Contents

Sports Equipment Cafe Business Plan

Introduction

The Boulder Stop is a coffee shop and rock climbing gear store located near one of the Pacific Northwest’s premier climbing spots. Our strategy is to develop The Boulder Stop as a rock climbing cultural center for regulars and visitors to Smith Rock, Oregon.

This business plan lays the foundations of the company’s vision, philosophy, and strategy to the firm’s principal investors and debtors to create a coherent system of sustainable customer satisfaction and profits.

The Company

The store is located one mile from Smith Rock State Park in the Central Oregon desert. It is conveniently located in an area frequented by national and international tourists.

We expect expertise and enthusiasm from our employees and will compensate them accordingly. All employees are hired for their expertise and enthusiasm and will be paid well above the minimum wage to facilitate low-turnover and long-term loyalty. The company plans to hire two part-time employees as espresso servers/gear experts.

Sourcing is critical for any retail operation. The Espresso Harvest will be our coffee vendors and will handle in-store merchandising for their line of coffee products. The sport and recreation inventory will be sourced directly from manufacturers like Black Diamond, Boreal, and Petzl.

Luke Walsh, a graduate from the University of Oregon with a Business Management degree, will be the general manager and founder of The Boulder Stop. Luke’s success as a Nordstrom employee combined with his formal business training makes him an ideal community leader and business owner.

The Market

Consumer expenditures for rock climbing equipment rose to $4,000,000 in Central Oregon last year. We expect sales to increase as Oregon’s population grows and the rock climbing industry becomes more popular.

The presence of several large universities in Western Oregon is expected to fuel our business, as does the status of Smith Rock as an international destination for rock climbing enthusiasts. Individuals from Japan, Europe, South America, and Australia seek out Smith Rock as a beautiful and challenging sport and rock climbing destination. We count worldwide readers of publications such as Rock & Ice magazine and Outdoor Adventure among our target audience.

There are three major trends in our market:

- Outdoor sports, particularly rock climbing, are gaining exposure.

- Central Oregon is becoming a major vacation destination and recreation spot.

- The gourmet coffee trend started in the Northwest and is spreading quickly throughout the nation.

Two important underlying market needs are a highly professional provider of climbing gear and a social meeting place/refreshment provider near the Smith Rock location. The Boulder Stop mimics the positioning of a ski lodge; selling gear while providing a place for coffee, snacks, and talk.

The Boulder Stop has several advantages over its leading competitor, including newer inventory and modern interior fixtures, a wider market appeal, and the coffee/espresso concept.

We will use advertising and sales programs to reach customers through four-color brochures, half-page newspaper advertisements in Oregon regional newspapers, and web promotions.

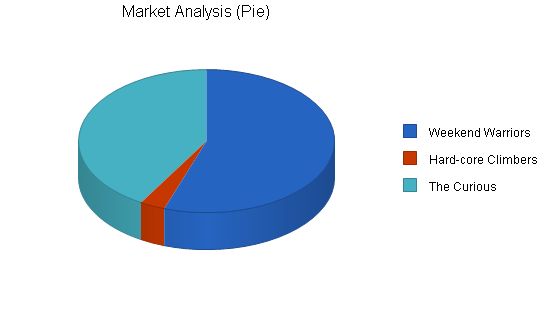

Our three main target markets are weekend warriors, hard-core climbers, and the curious. We predict that the number of hard-core climbers will grow faster than the number of weekend warriors.

Financial Projections

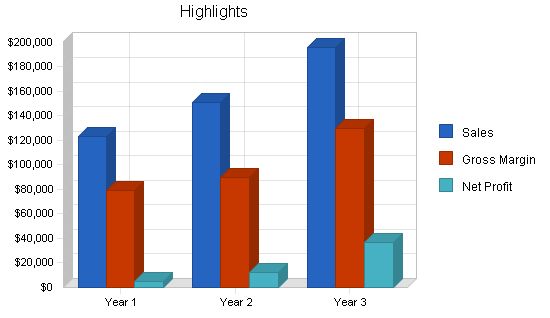

The Boulder Stop expects to earn modest profits by year three based on projected sales. These projections are based on the following assumptions:

- Growth will be moderate, and cash balance always positive.

- Marketing will remain at or below 15% of sales.

- Residual profits will be invested in company expansion and personnel.

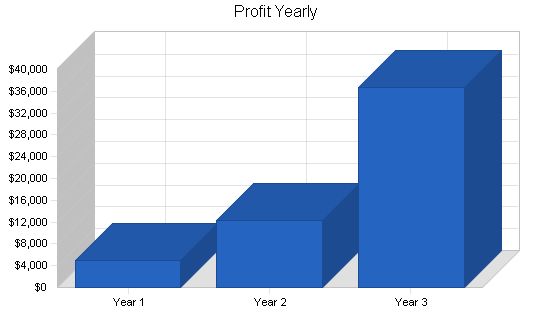

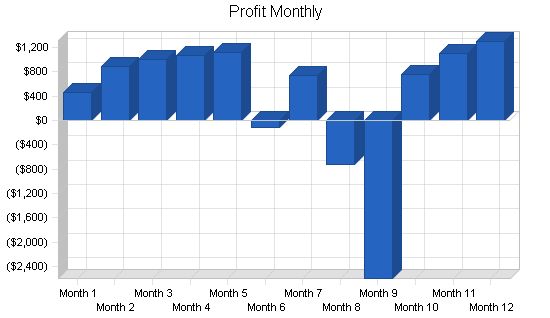

We predict advertising costs and consulting costs will increase in the next three years. This will give The Boulder Stop an acceptable profit-to-sales ratio by Year 3. Normally, a start-up concern will operate with negative profits through the first two years. We expect to avoid that kind of operating loss through understanding our competitors, target markets, industry direction, and the products we sell.

1.1 Objectives

- The Boulder Stop aims to become a local favorite for tourists, hikers, and climbers traveling to or from Smith Rock.

- Our goal is to achieve the largest market share in the region for appeals gear, based on State of Oregon economic data.

- We strive to be an active and vocal member of the community, reinvesting in it through sponsorship of various events and activities.

- We aim to achieve a conservatively projected gross margin within the first year.

- By year two, our objective is to achieve a net profit and reinvest these profits in our business as well as the community’s future.

1.2 Mission

The Boulder Stop is a cafe and equipment store that specializes in premium appeals gear and coffee/espresso drinks. Our belief is that appeals should be both safe and fun, providing climbers with the latest gear, snacks, and caffeine they need.

Our goal is to be the hub for rock climbers living in and visiting Central Oregon. Located near Smith Rock State Park, one of the world’s top rock climbing parks, our vibrant and popular shop attracts locals and tourists alike. Our multilingual staff, fluent in Spanish, German, and French, adds to the appeal of our shop. People will long for the unique experience we offer, encompassing our staff, setting, gear, and coffee.

Our mission extends beyond profitability; we are committed to making a positive impact on people’s lives. We host community events that bring out the best in individuals.

We strive to become the go-to destination in the region for all things related to rock climbers gear, safety, rules, and events. Our level of commitment determines the future of rock climbers in Central Oregon.

1.3 Keys to Success

To succeed in this business, we must:

- Offer products that are highly reliable and of exceptional quality, including all premium brands of climbing equipment and gear.

- Provide promotions and loss leaders that attract customers to our store, allowing them to explore our services and sign up for future events.

- Ensure 100% customer and vendor satisfaction by implementing a comprehensive customer care plan to manage complaints, handle feedback, maintain supplier accounts, and predict potential conflicts.

- Be actively involved in the community by hosting sport climbing events and other activities.

- Negotiate valuable contracts with top distributors to establish a cost structure that supports a high-margin business plan.

Company Summary

The Boulder Stop is a premier coffee and gear provider located one mile from Smith Rock State Park in Central Oregon.

The company, privately held and managed by Luke Walsh, has established a central office at 1455 Portland St., Bend, OR 97701, for purchasing, storage, and contract negotiations. Service purchases and all PO authorizations will be approved at this office.

2.1 Company Ownership

The Boulder Stop is an S Corporation owned by Luke Walsh (60%) and his wife Lisa (40%). There are plans to re-establish the company as a "C" corporation in the future if exponential growth occurs. The company operates under the jurisdiction of the State of Oregon and the United States of America.

At present, the owners intend to benefit from the single taxation advantage of an S corporation.

2.2 Start-up Summary

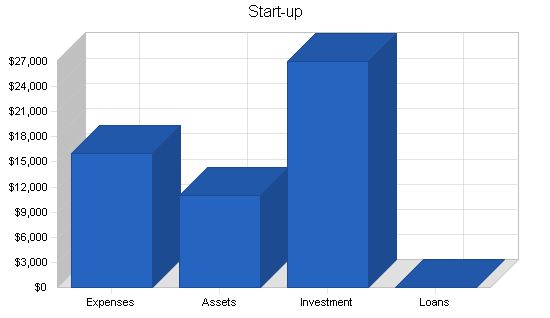

The start-up costs include incorporation expenses, fees for a marketing consultant, and a lawyer to handle any potential conflicts with local government regulations.

Other normal business costs will include liability insurance, rent, interior design expenses, and opening day promotions.

The largest equipment purchase will be a Conti brand commercial espresso machine named "The TwinStar," renowned for its quality and performance. The machine comes with an 18-month parts warranty and a 12-month labor warranty. The company will begin with a two-month inventory on-hand, and the majority of company assets will be in inventory. The starting cash balance will be $3,000.

The purpose of this business plan is to secure an SBA loan, which is listed in the long-term liability section of the attached Start-up Funding table.

Start-up Requirements:

– Legal: $300

– Marketing Consultant: $4,500

– Business and Liability Insurance: $600

– Rent-1st Month + Deposit: $2,500

– Design Cost: $3,500

– First Week Promotion: $1,100

– Expensed Equipment: $3,500

– Total Start-up Expenses: $16,000

Start-up Assets:

– Cash Required: $3,000

– Start-up Inventory: $7,000

– Other Current Assets: $1,000

– Long-term Assets: $0

– Total Assets: $11,000

Total Requirements: $27,000

Start-up Funding:

– Start-up Expenses to Fund: $16,000

– Start-up Assets to Fund: $11,000

– Total Funding Required: $27,000

Assets:

– Non-cash Assets from Start-up: $8,000

– Cash Requirements from Start-up: $3,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $3,000

– Total Assets: $11,000

Liabilities and Capital:

– Liabilities

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital

– Planned Investment

– Owner: $0

– Investor: $0

– Additional Investment Requirement: $27,000

– Total Planned Investment: $27,000

– Loss at Start-up (Start-up Expenses): ($16,000)

– Total Capital: $11,000

– Total Capital and Liabilities: $11,000

– Total Funding: $27,000

Company Locations and Facilities:

The company office is located in the owner’s residence, 1455 Portland St., Bend, OR 97701. The office is about 1,000 square feet and has ample space for the first three years of growth. Deliveries and shipments are serviced through the store located at 432 Smith Rock Drive, Redmond, OR 97756. The 5,000 square foot retail building is owned by The Boulder Stop and there is no excess storage capacity.

Products:

Espresso is the big money maker for The Boulder Stop, with coffee peripherals coming in a close second. The sport climbing gear is a long-term sales project that will rely on future catalog and “word-of-mouth” sales to achieve a positive ROI. The Boulder Stop sells high-quality sport climbing gear to serious climbers. The gear is checked by knowledgeable employees who use and recommend equipment to customers and management. The gear is purchased from well-known manufacturers like Black Diamond, Boreal, and Petzl. Management will rely on employees and customers to shorten the feedback loop in product and service offerings. Climbing gear is delivered every Thursday via UPS. Straight espresso bean rebuys arrive on Mondays and Thursdays, ensuring the freshest beans possible. Modified rebuys begin on the first of each month. The owner will oversee all purchases, shipments, and deliveries.

Product Description:

The Boulder Stop sells the entire raft of coffee drinks: lattes, mochas, cappuccino, espresso, and a delicious house blend. The coffee and espresso beans are freshly roasted by Espresso Harvest. Our team of two part-time high school students will create the beverages for customers. They will be trained in “The Art of Making the Proper Espresso Beverage” at Espresso Harvest, which hosts such classes once a month. The Boulder Stop also sells carabiners, friends, nuts, ropes, webbing, shoes, and harnesses; our product mix is sufficient to satisfy even the most hard-core enthusiast. All products are quality checked when they arrive and quality checked before the customer takes them home.

Competitive Comparison:

The Boulder Stop has several advantages over its leading competitor.

1. Newer inventory and more modern interior fixtures.

2. Espresso drinks are made available to consumers while they shop, increasing marketing message impact. Our competitor offers the shopping experience that lacks the thrill of being able to sit down with friends, munch on a cookie, drink espresso, and “talk shop”.

3. The Boulder Stop is a fun, spacious store catering to both the climbing Pros and the inexperienced. Our competitor, Rockage, is an exclusive Pro shop that discourages some newcomers to the sport. Our positioning encourages those just getting started, a one-stop destination for equipment advice and purchasing opportunities, technique and safety instruction, and conversation with other enthusiasts.

4. We expect a high degree of expertise and enthusiasm from our employees and we compensate them accordingly. All employees are hired for their expertise and enthusiasm and will be paid at a rate well above the minimum wage to facilitate low-turnover and long-term loyalty.

Sales Literature:

The Boulder Stop will use advertising and sales programs to get the word out to customers.

– 2000 four-color brochures to be distributed throughout Bend-area facilities: outdoor clothing shops, hotels, ranger stations, chambers of commerce, tourism offices, eateries, and other tourist-frequented spots one month before May grand opening.

– Half-page newspaper advertisements in Oregon regional newspapers, advertising the following sales promotion: introductory rock-climbing classes, two days for $100 per person. Copy: magazine and newspaper advertisements.

– Web promotions: We will administer a website at www.boulder-stop.com. This website will present promotional material such as new marketing programs, product white papers, and contests. The site will allow for immediate purchase of gear online and will use a secure server to process transactions through Cybercash.

Future Products:

Future expansion may allow for a horizontal increase of our product line by offering additional product categories: water sport gear, camping gear, and mountain biking accessories. We won’t rule out the possibility of vertically integrating through our own line of climbing gear and/or espresso. We will also explore new services such as gear storage lockers, cellular phone rentals, and same day guide services. One dream the owner has is to develop an Internet environment within the store, not to remove people from those surrounding them, but to help them stay in touch with friends, family, and the latest information about rock climbing.

Sourcing:

Sourcing is critical for any enterprise, especially a retail operation. The Espresso Harvest will be our coffee vendors, and will handle many in-store merchandising issues for their line of coffee products. Operational supplies for the coffee bar will be purchased from the regional supply wholesaler, who will handle special merchandising issues, such as point-of-sale materials. The sport and recreation inventory will be sourced directly from manufacturers like Black Diamond, Boreal, and Petzl. We will solidify relationships with vendors to achieve decreased cost-of-goods. Advertising costs are outsourced to [Omitted]. Most sales promotion and public relations work is handled in-house. Future seminars and climbing clinics will be handled by the owner or certified and experienced tour and adventure professionals. We will use local contacts to research the availability of celebrity climbers to sponsor some of these clinics and events.

Technology:

We use off-the-shelf, PC-based software for accounting purposes, including AR/AP, inventory, purchasing, sales, and returns. Our business plan is generated on an annual basis using Business Plan Pro from Palo Alto Software, and reviewed quarterly for evaluation. Further functionality is provided by Palo Alto Software’s companion package, Marketing Plan Pro, which allows us to make the most use of our marketing dollars by focusing our communications on target markets and enhancing our marketing knowledge. We are in the process of implementing a website for The Boulder Stop.

Market Analysis Summary:

Consumer expenditures for sport climbing equipment rose to $4,000,000 in Central Oregon in 1997. We expect sales to increase steadily as Oregon’s population grows and the rock-climbing industry becomes increasingly popular. The Western Oregon presence of several large universities helps fuel our business, as does the status of Smith Rock as an international destination spot for sport climbing enthusiasts. Our three main target markets are Weekend warriors, Hard-core climbers, and The curious. We predict that the number of Hard-core climbers will grow faster than the number of Weekend warriors. Climbing is becoming more and more technical, an “Insider’s sport” and we believe this will fuel the growth of dedicated, highly sophisticated climbers. This market analysis is somewhat conservative when compared with Oregon’s predicted population growth of 2% per year and Bend’s 5% average gains over the last five years.

Market Segmentation:

– The weekend warriors purchase during weekends. When these climbers are on a rock wall, they want to look COOL. They want to hang out with their friends at Smith Rock and enjoy a nice pre-climb or post-climb espresso drink or ice cream cone. Weekend warriors pack special events with family members and friends. This market is our target for special events and climbing services such as tours and fun climbs.

– Hard-core climbers are very fickle about the gear they use. This segment is very brand loyal and provides the company with powerful word-of-mouth marketing. They are highly sophisticated climbers who know the jargon and want to let everyone know they are serious about the sport and its image.

– The Curious want to stop in for a gander on their way to their campsites or hotel rooms. They may be into hiking Smith Rock State Park or just taking a driving tour. They may be travelers or locals, depending upon the season and the event.

Market Analysis

Weekend Warriors – 2% growth

Year 1: 40,000

Year 2: 40,800

Year 3: 41,616

Year 4: 42,448

Year 5: 43,297

Hard-core Climbers – 2% growth

Year 1: 2,300

Year 2: 2,346

Year 3: 2,393

Year 4: 2,441

Year 5: 2,490

The Curious – 2% growth

Year 1: 30,000

Year 2: 30,600

Year 3: 31,212

Year 4: 31,836

Year 5: 32,473

Total – 2% growth

Year 1: 72,300

Year 2: 73,746

Year 3: 75,221

Year 4: 76,725

Year 5: 78,260

4.2 Target Market Segment Strategy

Focus on Hard-core climber as opinion leaders. Weekend warriors and The Curious will follow. Carry high-tech gear, know the jargon, use the latest technology, and become a “Futurist” product and services company.

Differentiate Weekend warriors from Hard-core climbers. Weekend warriors hike or explore, respect Hard-core climbers but don’t want to be classified as having “Rock on the brain.” 20-30% respond to family events, 70-80% climb with friends and occasionally compete. Market them with amateur climbing events and family fun climbs.

4.2.1 Market Trends

Three major trends in our market:

– Outdoor sports, including rock climbing, gaining exposure.

– Central Oregon becoming a major vacation destination and recreation spot.

– Gourmet coffee trend growing, with people seeing it as a way to enjoy a moment and be part of an outing or activity.

4.2.2 Market Growth

– Vacation spending in Oregon growing over 25% per year.

– Climbing spending growing faster than skiing or mountain biking, with 130% growth expected over next three years.

– Coffee spending up 15% this year.

4.2.3 Market Needs

Two important needs:

– Professional provider of climbing gear near Smith Rock location.

– Coffee, meeting place, and conversation.

Rock-climbing industry expanding rapidly. Climbing gear priced at premium, but provides adventurous and safe climbs.

High profit margins in espresso industry due to high coffee sales and low overhead costs. Coffee and espresso retail outlets expanding rapidly in last five years.

4.3.1 Competition and Buying Patterns

Climbers demand knowledgeable employees and convenient location.

– Comparison: [Omitted] and [Omitted] use location strategies to draw in customers.

– Brand name products sell well in stores with good selection, location, and knowledgeable employees.

– No espresso shops near The Boulder Stop.

4.3.2 Main Competitors

Nearest competitor: [Omitted]. Next closest: [Omitted]. Neither offers espresso to customers.

– [Omitted] sells limited gear and ice cream. Strength: complementary products. Weakness: limited store space.

– [Omitted] is toughest competitor, experienced staff, carry same gear.

4.3.3 Industry Participants

Sport climbing gear industry is young. Small, community-oriented stores. Bigger players like [omitted] serve larger community, but only largest stores combine espresso shop with shopping experience.

In espresso market, big name retailers like [omitted] and [omitted]. Local consumers move to businesses that differentiate from national model.

4.3.4 Distribution Patterns

Traditional distribution channels followed. Products bought from wholesalers, who have little say in marketing beyond occasional sales promotion. Low marketing and product costs, high profit margins.

Customers brand-oriented and affect distribution patterns on retail end. Increasingly buying directly from manufacturer. The Boulder Stop has website and direct distribution model. Build on strengths of location.

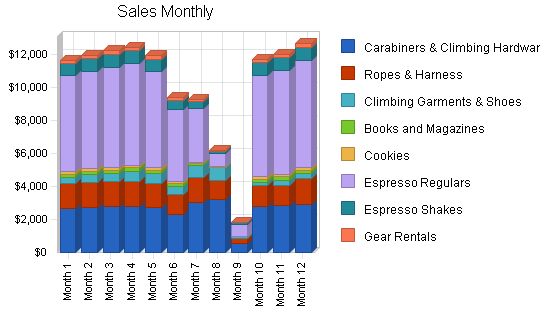

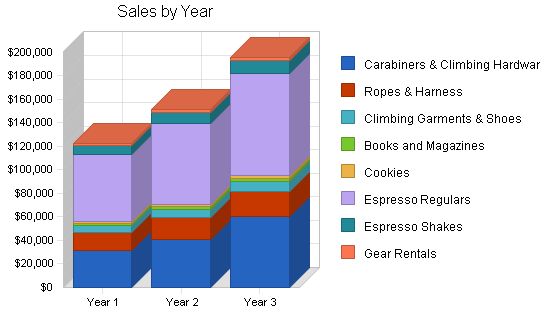

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Carabiners & Climbing Hardware | $31,094 | $40,876 | $60,176 |

| Ropes & Harness | $15,893 | $18,749 | $21,686 |

| Climbing Garments & Shoes | $5,500 | $7,000 | $8,500 |

| Books and Magazines | $1,803 | $2,158 | $2,697 |

| Cookies | $1,573 | $1,888 | $2,360 |

| Espresso Regulars | $57,695 | $69,233 | $86,542 |

| Espresso Shakes | $7,418 | $8,901 | $11,127 |

| Gear Rentals | $1,960 | $2,353 | $2,941 |

| Total Sales | $122,936 | $151,158 | $196,029 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Carabiners & Climbing Hardware | $12,438 | $16,350 | $24,070 |

| Ropes & Harness | $6,357 | $7,500 | $8,674 |

| Climbing Garments & Shoes | $1,375 | $3,500 | $4,250 |

| Books and Magazines | $1,098 | $1,170 | $995 |

| Cookies | $389 | $673 | $572 |

| Espresso Regulars | $17,973 | $27,134 | $23,064 |

| Espresso Shakes | $3,193 | $4,092 | $3,479 |

| Gear Rentals | $900 | $1,158 | $984 |

| Subtotal Direct Cost of Sales | $43,723 | $61,577 | $66,089 |

5.5.2 Sales Programs

Sales programs will include sales awards for highest sales and customer service awards for employees who best exemplify The Boulder Stop’s commitment to customers. The owner will award these valuable employees yearly with a $200-300 vacation to the Sunriver Resort in Bend.

- We will request rebate info from manufacturers and use those rebates to drive traffic to the store. We will also offer coupons in local area newspapers, providing buyers with discounts ranging from 100% to 50% off any espresso drink and/or buy one get one free espresso programs.

- We will offer gear rentals throughout the week. This will allow climbers without all the necessary gear to climb with their friends, creating goodwill and repeat customers. We will rent shoes, bags, and helmets, but not carabiners, ropes, or cams.

5.6 Milestones

The milestone table shows purchasing, sales, and marketing goals. The owner will conduct straight rebuys while maintaining communication with the Espresso Harvest. We have paid a deposit of $700 (06/28/97) to establish a 30-day grace period on all purchases from Espresso Harvest. There is no franchise fee, and Espresso Harvest will donate advertising, consulting, and literature, provided that 40% of sales from Espresso Harvest mugs, cups, and T-shirts go directly to Espresso Harvest, Inc.

Milestones:

– Start Date: 6/30/1998 End Date: 7/30/1998 Budget: $4,000 Manager: Luke Walsh Department: Purchasing

– Start Date: 6/25/1998 End Date: 6/30/1998 Budget: $700 Manager: Luke Walsh Department: Sales

– Start Date: 6/26/1998 End Date: 6/26/1998 Budget: $500 Manager: Luke Walsh Department: Marketing

– Start Date: 7/30/1998 End Date: 8/30/1998 Budget: $7,000 Manager: Luke Walsh Department: Purchasing

– Start Date: 8/23/1998 End Date: 9/23/1998 Budget: $650 Manager: Luke Walsh Department: Marketing

– Start Date: 8/30/1998 End Date: 9/30/1998 Budget: $4,000 Manager: Luke Walsh Department: Purchasing

– Start Date: 9/29/1998 End Date: 9/30/1998 Budget: $4,000 Manager: Luke Walsh Department: Purchasing

– Start Date: 10/29/1998 End Date: 10/30/1998 Budget: $2,500 Manager: Luke Walsh Department: Purchasing

– Start Date: 11/29/1998 End Date: 11/30/1998 Budget: $500 Manager: Luke Walsh Department: Purchasing

Management Summary:

The owner of The Boulder Stop strongly believes in straightforward relationships, structured work with room for creativity, and fair pay based on output and quality. Currently, this philosophy applies only to the President.

The President will evaluate the two part-time employees’ productivity every six months.

6.1 Organizational Structure:

The Boulder Stop is not departmentalized. Luke Walsh, the owner, is also the President, CFO, and lead manager. All decisions are made according to the company mission. Employees are assigned specific tasks based on their creativity, knowledge, and social abilities.

6.2 Management Team:

– Luke Walsh: Manager and founder.

Luke has four years of experience selling shoes and apparel for Nordstrom, Inc. He graduated from the University of Oregon in 1997 with a Business Management degree. Luke’s success at Nordstrom, the University, and in building a network of close friends is attributed to his common-sense problem-solving approach, ability to identify market strengths and weaknesses, and commitment to building trust-based relationships. These skills, combined with formal business training, make him an ideal community leader and business owner.

6.3 Personnel Plan:

The following table shows the personnel plan, including the owner’s salary and salaries for two part-time espresso servers/gear experts. Part-time employees will be eligible for the profit-sharing program after working with the company for twelve months. All part-time employees will start at $8/hr.

– Year 1: Owner – $36,000. Part-time Employee #1 – $4,700. Part-time Employee #2 – $4,700.

– Year 2: Owner – $36,000. Part-time Employee #1 – $4,935. Part-time Employee #2 – $4,935.

– Year 3: Owner – $40,000. Part-time Employee #1 – $5,182. Part-time Employee #2 – $5,182.

– Growth will be moderate, with a positive cash balance at all times.

– Marketing expenses will be kept at or below 15% of sales.

– Residual profits will be invested in company expansion and personnel.

7.1 Important Assumptions:

– We do not sell anything on credit.

– The personnel burden is low as benefits are not provided to part-timers.

– The short-term interest rate is exceptionally low due to the owner’s relationship with the USAA Credit Union.

General Assumptions:

– Year 1: Plan Month – 1. Current Interest Rate – 7.00%. Long-term Interest Rate – 7.50%. Tax Rate – 30.00%. Other – 0.

– Year 2: Plan Month – 2. Current Interest Rate – 7.00%. Long-term Interest Rate – 7.50%. Tax Rate – 30.00%. Other – 0.

– Year 3: Plan Month – 3. Current Interest Rate – 7.00%. Long-term Interest Rate – 7.50%. Tax Rate – 30.00%. Other – 0.

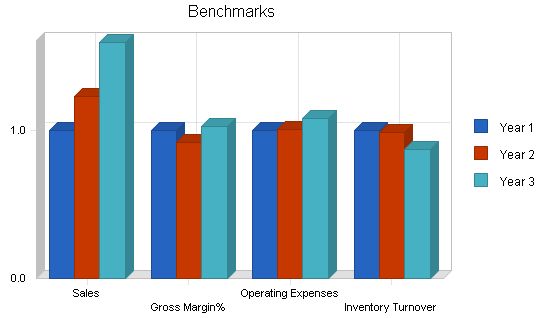

7.2 Key Financial Indicators:

The chart below illustrates that as sales increase, inventory turnover speeds up. This correlation is crucial for evaluating past inventory control techniques.

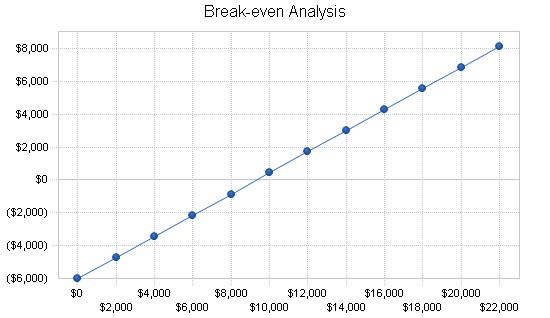

7.3 Break-even Analysis

The chart and table display our projected break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $9,336 |

| Assumptions: | |

| Average Percent Variable Cost | 36% |

| Estimated Monthly Fixed Cost | $6,016 |

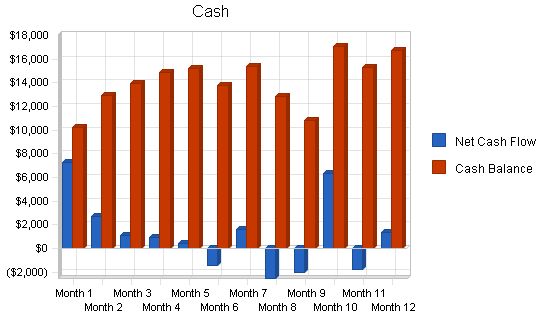

7.4 Projected Cash Flow

We position ourselves in the market as a medium risk concern with steady cash flows. Accounts payable is paid monthly while sales are in cash, giving The Boulder Stop an excellent cash flow structure. Solid Net Working Capital and intelligent marketing will secure a strong cash balance by January 1, 2000. Amounts above $10,000 will be invested in semi-liquid stock portfolios to decrease the opportunity cost of cash held. The interest will show up as dividends in the Cash Flow table and will be updated quarterly.

Pro Forma Cash Flow

Year 1 Year 2 Year 3

Cash Received

Cash from Operations

Cash Sales $122,936 $151,158 $196,029

Subtotal Cash from Operations $122,936 $151,158 $196,029

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $2,000 $0 $0

Subtotal Cash Received $124,936 $151,158 $196,029

Expenditures

Year 1 Year 2 Year 3

Expenditures from Operations

Cash Spending $45,400 $45,870 $50,364

Bill Payments $63,201 $94,460 $108,279

Subtotal Spent on Operations $108,601 $140,330 $158,643

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $2,640 $2,640 $2,640

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $111,241 $142,970 $161,283

Net Cash Flow $13,695 $8,188 $34,746

Cash Balance $16,695 $24,882 $59,629

7.5 Projected Profit and Loss

We predict advertising costs and consulting costs will increase in the next three years. This will give The Boulder Stop a strong profit-to-sales ratio by the year 2000. Normally, a start-up concern will operate with negative profits through the first two years. We will avoid that kind of operating loss by understanding our competitors, target markets, industry direction, and products.

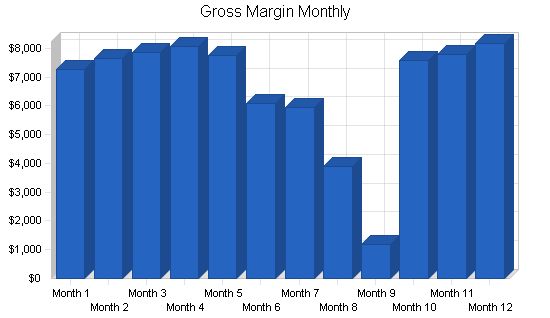

Note that we predict we will exceed our gross margin objective by the year 2000.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $122,936 | $151,158 | $196,029 |

| Direct Cost of Sales | $43,723 | $61,577 | $66,089 |

| Total Cost of Sales | $43,723 | $61,577 | $66,089 |

| Gross Margin | $79,213 | $89,581 | $129,940 |

| Gross Margin % | 64.43% | 59.26% | 66.29% |

| Expenses | |||

| Payroll | $45,400 | $45,870 | $50,364 |

| Marketing/Promotion | $4,040 | $3,100 | $3,500 |

| Depreciation | $0 | $0 | $0 |

| Rent | $20,400 | $21,012 | $21,642 |

| Utilities | $1,569 | $1,616 | $1,665 |

| Insurance | $780 | $803 | $828 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $72,189 | $72,401 | $77,999 |

| Profit Before Interest and Taxes | $7,024 | $17,180 | $51,941 |

| EBITDA | $7,024 | $17,180 | $51,941 |

| Interest Expense | ($107) | ($297) | ($495) |

| Taxes Incurred | $2,139 | $5,243 | $15,731 |

| Net Profit | $4,992 | $12,234 | $36,705 |

| Net Profit/Sales | 4.06% | 8.09% | 18.72% |

Projected Balance Sheet

All of our tables will be updated monthly to reflect past performance and future assumptions. Future assumptions will not be based on past performance but rather economic cycle activity, regional industry strength, and future cash flow possibilities. We expect solid growth in Net Worth beyond the year 2000.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $16,695 | $24,882 | $59,629 |

| Inventory | $4,882 | $6,876 | $7,380 |

| Other Current Assets | $1,000 | $1,000 | $1,000 |

| Total Current Assets | $22,577 | $32,758 | $68,008 |

| Long-term Assets | |||

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $22,577 | $32,758 | $68,008 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $7,225 | $7,812 | $8,997 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $7,225 | $7,812 | $8,997 |

| Long-term Liabilities | ($2,640) | ($5,280) | ($7,920) |

| Total Liabilities | $4,585 | $2,532 | $1,077 |

| Paid-in Capital | $29,000 | $29,000 | $29,000 |

| Retained Earnings | ($16,000) | ($11,008) | $1,226 |

| Earnings | $4,992 | $12,234 | $36,705 |

| Total Capital | $17,992 | $30,226 | $66,931 |

| Total Liabilities and Capital | $22,577 | $32,758 | $68,008 |

| Net Worth | $17,992 | $30,226 | $66,931 |

We expect our net profit margin, gross margin, and Return on Assets (ROA) to increase steadily over the three-year period. Return on Equity (ROE) will decrease due to lower equity needs and higher cash inflow. Our net working capital will increase significantly by year three, proving that we have the cash flows to remain a going concern. The following table shows these important financial ratios. NAICS code 451110, Sporting Goods Stores, used for industry profile comparisons.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 22.96% | 29.68% | 6.95% |

| Percent of Total Assets | ||||

| Inventory | 21.63% | 20.99% | 10.85% | 32.04% |

| Other Current Assets | 4.43% | 3.05% | 1.47% | 23.52% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 89.81% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 10.19% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | ||||

| Accounts Payable | 32.00% | 23.85% | 13.23% | 36.90% |

| Long-term Liabilities | -11.69% | -16.12% | -11.65% | 9.38% |

| Total Liabilities | 20.31% | 7.73% | 1.58% | 46.28% |

| Net Worth | 79.69% | 92.27% | 98.42% | 53.72% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 64.43% | 59.26% | 66.29% | 31.30% |

| Selling, General & Administrative Expenses | 60.37% | 51.17% | 47.56% | 16.09% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.20% |

| Profit Before Interest and Taxes | 5.71% | 11.37% | 26.50% | 2.45% |

| Main Ratios | ||||

| Current | 3.12 | 4.19 | 7.56 | 2.16 |

| Quick | 2.45 | 3.31 | 6.74 | 1.18 |

| Total Debt to Total Assets | 20.31% | 7.73% | 1.58% | 51.78% |

| Pre-tax Return on Net Worth | 39.64% | 57.82% | 78.34% | 7.58% |

| Pre-tax Return on Assets | 31.59% | 53.35% | 77.10% | 15.72% |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Cash | $3,000 | $10,231 | $12,914 | $13,970 | $14,856 | $15,232 | $13,754 | $15,356 | $12,812 | $10,791 | $17,093 | $15,326 | $16,695 |

| Inventory | $7,000 | $4,797 | $4,686 | $4,780 | $4,769 | $4,571 | $3,605 | $3,640 | $2,490 | $1,833 | $4,523 | $4,629 | $4,882 |

| Other Current Assets | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 | $1,000 |

| Total Current Assets | $11,000 | $16,028 | $18,599 | $19,750 | $20,625 | $20,803 | $18,359 | $19,997 | $16,302 | $13,624 | $22,616 | $20,956 | $22,577 |

| Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $11,000 | $16,028 | $18,599 | $19,750 | $20,625 | $20,803 | $18,359 | $19,997 | $16,302 | $13,624 | $22,616 | $20,956 | $22,577 |

| Liabilities and Capital | |||||||||||||

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $4,782 | $6,686 | $7,060 | $7,078 | $6,355 | $4,248 | $5,374 | $2,615 | $757 | $9,218 | $6,682 | $7,225 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $4,782 | $6,686 | $7,060 | $7,078 | $6,355 | $4,248 | $5,374 | $2,615 | $757 | $9,218 | $6,682 | $7,225 |

| Long-term Liabilities | |||||||||||||

| Long-term Liabilities | $0 | ($220) | ($440) | ($660) | ($880) | ($1,100) | ($1,320) | ($1,540) | ($1,760) | ($1,980) | ($2,200) | ($2,420) | ($2,640) |

| Total Liabilities | $0 | $4,562 | $6,246 | $6,400 | $6,198 | $5,255 | $2,928 | $3,834 | $855 | ($1,223) | $7,018 | $4,262 | $4,585 |

| Paid-in Capital | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $27,000 | $29,000 | $29,000 | $29,000 | $29,000 |

| Retained Earnings | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) | ($16,000) |

| Earnings | $0 | $466 | $1,353 | $2,350 | $3,426 | $4,548 | $4,431 | $5,163 | $4,447 | $1,847 | $2,598 | $3,694 | $4,992 |

| Total Capital | $11,000 | $11,466 | $12,353 | $13,350 | $14,426 | $15,548 | $15,431 | $16,163 | $15,447 | $14,847 | $15,598 | $16,694 | $17,992 |

| Total Liabilities and Capital | $11,000 | $16,028 | $18,599 | $19,750 | $20,625 | $20,803 | $18,359 | $19,997 | $16,302 | $13,624 | $22,616 | $20,956 | $22,577 |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% |

Business Plan Outline

|

|||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!