Machine Tooling, a Kansas City-based company, aims to succeed by using high-quality techniques and prioritizing customer service. Over the past two years, the company has worked hard to establish its infrastructure and systems for handling a significant amount of business. We have made leasehold improvements, hired a qualified and experienced staff, and built ready-to-market machines and automated systems. Additionally, we have developed strong relationships with customers and plan to offer value-added improvements to further integrate the business.

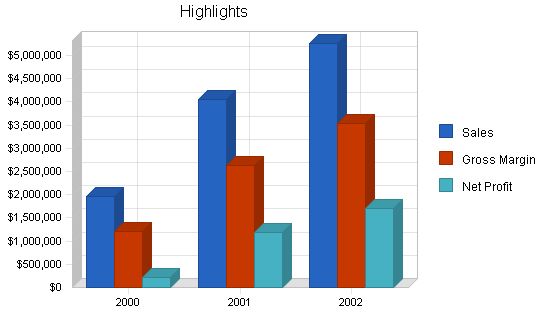

Our management team, consisting of Mr. Peter Newton (CEO), Mr. John Abbot (President), and Mr. Chris Manuel (VP of Marketing), has extensive knowledge and experience in manufacturing, automation, and finance. Projected revenues for Year 1 to Year 3 are $1.9 million, $4.1 million, and $5.3 million, respectively. To support growth and attract a larger customer base, we are seeking $500,000 for expansion purposes such as marketing new product lines, entering new markets, and purchasing additional equipment.

Going public will positively impact our sales ability, allowing us to reduce overall debt and gain a competitive advantage in the manufacturing industry. This expansion will enable us to establish a larger, more diversified customer base and generate increased sales revenue. Our mission is to succeed by utilizing high-quality techniques and prioritizing customer service. Our key to success lies in providing superb customer service, fast delivery, and securing new customers in the served market niches.

Company Summary

Business Description

Machine Tooling has been operating in Kansas City since May, 1989. We are a Kansas LLC. The company occupies 10,000 square feet of manufacturing area, including offices for administration, engineering, and quality assurance.

Overview of Technology and Products

Machine Tooling provides full-service, close-tolerance contract machining of machine and tooling components, production machining, and automation of production lines. The diverse manufacturing equipment at our facility allows the plant to operate self-sufficiently.

Managerial expertise and industry experience have helped the company show profits every year since its inception. Over the past three years, the company further entrenched its position in the market niche, resulting in healthy financials (see Table 2.1).

2.1 Company History

Machine Tooling was founded in Kansas City in 1989 to provide quality machine tools for selected industries. The owners had worked in this field for several years and had established multiple business contacts who helped the company pick up major accounts. By 1999, the company’s revenues reached $1.5 million, and the management realized that further growth would be difficult without additional working capital. To be less debt-dependent, the management decided to go public. However, before issuing the initial public offering (IPO), Machine Tooling seeks $500,000 for expansion purposes. Such expansion will improve the company’s sales ability and positively affect its IPO prospects.

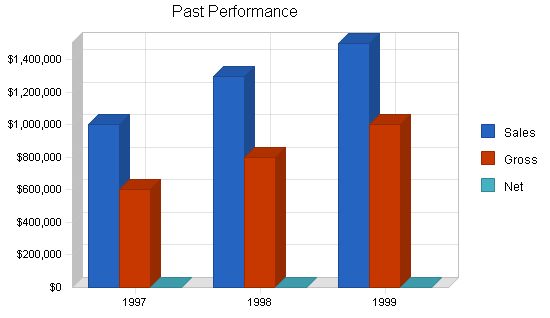

Past Performance:

1997 1998 1999

Sales $1,000,000 $1,300,000 $1,500,000

Gross Margin $600,000 $800,000 $1,000,000

Gross Margin % 60.00% 61.54% 66.67%

Operating Expenses $400,000 $550,000 $700,000

Collection Period 19 22 34

Inventory Turnover 3.00 3.00 3.00

Balance Sheet:

1997 1998 1999

Current Assets:

Cash $20,000 $40,000 $60,000

Accounts Receivable $40,000 $80,000 $130,000

Inventory $30,000 $60,000 $90,000

Other Current Assets $5,000 $10,000 $15,000

Total Current Assets $95,000 $190,000 $295,000

Long-term Assets:

Long-term Assets $100,000 $100,000 $100,000

Accumulated Depreciation $10,000 $20,000 $30,000

Total Long-term Assets $90,000 $80,000 $70,000

Total Assets $185,000 $270,000 $365,000

Current Liabilities:

Accounts Payable $25,000 $50,000 $75,000

Current Borrowing $15,000 $35,000 $50,000

Other Current Liabilities (interest free) $5,000 $5,000 $10,000

Total Current Liabilities $45,000 $90,000 $135,000

Long-term Liabilities:

$50,000 $50,000 $50,000

Total Liabilities $95,000 $140,000 $185,000

Paid-in Capital $50,000 $50,000 $50,000

Retained Earnings $40,000 $80,000 $130,000

Earnings $0 $0 $0

Total Capital $90,000 $130,000 $180,000

Total Capital and Liabilities $185,000 $270,000 $365,000

Other Inputs:

Payment Days 30 30 30

Sales on Credit $750,000 $1,000,000 $1,125,000

Receivables Turnover 18.75 12.50 8.65

Products:

Background on Products and Technology

Machine Tooling plans to assemble the first level of the armature assembly. Laminates will be assembled to rotors and shipped daily to supplement customer production. This will take place in the second quarter of 2000. An elite team of professionals experienced in this industry and this type of product has been put together for this project.

The Machine Tooling Engineering group will continue to support internal and external automation, contributing to production sales and value engineering. They will co-engineer the next generation of food processing equipment and pursue the building and assembly of the food processing machinery product line that the company currently manufactures components for, including rotor shafts, specialized manufacturing service, food processing equipment, engineering service, and assembly machinery.

Market Analysis Summary:

Overview U.S. machine tool industry (Provided by Standard & Poor’s)

The U.S. machine tool industry is relatively stable, with approximately 600 industry establishments concentrated in Ohio, Michigan, and Illinois. Consolidation and foreign investment have changed the industry since the 1990s. The automotive industry’s ongoing investment programs, globalization, and demand for specialized machine tools have contributed to the industry’s stability. U.S. machine tool companies are expanding their worldwide presence through joint ventures, cooperative agreements, and strategic alliances. The largest industry investments have been made in Mexico, Brazil, India, and China.

Market Segmentation:

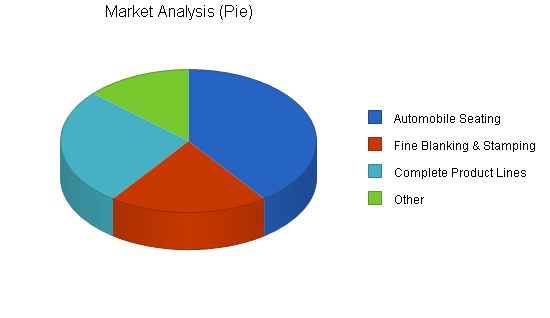

The company’s target customers include automobile seating manufacturers, fine blanking and stamping manufacturers, and manufacturers of complete product lines. These customers require customized machine tools, specialized manufacturing services, and value-adding assembly.

The table and chart below outline the total market potential and estimated growth rates for Machine Tooling’s products.

Market Analysis

| Market Analysis | |||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | |||

| Potential Customers | Growth | CAGR | |||||

| Automobile Seating | 2% | 300 | 306 | 312 | 318 | 324 | 1.94% |

| Fine Blanking & Stamping | 1% | 150 | 152 | 154 | 156 | 158 | 1.31% |

| Complete Product Lines | 1% | 200 | 202 | 204 | 206 | 208 | 0.99% |

| Other | 0% | 100 | 100 | 100 | 100 | 100 | 0.00% |

| Total | 1.31% | 750 | 760 | 770 | 780 | 790 | 1.31% |

The market strategy is to capitalize on our expertise by acquiring strategic companies within the industry. We plan to leverage our capacities to acquire companies that complement our manufacturing operations. Our goal in the next year is to secure more contract manufacturing positions and, in the next five years, to continue our "value-added" scheme and acquire key industry players.

Our products and services offer advantages such as on-time delivery, high quality, and competitive pricing. We have several competitive advantages, including engineering and technical support, automated system design and build, and quality systems. Our marketing strategy will focus on promoting sales of our product lines, systems, presses, automation projects, and machining capacity. We will utilize internal and external sales tactics, including a direct sales force, relationship selling, and subcontractors.

The pricing for our machined components is developed through thorough time study analysis. Our sales plan involves seeking businesses that will help us vertically integrate and become a stronger force in the manufacturing industry.

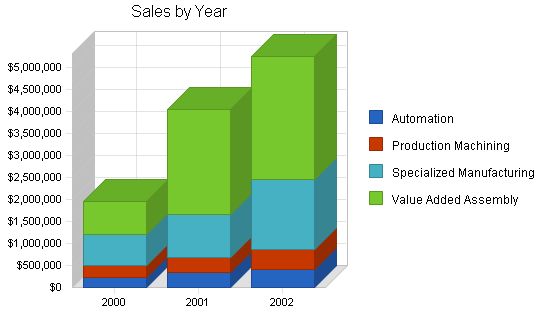

Our sales forecast shows a gradual increase in the share of high-value assembly services in our sales mix over the next two years.

The Sales Forecast for the years 2000, 2001, and 2002 is as follows:

Automation: $220,000, $330,000, $420,000

Production Machining: $270,000, $360,000, $440,000

Specialized Manufacturing: $710,000, $970,000, $1,600,000

Value Added Assembly: $760,000, $2,400,000, $2,800,000

Total Sales: $1,960,000, $4,060,000, $5,260,000

The Direct Cost of Sales for the same years is as follows:

Automation: $45,200, $67,000, $85,000

Production Machining: $54,700, $73,000, $89,000

Specialized Manufacturing: $144,400, $197,000, $325,000

Value Added Assembly: $155,700, $490,000, $570,000

Subtotal Direct Cost of Sales: $400,000, $827,000, $1,069,000

Management Summary:

The company’s management philosophy is based on responsibility and mutual respect. Machine Tooling will maintain an environment and structure that encourages productivity and respect for customers and employees.

Machine Tooling’s management team includes Mr. Peter Newton CEO, Mr. John Abbot, president, and Mr. Chris Manuel, vice president of Marketing. The company strives to maintain lean overhead. Besides the senior management team and an administrative assistant, Machine Tooling currently employs a production manager who oversees all production facilities and a staff of ten.

To accommodate the growing sales projections, an additional five production workers will be hired in 2001.

Personnel Plan:

The following is the personnel plan for the years 2000, 2001, and 2002:

Peter Newton, CEO: $75,000, $80,000, $90,000

John Abbot, President: $75,000, $80,000, $90,000

Chris Manuel, VP Marketing: $60,000, $65,000, $75,000

Production Manager: $45,000, $50,000, $55,000

Administrative Assistant: $30,000, $35,000, $40,000

Total People: 15, 20, 20

Total Payroll: $285,000, $310,000, $350,000

The company is seeking $500,000 for expansion purposes. The use of funds will be broken down as follows:

Marketing of new product lines: $30,000

Growth into new markets: $50,000

Purchasing additional equipment: $270,000

Working Capital: $100,000

Other (Debt Management): $50,000

Important Assumptions:

The following assumptions are important for this plan for the years 2000, 2001, and 2002:

Plan Month: 1, 2, 3

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 25.42%, 25.00%, 25.42%

Other: 0, 0, 0

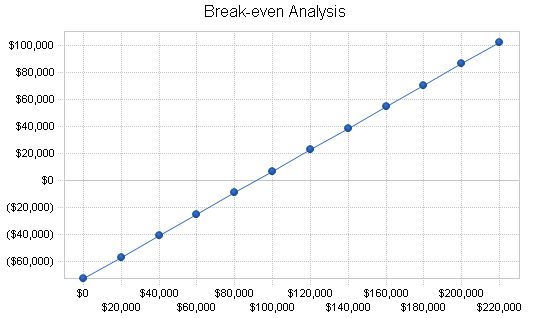

Break-even Analysis:

Machine Tooling is operating well above the break-even point.

Break-even Analysis

Monthly Revenue Break-even: $90,953

Assumptions:

– Average Percent Variable Cost: 20%

– Estimated Monthly Fixed Cost: $72,391

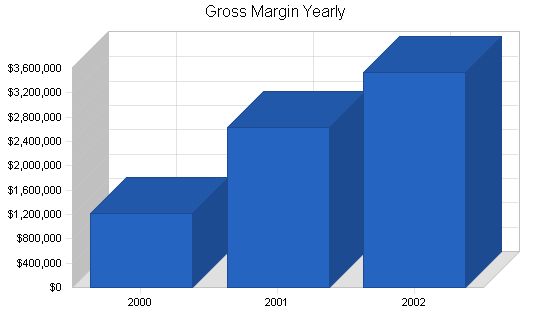

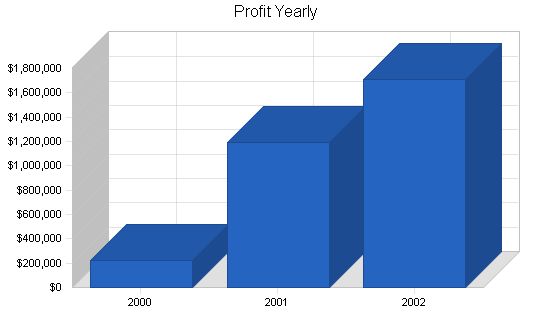

Projected Profit and Loss

The table below shows Machine Tooling’s projected income statements for 2000-2002.

Pro Forma Profit and Loss:

| Profit and Loss | |||

| Year | 2000 | 2001 | 2002 |

| Sales | $1,960,000 | $4,060,000 | $5,260,000 |

| Direct Cost of Sales | $400,000 | $827,000 | $1,069,000 |

| Production Personnel | $350,040 | $600,000 | $650,000 |

| Total Cost of Sales | $750,040 | $1,427,000 | $1,719,000 |

| Gross Margin | $1,209,960 | $2,633,000 | $3,541,000 |

| Gross Margin % | 61.73% | 64.85% | 67.32% |

| Expenses | |||

| Payroll | $285,000 | $310,000 | $350,000 |

| Marketing/Promotion | $167,900 | $220,000 | $265,000 |

| Depreciation | $9,996 | $30,000 | $40,000 |

| Quality Assurance | $93,800 | $104,000 | $125,000 |

| General & Administrative | $96,000 | $124,000 | $174,000 |

| Manufacturing & Engineering | $129,600 | $130,000 | $175,000 |

| Machining & Systems Building | $86,400 | $100,000 | $110,000 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $868,696 | $1,018,000 | $1,239,000 |

| Profit Before Interest and Taxes | $341,264 | $1,615,000 | $2,302,000 |

| EBITDA | $351,260 | $1,645,000 | $2,342,000 |

| Interest Expense | $47,705 | $29,150 | $12,470 |

| Taxes Incurred | $74,621 | $396,463 | $581,922 |

| Net Profit | $218,938 | $1,189,388 | $1,707,608 |

| Net Profit/Sales | 11.17% | 29.30% | 32.46% |

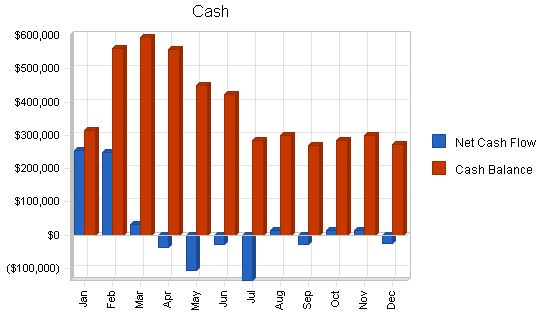

7.4 Projected Cash Flow:

The company’s projected cash flow statements are presented below.

The existing short-term liabilities ($50,000 in total) are paid out in ten monthly payments of $5,000 each starting in March, 2000.

Pro Forma Cash Flow

Cash Received

Cash from Operations

Cash Sales $490,000 $1,015,000 $1,315,000

Cash from Receivables $1,352,925 $2,780,277 $3,793,730

Subtotal Cash from Operations $1,842,925 $3,795,277 $5,108,730

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $500,000 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $2,342,925 $3,795,277 $5,108,730

Expenditures

Expenditures from Operations

Cash Spending $285,000 $310,000 $350,000

Bill Payments $1,350,401 $2,477,107 $3,134,443

Subtotal Spent on Operations $1,635,401 $2,787,107 $3,484,443

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $50,000

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $175,100 $166,800 $166,800

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $270,000 $200,000 $300,000

Dividends $0 $0 $0

Subtotal Cash Spent $2,130,501 $3,153,907 $3,951,243

Net Cash Flow $212,424 $641,370 $1,157,487

Cash Balance $272,424 $913,793 $2,071,280

7.5 Balance Sheet

The company’s projected balance sheets for 2000-2002 are presented below.

Pro Forma Balance Sheet

Assets

Current Assets

Cash $272,424 $913,793 $2,071,280

Accounts Receivable $247,075 $511,798 $663,069

Inventory $37,290 $77,097 $99,658

Other Current Assets $15,000 $15,000 $15,000

Total Current Assets $571,789 $1,517,689 $2,849,006

Long-term Assets

Long-term Assets $370,000 $570,000 $870,000

Accumulated Depreciation $39,996 $69,996 $109,996

Total Long-term Assets $330,004 $500,004 $760,004

Total Assets $901,793 $2,017,693 $3,609,010

Liabilities and Capital

Current Liabilities

Accounts Payable $117,955 $211,267 $261,777

Current Borrowing $0 $0 $0

Other Current Liabilities $10,000 $10,000 $10,000

Subtotal Current Liabilities $127,955 $221,267 $271,777

Long-term Liabilities $374,900 $208,100 $41,300

Total Liabilities $502,855 $429,367 $313,077

Paid-in Capital $50,000 $50,000 $50,000

Retained Earnings $130,000 $348,938 $1,538,325

Earnings $218,938 $1,189,388 $1,707,608

Total Capital $398,938 $1,588,325 $3,295,933

Total Liabilities and Capital $901,793 $2,017,693 $3,609,010

7.6 Business Ratios

The following table gives a detailed ratio analysis for Machine Tooling. The last column, Industry Profiles, is derived from the general machine industry, as described by the Standard Industry Classification (SIC) Index code 3569, General Industrial Machinery, NEC.

Ratio Analysis

Sales Growth 30.67% 107.14% 29.56% -0.50%

Percent of Total Assets

Accounts Receivable 27.40% 25.37% 18.37% 24.80%

Inventory 4.14% 3.82% 2.76% 26.10%

Other Current Assets 1.66% 0.74% 0.42% 24.20%

Total Current Assets 63.41% 75.22% 78.94% 75.10%

Long-term Assets 36.59% 24.78% 21.06% 24.90%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities 14.19% 10.97% 7.53% 35.70%

Long-term Liabilities 41.57% 10.31% 1.14% 18.50%

Total Liabilities 55.76% 21.28% 8.67% 54.20%

Net Worth 44.24% 78.72% 91.33% 45.80%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 61.73% 64.85% 67.32% 35.80%

Selling, General & Administrative Expenses 72.00% 52.86% 49.17% 20.80%

Advertising Expenses 2.27% 1.60% 1.33% 0.70%

Profit Before Interest and Taxes 17.41% 39.78% 43.76% 4.00%

Main Ratios

Current 4.47 6.86 10.48 2.20

Quick 4.18 6.51 10.12 1.15

Total Debt to Total Assets 55.76% 21.28% 8.67% 54.20%

Pre-tax Return on Net Worth 73.59% 99.84% 69.47% 7.30%

Pre-tax Return on Assets 32.55% 78.60% 63.44% 16.00%

Additional Ratios

Net Profit Margin 11.17% 29.30% 32.46% n.a

Return on Equity 54.88% 74.88% 51.81% n.a

Activity Ratios

Accounts Receivable Turnover 5.95 5.95 5.95 n.a

Collection Days 59 45 54 n.a

Inventory Turnover 10.42 14.46 12.10 n.a

Accounts Payable Turnover 11.81 12.17 12.17 n.a

Payment Days 29 23 27 n.a

Total Asset Turnover 2.17 2.01 1.46 n.a

Debt Ratios

Debt to Net Worth 1.26 0.27 0.09 n.a

Current Liab. to Liab. 0.25 0.52 0.87 n.a

Liquidity Ratios

Net Working Capital $443,834 $1,296,421 $2,577,229 n.a

Interest Coverage 7.15 55.40 184.60 n.a

Additional Ratios

Assets to Sales 0.46 0.50 0.69 n.a

Current Debt/Total Assets 14% 11% 8% n.a

Acid Test 2.25 4.20 7.68 n.a

Sales/Net Worth 4.91 2.56 1.60 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Sales Forecast

Sales

Automation $18,000 $18,000 $18,000 $18,000 $18,000 $18,000 $18,000 $18,000 $19,000 $19,000 $19,000 $19,000

Production Machining $22,000 $22,000 $22,000 $22,000 $22,000 $22,000 $22,000 $22,000 $22,000 $22,000 $23,000 $24,000 $25,000

Specialized Manufacturing $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $60,000 $60,000

Value Added Assembly $63,000 $63,000 $63,000 $63,000 $63,000 $63,000 $63,000 $63,000 $63,000 $64,000 $64,000 $64,000 $64,000

Total Sales $162,000 $162,000 $162,000 $162,000 $162,000 $162,000 $162,000 $162,000 $164,000 $165,000 $167,000 $168,000

Direct Cost of Sales

Automation $3,700 $3,700 $3,700 $3,700 $3,700 $3,700 $3,700 $3,700 $3,900 $3,900 $3,900 $3,900

Production Machining $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,500 $4,700 $4,700 $4,800

Specialized Manufacturing $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 $12,200 $12,200

Value Added Assembly $12,900 $12,900 $12,900 $13,000 $13,000 $13,000 $13,000 $13,000 $13,000 $13,000 $13,000 $13,000

Subtotal Direct Cost of Sales $33,100 $33,100 $33,100 $33,200 $33,200 $33,200 $33,200 $33,200 $33,400 $33,600 $33,800 $33,900

Personnel Plan:

Peter Newton, CEO: $6,250

John Abbot, President: $6,250

Chris Manuel, VP Marketing: $5,000

Production Manager: $3,750

Administrative Assistant: $2,500

Total People: 15

Total Payroll: $23,750

General Assumptions:

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00%

Other: 0

Pro Forma Profit and Loss:

Sales: $162,000, $162,000, $162,000, $162,000, $162,000, $162,000, $162,000, $162,000, $164,000, $165,000, $167,000, $168,000

Direct Cost of Sales: $33,100, $33,100, $33,100, $33,200, $33,200, $33,200, $33,200, $33,200, $33,400, $33,600, $33,800, $33,900

Production Personnel: $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170, $29,170

Total Cost of Sales: $62,270, $62,270, $62,270, $62,370, $62,370, $62,370, $62,370, $62,370, $62,570, $62,770, $62,970, $63,070

Gross Margin: $99,730, $99,730, $99,730, $99,630, $99,630, $99,630, $99,630, $99,630, $101,430, $102,230, $104,030, $104,930

Gross Margin %: 61.56%, 61.56%, 61.56%, 61.50%, 61.50%, 61.50%, 61.50%, 61.50%, 61.85%, 61.96%, 62.29%, 62.46%

Expenses:

Payroll: $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750, $23,750

Marketing/Promotion: $13,900, $13,900, $14,000, $13,900, $13,900, $14,000, $13,900, $13,900, $14,050, $14,000, $14,100, $14,350

Depreciation: $833, $833, $833, $833, $833, $833, $833, $833, $833, $833, $833, $833

Quality Assurance: $7,700, $7,700, $7,700, $7,700, $7,700, $7,700, $7,700, $7,700, $7,900, $8,000, $8,100, $8,200

General & Administrative: $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000, $8,000

Manufacturing & Engineering: $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800, $10,800

Machining & Systems Building: $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200, $7,200

Payroll Taxes: 15%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Operating Expenses: $72,183, $72,183, $72,283, $72,183, $72,183, $72,283, $72,183, $72,183, $72,533, $72,583, $72,783, $73,133

Profit Before Interest and Taxes: $27,547, $27,547, $27,447, $27,447, $27,447, $27,347, $27,447, $27,447, $28,897, $29,647, $31,247, $31,797

EBITDA: $28,380, $28,380, $28,280, $28,280, $28,280, $28,180, $28,280, $28,280, $29,730, $30,480, $32,080, $32,630

Interest Expense: $2,917, $5,000, $4,958, $4,500, $4,458, $4,069, $4,028, $3,986, $3,597, $3,555, $3,513, $3,124

Taxes Incurred: $7,389, $5,637, $5,622, $5,737, $5,747, $5,819, $5,855, $5,865, $6,325, $6,523, $6,933, $7,168

Net Profit: $17,241, $16,910, $16,867, $17,210, $17,242, $17,458, $17,565, $17,596, $18,975, $19,569, $20,800, $21,505

Net Profit/Sales: 10.64%, 10.44%, 10.41%, 10.62%, 10.64%, 10.78%, 10.84%, 10.86%, 11.57%, 11.86%, 12.46%, 12.80%

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash Sales | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $41,000 | $41,250 | $41,750 | $42,000 | |

| Cash from Receivables | $65,000 | $69,050 | $121,500 | $121,500 | $121,500 | $121,500 | $121,500 | $121,500 | $121,500 | $121,550 | $123,025 | $123,800 | |

| Subtotal Cash from Operations | $105,500 | $109,550 | $162,000 | $162,000 | $162,000 | $162,000 | $162,000 | $162,000 | $162,500 | $162,800 | $164,775 | $165,800 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | $0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $250,000 | $250,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $355,500 | $359,550 | $162,000 | $162,000 | $162,000 | $162,000 | $162,000 | $162,000 | $162,500 | $162,800 | $164,775 | $165,800 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | $23,750 | |

| Bill Payments | $77,903 | $87,507 | $100,701 | $120,543 | $120,312 | $120,168 | $119,955 | $119,851 | $119,849 | $120,675 | $121,094 | $121,843 | |

| Subtotal Spent on Operations | $101,653 | $111,257 | $124,451 | $144,293 | $144,062 | $143,918 | $143,705 | $143,601 | $143,599 | $144,425 | $144,844 | $145,593 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | $5,000 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $50,000 | $0 | $41,700 | $0 | $0 | $41,700 | $0 | $0 | $41,700 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $120,000 | $0 | $150,000 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $101,653 | $111,257 | $129,451 | $199,293 | $269,062 | $190,618 | $298,705 | $148,601 | $190,299 | $149,425 | $149,844 | $192,293 | |

| Net Cash Flow | $253,847 | $248,293 | $32,549 | ($37,293) | ($107,062) | ($28,618) | ($136,705) | $13,399 | ($27,799) | $13,375 | $14,931 | ($26,493) | |

| Cash Balance | $313,847 | $562,140 | $594,689 | $557,396 | $450,334 | $421,716 | $285,011 | $298,410 | $270,611 | $283,985 | $298,917 | $272,424 | |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!