Willamette Furniture Mfr. is experiencing a growth spurt, thanks to the high-end direct mail channel. This has opened up new potential volumes through distributors of office equipment that sell directly to corporations. Additionally, appearances in specialty catalogs have further expanded our reach.

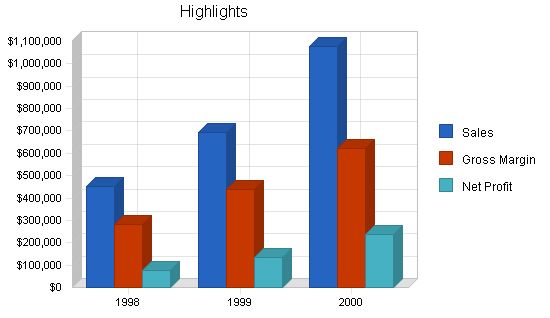

In the next three years, our annual business plan aims for accelerated growth. We are mindful of the working capital implications that come with sales growth, so we are carefully planning to manage growth and ensure steady cash flow. We anticipate higher profitability than ever before, as we are a healthy company with strong growth prospects.

Our objectives for the next phase of growth are to increase sales beyond the $1 million mark by Year 3, maintain a gross margin close to 60% despite increased sales, and significantly increase net profit by Year 3.

Willamette Furniture Mfr’s mission is to create pleasant and productive office environments with well-designed furniture that incorporates new technology. We value the look and feel of good wood and fine furniture, as well as high-powered personal computing. Our main goal is to provide the best possible value to our customers who prioritize quality office environments. We strive to create a healthy, creative, respectful, and enjoyable office and workshop environment where employees are fairly compensated and encouraged to respect the customer and the quality of our products. Our aim is to generate fair and responsible profit to ensure the long-term financial health of the company and provide fair compensation to owners and investors.

The keys to our success are an unwavering commitment to the quality of our products, successful niche marketing to quality-conscious customers in the right channels, and almost-automatic assembly that enhances the customer’s perception of quality.

Willamette Furniture Mfr. is a privately-owned specialty manufacturer of high-end office furniture for computer users who value elegant office space. Our customers range from businesses of all levels that can afford high-quality office furniture to high-end home offices.

Willamette Furniture Mfr. is an Oregon corporation owned entirely by Jim and Susan Graham. It was established in 1992 when the product line and industrial property rights (including trademarks) were purchased from the heirs of the Willamette Association, a 1970s commune in rural Oregon.

Although Willamette Furniture Mfr. had previously operated as a "hippy commune" in the 1970s, its present iteration began in 1992 when Jim and Susan Graham purchased the furniture line. The Grahams relocated from California to Oregon and acquired the business as part of their move.

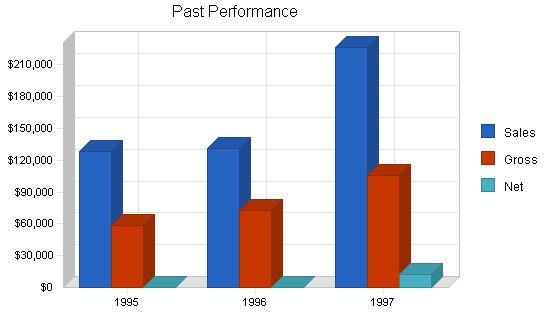

In 1997, our sales experienced significant growth due to more effective distribution channels. Our breakthrough came with inclusion in the Premier Executive office furniture catalog, which attracted the attention of Needham furniture distributors and secured display space in hundreds of stores.

While profitability and working capital posed challenges during our recent growth, we are confident that we now have control over costs and cash flow.

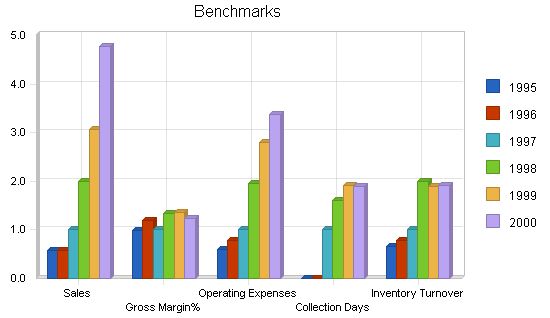

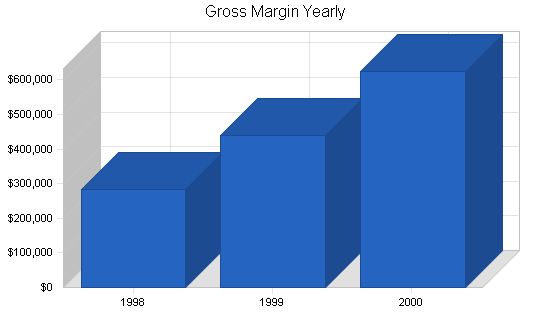

Past Performance:

Sales:

– 1995: $127,809

– 1996: $130,568

– 1997: $225,790

Gross Margin:

– 1995: $58,381

– 1996: $72,374

– 1997: $105,245

Gross Margin %:

– 1995: 45.68%

– 1996: 55.43%

– 1997: 46.61%

Operating Expenses:

– 1995: $54,602

– 1996: $69,801

– 1997: $90,125

Collection Period (days):

– 1995: 0

– 1996: 0

– 1997: 36

Inventory Turnover:

– 1995: 4.00

– 1996: 4.70

– 1997: 6.00

Current Assets:

Cash:

– 1995: $0

– 1996: $0

– 1997: $1,438

Accounts Receivable:

– 1995: $0

– 1996: $0

– 1997: $27,605

Inventory:

– 1995: $0

– 1996: $0

– 1997: $10,141

Other Current Assets:

– 1995: $0

– 1996: $0

– 1997: $2,375

Total Current Assets:

– 1995: $0

– 1996: $0

– 1997: $41,559

Long-term Assets:

Long-term Assets:

– 1995: $0

– 1996: $0

– 1997: $3,210

Accumulated Depreciation:

– 1995: $0

– 1996: $0

– 1997: $1,720

Total Long-term Assets:

– 1995: $0

– 1996: $0

– 1997: $1,490

Total Assets:

– 1995: $0

– 1996: $0

– 1997: $43,049

Current Liabilities:

Accounts Payable:

– 1995: $0

– 1996: $0

– 1997: $11,191

Current Borrowing:

– 1995: $0

– 1996: $0

– 1997: $0

Other Current Liabilities (interest free):

– 1995: $0

– 1996: $0

– 1997: $1,803

Total Current Liabilities:

– 1995: $0

– 1996: $0

– 1997: $12,994

Long-term Liabilities:

– 1995: $0

– 1996: $0

– 1997: $0

Total Liabilities:

– 1995: $0

– 1996: $0

– 1997: $12,994

Paid-in Capital:

– 1995: $0

– 1996: $0

– 1997: $4,500

Retained Earnings:

– 1995: $0

– 1996: $0

– 1997: $13,100

Earnings:

– 1995: $0

– 1996: $0

– 1997: $12,455

Total Capital:

– 1995: $0

– 1996: $0

– 1997: $30,055

Total Capital and Liabilities:

– 1995: $0

– 1996: $0

– 1997: $43,049

Other Inputs:

Payment Days:

– 1995: 0

– 1996: 0

– 1997: 35

Sales on Credit:

– 1995: $0

– 1996: $0

– 1997: $140,434

Receivables Turnover:

– 1995: 0.00

– 1996: 0.00

– 1997: 5.09

Company Locations and Facilities:

Willamette Furniture Mfr. is located in the West Eleventh industrial district in Eugene, OR. The facility includes office and workshop space, access to the local bus route, and good parking.

Products:

Willamette Furniture Mfr. offers high-quality office furniture designed to incorporate computer machinery into the executive or home office. The key product is an ergonomically effective desk that looks like an executive desk but is specifically designed to accommodate personal computers.

Product Description:

1. Our main line is the Willamette computer desk, available in several versions. It is an elegant piece of office furniture designed for executive or home offices, with fully adjustable keyboard and monitor height and angle. Cable runs and shelving enhance the utility of the desk without sacrificing elegance.

2. We also offer complementary pieces such as file cabinets, printer stands, and bookcases.

3. Custom designs are available to fit exact measurements.

Competitive Comparison:

Our main competitors in our niche are Acme Computer Furniture and ABC Manufacturing. Acme is a larger company but their marketing is better than their product quality. ABC is a subsidiary of Haines Furniture, a major manufacturer, and they have recently targeted our niche.

In general, our competition extends beyond our niche. We compete against generalized furniture manufacturers, cheaper computer-related furniture, and mainstream merchandise in major furniture and office supply stores. Customers often choose lesser quality, mainstream materials instead of the higher quality furniture we offer.

Sales Literature:

Sales literature is attached as an appendix to the plan.

For 1998, we plan to develop a company catalog that will include other products for the same target customers. The focus will be on the executive office catalog, featuring furniture, lamps, and other accessories.

Sourcing:

Our location in Oregon gives us an advantage in sourcing local wood. We can purchase higher quality oak and cherry than our competitors in California and New York. As our sales have increased, we have been able to negotiate better prices due to higher volumes.

We work with three local wood suppliers. Bambridge supplies most of our oak, cherry, and specialty woods. They have provided good service and competitive prices. Duffin Wood Products is a secondary source for cherry and specialty woods. Merlin Supplies is used when our main suppliers are short on stock.

We also work with specialty manufacturers for furniture fittings, drawer accessories, glass, shelving accessories, and related purchases.

Although we are not as big as major furniture manufacturers, we are one of the largest buyers of the custom materials we need. Our suppliers treat us as a major account, even though they primarily serve hobbyists and carpenters.

Technology:

We pride ourselves on staying on top of the latest technology in ergonomics and design. We continuously integrate new technologies in display, input and output, and communications into our products. Our latest models already include features such as a desktop digital scanner and audio capabilities for creating presentations and email attachments.

Our assembly patents give us a competitive edge. Our interlocking assembly system is seen as an enhancement to the sense of quality by our customers.

Future Products:

In 1998, we will introduce a new line based on the executive laptop computer, complete with a docking station for network connectivity. The new furniture will have a different configuration to accommodate easy access to the docking station and make better use of space that doesn’t need to be dedicated to the CPU case.

We are also exploring options to accommodate larger monitors, such as the 17" and 21" sizes, which are becoming more common in our high-end market. We will also keep an eye on new technologies like wall-mounted flat screens, such as liquid plasma and similar technologies.

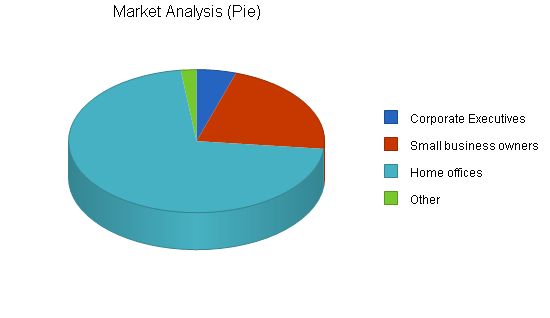

Market Analysis Summary:

Our target market includes individuals who appreciate high-quality furniture with the latest technology, combined with traditional craftsmanship and fine woodworking. Our customers can be found in corporate towers, small or medium businesses, or home offices. They all share an appreciation for quality and are not constrained by price.

Target Market Segment Strategy:

Our segment definition is strategic. We aim to satisfy the needs of high-end buyers who are willing to pay more for quality. Our target customers appreciate both the quality of our furniture craftsmanship and the excellence of the design, which incorporates technology and ergonomics.

Market Needs:

Our target market seeks more than just office furniture. They need furniture that specifically addresses the needs of personal computing, such as correct keyboard and monitor heights, proper cable management, and other features. Our customers not only want office furniture, but they also want a complete office environment with attractive design and high-quality workmanship.

Market Trends:

Our market has recognized the difference between standard office furniture and our own high-quality products. The development of high-end office workers, office owners, and baby-boomer executives is an important trend for us. These customers value both the functionality of computers and the craftsmanship of fine furniture.

Market Growth:

The market for office furniture is growing at an annual rate of XX percent, projected to increase further. The market for PC-related office furniture is growing even faster, at a YY percent annual rate, and is expected to reach $XX billion by 2000.

The growth of home offices equipped with personal computer equipment is particularly significant. As the cost of computers decreases, the number of home offices is increasing. Currently estimated at 36 million, home offices are growing at a rate of 15 percent per year. Last year, households spent $XX billion on home office equipment, with 15 percent of that budget allocated to furniture.

Market Segmentation:

– Corporate executives: Our market research shows a potential customer base of approximately 2.5 million managers in corporations with more than 100 employees. The target customer is typically at a high executive level, given the relatively higher price of our furniture compared to standard office furniture options.

Market Analysis

Corporate Executives 1998 1999 2000 2001 2002 CAGR

1% 2,500,000 2,525,000 2,550,250 2,575,753 2,601,511 1.00%

Small business owners 4% 11,000,000 11,440,000 11,897,600 12,373,504 12,868,444 4.00%

Home offices 10% 36,000,000 39,600,000 43,560,000 47,916,000 52,707,600 10.00%

Other 3% 1,000,000 1,030,000 1,060,900 1,092,727 1,125,509 3.00%

Total 8.23% 50,500,000 54,595,000 59,068,750 63,957,984 69,303,064 8.23%

The office furniture industry has changed significantly in this decade. Office superstores have dominated the market with inexpensive furniture that compromises quality. Traditional furniture makers are looking for niches to combat declining sales.

4.3.1 Industry Participants

The industry is primarily controlled by four major brands, including Office Depot, Office Max, Staples, and others. These brands also focus on club discount stores. Uniform designs, cost control, and channel management are crucial for success.

Traditional manufacturers have lost volume to office superstores. Smaller brands, smaller companies, and divisions of traditional furniture companies now dominate the market.

4.3.2 Distribution Patterns

The four main manufacturers sell directly to office superstores and discount clubs. Corporate purchases are made directly from manufacturers. Retail channels account for 51% of sales volume, direct sales make up 23%, and catalogs represent 18%.

4.3.3 Competition and Buying Patterns

Price and volume are crucial in the mainstream market. The corporate buyer prioritizes trouble-free buying and reliable quality. High-end specialty customers prioritize features, design, and quality.

4.3.4 Main Competitors

– Acme Computer Furniture: One of the first computer furniture manufacturers with a good catalog and strong distribution relationships. However, compromises design and quality.

– ABC Manufacturing: A division of Haines Furniture that specializes in high-quality products but lacks understanding of the niche market.

Strategy and Implementation Summary

Our target customers are those seeking high-quality office furniture that integrates well with modern technology. We focus on specialty channels, such as high-end catalogs like Sharper Image, to reach our customers and position ourselves as a premier provider.

Willamette Furniture Mfr. offers the discerning personal computer user the combination of highest quality furniture and the latest technology at a relatively high price.

Competitive Edge

Our competitive edge is our mastery of high-technology ergonomics and traditional high-quality furniture workmanship, a combination that few other manufacturers can match.

Our product is positioned carefully for customers who prioritize quality and are willing to spend on the best. We use high-quality catalogs and specialty distributors to convey the sense of quality in our marketing materials.

Pricing Strategy

We maintain our pricing as a premier provider, targeting discerning consumers who appreciate the best quality available in the market.

Promotion Strategy

Our primary sales promotion vehicle is the direct mail catalog of specialty retailers, such as Sharper Image. We also participate in industry events and have our own in-house catalog to reach our target market.

Distribution Strategy

Our most significant marketing program involves partnering with distributors selling directly to larger corporations. We also prioritize placement in high-end direct mail catalogs to reach our specialty customers.

For discerning personal computer users who want high-quality integration of their PCs with fine furniture, Willamette Furniture Mfr. offers exquisite workmanship, design, and state-of-the-art ergonomics and technology. We do not compromise on design for standardization like our competitors.

Sales Strategy

We focus on maintaining our identity with high-end buyers who appreciate the best quality and demand advanced computer systems. We utilize direct mail catalogs and direct sales to distributors to reach our target market.

Sales Programs

– Catalog sales: We aim to secure placement in an additional high-end catalog catering to office executives. Our budget for this program is $10,000, due March 15th.

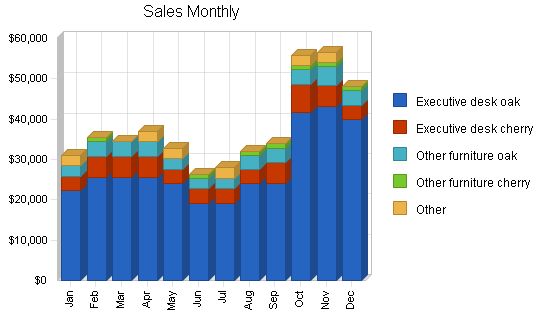

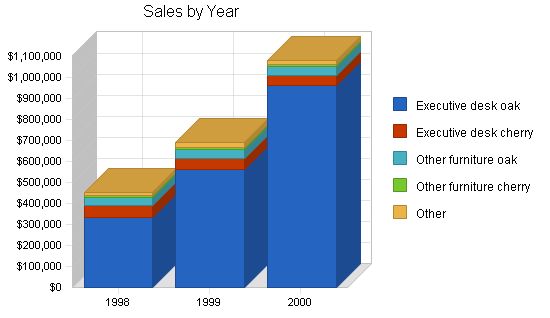

We project sales to double from $225,000 last year to $450,000 next year, and continue to grow at a rate of 50% annually to exceed $1 million by 2000. The growth is driven by new channels and the main desk product.

Title: Sales Forecast

Sales Forecast:

Unit Sales:

– Executive desk oak: 209 (1998), 350 (1999), 600 (2000)

– Executive desk cherry: 31 (1998), 30 (1999), 30 (2000)

– Other furniture oak: 45 (1998), 50 (1999), 50 (2000)

– Other furniture cherry: 7 (1998), 10 (1999), 10 (2000)

– Other: 6 (1998), 10 (1999), 10 (2000)

– Total Unit Sales: 298 (1998), 450 (1999), 700 (2000)

Unit Prices:

– Executive desk oak: $1,600.00 (1998), $1,600.00 (1999), $1,600.00 (2000)

– Executive desk cherry: $1,750.00 (1998), $1,750.00 (1999), $1,600.00 (2000)

– Other furniture oak: $900.00 (1998), $900.00 (1999), $900.00 (2000)

– Other furniture cherry: $1,000.00 (1998), $1,000.00 (1999), $1,000.00 (2000)

– Other: $2,500.00 (1998), $2,500.00 (1999), $1,600.00 (2000)

Sales:

– Executive desk oak: $334,400 (1998), $560,000 (1999), $960,000 (2000)

– Executive desk cherry: $54,250 (1998), $52,500 (1999), $48,000 (2000)

– Other furniture oak: $40,500 (1998), $45,000 (1999), $45,000 (2000)

– Other furniture cherry: $7,000 (1998), $10,000 (1999), $10,000 (2000)

– Other: $15,000 (1998), $25,000 (1999), $16,000 (2000)

– Total Sales: $451,150 (1998), $692,500 (1999), $1,079,000 (2000)

Direct Unit Costs:

– Executive desk oak: $400.00 (1998), $400.00 (1999), $400.00 (2000)

– Executive desk cherry: $525.00 (1998), $525.00 (1999), $480.00 (2000)

– Other furniture oak: $180.00 (1998), $180.00 (1999), $180.00 (2000)

– Other furniture cherry: $300.00 (1998), $300.00 (1999), $300.00 (2000)

– Other: $625.00 (1998), $625.00 (1999), $400.00 (2000)

Direct Cost of Sales:

– Executive desk oak: $83,600 (1998), $140,000 (1999), $240,000 (2000)

– Executive desk cherry: $16,275 (1998), $15,750 (1999), $14,400 (2000)

– Other furniture oak: $8,100 (1998), $9,000 (1999), $9,000 (2000)

– Other furniture cherry: $2,100 (1998), $3,000 (1999), $3,000 (2000)

– Other: $3,750 (1998), $6,250 (1999), $4,000 (2000)

– Subtotal Direct Cost of Sales: $113,825 (1998), $174,000 (1999), $270,400 (2000)

5.6 Milestones:

The table below displays the specific milestones, their assigned responsibilities, dates, and budgets. We will focus on key milestones to ensure their timely completion.

Milestones:

– Spring trade show (1/1/1998 – 5/15/1998, $10,000)

– Spring trade show (1/15/1998 – 5/15/1998, $20,000)

– Spring trade show (1/15/1998 – 5/15/1998, $6,000)

– Our in-house catalog plan (1/31/1998 – 2/28/1998, $0)

– First catalog (3/1/1998 – 4/15/1998, $125,000)

– New distributor (3/15/1998 – 3/30/1998, $5,000)

– New distributor (3/15/1998 – 4/30/1998, $3,000)

– Second catalog (4/1/1998 – 5/15/1998, $85,000)

– In-house catalog design (4/1/1998 – 5/1/1998, $2,000)

– In-house catalog mailing (5/1/1998 – 6/1/1998, $5,000)

– Third catalog placement (5/15/1998 – 6/15/1998, $54,000)

– Fall trade show (5/15/1998 – 10/15/1998, $8,000)

– Fall trade show (5/15/1998 – 10/15/1998, $20,000)

– Fall trade show (5/15/1998 – 10/15/1998, $6,000)

– Laptop product test (6/15/1998 – 6/20/1998, $1,000)

– Laptop product release (1/1/1998 – 10/15/1998, $15,000)

– Totals: $365,000

Management Summary:

We are a Subchapter S corporation owned and operated by Jim and Susan Graham. Jim is responsible for product design and development, while Susan manages the company as the president. Our management style emphasizes a sense of community and we strive to treat all employees well. We have a flat organizational structure where key managers report directly to Susan and Jim.

Management Team:

– Susan Graham, President (43): Susan has a background in retail, having worked as an area manager for Ross Stores, a buyer for Macy’s, and a merchandising assistant for Sears and Roebuck. She holds a degree in Literature from the University of Notre Dame.

– Jim Graham, Workshop Manager (44): Jim previously designed furniture for Haines Manufacturing and has extensive knowledge of furniture design and manufacturing. He holds a B.S. and M.S. in industrial design from Stanford University and the University of Oregon, respectively.

– Terry Hatcher, Marketing Manager (34): Terry joined our company from Thomasville Furniture, where they managed national catalog production and catalog advertising. Terry also has experience in direct sales at a furniture distributor. They have a B.A. degree in literature from the University of Washington.

Management Team Gaps:

We rely on our CPA and attorney for additional management support, as we lack expertise in finance and business management. We also need to develop more standardized assembly techniques as our manufacturing processes expand.

Personnel Plan:

The personnel plan assumes slow employee growth with 10% annual pay raises. We have a strong benefits policy and low turnover. Salaries are competitive for the Eugene area, and we anticipate increasing personnel as sales grow.

Personnel Plan:

– Production Personnel: Workshop manager ($30,000 in 1998, $50,000 in 1999, $75,000 in 2000), Assembly ($21,600 in 1998, $30,000 in 1999, $60,000 in 2000), and other employees ($0 in 1998, $0 in 1999, $50,000 in 2000). Subtotal: $51,600 (1998), $80,000 (1999), $185,000 (2000).

– Sales and Marketing Personnel: Marketing manager ($37,000 in 1998, $65,000 in 1999, $72,000 in 2000), and other employees ($0 in 1998, $0 in 1999, $0 in 2000). Subtotal: $37,000 (1998), $65,000 (1999), $72,000 (2000).

– General and Administrative Personnel: President ($48,000 in 1998, $75,000 in 1999, $100,000 in 2000), and other employees ($0 in 1998, $0 in 1999, $0 in 2000). Subtotal: $48,000 (1998), $75,000 (1999), $100,000 (2000).

– Other Personnel: Design ($3,000 in 1998, $15,000 in 1999, $25,000 in 2000), and other employees ($0 in 1998, $0 in 1999, $0 in 2000). Subtotal: $3,000 (1998), $15,000 (1999), $25,000 (2000).

– Total Payroll: $139,600 (1998), $235,000 (1999), $382,000 (2000).

We have been cautious with debt and plan to apply for a credit line of up to $150,000 to support our increasing sales. Dividends will also be distributed to the owners. The table below outlines our assumptions and key financial indicators.

Important Assumptions:

– Current interest rate: 10.00%, Long-term interest rate: 90.00%

– Tax rate: 25.42% (1998), 25.00% (1999-2000)

– Other: 0

Key Financial Indicators:

– Sales, gross margin, operating expenses, collection days, and inventory turnover will be closely monitored. Sales growth will be challenging to manage, and gross margin may decline slightly due to expanding into new product areas and increased competition. Collection days and inventory turnover are expected to decline as sales channels expand.

General Assumptions:

– Plan Month: 1 (1998), 2 (1999), 3 (2000)

– Current Interest Rate: 10.00%, Long-term Interest Rate: 90.00%

– Tax Rate: 25.42% (1998), 25.00% (1999-2000)

– Other: 0

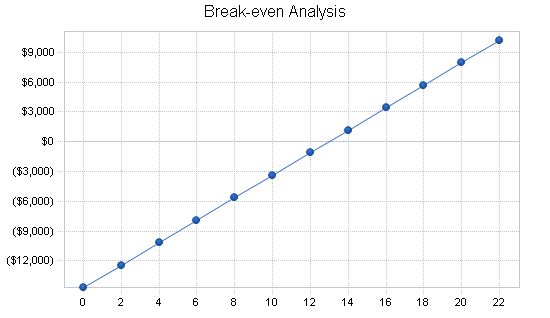

Our break-even analysis is based on running costs, the costs we incur to keep the business running, not theoretical fixed costs that would only be relevant if we were closing.

Our assumptions on unit sales and per-unit costs depend on averaging. We don’t need to calculate an exact average, this is close enough to help us understand the real break-even point.

The essential insight here is that our sales level seems to be comfortably above break-even.

Break-even Analysis

Monthly Units Break-even: 13

Monthly Revenue Break-even: $19,627

Assumptions:

Average Per-Unit Revenue: $1,513.93

Average Per-Unit Variable Cost: $381.96

Estimated Monthly Fixed Cost: $14,675

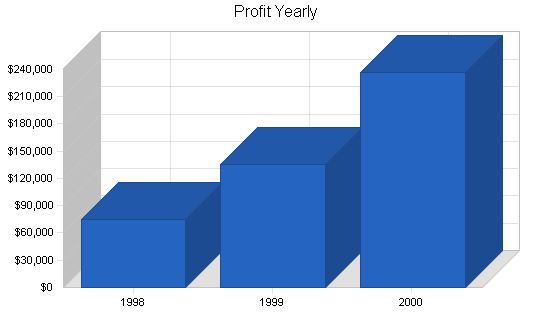

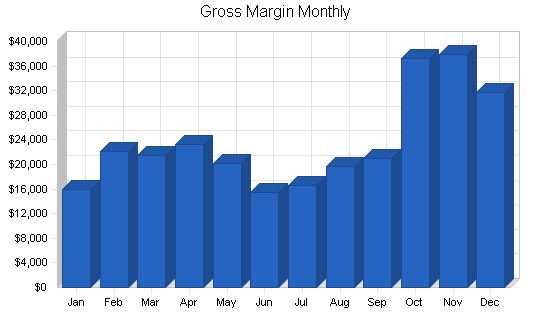

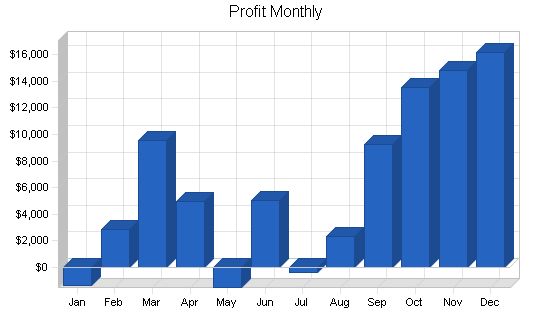

7.4 Projected Profit and Loss

We expect increased profitability this year and in the future due to our improved handling of higher sales levels through channels. Despite recent years’ lower profitability, we anticipate strong net profits in 1998 and beyond. Our higher sales volume has reduced costs and boosted our gross margin, which is crucial to profitability.

Pro Forma Profit and Loss

Sales:

– 1998: $451,150

– 1999: $692,500

– 2000: $1,079,000

Direct Cost of Sales:

– 1998: $113,825

– 1999: $174,000

– 2000: $270,400

Production Payroll:

– 1998: $51,600

– 1999: $80,000

– 2000: $185,000

Other Costs of Sales:

– 1998: $3,110

– 1999: $0

– 2000: $0

Total Cost of Sales:

– 1998: $168,535

– 1999: $254,000

– 2000: $455,400

Gross Margin:

– 1998: $282,615

– 1999: $438,500

– 2000: $623,600

Gross Margin %:

– 1998: 62.64%

– 1999: 63.32%

– 2000: 57.79%

Operating Expenses:

Sales and Marketing Expenses:

– Sales and Marketing Payroll:

– 1998: $37,000

– 1999: $65,000

– 2000: $72,000

– Advertising/Promotion:

– 1998: $64,000

– 1999: $70,400

– 2000: $77,400

– Miscellaneous:

– 1998: $2,400

– 1999: $2,600

– 2000: $2,900

– Events:

– 1998: $6,250

– 1999: $6,900

– 2000: $7,600

– 1998: $750

– 1999: $800

– 2000: $900

– Travel:

– 1998: $4,500

– 1999: $5,000

– 2000: $5,500

Total Sales and Marketing Expenses:

– 1998: $114,900

– 1999: $150,700

– 2000: $166,300

Sales and Marketing %:

– 1998: 25.47%

– 1999: 21.76%

– 2000: 15.41%

General and Administrative Expenses:

– General and Administrative Payroll:

– 1998: $48,000

– 1999: $75,000

– 2000: $100,000

– Depreciation:

– 1998: $1,000

– 1999: $1,100

– 2000: $1,200

– Leased Equipment:

– 1998: $1,500

– 1999: $1,700

– 2000: $1,900

– Rent:

– 1998: $3,600

– 1999: $4,000

– 2000: $4,400

– Utilities:

– 1998: $2,400

– 1999: $2,600

– 2000: $2,900

– Insurance:

– 1998: $500

– 1999: $600

– 2000: $700

– Payroll Taxes:

– 1998: $0

– 1999: $0

– 2000: $0

– Other General and Administrative Expenses:

– 1998: $1,200

– 1999: $1,300

– 2000: $1,400

Total General and Administrative Expenses:

– 1998: $58,200

– 1999: $86,300

– 2000: $112,500

General and Administrative %:

– 1998: 12.90%

– 1999: 12.46%

– 2000: 10.43%

Other Expenses:

– Other Payroll:

– 1998: $3,000

– 1999: $15,000

– 2000: $25,000

– Consultants:

– 1998: $0

– 1999: $0

– 2000: $0

– Other Expenses:

– 1998: $0

– 1999: $0

– 2000: $0

Total Other Expenses:

– 1998: $3,000

– 1999: $15,000

– 2000: $25,000

Other %:

– 1998: 0.66%

– 1999: 2.17%

– 2000: 2.32%

Total Operating Expenses:

– 1998: $176,100

– 1999: $252,000

– 2000: $303,800

Profit Before Interest and Taxes:

– 1998: $106,515

– 1999: $186,500

– 2000: $319,800

EBITDA:

– 1998: $107,515

– 1999: $187,600

– 2000: $321,000

Interest Expense:

– 1998: $6,094

– 1999: $5,875

– 2000: $4,875

Taxes Incurred:

– 1998: $25,009

– 1999: $45,156

– 2000: $78,731

Net Profit:

– 1998: $75,412

– 1999: $135,469

– 2000: $236,194

Net Profit/Sales:

– 1998: 16.72%

– 1999: 19.56%

– 2000: 21.89%

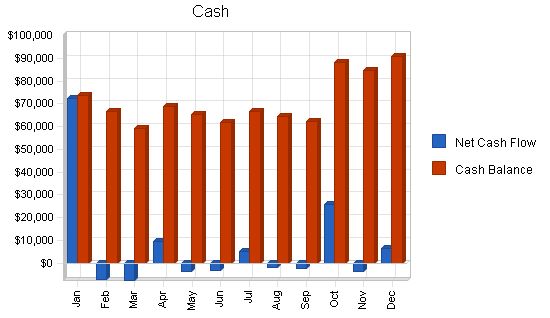

7.5 Projected Cash Flow

Although we expect to be more profitable in 1998, we still have drains on cash flow. We need to invest $25,000 in new assembly and manufacturing equipment, $15,000 in new computer equipment, and $10,000 in miscellaneous short-term assets, including office equipment. Due to increased sales through channels and the necessary increase in inventory levels, we need to increase working capital. We plan to extend our credit line to cover up to $150,000 in short-term credit, backed by receivables and inventory.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| 1998 | 1999 | 2000 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $112,788 | $173,125 | $269,750 |

| Cash from Receivables | $288,966 | $478,182 | $743,283 |

| Subtotal Cash from Operations | $401,754 | $651,307 | $1,013,033 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $125,000 | $50,000 | $100,000 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $50,000 | $0 | $0 |

| Subtotal Cash Received | $576,754 | $701,307 | $1,113,033 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $139,600 | $235,000 | $382,000 |

| Bill Payments | $231,587 | $317,081 | $458,115 |

| Subtotal Spent on Operations | $371,187 | $552,081 | $840,115 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $66,250 | $50,000 | $120,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $50,000 | $20,000 | $30,000 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $487,437 | $622,081 | $990,115 |

| Net Cash Flow | $89,317 | $79,226 | $122,918 |

| Cash Balance | $90,755 | $169,981 | $292,899 |

Projected Balance Sheet

Our projected balance sheet shows an increase in net worth to over $400 thousand in 2000, with projected sales of $1.1 million. We will be careful in supporting our working capital credit line and growing our assets to support sales growth.

| Pro Forma Balance Sheet | |||

| 1998 | 1999 | 2000 | |

| Assets | |||

| Current Assets | |||

| Cash | $90,755 | $169,981 | $292,899 |

| Accounts Receivable | $77,001 | $118,194 | $184,161 |

| Inventory | $12,070 | $18,451 | $28,673 |

| Other Current Assets | $2,375 | $2,375 | $2,375 |

| Total Current Assets | $182,201 | $309,001 | $508,109 |

| Long-term Assets | |||

| Long-term Assets | $53,210 | $73,210 | $103,210 |

| Accumulated Depreciation | $2,720 | $3,820 | $5,020 |

| Total Long-term Assets | $50,490 | $69,390 | $98,190 |

| Total Assets | $232,691 | $378,391 | $606,299 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $16,671 | $26,902 | $38,616 |

| Current Borrowing | $58,750 | $58,750 | $38,750 |

| Other Current Liabilities | $1,803 | $1,803 | $1,803 |

| Subtotal Current Liabilities | $77,224 | $87,455 | $79,169 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $77,224 | $87,455 | $79,169 |

| Paid-in Capital | $54,500 | $54,500 | $54,500 |

| Retained Earnings | $25,555 | $100,967 | $236,436 |

| Earnings | $75,412 | $135,469 | $236,194 |

| Total Capital | $155,467 | $290,936 | $527,130 |

| Total Liabilities and Capital | $232,691 | $378,391 | $606,299 |

| Net Worth | $155,467 | $290,936 | $527,130 |

Our ratios look healthy and solid. Gross margin is projected to decline slightly, return on assets will run well above industry standards, and the return on equity is excellent. Debt and liquidity ratios also look good, with our Quick ratio increasing over the next three years.

| Ratio Analysis | ||||

| 1998 | 1999 | 2000 | Industry Profile | |

| Sales Growth | 99.81% | 53.50% | 55.81% | 4.60% |

| Percent of Total Assets | ||||

| Accounts Receivable | 33.09% | 31.24% | 30.37% | 23.80% |

| Inventory | 5.19% | 4.88% | 4.73% | 32.10% |

| Other Current Assets | 1.02% | 0.63% | 0.39% | 19.00% |

| Total Current Assets | 78.30% | 81.66% | 83.81% | 74.90% |

| Long-term Assets | 21.70% | 18.34% | 16.19% | 25.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 16.71% | 26.90% | 38.61% | 38.40% |

| Current Borrowing | 58.75% | 58.75% | 38.75% | 15.90% |

| Other Current Liabilities | 1.80% | 1.80% | 1.80% | 19.00% |

| Subtotal Current Liabilities | 77.19% | 87.45% | 79.16% | 54.30% |

| Total Liabilities | 77.19% | 87.45% | 79.16% | 54.30% |

| Net Worth | 66.81% | 76.89% | 86.94% | 45.70% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 62.64% | 63.32% | 57.79% | 32.40% |

| Selling, General & Administrative Expenses | 45.93% | 43.76% | 35.90% | 18.90% |

| Advertising Expenses | 14.19% | 10.17% | 7.17% | 1.40% |

| Profit Before Interest and Taxes | 23.61% | 26.93% | 29.64% | 1.80% |

| Main Ratios | ||||

| Current | 2.36 | 3.53 | 6.42 | 2.14 |

| Quick | 2.20 | 3.32 | 6.06 | 1.02 |

| Total Debt to Total Assets | 33.19% | 23.11% | 13.06% | 54.30% |

| Pre-tax Return on Net Worth | 64.59% | 62.08% | 59.74% | 5.10% |

| Pre-tax Return on Assets | 43.16% | 47.73% | 51.94% | 11.10% |

Appendix

Sales Forecast

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Executive desk oak | 14 | 16 | 16 | 16 | 15 | 12 | 12 | 15 | 15 | 26 | 27 | 25 |

| Executive desk cherry | 2 | 3 | 3 | 3 | 2 | 2 | 2 | 2 | 3 | 4 | 3 | 2 |

| Other furniture oak | 3 | 4 | 4 | 4 | 3 | 3 | 3 | 4 | 4 | 4 | 5 | 4 |

| Other furniture cherry | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 1 | 1 | 1 |

| Other | 1 | 0 | 0 | 1 | 1 | 0 | 1 | 0 | 0 | 1 | 1 | 0 |

| Total Unit Sales | 20 | 24 | 23 | 24 | 21 | 18 | 18 | 22 | 23 | 36 | 37 | 32 |

Unit Prices

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 | $1,600.00 |

| $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 | $1,750.00 |

| $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 | $900.00 |

| $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

| $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 | $2,500.00 |

Sales

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| $22,400 | $25,600 | $25,600 | $25,600 | $24,000 | $19,200 | $19,200 | $24,000 | $24,000 | $41,600 | $43,200 | $40,000 |

| $3,500 | $5,250 | $5,250 | $5,250 | $3,500 | $3,500 | $3,500 | $3,500 | $5,250 | $7,000 | $5,250 | $3,500 |

| $2,700 | $3,600 | $3,600 | $3,600 | $2,700 | $2,700 | $2,700 | $3,600 | $3,600 | $3,600 | $4,500 | $3,600 |

| $0 | $1,000 | $0 | $0 | $0 | $1,000 | $0 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| $2,500 | $0 | $0 | $2,500 | $2,500 | $0 | $2,500 | $0 | $0 | $2,500 | $2,500 | $0 |

| $31,100 | $35,450 | $34,450 | $36,950 | $32,700 | $26,400 | $27,900 | $32,100 | $33,850 | $55,700 | $56,450 | $48,100 |

Personnel Plan

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Workshop manager | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 | $2,500 |

| Assembly | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 | $1,800 |

| Name or Title or Group | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Payroll | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 | $4,300 |

Pro Forma Profit and Loss

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales $31,100 $35,450 $34,450 $36,950 $32,700 $26,400 $27,900 $32,100 $33,850 $55,700 $56,450 $48,100

Direct Cost of Sales $7,815 $8,995 $8,695 $9,320 $8,215 $6,690 $7,015 $8,070 $8,595 $14,145 $14,200 $12,070

Production Payroll $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300 $4,300

Other Costs of Sales $3,110 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $15,225 $13,295 $12,995 $13,620 $12,515 $10,990 $11,315 $12,370 $12,895 $18,445 $18,500 $16,370

Gross Margin $15,875 $22,155 $21,455 $23,330 $20,185 $15,410 $16,585 $19,730 $20,955 $37,255 $37,950 $31,730

Gross Margin % 51.05% 62.50% 62.28% 63.14% 61.73% 58.37% 59.44% 61.46% 61.91% 66.89% 67.23% 65.97%

Operating Expenses

Sales and Marketing Expenses

Sales and Marketing Payroll $4,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

Advertising/Promotion $8,000 $8,000 $0 $8,000 $8,000 $0 $8,000 $8,000 $0 $8,000 $8,000 $0

Miscellaneous $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Events $0 $750 $0 $0 $3,000 $0 $0 $0 $0 $2,500 $0 $0

Public Relations $0 $250 $0 $0 $500 $0 $0 $0 $0 $0 $0 $0

Travel $0 $500 $0 $0 $2,000 $0 $500 $0 $0 $0 $1,500 $0

Total Sales and Marketing Expenses $12,200 $12,700 $3,200 $11,200 $16,700 $3,200 $11,700 $11,200 $3,200 $13,700 $12,700 $3,200

Sales and Marketing % 39.23% 35.83% 9.29% 30.31% 51.07% 12.12% 41.94% 34.89% 9.45% 24.60% 22.50% 6.65%

General and Administrative Expenses

General and Administrative Payroll $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000 $4,000

Marketing/Promotion $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $1,000

Leased Equipment $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125 $125

Rent $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300 $300

Utilities $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Insurance $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $500

Payroll Taxes 15% $0 $0 $0

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $7,775 | $8,863 | $8,613 | $9,238 | $8,175 | $6,600 | $6,975 | $8,025 | $8,463 | $13,925 | $14,113 | $12,025 | |

| Cash from Receivables | $13,803 | $14,580 | $23,434 | $26,563 | $25,900 | $27,606 | $24,368 | $19,838 | $21,030 | $24,119 | $25,934 | $41,794 | |

| Subtotal Cash from Operations | $21,578 | $23,443 | $32,046 | $35,800 | $34,075 | $34,206 | $31,343 | $27,863 | $29,493 | $38,044 | $40,046 | $53,819 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $75,000 | $5,000 | $0 | $5,000 | $0 | $0 | $0 | $5,000 | $5,000 | $20,000 | $10,000 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $25,000 | $0 | $0 | $0 | $0 | $0 | $0 | $25,000 | $0 | $0 | $0 | |

| Subtotal Cash Received | $96,578 | $53,443 | $32,046 | $40,800 | $34,075 | $34,206 | $31,343 | $32,863 | $59,493 | $58,044 | $50,046 | $53,819 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $12,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | $11,550 | |

| Bill Payments | $11,777 | $17,725 | $21,877 | $13,329 | $21,089 | $21,102 | $8,544 | $17,128 | $19,053 | $14,291 | $35,948 | $29,725 | |

| Subtotal Spent on Operations | $24,327 | $29,275 | $33,427 | $24,879 | $32,639 | $32,652 | $20,094 | $28,678 | $30,603 | $25,841 | $47,498 | $41,275 | |

| Additional Cash Spent | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!