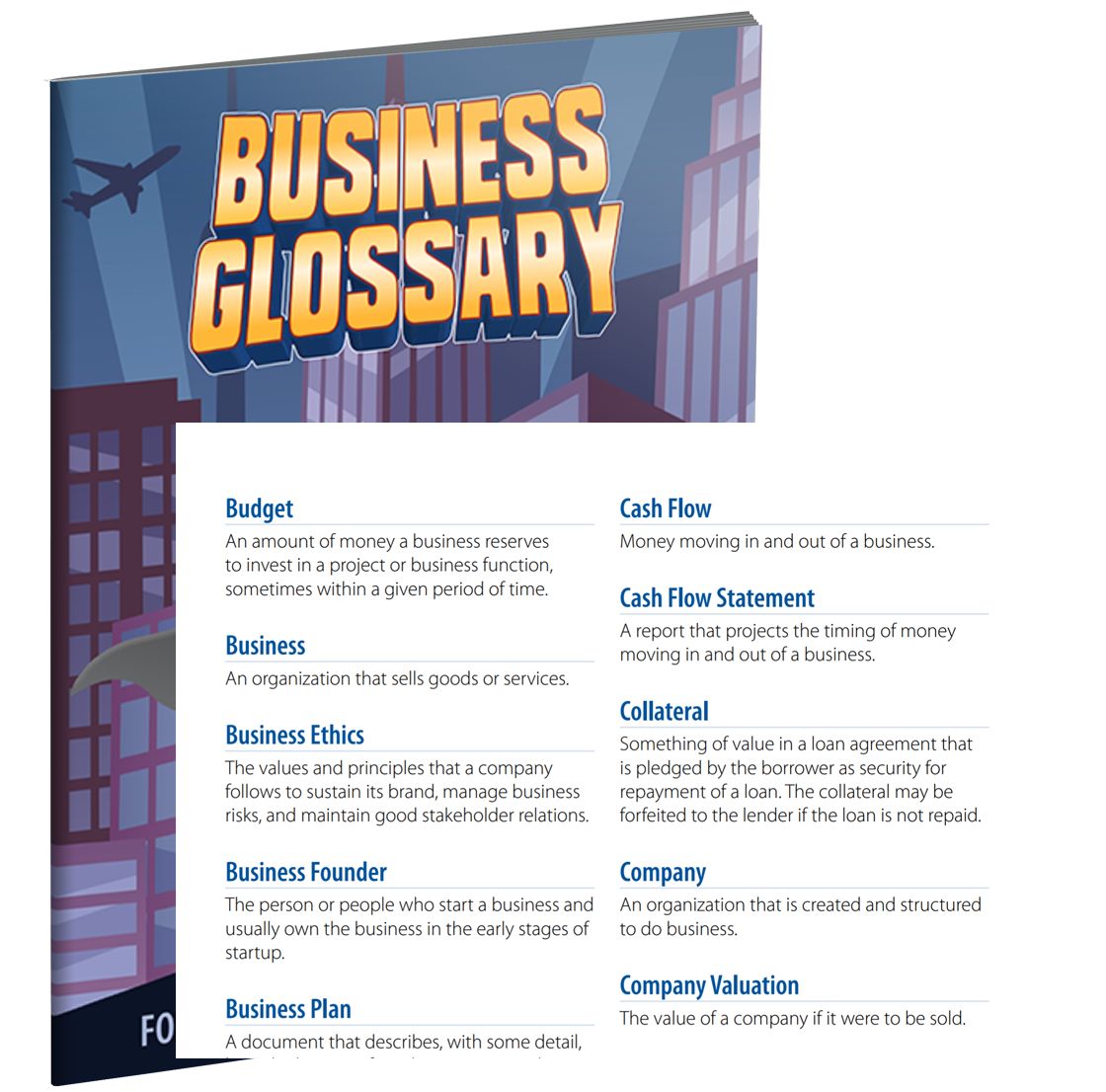

Business Terms Glossary

To start and run a business, you often need to understand business terms that may not be well-defined in a standard dictionary.

Our glossary of business terms provides definitions for common terminology and acronyms in business plans, accounting, finance, funding, and other aspects of small business.

A

Accounts Payable (AP)

Accounts payable (AP) are bills to be paid as part of the normal course of business. This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing. Businesses receive goods or services from a vendor, receive an invoice, and until that invoice is paid the amount is recorded as part of “accounts payable.”

Accounts Receivable (AR)

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid. The standard procedure in business-to-business sales is that when goods or services are delivered the come with an invoice, which is to be paid later.

Accrual-Based Accounting

Accrual-based accounting is standard business accounting, which assumes there will be accounts payable and/or sales on credit, as opposed to cash basis only.

Accumulated Depreciation

Total accumulated depreciation reduces the formal accounting value of assets. Each month’s accumulated balance is the same as last month’s balance plus this month’s depreciation.

Acid Test

An acid test is a business’s short-term assets minus accounts receivable and inventory, divided by short-term liabilities. This tests a company’s ability to meet its immediate cash requirements.

Acquisition Costs

Acquisition costs are the incremental costs involved in obtaining a new customer.

Adaptive Firm

An adaptive firm is an organization that can respond to and address changes in their market, their environment, and/or their industry to better position themselves for survival and profitability. To be adaptive, it’s smart to look at your business critically—and a tool like a SWOT analysis can be helpful here.

Adventure Capital

Adventure capital is capital needed in the earliest stages of the venture’s creation before the product or service is available to be provided.

Advertising Opportunity

A product or service may generate additional revenue through advertising if there is benefit from creating additional awareness, communicating differentiating attributes, hidden qualities, or benefits. Optimizing the opportunity may involve leveraging strong emotional buying motives and potential benefits.

Agent

An agent is a business entity that negotiates, purchases, and/or sells, but does not take title to the goods.

Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Assets

Assets are property that a business owns, including cash and receivables, inventory, and so on. Assets are any possessions that have value in an exchange. Assets can be long-term or short-term.

B

Back End (Websites)

Back end and front end describe website program interfaces relative to the user. The front end handles the graphic design and HTML portion of the website, while the back end handles the dynamic parts of the site that visitors don’t see or interact with.

Balance Sheet

The balance sheet is one of three essential parts that form the bedrock of a company’s financial statements: cash flow, balance sheet, and income statement. The balance sheet is a snapshot of a company’s assets, liabilities, and owner’s equity at a specific point in time.

Benchmark

A benchmark is a standard or guideline used to compare some aspect of a business to an objective or external standard measure. Industry benchmarks can tell you whether you are matching the profit margins of your peers, keeping too much inventory on hand, or getting paid faster or slower than others.

Brand

Your company’s brand includes your business name, logo, symbol, or design that differentiates your goods or services from competitors.

Brand Equity

Brand equity is the added value a brand name identity brings to a product or service beyond the functional benefits provided. For example, Apple benefits from the fact that its brand name is a household name in smartphones and computers.

Brand Extension Strategy

Brand extension strategy is the practice of using a current brand name to enter a new or different product class.

Brand Recognition

Brand recognition refers to a customer’s ability to identify a brand based on its name, logo, or colors.

Break-Even Analysis

A break-even analysis is used to assess the expected profitability of a company or a single product. It helps you determine at what point revenues and expenditures are equal.

Break-Even Point

The break-even point is the output of a standard break-even analysis. It represents the number of unit sales or sales amounts a company needs to equal its running expense rate and not lose or make money.

Broker

A broker is an intermediary that serves as a go-between for the buyer or seller.

Bundling

Bundling is the practice of marketing two or more products or services in a single package with one price.

Burden Rate

Burden rate refers to personnel burden, the sum of employer costs over and above salaries.

Business Mission

A business mission, also called a mission statement, is a brief description of an organization’s purpose with reference to its customers, products or services, markets, philosophy, and technology.

A business plan is a strategic roadmap for any new or growing business or startup venture. It captures the opportunity of the company and includes details on how it will execute its plan.

A buy-sell agreement is an agreement designed to address situations in which one or more entrepreneurs want to sell their interest in the venture.

C

C Corporation (C Corp)

The C corporation is the classic legal entity of most successful companies in the United States. It provides the best shielding from personal liability for owners and pays its own taxes.

Compound Average Growth Rate (CAGR)

Compound annual growth rate (CAGR) is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance if profits are reinvested every year.

Cannibalization

Cannibalization is the undesirable tradeoff where sales of a new product or service decrease sales from existing products or services.

Capital Assets

Capital assets are long-term assets, also known as fixed assets. These are possessions that have value in an exchange and are not meant to be sold or used up in the normal course of business within a year.

Capital Expenditure

Spending on capital assets, such as plant and equipment, that are intended to generate more revenue over a long period of time.

Cash

Cash refers to bills and coins, as well as the bank balance or checking account balance.

Cash Basis

Cash basis means an accounting system that records only cash receipts and cash spending, without assuming sales on credit or accounts payable.

Cash Flow

Cash flow measures the movement of money into and out of a business during a specific period of time.

Cash Flow Budget

A cash flow budget provides an overview of cash inflows and outflows during a specified period of time.

Cash Flow Statement

The cash flow statement shows the actual cash inflows and outflows of a business over a specific period of time.

Cash Sales

Cash sales are sales made in cash, with credit cards, or by check.

Cash Spending

Cash spending is money a business spends when it pays obligations immediately instead of letting them wait for a few days first.

Central Driving Forces Model

The central driving forces model is an entrepreneurial-based model that considers the positives and negatives of three areas of the venture: founder(s), opportunities, and resources.

Channel Conflicts

Channel conflicts refer to a situation where one or more channel members believe another member is engaged in behavior that is preventing it from achieving its goals.

Channels of Distribution

Channels of distribution are the systems through which customers are provided access to a company’s products or services.

Click-Through Rate

Click-through rate is a way of measuring the success of an online advertising campaign. It is obtained by dividing the number of users who clicked on an ad by the number of times the ad was delivered.

Co-Branding

Co-branding is the pairing of two manufacturer’s brand names on a single product or service.

Cost of Goods Sold

The cost of goods sold is the cost of materials and production of goods a business sells.

Collection Period

A collection period is the average number of days between delivering an invoice and receiving payment.

Commission

A commission is compensation paid to a person or entity based on the sale of a product.

Commission Percent

A commission percent is an assumed percentage used to calculate commission expense based on sales or gross margin.

Community Interest Company (CIC)

A CIC is a limited company designed for social enterprises that want to use their profits and assets for the public good.

Competitive Advantage

A competitive advantage is a strategic development where customers choose a firm’s product or service over competitors based on favorable perceptions or offerings.

Competitive Analysis

Competitive analysis means assessing and analyzing the strengths and weaknesses of competitors.

Competitive Entry Wedges

Competitive entry wedges are strategic competitive advantages that justify entering an established market or activity.

Completed Store Transactions

Completed store transactions refer to the number of purchases made on the website.

Concentrated Target Marketing

Concentrated target marketing is a process that occurs when a single target market segment is pursued.

Contribution

Contribution is the difference between total sales revenue and total variable costs.

Contribution Margin

Contribution margin is the difference between gross margin and sales and marketing expenses.

Conversion Rate

A conversion rate is the percentage of website visitors who take a desired action upon visiting the website.

Core Marketing Strategy

Core marketing strategy is a statement that communicates the predominant reason to buy to a specific target market.

Corporation

A corporation is a legal entity that is distinct from its owners and pays its own taxes.

Corridor Principal

Note: There are 364 words in the original text.

The corridor principle is when an entrepreneurial venture changes its focus from the initial concept as it responds and adapts to the market and profitability potential.

Cost of sales refers to the costs of producing sales.

In a manufacturing or distribution company, this is the same as the cost of goods sold. In a services company, it is personnel costs for delivering the service or subcontracting costs.

This term is often used interchangeably with "cost of goods sold," especially for product-based companies. For manufacturing, it includes materials, labor, and factory overhead. For retail, it is the cost of buying the goods.

For service businesses that don’t sell goods, it is called "cost of sales," not to be confused with "sales and marketing expenses." For consulting, it is the compensation paid to consultants and costs of research, photocopying, and production.

In standard accounting, costs of sales are subtracted from sales to calculate gross margin. These costs are different from operating expenses because gross profit is gross margin minus operating expenses.

Cross elasticity of demand is the change in quantity demanded of one product, impacting the demand for another product.

Current assets are the same as short-term assets.

Current debt refers to short-term debt and liabilities.

Current liabilities refer to short-term debt and liabilities.

DBA stands for "doing business as," which is a company name or fictitious business name.

When a sole proprietor uses a name other than their own, a DBA or fictitious business name registration establishes legal ownership.

You can obtain this registration through the county government for a small fee.

Debt and equity is the sum of liabilities and capital, which is equal to total assets.

Depreciation is the loss of value of assets over time. For example, cars depreciate with use.

Differentiated target marketing occurs when an organization pursues different market segments with different strategies.

Differentiation is creating a competitive advantage that customers appreciate and are willing to pay for.

Direct cost of sales is a shortcut for cost of goods sold, which includes materials and production.

Direct mail marketing involves sending information to potential customers through mail.

Direct marketing gives customers access to products and services without intermediaries and generates revenue.

A directory is a computer term for dividing disk storage space.

A distinctive competency is qualities that distinguish an organization and provide unique value.

Diversification is developing or acquiring offerings new to the organization and introducing them to new markets.

Dividends are profits distributed to business owners.

Dual distribution is distributing products or services through multiple marketing channels.

Early adopters are buyers who follow innovators and are not the first to purchase.

The early majority are interested in new technology but wait until innovations are proven.

Earnings are income or profits, calculated as sales minus costs of sales and expenses.

EBIT refers to earnings before interest and taxes.

EBITDA is earnings before interest, taxes, depreciation, and amortization.

Economies of scale allow fixed costs to be spread over more units, lowering average unit costs.

Effective demand is when buyers are willing and able to purchase.

The effective tax rate is the final tax payment compared to actual profits.

An entrepreneur in heat continues to develop new products beyond what the venture can support.

An entrepreneur starts a new business venture, recognizing opportunities and finding resources to accomplish goals.

Equity is business ownership, calculated as assets minus liabilities.

Equity financing is selling ownership in a venture to gain capital for startup.

Evaluating ideas and opportunities involves considering ideas, screening them using objective criteria, and personal criteria.

Everett Rogers is an author who studied the diffusion of innovations.

Exclusive distribution is selling products or services in one retail outlet in a specific area.

Expenses are deductible against taxable income, such as rent and salaries.

The experience curve represents exposure to a process that enhances efficiency and operations advantage over time.

A FAB analysis explores the features, advantages, and benefits of a product or service.

Entrepreneurial ventures often fail due to inadequate sales, competitive weaknesses, excessive operating expenses, and uncollected receivables.

Exceptions to the failure rule include high potential ventures, threshold concepts, promise of growth, and venture capital backing.

The fatal 2% rule suggests that if a venture can get 2% of the market share, it will be successful.

A fighting brand strategy is adding a new brand to compete with established brands.

The first mover attempts to establish a privileged market position by being the first in a given market.

First mover advantages include reputation effect, experience curve, and customer commitment.

First mover disadvantages include resolving uncertainty and the free-rider effect.

The fiscal year allows the accounting year to begin in any month.

The five forces model considers the risk of entry, bargaining power of suppliers and buyers, threat of substitutes, and rivalry among firms.

Fixed costs are running costs that do not fluctuate with output volume.

Fixed liabilities are long-term debts secured by assets with a stable value.

Floating liabilities are short-term debts secured by assets with a changing value.

A focus group is a small group brought together to discuss a topic and provide insight for product development and marketing efforts.

Frequency marketing encourages repeat purchasing through a formal program enrollment process.

The front end refers to the appearance of a website, while the back end handles the dynamic parts and makes the website work.

Full-cost price strategies consider variable cost and fixed cost in pricing.

Future value projections estimate the future value of a venture or investment.

Goodwill is when a company purchases another company for more than the value of its assets.

Gross margin is the difference between sales and cost of goods sold.

The gross margin percent is the gross margin divided by sales, displayed as a percentage.

Guerrilla marketing refers to marketing via events and media coverage instead of paid advertisements.

Harvesting refers to selling a business or product line.

Impressions occur each time an advertisement is seen.

An income statement shows sales, cost of sales, gross margin, expenses, and profit or loss.

An IPO is a company’s initial effort to raise capital through the sale of securities on the public stock market.

Innovation is the improvement or revolutionizing of a product or service.

Innovators are the first to purchase a new product or service.

Integrated marketing communications blend different elements of the communication mix.

Intensive distribution attempts to sell products or services in as many retail outlets as possible.

Interest expense is interest paid on debts, deducted from profits as expenses.

Intrapreneurship refers to entrepreneurial activities within a corporation supported by resources and commitments.

Inventory refers to goods in stock, either finished goods or materials.

Inventory turnover is the cost of sales divided by inventory.

Inventory turns, or inventory turnover, is the cost of sales divided by inventory.

A jobber is an intermediary that buys from producers to sell to retailers.

Labor costs are part of the cost of sales in making goods.

Laggards are customers who are not interested in new technology and are the last to buy.

A leveraged buy-out relies on cash receipts and positive cash flow indicators.

Liabilities are debts or money that must be paid.

A life cycle is the sales volume cycle of a product or service over time.

A limited (public) company is not limited in members or share transfers.

A limited liability company combines elements of partnerships and corporations.

A limited liability partnership combines limited liability and a different tax liability.

Long-term assets are depreciated over five years or more.

A long-term interest rate is the interest rate on long-term debt.

Long-term liabilities are loans with terms of five years or more.

Loss is the opposite of profit and is negative net profit.

Loyalty programs encourage repeat purchasing through program enrollment.

Loyalty programs encourage repeat purchasing through program enrollment and benefits. They are also known as frequency marketing.

A manufacturer’s agent operates on a contractual basis, often in an exclusive territory, selling non-competing but related goods and having defined authority regarding prices and terms of sale.

A market refers to individuals or organizations willing and able to purchase an organization’s offering.

Market development funds are monetary resources a company invests to help channel members increase sales volume.

A market development strategy introduces offerings to new markets through exportation licensing, joint ventures, or direct investment.

Market evolution involves changes in primary demand for a product class and changes in technology.

Market penetration is a business’s ability to sell a product or service compared to the estimated total available market. It helps define the serviceable available market and develop a strategy to increase the service obtainable market.

A market plan provides details regarding marketing strategy, pricing, sales tactics, service and warranty policies, advertising, promotion, and distribution plans for a venture.

Market redefinition involves changes in the offering demanded by buyers or promoted by competitors to enhance its perception and associated sales.

Market sales potential is the maximum level of sales available to all organizations serving a defined market in a specific period.

Market segmentation categorizes potential buyers into groups based on common characteristics related to purchase or consumption behavior.

Market share is an organization’s total sales divided by the sales of the market they serve.

Marketing refers to planned activities that positively influence perceptions and purchase choices of individuals and organizations.

A marketing audit identifies problem areas and opportunities in a company’s marketing environment, objectives, strategies, and activities.

Marketing mix includes the product, service, or idea offered, communication to customers, distribution method, and price.

A marketing plan contains descriptions and guidelines for marketing strategies, tactics, and programs over a defined planning period.

Marketing cost analysis assigns costs to a marketing activity or entity to capture its financial contribution to the organization.

Materials are involved in the assembly or manufacture of goods for sale.

Obligations incurred are costs to be paid as accounts payable.

An offering provides benefits or satisfaction to target markets and includes products or services and related offerings.

An offering mix is an organization’s complete array of offerings.

On-costs are labor costs in addition to wages, such as payroll tax, workers’ compensation, and liability insurance.

Operating expenses are expenses incurred in normal business operations, excluding interest, depreciation, and taxes.

Operating leverage refers to the use of fixed and variable costs in the production and marketing of products and services.

Operations control assesses how well an organization performs marketing activities to achieve planned outcomes.

Opportunity analysis identifies revenue enhancement or expense reduction situations to increase profitability, efficiencies, or market potential.

Opportunity cost refers to the resource use options given up by choosing one activity over others.

An original equipment manufacturer allows another entity to include, remanufacture, or label products or services under their name and sell through their distribution channels.

Other short-term liabilities include short-term debts that don’t cause interest expenses, such as loans from founders or accrued taxes.

Outsourcing is purchasing an item or service from an outside vendor instead of performing it internally.

Pageviews are requests for webpage files, which can generate multiple hits in log analysis.

Paid-in capital is real money invested in the company, not to be confused with the par value or market value of stock.

A partnership is a legal arrangement between owners, where income or loss passes through partners without any partnership tax.

Payables are bills to be paid as part of the normal course of business.

A payback period is the number of years to recapture an initial investment.

Payment days are the average number of days between receiving an invoice and paying it.

Payment delay is the number of days a business waits between receiving and paying a bill.

Payroll refers to wages, salaries, or employee compensation.

Payroll burden includes payroll taxes and benefits.

Penetration pricing involves setting a relatively low initial price for a new product or service.

Perceived risk is the level of uncertainty a customer has about the consequences of an action, often related to purchase decisions.

A perceptual map illustrates customer perceptions of competing products based on market research.

Personal selling is face-to-face communication between the seller and buyer.

PEST analysis examines political, economic, and social trends to generate marketing and product ideas.

Plant and equipment are long-term, fixed assets, such as machinery or equipment.

Point of purchase advertising displays products and communicates information to retail consumers at the place of purchase.

A portfolio is an organization’s complete array of offerings.

Positioning is strategically occupying a unique and valued place in the customer’s mind relative to competitors.

Premiums offer free or reduced-price items contingent on the purchase of advertised merchandise or services.

Price elasticity of demand measures demand change in response to price change.

A privately owned company is not traded publicly on a stock market.

A pro forma income statement is a projected income statement showing sales, cost of sales, gross margin, operating expenses, and profits.

Pro forma statements are non-GAAP-compliant financial statements.

Product definition translates concepts into actual products for additional testing based on interactions with customers.

Product development expenses include costs for creating new products.

A product development strategy introduces new offerings to existing markets.

The product life cycle includes introduction, growth, maturity, and decline stages.

A product line consists of closely related products with similar attributes or target markets.

Product line pricing sets prices for all items in a product line, including price differentials.

Profit is the difference between sales and costs.

Profit before interest and taxes is gross margin minus operating expenses.

A profit or loss statement, also known as an income statement, shows sales, gross margin, operating expenses, and profits or losses.

A proprietary limited company is a private company with restricted share transfers and limited membership.

Public relations involves non-personal communications distributed through media without a fee.

Publicly traded companies are owned by shareholders who trade their shares on the stock market.

A pull communication strategy generates interest among potential buyers who demand the offering through intermediaries.

A push communication strategy sequentially pushes an offering through a marketing channel, focusing on specific target markets.

Questionable costs may be considered variable or fixed costs depending on the situation.

Receivables are debts owed to a company from sales on credit.

Receivables turnover is the ratio of sales on credit to average accounts receivables balance.

Regional marketing uses different marketing strategies to accommodate unique preferences and conditions in different geographical areas.

Relevant costs are expected future expenditures that differ among potential marketing alternatives.

Repositioning strategically changes the perceptions surrounding a product or service.

Resource requirements for websites include personnel, time, space, and equipment necessary for creation and maintenance.

Retained earnings are earnings reinvested into the company, not paid out as dividends.

Return on assets is net profits divided by total assets.

Return on investment is net profits divided by net worth or total equity.

Return on sales is net profits divided by sales.

A return visitor is a website visitor who has made previous visits to the site.

The Rich-Gumpert evaluation system assigns a numeric value to product development and the entrepreneur and management team.

An S corporation passes profits or losses directly to owners without separate taxation.

A scenario analysis examines different potential outcomes and their effects on a business.

Search engine optimization improves a website’s visibility in search engine results.

Seasonality refers to fluctuations in sales volume due to specific times or seasons.

Series seed financing provides funds for early-stage startups, often coming after friends and family financing.

A service guarantee is a promise made by a company to provide a certain level of service or offer compensation.

A service offering is an intangible product consisting of activities, benefits, or satisfaction provided to customers.

A service recovery refers to actions taken to rectify a customer problem or complaint.

Short messaging service (SMS) is a text messaging service available on mobile phones.

A single channel system uses only one channel of distribution to reach customers.

Social media refers to online platforms that allow users to share content and interact with others.

Social responsibility involves actions by a company that benefit society beyond its legal obligations.

Software as a service (SaaS) provides software applications over the internet.

Start-up costs are expenses incurred in starting a new company or business.

Strategic alliances are partnerships formed between companies to achieve mutual benefits and competitive advantages.

A strategic evaluation assesses a company’s internal and external environment to inform decision-making.

A strategic plan is a document that outlines a company’s long-term goals and strategies.

A subscription-based business model charges customers a recurring fee for access to a product or service.

Supplier relationship management involves managing relationships with suppliers to ensure the timely delivery of goods or services.

Supply chain management encompasses the flow of goods and services from raw materials to the end consumer.

Sustainable competitive advantage refers to a company’s ability to maintain a superior position in the market over the long term.

SWOT analysis examines a company’s strengths, weaknesses, opportunities, and threats to inform strategic planning.

System integration involves combining different subsystems or components into one larger system.

Systematic risk refers to the potential for losses due to factors affecting the overall market or economy.

Target costing sets a target cost for a product or service based on the price customers are willing to pay and desired profit margin.

Target market segmenting involves dividing a market into distinct groups based on common characteristics and needs.

Technical support provides assistance with technical issues or problems related to a product or service.

The technology adoption curve categorizes consumers based on their willingness to adopt new technologies.

Total quality management focuses on continuous improvement and customer satisfaction through quality management practices.

Trade credit is an arrangement in which a buyer purchases goods or services on credit from a seller.

Trade discounts are reductions in the price of goods or services provided to certain groups, such as wholesalers or retailers.

Trademarks protect words, names, symbols, or logos that identify and distinguish products or services from others.

A transaction-based business model generates revenue through individual customer transactions.

Transportation costs are expenses associated with moving goods or materials from one location to another.

Trends refer to patterns or shifts in consumer behavior, attitudes, or preferences.

Triple bottom line focuses on the economic, social, and environmental impacts of a company’s operations.

Turnkey solution provides a complete solution that is ready to use or operate immediately.

A unique selling proposition (USP) identifies and communicates a company’s unique value or advantage in the market.

Unmet needs refer to customer needs or desires that are not currently fulfilled by existing products or services.

User experience (UX) refers to the overall experience and satisfaction users have when interacting with a product or service.

User-generated content (UGC) is content created by users or customers, often shared on social media or online platforms.

Utilization rate measures the percentage of time resources are used for productive activities.

Value chain analysis examines the activities and processes that create value for a company and its customers.

Variable costs are expenses that change in proportion to the production or sales volume.

Venture capital is funding provided to early-stage startups and high-potential, growth-oriented companies.

Virtual reality (VR) creates a simulated environment that users can interact with using specialized equipment.

Vision statement expresses a company’s aspirations and goals for the future.

Volatile organic compounds (VOCs) are organic chemicals that easily evaporate into the air.

Volume discounts are price reductions based on the quantity of goods or services purchased.

A web portal is a website that serves as a gateway to a variety of resources and services.

Whistleblowing refers to reporting unethical or illegal practices within an organization to the appropriate authorities.

Word-of-mouth marketing involves the spread of information or recommendations about a product or service through personal conversations.

In practical terms, this means that the owners of the corporation can take their profits home without first paying the corporation’s separate tax on profits, so those profits are taxed once for the S owner, and twice for the C owner. The C corporation doesn’t send its profits home to its owners as much as the S corporation does, because it usually has different goals and objectives. It often wants to grow and go public, or it already is public. In most states an S corporation is owned by a limited number (25 is a common maximum) of private owners, and corporations can’t hold stock in S corporations, just individuals.

Corporations can switch from C to S and back again, but not often. The IRS has strict rules for when and how those switches are made. You’ll almost always want to have your CPA and in some cases your attorney guide you through the legal requirements for switching.

Sales break-even is the sales volume at which costs are exactly equal to sales.

The exact formula is = Fixed_costs / (1 – (Unit_Variable_Cost / Unit_Price))

A sales forecast is the level of sales a single organization expects to achieve based on a chosen marketing strategy and assumed competitive environment.

Sales on credit refers to sales made on account; shipments against invoices to be paid later.

Scrambled merchandising is the practice by wholesalers and retailers that carry a wider assortment of merchandise.

Seed capital is investment contributed at a very early stage of a new venture, usually in relatively small amounts. It comes before what they call “first round” venture capital.

How much is that “relatively small amount?” Some high-end high-tech ventures in Silicon Valley call an investment of $500K seed capital, and other ventures call $35K investment seed capital, and the following $300K investment the first round. It depends on the point of view.

Selective distribution is a strategy where a producer sells its products or services in a few chosen retail outlets in a specific geographical area.

Selling approaches are potential selling resources based on the sales value and distribution of the product.

SCORE is a no-cost consulting and resources service offered through the Small Business Administration.

Shareholders are individuals or companies that legally own one or more shares of stock in a company.

Short-term is normally used to distinguish between short-term and long-term assets or liabilities. Definitions vary because different companies and accountants handle this in different ways.

Short-term assets are cash, securities, bank accounts, accounts receivable, inventory, business equipment, assets that last less than five years or are depreciated over terms of less than five years. Also called current assets.

Short-term notes are the same as short-term loans. These are debts with terms of five years or less.

Short-term liabilities are debts with terms of five years or less. Also called current liabilities, short-term loans, or short-term debts. These may also include short-term debts that don’t cause interest expenses. For example, they might be loans from founders or accrued taxes.

Simple linear regression is a linear correlation that offers a straight-line projection based on the variables considered.

A situation analysis is the assessment of operations to determine the reasons for the gap between what was or is expected, and what has happened or will happen.

Skimming pricing strategy refers to setting a high initial price for a new product or service when there is a strong price-perceived quality relationship that targets early adopters who are price insensitive. The price may be lowered over time.

Slotting allowances are payments to store chains for acquiring and maintaining shelf space.

The SBIC is a division of the Small Business Administration that offers “venture capital-like” resources to higher-risk businesses seeking capital.

The simplest business structure is the sole proprietorship. Simply put, your business is a sole proprietorship if you don’t create a separate legal entity for it. This is true whether you operate it in your own name, or under a trade name. If it isn’t your own name, then you register a company name as a “Fictitious business name,” also called a DBA (“Doing Business As”). Depending on your state, you can usually obtain this through the county government, and the cost is no more than a small registration fee plus a required newspaper ad, for a total of less than $100 in most states.

A sole trader is the easiest and quickest form of a corporation for a small, privately-owned business. Your Memorandum and Articles of Association are usually fairly straightforward to obtain, and your taxes will be lower than those of a public company. However, the owner of a sole trader is personally liable for all of its actions and debts, and may not be entitled to benefits, like unemployment payments, that would accrue to those running public companies.

Starting date refers to the starting date for the entire business plan.

Stock refers to goods on hand, either finished goods or materials to be used to manufacture goods. Also called inventory. Stock can also refer to privately held or publicly traded shares or securities representing an investment in, or partial ownership of, a business. Public trading of such stock occurs on the stock market.

The stock market is the organized trading of stocks, bonds, or other securities, or the place where such trading occurs.

Stock turnover is the total cost of sales divided by inventory. Usually calculated using the average inventory over an accounting period, not an ending-inventory value. Also called inventory turnover.

Strategic control is the practice of assessing the direction of the organization as evidenced by its goals, objectives, strategies, and capacity to perform in the context of changing environmental and competitive actions.

Strategic marketing management is the planned process of defining the organization’s business, mission, and goals; identifying and framing organizational opportunities; formulating product-market strategies, budgeting marketing, financial, and production resources; developing reformulation.

Primary success factors include considerations regarding the choice of business based on the status of the market, education and experience, people and collaboration, creativity and innovation, incubation potential, leveraging available resources, and management practices.

Success requirements are the basic tasks that must be performed by an organization in a market or industry to compete successfully.

Sunk cost refers to past expenditures for a given activity that are typically irrelevant in whole or in part to future decisions. The “sunk cost fallacy” is an attempt to recoup spent dollars by spending still more dollars in the future.

Surplus or deficit is a term used by nonprofits. It’s also called profit and loss statement or an income statement in for-profit plans. An income statement is a financial statement that shows funding, cost of funding, gross surplus, operating expenses, and surplus or deficit. Gross surplus is funding less cost of funding, and surplus (or deficit) is gross surplus less operating expenses and taxes. The result is a surplus if it is positive, a deficit if it is negative.

Switching costs are the costs incurred in changing from one provider of a product or service to another. These costs may be tangible or intangible costs incurred due to the change of this source.

A SWOT analysis is a formal framework of identifying and framing organizational growth opportunities. SWOT is an acronym for an organization’s internal strengths and weaknesses and external opportunities and threats.

Systematic innovation is innovation resulting from an intentional and organized process to evaluate opportunities to introduce change, based on a definition provided by Peter Drucker. The sources of innovation may be internal or external to the enterprise.

Tactics are a collection of tools, activities, and business decisions required to implement a strategy.

A target market is a defined segment of the market that is the strategic focus of a business or a marketing plan. Normally the members of this segment possess common characteristics and a relative high propensity to purchase a particular product or service. The target market is often defined in terms of geographic, demographic, and psychographic characteristics.

Target marketing is the process of marketing to a specific market segment or multiple segments. Differentiated target marketing occurs when an organization simultaneously pursues several different market segments, usually with a different strategy for each. Concentrated target marketing occurs when a single market segment is pursued.

Tax rate percent is an assumed percentage applied against pre-tax income to determine taxes.

Taxes incurred are taxes that are owed but not yet paid.

Telemarketing is a form of direct marketing that uses the telephone to reach potential customers.

Trade margin is the difference between unit sales price and unit cost at each level of a marketing channel, usually expressed in percentage terms.

Trading down is the process of reducing the number of features or quality of an offering to realize a lower purchase price.

Trading up is the practice of improving an offering by adding new features and higher-quality materials or adding products or services to increase the purchase price.

In broad, general terms, traffic is the number of visitors and visits a website receives.

Entrepreneurs may be categorized into eleven areas, including solo self-employed individuals, team builders, independent innovators, pattern multipliers, economy of scale exploiters, capital aggregators, acquirers, buy-sell artists, conglomerates, speculators, and apparent value manipulators.

User interface is the graphic design and appearance of a website, its function as seen and used by the person on the user end, at the website in a browser.

Unique user sessions are a website metric tracking the number of uniquely identified clients generating requests on the web server or viewing pages. A visitor can make multiple visits.

Unit variable cost is the specific labor and materials associated with a single unit of goods sold. Does not include general overhead.

Units break-even refers to the unit sales volume at which the fixed and variable costs are exactly equal to sales. The formula is UBE = Fixed_costs / (Unit_Price – Unit_Variable_Cost).

Unpaid expenses are money owed to vendors for expenses incurred but not yet paid. In bookkeeping and accounting, this is called accounts payable.

User benefits refer to understanding and appreciating the base reason an individual purchases a product or service that may not directly correlate with the feature or function of the good or service. These benefits may be intangible.

User registrations is a conversion value measuring the number of website visitors who voluntarily include themselves in your database in order to access the content you provide on your website.

Used as a noun, valuation is what a business is worth. This would mean that a company is valued at $10 million, or worth $10 million. The term is used most often for discussions of the sale or purchase of a company.

Value is the ratio of perceived benefits compared to price for a product or service.

Variable costs are costs that fluctuate in direct proportion to the volume of units produced. The best and most obvious example is the physical costs of goods sold, direct costs such as materials, products purchased for resale, production costs, and overhead, etc.

Variance is a calculation of the difference between planned and actual results, used by analysts to manage and track the impact of planning and budgeting.

Venture capitalists are individuals or firms that invest in young companies. Among more informed investors, analysts, and entrepreneurs, a venture capitalist is a manager of a mainstream venture capital fund.

Venture capital is investment money obtained through private or public investment funds directed to high-risk and high-potential enterprises. Within more informed and sophisticated circles, venture capital is defined more narrowly as investment money from mainstream venture capital firms.

A website (or site) is a virtual location, identified and located by a URL, an address that can lead you to a file on any connected machine anywhere in the world.

Website metrics are measurement tools used to evaluate how effectively a website is marketing a business. These can include pageviews, impressions, unique user sessions, new visitors, return visitors, click-through rate, and conversion rate.

In broad, general terms, website traffic is the number of visitors and visits a website receives.

A wholesaler is a channel member that purchases from the producer and supplies to the retailer, primarily performing the function of physical distribution and amassing inventory for rapid delivery.

Working capital refers to the accessible resources needed to support the day-to-day operations of an organization. It commonly includes cash, current assets, accounts payable, and current unpaid income taxes.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!