Youth will be served! Over the past 10 years, Christian music has made inroads in every area of popular music except Heavy Metal. Heavy Metal Praise Records will focus on recording Christian Heavy Metal performers and promoting their success in the mainstream of Punk and Ska music.

1.1 Objectives:

– Sign and record two new Heavy Metal bands in the first year.

– Release the first CD of each group in the first year.

– Establish a strong distribution network for CD sales.

– Establish strategic alliances for wide music distribution.

1.2 Mission:

The idea of Heavy Metal Praise Records was created by a group of dedicated Christians who formed the Skate Ministry three years ago. The Skate ministry consists of 10 adult skateboarders who spread the word of God to young skateboarders at local skate parks. Most of the young skateboarders are boys aged 12 to 18. Heavy Metal music is predominant in the skateboard culture and is played at all skateparks in the area. The group realized that this music was promoting negative behavior and contributing to a culture of selfishness and violence.

Heavy Metal Praise’s mission is to introduce Christian Heavy Metal bands to the target audience. These bands provide the same musical intensity as popular Heavy Metal bands but with a more positive and constructive message, aiming to draw young people closer to God.

1.3 Keys to Success:

– Delivering irresistible Heavy Metal groups to the target audience.

– Accessing the music and distribution network that reaches Heavy Metal artists within the skate culture.

– Accessing the traditional Christian music and distribution network to establish a customer base for Heavy Metal Praise Records artists.

Heavy Metal Praise Records is a recording business that exclusively focuses on Christian Heavy Metal music groups.

2.1 Company Ownership:

The sole founder and owner of Heavy Metal Praise Records is Johnny Young, who is also a founding member of the Skate Ministry and a skateboarder for the past 20 years.

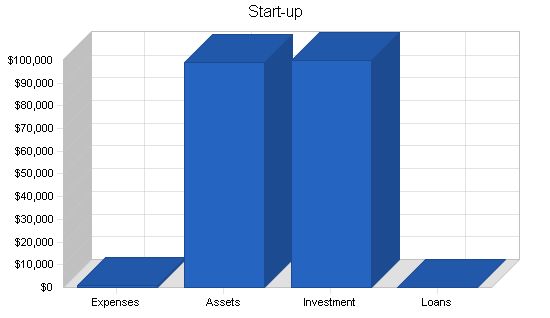

2.2 Start-up Summary:

Heavy Metal Praise Records has the following start-up expenses and equipment purchases:

– Computer system with three workstations, a printer, CD-RW, Microsoft Office, and Microsoft Access.

– Legal fees for business formation and contract generation and review.

– Copier, fax, and phone line.

– Various office supplies.

Start-up

Requirements

Start-up Expenses

Legal – $1,000

Stationery etc. – $100

Rent – $0

Other – $0

Total Start-up Expenses – $1,100

Start-up Assets

Cash Required – $83,900

Start-up Inventory – $0

Other Current Assets – $15,000

Long-term Assets – $0

Total Assets – $98,900

Total Requirements – $100,000

Start-up Funding

Start-up Expenses to Fund – $1,100

Start-up Assets to Fund – $98,900

Total Funding Required – $100,000

Assets

Non-cash Assets from Start-up – $15,000

Cash Requirements from Start-up – $83,900

Additional Cash Raised – $0

Cash Balance on Starting Date – $83,900

Total Assets – $98,900

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $0

Accounts Payable (Outstanding Bills) – $0

Other Current Liabilities (interest-free) – $0

Total Liabilities – $0

Capital

Planned Investment

Johnny – $100,000

Investor 2 – $0

Other – $0

Additional Investment Requirement – $0

Total Planned Investment – $100,000

Loss at Start-up (Start-up Expenses) – ($1,100)

Total Capital – $98,900

Total Capital and Liabilities – $98,900

Total Funding – $100,000

Products

Heavy Metal Praise Records produces CDs of Heavy Metal Christian music groups.

The typical Heavy Metal Praise Records buyer is in the 13-22 year old age bracket and is a direct result of the attitudes expressed by the label’s bands. The spirit of youth is the driving force of the label, offering proof that the energy of Heavy Metal Praise music exists beyond constraints and categorizations.

While Heavy Metal Praise Records hates to pigeonhole any of its artists’ musical sounds, it can be generalized that all the bands convey an in-your-face sound Christian music. This sound, when coupled with each band’s own creativity and inspiration, allows for the artists to maintain their identity while sharing the same energy, focus, and often fan base with their label mates. Heavy Metal Praise Records is an artist-friendly label, priding itself on giving its bands complete artistic and creative freedom.

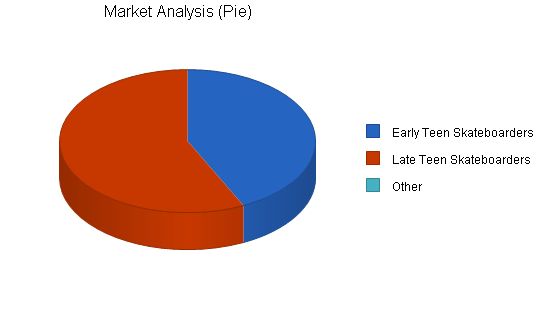

Market Analysis Summary

Heavy Metal music is the music of preference among boys and young men, ages 12-22, who are part of the skateboarding culture. Heavy Metal music generated $180 million dollars in sales last year.

Skateboarding has grown into an enormously popular recreational sport that generated half a billion dollars in sales last year. Each year the base of skateboarders grows even larger. The sport is still enjoyed by young men in their thirties. In many cases, these older skateboarders still enjoy Heavy Metal music. This represents a huge market opportunity for Christian music.

Heavy Metal Praise Records will focus on two customer groups:

Early teen skateboarder.

Late teen skateboarder.

4.1 Market Segmentation

Early Teen Skateboarders: This group has limited mobility to attend most Heavy Metal group performances. Yet they represent the largest consumer group of Heavy Metal music. Generally, this target group hears the music from friends, at skateboard parks, and at skateboard shops.

Late Teen Skateboarders: This group represents the strong fan base that comes out for live performances at local clubs. They are also exposed to the music at skateboard parks and skateboard shops. It is critical to build a secure fan base with this group in order to generate sales among the younger skateboarders.

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Early Teen Skateboarders 10% 3,000,000 3,300,000 3,630,000 3,993,000 4,392,300 10.00%

Late Teen Skateboarders 10% 4,000,000 4,400,000 4,840,000 5,324,000 5,856,400 10.00%

Other 0% 0 0 0 0 0 0.00%

Total 10.00% 7,000,000 7,700,000 8,470,000 9,317,000 10,248,700 10.00%

Contents

Strategy and Implementation Summary

Heavy Metal Praise Records will use their competitive advantages in a new musical area of Christian music to gain market share. The first advantage is Johnny’s extensive inside knowledge of the recording industry. The second advantage is an established network of industry contacts.

5.1 Competitive Edge

Currently, there are few Christian Heavy Metal bands with CDs in the marketplace. The only competition is the acceptance of the skateboard culture. Can a Heavy Metal group with a Christian message gain a fan base? The success of a Heavy Metal band depends on its fan base and live performances. If there is energy, the fan base will grow and CD sales will follow.

Heavy Metal Praise Records understands that their bands must have energy before the message can be heard.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis.

5.2 Marketing Strategy

Heavy Metal Praise Records has established the following Promotion and Distribution strategies.

5.2.1 Promotion Strategy

- Early Teens: Heavy Metal Praise recording artists will be marketed at weekly sponsored skateboarding events by the Skate Ministry. A band will play at each event during the summer months. In addition, Heavy Metal Praise recording artists will perform as part of the concert series sponsored by Rally Skateboards. At these events, free CD samplers will be given out of Heavy Metal Praise recording artists.

- Late Teens: Heavy Metal Praise recording artists will be booked to play extensively during the summer of 2002. A Heavy Metal Praise band will be part of the “Split Cross” tour in the region. Split Cross is a Christian music website and a strategic partner of Heavy Metal Praise recording. At these events, free CD samplers will be given out of Heavy Metal Praise recording artists.

5.2.2 Distribution Strategy

Heavy Metal Praise Records has made strategic alliances with the Coalition of Independent Music Stores (CIMS) and Straight Arrow, the number one Christian Music Website in the country. Heavy Metal Praise Records CDs will be distributed through CIMS to stores regionally and with greater visibility of the bands, the distribution will expand nationally. Straight Arrow will sell the CDs online as part of their campaign to widen the range of artists they offer. Last year, Straight Arrow sales topped $50 million.

5.3 Strategic Alliances

The strategic alliance with the Coalition of Independent Music Stores (CIMS) and Straight Arrow holds great potential.

- Straight Arrow is a distribution system for Christian artists who want to do it without major label backing. Some of the most sincere, yet cutting edge artists existing today are available to purchase at the Straight Arrow website. They will focus on building sales in the field of Heavy Metal music starting with Heavy Metal Praise artists.

- Coalition of Independent Music Stores represents a distribution system of 10,000 stores nationally. CIMS creates its own sales programs that focus on independent artists. They have committed to packaging Heavy Metal Praise Recording artists to its regional members. With the bands’ success, they plan to distribute the CDs nationally.

5.4 Sales Strategy

Our combined sales strategy of distributing our product online and in stores will result in the following first-year sales goals:

- 5,000 CDs sold online.

- 10,000 CDs sold in stores.

The sales totals represent only six months of sales activity. The first six months will be focused on signing the bands and producing the recording.

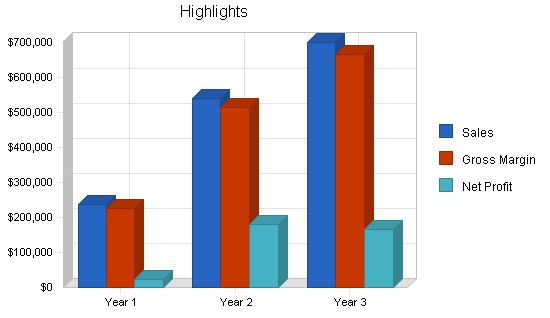

5.4.1 Sales Forecast

The following table and chart present specific sales forecasts by month over the first year of development. Years two and three are cumulative totals only.

Sales

Online: $84,000, $160,000, $200,000

In Store: $154,000, $380,000, $500,000

Total Sales: $238,000, $540,000, $700,000

Direct Cost of Sales

Online: $4,200, $8,000, $10,000

In Store: $7,700, $19,000, $25,000

Subtotal Direct Cost of Sales: $11,900, $27,000, $35,000

Milestones

Heavy Metal Praise Records will have several milestones:

– Sign two Heavy Metal Christian bands.

– Produce two new recordings in the first six months.

– Release recordings within six months.

Milestones

Milestone Start Date End Date Budget Manager Department

Signing of Bands 1/1/2001 3/1/2001 $10,000 JY Owner

Recording 3/31/2001 6/30/2001 $65,000 JY Owner

CD Release 6/30/2001 9/30/2001 $40,000 JY Owner

Totals $115,000

Management Summary

Heavy Metal Praise Records is solely operated by Johnny Young, a Christian music industry veteran with over 13 years of music ministry experience and extensive connections with producers and distributors. Johnny toured the USA with the CCM group "Seeds of Change" from 1991 to 1998. During this time, he felt a calling to usher in powerful and fresh Heavy Metal music that would lead people to a closer relationship with God.

The following sections outline the general financial assumptions, break-even analysis, profit and loss, cash flow, balance sheet, and business ratios.

Important Assumptions

General Assumptions

Plan Month: 1, 2, 3

Current Interest Rate: 10.00%

Long-term Interest Rate: 10.00%

Tax Rate: 30.00%

Other: 0

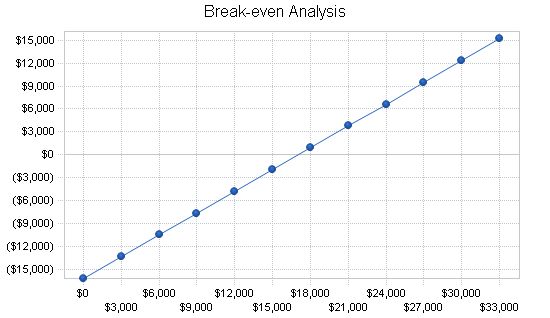

Break-even Analysis

The Break-even Analysis shows a need for approximately $1,700 in monthly revenue to break even. The Estimated Monthly Fixed Cost varies throughout the first year, as shown in the P & L appendix table, and this figure is an average based on the first-year totals.

Break-even Analysis:

Monthly Revenue Break-even: $17,022

Assumptions:

– Average Percent Variable Cost: 5%

– Estimated Monthly Fixed Cost: $16,171

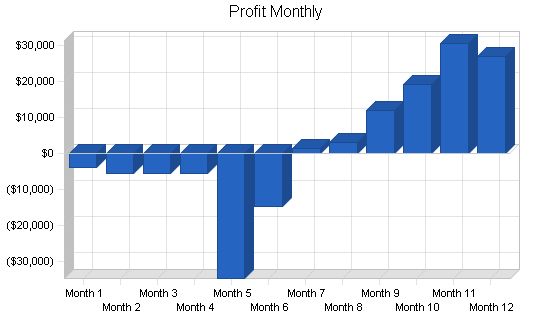

7.3 Projected Profit and Loss:

The following table will indicate projected profit and loss.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| 1 | 2 | 3 | |

| Sales | $238,000 | $540,000 | $700,000 |

| Direct Cost of Sales | $11,900 | $27,000 | $35,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $11,900 | $27,000 | $35,000 |

| Gross Margin | $226,100 | $513,000 | $665,000 |

| Gross Margin % | 95.00% | 95.00% | 95.00% |

| Expenses | |||

| Payroll | $27,000 | $35,000 | $42,000 |

| Sales and Marketing and Other Expenses | $142,000 | $190,000 | $350,000 |

| Depreciation | $3,000 | $3,000 | $3,000 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $0 | $0 | $0 |

| Insurance | $6,000 | $8,000 | $10,000 |

| Rent | $12,000 | $15,000 | $18,000 |

| Payroll Taxes | $4,050 | $5,250 | $6,300 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $194,050 | $256,250 | $429,300 |

| Profit Before Interest and Taxes | $32,050 | $256,750 | $235,700 |

| EBITDA | $35,050 | $259,750 | $238,700 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $9,615 | $77,025 | $70,710 |

| Net Profit | $22,435 | $179,725 | $164,990 |

| Net Profit/Sales | 9.43% | 33.28% | 23.57% |

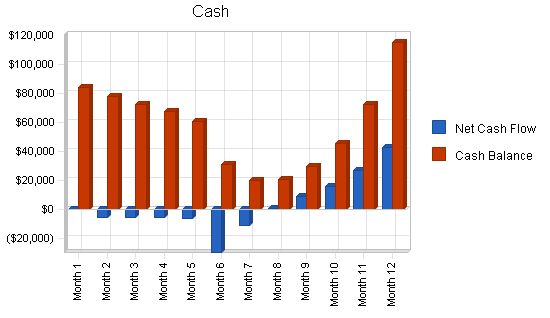

Projected Cash Flow:

7.4 Projected Cash Flow

Heavy Metal Praise will start with enough investment to cover the initial months of negative cash flow. By the end of the first year, there will be an overall increase in the cash balance.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $166,600 | $378,000 | $490,000 |

| Cash from Receivables | $31,740 | $111,675 | $183,338 |

| Subtotal Cash from Operations | $198,340 | $489,675 | $673,338 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $198,340 | $489,675 | $673,338 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $27,000 | $35,000 | $42,000 |

| Bill Payments | $140,307 | $350,569 | $479,397 |

| Subtotal Spent on Operations | $167,307 | $385,569 | $521,397 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $167,307 | $385,569 | $521,397 |

| Net Cash Flow | $31,033 | $104,107 | $151,940 |

| Cash Balance | $114,933 | $219,039 | $370,980 |

Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $114,933 | $219,039 | $370,980 |

| Accounts Receivable | $39,660 | $89,985 | $116,647 |

| Inventory | $4,400 | $9,983 | $12,941 |

| Other Current Assets | $15,000 | $15,000 | $15,000 |

| Total Current Assets | $173,993 | $334,007 | $515,568 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $3,000 | $6,000 | $9,000 |

| Total Long-term Assets | ($3,000) | ($6,000) | ($9,000) |

| Total Assets | $170,993 | $328,007 | $506,568 |

Business Ratios

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 126.89% | 29.63% | 15.20% |

| Percent of Total Assets | ||||

| Accounts Receivable | 23.19% | 27.43% | 23.03% | 6.80% |

| Inventory | 2.57% | 3.04% | 2.55% | 3.10% |

| Other Current Assets | 8.77% | 4.57% | 2.96% | 33.90% |

| Total Current Assets | 101.75% | 101.83% | 101.78% | 43.80% |

| Long-term Assets | ||||

| Long-term Assets | $0 | $0 | $0 | 56.20% |

| Accumulated Depreciation | $3,000 | $6,000 | $9,000 | |

| Total Long-term Assets | ($3,000) | ($6,000) | ($9,000) | |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 29.04% | 8.22% | 8.00% | 38.30% |

| Long-term Liabilities | $0 | $0 | $0 | 23.30% |

| Total Liabilities | 29.04% | 8.22% | 8.00% | 61.60% |

| Net Worth | 70.96% | 91.78% | 92.00% | 38.40% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 95.00% | 95.00% | 95.00% | 0.00% |

| Selling, General & Administrative Expenses | 84.69% | 61.33% | 71.13% | 75.30% |

| Advertising Expenses | 13.45% | 7.41% | 7.14% | 2.90% |

| Profit Before Interest and Taxes | 13.47% | 47.55% | 33.67% | 2.90% |

| Main Ratios | ||||

| Current | 3.50 | 12.39 | 12.72 | 1.22 |

| Quick | 3.42 | 12.02 | 12.41 | 0.82 |

| Total Debt to Total Assets

General Assumptions: – Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 – Current Interest Rate: 10.00% – Long-term Interest Rate: 10.00% – Tax Rate: 30.00% – Other: 0 Pro Forma Profit and Loss: – Month 1: $0 – Month 2: $0 – Month 3: $0 – Month 4: $0 – Month 5: $0 – Month 6: $6,000 – Month 7: $14,000 – Month 8: $18,000 – Month 9: $28,000 – Month 10: $38,000 – Month 11: $54,000 – Month 12: $80,000 – Sales: $0, $0, $0, $0, $0, $6,000, $14,000, $18,000, $28,000, $38,000, $54,000, $80,000 – Direct Cost of Sales: $0, $0, $0, $0, $0, $300, $700, $900, $1,400, $1,900, $2,700, $4,000 – Other Production Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Total Cost of Sales: $0, $0, $0, $0, $0, $300, $700, $900, $1,400, $1,900, $2,700, $4,000 – Gross Margin: $0, $0, $0, $0, $0, $5,700, $13,300, $17,100, $26,600, $36,100, $51,300, $76,000 – Gross Margin %: 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, 95.00%, 95.00%, 95.00%, 95.00%, 95.00%, 95.00%, 95.00% – Expenses: – Payroll: $0, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $3,000, $3,000, $3,000, $3,000, $3,000 – Sales and Marketing and Other Expenses: $5,000, $5,000, $5,000, $5,000, $45,000, $22,000, $7,000, $7,000, $4,000, $3,000, $2,000, $32,000 – Depreciation: $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250 – Leased Equipment: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Utilities: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Insurance: $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500 – Rent: $0, $0, $0, $0, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500 – Payroll Taxes: 15%, $0, $300, $300, $300, $300, $300, $300, $450, $450, $450, $450, $450 – Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Total Operating Expenses: $5,750, $8,050, $8,050, $8,050, $49,550, $26,550, $11,550, $12,700, $9,700, $8,700, $7,700, $37,700 – Profit Before Interest and Taxes: ($5,750), ($8,050), ($8,050), ($8,050), ($49,550), ($20,850), $1,750, $4,400, $16,900, $27,400, $43,600, $38,300 – EBITDA: ($5,500), ($7,800), ($7,800), ($7,800), ($49,300), ($20,600), $2,000, $4,650, $17,150, $27,650, $43,850, $38,550 – Interest Expense: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 – Taxes Incurred: ($1,725), ($2,415), ($2,415), ($2,415), ($14,865), ($6,255), $525, $1,320, $5,070, $8,220, $13,080, $11,490 – Net Profit: ($4,025), ($5,635), ($5,635), ($5,635), ($34,685), ($14,595), $1,225, $3,080, $11,830, $19,180, $30,520, $26,810 – Net Profit/Sales: 0.00%, 0.00%, 0.00%, 0.00%, 0.00%, -243.25%, 8.75%, 17.11%, 42.25%, 50.47%, 56.52%, 33.51% Pro Forma Cash Flow: Cash Received: – Cash from Operations: – Cash Sales: – Month 6: $4,200 – Month 7: $9,800 – Month 8: $12,600 – Month 9: $19,600 – Month 10: $26,600 – Month 11: $37,800 – Month 12: $56,000 – Cash from Receivables: – Month 7: $60 – Month 8: $1,880 – Month 9: $4,240 – Month 10: $5,500 – Month 11: $8,500 – Month 12: $11,560 – Subtotal Cash from Operations: – Month 6: $4,200 – Month 7: $9,860 – Month 8: $14,480 – Month 9: $23,840 – Month 10: $32,100 – Month 11: $46,300 – Month 12: $67,560 – Additional Cash Received: – Sales Tax, VAT, HST/GST Received: $0 – New Current Borrowing: $0 – New Other Liabilities (interest-free): $0 – New Long-term Liabilities: $0 – Sales of Other Current Assets: $0 – Sales of Long-term Assets: $0 – New Investment Received: $0 – Subtotal Cash Received: – Month 6: $4,200 – Month 7: $9,860 – Month 8: $14,480 – Month 9: $23,840 – Month 10: $32,100 – Month 11: $46,300 – Month 12: $67,560 Expenditures: – Expenditures from Operations: – Cash Spending: – Month 2: $2,000 – Month 3: $2,000 – Month 4: $2,000 – Month 5: $2,000 – Month 6: $2,000 – Month 7: $2,000 – Month 8: $3,000 – Month 9: $3,000 – Month 10: $3,000 – Month 11: $3,000 – Month 12: $3,000 – Bill Payments: – Month 1: $126 – Month 2: $3,762 – Month 3: $3,385 – Month 4: $3,385 – Month 5: $4,353 – Month 6: $31,989 – Month 7: $18,771 – Month 8: $10,857 – Month 9: $11,823 – Month 10: $13,452 – Month 11: $16,286 – Month 12: $22,119 – Subtotal Spent on Operations: – Month 1: $126 – Month 2: $5,762 – Month 3: $5,385 – Month 4: $5,385 – Month 5: $6,353 – Month 6: $33,989 – Month 7: $20,771 – Month 8: $13,857 – Month 9: $14,823 – Month 10: $16,452 – Month 11: $19,286 – Month 12: $25,119 – Additional Cash Spent: – Sales Tax, VAT, HST/GST Paid Out: $0 – Principal Repayment of Current Borrowing: $0 – Other Liabilities Principal Repayment: $0 – Long-term Liabilities Principal Repayment: $0 – Purchase Other Current Assets: $0 – Purchase Long-term Assets: $0 – Dividends: $0 – Subtotal Cash Spent: – Month 1: $126 – Month 2: $5,762 – Month 3: $5,385 – Month 4: $5,385 – Month 5: $6,353 – Month 6: $33,989 – Month 7: $20,771 – Month 8: $13,857 – Month 9: $14,823 – Month 10: $16,452 – Month 11: $19,286 – Month 12: $25,119 Net Cash Flow: – Month 1: ($126) – Month 2: ($5,762) – Month 3: ($5,385) – Month 4: ($5,385) – Month 5: ($6,353) – Month 6: ($29,789) – Month 7: ($10,911) – Month 8: $624 – Month 9: $9,017 – Month 10: $15,648 – Month 11: $27,014 – Month 12: $42,441 Cash Balance: – Month 1: $83,774 – Month 2: $78,012 – Month 3: $72,627 – Month 4: $67,242 – Month 5: $60,889 – Month 6: $31,100 – Month 7: $20,189 – Month 8: $20,813 – Month 9: $29,830 – Month 10: $45,478 – Month 11: $72,491 – Month 12: $114,933 |

||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!