City Taxi, a San Francisco-based company, aims to provide reliable, timely, and safe cab services through in-car credit and debit card access and computer-aided dispatch. The company plans to acquire Mighty Cab, a family-owned business formed 12 years ago, to establish its presence in the industry.

City Taxi will offer complete taxi cab services using the latest equipment and technology to facilitate travel in and around San Francisco. Our innovative and forward-thinking approach reflects our understanding of the ever-changing customer needs. Our philosophy emphasizes service and effective communication to maintain a leading edge in a competitive environment.

Our drivers and employees are helpful, courteous, and fully trained on our computer dispatch system. For added safety, all our cabs are fitted with Global Positioning Systems (GPS) to track or locate them in emergencies. We prioritize cleanliness, regular inspections, and comfort of our cabs.

Our strategy is to build a reputation and market share, positioning ourselves as a viable alternative to existing taxi cab services in the area. Our goal for the next year is to pursue an aggressive marketing campaign and capture at least 65% of the market share. Ultimately, our long-term goal is to become the top-rated ground transportation company in San Francisco.

We focus on the dispatch, mobile data, and credit/debit card markets of the taxi industry. These markets have the potential for sales exceeding $119 million as of March 1999. We specifically target the lucrative credit card/debit card segment, which has shown a consistent annual growth of 20% in Maryland and Virginia, and 25-35% in New York.

Our competitors include Transportation, Inc., Capital Cab, Yellow Cab, and Diamond Cab. Their weaknesses lie in their lack of credit/debit card payment options and their continued use of the radio dispatch system. In contrast, City Taxi has a competitive advantage with our unique technology in San Francisco. The GPS allows us to provide timely service by estimating accurate arrival times (ETA). The credit/debit card feature offers customers convenience and privacy during transactions.

Reliable communications are vital in this business. Therefore, City Taxi utilizes the KDT 5000 system, known for its multiple levels of reliability. Additionally, we operate a state-of-the-art call center established by Rockwell International.

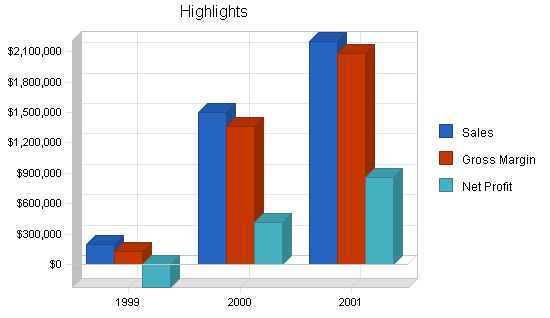

To fund the acquisition of Mighty Cab Association and cover initial operations, we are seeking $2.5 million in financing. This funding will also support marketing efforts, purchase of additional vehicles, and investment in software and hardware. Projected revenues for 1999 to 2001 are $200,000, $1.5 million, and $2.2 million, respectively.

1.1 Objectives:

The company aims to aggressively market and capture at least 65% of the market share in the next year. In the next two to five years, the goal is to become the top-rated ground transportation company in the San Francisco Metro Area by monitoring, evaluating, and following up on customer call-ins.

Key components of City Taxi’s initial strategy include:

– Establishing a relationship with Rockwell International to access their services such as managerial, call center and customer service efficiency, management and technology consulting, product management, and continuous improvement.

1.2 Mission:

City Taxi’s mission is to provide reliable, timely, and safe cab services with complete in-car credit/debit card access and computer-aided dispatch.

1.3 Highlights:

Highlights of City Taxi include:

– Technology: City Taxi utilizes a unique GPS system to locate the nearest driver, providing accurate ETAs.

– Credit/debit card system: The first of its kind in San Francisco, this system offers instant approval with a swipe machine located in the back seat for passenger privacy.

– Trademarks: The name "Patriot" is in the process of being registered as a trademark.

– Advertising: City Taxi is in discussions with TCI Media Services for advertising services and market research.

– Seasoned management: The highly experienced and qualified management team brings extensive industry experience.

– Strategic relationships: City Taxi establishes alliances to enhance professional growth, gain updates on technology, tech support, and establish a strong market presence.

– Exclusive rights to software: City Taxi has exclusive rights to the latest taxi cab software in San Francisco.

Legal Business Description:

City Taxi, founded in 1997 by Mr. Johnson Taylor in San Francisco, California, operates as a California C-Corporation under the name Patriot, Inc. d.b.a. City Taxi.

2.1 Company Strategy:

City Taxi aims to dominate the market by showcasing itself as a premier taxi service through television ads. Leveraging the latest in-car technology, the company aims to dominate the credit card segment, a unique offering in the market. By establishing itself as a viable alternative to existing taxi cab services, City Taxi intends to gain customer confidence and reputation for superior customer service through the use of up-to-date technology.

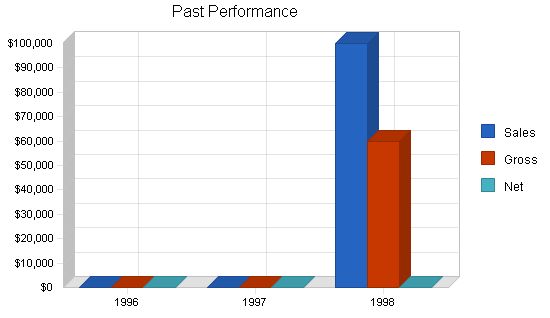

2.2 Company History:

Although the company performed well in its first year, sales have not been fully realized. The purpose of this plan is to increase sales by utilizing competitive advantages and acquiring a rival taxi company.

Past Performance:

Sales:

– 1996: $0

– 1997: $0

– 1998: $100,000

Gross Margin:

– 1996: $0

– 1997: $0

– 1998: $60,000

Gross Margin %:

– 1996: 0.00%

– 1997: 0.00%

– 1998: 60.00%

Operating Expenses:

– 1996: $0

– 1997: $0

– 1998: $20,000

Balance Sheet:

Current Assets:

– Cash:

– 1996: $0

– 1997: $0

– 1998: $45,000

– Other Current Assets:

– 1996: $0

– 1997: $0

– 1998: $13,400

– Total Current Assets:

– 1996: $0

– 1997: $0

– 1998: $58,400

Long-term Assets:

– Long-term Assets:

– 1996: $0

– 1997: $0

– 1998: $75,000

– Accumulated Depreciation:

– 1996: $0

– 1997: $0

– 1998: $10,000

– Total Long-term Assets:

– 1996: $0

– 1997: $0

– 1998: $65,000

Total Assets:

– 1996: $0

– 1997: $0

– 1998: $123,400

Current Liabilities:

Accounts Payable:

– 1996: $0

– 1997: $0

– 1998: $23,600

Current Borrowing:

– 1996: $0

– 1997: $0

– 1998: $10,000

Other Current Liabilities (interest free):

– 1996: $0

– 1997: $0

– 1998: $25,400

Total Current Liabilities:

– 1996: $0

– 1997: $0

– 1998: $59,000

Long-term Liabilities:

– 1996: $0

– 1997: $0

– 1998: $25,000

Total Liabilities:

– 1996: $0

– 1997: $0

– 1998: $84,000

Paid-in Capital:

– 1996: $0

– 1997: $0

– 1998: $37,000

Retained Earnings:

– 1996: $0

– 1997: $0

– 1998: $2,400

Earnings:

– 1996: $0

– 1997: $0

– 1998: $0

Total Capital:

– 1996: $0

– 1997: $0

– 1998: $39,400

Total Capital and Liabilities:

– 1996: $0

– 1997: $0

– 1998: $123,400

Other Inputs:

Payment Days:

– 1996: 0

– 1997: 0

– 1998: 30

2.3 Risks

The company recognizes market and technological risks. The company’s view of its risks and how each is being addressed is as follows:

– Lock out in industry for new cab companies: City Taxi establishes an alliance with Transportation, Inc., the leading cab company in San Francisco, to mitigate this risk. City Taxi also plans to acquire Mighty Cab.

– Acquiring insurance: City Taxi plans to use the relationship with Transportation, Inc. to run under their insurance companies. Alternatively, the company plans to purchase insurance from Newark Insurance and Amalgamated Insurance, which offer lower rates. This will also bring leverage in negotiating with Transportation, Inc.

– Adequate facility: City Taxi has found a facility with ample space for all operations, including repair facilities and vehicle storage.

City Taxi’s products and services offer the following advantages to customers:

– Convenience: City Taxi provides a credit/debit card system for instant approval.

– State-of-the-art Call Center: City Taxi’s call center ensures timely service by picking up the closest vehicle when a call comes in.

Services

City Taxi provides taxi services utilizing computer dispatch and credit/debit card payment options. The software and hardware systems used by City Taxi provide convenience to customers.

3.1 Service Description

Taxi Cab Services:

– Clean and tidy taxis

– Friendly and polite drivers

– Careful driving

– Most practical route taken

Maintenance/Repair Services:

– Pure maintenance of vehicles

– Discounted rates for tune-ups, wheel alignments, and repairs

3.2 Technology

Global Positioning Systems (GPS):

– City Taxi has a unique GPS that pinpoints the nearing driver for accurate estimated time of arrival.

Radio System:

– City Taxi uses the KDT 5000 system design for reliable communications under all circumstances.

Credit/Debit Card System:

– City Taxi uses an in-car credit/debit card system for instant approval, providing convenience and reliability to customers. The company also features a computer-aided dispatch system named Patriot.

3.3 Future Services

City Taxi plans to introduce wheelchair accessible taxi vans with credit card access (taxi plus) within the next 5 years. The company also plans to offer rent to own options for drivers. Introduction of the company’s next generation products and services is expected within 12 months.

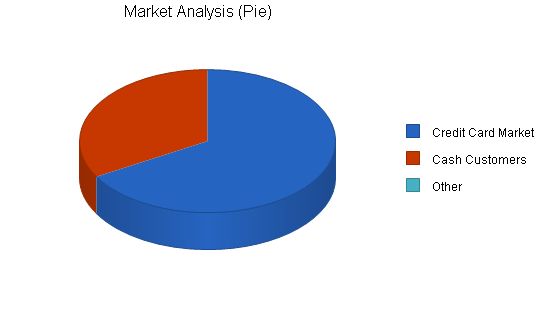

Market Analysis Summary

The company’s emphasis is on the dispatch, mobile data, and credit/debit card markets of the taxi industry, which represent potential sales in excess of $119 million as of March 1999. City Taxi will focus on the credit/debit card segment, which has shown steady growth over the years.

The company believes that the major future trend in the industry will be complete credit card access for consumers. The International Taxi Livery Association (ITLA) forecasts steady growth for the taxi industry in the next four years.

Market Size Statistics:

– Estimated number of U.S. establishments: 6,431

– Number of people employed in this industry: 49,005

– Total annual sales in this industry: $1.34 million

– Average employees per establishment: 12

– Average sales per establishment: $0.3 million

4.1 Market Segmentation

Customers and Target Markets:

– City Taxi’s focus is on the credit card market.

– Target customers are in the low to mid income range in the Metropolitan San Francisco area.

– Target customers choose City Taxi for convenience and quality.

Customer Buying Criteria:

– Performance: Prompt, efficient, comfortable, and safe transportation.

– Superior Service: Timely pick up, private usage, and customer care.

– Quality: Courteous service in clean, well-maintained cars.

– Convenience: Credit/debit card payment option.

Market Analysis

| Market Analysis | |||||||

| 1999 | 2000 | 2001 | 2002 | 2003 | |||

| Potential Customers | Growth | 200,000 | 250,000 | 312,500 | 390,625 | 488,281 | 25.00% |

| Credit Card Market | 25% | 200,000 | 250,000 | 312,500 | 390,625 | 488,281 | 25.00% |

| Cash Customers | 10% | 100,000 | 110,000 | 121,000 | 133,100 | 146,410 | 10.00% |

| Other | 0% | 0 | 0 | 0 | 0 | 0 | 0.00% |

| Total | 20.60% | 300,000 | 360,000 | 433,500 | 523,725 | 634,691 | 20.60% |

4.2 Service Business Analysis

Market 1-Taxi Cabs

This category covers establishments engaged in passenger transportation by automobiles not operated on regular schedules or between fixed terminals. Taxi cab fleet owners and organizations are included, regardless of driver arrangements.

Industry Snapshot

In 1990, U.S. consumers spent an estimated $3.17 billion on taxis. Approximately 32,600 individuals were employed in the industry performing various roles. Since the mid-1970s, independent contracting among drivers became popular, with three out of every four drivers becoming independent contractors licensed through or renting their vehicles from taxi companies. In 1993, the U.S. taxi industry had a total of 205,300 vehicles, including licensed taxis, hired cars, and minibuses or vans for the elderly and disabled.

Organization and Structure

Most taxi companies followed a similar pattern with managers running the business and dispatchers assigning cabs to passenger locations. In the early 1990s, computer-based dispatching became more common, favoring computer skills over specialized knowledge of local geography.

Regulations for the U.S. taxi industry varied by city. San Francisco, for example, regulated fares based on designated zones of the city.

Current Conditions

In 1998, there were 6,342 taxi fleets operating in the United States with a total of 144,000 cars. Most taxi fleets were small, family-owned businesses or individual partnerships, with 5% being corporations. Rural areas had extremely small companies with 1 to 3 cars, while urban centers had hundreds of cars in their cab companies.

Research and Technology

Although the taxi cab industry did not require high technology, innovations such as computerized dispatching and the use of certain radio frequencies improved efficiency. Computerized dispatching allowed for more efficient assignment of cabs to passengers, and the use of radio frequencies opened opportunities for cab-related services in the telecommunications industry.

Industry Leaders

Few national taxi corporations were in operation in the early 1990s due to increasing decentralization. However, some companies owned by larger holding corporations had operations beyond the local level. In the San Francisco area, Transportation Inc. had the largest market share with 38%, followed by Capital Cab with 23%, Yellow Cab with 13%, Diamond Cab with 8%, and others with 18%.

Market 2- Taxi top Display

Taxi top display is a market from which City Taxi can gain substantial revenue. This advertising method has been proven effective by many companies. Figure 2 shows the growth in the taxi top display market segment from 1993.

| 1994 | 1995 | 1996 | 1997 | 03/1998 |

| 600 | 1,670 | 2,000 | 3,500 | 5,000 |

4.2.1 Competition and Buying Patterns

Competitive threats come from existing taxi cab companies in the San Francisco area. Their weaknesses are that they lack credit/debit card payment options and some still use the radio dispatch system. Transportation Inc. has computer-aided dispatch but no credit card processing capabilities. Capital Cab, Yellow Cab, and Diamond Cab all have radio dispatch with selected drivers accepting credit cards, but approval must be given at the home office.

Taxi Cabs

City Taxi’s competitors in the San Francisco area include:

- Transportation Inc., a family-owned company with a fleet of 1,200 cars and other related businesses

- Yellow Cab, founded 25 years ago with a fleet of 2,200 cabs, some equipped with the credit/debit card feature

- Diamond Cab, owned and operated by Mr. Jay Newman, with a fleet of approximately 800 cabs

- Town Cab, an organization run by Mr. Pete Whitehead, with a fleet of 800 cabs

City Taxi’s competitive advantage lies in its cutting-edge technology, including GPS for accurate ETA and credit/debit card payment options.

Maintenance and Repair Services

City Taxi’s competitors include the aforementioned companies as well as general maintenance and repair shops in the area. Some operations lack the capacity to handle a large number of vehicles, while others may have the capacity but use primitive operation methods.

City Taxi’s competitive advantages in maintenance and repair services include availability of space, efficient operations management, and skilled employees.

Strategy and Implementation Summary

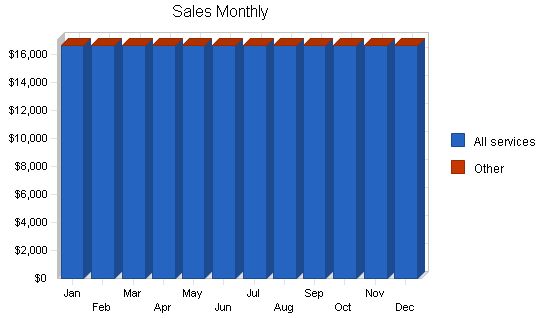

Sales Strategy

City Taxi’s sales process is the same for both taxi cab services and maintenance and repair services. The company aims to establish an online presence through the development of a website for generating sales. Pricing for taxi cab services is regulated by the District of Columbia Cab Commission.

| Sales Forecast | |||

| 1999 | 2000 | 2001 | |

| Sales | |||

| All services | $200,000 | $1,500,000 | $2,200,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $200,000 | $1,500,000 | $2,200,000 |

| Direct Cost of Sales | 1999 | 2000 | 2001 |

| All services | $65,000 | $125,000 | $100,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $65,000 | $125,000 | $100,000 |

5.1 Marketing Strategy

City Taxi markets its products and services as transportation solutions in San Francisco and other target markets. Direct mailings and television advertising will be the company’s main channels. These channels ensure that target customers are reached effectively. The company will continuously monitor its market position through tracking by Value Pack and TCI Media, Inc.

TCI Media Services – The proposed advertising package, titled "The Championship," will include:

- One commercial in every regular season NBA game on TNT for the 1999-2000 season

- One commercial in 2000; 1999-2000 regular season Wizard games on HTS

- 900 6 a.m. – 12 a.m. commercials on a minimum of 4 networks

- Ads on the TV guide channel

To develop effective business strategies, perform a SWOT analysis of your business. Our free guide and template can help you easily perform a SWOT analysis.

5.1.1 Marketing Programs

City Taxi plans to communicate through direct mail and television advertising to generate sales. TCI Media Services and Val-Pak Direct Marketing will spearhead the marketing campaign. The key message associated with our products and services is cleaner, efficient, flexible, and convenient taxi cabs.

Additional Plans – The company also has diverse and comprehensive promotional plans, including:

- Trade shows: company representatives will attend and participate in trade shows to keep up with industry changes

- Print advertising and article publishing: the company’s print advertising program will include advertisements in local newspapers and publications like the San Francisco Magazine. City Taxi will feature articles on services provided in these publications

- Val-Pak Direct Marketing: Val-Pak, a leader in local, cooperative direct mail advertising, will help tailor messages to targeted market segments. Val-Pak offers a variety of advertising formats for effective direct mail programs

5.2 Strategic Alliances

The company has valuable strategic alliances with King Communications, Surfside Systems, and Commercial Electronic Services. These alliances provide City Taxi with technology updates, added tech support, and advantages in the market. Details of these strategic relationships are given below.

- International Taxi Cab and Livery Association (ITLA): ITLA is a non-profit association representing the private, for-profit ground transportation industry. City Taxi will use ITLA resources to stay updated on industry trends and trade shows

- Rockwell International: Rockwell International will assist in the development of the call center and provide support in customer service techniques

- TCI Media, Inc: City Taxi has a verbal agreement with TCI Media, Inc. to market its products and services through various cable networks

- Surfside Systems: Surfside Systems will supply dispatch software and CAD software to City Taxi

- King Communications: King Communications will supply mobile data and in-car credit/debit card processing equipment hardware to City Taxi. King Communications guarantees an interface to Surfside Systems

- Transportation, Inc: This alliance provides City Taxi with insights from Jerry Schafer (Transportation, Inc.) to learn from their 20-year experience in the business and overcome the shortfalls they have experienced

- Barwood, Inc: Barwood will be the source of used taxis when there is a need to expand the fleet

- Val-Pak Direct Marketing: This relationship gives us access to a variety of advertising formats for our direct mail program

- Commercial Electronics Services (CES): CES supplies advanced technology systems used in taxi cabs. This relationship allows City Taxi to get the latest technology and excellent tech support

- Mighty Cab Body Shop: Mighty Cab owns a body shop, and City Taxi seeks to establish a relationship for body work and towing services

Management Summary

Organization

City Taxi has a management philosophy based on responsibility and mutual respect. The company’s environment and structure encourage productivity and respect for customers and employees.

The City Taxi team is organized into two groups:

- Taxi Cabs: This division consists of the fleet of taxis, the call center, and administration. Daily operations are handled in this division. Mr. Taylor, the CEO, is responsible for vehicle purchases and vendor/supplier dealings. The call center consists of 10 to 20 employees, including three supervisors, three dispatchers, an office manager, a data entry clerk, and an employee responsible for accounts receivables/payables.

- Maintenance and Repair Services: This division handles the maintenance of vehicles. Drivers receive discounted rates for tune-ups, wheel alignments, and repairs. This division will begin with seven employees.

Officers and Key Employees

City Taxi’s management team is highly experienced and qualified. Key members of City Taxi’s management team, their backgrounds, and responsibilities are:

- Mr. Johnson Taylor, President and CEO

- Mr. Peter Jackson, Senior Vice President – Operations

- Ms. Glenda Jones, Call Center Supervisor

| Personnel Plan | |||

| 1999 | 2000 | 2001 | |

| Taxi Cabs & Administrative | $108,696 | $365,217 | $395,652 |

| Maintenance & Repair | $108,695 | $156,522 | $169,565 |

| Total People | 8 | 17 | 20 |

| Total Payroll | $217,391 | $521,739 | $565,217 |

Financial Plan

The company is seeking $2.5 million of financing to fund the acquisition of Mighty Cab Association and its initial operations. This funding will cover the purchase of Mighty Cab, marketing, purchase of extra vehicles, software, and hardware.

7.1 Important Assumptions

The table below shows the key assumptions for City Taxi.

| General Assumptions | |||

| 1999 | 2000 | 2001 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

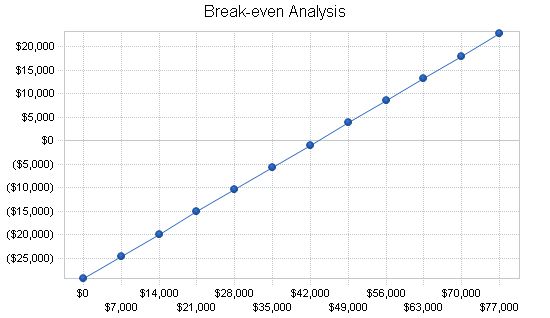

7.2 Break-even Analysis

City Taxi’s Break-even Analysis indicates that the firm has a strong balance of costs and sales. The company estimates a monthly break-even sales volume of approximately $43,000, which will be reached by Fiscal Year (FY) 2000.

Break-even Analysis

Monthly Revenue Break-even: $43,333

Assumptions:

– Average Percent Variable Cost: 32%

– Estimated Monthly Fixed Cost: $29,250

7.3 Projected Profit and Loss

City Taxi is in the early stage of development, so initial projections are based only on accounts that drive the income statement.

Pro Forma Profit and Loss

1999 2000 2001

Sales $200,000 $1,500,000 $2,200,000

Direct Cost of Sales $65,000 $125,000 $100,000

Other $5,000 $10,000 $15,000

Total Cost of Sales $70,000 $135,000 $115,000

Gross Margin $130,000 $1,365,000 $2,085,000

Gross Margin % 65.00% 91.00% 94.77%

Expenses:

Payroll $217,391 $521,739 $565,217

Sales and Marketing and Other Expenses $64,000 $164,000 $214,000

Depreciation $14,997 $17,500 $17,500

Research & Development $15,000 $25,000 $40,000

Utilities $2,000 $2,000 $2,000

Insurance $5,000 $5,000 $5,000

Payroll Taxes $32,609 $78,261 $84,783

Other $0 $0 $0

Total Operating Expenses $350,997 $813,500 $928,500

Profit Before Interest and Taxes ($220,997) $551,500 $1,156,500

EBITDA ($206,000) $569,000 $1,174,000

Interest Expense $3,337 $2,841 $2,084

Taxes Incurred $0 $137,165 $293,414

Net Profit ($224,334) $411,494 $861,002

Net Profit/Sales -112.17% 27.43% 39.14%

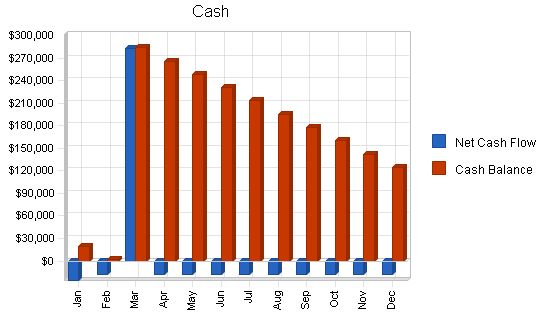

7.4 Projected Cash Flow

The table below shows the company’s cash flows for FY 1999-2001. The company will spend $2.5 million to acquire Mighty Cab’s operations ($1.25 million), purchase additional property ($250,000), and buy equipment ($200,000). An additional $500,000 will be spent on other short-term assets.

| Pro Forma Cash Flow | |||

| 1999 | 2000 | 2001 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $200,000 | $1,500,000 | $2,200,000 |

| Subtotal Cash from Operations | $200,000 | $1,500,000 | $2,200,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $2,500,000 | $0 | $0 |

| Subtotal Cash Received | $2,700,000 | $1,500,000 | $2,200,000 |

| Expenditures | 1999 | 2000 | 2001 |

| Expenditures from Operations | |||

| Cash Spending | $217,391 | $521,739 | $565,217 |

| Bill Payments | $200,095 | $519,573 | $739,266 |

| Subtotal Spent on Operations | $417,486 | $1,041,312 | $1,304,483 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $3,000 | $3,000 | $3,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $4,181 | $4,951 |

| Purchase Other Current Assets | $500,000 | $0 | $0 |

| Purchase Long-term Assets | $1,700,000 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,620,486 | $1,048,493 | $1,312,434 |

| Net Cash Flow | $79,514 | $451,507 | $887,566 |

| Cash Balance | $124,514 | $576,021 | $1,463,587 |

7.5 Projected Balance Sheet

The table below provides City Taxi’s actual and projected balance sheets for 1999-2001.

| Pro Forma Balance Sheet | |||

| 1999 | 2000 | 2001 | |

| Assets | |||

| Current Assets | |||

| Cash | $124,514 | $576,021 | $1,463,587 |

| Other Current Assets | $513,400 | $513,400 | $513,400 |

| Total Current Assets | $637,914 | $1,089,421 | $1,976,987 |

| Long-term Assets | |||

| Long-term Assets | $1,775,000 | $1,775,000 | $1,775,000 |

| Accumulated Depreciation | $24,997 | $42,497 | $59,997 |

| Total Long-term Assets | $1,750,003 | $1,732,503 | $1,715,003 |

| Total Assets | $2,387,917 | $2,821,924 | $3,691,990 |

| Liabilities and Capital | 1999 | 2000 | 2001 |

| Current Liabilities | |||

| Accounts Payable | $15,451 | $45,145 | $62,160 |

| Current Borrowing | $7,000 | $4,000 | $1,000 |

| Other Current Liabilities | $25,400 | $25,400 | $25,400 |

| Subtotal Current Liabilities | $47,851 | $74,545 | $88,560 |

| Long-term Liabilities | $25,000 | $20,819 | $15,868 |

| Total Liabilities | $72,851 | $95,364 | $104,428 |

| Paid-in Capital | $2,537,000 | $2,537,000 | $2,537,000 |

| Retained Earnings | $2,400 | ($221,934) | $189,560 |

| Earnings | ($224,334) | $411,494 | $861,002 |

| Total Capital | $2,315,066 | $2,726,560 | $3,587,562 |

| Total Liabilities and Capital | $2,387,917 | $2,821,924 | $3,691,990 |

| Net Worth | $2,315,066 | $2,726,560 | $3,587,562 |

7.6 Business Ratios

The following table contains important business ratios from the taxi cab industry, as determined by the Standard Industry Classification (SIC) Index #4121, Taxi Cabs.

| Ratio Analysis | ||||

| 1999 | 2000 | 2001 | Industry Profile | |

| Sales Growth | 100.00% | 650.00% | 46.67% | 0.50% |

| Percent of Total Assets | ||||

| Other Current Assets | 21.50% | 18.19% | 13.91% | 45.90% |

| Total Current Assets | 26.71% | 38.61% | 53.55% | 63.00% |

| Long-term Assets | 73.29% | 61.39% | 46.45% | 37.00% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 2.00% | 2.64% | 2.40% | 29.10% |

| Long-term Liabilities | 1.05% | 0.74% | 0.43% | 27.00% |

| Total Liabilities | 3.05% | 3.38% | 2.83% | 56.10% |

| Net Worth | 96.95% | 96.62% | 97.17% | 43.90% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 65.00% | 91.00% | 94.77% | 82.50% |

| Selling, General & Administrative Expenses | 177.25% | 63.59% | 55.44% | 58.00% |

| Advertising Expenses | 25.00% | 10.00% | 9.09% | 1.00% |

| Profit Before Interest and Taxes | -110.50% | 36.77% | 52.57% | 2.60% |

| Main Ratios | ||||

| Current | 13.33 | 14.61 | 22.32 | 1.58 |

| Quick | 13.33 | 14.61 | 22.32 | 1

Pro Forma Profit and Loss |

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | |

| Direct Cost of Sales | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | |

| Other | $417 | $417 | $417 | $417 | $417 | $417 | $417 | $417 | $417 | $417 | $417 | $417 | |

| Total Cost of Sales | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | $5,833 | |

| Gross Margin | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | $10,833 | |

| Gross Margin % | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | 65.00% | |

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash Sales | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | |

| Subtotal Cash from Operations | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | $16,667 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $18,115 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | $18,116 | |

| Bill Payments | $24,134 | $16,007 | $16,005 | $16,003 | $16,001 | $15,999 | $15,996 | $15,994 | $15,992 | $15,990 | $15,988 | $15,986 | |

| Subtotal Spent on Operations | $42,249 | $34,123 | $34,121 | $34,119 | $34,117 | $34,115 | $34,112 | $34,110 | $34,108 | $34,106 | $34,104 | $34,102 | |

| Net Cash Flow | ($25,832) | ($17,706) | $282,296 | ($17,702) | ($17,700) | ($17,698) | ($17,696) | ($17,694) | ($17,692) | ($17,690) | ($17,687) | ($17,685) | |

| Cash Balance | $19,168 | $1,462 | $283,758 | $266,056 | $248,356 | $230,658 | $212,962 | $195,268 | $177,577 | $159,887 | $142,200 | $124,514 | |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!