DocBuzz, Inc. is a medical marketing company specializing in pharmaceutical, biotechnical, and medical device detailing for the benefit of the medical community. DocBuzz, Inc. is the only company of its kind, owned and operated by practicing physicians.

The pharmaceutical market is highly profitable, with annual revenue exceeding $96.3 billion. However, the pharmaceutical industry faces a time constraint for research, development, branding, marketing, sales, and gaining trust from the medical community.

Similarly, the biotech and medical device industries also face similar time constraints and competition within their respective industries.

DocBuzz, Inc. has developed a method that allows these industries to benefit from prelaunch marketing, branding, and postlaunch sales support. We achieve this through the direct intervention of practicing physicians, providing credibility through our network of physicians and medical professionals. Our e-detailing services, including live conferences, access to current information, medical chat rooms, and online marketing, are the most cost-effective in the market.

Pharmaceutical, biotech, and medical device industries can contract with DocBuzz, Inc. for marketing services at 75% of their current budget. In addition, our unique incentive program allows participating physicians and medical practitioners to earn additional revenue.

DocBuzz offers the medical community up-to-date industry information and the option to request samples, additional product information, or a visit from a pharmaceutical representative.

Keys to our success include improving access to pharmaceuticals for prescribing doctors through Internet technology, recruiting and retaining medical professionals through our value incentive referral point program, providing evidence-based analysis for the pharmaceutical industry, and maintaining controlled growth to ensure the quality of our service.

1.2 Mission

DocBuzz, Inc. offers pharmaceutical, biotechnical, and medical device manufacturers a reliable alternative to in-house resources for sales and marketing. We improve the return on sales and marketing investment by accelerating the physician learning curve on prelaunch, new, and existing products. This is achieved through web access to educational detailing and marketing research. Additionally, DocBuzz, Inc. benefits small and innovative biotechnology and pharmaceutical companies without an extensive sales force in North America.

1.3 Objectives

- To establish ourselves as a premier pharmaceutical e-detailing company, targeting medical professionals such as physicians, nurse practitioners, physician assistants, dentists, and podiatrists.

- We will offer value-added services such as CME, current medical information updates, and physician meeting facilities.

- To hire staff to implement our business concept.

- To sign up 5% of the more than 650K prescribing medical professionals by year three and provide 300K pharmaceutical detailing per year by year three.

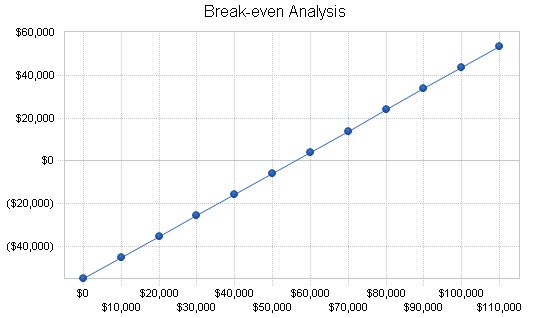

- To reach a break-even point of $35,936 by the end of year two.

Company Summary

DocBuzz, Inc. was founded by experienced physicians as a company providing high-level expertise in e-detailing of pharmaceutical, biotechnical products, and medical equipment to physicians and other medical professionals. It serves to capitalize on the growing number of small and mid-sized companies, as well as established larger companies, to improve awareness and increase the written prescription pattern of pharmaceutical products.

2.1 Company Ownership

DocBuzz, Inc. is a privately held Delaware corporation. The founders and managing partners are Robert E. Rayder, MD, FAAP, and Michael Y. Wu, MD, FAAP.

2.2 Start-up Summary

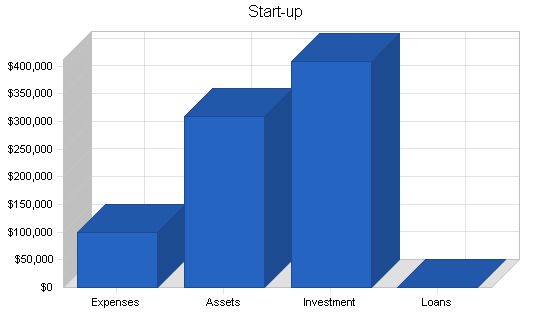

Total start-up expenses, including legal costs, logo design, stationery, and related expenses, amount to $99,000. The table below illustrates a complete breakdown of all start-up assets and requirements. Currently, we have no short-term liabilities.

Start-up Funding

Start-up Expenses to Fund: $99,000

Start-up Assets to Fund: $309,000

Total Funding Required: $408,000

Assets

Non-cash Assets from Start-up: $5,000

Cash Requirements from Start-up: $304,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $304,000

Total Assets: $309,000

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $0

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $0

Capital

Planned Investment

Investor 1: $158,000

Investor 2: $250,000

Additional Investment Requirement: $0

Total Planned Investment: $408,000

Loss at Start-up (Start-up Expenses): ($99,000)

Total Capital: $309,000

Total Capital and Liabilities: $309,000

Total Funding: $408,000

Start-up Requirements

Start-up Expenses

Legal: $3,000

Stationery etc.: $20,000

Brochures: $7,500

Consultants: $20,000

Insurance: $2,500

Rent: $10,000

Research and Development: $5,000

Expensed Equipment: $30,000

Other: $1,000

Total Start-up Expenses: $99,000

Start-up Assets

Cash Required: $304,000

Other Current Assets: $5,000

Long-term Assets: $0

Total Assets: $309,000

Total Requirements: $408,000

2.3 Company Locations and Facilities

DocBuzz, Inc., currently occupies a shared office space at 2476 North University Drive, Pembroke Pines, FL 33024. Prior to implementation, separate facilities with easy access and the ability to have T-1 or T-4 connections will be required to implement our Internet program.

Services

DocBuzz, Inc., offers e-detailing of pharmaceutical products and augmentation of pharmaceutical companies sales forces. According to the IMS Health Report, pharmaceutical detailing is a $50 billion a year industry. Detailing provides information on new pharmaceutical products, face-to-face meetings with medical professionals, and is vital for introducing new products. DocBuzz, Inc., offers e-detailing through the Internet, websites, personal referral networks, conferences, and Web conferences to achieve effective results at a lower cost.

3.1 Service Description

DocBuzz, Inc., provides physician assisted marketing and sales of pharmaceutical products. Our service is vital during the introduction of new products, prelaunch, and increasing present market share. We have the understanding of physicians’ needs and offer 24/7 service through our online literature and sampling requests.

One of the tasks of a pharmaceutical company is to provide educational descriptions of their products to targeted physicians. This is cost effectively achieved through the Internet’s 24/7 access availability and our unique incentive program (VIRP).

3.2 Sales Literature

All literature, product descriptions, and other information will be available for immediate access through our Internet site. Detailed information will be mailed to the medical professional prior to a DocBuzz, Inc., representative conference or visit.

3.3 Competitive Comparison

Competition in the pharmaceutical industry is intense. Timely development of new products and making strategic alliances successful are top issues facing the industry. DocBuzz, Inc., faces competition from other e-detailing companies and traditional sales and marketing representatives.

3.4 Technology

DocBuzz, Inc., has complete e-detailing facilities with the ability to deliver interactive multimedia presentations. We provide live chat and prerecorded video presentations on a private and secured site.

3.5 Future Services

Once we achieve market share in the US, we will expand to South America, Japan, Israel, and Europe.

3.6 Fulfillment

DocBuzz, Inc., provides consulting, sales, and marketing services to the pharmaceutical industry. We charge an upfront fee for our consulting service and generate additional income by selling our clients’ products.

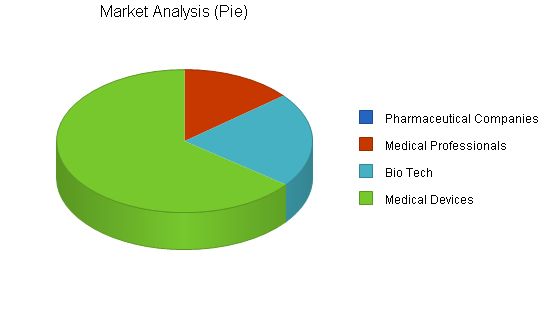

Market Analysis Summary

Currently, the largest market segment is the pharmaceutical industry. DocBuzz, Inc., targets pharmaceutical, biotechnical, and medical device companies. The market has shown sustained annual growth of approximately 11 percent.

4.1 Market Segmentation

DocBuzz, Inc., works with large pharmaceutical companies as well as smaller companies with solid financial bases. We also target medical professionals, the biotech industry, and medical device manufacturers. Our ability to reach the medical decision maker sets us apart from our competitors.

Overall, the original text contains redundant phrases and unnecessary descriptions. By removing redundant words and simplifying the content, the text becomes more concise and impactful while maintaining its original meaning.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Pharmaceutical Companies | 14% | 31 | 35 | 40 | 46 | 52 | 13.80% |

| Medical Professionals | 14% | 650,000 | 741,000 | 844,740 | 963,004 | 1,097,825 | 14.00% |

| Bio Tech | 17% | 1,000,000 | 1,170,000 | 1,368,900 | 1,601,613 | 1,873,887 | 17.00% |

| Medical Devices | 7% | 3,000,000 | 3,210,000 | 3,434,700 | 3,675,129 | 3,932,388 | 7.00% |

| Total | 10.39% | 4,650,031 | 5,121,035 | 5,648,380 | 6,239,792 | 6,904,152 | 10.39% |

4.2 Target Market Segment Strategy

Building a successful Internet e-detailing site is paramount for DocBuzz, Inc. to provide the quantity and quality of service that will ensure the total success of our venture. Each of our target markets uses the access to information that the Internet provides. DocBuzz, Inc. provides the much-needed up-to-date information to medical professionals and provides additional service by assigning a sales and marketing representative to work directly with them.

Each of our target markets has specific unique needs. DocBuzz, Inc. focuses on the common needs shared by these markets. In addition to providing the services that fill our target markets’ needs, we also offer an economic incentive for companies to choose our services.

4.2.1 Market Trends

Cost escalation continues in research and development, and sales and marketing. Each of our target markets shares the same rising cost of developing and marketing a product. DocBuzz, Inc. provides a more cost-effective method of marketing finished products to the market place. E-detailing provides instant access to qualified and interested decision makers within the medical community.

Additionally, DocBuzz, Inc. works with companies to provide market branding, strategic marketing, prelaunch and postlaunch consulting. Our services provide speed and access 24/7, with the ability to download product information immediately. DocBuzz, Inc. representatives will follow up with these professionals and secure sales at about 75% of the current sales and marketing expense.

4.2.2 Market Growth

Pharmaceutical companies enjoy between 10-15 percent annual growth, according to IMS Health marketing surveys. Additionally, the biotech industry has an annual growth rate of approximately 14% and the medical device industry is growing at about 7% per year. With e-detailing, we can further increase growth.

Strategy and Implementation Summary

The initial focus of DocBuzz, Inc. is the United States pharmaceutical market, emphasizing the sale of pharmaceutical products to all targeted professionals. A special DocBuzz, Inc. liaison is assigned to evaluate pharmaceutical companies’ current market position, strength, and weaknesses. Then, DocBuzz, Inc. designs a complimentary e-marketing strategy and a targeted list of medical professional end users. Due to the revenue generated by the pharmaceutical industry, this is the primary targeted industry. The growing biotech and medical devices industries will receive similar service, requiring prelaunch marketing and focusing the medical community’s attention on new products and their benefits prior to official launch.

5.1 Competitive Edge

The pharmaceutical industry is under increasing pressure to improve profitability due to pressure from non-pharmaceutical related entities. For example, Well-Point, a California HMO, recently petitioned the FDA to change three major top revenue generating prescription antihistamines to over-the-counter status. DocBuzz recognizes this development and will assist the pharmaceutical industry to speed up through prelaunch education and marketing to increase profit.

The key to successful e-detailing is an extensive, loyal, and active medical professional network. DocBuzz, Inc. is a physician-owned company, which is vital. As practicing physicians, we understand how to recruit and retain physicians. We have developed recruitment and retention tools, such as our unique VIRP, CME programs, chat rooms, live conferences, and an extensive prize gallery. We better than anyone else understand why a physician has certain prescribing habits and what will encourage them to change those habits.

Building this type of loyal network is a new business concept, and several start-up companies are in various developmental stages to provide similar services. These start-up companies target only the "top tier" pharmaceutical companies. In addition to the "top tier" pharmaceutical companies, DocBuzz, Inc. also targets small- and medium-sized pharmaceutical, biotech, and medical device companies. As a physician-owned company, we have developed a unique retention program (VIRP) that caters to the needs of physicians.

Currently, there is no e-detailing to the thousands of advanced practice registered nurses (ARNPs) and physician assistants (PAs) who prescribe millions of prescriptions yearly. DocBuzz, Inc. intends to market to these significant physician extenders as well. We also plan to expand our service to the thousands of physicians in training (interns, residents, and medical students).

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

5.2 Marketing Strategy

DocBuzz, Inc.’s marketing strategy is the core of the main strategy:

- DocBuzz, Inc. will utilize the principal’s personal contacts within the pharmaceutical, biotech, and medical device industry.

- All brochures and interactive CD presentations will be designed and created by DocBuzz, Inc.

- Personal telephone calls by one of the physicians will follow every mailing of material.

- Live presentations and question and answer sessions will be arranged by DocBuzz, Inc.

5.2.1 Pricing Strategy

DocBuzz, Inc. has developed a pricing strategy that provides a solid profit for our company while offering good value for our client companies.

- The industry average per face-to-face detailing is $200, with poor to moderate effectiveness.

- DocBuzz, Inc. provides e-detailing availability 24/7 for the modest charge of $150 per e-detailing.

- DocBuzz, Inc. offers discounts for high-volume clients (package discounts).

5.2.2 Promotion Strategy

We depend on our extensive network of physicians and other professional contacts within the medical community. As technology and our client industries change, we will adapt our strategies.

Networking and Support:

- DocBuzz, Inc. will use known contacts of the company’s principals as a base to build our network core.

- DocBuzz, Inc. will use the Internet to deliver literature mailing requests and real-time demonstrations.

- Literature mailing, phone sales, automated multimedia Power Point presentations, and personal visits by our principal physicians.

5.3 Sales Strategy

Due to critical internal information that is not for public disclosure, the specific sales strategy has been omitted.

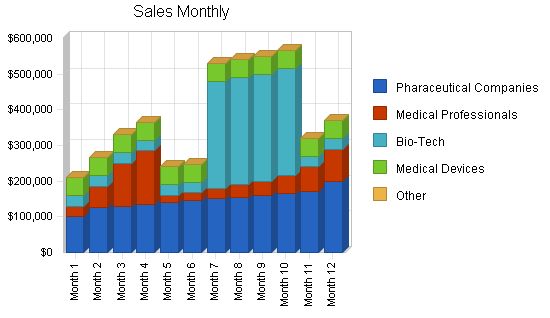

5.3.1 Sales Forecast

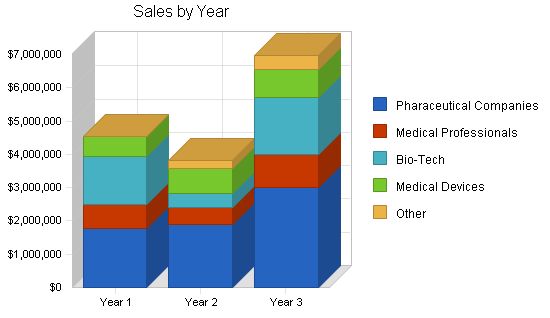

The monthly sales forecast summary is included in the appendix. The annual sales projections are included in the following table.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Pharmaceutical Companies | $1,775,000 | $1,900,000 | $3,000,000 |

| Medical Professionals | $717,000 | $500,000 | $1,000,000 |

| Bio-Tech | $1,440,000 | $430,000 | $1,714,200 |

| Medical Devices | $600,000 | $750,000 | $850,000 |

| Other | $0 | $234,800 | $417,992 |

| Total Sales | $4,532,000 | $3,814,800 | $6,982,192 |

5.4 Strategic Alliances

- Professional groups like the AMA and other specialty organizations.

- IMS Health (to capture individual data and physician prescription patterns).

- PEER GROUP is providing marketing/consulting through non-Internet media.

- Technology alliance (i.e. DELL, IBM, ATT).

- Established Internet product distribution organizations – Amazon.com, Buy.com, various Travel sites.

- Other medical Internet sites for cross-promotion.

5.5 Milestones

The table below indicates milestones critical to our success. Each milestone is replaced as it is reached.

Our business plan is a living document that constantly changes and grows. We review our milestones on a monthly basis and meet with our strategic consultants until they can be replaced with our own employees.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Interview Plan Consultants | 3/4/2001 | 5/1/2001 | $0 | Mike Wu | Admin |

| Write Business Plan | 5/3/2001 | 6/3/2001 | $1,500 | DFN | Consultant |

| Presign Pharma companies | 5/20/2001 | 7/5/2001 | $600 | Mike Wu | Admin |

| Call Center Alliance | 5/1/5393 | 7/5/2001 | $0 | DFN | Consultant |

| Global-Outsource Call Center | 7/5/2001 | 12/30/2001 | $3,000 | Christian Rose | G-O President |

| Other | 5/1/2001 | 12/30/2001 | $0 | Dr. Rayner | Admin |

| Totals | $5,100 | ||||

Management Summary

We recognize the need to fill management gaps on a temporary basis with virtual executives. Our plan is a living document that evolves with our company. We meet monthly to review milestones with strategic consultants until replaced by our own employees.

- Robert E. Rayder, MD, FAAP – Founder and Principal

- Michael Y. Wu, MD, FAAP – Founder and Principal

- CEO (TBA) – An MBA with pharmaceutical and Internet expertise to manage the company

- IT Director (TBA) – Oversees IT development and web development

- CFO (TBA) – In charge of overall finance

- Marketing Director (TBA) – Develops and implements marketing plan

6.1 Management Team Gaps

We acknowledge management team gaps, which will be filled temporarily by a virtual management team that will be compensated for their specific services. This allows us to avoid hiring someone who may not be a good fit for our company just because they are qualified for the position.

6.2 Personnel Plan

The table below details our personnel plan. For virtual management positions, we have listed their office title. Names will be added once we hire individuals for these positions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Dr. Wu | $75,000 | $75,000 | $82,500 |

| Dr. Rayder | $75,000 | $75,000 | $82,500 |

| CEO | $50,004 | $50,004 | $55,000 |

| IT Director | $39,996 | $39,996 | $44,000 |

| Marketing Director | $39,996 | $39,996 | $44,000 |

| Secretary | $22,800 | $23,500 | $25,000 |

| Secretary 2 | $0 | $22,800 | $23,500 |

| Secretary 3 | $0 | $22,800 | $23,500 |

| Bookkeeper | $0 | $0 | $22,800 |

| Secretary 4 | $0 | $0 | $22,800 |

| Secretary 5 | $0 | $0 | $28,000 |

| CFO | $50,004 | $50,004 | $55,000 |

| Total People | 7 | 9 | 12 |

| Total Payroll | $352,800 | $399,100 | $508,600 |

We seek funding of $836,000 to support our growth plan, management style, and vision. This funding has been divided into three phases, but further funding may not be necessary.

Our three-year sales projection, profit and loss statement, cash flow analysis, and balance sheet support our financial plan.

7.1 Important Assumptions

The table below summarizes key financial assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

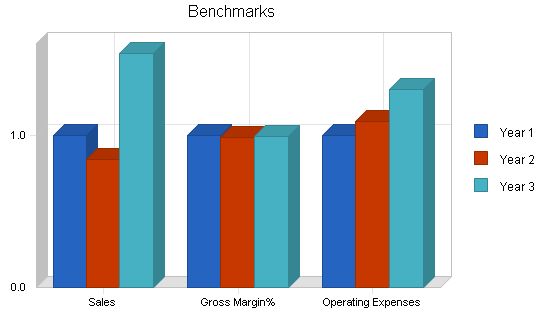

7.2 Key Financial Indicators

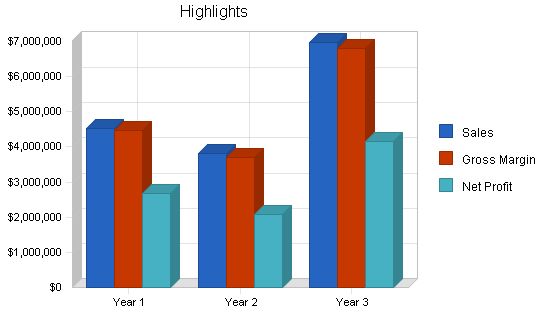

The benchmark chart below indicates our key financial indicators for the first three years. Sales and operating expenses are projected to significantly increase during times of expansion.

The table below summarizes the break-even analysis, calculated based on the company’s "burn rate." This approach provides the investor with a more accurate risk assessment of the venture.

| Break-even Analysis | |

| Monthly Revenue Break-even | $55,836 |

| Assumptions: | |

| Average Percent Variable Cost | 2% |

| Estimated Monthly Fixed Cost | $54,976 |

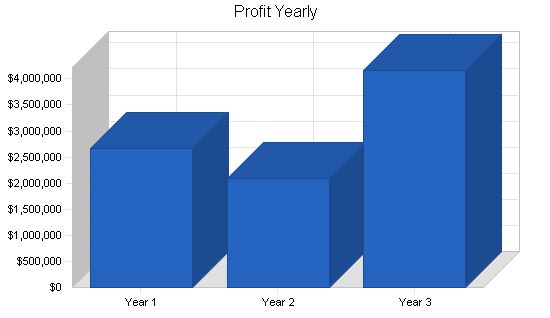

7.4 Projected Profit and Loss

The table and charts below summarize the profit and loss for the first three fiscal years.

Pro Forma Profit and Loss

Year 1 Year 2 Year 3

Sales $4,532,000 $3,814,800 $6,982,192

Direct Cost of Sales $69,765 $112,000 $169,000

Other Production Expenses $0 $0 $0

Total Cost of Sales $69,765 $112,000 $169,000

Gross Margin $4,462,235 $3,702,800 $6,813,192

Gross Margin % 98.46% 97.06% 97.58%

Expenses

Payroll $352,800 $399,100 $508,600

Sales and Marketing and Other Expenses $204,000 $214,000 $224,000

Depreciation $0 $0 $0

Leased Equipment $30,000 $30,000 $30,000

Utilities $0 $0 $0

Insurance $0 $0 $0

Rent $19,992 $20,000 $20,000

Payroll Taxes $52,920 $59,865 $76,290

Other $0 $0 $0

Total Operating Expenses $659,712 $722,965 $858,890

Profit Before Interest and Taxes $3,802,523 $2,979,835 $5,954,302

EBITDA $3,802,523 $2,979,835 $5,954,302

Interest Expense $0 $0 $0

Taxes Incurred $1,140,757 $893,951 $1,786,291

Net Profit $2,661,766 $2,085,885 $4,168,011

Net Profit/Sales 58.73% 54.68% 59.69%

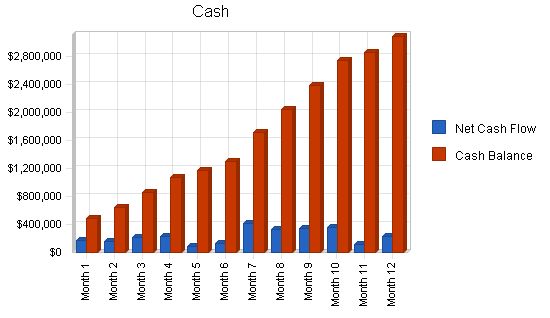

7.5 Projected Cash Flow

Cash flow projections are critical to our success. The monthly cash flow is shown in the illustration, with one bar representing cash flow per month and the other representing the monthly balance. The annual cash flow figures are included in the following table.

Pro Forma Cash Flow:

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $4,532,000 | $3,814,800 | $6,982,192 |

| Subtotal Cash from Operations | $4,532,000 | $3,814,800 | $6,982,192 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $4,532,000 | $3,814,800 | $6,982,192 |

Projected Balance Sheet:

The balance sheet shows healthy growth of net worth and strong financial position. The monthly estimates are included in the appendix.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $3,087,294 | $5,160,951 | $9,409,162 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Total Current Assets | $3,092,294 | $5,165,951 | $9,414,162 |

| Long-term Assets | |||

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $3,092,294 | $5,165,951 | $9,414,162 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $121,528 | $109,300 | $189,500 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $121,528 | $109,300 | $189,500 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $121,528 | $109,300 | $189,500 |

| Paid-in Capital | $408,000 | $408,000 | $408,000 |

| Retained Earnings | ($99,000) | $2,562,766 | $4,648,651 |

| Earnings | $2,661,766 | $2,085,885 | $4,168,011 |

| Total Capital | $2,970,766 | $5,056,651 | $9,224,662 |

| Total Liabilities and Capital | $3,092,294 | $5,165,951 | $9,414,162 |

| Net Worth | $2,970,766 | $5,056,651 | $9,224,662 |

The following table shows the projected business ratios. We expect to maintain healthy ratios for profitability, risk, and return. Industry profile ratios based on the Standard Industrial Classification (SIC) code 8742, Management Consulting Services, are shown for comparison.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | -15.83% | 83.03% | 8.60% |

| Percent of Total Assets | ||||

| Other Current Assets | 0.16% | 0.10% | 0.05% | 46.70% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 74.90% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 25.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3.93% | 2.12% | 2.01% | 42.80% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 17.20% |

| Total Liabilities | 3.93% | 2.12% | 2.01% | 60.00% |

| Net Worth | 96.07% | 97.88% | 97.99% | 40.00% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 98.46% | 97.06% | 97.58% | 0.00% |

| Selling, General & Administrative Expenses | 39.73% | 42.39% | 37.88% | 83.50% |

| Advertising Expenses | 1.32% | 1.83% | 1.15% | 1.20% |

| Profit Before Interest and Taxes | 83.90% | 78.11% | 85.28% | 2.60% |

| Main Ratios | ||||

| Current | 25.45 | 47.26 | 49.68 | 1.59 |

| Quick | 25.45 | 47.26 | 49.68 | 1.26 |

| Total Debt to Total Assets | 3.93% | 2.12% | 2.01% | 60.00% |

| Pre-tax Return on Net Worth | 128.00% | 58.93% | 64.55% | 4.40% |

| Pre-tax Return on Assets | 122.97% | 57.68% | 63.25% | 10.90% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | 58.73% | 54.68% | 59.69% | n.a |

| Return on Equity | 89.60% | 41.25% | 45.18% | n.a |

| Activity Ratios | ||||

| Accounts Payable Turnover | 12.49 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 32 | 24 | n.a |

| Total Asset Turnover | 1.47 | 0.74 | 0.74 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.04 | 0.02 | 0.02 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $2,970,766 | $5,056,651 | $9,224,662 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.68 | 1.35 | 1.35 | n.a |

| Current Debt/Total Assets | 4% | 2% | 2% | n.a |

| Acid Test | 25.45 | 47.26 | 49.68 | n.a |

| Sales/Net Worth | 1.53 | 0.75 | 0.76 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix:

Sales Forecast:

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Pharaceutical Companies | $100,000 | $125,000 | $130,000 | $135,000 | $140,000 | $145,000 | $150,000 | $155,000 | $160,000 | $165,000 | $170,000 | $200,000 | |

| Medical Professionals | $30,000 | $60,000 | $120,000 | ||||||||||

| Dr. Wu | 0% | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 |

| Dr. Rayder | 0% | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 |

| CEO | 0% | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 |

| IT Director | 0% | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 |

| Marketing Director | 0% | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 | $3,333 |

| Secretary | 0% | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 | $1,900 |

| Secretary 2 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Secretary 3 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Bookkeeper | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Secretary 4 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Secretary 5 | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| CFO | 0% | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 | $4,167 |

| Total People | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | 7 | |

| Total Payroll | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 | $29,400 |

General Assumptions:

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $210,000 | $265,000 | $330,000 | $365,000 | $240,000 | $247,000 | $530,000 | $540,000 | $550,000 | $565,000 | $320,000 | $370,000 | |

| Direct Cost of Sales | $2,700 | $2,650 | $3,050 | $3,170 | $3,450 | $3,960 | $17,860 | $5,075 | $5,900 | $6,750 | $7,150 | $8,050 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $2,700 | $2,650 | $3,050 | $3,170 | $3,450 | $3,960 | $17,860 | $5,075 | $5,900 | $6,750 | $7,150 | $8,050 | |

| Gross Margin | $207,300 | $262,350 | $326,950 | $361,830 | $236,550 | $243,040 | $512,140 | $534,925 | $544,100 | $558,250 | $312,850 | $361,950 | |

| Gross Margin % | 98.71% | 99.00% | 99.08% | 99.13% | 98.56% | 98.40% | 96.63% | 99.06% | 98.93% | ||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Sales | $210,000 | $265,000 | $330,000 | $365,000 | $240,000 | $247,000 | $530,000 | $540,000 | $550,000 | $565,000 | $320,000 | $370,000 |

| Subtotal Cash from Operations | $210,000 | $265,000 | $330,000 | $365,000 | $240,000 | $247,000 | $530,000 | $540,000 | $550,000 | $565,000 | $320,000 | $370,000 |

Pro Forma Balance Sheet

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash | $304,000 | $482,134 | $643,212 | $852,715 | $1,077,744 | $1,168,785 | $1,302,805 | $1,714,295 | $2,044,508 | $2,390,353 | $2,747,570 | $2,857,303 | $3,087,294 |

| Total Current Assets | $309,000 | $487,134 | $648,212 | $857,715 | $1,082,744 | $1,173,785 | $1,307,805 | $1,719,295 | $2,049,508 | $2,395,353 | $2,752,570 | $2,862,303 | $3,092,294 |

| Total Liabilities | $0 | $71,507 | $87,424 | $106,544 | $116,775 | $80,715 | $83,090 | $174,566 | $168,815 | $172,273 | $177,198 | $106,419 | $121,528 |

| Total Capital | $309,000 | $415,627 | $560,789 | $751,170 | $965,968 | $1,093,070 | $1,224,715 | $1,544,730 | $1,880,694 | $2,223,081 | $2,575,373 | $2,755,884 | $2,970,766 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!