Cigar World is a company that offers high-quality cigars at an affordable price. Our flagship product will be launched at the Retailers Tobacco Dealers of America (RTDA) in Las Vegas and will come in three forms: premium bundle, short filler, and boxed premium cigars. Based in Raleigh, our mission is to revolutionize the industry by producing affordable, top-notch products.

Like any company, Cigar World acknowledges its risks. We are researching industry trends and customer needs to address them effectively. Our goal is to provide exceptional service and products that keep customers coming back.

Our target market consists of high-end customers, mainly professionals with medium to high income, aged 25 to 65. We will primarily focus on wholesalers, retailers, and catalog companies.

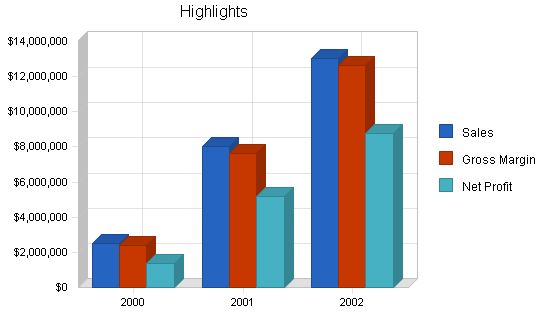

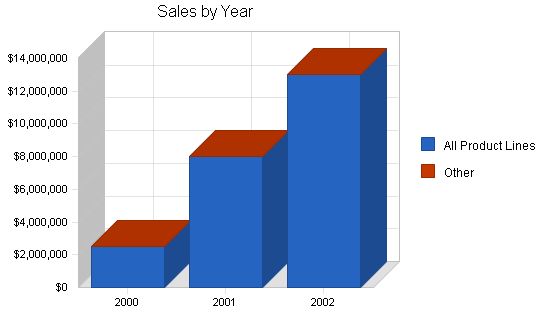

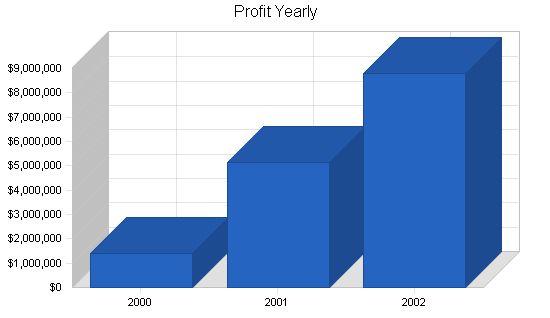

With adequate funding, we believe that the company can capture 5-10% of the bundle premium market in the United States and Canada, as well as up to 5% of the world premium boxed market within 18 to 24 months. These market shares would generate revenues of $2,500,000 in Year 1, rising to $8,000,000 and $13,050,000 in Year 2 and Year 3, respectively.

Cigar World’s mission is to revolutionize the industry by producing high-quality, affordable products. Our keys to success include offering unparalleled customer service, state-of-the-art quality control, quick turnaround time, and flexible production. Additionally, we take pride in our ‘Fine Cigar’ premium cigar’s superior presentation. As a member of reputable associations, such as the American Wholesaler Marketers Association and the Raleigh Chamber of Commerce, and being listed with Dunn and Bradstreet, we have established ourselves in the market.

In summary, our goal is to establish Cigar World as the industry leader in customer service. Our exceptional customer service, coupled with our superior quality control and production flexibility, enables us to compete with other companies. We excel in quick turnaround time and flexibility to accommodate customers of any size.

We have implemented a robust business-to-business telemarketing effort that has successfully generated new business for us. Despite being a large industry, very few companies are as aggressive as us in capturing new business opportunities. Our management team will attend the Retailers Tobacco Dealers of America (RTDA) trade convention to officially launch our products. Additionally, we have acquired a vehicle for our sales representatives, allowing us to better serve customers in North Carolina.

We have obtained all the necessary permits at the federal, state, and county levels. Currently, there are no regulations regarding the production, import, and commercialization of cigars. Although not mandatory, we will include health-warning labels on our products to protect against potential lawsuits.

Cigar World is a North Carolina corporation, owned equally by Michael Jones (President), Nathan Smith (Vice President), and John Thompson (Production Manager).

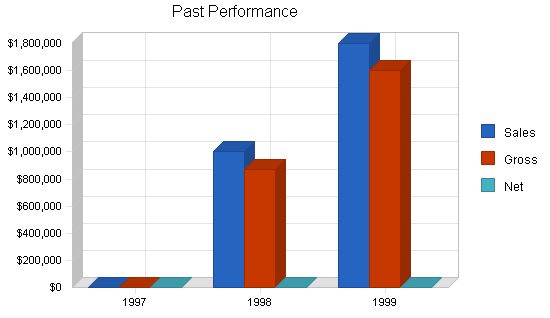

Please refer to the table and chart below for a summary of Cigar World’s performance over the past two fiscal years.

Cigar World has filed a design patent for our main product, ‘Fine Cigar.’ Our packaging conveys refinement and excellence, setting us apart from the competition. The Fine Cigar offers high-quality at an affordable price and will be launched at the Retailers Tobacco Dealers of America (RTDA) in Las Vegas, July 1999.

The history of our ‘Fine Cigar’ project dates back to 1995. After extensive research and development, we created a high-powered presentation to introduce our product to the world. We also plan to launch a limited edition of another wrapper called the exquisite collection.

Our main product has been developed, and we have filed for a patent for our box, designed the cigar band, and filed for a trademark. Our product will compete with well-known brands such as Fuentes, Monte Cristo, Romeo, and Julianta. To protect against copycats, we are filing a design patent.

All of our products, except for machine-made cigars, are handmade in Jamaica. We plan to relocate near the main airport to reduce ground transportation costs.

Our research and development team is working on a new line of products. We have invested over $100,000 in the ‘Fine Cigar’ project and plan to spend an additional $250,000 in the next 24 months.

The company is competing in the cigar segment of the alcohol and tobacco industry. In the United States, alcoholic beverages and tobacco products generated approximately $148.3 billion in retail sales in 1997. Cigars accounted for 6% of these sales, with consumption increasing in recent years.

Cigars experienced the fastest unit growth in recent years, driven by increased luxury goods consumption. U.S. consumption of cigars rose 14% in 1997 and continued to rise in subsequent years. Our goal is to achieve a 5-10% market share in each subsegment of the premium cigar market within 24 months.

Our target market for premium cigars consists of males aged 25-65, mainly professionals with medium to high incomes. This segment has a large disposable income and is value-conscious.

Our customers include wholesalers, retailers, and catalog companies.

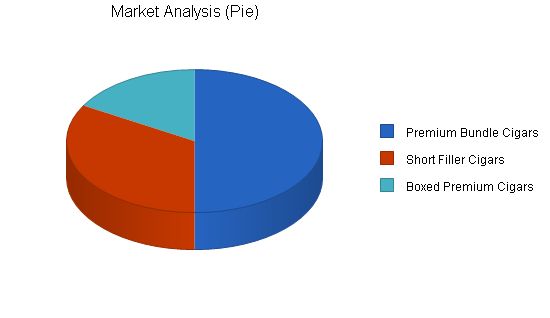

| Market Analysis | |||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | |||

| Potential Customers | Growth | CAGR | |||||

| Premium Bundle Cigars | 6% | 150,000 | 159,000 | 168,540 | 178,652 | 189,371 | 6.00% |

| Short Filler Cigars | 6% | 100,000 | 106,000 | 112,360 | 119,102 | 126,248 | 6.00% |

| Boxed Premium Cigars | 6% | 50,000 | 53,000 | 56,180 | 59,551 | 63,124 | 6.00% |

| Total | 6.00% | 300,000 | 318,000 | 337,080 | 357,305 | 378,743 | 6.00% |

Contents

4.2 Competition and Buying Patterns

We have developed a masterpiece in terms of quality, presentation, and price, but we face strong competition. To succeed, we need to aggressively market this cigar.

Our staff has interviewed prospective customers in all 50 states for feedback. We found that the market is ready for a new, unique cigar brand. The price was determined based on customer willingness to pay for a new product.

4.3 Main Competitors

The major competitors in the market are:

– Fuentes: The Fuentes family has been making world-class cigars for three generations. Their widespread popularity and great value make them difficult to obtain, but well worth the effort. The Fuentes family’s tobacco roots date back to old-world Cuba in the 1800s. The Arturo Fuentes brand is the most sought-after premium cigar in America.

4.4 Risks

The company recognizes that it is subject to market and industry risks. The biggest risk is the United States government’s pressure on tobacco products. However, current federal regulations are lenient with cigars.

Strategy and Implementation Summary

Our sales and marketing strategies are discussed in the following topics.

5.1 Value Proposition

Cigar World offers the following value proposition for customers:

- Presentation: The ‘Fine Cigar’ premium cigar has the best presentation in the industry.

- Extremely competitive prices: We offer very affordable prices.

- Quality: The ‘Fine Cigar’ has the same quality as major brands.

- Customer service: Customers can count on our timely delivery and easily reach us when needed.

To develop good business strategies, perform a SWOT analysis of your business. It’s easy with our free guide and template. Learn how to perform a SWOT analysis

5.2 Distribution Strategy

Our customers are satisfied with our customer service quality. We currently offer a toll-free line for customer service. Due to the nature of our product, we only offer a full return on box damage due to shipping. We do not offer a money-back guarantee on the cigars themselves. Customers can return the merchandise before accepting it. Customers can reach us by email, fax, or our 800 number.

5.3 Marketing Strategy

In marketing our products and services, we will rely on a combination of the following channels:

- Trade shows: This is a highly effective medium that allows us to showcase our products, make contact with industry leaders, and stay informed about changes and advancements.

The message associated with our products is high quality at affordable prices. We will gather feedback from customers through direct mail and telephone solicitations. Our promotional plan is diverse and will include a range of marketing communications. Future plans include company-owned stores nationwide and in Europe, as well as a magazine ad campaign.

The table below summarizes our sales forecast for fiscal years 2000-2002.

5.4 Sales Forecast

Cigar World forecasts modest but steady sales growth in the first year of this plan. As new releases are added to the product offerings, marketing increases our exposure in target segments, and the culture of smoking cigars gains greater acceptance, we anticipate skyrocketing sales in years two and three.

Sales Forecast

Sales

All Product Lines

$2,500,000

$8,000,000

$13,050,000

Other

$0

$0

$0

Total Sales

$2,500,000

$8,000,000

$13,050,000

Direct Cost of Sales

All Product Lines

$100,000

$370,000

$400,000

Other

$0

$0

$0

Subtotal Direct Cost of Sales

$100,000

$370,000

$400,000

5.5 Strategic Alliances

We are negotiating a merger with Cigar Maker in Jamaica, which will enable us to produce one million cigars a month, with potential for doubling capacity. The merger will also allow us to relocate to a larger facility near the main airport in Jamaica to expediate order dispatching and develop the facility as a tourist attraction.

Management Summary

At Cigar World, our management philosophy is based on responsibility, hard work, and a desire to succeed. Our key officers and their backgrounds are:

– Michael Jones, president

– Nathan Smith, vice president

– John Thompson, production manager

Confidential and Proprietary resume information has been omitted from this sample plan.

Personnel Plan

President

$36,000

$43,200

$47,500

Vice president

$36,000

$43,200

$47,500

Production manager

$36,000

$43,200

$47,500

Workers

$132,000

$271,500

$323,500

Other

$0

$0

$0

Total People

10

15

16

Total Payroll

$240,000

$401,100

$466,000

Based on our projections, we are requesting a loan of $150,000 to cover manufacturing, production, marketing, and initial operating expenses. We plan to go public within the next 12 to 18 months, which will provide additional funds to repay the loan. An exit for this loan can be provided immediately after going public through a recapitalization of funds.

7.1 Business Ratios

The following table contains important ratios from the Tobacco and Tobacco Products industry (SIC 5194), as determined by the Standard Industry Classification (SIC) Index.

Ratio Analysis

Sales Growth

38.89%

220.00%

63.13%

Industry Profile

8.50%

Percent of Total Assets

Accounts Receivable

22.85%

18.42%

13.18%

29.90%

Inventory

0.68%

0.64%

0.30%

27.70%

Other Current Assets

2.01%

0.51%

0.22%

24.50%

Total Current Assets

95.75%

97.63%

98.26%

82.10%

Long-term Assets

4.25%

2.37%

1.74%

17.90%

Total Assets

100.00%

100.00%

100.00%

100.00%

Current Liabilities

13.71%

3.97%

2.39%

46.30%

Long-term Liabilities

4.92%

0.98%

0.30%

10.90%

Total Liabilities

18.64%

4.95%

2.70%

57.20%

Net Worth

81.36%

95.05%

97.30%

42.80%

Percent of Sales

Sales

100.00%

100.00%

100.00%

100.00%

Gross Margin

95.80%

95.25%

96.86%

22.90%

Selling, General & Administrative Expenses

40.46%

30.77%

28.99%

16.20%

Advertising Expenses

2.00%

1.25%

0.77%

0.70%

Profit Before Interest and Taxes

75.16%

86.19%

90.28%

1.30%

Main Ratios

Current

6.98

24.61

41.08

1.72

Quick

6.93

24.45

40.96

0.95

Total Debt to Total Assets

18.64%

4.95%

2.70%

57.20%

Pre-tax Return on Net Worth

130.79%

104.58%

76.65%

3.30%

Pre-tax Return on Assets

106.41%

99.40%

74.59%

7.70%

Additional Ratios

Net Profit Margin

55.53%

64.47%

67.26%

n.a

Return on Equity

97.88%

78.43%

57.17%

n.a

Activity Ratios

Accounts Receivable Turnover

4.71

4.71

4.71

n.a

Collection Days

57

51

63

n.a

Inventory Turnover

10.91

13.25

8.75

n.a

Accounts Payable Turnover

9.80

12.17

12.17

n.a

Payment Days

28

22

25

n.a

Total Asset Turnover

1.43

1.16

0.83

n.a

Debt Ratios

Debt to Net Worth

0.23

0.05

0.03

n.a

Current Liab. to Liab.

0.74

0.80

0.89

n.a

Liquidity Ratios

Net Working Capital

$1,429,924

$6,479,464

$15,127,078

n.a

Interest Coverage

77.36

367.18

931.63

n.a

Additional Ratios

Assets to Sales

0.70

0.86

1.21

n.a

Current Debt/Total Assets

14%

4%

2%

n.a

Acid Test

5.27

19.81

35.45

n.a

Sales/Net Worth

1.76

1.22

0.85

n.a

Dividend Payout

0.00

0.00

0.00

n.a

7.2 Important Assumptions

The following table shows the assumptions important to the success of Cigar World.

General Assumptions

1

2

3

Current Interest Rate

10.00%

10.00%

10.00%

Long-term Interest Rate

10.00%

10.00%

10.00%

Tax Rate

25.42%

25.00%

25.42%

Other

0

0

0

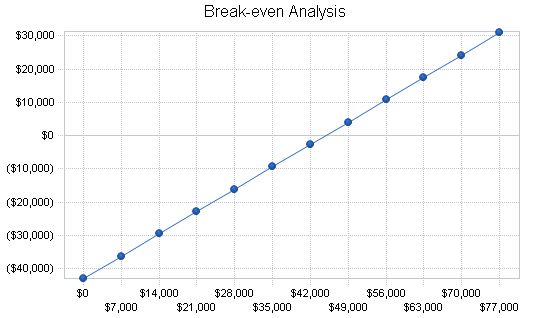

7.3 Break-even Analysis

Cigar World’s margins provide enough resources to break-even.

Break-even Analysis:

Monthly Revenue Break-even: $44,792

Assumptions:

– Average Percent Variable Cost: 4%

– Estimated Monthly Fixed Cost: $43,000

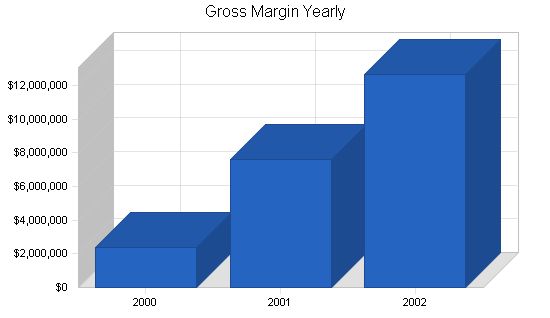

7.4 Projected Profit and Loss:

The table displays our projected income statement.

Pro Forma Profit and Loss

Year 2000 2001 2002

Sales $2,500,000 $8,000,000 $13,050,000

Direct Cost of Sales $100,000 $370,000 $400,000

Other $5,000 $10,000 $10,000

Total Cost of Sales $105,000 $380,000 $410,000

Gross Margin $2,395,000 $7,620,000 $12,640,000

Gross Margin % 95.80% 95.25% 96.86%

Expenses

Payroll $240,000 $401,100 $466,000

Sales and Marketing and Other Expenses $218,000 $230,000 $295,000

Depreciation $6,000 $10,000 $10,000

Utilities $2,000 $3,500 $4,000

Insurance $10,000 $15,000 $15,000

Rent $2,500 $5,000 $5,000

Payroll Taxes $37,500 $60,000 $63,750

Other $0 $0 $0

Total Operating Expenses $516,000 $724,600 $858,750

Profit Before Interest and Taxes $1,879,000 $6,895,400 $11,781,250

EBITDA $1,885,000 $6,905,400 $11,791,250

Interest Expense $24,290 $18,780 $12,646

Taxes Incurred $466,585 $1,719,155 $2,991,187

Net Profit $1,388,125 $5,157,465 $8,777,417

Net Profit/Sales 55.53% 64.47% 67.26%

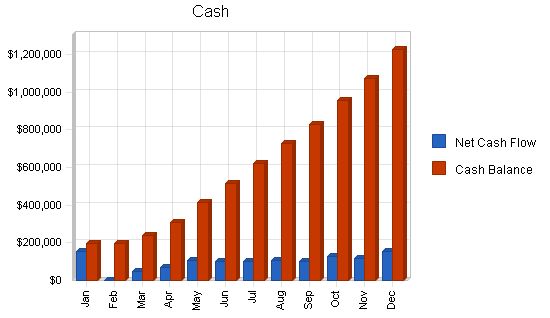

7.5 Projected Cash Flow

The company’s cash reserves are sufficient for everyday operations and investments.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 2000 | 2001 | 2002 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $625,000 | $2,000,000 | $3,262,500 |

| Cash from Receivables | $1,526,750 | $5,123,850 | $8,983,035 |

| Subtotal Cash from Operations | $2,151,750 | $7,123,850 | $12,245,535 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $150,000 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $2,301,750 | $7,123,850 | $12,245,535 |

| Expenditures | 2000 | 2001 | 2002 |

| Expenditures from Operations | |||

| Cash Spending | $240,000 | $401,100 | $466,000 |

| Bill Payments | $803,720 | $2,350,065 | $3,690,286 |

| Subtotal Spent on Operations | $1,043,720 | $2,751,165 | $4,156,286 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $78,081 | $6,864 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $14,201 | $17,926 | $19,803 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $60,000 | $100,000 | $120,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $1,117,921 | $2,947,172 | $4,302,953 |

| Net Cash Flow | $1,183,829 | $4,176,678 | $7,942,582 |

| Cash Balance | $1,223,829 | $5,400,507 | $13,343,089 |

7.6 Projected Balance Sheet

The company’s projected balance sheets for fiscal year 2000-2002 are provided below.

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||

| 2000 | 2001 | 2002 | |

| Assets | |||

| Current Assets | |||

| Cash | $1,223,829 | $5,400,507 | $13,343,089 |

| Accounts Receivable | $398,250 | $1,274,400 | $2,078,865 |

| Inventory | $11,880 | $43,956 | $47,520 |

| Other Current Assets | $35,000 | $35,000 | $35,000 |

| Total Current Assets | $1,668,959 | $6,753,863 | $15,504,474 |

| Long-term Assets | |||

| Long-term Assets | $85,000 | $185,000 | $305,000 |

| Accumulated Depreciation | $11,000 | $21,000 | $31,000 |

| Total Long-term Assets | $74,000 | $164,000 | $274,000 |

| Total Assets | $1,742,959 | $6,917,863 | $15,778,474 |

| Liabilities and Capital | 2000 | 2001 | 2002 |

| Current Liabilities | |||

| Accounts Payable | $89,035 | $202,480 | $312,341 |

| Current Borrowing | $150,000 | $71,919 | $65,055 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $239,035 | $274,399 | $377,396 |

| Long-term Liabilities | $85,799 | $67,873 | $48,070 |

| Total Liabilities | $324,834 | $342,272 | $425,466 |

| Paid-in Capital | $25,000 | $25,000 | $25,000 |

| Retained Earnings | $5,000 | $1,393,125 | $6,550,591 |

| Earnings | $1,388,125 | $5,157,465 | $8,777,417 |

| Total Capital | $1,418,125 | $6,575,591 | $15,353,008 |

| Total Liabilities and Capital | $1,742,959 | $6,917,863 | $15,778,474 |

| Net Worth | $1,418,125 | $6,575,591 | $15,353,008 |

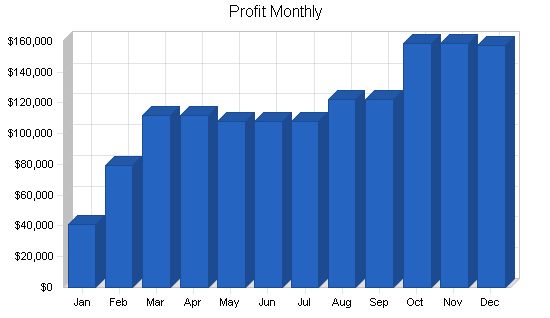

Appendix

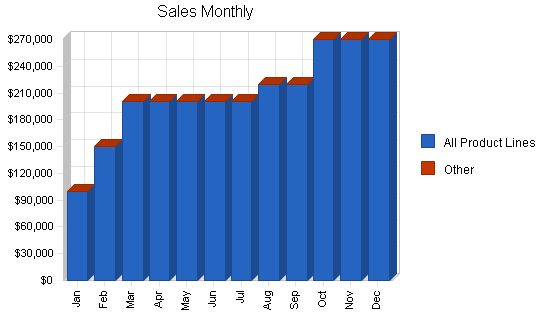

Sales Forecast

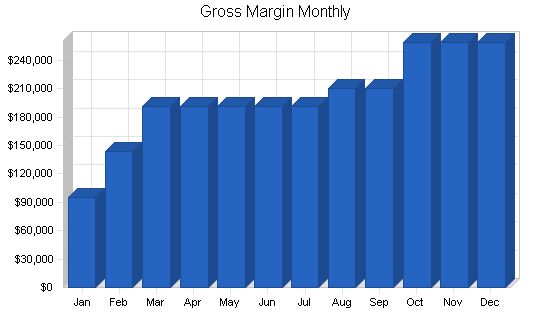

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | |||||||||||||

| All Product Lines | 0% | $100,000 | $150,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $220,000 | $220,000 | $270,000 | $270,000 | $270,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $100,000 | $150,000 | $200,000 | $200,000 | $200,000 | $200,000 | $200,000 | $220,000 | $220,000 | $270,000 | $270,000 | $270,000 | |

| Direct Cost of Sales | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | ||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!