Noah’s Arf is an animal care facility focused on providing excellent service and pet care in a clean, enjoyable atmosphere at a reasonable price. We value diversity, ideas, and hard work.

The timing is right for this venture as people are increasingly including animals in their lives and seeking better lives for their pets. We offer a range of services including day care, overnight care, in-home care, pet grooming, animal behavior, and more.

Owner Kris Price has 23 years of experience in a customer service profession and has earned the respect of her colleagues. Her daughter, a graduate from veterinarian technical college, will join the staff. Kris has a strong reputation and is committed to exceeding expectations and building a client base.

To achieve our goals, Noah’s Arf is seeking a long-term commercial loan collateralized by company assets and supported by the owner’s experience and integrity. Start-up costs will be used for fixed assets, supplies, advertising, and initial cash on hand.

Contents

1.1 Objectives:

- Monthly sales increase throughout FY 1.

- Gross margin over 50% on pet products.

- Reach full capacity by year end FY 2.

- Expand services by FY 3.

1.2 Mission:

To provide excellent animal care and customer service in a pet-friendly atmosphere, ensuring both pets and owners receive exceptional service in a safe and playful environment.

1.3 Keys to Success:

- Superior Customer Service: 24-hour high-quality care and service.

- Environment: clean, upscale, odor-free environment conducive to professional and trustworthy service.

- Convenience: offer a wide range of services in one location for client convenience.

- Location: easily accessible location for customer convenience.

- Reputation: credibility, integrity, and 100% dedication with 23+ years of employment at current workplace.

Company Summary:

Noah’s Arf is a new company that provides high-level animal care and customer service in the following categories:

- Overnight care

- Day care

- In-home care

- Self-serve pet wash

- Pet grooming

- Animal behavior classes

- Pet portraits

- Gift shop

- Special events

- Special requests

- 24-hour service

What sets Noah’s Arf apart is its commitment to provide these services in one convenient location for all types of pets, not just dogs and cats.

2.1 Company Ownership:

Noah’s Arf will be a privately-owned Oregon Limited Liability Company (LLC) based in Multnomah County.

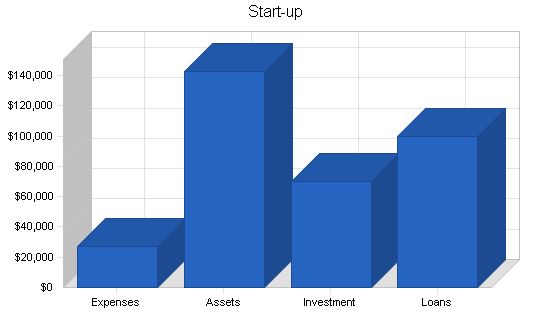

2.2 Start-up Summary:

The start-up requirements include legal costs, logo design, stationery, and related expenses. The start-up costs will be partially financed by the owner’s investment and long-term loan financing. Refer to the table and chart below for more details.

Start-up Requirements

Start-up Expenses

Legal and Accounting $2,000

Office Supplies $500

Collateral Materials $4,000

Consultants/Permits $5,000

Insurance $3,000

Rent/Lease $7,500

Space Design/Contractor $2,000

Sales and Marketing $2,500

Expensed Equipment $0

Other $500

Total Start-up Expenses $27,000

Start-up Assets

Cash Required $39,000

Start-up Inventory $4,000

Other Current Assets $0

Long-term Assets $100,000

Total Assets $143,000

Total Requirements $170,000

Start-up Funding

Start-up Expenses to Fund $27,000

Start-up Assets to Fund $143,000

Total Funding Required $170,000

Assets

Non-cash Assets from Start-up $104,000

Cash Requirements from Start-up $39,000

Additional Cash Raised $0

Cash Balance on Starting Date $39,000

Total Assets $143,000

Liabilities and Capital

Liabilities

Current Borrowing $0

Long-term Liabilities $100,000

Accounts Payable $0

Other Current Liabilities $0

Total Liabilities $100,000

Capital

Planned Investment

Investor 1 $70,000

Investor 2 $0

Other $0

Additional Investment Requirement $0

Total Planned Investment $70,000

Loss at Start-up (Start-up Expenses) ($27,000)

Total Capital $43,000

Total Capital and Liabilities $143,000

Total Funding $170,000

2.3 Company Locations and Facilities

This facility will be in the upscale Pearl District in Northwest Portland. We will serve the growing condominium area, the West Hills, and the Beaverton area. Our facility is zoned EXD, allowing for day and overnight care.

Products and Services

Noah’s Arf offers a comprehensive range of services for pet owners. We provide day care and overnight care, as well as in-home animal care, self-wash stations, pet grooming, animal behavior courses, pet portraits, a gift shop, special events coordination, pet transportation, and services for pets with special needs.

Competitive Comparison

There are several competitors in the animal care industry, but none offer the same level of services that Noah’s Arf provides. We differentiate ourselves by offering 24-hour care and a wide range of services at one location.

Sales Literature

We will develop a corporate brochure to showcase our services and distribute it to various businesses, veterinarians, pet stores, and more. We will also utilize direct mail and create a website.

Technology

Noah’s Arf will utilize the latest technology, including email capabilities and a website, to efficiently communicate with clients and provide information about our services.

Future Products and Services

In the future, we plan to expand our services by offering veterinarian technicians on staff, internet-based pet monitoring, a monthly newsletter, weekly play hours, an espresso and juice bar, additional overnight kennels, a mobile pet wash service, online sales of gifts and products, an exercise pool, and potential partnerships with local veterinarians. We may also explore franchising opportunities.

Market Analysis Summary

Noah’s Arf targets dual-income, traveling professional families who require reliable and convenient pet care. Our focus is on providing comprehensive services and convenience for busy pet owners.

Target Market Segment Strategy

Instead of waiting for customers to come to us, we will actively target specific market segments that align with our services. We will tailor our marketing message to showcase the convenience and multiple services we offer.

Market Needs

Our target customers are working professionals who need reliable and convenient pet care to accommodate their busy schedules. They seek one-stop convenience for all their pet care needs.

Market Trends

The trend among pet owners is to treat their pets as part of the family, investing in their well-being and seeking high-quality care. Professionals are working longer hours and traveling more frequently, creating a need for reliable and playful pet care services.

Market Growth

The number of pet owners is increasing, with millions of dollars being spent on pets each year. Portland has a large number of pet owners, and Noah’s Arf aims to capture a significant share of this market by offering exceptional pet care services.

Service Business Analysis

The animal care industry is comprised of many small facilities that offer limited services. Noah’s Arf stands out by providing comprehensive care, including day care, overnight care, and in-home care, all in one location.

Business Participants

Most businesses in the animal care industry offer one or two services. Noah’s Arf sets itself apart by offering a full range of services and 24-hour care, fulfilling the needs of busy pet owners.

Strategy and Implementation Summary

Our strategy is to emphasize customer service, build long-term relationships with clients, focus on target markets, and differentiate ourselves by delivering on our promises. We have a competitive edge in offering multiple services, 24-hour care, and customer convenience.

Pricing Strategy

Noah’s Arf will price its services at a level that is competitive with similar businesses in the area.

Promotion Strategy

We will host an open house and offer discounts to new clients for the first six months. We will also implement referral programs, create specified packages, and use promotional items with our logo.

Our marketing strategy focuses on delivering excellent service to create satisfied customers who will promote our business through word-of-mouth. We will also distribute advertising brochures, contact local TV news shows, send direct mail to registered pet owners, and advertise in relevant publications.

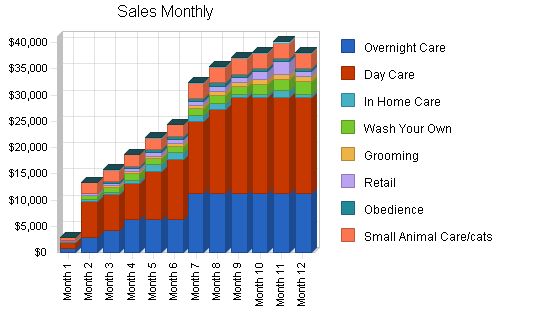

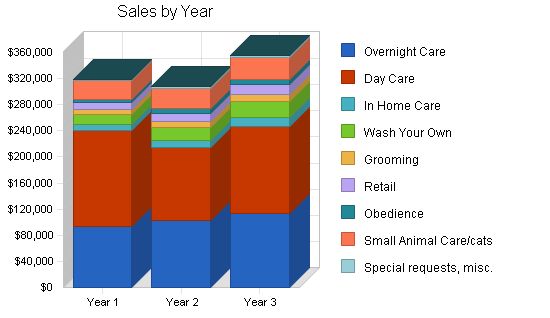

Our sales forecast indicates steady growth as we establish our client base and gain recognition in the market. With our comprehensive services and customer-centric approach, we are confident in our ability to attract and retain customers.

Review: Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Overnight Care | $93,940 | $103,334 | $113,668 |

| Day Care | $146,050 | $111,360 | 133,600 |

| In Home Care | $9,240 | $11,090 | $13,310 |

| Wash Your Own | $15,900 | $19,800 | $23,760 |

| Grooming | $7,000 | $8,880 | $10,660 |

| Retail | $10,600 | $12,720 | $15,260 |

| Obedience | $5,460 | $6,790 | $8,150 |

| Small Animal Care/cats | $28,620 | $31,482 | $34,630 |

| Special requests, misc. | $1,600 | $1,920 | $2,300 |

| Other | $0 | $0 | $0 |

| Total Sales | $318,410 | $307,376 | $355,338 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Overnight Care | $3,300 | $4,000 | $4,400 |

| Day Care | $2,425 | $3,000 | $3,300 |

| In Home Care | $205 | $250 | $300 |

| Wash Your Own | $370 | $440 | $530 |

| Grooming | $280 | $340 | $410 |

| Retail | $5,300 | $6,360 | $7,630 |

| Obedience | $275 | $330 | $400 |

| Small Animal Care/cats | $1,025 | $1,200 | $1,400 |

| Special requests, misc. | $155 | $190 | $230 |

| Other | $0 | $895 | $1,070 |

| Subtotal Direct Cost of Sales | $13,335 | $17,005 | $19,670 |

Management Summary

Noah’s Arf will be organized and managed in a creative, innovative fashion to generate high customer satisfaction. We will create a working climate conducive to personal development and satisfaction for employees.

A policy manual will be implemented and job descriptions developed to identify necessary competencies and skill sets. Team-oriented professionals with common goals will be hired.

We will conduct weekly staff meetings to discuss ideas, suggestions, and operations. An annual motivational seminar will be held, and we will develop an employee recognition program. As the business grows, the company will offer an employee benefit package, including health and vacation benefits for everyone.

Personnel Plan

The personnel plan is as follows:

– One manager to oversee and fill-in for all areas.

– Two front desk receptionists to greet customers, receive payments, set appointments, answer phones, check-in pets, distribute wash your own supplies, and maintain client files with data entry.

– Four playground supervisors to feed and water pets, keep the area clean, walk and exercise pets, and collect pets at check-out time. Two will be on staff full time, and two will work part time.

– One pet groomer.

– One behavioral trainer.

In the first year, assumptions are that there will be only one receptionist, four playground supervisors, and the manager will serve as a part-time receptionist and night personnel. The groomer and trainer will work on contract. In the second year, a second receptionist, two playground supervisors, and a groomer will be added to the payroll.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Production Personnel | |||

| Playground supervisor | $14,720 | $15,840 | $16,320 |

| Playground supervisor | $11,200 | $11,880 | $12,240 |

| Playground supervisor part-time | $5,520 | $5,952 | $6,144 |

| Playground supervisor part-time | $2,760 | $2,976 | $3,072 |

| Playground supervisor | $0 | $15,840 | $16,320 |

| Playground Supervisor | $0 | $11,880 | $12,240 |

| Groomer | $0 | $23,040 | $24,000 |

| Pet taxi/in-home care/dog walker | $0 | $15,360 | $15,840 |

| Subtotal | $34,200 | $102,768 | $106,176 |

| Sales and Marketing Personnel | |||

| Other | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 |

| General and Administrative Personnel | |||

| Manager | $36,000 | $36,000 | $36,000 |

| Reception 1 | $16,560 | $17,760 | $18,240 |

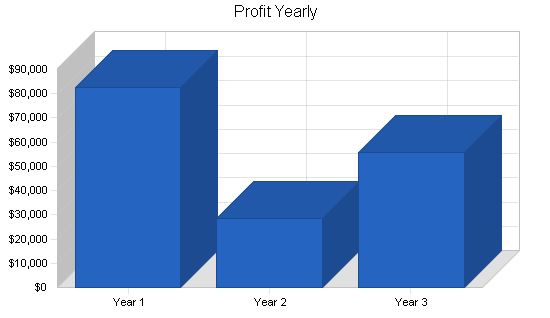

| Pro Forma Profit and Loss | |||

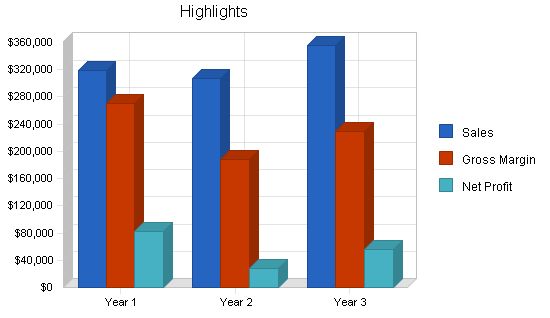

| Year 1 | Year 2 | Year 3 | |

| Sales | $318,410 | $307,376 | $355,338 |

| Direct Cost of Sales | $13,335 | $17,005 | $19,670 |

| Production Payroll | $34,200 | $102,768 | $106,176 |

| Other | $0 | $0 | $0 |

| Total Cost of Sales | $47,535 | $119,773 | $125,846 |

| Gross Margin | $270,875 | $187,603 | $229,492 |

| Gross Margin % | 85.07% | 61.03% | 64.58% |

| Operating Expenses | |||

| Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $0 | $0 | $0 |

| Advertising/Promotion | $2,700 | $5,500 | $7,000 |

| Travel | $0 | $0 | $0 |

| Miscellaneous | $600 | $1,000 | $1,000 |

| Total Sales and Marketing Expenses | $3,300 | $6,500 | $8,000 |

| Sales and Marketing % | 1.04% | 2.11% | 2.25% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $52,560 | $60,672 | $61,344 |

| Sales and Marketing and Other Expenses | $0 | $0 | $0 |

| Depreciation | $12,000 | $12,000 | $12,000 |

| Vehicle Maintenance | $1,200 | $1,500 | $1,700 |

| Utilities | $14,400 | $15,000 | $15,500 |

| Insurance | $12,000 | $13,000 | $14,000 |

| Taxes | $6,000 | $7,000 | $8,000 |

| Rent | $38,500 | $3,600 | $3,800 |

| Payroll Taxes | $10,411 | $19,613 | $20,102 |

| Other General and Administrative Expenses | $0 | $0 | $0 |

| Total General and Administrative Expenses | $147,071 | $132,385 | $136,446 |

| General and Administrative % | 46.19% | 43.07% | 38.40% |

| Other Expenses: | |||

| Other Payroll | $0 | $0 | $0 |

| Consultants | $0 | $0 | $0 |

| Contract/Consultants | $3,000 | $4,000 | $5,000 |

| Total Other Expenses | $3,000 | $4,000 | $5,000 |

| Other % | 0.94% | 1.30% | 1.41% |

| Total Operating Expenses | $153,371 | $142,885 | $149,446 |

| Profit Before Interest and Taxes | $117,504 | $44,718 | $80,046 |

| EBITDA | $129,504 | $56,718 | $92,046 |

| Interest Expense | $8,210 | $6,630 | $5,050 |

| Taxes Incurred | $26,884 | $9,522 | $19,061 |

| Net Profit | $82,410 | $28,566 | $55,934 |

| Net Profit/Sales | 25.88% | 9.29% | 15.74% |

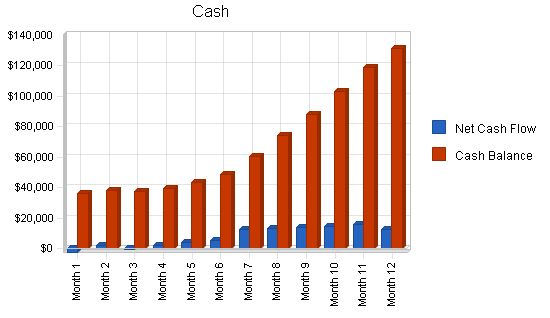

Projected Cash Flow:

7.5 Projected Cash Flow

The following chart and table show the projected cash flow for Noah’s Arf.

Table: Pro Forma Cash Flow

Year 1 Year 2 Year 3

—————————–

Cash Received

Cash from Operations

Cash Sales $318,410 $307,376 $355,338

Subtotal Cash from Operations $318,410 $307,376 $355,338

Additional Cash Received

Sales Tax, VAT, HST/GST Received $0 $0 $0

New Current Borrowing $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0

New Long-term Liabilities $0 $0 $0

Sales of Other Current Assets $0 $0 $0

Sales of Long-term Assets $0 $0 $0

New Investment Received $0 $0 $0

Subtotal Cash Received $318,410 $307,376 $355,338

Expenditures

Expenditures from Operations

Cash Spending $86,760 $163,440 $167,520

Bill Payments $121,390 $109,197 $118,933

Subtotal Spent on Operations $208,150 $272,637 $286,453

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0

Long-term Liabilities Principal Repayment $17,556 $17,556 $17,556

Purchase Other Current Assets $0 $0 $0

Purchase Long-term Assets $0 $0 $0

Dividends $0 $0 $0

Subtotal Cash Spent $225,706 $290,193 $304,009

Net Cash Flow $92,704 $17,183 $51,329

Cash Balance $131,704 $148,887 $200,216

7.6 Projected Balance Sheet

The Projected Balance Sheet is solid, with no projected trouble meeting debt obligations as long as specific objectives are achieved.

Table: Pro Forma Balance Sheet

Year 1 Year 2 Year 3

—————————–

Assets

Current Assets

Cash $131,704 $148,887 $200,216

Inventory $1,974 $2,517 $2,912

Other Current Assets $0 $0 $0

Total Current Assets $133,678 $151,405 $203,128

Long-term Assets

Long-term Assets $100,000 $100,000 $100,000

Accumulated Depreciation $12,000 $24,000 $36,000

Total Long-term Assets $88,000 $76,000 $64,000

Total Assets $221,678 $227,405 $267,128

Liabilities and Capital

Current Liabilities

Accounts Payable $13,824 $8,541 $9,886

Current Borrowing $0 $0 $0

Other Current Liabilities $0 $0 $0

Subtotal Current Liabilities $13,824 $8,541 $9,886

Long-term Liabilities $82,444 $64,888 $47,332

Total Liabilities $96,268 $73,429 $57,218

Paid-in Capital $70,000 $70,000 $70,000

Retained Earnings ($27,000) $55,410 $83,976

Earnings $82,410 $28,566 $55,934

Total Capital $125,410 $153,976 $209,910

Total Liabilities and Capital $221,678 $227,405 $267,128

Net Worth $125,410 $153,976 $209,910

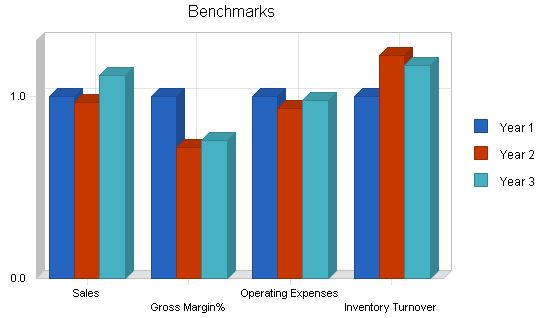

7.7 Business Ratios

The following table shows our main business ratios. We aim to improve gross margins and inventory turnover. Industry profile ratios based on the Standard Industrial Classification (SIC) code 0752, Animal Specialty Services, nec., are provided for comparison.

Table: Ratio Analysis

Year 1 Year 2 Year 3 Industry Profile

————————————————-

Sales Growth 0.00% -3.47% 15.60% -2.90%

Percent of Total Assets

Inventory 0.89% 1.11% 1.09% 8.20%

Other Current Assets 0.00% 0.00% 0.00% 31.90%

Total Current Assets 60.30% 66.58% 76.04% 55.90%

Long-term Assets 39.70% 33.42% 23.96% 44.10%

Total Assets 100.00% 100.00% 100.00% 100.00%

Current Liabilities

Accounts Payable 6.24% 3.76% 3.70% 32.70%

Long-term Liabilities 37.19% 28.53% 17.72% 19.90%

Total Liabilities 43.43% 32.29% 21.42% 52.60%

Net Worth 56.57% 67.71% 78.58% 47.40%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00%

Gross Margin 85.07% 61.03% 64.58% 42.50%

Selling, General & Administrative Expenses 59.33% 51.74% 48.76% 26.40%

Advertising Expenses 0.85% 1.79% 1.97% 0.50%

Profit Before Interest and Taxes 36.90% 14.55% 22.53% 2.40%

Main Ratios

Current 9.67 17.73 20.55 2.19

Quick 9.53 17.43 20.25 1.48

Total Debt to Total Assets 43.43% 32.29% 21.42% 52.60%

Pre-tax Return on Net Worth 87.15% 24.74% 35.73% 4.50%

Pre-tax Return on Assets 49.30% 16.75% 28.07% 9.40%

Additional Ratios

Net Profit Margin 25.88% 9.29% 15.74% n.a

Return on Equity 65.71% 18.55% 26.65% n.a

Activity Ratios

Inventory Turnover 6.20 7.57 7.25 n.a

Accounts Payable Turnover 9.78 12.17 12.17 n.a

Payment Days 27 39 28 n.a

Total Asset Turnover 1.44 1.35 1.33 n.a

Debt Ratios

Debt to Net Worth 0.77 0.48 0.27 n.a

Current Liab. to Liab. 0.14 0.12 0.17 n.a

Liquidity Ratios

Net Working Capital $119,854 $142,864 $193,242 n.a

Interest Coverage 14.31 6.74 15.85 n.a

Additional Ratios

Assets to Sales 0.70 0.74 0.75 n.a

Current Debt/Total Assets 6% 4% 4% n.a

Acid Test 9.53 17.43 20.25 n.a

Sales/Net Worth 2.54 2.00 1.69 n.a

Dividend Payout 0.00 0.00 0.00 n.a

Appendix

Personnel Plan

Production Personnel

Playground supervisor

– $640

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

– $1,280

Playground supervisor part time

– $240

– $480

– $480

– $480

– $480

– $480

– $480

– $480

– $480

– $480

– $480

– $480

– $480

Subtotal

– $1,640

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

– $2,960

Sales and Marketing Personnel

Other

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

Subtotal

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

General and Administrative Personnel

Manager

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

– $3,000

Reception 1

– $720

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

– $1,440

Reception 2

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

Subtotal

– $3,720

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

– $4,440

Other Personnel

Other

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

Subtotal

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

– $0

Total People

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

– 6

Total Payroll

– $5,360

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

– $7,400

General Assumptions

– 1

– 2

– 3

– 4

– 5

– 6

– 7

– 8

– 9

– 10

– 11

– 12

Current Interest Rate

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

– 0.00%

Long-term Interest Rate

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

– 9.00%

Tax Rate

– 30.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

– 25.00%

Other

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

– 0

Pro Forma Profit and Loss

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Sales $2,800 $13,420 $15,760 $18,750 $21,845 $24,495 $32,415 $35,415 $37,115 $38,165 $40,165 $38,065

Direct Cost of Sales $235 $510 $640 $855 $910 $1,015 $1,265 $1,375 $1,375 $1,635 $2,140 $1,380

Production Payroll $1,640 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960 $2,960

Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Cost of Sales $1,875 $3,470 $3,600 $3,815 $3,870 $3,975 $4,225 $4,335 $4,335 $4,595 $5,100 $4,340

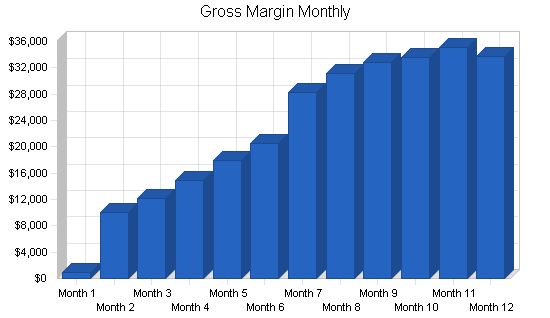

Gross Margin $925 $9,950 $12,160 $14,935 $17,975 $20,520 $28,190 $31,080 $32,780 $33,570 $35,065 $33,725

Gross Margin % 33.04% 74.14% 77.16% 79.65% 82.28% 83.77% 86.97% 87.76% 88.32% 87.96% 87.30% 88.60%

Operating Expenses Sales and Marketing Expenses Sales and Marketing Payroll $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Advertising/Promotion $500 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200 $200

Travel $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Miscellaneous $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50 $50

Total Sales and Marketing Expenses $550 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250

Sales and Marketing % 19.64% 1.86% 1.59% 1.33% 1.14% 1.02% 0.77% 0.71% 0.67% 0.66% 0.62% 0.66%

General and Administrative Expenses General and Administrative Payroll $3,720 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440 $4,440

Sales and Marketing and Other Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Vehicle Maintenance $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100

Utilities $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200 $1,200

Insurance $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000 $1,000

Taxes $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500

Rent $0 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500 $3,500

Payroll Taxes 12% $643 $888 $888 $888 $888 $888 $888 $888

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,800 | $13,420 | $15,760 | $18,750 | $21,845 | $24,495 | $32,415 | $35,415 | $37,115 | $38,165 | $40,165 | $38,065 | |

| Subtotal Cash from Operations | $2,800 | $13,420 | $15,760 | $18,750 | $21,845 | $24,495 | $32,415 | $35,415 | $37,115 | $38,165 | $40,165 | $38,065 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | |||||||||||||

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $2,800 | $13,420 | $15,760 | $18,750 | $21,845 | $24,495 | $32,415 | $35,415 | $37,115 | $38,165 | $40,165 | $38,065 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $5,360 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | $7,400 | |

| Bill Payments | $79 | $2,526 | $7,465 | $8,013 | $8,734 | $10,447 | $11,117 | $12,997 | $14,009 | $14,491 | $15,239 | $16,272 | |

| Subtotal Spent on Operations | $5,439 | $9,926 | $14,865 | $15,413 | $16,134 | $17,847 | $18,517 | $20,397 | $21,409 | $21,891 | $22,639 | $23,672 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | |||||||||||||

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | $1,596 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $5,439 | $11,522 | $16,461 | $17,009 | $17,730 | $19,443 | $20,113 | $21,993 | $23,005 | $23,487 | $24,235 | $25,268 | |

| Net Cash Flow | ($2,639) | $1,898 | ($701) | $1,741 | $4,115 | $5,052 | $12,302 | $13,422 | $14,110 | $14,678 | $15,930 | $12,797 | |

| Cash Balance | $36,361 | $38,259 | $37,558 | $39,299 | $43,414 | $48,466 | $60,767 | $74,190 | $88,300 | $102,978 | $118,908 | $131,704 |

Pro Forma Balance Sheet

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $39,000 | $36,361 | $38,259 | $37,558 | $39,299 | $43,414 | $48,466 | $60,767 | $74,190 | $88,300 | $102,978 | $118,908 | $131,704 |

| Inventory | $4,000 | $3,765 | $3,255 | $2,615 | $1,760 | $1,850 | $1,835 | $1,570 | $1,513 | $1,513 | $1,799 | $2,354 | $1,974 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $43,000 | $40,126 | $41,514 | $40,173 | $41,059 | $45,264 | $50,301 | $62,337 | $75,702 | $89,812 | $104,776 | $121,262 | $133,678 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $100,000 | $100,000 | $100

Sales Forecast Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Sales Overnight Care $840 $2,800 $4,200 $6,300 $6,300 $6,300 $11,200 $11,200 $11,200 $11,200 $11,200 $11,200 Day Care $1,150 $6,900 $6,900 $6,900 $9,200 $11,500 $13,800 $16,100 $18,400 $18,400 $18,400 $18,400 In Home Care $120 $360 $360 $600 $1,200 $1,200 $1,200 $1,200 $600 $600 $1,200 $600 Wash Your Own $0 $900 $900 $1,200 $1,200 $1,200 $1,200 $1,500 $1,500 $1,800 $2,100 $2,400 Grooming $0 $0 $400 $500 $500 $600 $600 $750 $750 $1,000 $1,000 $900 Retail $150 $250 $400 $600 $600 $800 $800 $1,000 $1,000 $1,500 $2,500 $1,000 Obedience $0 $0 $390 $390 $585 $585 $585 $585 $585 $585 $585 $585 Small Animal Care/cats $540 $2,160 $2,160 $2,160 $2,160 $2,160 $2,880 $2,880 $2,880 $2,880 $2,880 $2,880 Special requests, misc. $0 $50 $50 $100 $100 $150 $150 $200 $200 $200 $300 $100 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Total Sales $2,800 $13,420 $15,760 $18,750 $21,845 $24,495 $32,415 $35,415 $37,115 $38,165 $40,165 $38,065 Direct Cost of Sales Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Overnight Care $50 $100 $150 $200 $200 $200 $400 $400 $400 $400 $400 $400 Day Care $75 $150 $150 $150 $200 $200 $250 $250 $250 $250 $250 $250 In Home Care $10 $10 $10 $15 $20 $20 $20 $20 $20 $20 $20 $20 Wash Your Own $0 $25 $25 $30 $30 $30 $30 $35 $35 $40 $40 $50 Grooming $0 $20 $25 $25 $25 $25 $25 $25 $25 $30 $30 $25 Retail $75 $125 $200 $300 $300 $400 $400 $500 $500 $750 $1,250 $500 Obedience $0 $25 $25 $25 $25 $25 $25 $25 $25 $25 $25 $25 Small Animal Care/cats $25 $50 $50 $100 $100 $100 $100 $100 $100 $100 $100 $100 Special requests, misc. $0 $5 $5 $10 $10 $15 $15 $20 $20 $20 $25 $10 Other $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Subtotal Direct Cost of Sales Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Overnight Care $50 $100 $150 $200 $200 $200 $400 $400 $400 $400 $400 $400

Business Plan Outline

|

||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!