Laser Dreams specializes in laser hair removal, electrolysis, and microdermabrasion. We prioritize the needs of our patients and provide state-of-the-art technology and superior quality service. Our hair removal methods are FDA approved, gentle, and effective, offering a quicker and more cost-effective solution compared to other permanent hair removal methods. We are experts in treating difficult cases and use the latest generation lasers, specifically the GentleLASE™ Plus and Lightsheer Diode, both FDA approved for "PERMANENT HAIR REDUCTION." These lasers deliver remarkable results while ensuring the skin’s surface remains cool.

Located downtown in the Millman Building, Laser Dreams caters to over 6,000 urban professionals who value convenience. Our location allows them to visit our facility and return to work within 30 minutes. Joe Jackson and Allison Fremont, co-owners of Laser Dreams, have over ten years of experience managing laser hair removal centers. They believe that excellent customer service is vital to retain and generate referrals from customers.

Contents

1.1 Objectives

The objectives of Laser Dreams are:

- Exceed 60% of daily appointment times filled by the end of the first year.

- Achieve 50% of new customers from referrals by the end of the first year.

- Increase sales by 15% by the end of the second year.

1.2 Mission

The mission of Laser Dreams:

- Create a customer-focused environment that promotes referrals.

- Promote the success of clients in meeting their cosmetic goals.

Company Summary

Laser Dreams specializes in laser hair removal, electrolysis, and microdermabrasion. We are a professional facility that provides state-of-the-art technology and superior quality service. Our FDA-approved hair removal methods are gentle, effective, and cost and time-efficient. Laser Dreams operates as a general partnership, managed by Joe Jackson and Allison Fremont.

2.1 Company Ownership

Laser Dreams is co-owned by Joe Jackson and Allison Fremont.

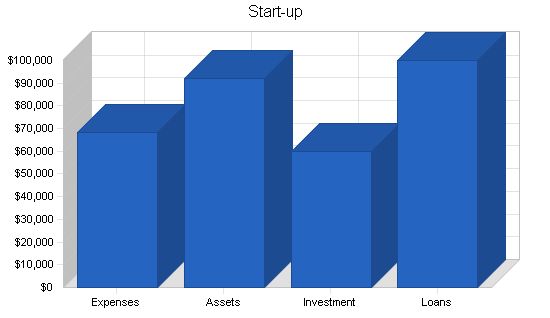

2.2 Start-up Summary

The start-up expenses for Laser Dreams primarily focus on equipment and treatment rooms. Joe and Allison will each invest $30,000, and the facility will secure a $100,000 long-term loan.

Start-up

Requirements

Start-up Expenses

Legal: $1,000

Stationery etc.: $100

Brochures: $3,000

Insurance: $1,000

Rent: $3,000

Expensed Equipment: $60,000

Total Start-up Expenses: $68,100

Start-up Assets

Cash Required: $41,900

Other Current Assets: $20,000

Long-term Assets: $30,000

Total Assets: $91,900

Total Requirements: $160,000

Start-up Funding

Start-up Expenses to Fund: $68,100

Start-up Assets to Fund: $91,900

Total Funding Required: $160,000

Assets

Non-cash Assets from Start-up: $50,000

Cash Requirements from Start-up: $41,900

Additional Cash Raised: $0

Cash Balance on Starting Date: $41,900

Total Assets: $91,900

Liabilities and Capital

Liabilities

Current Borrowing: $0

Long-term Liabilities: $100,000

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $100,000

Capital

Planned Investment

Investor 1: $30,000

Investor 2: $30,000

Additional Investment Requirement: $0

Total Planned Investment: $60,000

Loss at Start-up (Start-up Expenses): ($68,100)

Total Capital: ($8,100)

Total Capital and Liabilities: $91,900

Total Funding: $160,000

2.3 Company Locations and Facilities

Laser Dreams is located in downtown Monroe, in the Millman Building. The facility is quickly accessible to over 6,000 urban professionals who Laser Dreams considers potential customers.

Products and Services

Laser Dreams’ services and products:

– Laser hair removal: A laser beam disables hair follicles. It is quick and total areas can be treated in a short time (five weeks) unlike electrolysis that takes months or years to permanently remove hair. One hour for larger areas: arms, back, and legs. Fifteen minutes for small areas: face, chin, lip, neck.

– Electrolysis: Thermolysis, Galvanic and the Blend are offered. Together with laser hair removal, it offers a permanent solution to any hair left untreated by the laser, such as gray, light blondes, and some redheads.

– Waxing: Using only the finest waxes available (suitable for customer skin type) for temporary hair removal.

– END-ZIT: Welcome to the extraordinary world of END-ZIT Blemish Drying Lotion and family of blemish control and oily skin care products! All products are dermatology tested and approved. By using the END-ZIT Control Program of cleansing, toning, and treatment, you can eradicate those ghastly zits!

– END-ZIT Blemish Drying Lotion: An extraordinary, medicated, skin-tone tinted drying lotion formula designed to conceal, while it heals and dries unsightly pimples. Amazingly, most blemish breakouts simply disappear after just a day or two of use.

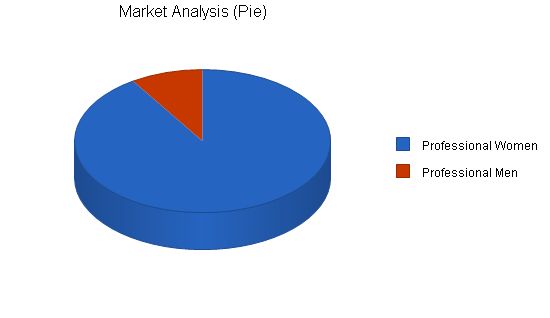

Market Analysis Summary

Downtown Monroe has emerged from the recent recession to regain its position as the heart of the city. The growth has been fueled by increased employment in the city’s high-technology companies. This has attracted the target customer for Laser Dreams: professional women aged 21-45.

Another target group is professional men who want excess hair removed. Joe and Allison are aware that these men may be uncomfortable visiting the facility, so a side entrance has been set up with a small waiting room to accommodate any customer who wants privacy.

4.1 Market Segmentation

Laser Dreams will focus on two customer groups:

– Urban professional women aged 21-45

– Urban professional men aged 21-35

Market Analysis

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Professional Women 15% 10,000 11,500 13,225 15,209 17,490 15.00%

Professional Men 5% 1,000 1,050 1,103 1,158 1,216 5.01%

Total 14.19% 11,000 12,550 14,328 16,367 18,706 14.19%

Strategy and Implementation Summary

Laser Dreams will market through downtown fitness clubs, beauty salons, tanning salons, and boutiques. Additionally, Laser Dreams will offer the first treatment free.

Competitive Edge

Laser Dreams’ competitive advantage is its location. Once we attract customers, our customer-focused environment will be our advantage. Each customer represents a potential lead to ten more customers.

To develop effective business strategies, perform a SWOT analysis of your business. Use our free guide and template to learn how.

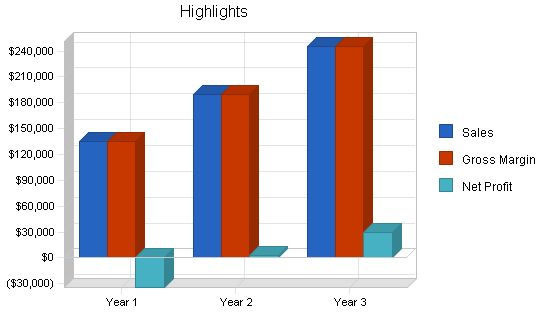

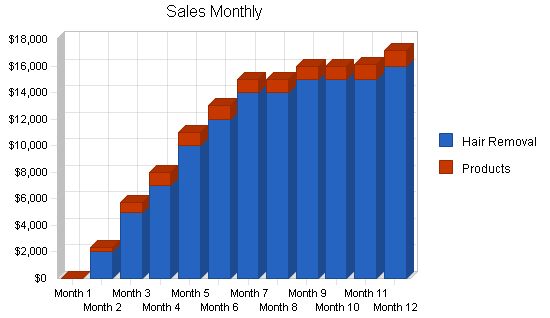

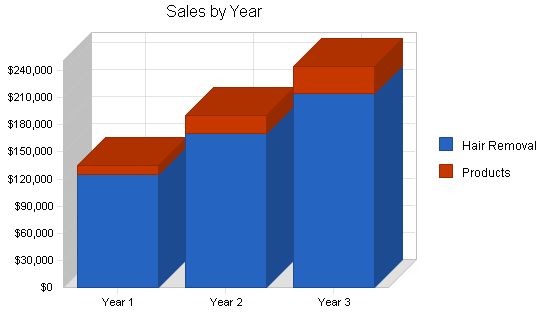

Laser Dreams expects sales to be slow in the first and second month due to our "first treatment free" promotion. Afterwards, sales will increase as satisfied customers refer their friends. Below is the sales forecast for three years.

Sales Forecast:

Year 1 Year 2 Year 3

Hair Removal $125,000 $170,000 $215,000

Products $10,300 $20,000 $30,000

Total Sales $135,300 $190,000 $245,000

Direct Cost of Sales:

Year 1 Year 2 Year 3

Hair Removal $0 $0 $0

Products $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0

Personnel Plan:

Joe Jackson has managed both the BareAll Laser Center (two years) and the Laser Works (three years). Customer traffic increased by 15% each year at both locations.

Allison Fremont set up and managed the laser hair removal section of Maximum Beauty Salon for five years. Sales grew by 10% each year under her leadership.

Both Joe and Allison have the following certifications and association memberships:

Registered Electrologists (R.E.)

Certified Clinical Electrologists (C.C.E.)

Society of Clinical and Medical Electrologists (S.C.M.E.)

Laser Dreams’ personnel will be:

– Joe Jackson

– Allison Fremont

– Receptionist/clerk (1)

Personnel Plan:

Year 1 Year 2 Year 3

Joe Jackson $36,000 $40,000 $45,000

Allison Fremont $36,000 $40,000 $45,000

Receptionist/Clerk $21,600 $25,000 $28,000

Total People 3 3 3

Total Payroll $93,600 $105,000 $118,000

The financial plan for Laser Dreams is as follows.

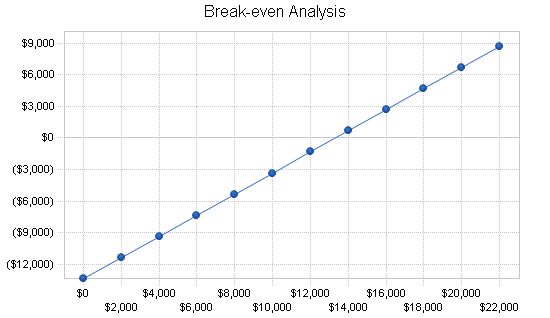

Break-even Analysis:

The monthly break-even point is approximately $13,300.

Break-even Analysis:

Monthly Revenue Break-even: $13,329

Assumptions:

– Average Percent Variable Cost: 0%

– Estimated Monthly Fixed Cost: $13,329

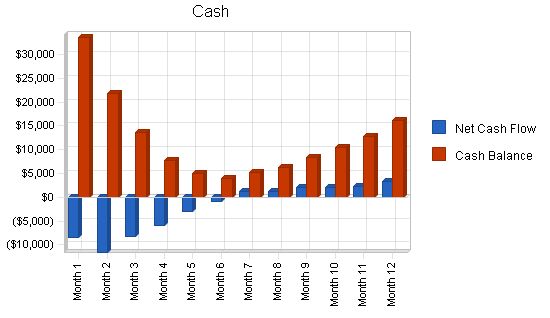

7.2 Projected Cash Flow:

The table and chart below show the projected cash flow for three years.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $135,300 | $190,000 | $245,000 |

| Subtotal Cash from Operations | $135,300 | $190,000 | $245,000 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $135,300 | $190,000 | $245,000 |

| Expenditures | |||

| Expenditures from Operations | |||

| Cash Spending | $93,600 | $105,000 | $118,000 |

| Bill Payments | $62,348 | $72,440 | $87,565 |

| Subtotal Spent on Operations | $155,948 | $177,440 | $205,565 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $5,160 | $5,160 | $5,160 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $161,108 | $182,600 | $210,725 |

| Net Cash Flow | ($25,808) | $7,400 | $34,275 |

| Cash Balance | $16,092 | $23,492 | $57,767 |

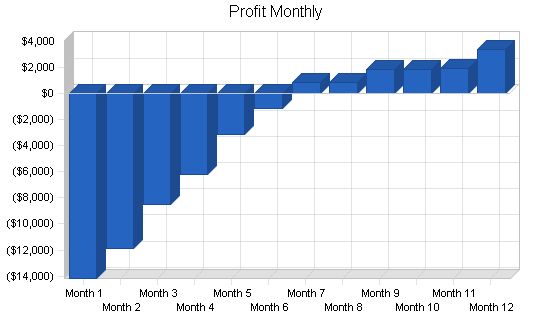

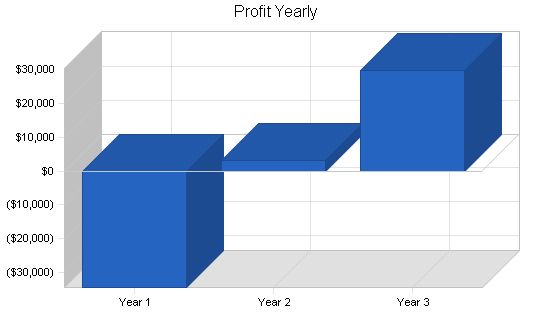

7.3 Projected Profit and Loss

The table and charts below display the projected profit and loss for three years.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $135,300 | $190,000 | $245,000 |

| Direct Cost of Sales | $0 | $0 | $0 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $0 |

| Gross Margin | $135,300 | $190,000 | $245,000 |

| Gross Margin % | 100.00% | 100.00% | 100.00% |

| Expenses | |||

| Payroll | $93,600 | $105,000 | $118,000 |

| Sales and Marketing and Other Expenses | $6,000 | $8,000 | $10,000 |

| Depreciation | $8,568 | $8,568 | $8,568 |

| Leased Equipment | $0 | $0 | $0 |

| Utilities | $3,300 | $3,300 | $3,300 |

| Insurance | $2,400 | $2,400 | $2,400 |

| Rent | $36,000 | $36,000 | $36,000 |

| Payroll Taxes | $10,080 | $13,050 | $15,750 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $159,948 | $176,318 | $194,018 |

| Profit Before Interest and Taxes | ($24,648) | $13,682 | $50,982 |

| EBITDA | ($16,080) | $22,250 | $59,550 |

| Interest Expense | $9,721 | $9,226 | $8,710 |

| Taxes Incurred | $0 | $1,337 | $12,682 |

| Net Profit | ($34,369) | $3,119 | $29,590 |

| Net Profit/Sales | -25.40% | 1.64% | 12.08% |

Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $16,092 | $23,492 | $57,767 |

| Other Current Assets | $20,000 | $20,000 | $20,000 |

| Total Current Assets | $36,092 | $43,492 | $77,767 |

| Long-term Assets | |||

| Long-term Assets | $30,000 | $30,000 | $30,000 |

| Accumulated Depreciation | $8,568 | $17,136 | $25,704 |

| Total Long-term Assets | $21,432 | $12,864 | $4,296 |

| Total Assets | $57,524 | $56,356 | $82,063 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $5,153 | $6,026 | $7,302 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $5,153 | $6,026 | $7,302 |

| Long-term Liabilities | $94,840 | $89,680 | $84,520 |

| Total Liabilities | $99,993 | $95,706 | $91,822 |

| Paid-in Capital | $60,000 | $60,000 | $60,000 |

| Retained Earnings | ($68,100) | ($102,469) | ($99,349) |

| Earnings | ($34,369) | $3,119 | $29,590 |

| Total Capital | ($42,469) | ($39,349) | ($9,759) |

| Total Liabilities and Capital | $57,524 | $56,356 | $82,063 |

| Net Worth | ($42,468) | ($39,349) | ($9,759) |

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 40.43% | 28.95% | 7.50% |

| Percent of Total Assets | ||||

| Other Current Assets | 34.77% | 35.49% | 24.37% | 36.10% |

| Total Current Assets | 62.74% | 77.17% | 94.77% | 52.40% |

| Long-term Assets | 37.26% | 22.83% | 5.23% | 47.60% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 8.96% | 10.69% | 8.90% | 31.90% |

| Long-term Liabilities | 164.87% | 159.13% | 102.99% | 26.80% |

| Total Liabilities | 173.83% | 169.82% | 111.89% | 58.70% |

| Net Worth | -73.83% | -69.82% | -11.89% | 41.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 100.00% | 100.00% | 100.00% | 0.00% |

| Selling, General & Administrative Expenses | 105.89% | 91.73% | 84.21% | 73.40% |

| Advertising Expenses | 4.43% | 4.21% | 4.08% | 2.50% |

| Profit Before Interest and Taxes | -18.22% | 7.20% | 20.81% | 3.20% |

| Main Ratios | ||||

| Current | 7.00 | 7.22 | ||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!