Auto Insurance Claims Business Plan

CollisionSyzygy, Inc. (CSI) is a leading provider of claims outsourcing services using a highly technological delivery platform involving the Internet and proprietary software systems. CollisionSyzygy efficiently connects an insurance company’s auto damage claim with the body repair shop, reducing costs for both parties.

The goal of this business plan is to secure capital investment so that CollisionSyzygy can expand its proven business strategy and reach a wider market. Time is crucial. CollisionSyzygy has a technological lead of up to 18 months over its competitors in collision claims processing, resulting in profits for its clients. Rapid infusion of funds into CSI will keep competitors trailing behind. CollisionSyzygy’s technological advantage and untapped market potential make it a remarkable investment opportunity. Smaller insurance companies cannot operate profitably without outsourcing collision claims due to their inability to achieve the lower costs associated with high-volume transactions.

Another key attraction of CollisionSyzygy is its full-spectrum claims processing services, rapid transaction clearance, and access to both national and international buyers. Unlike competitors with limited services, CSI leverages technology to offer every available service.

CollisionSyzygy, led by William Smith with 18 years of managerial experience in collision repairs and insurance adjusting, is an established company that has been developing and using advanced technologies for the past five years. It is rapidly building a network of body shop facilities, exchanging geographic territories for stringent quality control standards, certifications, and discounted pricing, further improving insurance companies’ profit margins.

CollisionSyzygy’s proprietary software programs and multi-platform reporting capability position CSI as a dominant player in generic services.

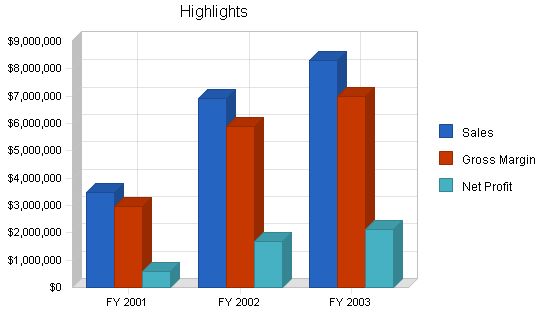

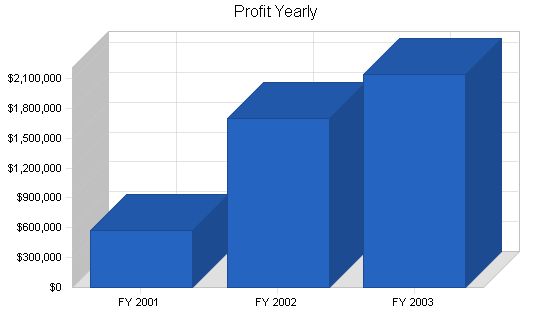

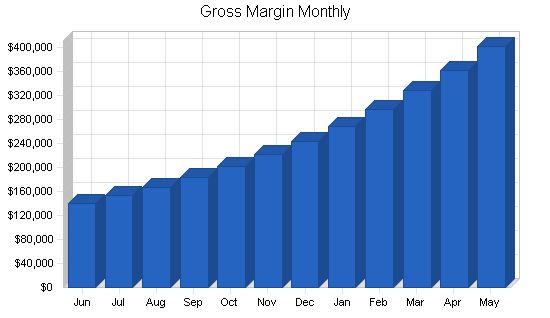

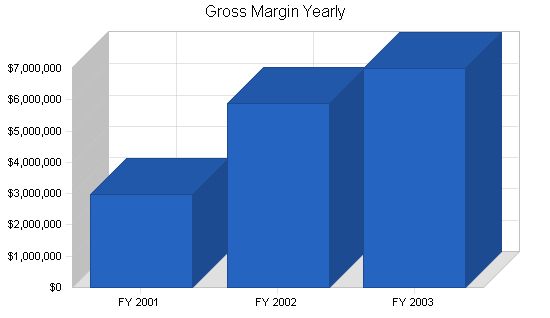

The company is currently profitable. With new investment, CollisionSyzygy is expected to achieve remarkable sales in the first 12-month period. Profits before taxes will be staggering. Sales are projected to soar within two years, resulting in sky-high pre-tax profits and breathtaking after-tax profits. The following chart illustrates after-tax profits.

Contents

1.1 Keys to Success

- Extensive experience of the Chief Executive Officer in the industry.

- CollisionSyzygy is the sole provider of generic services to insurance companies in the U.S. until now claims processing was done internally by large insurance companies.

- CollisionSyzygy is nearly two years ahead of most competitors in developing proprietary software necessary for insurance carriers to administer claims processing. CollisionSyzygy’s special software, Accident Claims Technology (ACT), empowers insurance companies and repair shops with claims management and reporting capabilities. This head start in software development hampers competitors’ entry into the market before CollisionSyzygy establishes a significant market position.

- CSI’s network of repair shops, currently comprising over 100 facilities, continues to grow.

- With ACT software already functional, CollisionSyzygy is just one website away from offering internet connectivity between insurance companies and repair shops.

- By attracting more repair shops to CSI, business can dramatically increase while maintaining competitive pricing and high-quality repairs.

- Using proprietary Windows®-based software, customer service between repair shops and customers is greatly enhanced. Quick and accurate cost estimates save time for repair shops and allow for more customer interaction. Insurance companies benefit from reliable costing through the database resource. Another software program transmits necessary estimates, photographs, and claims materials to insurance carriers promptly.

1.2 Mission

CollisionSyzygy, Inc. is the only company in the United States offering a low-cost, generic solution for processing, administration, and resolution of auto insurance claims. Through its proprietary high-tech process and software, CollisionSyzygy acts as a phone conferencing switch, channeling insured claims from the insurance company to the appropriate auto repair shop. This process guarantees quality, lifetime-warranted repairs for the insured. CSI manages the entire process and provides comprehensive reporting to the insurance carrier. CollisionSyzygy’s mission is to optimize the claims delivery process for each participant in a unique way compared to competitors.

The result of CollisionSyzygy’s high-tech process:

An insurance company’s claim:

- Processed faster than with traditional, in-house methods. Claimants receive the repair shop location at the time of filing the claim.

- Significantly reduced costs for the insurer, including thousands of dollars saved on indemnity payments, a five percent automatic savings on all repairs at CollisionSyzygy’s member repair facilities, substantial reductions in loss adjustment expenses and administrative expenses, control over repair costs, avoidance of costly auto storage through rapid claim resolution. CollisionSyzygy schedules random quality checks of member shop repairs to ensure quality and necessity, and any unnecessary repairs are refunded by member repair shops.

- Enables the insurer to access comprehensive management reports detailing underwriting, repair, and resolution activities.

- Guarantees repairs for the life of the repair, through all participating CollisionSyzygy repair facilities.

A customer/claimant:

- Enjoys lower insurance premiums resulting from reduced insurance costs.

- Experiences rapid resolution of an auto claim, providing convenience.

Member repair shops:

- Can focus on quality repairs and service instead of costly marketing efforts.

- Benefit from simplified claim estimation through CollisionSyzygy’s multi-platform software interface, allowing accurate cost estimates in minutes and more time for customer service.

In summary, CollisionSyzygy uses a managed auto body repair process, similar to the Health Management Organization (HMO) approach implemented by the healthcare industry to contain costs. However, in this case, cost efficiency is achieved by eliminating unnecessary elements of the traditional claims process, rather than necessary repair procedures or parts.

Claims processing is profitable at a large volume. This poses a challenge, if not a barrier, for smaller insurance companies to run profitable claims operations. The claims processing formula established by CollisionSyzygy enables smaller insurers to handle claims profitably and increases margins for larger companies.

1.3 Objectives

CollisionSyzygy from June 1, 2000, to May 31, 2001:

- Achieve astounding pre-tax income on immense revenues, resulting in splendid net income before taxes.

- Capture and control a minimum of ten medium and large insurance company accounts in the claims processing market. By the end of Year 2, increase market share to 60 companies. The full target market consists of approximately 2,600 insurance companies.

- Establish name branding for CollisionSyzygy, certifying a minimum of 220 repair shops as members of the company’s program. By the start of Year 3, aim for approximately 2,000 repair shops due to the implementation of unique programs and technologies not currently available in the marketplace.

- Transform the proprietary software platform into an e-commerce website to enhance access to the CollisionSyzygy process for insurance companies and repair shops.

- Launch a full online service auction for bidding and sales of salvageable automobiles in conjunction with the site launch.

Company Summary

CollisionSyzygy was founded in 1995 by William Smith with the goal of streamlining claims processing for small and mid-sized insurance companies. By creating economies of scale, CollisionSyzygy enables these companies to compete with larger ones. The program focuses on cost containment, improved and timely reporting, swift claim resolution, and quality repair service. Mitchell International, CSI’s strategic business partner, provides software to support the repair shops.

2.1 Company Ownership

William Smith has been the founder, CEO, and sole shareholder of CollisionSyzygy, Inc. for the past five years. The company currently has 300,000 authorized shares of common stock, with half of them issued and owned by Mr. Smith.

Mr. Smith brings nearly 18 years of claims experience to CollisionSyzygy.

CSI maintains an active strategic business partnership with Mitchell International, an influential player in the third party administration (TPA) process.

2.2 Company History

CollisionSyzygy started its operations in 1995. Founder William Smith envisioned an independent and generic process that would allow small- and mid-sized insurance companies to pool claims, thus achieving cost savings like larger counterparts. This pooling of claims provides smaller insurance companies with economies of scale, including volume pricing for repair shops.

In 1998, CollisionSyzygy formed a strategic business partnership with Mitchell International to enhance its ACT software using ImageMate® and UltraMate® software technologies. UltraMate® is an advanced Windows®-based program for estimating job costs, while ImageMate® is a Windows®-based program used by automotive collision-repair shops to send images and estimating data via phone modem and Internet.

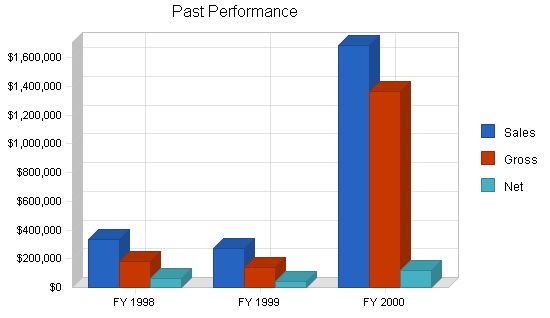

The following chart and table present the past performance of CollisionSyzygy for the last two calendar years. Year 1 is estimated based on actual first-quarter results and projections for the remaining three quarters, assuming investment capital is employed into operations at the start of Year 1.

| Past Performance | |||

| FY 1998 | FY 1999 | FY 2000 | |

| Sales | $333,669 | $274,758 | $1,685,200 |

| Gross Margin | $183,479 | $139,070 | $1,364,458 |

| Gross Margin % | 54.99% | 50.62% | 80.97% |

| Operating Expenses | $84,811 | $94,765 | $1,089,024 |

| Collection Period (days) | 0 | 0 | 0 |

| Balance Sheet | |||

| FY 1998 | |||

| FY 1999 | |||

| FY 2000 | |||

| FY 1998 | FY 1999 | FY 2000 | |

| Current Assets | |||

| Cash | $14,469 | $18,850 | $1,961,328 |

| Accounts Receivable | $0 | $0 | $130,597 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $14,469 | $18,850 | $2,091,925 |

| Long-term Assets | |||

| Long-term Assets | $30,043 | $57,791 | $192,291 |

| Accumulated Depreciation | $24,970 | $24,970 | $40,664 |

| Total Long-term Assets | $5,073 | $32,821 | $151,627 |

| Total Assets | $19,542 | $51,671 | $2,243,552 |

| Current Liabilities | |||

| Accounts Payable | $0 | $0 | $71,551 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Total Current Liabilities | $0 | $0 | $71,551 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $0 | $0 | $71,551 |

| Paid-in Capital | ($80,488) | ($92,665) | $1,907,335 |

| Retained Earnings | $34,650 | $100,031 | $144,336 |

| Earnings | $65,380 | $44,305 | $120,330 |

| Total Capital | $19,542 | $51,671 | $2,172,001 |

| Total Capital and Liabilities | $19,542 | $51,671 | $2,243,552 |

| Other Inputs | |||

| Payment Days | 0 | 0 | 0 |

| Sales on Credit | $0 | $0 | $0 |

| Receivables Turnover | 0.00 | 0.00 | 0.00 |

2.3 Company Locations and Facilities

CollisionSyzygy is located in Costa Mesa, California. The company contact is the vice president of Marketing and Administration.

CollisionSyzygy’s strategic business partner, Mitchell International, is headquartered in San Diego, California. Mitchell International also maintains offices in Chicago, Milwaukee, and Toronto. The company is comprised of six operating units: electronic products, publications, business systems, medical, National Auto Glass Specifications (NAGS) and the E. H. Boeckh Company.

Services

CollisionSyzygy offers a comprehensive list of services that supports the insurance claim process and “brokers” this process between the insurance carrier and the repair shop. Through current and developmental technologies, CSI is striving to increase the efficiency of this process in order to “sell more profit” to both the insurer and the repair shop who are experiencing tremendous competition from existing and new entrants to the industry. In addition, CollisionSyzygy can help the smaller insurer take advantage of the economies of scale inherent in large volume claims processing by acting as a pathway in which claims are pooled from numerous sources and handled through the vast services network managed by CSI.

3.1 Summary of Claims Process

Program: In general, our services provide a unique pathway through which insurance companies are directly referred to certified, member repair shops nationwide using our ACT software. Each CollisionSyzygy repair shop must offer the following services to our insurance company clients:

- Free computerized estimates.

- Free digital images.

- Five percent discount on all repairs.

- Free towing within a 15-mile radius.

- Free vehicle storage for up to 30 days.

- Immediate status reports using CSI technology.

Direct Computer Link: CollisionSyzygy’s proprietary software allows insurance company claims staff to:

- Obtain first loss reports.

- Dispatch appraisals, inspections and reinspections.

- Obtain “real time” status of claims progress to permit assessment of average cost and savings of physical damage losses.

- System is dynamic, yet simple to use, so any authorized person or agent with a personal computer and Internet access can monitor the claims process.

Complete Appraisal Process: Vehicle inspections are scheduled within 48 hours of assignment estimates, and vehicle images are electronically transmitted, same day, to the insurance carrier.

Active Reinspection Program:

- Random inspection of between 10% and 15% of all vehicles repaired by CollisionSyzygy shops are performed to ensure quality and accuracy of repairs.

- Any non-conforming, overpriced or unnecessary repairs, determined by a CSI inspector, result in a refund back to the insurance company.

Internet Salvage Recovery and Bids (Available June, 2000)

- www.salvage.com is an online auction house by which insurance companies can post vehicle photos to receive bids from prospective buyers.

- Insurers can usually obtain bids or sell salvages BEFORE settling the claims process basing offers on real values rather than guesswork.

3.2 Competitive Comparison

CollisionSyzygy is positioning itself to sell “profit” to those insurers who have used the costly, traditional distribution methods involving agents, brokers, and direct writers (working for one company). Offering services that trim claims expenses, “loss adjustment expenses,” and streamline the automotive claim administration process for insurers will directly add profits.

Various competitors have begun their siege for market share in the industry. CCC Information Services, Inc. (CCC) has built its third party administrator (TPA) services around its claims software, boasting a yearly revenue of over $10 million for 1998. Other national competitors include Crawford & Company with $208 million in claim revenues for 1998, Gallagher Bassett Services ($134 million), INSpire Insurance Solutions ($85 million), and Hertz Claim Management ($18 million). With the exception of CCC, none of these competitors have automotive information systems that permit a national network. CollisionSyzygy has already established an operating national network which positions it to uniquely compete with these larger TPA organizations.

Carstation.com has been very successful in attracting investor capital and recently raised $74 million in a venture capital deal to promote and build its business.

3.3 Sales Literature

Body Shops

CollisionSyzygy has primarily used direct-mail pieces targeted at building the repair facility network. The initial mailer offered competition-free territories to body shops who became members of CollisionSyzygy. Body shops have to meet a stringent list of requirements to qualify for membership.

CollisionSyzygy technologies were described so that body shops considering membership could appreciate what the relationship would mean. A one-time membership fee was charged for the territory. A second generation version of the body shop brochure was later introduced. The one-time fee was dramatically decreased and a non-refundable application fee was added. Effectively, the membership fee in the original mailer was cut in half when contrasted with the two fees charged by the newer brochure. The idea was to build the body shop network without reducing the standards or requirements for membership.

Insurance Companies

Informing and attracting insurance companies to CollisionSyzygy’s services has been accomplished primarily with a high quality, spiral bound brochure piece bearing a colorful icon of CollisionSyzygy’s logo. The protocol for this advertising campaign is to mail the brochure to a targeted list of insurance carriers and follow up with individual phone calls to the claims executive.

Miscellaneous and Future Advertising

One successful manner of advertising for CollisionSyzygy has been its media press releases and client testimonials. An article in Hammer and Dolly magazine, April 1998, described the company’s process at length.

A press release in June 1999, mentioned the strategic alliance between Mitchell International and CollisionSyzygy. This new relationship added database estimating systems and electronic submission of images and reporting to CollisionSyzygy’s own proprietary software platform, which manages the entire claims process – from notification, to claims submission, to claims resolution and settlement.

Due to the speed and availability of information that the Internet provides, CollisionSyzygy plans to host most of its advertising via its website. Once operational, the marketing budget will focus on encouraging both repair shops and insurance companies to visit the website to discover how each might enjoy significant savings by using the CSI process.

3.4 Fulfillment

The services provided by CollisionSyzygy involve advanced software technology, use of the Internet, and a growing network of pre-certified repair shops. Since services are accessed through the use of CollisionSyzygy’s proprietary software, high cost personnel, expensive office space, and other supporting costs can be minimized to increase overall profits for the insurance company. The repair facility can receive a steady stream of business referrals from CSI, averting the need to employ expensive marketing and advertising programs of its own.

Eventually, CollisionSyzygy expects to have as much as 99 percent of its business deriving from e-commerce over the Internet rather than direct distribution of its proprietary software to repair shops and insurers. As a precautionary measure, CollisionSyzygy ensures that all Internet users retain an up-to-date hardcopy version of its software in the event of an Internet or file server problem that could interrupt claims operations.

Currently, the insurance company notifies CollisionSyzygy of a claim assignment through computer input into CSI’s software. CollisionSyzygy then notifies the appropriate repair facility. The repair shop prepares the estimate and photo images and conveys them back to CSI for review and analysis by a staff auditor. If everything is in order, the insurance company is notified electronically that the claim is approved for payment. During this process, complete management and status reporting is available to all participants in the claims process.

- Revenue Sources:

- Fee charged insurance company for claim assignment.

- Referral fees from body shops.

- Body shop facilities prepay for 10 claim referrals in advance, on account.

- A referral fee of five dollars per referral, times 10 referrals, results in a $50 prepaid fee being paid to CollisionSyzygy by each body shop. After 10 claims have been referred by CollisionSyzygy, the body shop prepays another $50 on account.

- An appraiser’s fee is charged to insurance carrier on each claim.

- Transaction fees are billed to outside adjusters.

- Fees for salvage and sale of non-repairable vehicles are charged to both the seller (insurance company) and the buyer.

- In the future, this “auctioning” of vehicles will be accomplished very efficiently through the Internet, making this revenue source even more profitable.

- Two dollar warranty cost paid per claim.

- Fee paid to independent appraisers, offset by revenues created by the claim.

3.5 Technology

Technology in the industry is vital to achieving market share. It is the competitive tool that a company must use to survive this increasingly competitive industry. Technology will:

- <

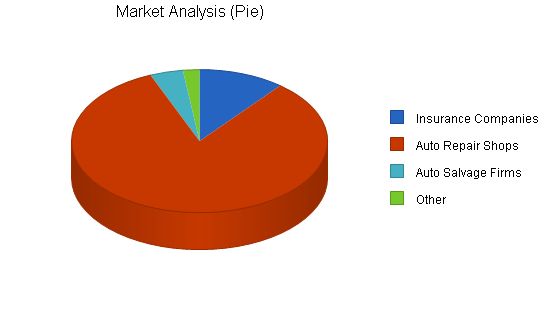

| Market Analysis | ||||

| 2000 | 2001 | 2002 | 2003 | 2004 |

| Potential Customers | Growth | CAGR | ||

| Insurance Companies | 5% | 5.01% | ||

| Auto Repair Shops | 5% | 5.00% | ||

| Auto Salvage Firms | 5% | 5.01% | ||

| Other | 5% | 5.01% | ||

| Total | 5.00% | 5.00% | ||

4.2 Target Market Segment Strategy

The obvious place to begin target marketing is where such marketing can effectively assist in building the services platform that can be employed to enter other market segments later on. CollisionSyzygy, Inc. is pursuing the expansion of its body shop network to take advantage of insurance company claims which are geographically positioned on a national basis. This, in turn, will attract more insurance company accounts. Currently, the insurance industry is being segmented as Personal Casualty and Business Casualty. CollisionSyzygy will concentrate on the Personal Casualty side at this time. As it expands the number of insurance company accounts that see it as a resource for Personal Casualty, CSI is only a step away from convincing these same accounts to utilize its services on the commercial Business Casualty side. The ground that has already been covered in order to acquire personal casualty accounts does not need to be travelled a second time in capturing the commercial side accounts.

The salvage market segment is born from a need to dispose of non-repairable vehicles on behalf of the insurance company.

These three market segments need to be expanded to perfect the services platform and increase the financial resources of CollisionSyzygy. Using technology-based claims processing services will make it easier for CSI to enter additional market segments and to more efficiently process the business that arises from it, making CSI more profitable and reliable in the delivery of its services than its competitors.

Banks, other lending institutions, and leasing market segments will have great need to process claims on vehicles that they finance. They will not want to increase operating overhead to process these claims internally and will look to the TPA to handle claims on a cost-efficient basis.

Vehicle manufacturers will have a need to settle claims on damaged vehicles, very similar to the Fleet Leasing market segment.

Many of the vendors used in the claims settlement process become an excellent market segment to capture and involve in the process. Revenues can be generated for CollisionSyzygy in making referrals to these “outside vendors.” Examples include glass vendors, aftermarket and used parts vendors, and mobile services.

Finally, a vast market to handle claims for Government agencies could prove very profitable for CollisionSyzygy.

4.2.1 Market Needs

In designing and creating its concept, CollisionSyzygy has focused on what needs are satisfied by the offering of its services to each of its target markets. Here is a brief look at each segment and what CollisionSyzygy offers.

Repair Facilities. Since CollisionSyzygy brokers the insurance company’s claim to a member repair facility, the repair shop benefits from a steady stream of referrals without the need to spend money on its own marketing and advertising program. This increases revenues and profits.

Salvage. To reduce the costs of settling a claim, the insurance company must sell non-repairable vehicles. This is a very specialized marketplace that requires that many potential buyers be identified and the best price accepted. This process must be swiftly conducted in order to further reduce the insurer’s costs of vehicle storage. CSIs network of foreign buyers, salvage companies, private parties, and used parts companies can satisfy this need. Add the Internet as a public auction system, and you deeply magnify the ability of finding a buyer rapidly who will pay the highest possible price.

Insurance Company. The use of CollisionSyzygy offers numerous benefits that cannot be ignored by the insurance company client:

– Pooling of claims to obtain cheapest repair shop pricing.

– Mandatory five percent pricing discount by CollisionSyzygy member repair shops.

– Online, current status management reports on repair progress and claims flow.

– Reduce personnel and equipment costs by outsourcing the claims process.

– More rapid turnover of capital reserves dollars to allow for more insurance policy sales (more revenue dollars).

– More accurate claims estimates can be processed more quickly, reducing the need for costly vehicle storage.

Fleet Leasing, Banks/Lending Institutions, and Vehicle Manufacturers. In addition to many of the benefits mentioned above, these market segments benefit from outsourcing vehicle inspections and repairs on vehicles that are self-insured.

4.2.2 Market Trends

Traditional insurance distribution has generally consisted of either independent or captive agents distributing insurance products and assisting the insurance company in servicing product claims. While this model is still predominant, increasing pressure is changing the direction of the claims processing business. A trend towards outsourcing the process to TPAs is eliminating the extra cost associated with sales commissions and in-house claims processing. Hence, the birth of the Direct Response industry seems very healthy and long lived. It is this latter approach that defines the vision of CollisionSyzygy.

According to A.M. Best and Company, an insurance company directory and ratings service, in 1995, there were over 3,350 property and casualty insurers in the United States. Annual premium collected by these companies is $270 billion. Premiums collection is growing at three percent annually. Approximately 47%, or $126 billion, is written for automobile insurance.

Each year, an average of 11% of automobile and light truck policyholders file claims on 150 million vehicles. In 1994, the insurance industry paid $23.6 billion to repair shop facilities, another $13 billion was paid for total loss claims, and $40 billion was paid for personal injury claims.

In 1996, the costs of the claims administration process were over $12 billion. Claims processing expense and claims payment expense amounted to 78.3 cents of every premium dollar collected by insurers in 1996. At present, the claims outsourcing marketplace is estimated to be $3 billion.

In a world of ever-increasing specialization caused by the need to minimize costs, the industry is positioned to take its fair share of this huge insurance market and the enormous revenue dollars available. In the past, large insurance companies maintained sizeable resources and staff to process claims in-house. It is becoming obvious to the profit and loss statements of most insurance carriers, both large and small, that outsourcing the claims activity can produce greater profits to the bottom line. Yet, the conversion of internal processing departments to outsourcing to direct response companies, like CollisionSyzygy, has only begun. Only 12% of the U.S. auto market is serviced by direct response companies. This is expected to grow to nearly 20% by 2005.

The rapidly changing automobile insurance marketplace is experiencing price constraints as a result of increasing competition and regulatory activity. At the same time, policyholders are demanding ever-higher levels of customer service. Competitive pressures and resistance by policyholders and regulators to premium increases are causing insurance companies to focus on cost management.

The insurance industry’s focus on cost management has been accompanied by an increasing recognition that it is far easier and more cost effective to retain an existing policyholder than to attract a new customer away from a competitor. Dissatisfaction with the claims handling process is cited frequently as a cause of policy non-renewal.

Automobile insurers need to increase consumer satisfaction through a faster, more efficient claims handling procedure. This has led many property and casualty insurers to use third-party administrators to provide certain functions or services that the insurers historically performed in-house. This allows the insurance carrier to focus on core competencies, reduce costs, and avoid the significant investment associated with developing, installing, operating, and maintaining information management and automation systems.

Recent U.S. government legislation has further opened the market by allowing the banking industry to enter the insurance industry for the first time.

Insurance companies selling directly to policyholders are reducing sales commission costs by not having to compensate agents or brokers. This puts pressure on the pricing of policies to consumers, making it harder for insurers who use a sales distribution force to compete. By reducing claims processing costs, those companies using a sales force can compete more effectively with those who use direct sales channels.

In order for smaller insurance companies to compete with larger insurers, they need to achieve economies of scale resulting from large volume. The expense of setting up automated systems, processes, and the hiring and training of specialized personnel to handle claims processing, on a lower volume of claims, is prohibitive. By pooling the claims of many smaller insurance carriers, the third-party administrator can provide the smaller company with the economies of scale to compete with larger insurers.

New market opportunities can be more readily sought by insurers who outsource the infrastructure that would otherwise need to be built internally to support the claims processing of these new markets.

Deregulation has allowed non-traditional, or “virtual” insurance companies to enter the property and casualty (P&C) marketplace. Examples are banks, credit unions, and other financial services companies who are underwriting P&C insurance. These new market entrants generally do not have policy and claims administration infrastructure or expertise in place and are natural candidates for outsourcing. This allows these virtual companies to concentrate resources and existing expertise on the core marketing, underwriting, and other financial aspects of the P&C insurance business.

Risk distribution often requires insurance companies to discontinue selling new policies in a particular market area in which they are over-concentrated. Rather than service this business internally, these policies are often outsourced for administration and claims processing until the concentration of policies diminishes or the book of business is sold to another carrier.

4.2.3 Market Growth

The real future growth of the industry has only begun to occur. Demographics will play a significant role. The baby boomer generation totals approximately 78 million people and is approaching the age of 50. They are the largest single component of demand trickling through to the industry. They are a mature market with sizable disposable income. Traditionally, this group has remained loyal to the larger insurance companies, who use internal claims processing. Examples of these companies are State Farm and Allstate.

The offspring of the baby boomers, the boomlets, are nearly as large a market as the boomers. The future growth of the industry will rely on the boomlets, a higher risk group who are now reaching driving age. They do not remain loyal to the traditional, large insurance carrier model and will channel their business through the medium and small insurance carriers, thus, companies. This generation will shop and bank through the Internet 24 hours per day, 7 days per week. This is where the banking and financial service industry will concentrate its marketing efforts, increasing the need for outsourcing services.

A.M. Best and Company performed a study indicating that the ten largest insured catastrophes occurred since 1989. Hurricane Hugo occurred in 1989, Hurricane Andrew in 1992, and the Northridge earthquake in 1994. Insurance carriers are decreasing their exposure in areas prone to natural disasters. New demand created by insurers leaving markets is absorbed by reinsurers and new market entrants who have not made major infrastructure investments and will not likely wish to do so. Claims outsourcing is very attractive to these new entrants and will enable them, as already mentioned, to enter new markets without incurring substantial fixed infrastructure costs.

4.3 Service Business Analysis

The primary participants in the industry are large national firms involved in information delivery systems to many aspects of business. As such, few can be called “specialists” in the industry. CollisionSyzygy offers only one line of business – generic claims processing. While not the largest firm in the industry, CollisionSyzygy’s focus and concentration will continue to develop its market presence and reputation as the firm that insurance carrier’s will contact when a claim needs to be processed.

Body repair facilities will appreciate the fact that only CollisionSyzygy has a territorial program that preempts the need for marketing efforts (and costs) to acquire business. Not only does this save the costs of marketing, but it increases revenues because marketing time is transferred to body repair time. CSI is the one firm that is unifying the various information reporting “languages” so that claim reporting can be interpreted whether its source is ADP, Mitchell or CCC. Not all of CSI’s steady technological developments have been noticed in the marketplace yet. But, its persistent and disciplined approach to building innovations with substance will make it a market leader in the very near future.

4.3.1 Main Competitors

There are a number of competitors in the industry. Notwithstanding the possibility of future mergers and consolidations, none currently pose a serious threat to CollisionSyzygy. This is because none have mastered all facets of service delivery to the extent CSI has reached.

CCC Information Systems, Inc. is a national organization and provides the biggest threat to the industry due to its service approach to all three insurance company markets and is actively seeking bank entrants and new upstarts. CCC does have a network of certified repair shops. However, unlike CollisionSyzygy who, through its brokerage services provides business directly to its body shops, CCC’s network must spend time and resources to market to the insurance carriers for the business they receive. Furthermore, CCC claim information is limited to the CCC platform. CollisionSyzygy can operate all three information platforms as mentioned earlier.

ADP is also a national firm which specializes primarily in repair estimating systems. Through its Claims Solutions Group, ADP offers automated collision estimating systems, a total loss valuation database, property loss estimating systems, electronic management reports, medical claims review software, and business management systems to the property and casualty insurance, automotive recycling, and collision repair industries.

Crawford & Company is an international provider of third party administrator services, concentrating on traditional claims and appraisal services to the property and casualty industry. Its services include claims management, loss adjustment, health care management, risk management services, class action administration, and risk information services. Crawford & Company is based in Atlanta and has approximately 10,000 employees worldwide, operating over 700 offices in 65 countries. The corporation’s shares are publicly traded on the New York Stock Exchange under the symbols CRD.A and CRD.B.

Gallagher Bassett is another national firm serving primarily as a third-party administrator. Again, they have no program nor a program to deal with salvage.

INSpire Insurance Solutions is another third-party administrator. It does not have a salvage disposal program.

Carstation.com was founded in October, 1998 in San Francisco, California. Thus far, it has focused on parts ordering by its network of body shops. Its primary success has been its ability to raise large sums of capital from investors.

Acar.net (Automotive Care & Repair Network) is a “virtual” provider with a network of body shops. It does not have a program nor is its network even managed by Acar.

Copart is a third-party administrator offering an online salvage auction. Currently, its fees are much higher than CollisionSyzygy’s. Further, where CSI’s sales are nearly instantaneous, Copart’s sales take extra time to clear. Copart Salvage Auto Auctions, founded in 1982, provides vehicle suppliers, primarily insurance companies, with a capability to sell salvage vehicles through auctions, principally to licensed dismantlers, rebuilders, and used vehicle dealers. Salvage vehicles are either damaged vehicles deemed a total loss for insurance or business purposes or are recovered stolen vehicles for which an insurance settlement with the vehicle owner has already been made. Copart generates revenues primarily from auction fees paid by vehicle suppliers and vehicle buyers as well as related fees for services such as towing and storage. Copart currently operates 72 facilities in 35 states. The company is listed on the NASDAQ with the symbol CPRT.

4.3.2 Competition and Buying Patterns

What makes CollisionSyzygy, Inc. so different from its competitors is the scope of its services and the technology used to deliver those

CollisionSyzygy is positioning itself as a leader in the industry by developing and maintaining leading-edge technologies for its services. It offers a value proposition to insurance carriers that is hard for competitors to imitate and utilizes effective marketing methods. The company’s strategy pyramid includes:

1. BODY SHOP NETWORK EXPANSION:

– Territorial Franchises: Body shops licensed in a geographic territory to generate more business.

– Direct Business Referrals: CollisionSyzygy provides body shops with cases to work.

– Quality Standards and Inspections: CollisionSyzygy maintains quality standards for body shops and performs inspections for insurance carriers.

– Proprietary Software: Body shops have access to software for case process management, damage repair estimates, and processing images.

– Marketing Representatives: CollisionSyzygy uses marketing representatives to promote its services.

– Other Marketing Methods: CollisionSyzygy uses direct mail and internet marketing to attract new body shops.

2. ATTRACT INSURANCE COMPANY ACCOUNTS:

– Discount on Repairs: Claims through CollisionSyzygy receive a 5% discount on repairs.

– Reduction in Turnaround Time and Cost Savings: Claim processing time is reduced, providing cost savings for insurance companies.

– Lifetime Repair Warranty: Repairs are warranted for life at all CollisionSyzygy repair shop facilities.

– Improved Communications: CollisionSyzygy’s software allows insurance companies to track the progress of a claim.

– Quality Repairs: CollisionSyzygy repair shops meet stringent requirements for customer satisfaction.

– Other Special Extras: Free estimates, towing, and storage.

– Build National Network: CollisionSyzygy’s national network appeals to insurance carriers across the US.

– Marketing Representatives: CollisionSyzygy uses marketing representatives to promote its services.

3. EASE TO WORK WITH CollisionSyzygy:

– Internet Gateway: CollisionSyzygy is designing a website for easy access to its services.

– Software Technologies: CollisionSyzygy’s software streamlines the claims process.

4. UNIFY INFORMATION REPORTING PLATFORMS:

– Multi-Platform Translator: CollisionSyzygy is creating software to make different data reporting standards compatible.

In terms of the value proposition, CollisionSyzygy creates additional profits for insurance companies by offering lower costs compared to internal processing. It creates a competitive edge through software technologies, open information platforms, internet presence, experience, value-added services, online salvage auctions, quality control, industry recognition, fleet management, and generic direct repair services.

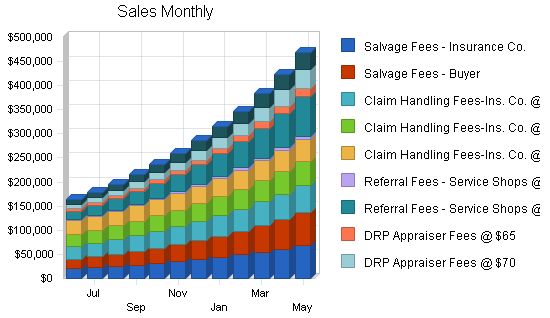

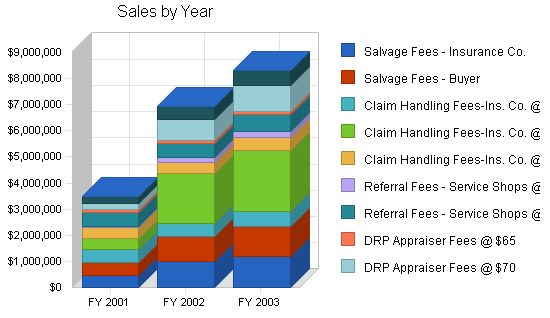

The marketing strategy includes direct mail, internet marketing, account representatives, referrals, magazine advertising, trade shows, and events. Pricing is based on cost savings, while promotion includes direct mail, internet marketing, account representatives, referrals, magazine advertising, trade shows, and events. Sales strategy focuses on the benefits for repair shops and insurance companies, supported by full-time marketing representatives. The sales forecast estimates revenue growth due to the comprehensive array of claim processing services.

Sales Forecast

| Sales Forecast | |||

| FY 2001 | FY 2002 | FY 2003 | |

| Unit Sales | |||

| Salvage Fees – Insurance Co. | 9,540 | 19,540 | 23,448 |

| Salvage Fees – Buyer | 9,540 | 19,540 | 23,448 |

| Claim Handling Fees-Ins. Co. @ $45 | 10,740 | 10,740 | 12,888 |

| Claim Handling Fees-Ins. Co. @ $50 | 8,640 | 38,640 | 46,368 |

| Claim Handling Fees-Ins. Co. @ $70 | 6,180 | 6,180 | 7,416 |

| Referral Fees – Service Shops @ $5 | 8,340 | 38,340 | 46,008 |

| Referral Fees – Service Shops @ $30 | 17,220 | 17,220 | 20,664 |

| DRP Appraiser Fees @ $65 | 1,800 | 1,800 | 2,160 |

| DRP Appraiser Fees @ $70 | 3,552 | 11,552 | 13,862 |

| Dispatch Fees | 49,185 | 99,200 | 119,040 |

| Other | 0 | 0 | 0 |

| Total Unit Sales | 124,737 | 262,752 | 315,302 |

| Unit Prices | FY 2001 | FY 2002 | FY 2003 |

| Salvage Fees – Insurance Co. | $50.00 | $50.00 | $50.00 |

| Salvage Fees – Buyer | $50.00 | $50.00 | $50.00 |

| Claim Handling Fees-Ins. Co. @ $45 | $45.00 | $45.00 | $45.00 |

| Claim Handling Fees-Ins. Co. @ $50 | $50.00 | $50.00 | $50.00 |

| Claim Handling Fees-Ins. Co. @ $70 | $70.00 | $70.00 | $70.00 |

| Referral Fees – Service Shops @ $5 | $5.00 | $5.00 | $5.00 |

| Referral Fees – Service Shops @ $30 | $30.00 | $30.00 | $30.00 |

| DRP Appraiser Fees @ $65 | $65.00 | $65.00 | $65.00 |

| DRP Appraiser Fees @ $70 | $70.00 | $70.00 | $70.00 |

| Dispatch Fees | $5.00 | $5.00 | $5.00 |

| Other | $0.00 | $0.00 | $0.00 |

| Sales | |||

| Salvage Fees – Insurance Co. | $477,016 | $977,000 | $1,172,400 |

| Salvage Fees – Buyer | $477,016 | $977,000 | $1,172,400 |

| Claim Handling Fees-Ins. Co. @ $45 | $483,308 | $483,300 | $579,960 |

| Claim Handling Fees-Ins. Co. @ $50 | $431,983 | $1,932,000 | $2,318,400 |

| Claim Handling Fees-Ins. Co. @ $70 | $432,580 | $432,600 | $519,120 |

| Referral Fees – Service Shops @ $5 | $41,699 | $191,700 | $230,040 |

| Referral Fees – Service Shops @ $30 | $516,588 | $516,600 | $619,920 |

| DRP Appraiser Fees @ $65 | $117,007 | $117,000 | $140,400 |

| DRP Appraiser Fees @ $70 | $248,656 | $808,640 | $970,368 |

| Dispatch Fees | $245,927 | $496,000 | $595,200 |

| Other | $0 | $0 | $0 |

| Total Sales | $3,471,781 | $6,931,840 | $8,318,208 |

| Direct Unit Costs | FY 2001 | FY 2002 | FY 2003 |

| Salvage Fees – Insurance Co. | $7.26 | $7.62 | $8.00 |

| Salvage Fees – Buyer | $7.26 | $7.62 | $8.00 |

| Claim Handling Fees-Ins. Co. @ $45 | $6.53 | $6.86 | $7.20 |

| Claim Handling Fees-Ins. Co. @ $50 | $7.26 | $7.62 | $8.00 |

| Claim Handling Fees-Ins. Co. @ $70 | $10.16 | $10.66 | $11.20 |

| Referral Fees – Service Shops @ $5 | $0.73 | $0.76 | $0.80 |

| Referral Fees – Service Shops @ $30 | $4.35 | $4.57 | $4.80 |

| DRP Appraiser Fees @ $65 | $9.43 | $9.90 | $10.40 |

| DRP Appraiser Fees @ $70 | $10.16 | $10.66 | $11.20 |

| Dispatch Fees | $0.73 | $0.76 | $0.80 |

| Other | $0.00 | $0.00 | $0.00 |

| Direct Cost of Sales | |||

| Salvage Fees – Insurance Co. | $69,215 | $148,851 | $187,553 |

| Salvage Fees – Buyer | $69,215 | $148,851 | $187,553 |

| Claim Handling Fees-Ins. Co. @ $45 | $70,128 | $73,633 | $92,778 |

| Claim Handling Fees-Ins. Co. @ $50 | $62,681 | $294,351 | $370,882 |

| Claim Handling Fees-Ins. Co. @ $70 | $62,768 | $65,909 | $83,045 |

| Referral Fees – Service Shops @ $5 | $6,051 | $29,207 | $36,800 |

| Referral Fees – Service Shops @ $30 | $74,957 | $78,707 | $99,171 |

| DRP Appraiser Fees @ $65 | $16,978 | $17,826 | $22,460 |

| DRP Appraiser Fees @ $70 | $36,080 | $123,201 | $155,233 |

| Dispatch Fees | $35,684 | $75,568 | $95,216 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $503,757 | $1,056,105 | $1,330,692 |

5.6 Strategic Alliances

The primary strategic alliance is the UltraMate and UltraImage software systems provided by Mitchell International. These systems enable quick and accurate creation of repair estimates and transmission of claim data and images to CollisionSyzygy and insurance carriers.

Another key alliance is the body shop network that receives claim assignments from CollisionSyzygy. The growing

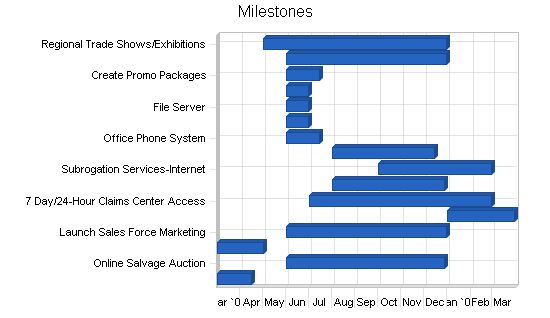

Milestones:

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Internet & E-Commerce Service Platform | 3/1/2000 | 4/15/2000 | $50,000 | William | N/A |

| Online Salvage Auction | 6/1/2000 | 12/28/2000 | $75,000 | William | N/A |

| Compatibile Information Reporting | 3/1/2000 | 5/1/2000 | $50,000 | William | N/A |

| Launch Sales Force Marketing | 6/1/2000 | 12/31/2000 | $125,000 | William | N/A |

| Expand to Commercial Service Offerings | 1/1/2001 | 3/31/2001 | $40,000 | William | N/A |

| 7 Day/24-Hour Claims Center Access | 7/1/2000 | 2/28/2001 | $60,000 | William | N/A |

| Rental Management Services-Internet | 8/1/2000 | 12/28/2000 | $50,000 | William | N/A |

| Subrogation Services-Internet | 10/1/2000 | 2/28/2001 | $75,000 | William | N/A |

| Attend NACE Trade Show | 8/1/2000 | 12/15/2000 | $150,000 | William | N/A |

| Office Phone System | 6/1/2000 | 7/15/2000 | $15,000 | Karen | N/A |

| Computers & Office Furniture | 6/1/2000 | 6/30/2000 | $25,000 | William/Karen | N/A |

| File Server | 6/1/2000 | 6/30/2000 | $50,000 | William | N/A |

| ISP Connections (12) | 6/1/2000 | 6/30/2000 | $12,000 | IS Mgr. | N/A |

| Create Promo Packages | 6/1/2000 | 7/15/2000 | $97,500 | Karen | N/A |

| Operating Expense Float – 6 months | 6/1/2000 | 12/31/2000 | $951,204 | N/A | N/A |

| Regional Trade Shows/Exhibitions | 5/1/2000 | 12/31/2000 | $125,000 | William/Karen | N/A |

| Totals | $1,950,704 | ||||

Management Summary:

William Smith, the founder and president of CollisionSyzygy, is expanding the company and hiring the necessary positions to achieve the listed milestones. Karen Zabo, with a background in banking management, will be the vice president responsible for administration and marketing. Harry Bannister, with trade skills and management experience in collision repair, will be the vice president of Operations.

Personnel Plan:

The table below shows the estimated personnel costs from June 1, 2000, to May 31, 2002.

| Personnel Plan | |||

| FY 2001 | FY 2002 | FY 2003 | |

| President | $120,000 | $144,000 | $172,800 |

| Vice-President Operations | $85,000 | $97,750 | $112,413 |

| Vice-President Administration | $85,000 | $97,750 | $112,413 |

| IS Manager | $85,000 | $97,750 | $112,413 |

| CFO | $41,665 | $115,000 | $132,250 |

| COO | $41,665 | $115,000 | $132,250 |

| Software Developers (2) | $150,000 | $172,500 | $198,375 |

| Staff Appraisers (Total) | $320,004 | $640,000 | $736,000 |

| Customer Service Rep’s (Total) | $162,000 | $324,000 | $372,600 |

| Marketing Rep’s (Total) | $99,996 | $250,000 | $287,500 |

| Marketing Rep 10% x Net Income Bonus | $136,560 | $196,200 | $225,630 |

| Operations Manager | $35,415 | $97,750 | $112,413 |

| Administrative Manager | $31,250 | $86,250 | $99,188 |

| Total People | 24 | 43 | 43 |

| Total Payroll | $1,393,555 | $2,433,950 | $2,806,243 |

The Financial Plan assumes an equity investment into CollisionSyzygy and includes capital investments for the addition of key personnel. The total capital and operating expenses needed for key promotional programs and travel expenses is approximately $444,500.

With these investments, CollisionSyzygy expects significant sales growth. Sales are projected to increase from May 31, 2001, to June 30, 2003, with net profits after taxes ranging from May 31, 2001, to May 31, 2003.

Important Assumptions:

The calculations in this business plan are based on key assumptions summarized in the table below:

| General Assumptions | |||

| FY 2001 | FY 2002 | FY 2003 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 12.00% | 12.00% | 12.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 35.00% | 35.00% | 35.00% |

| Other | 0 | 0 | 0 |

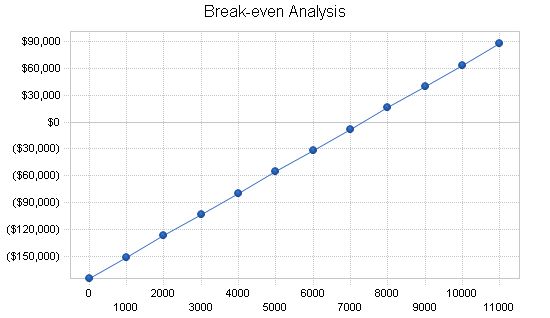

Break-even Analysis:

By using the estimated average monthly fixed expenses, average per-unit revenue, and average variable costs, CollisionSyzygy determined the sales level needed per month to break even. The management expects to reach the break-even sales volume by the fourth month of operations.

Break-even Analysis:

Monthly Units Break-even: 7,335

Monthly Revenue Break-even: $204,148

Assumptions:

Average Per-Unit Revenue: $27.83

Average Per-Unit Variable Cost: $4.04

Estimated Monthly Fixed Cost: $174,526

Projected Profit and Loss:

June and July, 2000 are expected to result in slight losses as CollisionSyzygy uses venture equity to retool its operation for higher sales generation. A net after-tax loss for June, 2000 is estimated, with monthly after-tax profits by May 31, 2001. A jump in personnel costs, expected in January, 2001 as new CFO and COO additions are made, reduces profits from the prior month, December, 2000.

By May 31, 2002, after-tax profits for the year should climb to nearly (yippie) on gross margin (sales after Cost of Sales) of (whoa Nellie!). After-tax profit margin should be approximately (green w/envy)%.

By May 31, 2003, after-tax profits for the year should reach (yowzah!) on gross margin of (huzzah-huzzah). An after-tax profit margin of (O-M-G)% is expected.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| FY 2001 | FY 2002 | FY 2003 | |

| Sales | $3,471,781 | $6,931,840 | $8,318,208 |

| Direct Cost of Sales | $503,757 | $1,056,105 | $1,330,692 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $503,757 | $1,056,105 | $1,330,692 |

| Gross Margin | $2,968,024 | $5,875,735 | $6,987,516 |

| Gross Margin % | 85.49% | 84.76% | 84.00% |

| Expenses | |||

| Payroll | $1,393,555 | $2,433,950 | $2,806,243 |

| Sales and Marketing and Other Expenses | $444,500 | $466,725 | $490,061 |

| Depreciation | $26,904 | $26,904 | $26,904 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $12,000 | $12,600 | $13,230 |

| Insurance | $24,000 | $25,200 | $26,460 |

| Rent | $54,000 | $56,700 | $59,535 |

| Payroll Taxes | $139,356 | $243,395 | $280,624 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $2,094,315 | $3,265,474 | $3,703,058 |

| Profit Before Interest and Taxes | $873,709 | $2,610,261 | $3,284,459 |

| EBITDA | $900,613 | $2,637,165 | $3,311,363 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $305,798 | $913,591 | $1,149,561 |

| Net Profit | $567,911 | $1,696,670 | $2,134,898 |

| Net Profit/Sales | 16.36% | 24.48% | 25.67% |

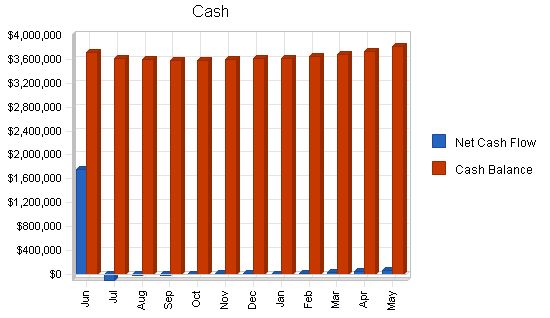

7.4 Projected Cash Flow

After July 2000, cash flow from operations continues to trend upward and results in a positive cash balance for the period ending May 31, 2001. The following chart illustrates monthly cash flows from June 2000 to May 31, 2001. The Pro Forma Cash Flow table shows that CollisionSyzygy can have a cash balance twice the size of the net capital injection.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| FY 2001 | FY 2002 | FY 2003 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $69,436 | $138,637 | $166,364 |

| Cash from Receivables | $2,671,342 | $5,934,512 | $7,807,786 |

| Subtotal Cash from Operations | $2,740,778 | $6,073,149 | $7,974,150 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $2,000,000 | $0 | $0 |

| Subtotal Cash Received | $4,740,778 | $6,073,149 | $7,974,150 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $1,393,555 | $2,433,950 | $2,806,243 |

| Bill Payments | $1,362,952 | $2,738,301 | $3,302,833 |

| Subtotal Spent on Operations | $2,756,507 | $5,172,251 | $6,109,076 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $134,500 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,891,007 | $5,172,251 | $6,109,076 |

| Net Cash Flow | $1,849,771 | $900,898 | $1,865,074 |

| Cash Balance | $3,811,099 | $4,711,998 | $6,577,071 |

7.5 Projected Balance Sheet

The following Balance sheet shows the year-end values for 2001 through 2003. It reflects the capital contribution and reduction of a shareholder loan from Mr. Smith.

| Pro Forma Balance Sheet | |||

| FY 2001 | FY 2002 | FY 2003 | |

| Assets | |||

| Cash | $3,811,099 | $4,711,998 | $6,577,071 |

| Accounts Receivable | $861,600 | $1,720,291 | $2,064,349 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $4,672,699 | $6,432,289 | $8,641,421 |

| Long-term Assets | |||

| Long-term Assets | $326,791 | $326,791 | $326,791 |

| Accumulated Depreciation | $67,568 | $94,472 | $121,376 |

| Total Long-term Assets | $259,223 | $232,319 | $205,415 |

| Total Assets | $4,931,922 | $6,664,608 | $8,846,836 |

| Liabilities and Capital | |||

| Current Liabilities | |||

| Accounts Payable | $192,010 | $228,026 | $275,356 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $192,010 | $228,026 | $275,356 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $192,010 | $228,026 | $275,356 |

| Paid-in Capital | $3,907,335 | $3,907,335 | $3,907,335 |

| Retained Earnings | $264,666 | $832,577 | $2,529,247 |

| Earnings | $567,911 | $1,696,670 | $2,134,898 |

| Total Capital | $4,739,912 | $6,436,582 | $8,571,480 |

| Total Liabilities and Capital | $4,931,922 | $6,664,608 | $8,846,836 |

| Net Worth | $4,739,912 | $6,436,582 | $8,571,480 |

7.6 Business Ratios

CollisionSyzygy is virtually debt-free and more resistant to economic downturns.

Profitability ratios indicate strong after-tax profit margins from May 31, 2001 to May 31, 2003. Return on equity (ROE) is also very strong during that period.

Activity ratios indicate that asset turnover should be 1.27 for the first year, and sales on credit should average approximately 16 times the average accounts receivable balance.

Liquidity of the firm’s cash position is excellent. The current ratio indicates that CollisionSyzygy has enough short-term assets to cover each dollar of short-term debt. Even after subtracting expected accounts receivable, the firm still has ample funds available for each dollar of short-term debt.

Net working capital reflects the cash investment.

The following table summarizes the financial health of CollisionSyzygy, with industry profile ratios provided for comparison.

Ratio Analysis

| Ratio Analysis | ||||

| FY 2001 | FY 2002 | FY 2003 | Industry Profile | |

| Sales Growth | 106.02% | 99.66% | 20.00% | 2.40% |

| Percent of Total Assets | ||||

| Accounts Receivable | 17.47% | 25.81% | 23.33% | 26.30% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 64.30% |

| Total Current Assets | 94.74% | 96.51% | 97.68% | 90.60% |

| Long-term Assets | 5.26% | 3.49% | 2.32% | 9.40% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 3.89% | 3.42% | 3.11% | 48.20% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 9.50% |

| Total Liabilities | 3.89% | 3.42% | 3.11% | 57.70% |

| Net Worth | 96.11% | 96.58% | 96.89% | 42.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 85.49% | 84.76% | 84.00% | 100.00% |

| Selling, General & Administrative Expenses | 69.13% | 60.29% | 58.34% | 60.10% |

| Advertising Expenses | 10.73% | 5.64% | 4.94% | 1.70% |

| Profit Before Interest and Taxes | 25.17% | 37.66% | 39.49% | 5.20% |

| Main Ratios | ||||

| Current | 24.34 | 28.21 | 31.38 | 1.66 |

| Quick | 24.34 | 28.21 | 31.38 | 1.45 |

| Total Debt to Total Assets | 3.89% | 3.42% | 3.11% | 57.70% |

| Pre-tax Return on Net Worth | 18.43% | 40.55% | 38.32% | 5.80% |

| Pre-tax Return on Assets | 17.72% | 39.17% | 37.13% | 13.70% |

| Additional Ratios | FY 2001 | FY 2002 | FY 2003 | |

| Net Profit Margin | 16.36% | 24.48% | 25.67% | n.a |

| Return on Equity | 11.98% | 26.36% | 24.91% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.95 | 3.95 | 3.95 | n.a |

| Collection Days | 56 | 69 | 85 | n.a |

| Accounts Payable Turnover | 7.73 | 12.17 | 12.17 | n.a |

| Payment Days | 28 | 28 | 27 | n.a |

| Total Asset Turnover | 0.70 | 1.04 | 0.94 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.04 | 0.04Sales Forecast

Unit Sales Salvage Fees – Insurance Co. 0% 400 447 500 559 625 699 782 874 977 1,092 1,221 1,364 Salvage Fees – Buyer 0% 400 447 500 559 625 699 782 874 977 1,092 1,221 1,364 Claim Handling Fees-Ins. Co. @ $45 0% 600 642 687 735 787 842 901 964 1,032 1,104 1,181 1,265 Claim Handling Fees-Ins. Co. @ $50 0% 500 532 566 602 641 682 726 772 822 875 931 990 Claim Handling Fees-Ins. Co. @ $70 0% 400 418 437 456 477 498 520 544 568 593 619 650 Referral Fees – Service Shops @ $5 0% 300 343 392 448 512 586 669 765 875 1,000 1,144 1,306 Referral Fees – Service Shops @ $30 0% 600 689 791 908 1,043 1,198 1,376 1,580 1,814 2,083 2,392 2,746 DRP Appraiser Fees @ $65 0% 75 84 94 105 118 132 147 165 185 206 231 259 DRP Appraiser Fees @ $70 0% 125 143 164 188 216 248 284 326 374 429 491 563 Dispatch Fees 0% 2,000 2,246 2,523 2,833 3,182 3,574 4,014 4,508 5,063 5,686 6,386 7,172 Other 0% 0 0 0 0 0 0 0 0 0 0 0 0 Total Unit Sales 5,400 5,992 6,654 7,396 8,226 9,157 10,200 11,371 12,685 14,160 15,817 17,680 Unit Prices Salvage Fees – Insurance Co. $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 Salvage Fees – Buyer $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 Claim Handling Fees-Ins. Co. @ $45 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 $45.00 Claim Handling Fees-Ins. Co. @ $50 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 Claim Handling Fees-Ins. Co. @ $70 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 Referral Fees – Service Shops @ $5 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 $5.00 Referral Fees – Service Shops @ $30 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 $30.00 DRP Appraiser Fees @ $65 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 $65.00 DRP Appraiser Fees @ $70 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 $70.00 Personnel Plan |

||

| Personnel Plan | |||||||||||||

| Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | ||

| President | 0% | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Vice-President Operations | 0% | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,084 | $7,084 | $7,084 | $7,084 |

| Vice-President Administration | 0% | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,084 | $7,084 | $7,084 | $7,084 |

| IS Manager | 0% | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 | $7,084 | $7,084 | $7,084 | $7,084 |

| CFO | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 |

| COO | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 |

| Software Developers (2) | 0% | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 | $12,500 |

| Staff Appraisers (Total) | 0% | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 | $26,667 |

| Customer Service Rep’s (Total) | 0% | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 | $13,500 |

| Marketing Rep’s (Total) | 0% | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 | $8,333 |

| Marketing Rep 10% x Net Income Bonus | 0% | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 | $11,380 |

| Operations Manager | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $7,083 | $7,083 | $7,083 | $7,083 | $7,083 |

| Administrative Manager | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $6,250 | $6,250 | $6,250 | $6,250 | $6,250 |

| Total People | 22 | 22 | 22 | 22 | 22 | 22 | 22 | 24 | 24 | 24 | 24 | 24 | |

| Total Payroll | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $133,628 | $133,631 | $133,631 | $133,631 | $133,631 | |

General Assumptions

| General Assumptions | |||||||||||||

| Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | 12.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | 35.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||||||||||||

| Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | ||

| Sales | $163,125 | $178,578 | $195,716 | $214,741 | $235,880 | $259,391 | $285,562 | $314,720 | $347,234 | $383,519 | $423,941 | $469,374 | |

| Direct Cost of Sales | $23,670 | $25,912 | $28,398 | $31,159 | $34,226 | $37,638 | $41,435 | $45,666 | $50,384 | $55,649 | $61,514 | $68,106 | |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |||

| Pro Forma Cash Flow | |||||||||||||

| Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $3,263 | $3,572 | $3,914 | $4,295 | $4,718 | $5,188 | $5,711 | $6,294 | $6,945 | $7,670 | $8,479 | $9,387 | |

| Cash from Receivables | $65,299 | $70,627 | $160,367 | $175,566 | $192,423 | $211,137 | $231,931 | $255,058 | $280,803 | $309,488 | $341,474 | $377,170 | |

| Subtotal Cash from Operations | $68,561 | $74,199 | $164,282 | $179,861 | $197,141 | $216,324 | $237,642 | $261,352 | $287,748 | $317,158 | $349,953 | $386,557 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $2,000,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $2,068,561 | $74,199 | $164,282 | $179,861 | $197,141 | $216,324 | $237,642 | $261,352 | $287,748 | $317,158 | $349,953 | $386,557 | |

| Expenditures | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $103,629 | $133,628 | $133,631 | $133,631 | $133,631 | $133,631 | |

| Bill Payments | $73,921 | $71,341 | $78,232 | $85,875 | $94,359 | $103,787 | $114,272 | $125,660 | $130,400 | $144,901 | $161,085 | $179,118 | |

| Subtotal Spent on Operations | $177,550 | $174,970 | $181,861 | $189,504 | $197,988 | $207,416 | $217,901 | $259,288 | $264,031 | $278,532 | $294,716 | $312,749 | |

| Additional Cash Spent | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!