Grutzen Watches is a start-up watch producer and distribution company. It aims to serve upscale niche markets in the watch industry, capitalizing on German engineering and manufacturing. Many untapped potential markets desire high-quality, stylish goods but think they can’t afford them or don’t know where to purchase them.

The company’s objectives are to export its products to the United States, become the top-selling European watch in the Western U.S., achieve a 20% market share, build brand image and equity through marketing, attain a sustainable 55% profit margin, and eventually produce luxury watches alongside the initial line.

Grutzen Watches is a privately-held international corporation, with production in Germany and sales and marketing focused on California. Ownership is divided among three individuals: Franz Grutzen, head of production; Henry Winster, head of American division and sales and marketing; and Walter Young, vice president of American division.

The German factory, located at 210 Autoroute 17, Frankfurt, Germany, spans 1,000 square meters and will suffice for the company’s initial three years of growth. The watches will be shipped to and distributed from Henry Winster’s house at 343 Palm Avenue in Los Angeles and sold in upscale watch stores in Los Angeles and San Francisco.

Grutzen’s sales force will consist of Henry Winster and two freelancing sales representatives, with order processing handled by communication between Henry Winster and Franz Grutzen.

The initial product line will include elegant analog watches with sporting characteristics, suitable for use in waters up to 100 meters deep. Two versions will be released: the "sport" watch and the "night" watch.

The pricing strategy involves initially undercutting main competitors by 10%, employing a market penetration approach. Prices will then be adjusted to be directly competitive with other major competitors. Each watch is expected to cost around $100-$200.

Entry into the high-end watch industry is opportune, with a 50% increase in the purchase of mid-level and high-level European watches in the U.S. over the past two years. Potential buyers are willing to spend more on watches due to enhanced image appeal, offering a competitive advantage to companies that can build a substantial brand image. Grutzen aims to capitalize on its high quality, reasonable prices, and innovative styles for brand building.

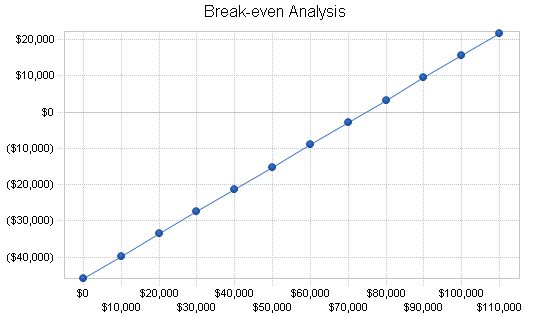

The company’s start-up costs amount to ~$226,000, with $171,000 provided by owners’ equity, $30,000 from short-term borrowing, and the remainder from long-term loans. Start-up costs primarily include rent, research and development, initial inventory, and a strong cash account. The Break-even Analysis shows Grutzen Watches will achieve a steady profit by the second year.

1.1 Objectives

- Make Grutzen Watches the top-selling European watch brand.

- Expand product range to include luxury watches alongside the moderately priced line.

- Achieve a 55% profit margin.

- Attain a 20% market share in the U.S.

1.2 Mission

Grutzen Watches is a company that produces and sells wrist watches in the United States, starting in California. The company aims to establish a reputation for producing high-quality watches and then introduce luxury watches with higher profit margins.

1.3 Keys to Success

To succeed, Grutzen Watches must:

- Create and sell high-quality products.

- Ensure 100% customer satisfaction.

- Build brand image and equity through marketing.

Company Summary

Grutzen Watches offers quality watches and excellent customer service to customers seeking reliable timepieces. The company plans to enter the luxury watch market in the future.

2.1 Company Ownership

Grutzen Watches is a privately held international corporation. Production takes place in Germany, while sales and marketing primarily focus on California in the United States.

Ownership:

- Franz Grutzen: 55% (Germany)

- Henry Winster: 30% (U.S.)

- Walter Young: 15% (U.S.)

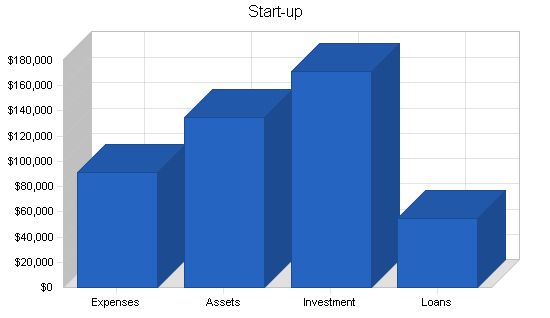

2.2 Start-up Summary

60% of start-up costs will go towards assets. Financing for start-up costs will come from the owners’ investments and loans. The assumptions are displayed in the following table and chart.

*NOTE: The tables in this sample plan were converted from German deutschmarks to dollars. However, the numbers do not reflect current monetary exchange rates.

Start-up Requirements

Start-up Expenses

Legal: $20,000

Stationery etc.: $500

Brochures: $3,000

Consultants: $10,000

Insurance: $10,000

Rent: $20,000

Research and Development: $10,000

Expensed Equipment: $10,000

Other: $7,500

Total Start-up Expenses: $91,000

Start-up Assets

Cash Required: $70,000

Start-up Inventory: $25,000

Other Current Assets: $5,000

Long-term Assets: $35,000

Total Assets: $135,000

Total Requirements: $226,000

Start-up Funding

Start-up Expenses to Fund: $91,000

Start-up Assets to Fund: $135,000

Total Funding Required: $226,000

Assets

Non-cash Assets from Start-up: $65,000

Cash Requirements from Start-up: $70,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $70,000

Total Assets: $135,000

Liabilities and Capital

Liabilities

Current Borrowing: $30,000

Long-term Liabilities: $20,000

Accounts Payable (Outstanding Bills): $5,000

Other Current Liabilities (interest-free): $0

Total Liabilities: $55,000

Capital

Planned Investment

Investor 1: $100,000

Investor 2: $71,000

Other: $0

Additional Investment Requirement: $0

Total Planned Investment: $171,000

Loss at Start-up (Start-up Expenses): ($91,000)

Total Capital: $80,000

Total Capital and Liabilities: $135,000

Total Funding: $226,000

Company Locations and Facilities

– The German factory is located at 210 Autoroute 17, Frankfurt, Germany.

– The factory is 1000 square meters and suitable for the first three years of growth.

– Watches will be shipped and distributed from Henry Winster’s house at 343 Palm Avenue in Los Angeles, California.

– Initially, watches will be sold in upscale watch stores in Los Angeles and San Francisco.

Products

The watches will be mid-level all-around high-quality sports watches.

The price will be competitive: $100-$200.

Product Description

Grutzen Watches are elegant analog watches with sporting characteristics, usable at depths of 100 meters underwater.

– The “sport” watch will be made of durable steel and hard rubber for style and durability.

– The “night” watch will be all black with minimal white writing for the numbers and feature white hands.

Competitive Comparison

Grutzen Watches will have the following sustainable competitive advantages:

1. German technology, experience, proficiency, and reputation.

2. High quality at a moderate price.

3. Elegant and ergonomic styling.

4. Devoted German work force.

5. American marketing skills.

Sales Literature

Grutzen Watches will use advertising, public relations, and sales programs to promote awareness of the watches.

1. Advertisements and public relations pieces in local newspapers, including The Los Angeles Times and The San Francisco Chronicle.

2. Full-color brochures will be distributed at watch stores.

Sourcing

Grutzen Watches will only sell watches produced at its German factory, eliminating the need for additional sourcing. However, sourcing parts for manufacturing the watches will impact profitability. Initially, most parts will be sourced from Eastern European suppliers due to beneficial exchange rates.

Technology

PC-based software will manage accounts receivable/payable, inventory, purchasing, sales, shipping, and returns. This business plan uses Business Plan Pro from Palo Alto Software, Inc. and will be reviewed and updated as needed.

Future Products

The current focus is on a luxury watch. Other future products could include alarm clocks, wall clocks, and clocks for luxury automobiles built in Germany.

Market Analysis Summary

The purchase of mid-level and high-level European watches has increased by 50 percent over the past two years. Sales are expected to continue growing as watches are a constant need.

Market Segmentation

The market segments are divided according to target markets, each requiring a different marketing strategy.

– "Yuppies" who enjoy being early adopters of new, trendy products.

– "Yuppies" who follow trends and buy popular products.

– Older adults with good taste and a sense of style.

– Wealthier college students.

– Stylish senior citizens.

Market Analysis

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| New Yuppies | 5% | 100,000 | 105,000 | 110,250 | 115,763 | 121,551 | 5.00% |

| Trend Yuppies | 2% | 50,000 | 51,000 | 52,020 | 53,060 | 54,121 | 2.00% |

| Older Adults | 5% | 25,000 | 26,250 | 27,563 | 28,941 | 30,388 | 5.00% |

| Other | 4% | 20,000 | 20,800 | 21,632 | 22,497 | 23,397 | 4.00% |

| Total | 4.15% | 195,000 | 203,050 | 211,465 | 220,261 | 229,457 | 4.15% |

4.2 Target Market Segment Strategy

The watch industry, especially the upscale market, is growing rapidly. Potential buyers are willing to spend on watches as they enhance their appearance and boost their self-esteem. Grutzen Watches will be built to last a lifetime, requiring only a battery replacement every ten years, adding value to our watches.

The upscale niche market Grutzen Watches is targeting is competitive, with a focus on quality rather than price.

4.2.1 Market Needs

The upscale watch industry is currently experiencing growth, making it an ideal time to enter the market.

4.2.2 Market Trends

Henry Winster will distribute the watches to outlets in Los Angeles and San Francisco from his residence in Los Angeles.

The cost of marketing the new product is expected to be the biggest challenge, but using Henry Winster’s facilities as a distribution channel will result in cost savings.

4.2.3 Market Growth

The leading competitor in the market is Swiss Army Watches.

Consumers typically buy a new watch every 5 to 10 years, often as gifts. Therefore, advertising will be increased during the Christmas holiday season.

The intended retail outlets are full price and full service, so Grutzen will not need to use an extreme price strategy to gain a foothold in the market.

4.2.4 Main Competitors

Our main competitor is Swiss Army Watches. The next closest competitor is Tag Heuer. Both companies have strong brand equity, but there is room in the market for a new company as brand loyalty is not a significant factor in a customer’s decision to purchase.

Strategy and Implementation Summary

Grutzen Watches’ strategy is to serve niche markets in the watch industry, capitalizing on German engineering and manufacturing. There are untapped potential markets that desire high-quality goods but may believe they cannot afford them or do not know where to purchase them. Grutzen Watches’ marketing strategy will address this problem.

5.1 Marketing Strategy

The marketing strategy will focus on two segments:

- The company will benchmark objectives for promotion, outlet selling, and personal selling.

- The marketing budget will be $36,000 per year.

To develop effective business strategies, perform a SWOT analysis of your business. Get started with our free guide and template to learn how to perform a SWOT analysis.

5.1.1 Pricing Strategy

The pricing strategy will be to initially undercut our main competitors by 10%, using a market penetration strategy. Afterward, pricing will be adjusted to be directly competitive with other major competitors.

5.1.2 Promotion Strategy

Promotion will be initially spearheaded by public relations due to its low cost, and later through advertising as the company’s cash flow increases.

5.2 Sales Strategy

Grutzen’s sales force will consist of Henry Winster and two freelancing sales representatives. Order processing will be achieved through communication between Henry Winster in the U.S. and Franz Grutzen in Germany.

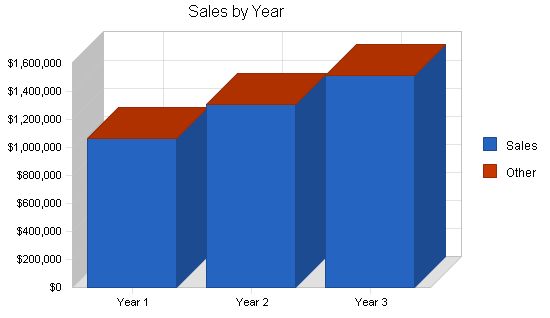

5.2.1 Sales Forecast

The following table and chart present our sales forecast.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Sales | $1,066,000 | $1,307,000 | $1,515,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $1,066,000 | $1,307,000 | $1,515,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Sales | $410,000 | $500,000 | $610,000 |

| Other | $0 | $0 | $0 |

| Subtotal Direct Cost of Sales | $410,000 | $500,000 | $610,000 |

5.2.2 Sales Programs

Henry Winster and the sales reps will make sales. Outlets with the highest sales figures will receive 2% discounts to encourage increased sales.

5.3 Milestones

This table lists important program milestones, including dates, managers, and budgets. The milestone schedule emphasizes planning for implementation.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business Plan | 4/16/1998 | 4/16/1998 | $4,000 | FG | Devpt |

| Factory Selection | 5/5/1998 | 5/5/1998 | $6,000 | FG | Finance |

| Retainer Contracts | 6/1/1998 | 6/1/1998 | $2,500 | HW | Sales |

| Brochures | 6/11/1998 | 6/11/1998 | $5,500 | HW | Marketing |

| Copywrite | 6/28/1998 | 6/28/1998 | $6,500 | WY | Legal |

| Totals | $24,500 | ||||

Management Summary

Grutzen Watches is not currently hiring more employees. Further hiring will be postponed until the company begins to succeed.

After approximately one year, two employees will be added to the current six.

6.1 Organizational Structure

Grutzen Watches is divided by location and functionality. The production division, run by Franz Grutzen, is located in Germany where the factory is. The sales and marketing, and finance and administration divisions, run by Henry Winster and Walter Young, are located in Los Angeles.

6.2 Management Team

Franz Grutzen: president, founder, and head of production department. Grutzen was president of production at Swiss Army Watches before starting his own company. He graduated from the University of Frankfurt and received an MBA at The University of Paris at Sorbonne. Forty-eight years old, no children.

Henry Winster: head of American division and sales and marketing division. He has worked at Wright and Winster, an advertising agency, for fifteen years. BA from USC, MBA from Stanford. Fifty-six years old, three children.

Walter Young: vice president of American division. He was previously vice president of operations at Greentree Sports in Phoenix, AZ. He received his BA from Emory University and his MBA from UCLA.

6.3 Management Team Gaps

The following important gaps exist:

- The present team lacks sales experience.

- There is no current in-house designer – this should be corrected within a year.

- There is no international manager.

6.4 Personnel Plan

Two employees will be added by the end of the first year, bringing the total to eight. Another four employees will be added after the second year. These new employees will work in production and sales.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| President | $72,000 | $77,000 | $82,000 |

| Head of American Division | $66,000 | $70,000 | $74,000 |

| Vice President American Division | $54,000 | $58,000 | $62,000 |

| Other | $104,400 | $118,000 | $131,000 |

| Total People | 6 | 8 | 8 |

| Total Payroll | $296,400 | $323,000 | $349,000 |

Growth will be supported by cash flow and owner investment. This will ensure slow and manageable initial growth and allow complete control over the firm.

7.1 Important Assumptions

Grutzen’s financial plan relies on several important assumptions, most of which are shown in the following table.

The key assumptions are:

- Sufficient access to capital.

- Steady economy without a major recession.

- No unforeseen drastic technology changes.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 9.00% | 9.00% | 9.00% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

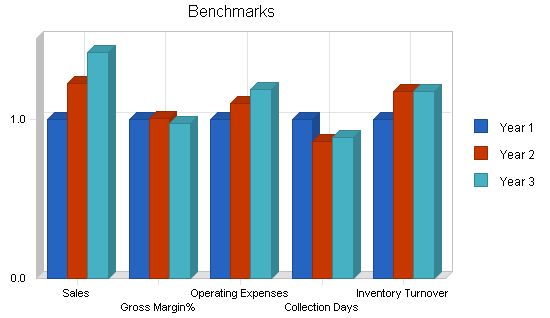

7.2 Key Financial Indicators

- Keeping average collection days at 60 days or below is crucial to avoid cash flow problems in the first year.

- Gross margins must remain above 55%.

The Break-even Analysis chart and table indicate that Grutzen Watches can achieve a consistent profit by the second year if costs remain at the current or stable level.

Break-even Analysis

Monthly Revenue Break-even: $74,602

Assumptions:

Average Percent Variable Cost: 38%

Estimated Monthly Fixed Cost: $45,909

Projected Profit and Loss:

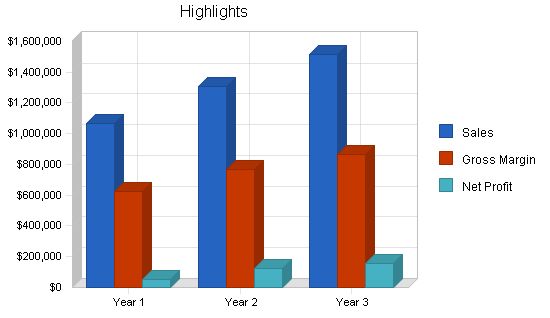

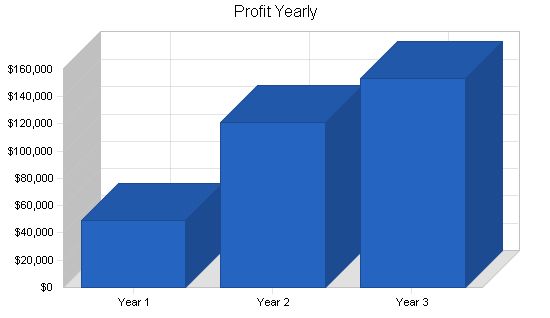

Grutzen expects to start making a profit in its second year of operation. The table and chart below illustrate the company’s profit and loss expectations.

Review: Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $1,066,000 | $1,307,000 | $1,515,000 |

| Direct Cost of Sales | $410,000 | $500,000 | $610,000 |

| Other | $33,000 | $38,000 | $43,000 |

| Total Cost of Sales | $443,000 | $538,000 | $653,000 |

| Gross Margin | $623,000 | $769,000 | $862,000 |

| Gross Margin % | 58.44% | 58.84% | 56.90% |

| Expenses | |||

| Payroll | $296,400 | $323,000 | $349,000 |

| Sales and Marketing and Other Expenses | $100,675 | $112,900 | $129,200 |

| Depreciation | $3,504 | $3,500 | $3,500 |

| Leased Equipment | $72,000 | $80,000 | $81,000 |

| Utilities | $6,325 | $7,000 | $8,000 |

| Insurance | $18,000 | $21,000 | $23,000 |

| Rent | $48,000 | $51,000 | $55,000 |

| Other | $6,000 | $6,300 | $6,500 |

| Payroll Taxes | $0 | $0 | $0 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $550,904 | $604,700 | $655,200 |

| Profit Before Interest and Taxes | $72,096 | $164,300 | $206,800 |

| EBITDA | $75,600 | $167,800 | $210,300 |

| Interest Expense | $6,180 | $2,810 | $900 |

| Taxes Incurred | $16,480 | $40,373 | $52,333 |

| Net Profit | $49,437 | $121,118 | $153,567 |

| Net Profit/Sales | 4.64% | 9.27% | 10.14% |

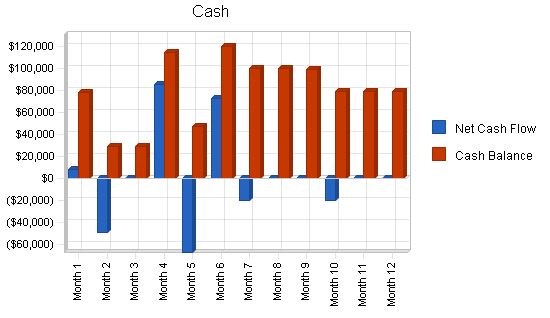

7.5 Projected Cash Flow

Cash flow will be managed with a revolving line of credit. We expect to borrow $41,000 in the first year to cover our receivables.

Pro Forma Cash Flow

Cash Received

– Cash from Operations

– Cash Sales: $533,000, $653,500, $757,500

– Cash from Receivables: $453,350, $635,493, $741,959

– Additional Cash Received

– Sales Tax, VAT, HST/GST Received: $0, $0, $0

– New Current Borrowing: $41,000, $0, $0

– New Other Liabilities (interest-free): $0, $0, $0

– New Long-term Liabilities: $0, $0, $0

– Sales of Other Current Assets: $0, $0, $0

– Sales of Long-term Assets: $0, $0, $0

– New Investment Received: $0, $0, $0

Subtotal Cash Received: $1,027,350, $1,288,993, $1,499,459

Expenditures

– Expenditures from Operations

– Cash Spending: $296,400, $323,000, $349,000

– Bill Payments: $677,740, $849,960, $1,005,944

Subtotal Spent on Operations: $974,140, $1,172,960, $1,354,944

Additional Cash Spent

– Sales Tax, VAT, HST/GST Paid Out: $0, $0, $0

– Principal Repayment of Current Borrowing: $40,000, $31,000, $0

– Other Liabilities Principal Repayment: $0, $0, $0

– Long-term Liabilities Principal Repayment: $4,000, $4,000, $4,000

– Purchase Other Current Assets: $0, $0, $0

– Purchase Long-term Assets: $0, $0, $0

– Dividends: $0, $0, $0

Subtotal Cash Spent: $1,018,140, $1,207,960, $1,358,944

Net Cash Flow: $9,210, $81,033, $140,515

Cash Balance: $79,210, $160,243, $300,758

Projected Balance Sheet

As seen in the balance sheet, there is a strong growth in net worth over the next three years.

Pro Forma Balance Sheet

Assets

– Current Assets

– Cash: $79,210, $160,243, $300,758

– Accounts Receivable: $79,650, $97,657, $113,199

– Inventory: $35,200, $42,927, $52,371

– Other Current Assets: $5,000, $5,000, $5,000

– Total Current Assets: $199,060, $305,827, $471,327

– Long-term Assets

– Long-term Assets: $35,000, $35,000, $35,000

– Accumulated Depreciation: $3,504, $7,004, $10,504

– Total Long-term Assets: $31,496, $27,996, $24,496

Total Assets: $230,556, $333,823, $495,823

Liabilities and Capital

– Current Liabilities

– Accounts Payable: $54,120, $71,269, $83,702

– Current Borrowing: $31,000, $0, $0

– Other Current Liabilities: $0, $0, $0

– Subtotal Current Liabilities: $85,120, $71,269, $83,702

– Long-term Liabilities: $16,000, $12,000, $8,000

Total Liabilities: $101,120, $83,269, $91,702

Paid-in Capital: $171,000, $171,000, $171,000

Retained Earnings: ($91,000), ($41,563), $79,554

Earnings: $49,437, $121,118, $153,567

Total Capital: $129,437, $250,554, $404,121

Total Liabilities and Capital: $230,556, $333,823, $495,823

Net Worth: $129,437, $250,554, $404,121

Standard business ratios are provided in the following table. The ratios show strong and safe growth. Industry Profile ratios are based on Standard Industrial Classification (SIC) Index code 3873.

Ratio Analysis

– Sales Growth: 0.00%, 22.61%, 15.91%, 3.90%

Percent of Total Assets

– Accounts Receivable: 34.55%, 29.25%, 22.83%, 27.20%

– Inventory: 15.27%, 12.86%, 10.56%, 29.70%

– Other Current Assets: 2.17%, 1.50%, 1.01%, 26.70%

– Total Current Assets: 86.34%, 91.61%, 95.06%, 83.60%

– Long-term Assets: 13.66%, 8.39%, 4.94%, 16.40%

– Total Assets: 100.00%, 100.00%, 100.00%, 100.00%

Current Liabilities

– Accounts Payable: 36.92%, 21.35%, 16.88%, 36.30%

– Long-term Liabilities: 6.94%, 3.59%, 1.61%, 19.00%

– Total Liabilities: 43.86%, 24.94%, 18.49%, 55.30%

– Net Worth: 56.14%, 75.06%, 81.51%, 44.70%

Percent of Sales

– Sales: 100.00%, 100.00%, 100.00%, 100.00%

– Gross Margin: 58.44%, 58.84%, 56.90%, 34.40%

– Selling, General & Administrative Expenses: 58.66%, 54.01%, 50.88%, 23.80%

– Advertising Expenses: 3.38%, 3.21%, 3.17%, 0.70%

– Profit Before Interest and Taxes: 6.76%, 12.57%, 13.65%, 1.70%

Main Ratios

– Current: 2.34, 4.29, 5.63, 2.42

– Quick: 1.93, 3.69, 5.01, 1.31

– Total Debt to Total Assets: 43.86%, 24.94%, 18.49%, 55.30%

– Pre-tax Return on Net Worth: 50.93%, 64.45%, 50.95%, 2.10%

– Pre-tax Return on Assets: 28.59%, 48.38%, 41.53%, 4.80%

Additional Ratios

– Net Profit Margin: 4.64%, 9.27%, 10.14%, n.a

– Return on Equity: 38.19%, 48.34%, 38.00%, n.a

Activity Ratios

– Accounts Receivable Turnover: 6.69, 6.69, 6.69, n.a

– Collection Days: 58, 50, 51, n.a

– Inventory Turnover: 10.91, 12.80, 12.80, n.a

– Accounts Payable Turnover: 13.43, 12.17, 12.17, n.a

– Payment Days: 27, 26, 28, n.a

– Total Asset Turnover: 4.62, 3.92, 3.06, n.a

Debt Ratios

– Debt to Net Worth: 0.78, 0.33, 0.23, n.a

– Current Liab. to Liab.: 0.84, 0.86, 0.91, n.a

Liquidity Ratios

– Net Working Capital: $113,941, $234,558, $387,625, n.a

– Interest Coverage: 11.67, 58.47, 229.78, n.a

Additional Ratios

– Assets to Sales: 0.22, 0.26, 0.33, n.a

– Current Debt/Total Assets: 37%, 21%, 17%, n.a

– Acid Test: 0.99, 2.32, 3.65, n.a

– Sales/Net Worth: 8.24, 5.22, 3.75, n.a

– Dividend Payout: 0.00, 0.00, 0.00, n.a

Appendix

Sales Forecast

– Sales: $81,000, $81,000, $81,000, $175,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000

– Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Sales: $81,000, $81,000, $81,000, $175,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000, $81,000

Direct Cost of Sales

– Sales: $32,000, $32,000, $32,000, $58,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000

– Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Subtotal Direct Cost of Sales: $32,000, $32,000, $32,000, $58,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000, $32,000

"Personnel Plan"

President: 0% ($6,000/month for months 1-12)

Head of American Division: 0% ($5,500/month for months 1-12)

Vice President American Division: 0% ($4,500/month for months 1-12)

Other: 0% ($8,700/month for months 1-12)

Total People: 6 across all months

Total Payroll: $24,700 for each month

"General Assumptions"

Plan Month: 1-12

Current Interest Rate: 10.00% for each month

Long-term Interest Rate: 9.00% for each month

Tax Rate: 30.00% for month 1, 25.00% for months 2-12

Other: 0 for all months

"Pro Forma Profit and Loss"

Sales: $81,000 for each month

Direct Cost of Sales: $32,000 for each month

Other: $2,750 for each month

Total Cost of Sales: $34,750 for each month

Gross Margin: $46,250 for each month

Gross Margin %: 57.10% for each month

Expenses:

– Payroll: $24,700 for each month

– Sales and Marketing and Other Expenses: $8,350 for month 1, $8,275 for month 2, $8,350 for months 3-12

– Depreciation: $292 for each month

– Leased Equipment: $6,000 for each month

– Utilities: $500 for month 1, $550 for month 3, $600 for month 4, $575 for month 5, $550 for months 6-8, $500 for months 9-12

– Insurance: $1,500 for each month

– Rent: $4,000 for each month

– Other: $500 for each month

– Payroll Taxes: 12% for all months

– Other: $0 for all months

Total Operating Expenses: $45,842 for months 1-12

Profit Before Interest and Taxes: $408 for months 1, 2, 4-6, 8-12, $358 for month 3, $67,758 for month 4, $114,250 for month 5

EBITDA: $700 for months 1, 2, 4-6, 8-12, $650 for month 3, $68,050 for month 4, $114,250 for month 5

Interest Expense: $397 for month 1, $395 for month 2, $392 for month 3, $732 for month 4, $729 for month 5, $727 for month 6, $557 for month 7, $555 for month 8, $552 for month 9, $383 for month 10, $381 for month 11, $378 for month 12

Taxes Incurred: $3 for months 1, 2, 4-6, 8-12, ($9) for month 3, $16,757 for month 4, ($80) for month 5, ($92) for month 6, ($37) for month 7-9, ($36) for month 10, $6 for month 11, ($6) for month 12, $7 for month 12

Net Profit: $7 for months 1, 2, 9-12, $10 for month 3, ($26) for month 4, ($241) for month 5, ($276) for month 6, ($112) for month 7, ($110) for month 8, ($108) for month 9, $19 for month 10, ($17) for month 11, $22 for month 12

Net Profit/Sales: 0.01% for months 1, 2, 10-12, -0.03% for month 3, 28.73% for month 4, -0.30% for month 5, -0.34% for month 6, -0.14% for month 7, -0.13% for month 8, 0.02% for month 9, -0.02% for month 11, 0.03% for month 12

Pro Forma Cash Flow

| Pro Forma Cash Flow | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Cash Received | ||||||||||||

| Cash from Operations | ||||||||||||

| Cash Sales | $40,500 | $40,500 | $40,500 | $87,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 |

| Cash from Receivables | $0 | $1,350 | $40,500 | $40,500 | $42,067 | $85,933 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 | $40,500 |

| Subtotal Cash from Operations | $40,500 | $41,850 | $81,000 | $128,000 | $82,567 | $126,433 | $81,000 | $81,000 | $81,000 | $81,000 | $81,000 | $81,000 |

| Additional Cash Received | ||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $41,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Received | $40,500 | $41,850 | $81,000 | $169,000 | $82,567 | $126,433 | $81,000 | $81,000 | $81,000 | $81,000 | $81,000 | $81,000 |

| Expenditures | ||||||||||||

| Expenditures from Operations | ||||||||||||

| Cash Spending | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 | $24,700 |

| Bill Payments | $7,207 | $65,861 | $55,999 | $58,444 | $124,982 | $28,603 | $56,279 | $56,120 | $56,118 | $56,112 | $55,991 | $56,024 |

| Subtotal Spent on Operations | $31,907 | $90,561 | $80,699 | $83,144 | $149,682 | $53,303 | $80,979 | $80,820 | $80,818 | $80,812 | $80,691 | $80,724 |

| Additional Cash Spent | ||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $20,000 | $0 | $0 | $20,000 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $334 | $334 | $334 | $334 | $333 | $333 | $333 | $333 | $333 | $333 | $333 | $333 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cash Spent | $32,241 | $90,895 | $81,033 | $83,478 | $150,015 | $53,636 | $101,312 | $81,153 | $81,151 | $101,145 | $81,024 | $81,057 |

| Net Cash Flow | $8,259 | ($49,045) | ($33) | $85,522 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!