to fill orders, receive orders, and process quotes. Our system will integrate our clients’ needs with our abilities and those of our distributor partners to fulfill requirements.

5.3.4 Marketing Programs

1. Internet-based industrial website banner Ads

2. Promotional e-mail-based product e-flyers

3. Catalog supplemental flyer programs delivered with shipments

4. Fax-based special promotions

5. Direct telephone solicitation while taking orders

5.3.5 Positioning Statement

Our positioning strategy combines the strengths of our individual divisions, marketing each division’s capabilities to our intended clientele. Our integrated technologies will place our business directly into individual marketplaces, offering direct access when potential clients are seeking products and services.

5.4 Strategic Alliances

JTB will develop and implement strategic alliances to build our product and services offering. These alliances will allow us to access production capabilities and offer additional products and services. Our integrated technologies division will form relationships with media developers to provide a broad offering of products and services.

5.5 Sales Strategy

JTB’s Industrial Sales Division’s strategy consists of Marketing, Engineering, and Sales. Customers can access their accounts online, request quotes, and place orders. Pre-sales engineering and consultation services are offered. JTB aims to provide a comfortable, customer-oriented purchasing environment.

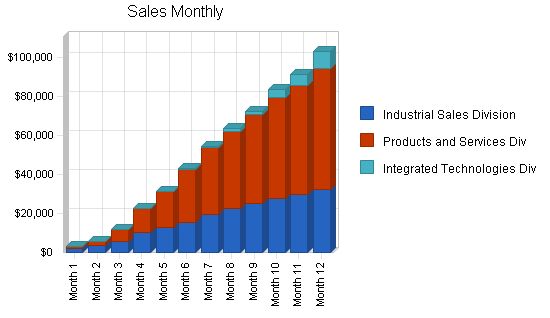

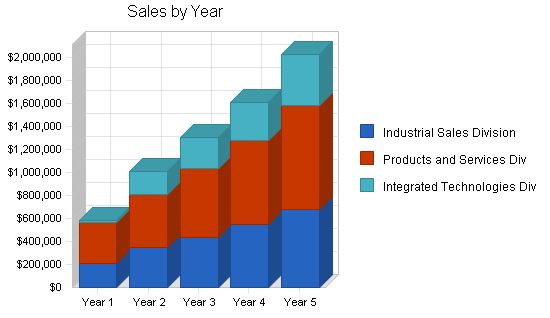

5.5.1 Sales Forecast

JTB’s Industrial Sales Division’s forecast highlights key products to be initially offered. Flexibility will allow the addition of further avenues of business. We anticipate better margins as we become established as direct distributors and reduce costs through relationships with manufacturing partners.

JTB’s Products and Services Division provides billable hourly services at $60.00 per hour. Some internally manufactured products will have a lower shop rate for competitive pricing in different markets. Patented products will be outsourced to maximize profitability. Contingencies are necessary for personnel and equipment issues, and they also affect the break-even analysis. This plan offers more profitable services to clients. Services include fixed price list services and billable hourly work.

The sales forecast for JTB’s Integrated Technologies Division is strong, with potential clients and distributor partners numbering near 330,000. The market is substantial, with businesses spending approximately $3,000 or more annually, resulting in a $990 Million marketplace.

The sales forecast table assumes average growth rates for different product categories. Metal Tools have a 29.5% annual growth rate, while Commercial, Contractor, and Utilities have a 25% growth rate. Safety Products, Work Holding Products, and Precision Measuring Products have a 66% growth rate. Catalog Industrial Products have a 34.3% growth rate. Specialty Purchased Components have a 66.7% growth rate. Tool-related Services have a 34.5% annual growth rate. The industry analysis shows a compound annual growth rate of 7.02%.

Sales growth is influenced by several factors. These include JTB’s ability to develop its internal sales staff, rebuild previous industry relations channels, develop the Products and Services Division’s services, and develop the Business Development Division’s marketing products.

Sales Forecast

| Sales Forecast | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Sales | – | – | – | – | – |

| Industrial Sales Division | $206,525 | $347,300 | $433,420 | $542,963 | $674,518 |

| Products and Services Div | $354,705 | $461,550 | $601,569 | $729,944 | $902,842 |

| Integrated Technologies Div | $23,204 | $199,948 | $268,330 | $331,797 | $443,411 |

| Total Sales | $584,434 | $1,008,798 | $1,303,319 | $1,604,704 | $2,020,771 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Industrial Sales Division | $128,259 | $212,185 | $263,461 | $315,420 | $407,383 |

| Products and Services Div | $199,051 | $229,974 | $279,739 | $342,839 | $419,700 |

| Integrated Technologies Div | $8,448 | $35,795 | $55,219 | $66,051 | $90,527 |

| Subtotal Direct Cost of Sales | $335,758 | $477,954 | $598,419 | $724,310 | $917,610 |

5.6 Milestones

Secure Leasing, Banking, and Attorney Arrangements – Establishing long-term arrangements for equipment financing, banking relations, and general and patent attorney needs.

Setup JTB’s Industrial Services Location – Prepare working area for equipment, wiring, shipping and receiving areas, networked accounting systems, and develop a workflow methodology.

Complete equipment selections and installation – Select high-quality equipment within budget from machine tool dealers throughout the U.S.

Contractor selection for outsourced manufacturing – Obtain sample parts and quotations from competing contract manufacturers, particularly for Automotive and Sporting Goods lines.

Contracted Application Developer selection – Partner with a well-established individual to create P.C.-based business applications.

Re-establish business contacts – Sales manager will rebuild previous industry relationships to strengthen client and vendor connections.

JTB Service associate selection and training – Select and train service associates with manufacturing and machining experience, focusing on cost-effective training.

Selection of Sales Associates – Recruit sales-oriented individuals for customer support, sales, and marketing initiatives.

Begin Catalog Program – Order 250 sets of custom catalogs and target up to 1,200 catalog clients over 4 years.

Applications development begins – Develop sales, marketing, and engineering applications for integration with websites to support customer requests and export sales and engineering information.

JTB Industrial Services Marketing Campaign – Launch a local marketing campaign targeting key personnel in the industry.

Marketing Sites are established – Develop and manage marketing sites dedicated to promoting JTB’s industrial products and services.

Revenue Sites are established – Create industry-specific sites for matching buyers with suppliers and generate revenue through pay-per-ad advertisements.

Distributorship Partnership Development Begins – Implement a distributor partnership program to expand the client base and share inventory and services.

Milestones:

– Secure Leasing and Banking Arrangements, 2/1/2005 – 2/15/2005

– Set up JTB’s operating facility, 2/1/2005 – 3/1/2005

– Equipment selections and installation, 2/1/2005 – 6/15/2005

– Outsourced manufacturers selections, 2/15/2005 – 3/15/2005

– Hire application developers, 2/15/2005 – 3/15/2005

– Selection of Sales Associates, 2/15/2005 – 3/1/2006

– Begin industrial services marketing campaign, 3/1/2005 – 1/30/2006

– Re-establishment of business sources, 3/1/2005 – 3/1/2006

– Selection of Service Associates, 3/10/2005 – 10/1/2005

– Revenue sites are established, 4/14/2005 – 12/15/2006

– Begin Applications Development, 4/15/2005 – 8/15/2005

– Marketing sites are established, 4/15/2005 – 9/15/2005

– Begin Sales and Catalog Campaign, 4/15/2005 – 12/15/2006

– Distributor Partnerships development begins, 6/1/2005 – 5/30/2007

– Totals: $201,000 budget

Web Plan Summary:

JTB’s Web-based marketing plan is the same for all JTB divisions, with each division targeting clients differently. JTB will add its services to marketplaces and gather information and feedback from paid ads in trade magazines and other websites. The Web plan is to link products and services with affiliate sites.

Website Marketing Strategy:

JTB will develop and manage industrial marketplaces and embed itself into other sites using search engine technology, affiliate marketing programs, and paid banner ads. Developing and managing sites and Internet-based applications will cost less than competitors.

Management Summary:

– President and Sales Manager: Mitchell R. Jeremy

– Mr. Jeremy will work with the managers and staff of the industrial sales division to train staff and act as the project manager for larger projects. He will also train the staff on product technical aspects and the use of the corporate intranet. Mitchell will develop sales and marketing programs and add new products as they are developed.

– Intranet: Mitchell Jeremy will continually develop the company intranet and make it searchable for items in the inventory, distributor partners, and catalogs. Staff will work with standardized product lists and promotions.

– Vice President, Production Manager and Secretary: Rachel L. Jeremy

– Rachel will act as the Service Team Manager in the first year and oversee order processing and scheduling of outsourced orders. She will also manage day-to-day work schedule and track deliveries and customer requirements.

Middle Management Team:

– Sales Team Leader: In sales and marketing role, provides customer support and trains on new products and services.

– Customer Support Associate/Manager: Works in sales, marketing, and customer support, provides customer support and trains on new products.

– Service Team Manager: Tracks services offered, trains service personnel, and ensures quick response time to customer service needs.

Personnel Plan:

– Sales Associates: Work in sales and provide customer support while training on new products and services.

– Shipping and Receiving: Responsible for shipping, inventory, and receiving goods.

– Customer Support Associate/Manager: Works in sales, marketing, and customer support, provides customer support and trains on new products.

– Customer Support Associate: Covers office hours and focuses on developing new clients while providing customer support.

– Sales and Marketing Associate: Works in sales, new customer development, and follow-up marketing.

– Application Developer, 2nd Part-time App Developer/QA Tester, Web Developer: Develop products and provide custom work when needed.

– Service Team Manager: Maintains knowledge of manufacturing processes and answers to the Operations Manager.

– Service Team Member: Performs manual labor in the service and production department.

JTB’s financial plan involves raising $445,000 through private equity and obtaining a long-term loan of $253,150 for equipment. For the Industrial Sales Division, JTB plans to receive $181,000 in long-term loans and develop Internet-based industrial sales applications and portals.

Important Assumptions:

– Current business, banking, and economic trends remain stable.

– Customer buying trends and orders remain strong.

– Overhead and outsourced costs grow as projected.

– Internet buying trends continue to grow in the industrial sector.

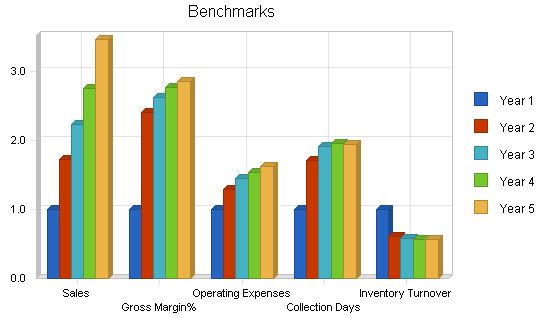

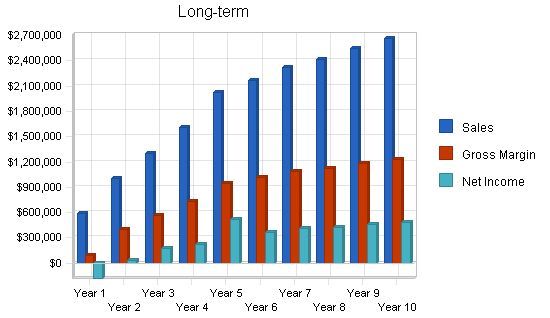

Key Financial Indicators:

– Sales growth is projected to be approximately 37% per year.

– Gross margins average 38% annually.

– Operating expenses remain stable during the first five years.

– Inventory turnover is well-controlled.

– Collection days average 45 days.

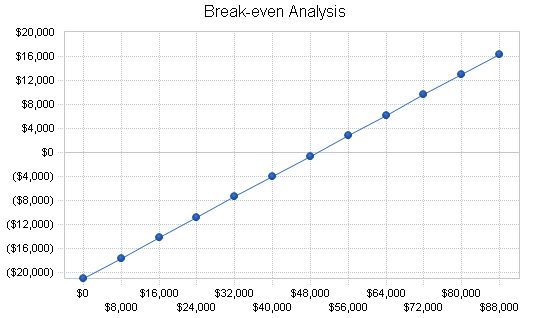

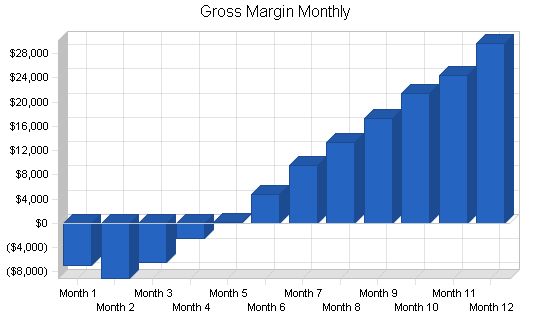

JTB’s break-even analysis is difficult to project as a start-up due to the mixed industrial products, product development lead times, and the initial time to market. The long lead-time for JTB’s software development is the major factor in reaching the break-even point. We expect to achieve break-even for the entire corporation in the second year.

Our initial goal is to bring the hard products to market within 60 days from startup, along with well-accepted industrial products for resale. What sets JTB apart from other industrial entities is its flexibility, expansion, and individual divisions targeting each market segment.

Our aim is to establish a solid base for the corporation with our primary products and services while continuing the development phase of our distribution software.

Break-even Analysis

Monthly Revenue Break-even: $49,492

Assumptions:

– Average Percent Variable Cost: 57%

– Estimated Monthly Fixed Cost: $21,059

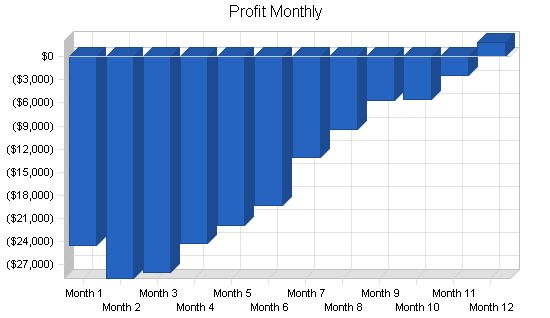

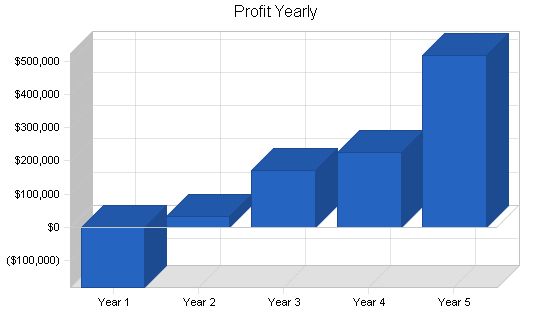

8.4 Projected Profit and Loss

Please be sure to read note 8.1.1 in the Important Assumptions, section 8.1 regarding our Accounting system and methodology.

The Projected Profit and Loss table considers all operating costs for the corporation and its divisions. The P&L in this business plan includes a depreciation schedule while remaining profitable. Ideally, we would have projected a gradual expense growth as we added equipment and services.

Our goal is to work with a leasing company for a loan/lease situation, allowing us to select the best equipment while minimizing cash outlay. For this plan, we have expensed the equipment in the start-up table. However, our long-term goal remains unchanged and is reflected in year 2006.

Considering note 8.1.1, we believe we can create a better-structured corporation than what is shown in the existing business plan. The P&L does not include the burden of management and management’s output. Please remember that the 3 JTB divisions will operate under one roof, with management filling in all areas of production as needed.

Our operating schedule will involve longer hours than typical 9 to 5 operations. We anticipate running at least 50 hours per week to develop more business on the west coast, which is not calculated in the P&L.

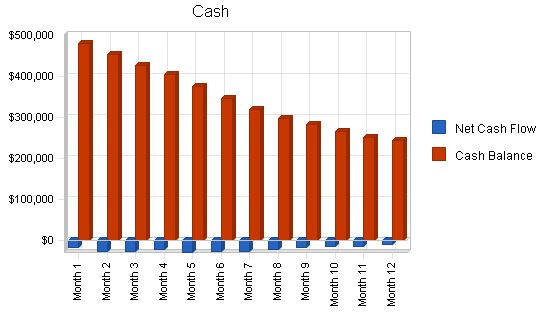

The projected cash flow reflects the business’s ability to repay investors in year 4 and 5. It’s important to note that the largest sales growth comes from outsourced manufacturing. This allows the company to focus on more profitable services. The outsourced products operate under a fixed cost situation, while the services area will work on cost plus situations. As the cash flow only projects the base products described in the business plan, it’s likely that the company will engage in more outsourced products in years two through five, increasing profitability. Please refer to section 8.1 for important assumptions related to the projected cash flow.

The projected balance sheet reveals JTB’s strong cash development capability over the 5-year plan. The assumption is that the business will remain at its startup location, resulting in relatively fixed costs for the projections. Management believes it can achieve a stronger situation than what is depicted here.

The business will increase its cash position and net worth, with total assets exceeding $1 million by year 5. The long-term assets will be depreciated according to a schedule. Inventory requirements may change as different purchasing options are offered and the inventory of used products expands. Efforts will be made to keep required inventory at reasonable levels.

The products and services division offers multiple income streams through service-oriented segments tied to particular product lines. The other two divisions can also provide labor-based services alongside their product offerings.

Overall, the projected balance sheet reflects a strong corporation capable of fully repaying investors and attracting further investment. The distributor partner program’s growth is also promising.

The business ratios show strong growth in gross margins, with elements from distribution, products, and services contributing to these margins. Initially, gross margins may be slightly lower due to new equipment debt and a training period. Long-term assets will decline as equipment is paid down, but the debt to asset ratios are better than industry standards.

General and administrative ratios may be initially higher than industry standards due to the essential role of personnel in the business’s growth. Sales growth is substantial due to the addition of new products and services, resulting in higher gross average margins.

In summary, the business has better overall ratios than the industry profile. Marketing budgets and avenues have been maximized, and sales staff are trained to maintain profit per order levels. Streamlined order processing methods and reduced internal costs contribute to increased efficiency.

Ratio Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 Industry Profile

Sales Growth 0.00% 72.61% 29.20% 23.12% 25.93% 2.95%

Percent of Total Assets

Accounts Receivable 21.62% 37.67% 34.90% 34.90% 31.18% 24.07%

Inventory 12.95% 18.61% 16.70% 16.70% 14.92% 46.47%

Other Current Assets 3.38% 3.41% 2.44% 1.98% 1.41% 15.56%

Total Current Assets 86.34% 88.36% 93.19% 95.72% 97.85% 86.10%

Long-term Assets 13.66% 11.64% 6.81% 4.28% 2.15% 13.90%

Total Assets 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Current Liabilities 17.71% 13.49% 11.32% 11.77% 9.26% 45.21%

Long-term Liabilities 47.00% 44.14% 29.28% 21.86% 14.15% 15.13%

Total Liabilities 64.71% 57.63% 40.60% 33.63% 23.41% 60.34%

Net Worth 35.29% 42.37% 59.40% 66.37% 76.59% 39.66%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Gross Margin 16.39% 39.35% 42.98% 45.35% 46.61% 19.32%

Selling, General & Administrative Expenses 47.42% 36.01% 29.79% 31.32% 21.06% 11.47%

Advertising Expenses 2.36% 1.78% 1.86% 1.58% 1.30% 0.31%

Profit Before Interest and Taxes -26.85% 7.04% 14.82% 21.27% 26.44% 0.58%

Main Ratios

Current 4.88 6.55 8.23

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!