Introduction

Business Solutions Consulting (BSC) is a start-up consulting firm that serves the comprehensive needs of businesses in the full range of the business cycle. With experienced professionals and a team approach to consulting projects, BSC offers a balanced quality service.

The Company

Business Solutions Consulting is a team of six business consultants specializing in finance, sales and marketing, technology, management, operations, and human resources.

BSC provides a range of services for business owners, including business and marketing plan preparation, financial search and procurement, IT consulting services, management development, and human resources advising.

BSC focuses on start-up businesses, preferably in the earlier stages of operation, establishing and nurturing long-term relationships with younger operations. BSC is an Oregon-based LLC with two principal partners, Mr. Andrew B. Christiansen and Mr. David E. Fields, each owning a 50% share in the company. Mr. Christiansen has extensive experience in business planning and finance, while Mr. Fields specializes in marketing, advertising, and communications.

The Market

The business consulting industry is fragmented, dominated by large multinational companies and smaller specialized firms. Major management consulting companies like McKinsey, Bain, and Boston Consulting Group provide services to leading companies in various industries. Start-up companies are the target market for BSC, which seeks new clients through business contacts, referrals, and Internet marketing efforts.

BSC’s competitors offer similar information-based consulting, integration and management services designed to improve clients’ operations effectiveness and introduce new products and services. Competing firms include regional and specialty consulting firms, as well as the consulting groups of international accounting firms like KPMG LLP, Ernst & Young LLP, Deloitte & Touche LLP, PricewaterhouseCoopers LLP, and Andersen Consulting.

Financial

BSC’s co-owners, Andrew B. Christiansen and David E. Fields, will provide $50,000 each for start-up expenses. Additional financing will come from a $100,000 10-year loan from the Small Business Administration (SBA). These funds will cover the company’s expenses throughout the critical first year of operations.

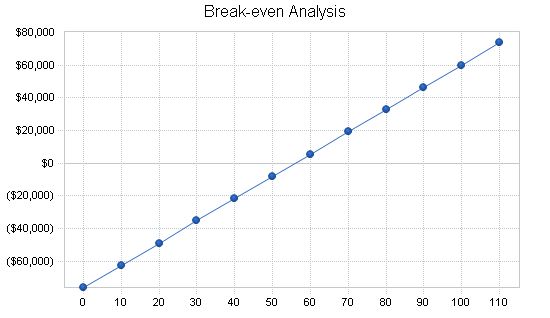

BSC’s Break-even Analysis shows that the company will break-even by the tenth month of operations, calculated based on the first-year figures for total sales, salaries, bonuses, and operating expenses.

BSC aims to offer comprehensive consulting services by providing personal and specialized services to meet each client’s specific needs. The keys to BSC’s success include a group of professionals with a broad range of specialty areas that complement each other, a high level of experience in these specialty areas, a team approach on most consulting projects, and many business contacts among the consultant group.

Business Solutions Consulting is a startup firm that will focus on providing a wide range of business consulting services to other startups and companies in early stages of their operations. It consists of six Business Consultants, each specializing in a particular discipline, including finance, sales and marketing, technology, management, operations, and human resources.

Business Solutions Consulting was registered as an Oregon LLC equally owned by Andrew B. Christiansen and David E. Fields.

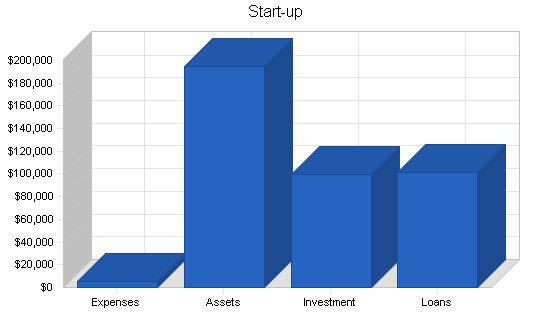

BSC’s co-owners, Andrew B. Christiansen and David E. Fields, will each provide $49,750 in investment to cover the bulk of the start-up expenses. The rest of the required financing will come from a $100,000 Small Business Administration (SBA) 10-year loan. Together, these funds will be sufficient to cover the company’s expenses throughout the critical first year of operations from a cash flow standpoint.

The following chart and table contain projected initial start-up cost data.

Start-up Requirements

– Legal: $2,500

– Office Supplies: $2,000

– Other: $1,000

– Total Start-up Expenses: $5,500

Start-up Assets

– Cash Required: $150,000

– Other Current Assets: $20,000

– Long-term Assets: $25,000

– Total Assets: $195,000

Total Requirements: $200,500

Start-up Funding

– Start-up Expenses to Fund: $5,500

– Start-up Assets to Fund: $195,000

– Total Funding Required: $200,500

Assets

– Non-cash Assets from Start-up: $45,000

– Cash Requirements from Start-up: $150,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $150,000

– Total Assets: $195,000

Liabilities and Capital

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $100,000

– Accounts Payable (Outstanding Bills): $1,000

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $101,000

– Capital

– Planned Investment

– Investor 1: $49,750

– Investor 2: $49,750

– Additional Investment Requirement: $0

– Total Planned Investment: $99,500

– Loss at Start-up (Start-up Expenses): ($5,500)

– Total Capital: $94,000

Total Capital and Liabilities: $195,000

Total Funding: $200,500

Services

BSC offers a range of services for business owners to choose from, based on their specific needs. Start-up services include business plan preparation, marketing plan preparation, and financing search and procurement. Ongoing services include business plan updates, marketing plan updates, search and procurement of additional rounds of financing, management development, IT consulting services, e-commerce consulting services, operational advising, and human resources advising. BSC is flexible and works with clients on-site, remotely, or in a combination of both. BSC teams work on projects to assist clients in all areas of the business simultaneously, ensuring a comprehensive understanding of the business’s functional areas.

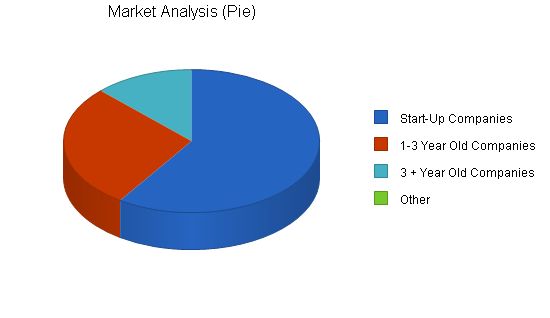

Market Analysis Summary

BSC focuses on start-up businesses, particularly those in the early stages of operation. Small and mid-sized businesses make up a majority of U.S. and international markets. BSC prefers to establish long-term relationships with younger operations. The following chart and table show BSC’s projected target markets and growth for the first three years of the plan.

Market Analysis

Start-Up Companies: 10% Growth in Year 1-5

1-3 Year Old Companies: 8% Growth in Year 1-5

3+ Year Old Companies: 6% Growth in Year 1-5

Other: 0% Growth in Year 1-5

Total: 8.96% CAGR in Year 1-5

5.1 Market Segmentation

Start-Ups

Start-up companies often need expert advice and planning for a successful start-up. Most start-ups seek comprehensive consulting services.

1-3 Year Old Companies

Young companies, between 1 and 3 years old, are less likely to need expert business consulting services. They have already secured financing and have a satisfactory level of security. However, these businesses still need the expertise of a team of consultants.

3+ Year-Old Companies

Established companies have a smaller need for services compared to start-ups. They require specialized services in operational planning or human resources.

5.2 Target Market Segment Strategy

The target market of this firm is start-up companies. BSC intends to stay updated on new business activity in the local area. They will also pursue new clients through business contacts, referrals, and internet marketing efforts.

5.3 Market Needs

Start-up company owners often lack the knowledge and expertise required to launch a new business. There is a significant demand for start-up consulting services.

5.4 Service Business Analysis

The business consulting industry is fragmented. Large multinational companies dominate the industry, while smaller specialized firms occupy market niches. Major management consulting companies like McKinsey, Bain, and Boston Consulting Group provide services to leading companies in various industries. Consulting practices of major accounting firms have a worldwide presence and sell packaged services. Small firms and individual consultants prosper in market niches that bigger players consider unprofitable to enter.

5.5 Competition and Buying Patterns

Competitors in the marketplace offer information-based consulting, integration, and management services. They aim to increase operations effectiveness, reduce costs, improve customer service, enhance quality, and introduce new products and services quickly. Competitors also offer industry-specific expertise to evaluate, select, develop, implement, and manage information systems.

Consulting services focus on technology-based solutions to improve cost management, quality, service, research and development, and obtain differentiation and competitive advantage. E-strategy services provide education, insights, and strategies to utilize the internet for improved performance. IT strategy consulting services focus on using IT to support business goals and transform product and service distribution and retailing.

Strategic planning consulting services consist of strategic alignment, IT department operational excellence, and IT value realization. Performance improvement services consist of process redesigning to reduce costs, improve financial performance, engage and retain customers, and improve accountability and reporting.

Other services among competitors include long-term IT management expertise, as well as assessment/due diligence, program management, discrete outsourcing, and full IT outsourcing services.

Consulting firms BSC competes with include regional and specialty consulting firms, and consulting groups of international accounting firms. In management and IT consulting services, BSC competes with information system vendors and e-commerce-related services.

Strategy and Implementation Summary

BSC offers companies a comprehensive range of multi-cycle business planning solutions.

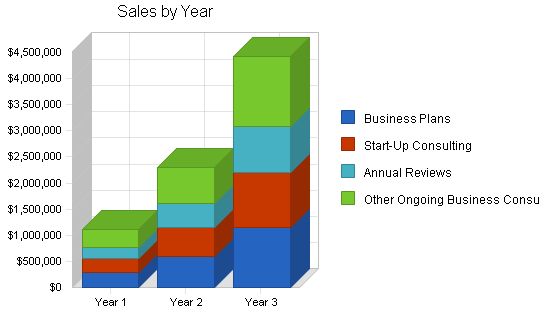

6.1 Sales Strategy

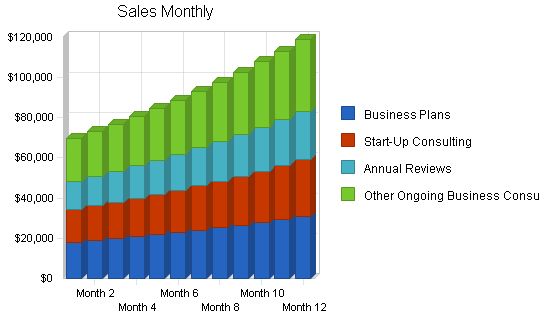

BSC aims to succeed by offering companies a comprehensive range of multi-cycle business planning solutions. The company will optimize its billing hours. The following table outlines the sales forecast for the next three years.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

Sales Forecast

Unit Sales

Business Plans: 191, 397, 763

Start-Up Consulting: 175, 364, 699

Annual Reviews: 223, 464, 890

Other Ongoing Business Consulting: 223, 464, 890

Total Unit Sales: 812, 1,688, 3,242

Unit Prices

Business Plans: $1,500.00

Start-Up Consulting: $1,500.00

Annual Reviews: $1,000.00

Other Ongoing Business Consulting: $1,500.00

Sales

Business Plans: $286,508, $595,937, $1,144,199

Start-Up Consulting: $262,633, $546,276, $1,048,850

Annual Reviews: $222,840, $463,507, $889,933

Other Ongoing Business Consulting: $334,260, $695,260, $1,334,899

Total Sales: $1,106,240, $2,300,980, $4,417,881

Direct Unit Costs

Business Plans: $0.00

Start-Up Consulting: $0.00

Annual Reviews: $0.00

Other Ongoing Business Consulting: $0.00

Direct Cost of Sales

Business Plans: $0

Start-Up Consulting: $0

Annual Reviews: $0

Other Ongoing Business Consulting: $0

Subtotal Direct Cost of Sales: $0

Competitive Edge

Our competitive edge is the team approach of consultants specializing in specific business disciplines.

Management Summary

Andrew B. Christiansen has extensive experience in business planning and finance, including CFO positions with ABC Conglomerate and DEF International. David E. Fields brings experience in marketing, advertising, and communications.

Personnel Plan

Owner / Consultants: $600,000, $660,000, $726,000

Other: $0

Total People: 6, 7, 8

Total Payroll: $600,000, $660,000, $726,000

BSC plans to raise $100,000 as its capital and borrow $100,000 guaranteed by the SBA as a 10-year loan. This provides the majority of the required financing.

Break-even Analysis

BSC’s Break-even Analysis is based on the average of first-year figures for total sales, salaries, bonuses costs, and other operating expenses. These are presented as per-unit revenue, per-unit cost, and fixed costs. These conservative assumptions provide a more accurate estimate of risk. Analysis shows that BSC will break-even by the tenth month of operations.

Break-even Analysis:

Monthly Units Break-even: 56

Monthly Revenue Break-even: $76,150

Assumptions:

Average Per-Unit Revenue: $1,362.36

Average Per-Unit Variable Cost: $0.00

Estimated Monthly Fixed Cost: $76,150

Projected Profit and Loss:

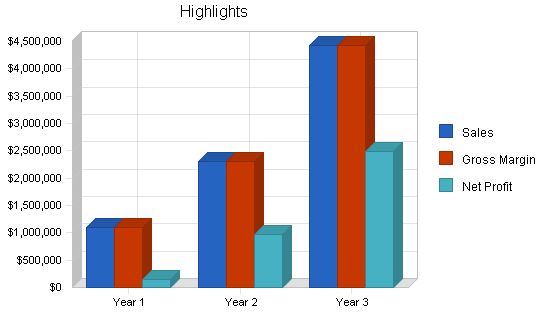

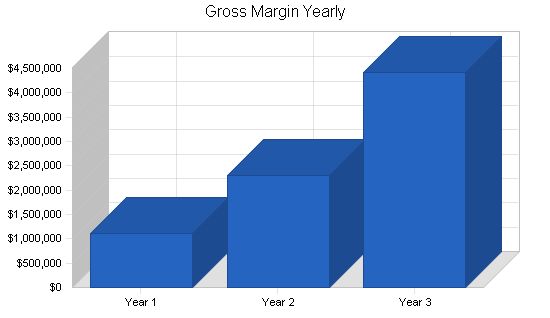

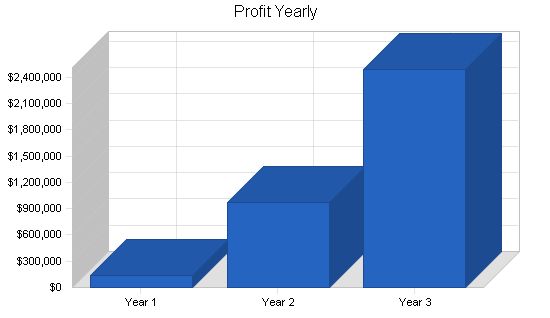

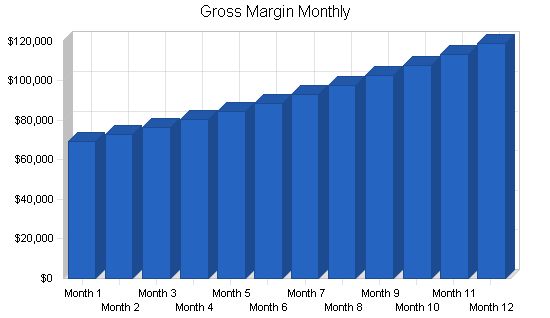

The profit and loss table demonstrates BSC’s anticipated steady growth in profitability over the next three years of operations.

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3

Sales $1,106,240 $2,300,980 $4,417,881

Direct Cost of Sales $0 $0 $0

Other $0 $0 $0

Total Cost of Sales $0 $0 $0

Gross Margin $1,106,240 $2,300,980 $4,417,881

Gross Margin % 100.00% 100.00% 100.00%

Expenses

Payroll $600,000 $660,000 $726,000

Sales and Marketing and Other Expenses $216,600 $227,430 $238,802

Depreciation $6,000 $6,300 $6,615

Utilities $1,200 $1,266 $1,336

Payroll Taxes $90,000 $99,000 $108,900

Other $0 $0 $0

Total Operating Expenses $913,800 $993,996 $1,081,652

Profit Before Interest and Taxes $192,440 $1,306,984 $3,336,229

EBITDA $198,440 $1,313,284 $3,342,844

Interest Expense $8,050 $6,065 $5,356

Taxes Incurred $45,725 $325,230 $846,597

Net Profit $138,666 $975,689 $2,484,276

Net Profit/Sales 12.53% 42.40% 56.23%

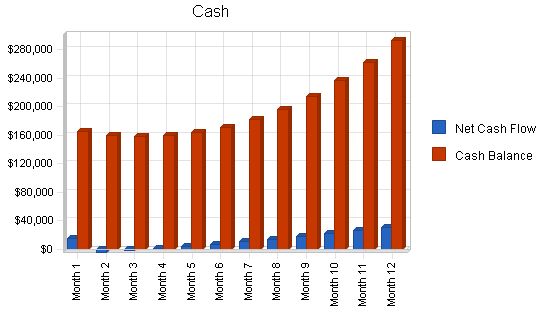

8.3 Projected Cash Flow:

The cash flow statement illustrates that BSC expects to maintain a steady rate of cash flow over the next three years of operations.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $1,106,240 | $2,300,980 | $4,417,881 |

| Subtotal Cash from Operations | $1,106,240 | $2,300,980 | $4,417,881 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $1,106,240 | $2,300,980 | $4,417,881 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $600,000 | $660,000 | $726,000 |

| Bill Payments | $327,069 | $640,332 | $1,156,442 |

| Subtotal Spent on Operations | $927,069 | $1,300,332 | $1,882,442 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $36,000 | $6,700 | $7,486 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $45,000 | $55,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $963,069 | $1,352,032 | $1,944,928 |

| Net Cash Flow | $143,171 | $948,947 | $2,472,953 |

| Cash Balance | $293,171 | $1,242,118 | $3,715,072 |

8.4 Projected Balance Sheet

Following is a copy of the company’s projected balance sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Cash | $293,171 | $1,242,118 | $3,715,072 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $313,171 | $1,262,118 | $3,735,072 |

| Long-term Assets | |||

| Long-term Assets | $25,000 | $70,000 | $125,000 |

| Accumulated Depreciation | $6,000 | $12,300 | $18,915 |

| Total Long-term Assets | $19,000 | $57,700 | $106,085 |

| Total Assets | $332,171 | $1,319,818 | $3,841,157 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $35,505 | $54,164 | $98,711 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $35,505 | $54,164 | $98,711 |

| Long-term Liabilities | $64,000 | $57,300 | $49,814 |

| Total Liabilities | $99,505 | $111,464 | $148,525 |

| Paid-in Capital | $99,500 | $99,500 | $99,500 |

| Retained Earnings | ($5,500) | $133,166 | $1,108,855 |

| Earnings | $138,666 | $975,689 | $2,484,276 |

| Total Capital | $232,666 | $1,208,355 | $3,692,631 |

| Total Liabilities and Capital | $332,171 | $1,319,818 | $3,841,157 |

| Net Worth | $232,666 | $1,208,355 | $3,692,631 |

8.5 Business Ratios

The following table outlines the important business ratios for Business Solutions Consulting, as determined by the Standard Industry Classification (SIC) Index. Ratios for the Business Consulting services industry (SIC 8748) are used as a benchmark in this table.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 108.00% | 92.00% | 12.40% |

| Percent of Total Assets | ||||

| Other Current Assets | 6.02% | 1.52% | 0.52% | 44.70% |

| Total Current Assets | 94.28% | 95.63% | 97.24% | 74.50% |

| Long-term Assets | 5.72% | 4.37% | 2.76% | 25.50% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable Turnover | 10.18 | 12.17 | 12.17 | |

| Payment Days | 27 | 25 | 23 | |

| Total Asset Turnover | 3.33 | 1.74 | 1.15 | |

| Debt Ratios | ||||

| Debt to Net Worth | 0.43 | 0.09 | 0.04 | |

| Current Liab. to Liab. | 0.36 | 0.49 | 0.66 | |

| Liquidity Ratios | ||||

| Net Working Capital | $277,666 | $1,207,955 | $3,636,360 | |

| Interest Coverage | 23.91 | 215.50 | 622.93 | |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 12.53% | 42.40% | 56.23% | n.a |

| Return on Equity | 59.60% | 80.75% | 67.28% | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

"

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Unit Sales | |||||||||||||

| Business Plans | 0% | 12 | 13 | 13 | 14 | 15 | 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| Start-Up Consulting | 0% | 11 | 12 | 12 | 13 | 13 | 14 | 15 | 15 | 16 | 17 | 18 | 19 |

| Annual Reviews | 0% | 14 | 15 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| Other Ongoing Business Consulting | 0% | 14 | 15 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| Total Unit Sales | 51 | 54 | 56 | 59 | 62 | 65 | 68 | 72 | 75 | 79 | 83 | 87 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $69,500 | $72,975 | $76,624 | $80,455 | $84,478 | $88,702 | $93,137 | $97,793 | $102,683 | $107,817 | $113,208 | $118,869 | |

| Direct Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Gross Margin | $69,500 | $72,975 | $76,624 | $80,455 | $84,478 | $88,702 | $93,137 | $97,793 | $102,683 | $107,817 | $113,208 | $118,869 | |

| Gross Margin % | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | |

| Expenses | |||||||||||||

| Payroll | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | |

| Sales and Marketing and Other Expenses | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | $18,050 | |

| Depreciation | 5% | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 |

| Utilities | 6% | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 | $100 |

| Payroll Taxes | 15% | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 | $7,500 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $76,150 | $76,150 | $76,150 | $76,150 | $76,150 | $76,150 | $76,150 | $76,150 | $76,150 | ||||

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $69,500 | $72,975 | $76,624 | $80,455 | $84,478 | $88,702 | $93,137 | $97,793 | $102,683 | $107,817 | $113,208 | $118,869 | |

| Subtotal Cash from Operations | $69,500 | $72,975 | $76,624 | $80,455 | $84,478 | $88,702 | $93,137 | $97,793 | $102,683 | $107,817 | $113,208 | $118,869 | |

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

Personnel Plan

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Owner / Consultants | 0% | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 | |

| Total Payroll | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 | $50,000 |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | ||||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |||

| Assets | Starting Balances | |||||||||||||

| Current Assets | ||||||||||||||

| Cash | $150,000 | $164,693 | $160,406 | $158,556 | $159,643 | $163,811 | $171,215 | $182,015 | $196,380 | $214,487 | $236,523 | $262,682 | $293,171 | |

| Other Current Assets | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | $20,000 | ||

| Total Current Assets | $170,000 | $184,693 | $180,406 | $178,556 | $179,643 | $183,811 | $191,215 | $202,015 | $216,380 | $234,487 | $256,523 | $282,682 | $313,171 | |

| Long-term Assets | ||||||||||||||

| Long-term Assets | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | $25,000 | ||

| Accumulated Depreciation | $0 | $500 | $1,000 | $1,500 | $2,000 | $2,500 | $3,000 | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 | $6,000 | |

| Total Long-term Assets | $25,000 | $24,500 | $24,000 | $23,500 | $23,000 | $22,500 | $22,000 | $21,500 | $21,000 | $20,500 | $20,000 | $19,500 | $19,000 | |

| Total Assets | $195,000 | $209,193 | $204,406 | $202,056 | $202,643 | $206,311 | $213,215 | $223,515 | $237,380 | $254,987 | $276,523 | $302,182 | $332,171 | |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Current Liabilities | ||||||||||||||

| Accounts Payable | $1,000 | $23,413 | $24,596 | $25,459 | $26,367 | $27,321 | $28,324 | $29,377 | $30,485 | $31,648 | $32,871 | $34,156 | $35,505 | |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Current Liabilities | $1,000 | $23,413 | $24,596 | $25,459 | $26,367 | $27,321 | $28,324 | $29,377 | $30,485 | $31,648 | $32,871 | $34,156 | $35,505 | |

| Long-term Liabilities | $100,000 | $97,000 | $94,000 | $91,000 | $88,000 | $85,000 | $82,000 | $79,000 | $76,000 | $73,000 | $70,000 | $67,000 | $64,000 | |

| Total Liabilities | $101,000 | $120,413 | $118,596 | $116,459 | $114,367 | $112,321 | $110,324 | $108,377 | $106,485 | $104,648 | $102,871 | $101,156 | $99,505 | |

| Paid-in Capital | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | $99,500 | |

| Retained Earnings | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | ($5,500) | |

| Earnings | $0 | ($5,221) | ($8,190) | ($8,403) | ($5,724) | ($10) | $8,891 | $21,138 | $36,895 | $56,339 | $79,652 | $107,027 | $138,666 | |

| Total Capital | $94,000 | $88,779 | $85,810 | $85,597 | $88,276 | $93,990 | $102,891 | $115,138 | $130,895 | $150,339 | $173,652 | $201,027 | $232,666 | |

| Total Liabilities and Capital | $195,000 | $209,193 | $204,406 | $202,056 | $202,643 | $206,311 | $213,215 | $223,515 | $237,380 | $254,987 | $276,523 | $302,182 | $332,171 | |

| Net Worth | $94,000 | $88,779 | $85,810 | $85,597 | $88,276 | $93,990 | $102,891 | $115,138 | $130,895 | $150,339 | $173,652 | $201,027 | $232,666 | |

Business Plan Outline

- Executive Summary

- Company Summary

- Start-Up Summary

- Services

- Market Analysis Summary

- Strategy and Implementation Summary

- Management Summary

- Financial Plan

- Appendix

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!