Cap Table Explained — What is it and How to Maintain it for Investors

Starting a business requires a great idea, hard work, and innovation for stable traction and growth. As the company grows, it may issue stock options to attract new staff and funding from investors, all of which are incorporated into a document known as a Cap Table.

A cap table, short for capitalization table, outlines the company’s capitalization. It lists all the shareholders and grants in the company and tracks the total amount, value, and equity ownership of shares. The cap table also includes data on debt, equity ownership, liquidation rights, and total capital. Startups typically lack traditional debt lenders, so the table mainly consists of shareholder data and their percentages of ownership. Various forms of equity, such as preferred stock, common stock, and convertible notes, also influence the present and potential future investors.

Why is a cap table important for a small business?

A cap table assists in making decisions related to business activities such as available options and pre-money valuations. It enables faster decision-making, like when hiring a COO who asks for percentage ownership in the company. With a cap table, you can quickly determine how much ownership to offer. Ultimately, it illustrates who owns the company.

Additionally, the cap table represents a significant amount of money for the company. Investments in startups can range from three to seven figures, and as the company develops and becomes profitable, the stock’s value can double or triple. Therefore, accurately maintaining a cap table is crucial, as a small error can lead to a difference of thousands of dollars. The importance of a cap table can be justified by the following points:

- Potential investors assess control and leverage using the cap table.

- Current investors determine their position and potential profit using the cap table.

- Stockholders check real-time share values through the cap table.

- A cap table provides historical insights that can impact startup valuation during fundraising.

- It helps present the history of the company and its holdings during audits.

- Founders can use the cap table to determine their percentage of the startup when proposing to new investors.

A well-maintained cap table becomes more valuable over time as your business exists. It is the key to success, and accuracy from the beginning is crucial.

Basic elements of a cap table

Let’s discuss the various elements used in a cap table:

Shareholders are individuals or corporations that own shares in the company.

Authorized shares are the total number of shares reserved for issuance by the owner of the startup.

Common shares represent the most fundamental form of ownership in the company.

Preference shares are a class of stock with special rights as described in the startup. They can be convertible, participating, or non-participating.

Convertible notes

Convertible notes are loans that can be converted into company equity, usually during a liquidation event, such as the company’s acquisition.

Total share ownership is the sum of common stock, stock options, preferred stock, and any other stock category for an individual.

Example of a cap table

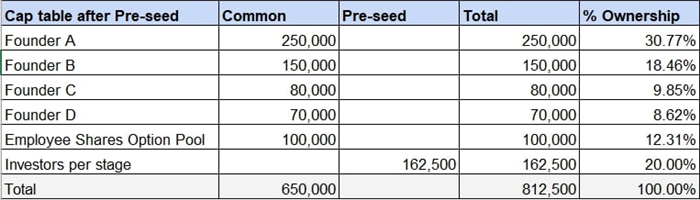

Here, the founders own 67.7% of the shares, the ESOP (employee stock option pool) owns 12.31%, and the investors own 20%. It’s important to know the ownership breakdown before pitching to new investors.

How to create a cap table:

The cap table should have a simple and organized layout that clearly shows ownership and the number of shares.

There are two ways to create a cap table:

1. Excel sheet templates:

Most organizations use spreadsheets to create a cap table. The layout typically lists investors/security owners vertically and types of securities horizontally.

2. Spreadsheet templates:

Companies can use a spreadsheet template to input information and figures about their business. The first row should indicate the total number of company shares. Subsequent rows should list authorized, outstanding, unissued shares, as well as shares reserved for the stock option plan and investors.

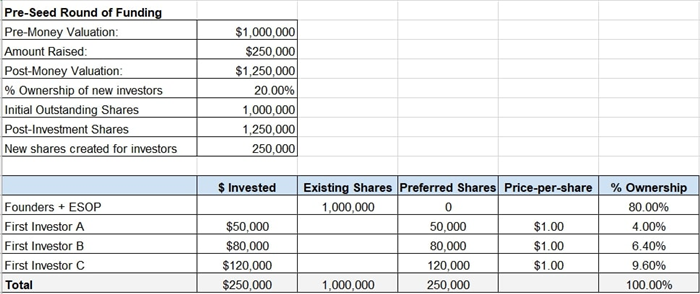

Here is an example of a cap table after a round of funding, with a pre-money valuation of $1 million. 20 percent of the company is split between the 3 incoming investors, with 4 percent going to Investor A, 6.4 percent going to Investor B, and 9.6 percent going to Investor C.

Using software

Maintaining an excel cap table with many shareholders can be a hassle as the business grows. The number of investors and classes of shares increases over time. More rows and columns are required, along with testing schedules and tracking option grants. To overcome this hassle, a cap table software is used that can handle any company size.

Best ways to maintain a cap table for investors

1. Keep information up-to-date & record every detail

To make the best use of a cap table, keep it simple and organized. Ensure that the cap table is always up to date. This means updating any changes such as new shareholders, share transfers, stock option exercises, share repurchases, and other transactions. A well-organized cap table allows for immediate and intelligent decisions. Cap table software is preferred for organizing and maintaining the cap table when pitching to new investors.

2. Include details of Convertible Notes on the Cap Table

Convertible notes are popular for seed-stage companies. However, startups often forget to include them on their cap table. Incoming investors can be surprised by overlooked convertible notes and their dilution effects.

3. Outline your plans for future employee stock option pools

A properly outlined ESOP can significantly impact future hires and business growth. Take the time to outline your plan for future employee stock option pools, especially regarding vesting.

4. Add pre-money valuation & calculation for it

The pre-money valuation, added to the company’s cap table, provides a reference for fair share value and assists with investor negotiations.

5. Add details of possible dilution when bringing on investors

Dilution occurs when new shares are issued, reducing existing stockholders’ ownership percentage. To maintain your cap table for investors, add details of possible dilution effects when bringing on new shareholders.

Ready to add investors to your cap table?

Now that you understand what a cap table is and how it affects the company, keep the details in excel initially. As your business grows, consider using cap table software to simplify management and focus on running your business.

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!