Insurance Solutions LLC (ISL) aims to be the leading provider of web-based property and contents valuation software for various stakeholders. ISL offers two products:

1. IV Software: This web-based "Insurance Valuer" (IV) software enables insurers to accurately assess risks and price them accordingly. It also helps mortgage and small business lenders ensure the proper valuation and insurance of collateral property. For consumers, the IV software provides independent property valuations and convenient links to insurance agencies and replacement property websites.

2. Documents Plus: This offering allows consumers to store and access vital insurance, legal, and financial documents online from anywhere in the world. It offers peace of mind by ensuring that property and contents insurance are fully covered and that important documents and information are safely stored and accessible.

The IV software has already been successfully implemented by major insurance providers in Australia, demonstrating its effectiveness.

ISL’s management team comprises individuals with extensive experience and expertise in the insurance and financial services marketplace. The company is a privately-held LLC jointly owned by its three chief officers and advisor Michael Bartlett, the founder of ISL’s Australian affiliate, International Cost Research (ICR). Additionally, a minority stock is available for a fifth investor who can contribute the required start-up costs of $92,500.

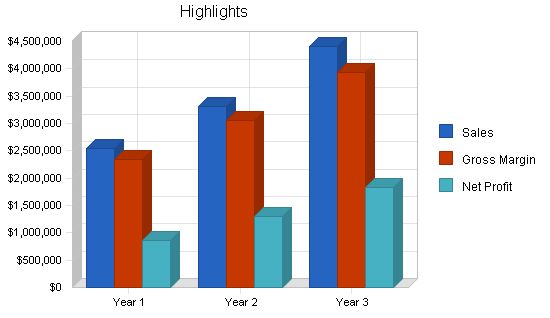

Potential customers have shown significant interest in ISL’s solutions, as they are dissatisfied with competitor products. Industry estimates and research indicate that the company has the potential to generate a strong net profit in the first year, with projections suggesting an increase in the insurance industry’s premium revenues by approximately $4.7 billion annually.

The founders plan to buy out the initial $92,500 start-up investment in the third year at a valuation of approximately $750,000.

The keys to our success will be our unique and complementary online data-retrieval systems, which fill a substantial void in the insurance market today. We will utilize our state of the art technology to closely meet customer needs, clearly differentiate our solutions from competitors, and offer superior service. ISL will create high product visibility and consumer awareness of our solutions through a consistent and carefully targeted marketing strategy. We will establish a brand identity and leverage client relationships to enhance credibility and encourage growth.

Objectives:

– Solutions marketed to insurance company clients to achieve $3.0 million in sales by Year 3

– Web-based consumer solutions to achieve $1.5 million in sales by Year 3

Mission:

Provide insurers the ability to assess risks accurately, price those risks accordingly, and provide enhanced services and solutions to their customers.

ISL will become the premier provider of Web-based property and contents valuation software and additional information solutions. Our products utilize an online data-retrieval system to offer up-to-date risk assessment cost data to insurers, property valuation to mortgage and lender groups, and secure insurance and valuation documents storage to consumers. ISL is a privately-owned Limited Liability Corporation, currently located in the “Executive Suite” facilities at 50 Washington Avenue in South Norwalk, Connecticut. These facilities are centrally located, with easy access and travel to our potential major clients, partners, and affiliates.

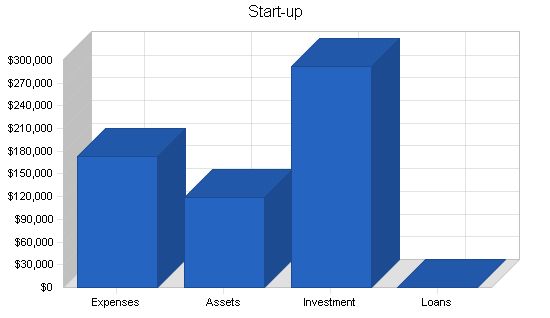

Start-up Summary:

Our start-up costs come to $292,250, including expenses for the cost of data, IV software models and licensing fees, and first month’s salaries. Additional start-up items include marketing and branding consulting services and costs for the initially outsourced server hosting. Information systems will eventually be brought in-house, depending on future development needs and cost analysis. Other usual start-up costs include legal, stationary, and expenses associated with opening our first office. We are confirming the sourcing of $200,000 from the company founders and key executives, and there is potential for sharing expenses with partner and affiliate organizations. We require additional funds of $92,250 to sustain our cash reserves during the critical first year and are seeking investment in that amount in exchange for a non-managing interest in the business. Based on market research and data from our Australian affiliate, we project that the company will be profitable in its first year, and investors will be bought out by the founding partners by the end of the third year. The tables below show the details of our start-up requirements and funding sources, including office furniture, servers, phones, a fax machine, and a copier.

Start-up Requirements:

– Legal Advice & Corporate Set-up: $5,000

– Initial Stationery: $5,000

– Brochures: $10,000

– Marketing & Branding – Consultants: $12,000

– Web Design & Development: $15,000

– 1 month start-up payroll: $56,250

– Accounting & Audit Advice: $5,000

– Expensed Computers and Software: $15,000

– Contents Data Collection Cost: $50,000

– Total Start-up Expenses: $173,250

Start-up Assets:

– Cash Required: $104,000

– Other Current Assets: $15,000

– Long-term Assets: $0

– Total Assets: $119,000

Total Requirements: $292,250

Start-up Funding:

– Start-up Expenses to Fund: $173,250

– Start-up Assets to Fund: $119,000

– Total Funding Required: $292,250

Assets:

– Non-cash Assets from Start-up: $15,000

– Cash Requirements from Start-up: $104,000

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $104,000

– Total Assets: $119,000

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $0

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $0

– Capital:

– Planned Investment:

– Hugh Lloyd-Thomas: $50,000

– Michael Bartlett: $50,000

– Chief Operating Officer: $50,000

– Chief Information Officer: $50,000

– Additional Investment Requirement: $92,250

– Total Planned Investment: $292,250

– Loss at Start-up (Start-up Expenses): ($173,250)

– Total Capital: $119,000

Total Capital and Liabilities: $119,000

Total Funding: $292,250

Company Ownership:

ISL is a privately-held Limited Liability Corporation (LLC), jointly owned by its three chief officers and an advisor, Michael Bartlett, the founder of ISL’s Australian affiliate, International Cost Research (ICR). The three managing partners are president and Chief Executive Officer (CEO), Hugh Lloyd-Thomas, Chief Operating Officer (COO) Mark Purowitz, and Chief Information and Technical Officer (CIO) Mark Metcalf.

Additional minority stock has been set aside for outside directors, including insurance industry, legal, marketing, and retail resources and expertise.

Products and Services:

Insurance Valuer (IV) Software:

ISL’s Web-based “Insurance Valuer” (IV) software allows customers to determine accurate insurance coverage needs for property and contents insurance. IV eliminates the need for printed valuation materials and keeps costs up-to-date and accurate. It is used by insurance companies, mortgage providers, small business lenders, consumers, and ancillary industries in the insurance sector. It enhances customer service, revenue, and retention, with a focus on high-risk areas.

Additional Links and Updates:

ISL provides links to contents and services providers, enabling insurance companies to offer rapid replacement of lost, stolen, or damaged property and contents at reduced cost. It includes individually-selected information, reminders, and updates for customers.

Documents Plus:

Documents Plus is a Web-based system that offers secure electronic storage and retrieval of important documents for insurance and security purposes. It allows consumers to store and access their documents from any location, reducing the risk of loss or damage.

Market Analysis Summary:

Insurance Sector:

Home Owner Multi Peril Premiums have grown at a compound annual growth rate of 10% since 1972, reaching $43.7 billion in 2003. Under-insurance is a chronic problem in the industry, with estimates that 70-80% of homeowners are under-insured. IV software can assist insurers in identifying potential premium increases and generate annual revenues of $200-250 million.

Additional Sources of Revenue:

ISL can generate revenue through referral and click-through fees from product and service providers.

Under-Insurance:

ISL can take advantage of the growing pressure on insurance companies to assist consumers in accurately estimating the replacement cost of their homes and valuables. Recent legislative efforts have addressed this concern, highlighting the need for ISL’s solutions.

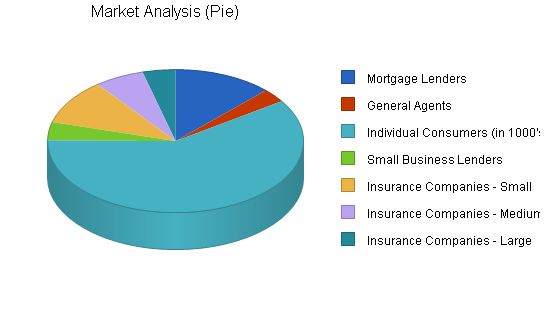

Market Segmentation:

ISL targets consumers, insurers, mortgage and small business lenders, and ancillary industries associated with casualty and property insurance. The individual policy holder segment includes homeowners with internet access, estimated at 58 million households. Mortgage brokers and small business lenders are also potential market segments.

Market Analysis

Potential Customers: Growth: Year 1, Year 2, Year 3, Year 4, Year 5, CAGR

Mortgage Lenders: 1%, 12,000, 12,120, 12,241, 12,364, 12,487, 1.00%

General Agents: 1%, 3,000, 3,030, 3,060, 3,091, 3,122, 1.00%

Individual Consumers (in 1000’s): 5%, 57,750, 60,638, 63,669, 66,853, 70,195, 5.00%

Small Business Lenders: 7%, 4,000, 4,280, 4,580, 4,900, 5,243, 7.00%

Insurance Companies – Small: 2%, 10,000, 10,200, 10,404, 10,612, 10,824, 2.00%

Insurance Companies – Medium: 1%, 6,000, 6,060, 6,121, 6,182, 6,244, 1.00%

Insurance Companies – Large: 1%, 4,000, 4,020, 4,040, 4,060, 4,081, 0.50%

Total: 3.77%, 96,750, 100,348, 104,115, 108,062, 112,196, 3.77%

Target Market Segment Strategy

Our prospective customers share the need for reliable, accurate, and current property valuation and risk assessment information. Existing industry sources cannot update their information regularly enough or provide a broad enough range of data for accurate insurance coverage assessment. Consumers have been neglected in the policy origination and underwriting process.

Our strategy is to focus on large insurers that account for 60% to 65% of total premium dollars collected each year. These insurers will benefit the most from the Insurance Valuer Software and have a significant online presence. We will also pursue opportunities with medium and small-sized insurers who currently rely on agent-driven referrals. Additionally, we will target the end-user – insurance consumers who need to accurately assess property value and store important insurance documents.

Service Business Analysis

Currently, there are no web-based valuation applications available in the North American market. There is also a chronic level of under-insurance in the U.S. home market. ISL will be the first web-based organization to provide solutions and services to the insurance market in an integrated and customer-focused manner.

Our research shows that consumers have not been made aware of the risks of under-insurance and are dissatisfied with existing solutions and providers. The insurance industry obtains data from in-house review and a few large research agencies, but their data may not be current or comprehensive. Our products offer more accurate information and additional services at a lower cost.

Competition and Buying Patterns

The market for building material and construction cost information is dominated by Marshall & Swift/Boeck (MSB). However, MSB does not provide web-based access for consumers to determine their insurance needs. Their costing database is not as accurate as our Dynamic Elemental Modeling process. MSB focuses on claims and underwriting, ignoring consumer-facing opportunities and services.

Buyers are increasingly expecting additional and integrated solutions. We can take advantage of our existing customer base and implementations in Australia to demonstrate the capabilities of our solutions in a live environment.

Strategy and Implementation Summary

ISL will operate as a software vendor and market directly to end-user clients. We are developing affiliations and partnerships with major software and services providers to enhance the performance and functionality of our solutions.

Positioning

We will position ourselves as the quality and innovation leader, emphasizing our superior integrated functionality and flexibility. We will provide highly customized solutions and be responsive to the needs of the marketplace.

Competitive Edge

Our unique products fill a substantial void in the market. We are the first web-based valuation application in the North American market and offer additional services that our competitors lack. We can expand and protect our market share through embedding our software into third-party solutions and forming alliances with industry service providers and consulting firms.

Marketing Strategy

We will market directly to insurance companies, general agents, mortgage lenders, and consumers. We will also develop affiliations and partnerships to enhance our distribution channels. Our consumer communication efforts will include financial advisory television and radio programs, web-based promotions, and general market advertising.

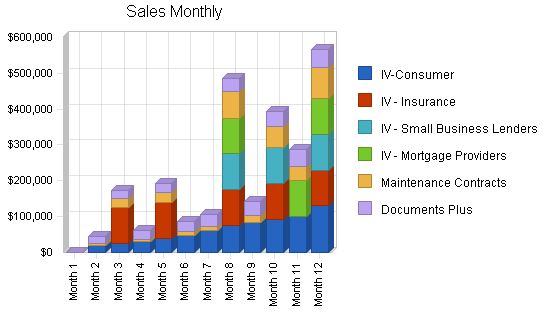

Sales Strategy

We believe our superior quality and functionality will drive sales. We will focus on top 10 market share accounts, U.S.-based organizations already using our solution in Australia, and direct-to-consumer sales. We will also develop partnerships with industry service providers and consulting firms. Our sales method is face-to-face selling, targeting senior underwriting and consumer marketing executives.

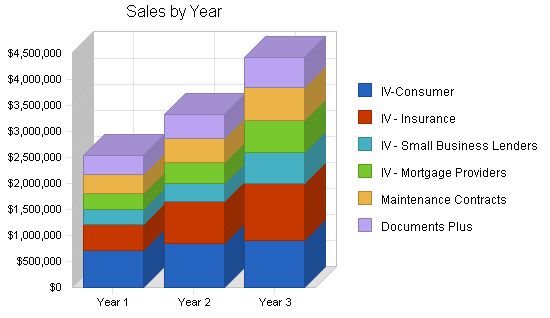

Our sales forecasts are based on conservative growth figures and initial contacts with major American insurers. We expect rapid growth in the second and third year as more organizations see the value of our solutions.

We will support our direct sales efforts through our website and targeted advertising. We offer net 30-day credit terms for businesses and cash terms for consumers.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| IV-Consumer | $707,176 | $850,000 | $905,000 |

| IV – Insurance | $500,000 | $800,000 | $1,100,000 |

| IV – Small Business Lenders | $300,000 | $350,000 | $600,000 |

| IV – Mortgage Providers | $300,000 | $400,000 | $600,000 |

| Maintenance Contracts | $361,435 | $469,866 | $641,000 |

| Documents Plus | $370,523 | $450,000 | $570,000 |

| Total Sales | $2,539,134 | $3,319,866 | $4,416,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| CD-ROM Production | $76,174 | $99,596 | $132,480 |

| Packaging and Shipping | $126,957 | $165,993 | $353,280 |

| Subtotal Direct Cost of Sales | $203,131 | $265,589 | $485,760 |

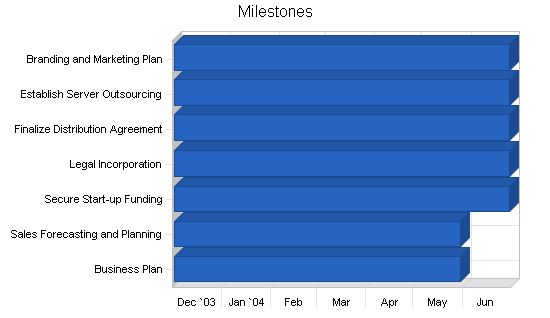

5.4 Milestones

The following table lists important program milestones, along with dates, managers in charge, and budgets. The milestone schedule emphasizes planning for implementation, with a focus on the sales and marketing programs mentioned in detail in the previous topics.

Milestones

| Milestone | Start Date | End Date | Budget | Manager | Department |

|——————————–|————-|————-|———-|——————-|—————-|

| Business Plan | 12/1/2003 | 5/30/2004 | $0 | Hugh Lloyd-Thomas | General Mgt |

| Sales Forecasting and Planning | 12/1/2003 | 5/30/2004 | $0 | Hugh Lloyd-Thomas | Sales |

| Secure Start-up Funding | 12/1/2003 | 6/30/2004 | $5,000 | Hugh Lloyd-Thomas | Finance |

| Legal Incorporation | 12/1/2003 | 6/30/2004 | $2,000 | Hugh Lloyd-Thomas | Legal |

| Finalize Distribution Agreement| 12/1/2003 | 6/30/2004 | $1,500 | Hugh Lloyd-Thomas | Marketing |

| Establish Server Outsourcing | 12/1/2003 | 6/30/2004 | $50,000 | Mark Metcalf | IT |

| Branding and Marketing Plan | 12/1/2003 | 6/30/2004 | $20,000 | Hugh Lloyd-Thomas | Marketing |

| Totals | | | $78,500 | | |

Web Plan Summary

Our commercial-customer website will showcase the Web-based capabilities of the IV software, as well as the portfolio of current big-name customers, both domestic and international. The website will provide resources, research, and weekly newsletters to interested parties.

The consumer website will provide independent valuation services, secure digital document storage, automated updates, and notifications to consumers regarding their insurance and legal needs. The consumer website will also provide links to ISL End-User insurance and ancillary service providers, who will offer additional services and discounts to ISL clients.

The customer service area of both websites will explain service issues, offer other resources for help, frequently asked questions and answers, an extensive searchable database of service/support information, the ability to e-mail for help with specific questions, and postings of newly discovered service suggestions and recommendations.

6.1 Website Marketing Strategy

As outlined in the previous Web Plan Summary, our website network has three main areas of focus:

1. Resource site for End-User B2B client information and service enhancement.

2. Sales site for consumers to utilize ISL services and connect with insurance service and ancillary service providers.

3. Tools for insurance and ancillary service providers to access “qualified” consumer and customer opportunities.

Our website is critical to our marketing strategy. It offers potential customers the chance to see our software’s key features, read customer reviews, and purchase software trials. We will market the website with paid search-engine keywords, click-through advertising from related insurance industry and consumer sites, and research customer online behavior to guide our online affiliations and spending.

6.2 Development Requirements

The ISL website will initially be modeled on the existing International Cost Research site in Australia. We will work with branding and marketing consultants to enhance the functionality and services of the website.

The site’s maintenance will initially be outsourced to branding and marketing resources. An internal technical resource may be required as the website develops and expands.

Management Summary

The company will be managed by the founding partner and two senior executives, covering all functional aspects of the business. Hugh Lloyd-Thomas will serve as the President and Chief Executive Officer, responsible for strategy development and marketing. Mark Purowitz will be the Chief Operating Officer, in charge of internal operations and marketing. Mark Metcalf will be the Chief Information and Technical Officer, overseeing information technology, web hosting, and delivery systems.

These key positions will be supported by a full-time staff of 3 employees working in administrative, sales support, technical, and operations roles. Initially, part-time staff and independent contractors will assist with branding and marketing development, accounting and taxation, legal, and Human Resources functions. As the organization grows, these functions will be brought in-house.

7.1 Personnel Plan

New staff will be added as the company achieves revenue benchmarks. The number of staff positions will reach 9 by the end of year one, 10 by the end of year two, and 12 by the end of year three. Recruitment strategies will be based on referrals and utilization of staffing consultants/recruiting agencies. Orientation and training will be the responsibility of the HR & Operations Manager.

Human resources are a crucial asset, and we will carefully screen new applicants through interviews and reference checks. We will regularly review employee performance and promote from within when possible. Salaries and benefit packages will be competitive with other firms in our area.

Utilization of outside resources

To obtain specialized expertise, the company will engage outside contractors and freelancers for legal services, accounting and tax services, and consumer and contents data gathering and research.

Customer Service

Customer service will be a key component of our marketing programs. We believe that providing our customers with what they want, when and how they want it, is the key to repeat business and word-of-mouth advertising. We will train our employees to deliver excellent service and give them the flexibility to respond creatively to client requests. In addition, we will monitor client satisfaction levels through surveys and feedback opportunities.

Business Development & Sales Force

We will employ 3 to 4 sales personnel, primarily focused on demonstrating our product to potential clients and closing sales with insurers. Additionally, one sales officer will be responsible for direct-to-consumer selling of the IV and Documents Plus software.

Personnel Plan

| | Year 1 | Year 2 | Year 3 |

|————————|———-|———-|———-|

| Hugh Lloyd-Thomas CEO | $120,000 | $125,000 | $130,000 |

| Mark Purowitz COO | $120,000 | $125,000 | $132,000 |

| Mark Metcalf, CIO | $120,000 | $125,000 | $132,000 |

| Administrative Assistant | $60,000 | $60,000 | $65,000 |

| Operations Support | $60,000 | $80,000 | $90,000 |

| Technical Assistant | $60,000 | $60,000 | $85,000 |

| HR & Operations Manager | $75,000 | $80,000 | $88,000 |

| Sales Staff | $124,800 | $125,000 | $130,000 |

| Total People | 9 | 10 | 12 |

| Total Payroll | $739,800 | $780,000 | $852,000 |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!