I&B Investments is a new limited liability company in Utah. This document provides information about our company, including business structure, goals, projected growth, capital requirements, start-up costs, investment analysis, and industry trends. Our primary interest is the family entertainment industry, and we are focused on developing family entertainment centers (FEC) in the Weber County, Utah area. We aim to provide quality entertainment activities to the community.

Entertainment has become the buzzword of the new millennium. David L. Malmuth, senior VP of TrizenHahn Development Corp. has observed that people want an experience, and successful experiences are based on authenticity, fun, and participation. Americans spend more on entertainment than on health care or clothing.

I&B Investments focuses on quality family entertainment. The initial development phase includes the construction of one FEC. We plan to offer the type of entertainment and adventure that the market demands. Our first proposed site is a ten-acre parcel in Weber County, with a second site planned within five years.

In addition to other funding efforts, we may seek assistance from the Government Redevelopment Agency for purchasing land. According to the U.S. Census Bureau, personal consumption and expenditures for amusement and recreation increased by $31.5 billion from 1990 to 1998, with an overall industry gross of $56.2 billion.

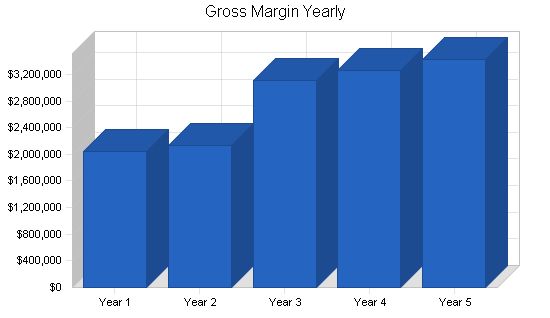

Considering the current prices and revenue structure in the local amusement and recreation industries, our FECs have the potential for several million dollars in gross sales in the first year. With a strong management team and an aggressive marketing plan, we project a consistent annual growth of five percent.

Contents

1.1 Objectives

The company’s objective is to build quality, full-service FECs that will command the approval of the predominantly LDS community it serves.

Our goals include:

- Achieve a 10% market share in our first year.

- Modestly increase our gross margins within the second year of operation.

- Increase our market share by a minimum of 10% for each of our first five years.

Currently, there are no quality FECs in Weber County or the surrounding areas within a 50-mile radius. The company believes that by entering the marketplace first and establishing quality facilities, it will become and remain a leader in the FEC industry in the Northern Wasatch Front.

Our fundamental objective is to understand and impact the community where we do business, knowing that we will stand the test of time if the local residents approve and support our center.

1.2 Mission

I&B Investments’ sole purpose is to establish a profitable and well-managed company while creating an atmosphere of fun and excitement for the entire family. We aim to please the local residents as well as the substantial tourist base of the Northern Wasatch Front with our activities.

1.3 Keys to Success

Based on our research, our primary target market is parents and their children (ages 5-15 to 54). We will design our facilities to address this primary market while also considering the secondary markets such as teens and young adults.

We believe that our main keys to success include:

- Providing popular and wide-ranging entertainment activities

- Offering ample and secure parking

- Providing indoor activities for year-round entertainment

- Utilizing state-of-the-art technology

- Ensuring easy access

- Targeting high traffic areas for maximum public exposure

- Designing facilities to curb overcrowding

- Having a seasoned management team

We can minimize certain risk factors by:

- Initial capitalization of the company to sustain operations through year one

- Maintaining low overhead through the use of multi-skilled employees and continual training

- Building a strong customer base through aggressive marketing

- Developing strong community ties and involvement

- Establishing cash/credit/debit card only facilities to eliminate collection costs

Company Summary

The company anticipates locating its first FEC in Weber County, Utah, facing the Majestic Wasatch Front Mountains. The company’s FEC will be the most modern in the Northern Wasatch area.

Initially named the Wasatch Family Fun Center, the company anticipates that its facility will have a positive impact on the local environment and economy.

Mr. Bill Rameson, CEO of Palace Entertainment, the largest FEC chain in the world, has observed, "With most family entertainment centers having a 15 to 20-mile reach and in today’s climate, you’ve got to understand what you’re trying to accomplish. You’ve got to understand your market. You’ve got to understand construction. The attractions have to be interactive and competitive."

I&B Investments plans to choose its locations after thoughtful and detailed research and demographic profiling.

2.1 Company Ownership

- Managing Partner – Mark D. Bergman

- Acting C.F.O.- Val R. Iverson

- Operations Manager & Public Relations – Senator Joseph L. Hull

- Retail Space Leasing Agent Gift Shop Manager.- Laura Strebel

- Director of Sales and Marketing – Roger Smout

- Manager of Treasury and General Accounting – Rod Schaffer

- Manager of Promotions & Customer Service – Darren Strebel

Consultants/Non-Partners (retained):

- General Entertainment Manager / Consultant – Harold Skripsky

- Redevelopment (RDA) Specialist – Randy Sant

2.2 Start-up Summary

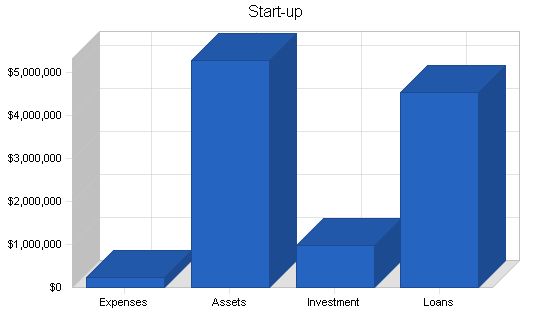

For Phase 1, the Start-up table reflects the cost of the center, activities, and 8.5 +/- acres.

All construction costs are included in the gross loan but not detailed in the "Start-up Cost Table" because these costs occur before the projected pro forma begins.

In the Start-Up Funding table, there are two types of investors listed:

The Seed Investors/Partners under #1-11 are the seed funding group and company management team. Their investment carries a greater risk of loss, and they receive a much greater company ownership than the secure partners do for their investment. These partners also earn sweat equity shares for their involvement/efforts rather than wages during development.

The Start-up Investors/Secure Partners under #1-4 are the start-up funding partners. They may or may not be part of the company’s management team but are the voting and percentage controlling partners. Their investment will be escrowed and secure until the company has secured funding for the entire project. There is no risk of loss associated with these investors.

The Use of Funds table details many of the Start-up Expenses.

Start-up Funding

Start-up Expenses to Fund: $229,575

Start-up Assets to Fund: $5,277,925

Total Funding Required: $5,507,500

Assets

Non-cash Assets from Start-up: $5,077,925

Cash Requirements from Start-up: $200,000

Additional Cash Raised: $0

Cash Balance on Starting Date: $200,000

Total Assets: $5,277,925

Liabilities and Capital

Liabilities

Current Borrowing: $890,000

Long-term Liabilities: $3,652,500

Accounts Payable (Outstanding Bills): $0

Other Current Liabilities (interest-free): $0

Total Liabilities: $4,542,500

Capital

Planned Investment

Seed Investor/Partner #1: $5,000

Seed Investor/Partner #2: $5,000

Seed Investor/Partner #3: $2,500

Seed Investor/Partner #4: $2,500

Seed Investor/Partner #5: $2,500

Seed Investor/Partner #6: $2,500

Seed Investor/Partner #7: $5,000

Seed Investor/Partner #8: $12,500

Seed Investor/Partner #9: $12,500

Seed Investor/Partner #10: $12,500

Seed Investor/Partner #11: $12,500

Start-up Investor/Secure Partner #1: $222,500

Start-up Investor/Secure Partner #2: $222,500

Start-up Investor/Secure Partner #3: $222,500

Start-up Investor/Secure Partner #4: $222,500

Additional Investment Requirement: $0

Total Planned Investment: $965,000

Loss at Start-up (Start-up Expenses): ($229,575)

Total Capital: $735,425

Total Capital and Liabilities: $5,277,925

Total Funding: $5,507,500

Start-up

Requirements

Start-up Expenses

Seed/Development Stage Cost: $35,000

Professional Fees: $60,000

Commercial Loan/Mortgage Points Cost: $109,575

Sweat Equity Cost: $25,000

Total Start-up Expenses: $229,575

Start-up Assets

Cash Required: $200,000

Other Current Assets: $0

Long-term Assets: $5,077,925

Total Assets: $5,277,925

Total Requirements: $5,507,500

Use of Funds

Use Amount

Phase 1 Construction Cost Breakdown: $0

Total Sq.Ft. Building (±): $15,000

Direct Construction Cost: $150,000

Table Top Games/FoosBall: $50,000

Redemption Games/Inventory: $50,000

Bumper Boats: $175,000

Batting Cage and Pitching Device: $140,000

Miniature Golf Course: $225,000

Street Construction: $800,000

Storm Water and Infiltration Program: $217,000

Building Permit/Subdivide/Connection: $35,000

Parking Lot: $167,000

Construction Insurance Cost: $4,000

Property Cost 8.6 ± Acres: $688,000

Drafting/Renderings: $90,000

Site and Building Engineering: $45,000

Computers/Desks Office Supplies: $14,000

Signs: $20,000

Go-carts and Tracks: $500,000

First Year Operations Captial: $200,000

Gross Cost of Equipment & Improvements: $3,570,000

Construction Cost of Building: $1,000,000

Construction Loan Cost: $300,000

Cost + Building: $4,870,000

25% Loan (LT) Buy Down Cost: $1,217,500

RDA Write Down: $0

Retail Pads Sales: $0

Net (LT) Loan: $3,652,500

Loan Points Cost: $109,575

Gross Cost: $1,327,075

Loan + Points Cost/Gross Investment: $4,979,575

Total: $24,611,225

2.3 Company Locations and Facilities

The first proposed site / property has two different aspects:

1. We purchase a 10 acre parcel on the site and construct our center.

2. We incorporate a Government Redevelopment Agency (RDA) that can provide our company with a government grant (funds) to help us purchase the entire 44.6 acres. This involves more risk but offers higher profits as we will need to resell 20 acres +/- once they are developed.

Therefore, within this business plan, we will present a primary look at both possibilities, including the basic business structure, start-up cost, projected growth, market, local demographics, economic impact, industry trends, construction costs, land development, oversight of operations during infrastructure development, and future management and marketing team.

Our proposed site is the 44.6 +/- acres on the west side of the Interstate, with three planned future accesses/easements.

The entire property is zoned commercial, and the owner supports our project and will carry a contract. Phase 1 would place our FEC just north of existing commercial establishments.

The latest traffic figures report an average daily traffic count of 30,685 cars exiting and entering the interstate at this junction, and the interstate (north and southbound) carries an average daily traffic count of 56,490 cars. Source: Utah Department of Transportation.

Services

Our FECs will provide customers with a wholesome environment that offers amusement, entertainment, excitement, competition, year-round activities, souvenirs, and great food, all while creating lasting memories at affordable prices.

Although there is currently no competition in the immediate area where we plan to establish our FECs, we believe that, due to the exponential expansion of the FEC industry, competition will eventually arise.

To maintain a solid leadership position in the marketplace, the company plans to become profitable by providing:

– Indoor facilities that can operate regardless of weather conditions.

– Year-round play with a wide variety of activities.

– A seasoned and successful management team.

– Top FEC consultants to advise on attraction layout and design.

– Collaboration with the USU Extension Program to determine tourism impact.

– Collaboration with the Utah Department of Tourism for national and international exposure.

– Family-oriented partnership-operated center for local insight.

– Aggressive marketing strategies.

– Customer Incentive Program to reward frequent visitors.

– Easy access and exposure.

3.1 Service Description

The ability of I&B Investments to accomplish its goals and lead the local family entertainment industry relies on the expertise and social conscience of the management team. Several members of our management team have been recognized in the past for their outstanding community service and involvement.

Local surveys have provided valuable information about the requirements that need to be met for an FEC to attract local residents. We strive to meet these desires and will continuously survey our customers to stay ahead of the curve. Source: USU Extension Program.

The Story of Dave & Busters – Family Entertainment Centers

“In 1982, Dave Corriveau and Buster Corley brought an idea to life. Create a place where adults can enjoy great food, terrific drinks, and the latest interactive games – all in one place. They discovered a winning formula. Over the past 18 years, Dave & Buster’s has grown from one location in Dallas, Texas, to a nationwide organization. And with the help of our creative and dedicated employees, we’re able to keep growing and providing our guests with a unique experience.” Source: Dave & Busters.

I&B Investments intends to build an FEC with a 15,000 to 20,000 square-foot main building located in Northern Utah. We will provide activities and services such as go-carts, miniature golf, climbing walls, batting cages, skycoaster or tower swing, air hockey, foosball, paintball, laser and phazer tag, skateboard arena, outdoor bumper boats, gaming and redemption center, chess/backgammon playing areas, souvenir/gift shop, ice cream, pizza, pretzels, drinks, private party rooms (birthday and corporate), massage therapy center, and a coffee shop.

I&B Investments plans to enter into an agreement with Harris Miniature Golf Company (HMGC) to construct the mini-golf course at our facility. The course’s landscaping will depict the Wasatch Mountains area. The environment will be casual, capturing the romantic era of a visit to the Olde West. The casual ambiance will be enhanced with mellow beat music and the sound of rushing water created by the falls and streams on the golf course. The quality of play and excellent service will ensure a large and loyal customer base.

“Miniature golf’s relatively low start-up cost have made it one of the most lucrative entertainment businesses around. Our latest figures show courses can return as much as 38 percent on an investment each year,” states Dave & Paul of the Professional Miniature Golf Association of Salt Lake City, Utah.

3.2 Future Services

I&B Investments will expand its family entertainment activities during its first year of operation by adding bumper boats, go-carts, and other attractions as discussed elsewhere in our plan.

In addition, I&B Investments is already working on contingency plans for adding more facilities along the Wasatch Front.

To further increase revenues and public attraction, I&B Investments is working to establish several other outdoor entertainment activities using revenue-sharing programs, such as the Skycoaster.

Market Analysis Summary

Research has indicated that the prime market for an FEC is in urban areas close to neighborhoods with large concentrations of middle to upper-income residents. Ease of access is important, but street frontage is not crucial.

Mr. Randy White, president of White Hutchinson Leisure & Learning Group, one of the leading FEC project developers in the United States, has observed, “Just as entertainment is becoming an essential component of shopping centers, entertainment is the backbone of today’s urban redevelopment. Often referred to as urban or location-based entertainment centers, these projects integrate entertainment with retail, dining, and cultural facilities to create a resident and tourist destination.”

A seven to ten-mile radius is considered the market area of an FEC. However, depending on competition, the market area can expand to a fifteen-mile radius, or even twenty miles with easy highway access.

The U.S. Census Bureau, Census 2000, and the Weber County Economic Development provide the following demographic information about our area within a 15-mile radius:

Counties Gross pop. Age 5-75

Weber 196,533 171,297

Box Elder 42,750 37,308

Davis 238,994 209,794

The population in a fifteen-mile radius exceeds 500,000. The median age is 27, with a 50% male and female distribution. Over 85% of the population is white, and over 40% are in the 25 to 50 age range. Over 75% own or are buying their homes. The average household size is 3.5 persons, and the average household adjusted gross income is $39,250.

4.1 Market Segmentation

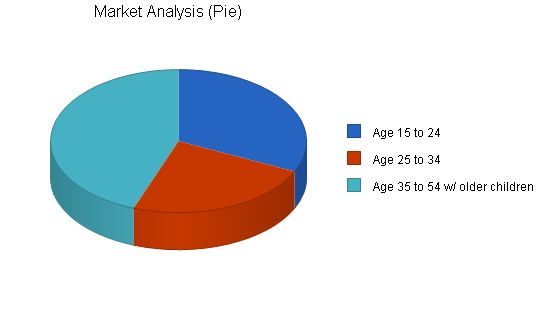

I&B Investments’ primary targeted market consists of three main groups: 15 to 24-year-olds, 25 to 34-year-olds, and 35 to 54-year-olds. For a comprehensive breakdown of the local population, refer to the following table and chart.

Market Analysis

Potential Customers: The number of potential customers in specific age groups is expected to grow over the next five years, with a compound annual growth rate (CAGR) ranging from 2% to 9%.

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Age 15 to 24: 90,450 96,329 102,590 109,258 116,360 6.50%

Age 25 to 34: 66,800 68,136 69,499 70,889 72,307 2.00%

Age 35 to 54 w/ older children: 125,250 136,523 148,810 162,203 176,801 9.00%

Total: 282,500 300,988 320,899 342,350 365,468 6.65%

4.2 Target Market Segment Strategy

A full-time public relations coordinator is vital for assuring customer satisfaction, generating public awareness, and promoting activities at our “FEC” to the public. Our success lies in providing enjoyable experiences for all age groups.

4.2.1 Market Needs

Our service fills a long-standing void in the local entertainment market, as identified through local demographic analysis of Weber and Davis County.

4.2.2 Market Trends

To avoid the negative impact of large chains, I&B Investments aims to establish its presence in the Utah market before national chains do. The amusement industry in Utah is projected to show significant growth, making it an opportune time for our establishment.

4.2.3 Market Growth

The population size and the type of entertainment we offer contribute to the projected growth and stability of our customer base in the coming years. With the majority of the population residing within close proximity to our chosen site, there is a clear advantage. Moreover, there is no existing FEC of our type within a 50-mile radius.

4.3 Service Business Analysis

Dr. DeeVon Bailey from Utah State University has conducted a study on Weber County’s economy and the impact of amusement companies. The study reveals the economic multipliers associated with our proposed business, highlighting the positive impact it can have on the local economy.

4.3.1 Competition and Buying Patterns

Our industry has minimal inventory requirements, allowing for quick shipment from suppliers. Being locally owned, we can connect with the community and meet their specific needs.

4.3.2 Main Competitors

There are no true FECs in the Rocky Mountain area, giving us a prime opportunity to serve the market. While there may be other recreational and amusement activities in the area, none can compete directly with our unique and diverse offerings.

Strategy and Implementation Summary

We aim to provide a premium amusement and entertainment experience, positioning ourselves in the market as a leader in quality and service. Our pricing strategy aligns with industry standards, and we plan to establish community involvement programs to contribute to the overall well-being of the community.

5.1 Competitive Edge

Our high standards and strategic location make it difficult for competitors to enter and survive in our market area. Our competitive edge lies in providing maximum profits at affordable prices while offering a wide range of entertainment options for all age groups.

Our target market includes customers from all demographics who seek enjoyable entertainment. We employ a full-time public relations manager to ensure customer satisfaction and stay connected with the community.

5.2.1 Pricing Strategy

Our pricing is consistent with industry recommendations and local competition. The detailed pricing chart showcases the variety of activities we offer and the projected number of customers per month.

5.2.2 Promotion Strategy

Word-of-mouth advertising is paramount to our success, and we also utilize advertisements, local newspapers, and a future website to reach new customers. We engage with Utah’s State Tourist Department and use signs and brochures to spread awareness.

5.3 Sales Strategy

We aim to provide a fun and competitive environment for the whole family, with minimum physical requirements. By offering exceptional service and value for money, we anticipate reaching a broader market than initially projected.

Our sales strategy is based on the core principles of business: satisfying our customers to ensure repeat business.

Based on a target market population of 418,399 people, we will outline how we can easily achieve our income goals.

– 10% of 418,399 people equals 41,839 customers annually, each spending $81.26 per year, or $8.50 per visit, and visiting 9.5 times per year.

– Alternatively, using our projected average expenditure per person, $8.50 multiplied by 1,225 customers daily equals $10,412. Multiply this by 313 days a year to get a yearly total of $3,259,112.

This means that if approximately one out of every three potential customers visits our center once a year and spends at least $8.50, we can meet or exceed our projected income.

In 2006, sales saw an increase due to the opening of Phase 2.

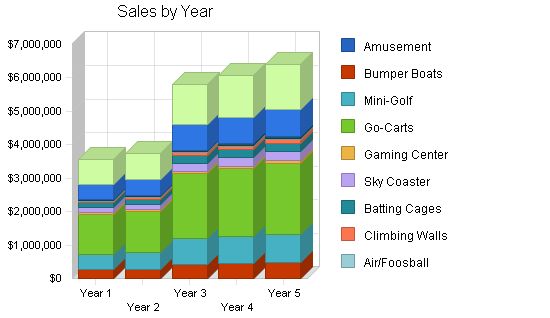

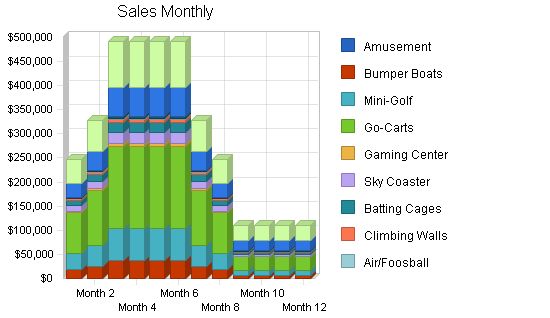

The chart below illustrates I&B Investments’ Projected Sales Forecast for the next five years. Monthly figures are provided in the appendix. For a breakdown of pricing and projected numbers, please refer to topic 4.2.

Sales Forecast:

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

Amusement $0 $0 $0 $0 $0

Bumper Boats $260,463 $273,486 $423,904 $445,099 $467,354

Mini-Golf $466,907 $490,252 $759,891 $797,886 $837,780

Go-Carts $1,193,801 $1,253,491 $1,942,911 $2,040,057 $2,142,060

Gaming Center $38,584 $40,513 $62,795 $65,935 $69,232

Sky Coaster $154,350 $162,068 $251,205 $263,765 $276,953

Batting Cages $144,697 $151,932 $235,494 $247,269 $259,633

Climbing Walls $55,997 $58,797 $91,136 $95,692 $100,477

Air/Foosball $18,308 $19,223 $29,796 $31,286 $32,850

Souvenirs $28,175 $29,584 $45,855 $48,148 $50,555

Party Rooms $460,238 $483,250 $749,037 $786,489 $825,813

Food & Drinks $739,588 $776,567 $1,203,679 $1,263,863 $1,327,057

Total Sales $3,561,108 $3,739,163 $5,795,703 $6,085,488 $6,389,763

Direct Cost of Sales:

Year 1 Year 2 Year 3 Year 4 Year 5

Amusement $0 $0 $0 $0 $0

Bumper Boats $65,116 $68,372 $105,976 $111,275 $116,838

Mini-Golf $70,036 $73,538 $113,984 $119,683 $125,667

Go-Carts $298,450 $313,373 $485,728 $510,014 $535,515

Gaming Center $19,292 $20,257 $31,398 $32,968 $34,616

Sky Coaster $38,588 $40,517 $62,801 $65,941 $69,238

Batting Cages $21,705 $22,790 $35,324 $37,090 $38,945

Climbing Walls $13,999 $14,699 $22,784 $23,923 $25,119

Air/Foosball $2,746 $2,884 $4,469 $4,693 $4,928

Souvenirs $7,044 $7,396 $11,464 $12,037 $12,639

Party Rooms $230,119 $241,625 $374,518 $393,244 $412,907

Food & Drinks $369,794 $388,284 $601,840 $631,932 $663,528

Subtotal Direct Cost of Sales $1,136,888 $1,193,733 $1,850,286 $1,942,800 $2,039,940

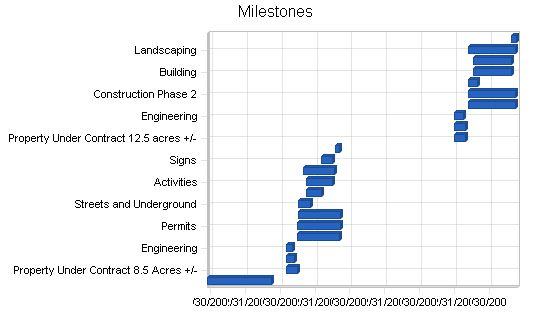

5.4 Milestones:

Set forth below are the main milestones in the proposed development schedule. We have reviewed the timelines for start-up and believe that once we are fully funded, we can construct and open our initial FEC within a year of breaking ground.

– Purchase property for FEC site by October 2002

– Preliminary architectural drawings

– Secure construction loan

– Approval of final architectural drawing

– Obtain all required permits

– Site preparation

– Order long lead items (go-carts, boats, skycoaster, etc.)

– Construction of center (three and five-month timelines for construction phases)

– Develop operations and employee manual

– Hire personnel

– Prepare and finalize marketing campaign

– Train staff

– Order inventory

– Soft open (training period of 30 to 45 days)

– Grand Opening/Mothers Day weekend 2003

– Construction on Phase 2 starts in 2005.

Milestones:

Write Business Plan

6/15/2001 – 5/15/2002

$25,000

ABC – Marketing

Property Under Contract 8.5 Acres +/-

8/1/2002 – 10/1/2002

$680,000

ABC – Marketing

Site Plans

8/1/2002 – 9/15/2002

$90,000

ABC – Marketing

Engineering

8/1/2002 – 9/1/2002

$45,000

ABC – Marketing

Insurances

9/30/2002 – 5/5/2003

$4,000

ABC – Marketing

Permits

10/1/2002 – 5/11/2003

$25,000

ABC – Marketing

Construction Phase 1

10/2/2002 – 5/14/2003

$150,000

ABC – Marketing

Streets and Underground

10/2/2002 – 12/5/2002

$175,000

ABC – Marketing

Building

11/15/2002 – 2/1/2003

$905,000

ABC – Marketing

Activities

11/15/2002 – 4/1/2003

$1,040,000

ABC – Marketing

Landscaping

11/1/2002 – 4/10/2003

$117,000

ABC – Marketing

Signs

2/1/2003 – 4/1/2003

$20,000

ABC – Marketing

Open Go-cart Center

4/14/2003 – 5/10/2003

$200,000

ABC – Marketing

Property Under Contract 12.5 acres +/-

1/1/2005 – 3/1/2005

$1,000,000

ABC – Marketing

Expanded Site plans

1/1/2005 – 3/1/2005

$95,000

ABC – Marketing

Engineering

1/1/2005 – 2/15/2005

$50,000

ABC – Web

Permits

3/15/2005 – 11/15/2005

$35,000

ABC – Web

Construction Phase 2

3/15/2005 – 11/15/2005

$250,000

ABC – Department

Streets & Underground

3/15/2005 – 5/1/2005

$200,000

ABC – Department

Building

4/10/2005 – 10/25/2005

$1,500,000

ABC – Department

Activities

4/10/2005 – 10/25/2005

$1,500,000

ABC – Department

Landscaping

3/15/2005 – 11/15/2005

$150,000

ABC – Department

Open Expanded (FEC) Center

10/27/2005 – 11/21/2005

$250,000

ABC – Department

Totals

$8,506,000

Management Summary

Our company philosophy is based on mutual respect for all contributions made by our partners, investors, consultants, and employees. We strive to create an environment that enables us to work smarter-not harder, and we value and reward suggestions.

6.1 Management Team

Mark D. Bergman, Managing Partner

Mr. Bergman is a self-starter and natural leader. He has a diverse background in various trades and has received commendations for community improvement and youth development programs. He is bilingual in Spanish.

Responsibilities: Design and manage construction phase, serve as operations director, develop and implement operation, safety, maintenance, and training programs.

Joseph L. Hull, Manager Operations (GM) & Public Relations Officer

Mr. Hull has degrees in chemistry, German, and a master’s degree in education. He is highly skilled in negotiations, public relations, budget oversight, business management, and problem-solving. He has served in Utah State Legislature and received numerous awards and recognitions.

Responsibilities: Participate in strategic business plan, coordinate training and operation programs, act as operations director and public relations consultant.

Darren B. Strebel, Manager of Promotions and Media

Mr. Strebel has experience in developing and operating his own businesses, including investment consulting and financial planning. He has extensive experience in advertising, marketing, distribution, and client fulfillment.

Responsibilities: Implement marketing direction, manage art and graphics work, promote company’s FECs.

Rod Schaffer, Treasurer/Comptroller

Mr. Schaffer is a certified public accountant (CPA) and has extensive experience in accounting, tax filings, budgeting, and financial matters. He also provides corporate services and serves as a point-of-contact for external payroll service contractor and independent CPA services.

Responsibilities: Comptroller duties, corporate bookkeeping, revenue review, statements reconciliation, accounts payable, and related matters.

Laura Strebel, Retail Space Agent and Gift Shop Manager

Ms. Strebel owns a successful business in custom gifts and crafts and is also a licensed real estate agent. She has been involved in community outreach programs and legislative task forces.

Responsibilities: Seek, review, and qualify tenants, manage gift and souvenir shop, assist in daily accounting oversight.

Senior Staff Consultants

Harold D. Skripsky, Entertainment and Activities Consultant

Mr. Skripsky has extensive experience in the leisure and entertainment industry. He was part of the team that developed and operated a successful FEC. He serves as a consultant to the entertainment division of Ogden Entertainment.

Responsibilities: Consult on entertainment activities, assist in building design and floor layout, assist with training.

Val R. Iverson, Financial Consultant/Advisor

Mr. Iverson has experience in business start-up, management, sales, marketing, and financial matters. He is highly skilled in playground equipment manufacturing and marketing.

Responsibilities: Consult in strategic plans, coordinate property purchase, review inventory control, pursue investment capital.

Roger Smout, Marketing and Sales Consultant

Mr. Smout is a sales manager with experience in employee management, product presentation, and advertising production. He has hands-on experience in graphic design and multimedia publishing.

Responsibilities: Consult and advise on marketing, sales, and advertising.

Steven Eames, General Contractor and Construction Consultant

Mr. Eames is a licensed general contractor with over twenty years of experience.

Responsibilities: Act as general contractor, consult on construction schedule.

Randy Sant, Government Redevelopment Consultant/Advisor

Mr. Sant has experience in organizing redevelopment agencies and is knowledgeable in RDA funding.

Responsibilities: Consult and assist in setting up redevelopment agency and contracts with city government.

Other Executive Support Agencies:

Legal services

Auditing services

Banking services

Architectural, planning, and design services.

6.2 Organizational Structure

Active Managing Partners/Senior Staff

Mark D. Bergman – Managing Partner

Senator Joseph L. Hull – Operations Manager/Public Relations

Laura Strebel – Retail Space Leasing Agent & Gift Shop Manager

Rod Schaffer – Treasurer/Comptroller

Darren Strebel – Manager of Promotions & Customer Service

Richard Grossenbach – Human Resource Manager

Limited Partners/Senior Staff Consultants

Val R. Iverson – Investment, Real Estate and Financial Consultant

Roger Smout – Sales and Marketing Consultant

Steven Eames – Licensed General Contractor Construction Consultant

Non-Partners/Senior Staff Consultants (retained)

Harold Skripsky – Entertainment & Activities Consultant

Randy Sant – Redevelopment (RDA) Consultant

This group represents 41% of the company ownership, with the remaining percentage of the company’s ownership under the control of the managing partner. All partners have equal voting rights, and the managing partner is responsible for overseeing operations and informing other partners of progress.

6.3 Personnel Plan

Customer service is paramount in our business, and we will target employees who are willing to be trained. We will provide incentives and employee leasing programs to ensure employee satisfaction and well-being.

Our Personnel Plan reflects our intention to cross-train employees and create a positive work environment. We believe that happy employees lead to satisfied customers, so we prioritize cleanliness and proper equipment maintenance.

Personnel Plan

Personnel Plan Year 1 Year 2 Year 3 Year 4 Year 5

Operations Personnel

John A $23,184 $24,343 $49,904 $52,399 $55,019

John B $23,184 $24,343 $49,904 $52,399 $55,019

John C $23,184 $24,343 $49,904 $52,399 $55,019

John D $15,000 $15,750 $32,288 $33,902 $35,597

John E $15,000 $15,750 $32,288 $33,902 $35,597

John F $15,000 $15,750 $32,288 $33,902 $35,597

John G $15,000 $15,750 $32,288 $33,902 $35,597

John H $15,000 $15,750 $32,288 $33,902 $35,597

John I $15,000 $15,750 $32,288 $33,902 $35,597

John J $15,000 $15,750 $32,288 $33,902 $35,597

John K $15,000 $15,750 $32,288 $33,902 $35,597

John L $15,000 $15,750 $32,288 $33,902 $35,597

John M $15,000 $15,750 $32,288 $33,902 $35,597

John N $15,000 $15,750 $32,288 $33,902 $35,597

John O $15,000 $15,750 $32,288 $33,902 $35,597

John P $18,768 $19,706 $40,398 $42,418 $44,539

John Q $18,768 $19,706 $40,398 $42,418 $44,539

John R $18,768 $19,706 $40,398 $42,418 $44,539

John S $27,600 $28,980 $59,409 $62,379 $65,498

John T $27,600 $28,980 $59,409 $62,379 $65,498

John U $27,600 $28,980 $59,409 $62,379 $65,498

Subtotal $388,656 $408,089 $836,582 $878,411 $922,332

Sales and Marketing Personnel

Darren Strebel $27,600 $28,980 $30,429 $31,950 $33,548

Other $27,600 $28,980 $30,429 $31,950 $33,548

Subtotal $55,200 $57,960 $60,858 $63,901 $67,096

General and Administrative Personnel

Joe Hull $40,848 $42,890 $87,925 $92,322 $96,938

Rod Schaffer $18,768 $19,706 $20,692 $21,726 $22,813

Restaurant Manager $40,848 $42,890 $87,925 $92,322 $96,938

Laura Strebel $20,976 $22,025 $23,126 $24,282 $25,496

Mark Bergman $49,680 $52,164 $106,936 $112,283 $117,897

Subtotal $171,120 $179,676 $326,605 $342,935 $360,082

Other Personnel

Jack A $18,768 $19,706 $40,398 $42,418 $44,539

Jack B $18,768 $19,706 $40,398 $42,418 $44,539

Jack C $20,976 $22,025 $45,151 $47,408 $49,779

Sara A $18,768 $19,706 $40,398 $42,418 $44,539

Subtotal $77,280 $81,144 $166,345 $174,662 $183,396

Total People 32 32 32 32 32

Total Payroll $692,256 $726,869 $1,390,390 $1,459,909 $1,532,905

It is anticipated that the multi-million dollar loan that the company will seek to secure will cover the business start-up costs and provide funds for operating expenses for the first year. Management projects that it will need to obtain additional investment capital to fund the loan and long-term assets.

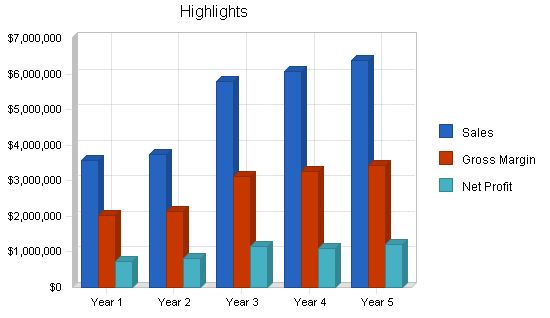

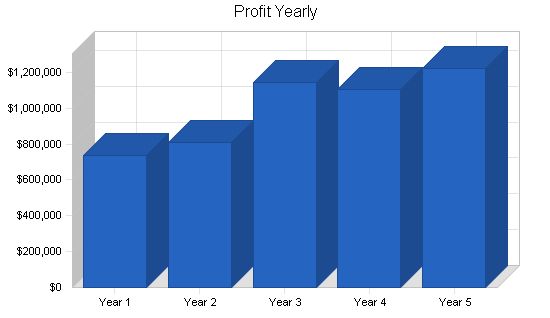

The Highlights chart that accompanies the Executive Summary sets forth the company’s anticipated profitability analysis. Management believes that even minimal revenues should be sufficient to offer investors an acceptable return on investment.

7.1 Important Assumptions

NOTES FOR PROJECTIONS

All sales projections/assumptions are based on operating at 35% +/- of capacity. Refer to the Sales Forecast topic for demographic break down and average cost per person.

1. The figure of $890,000 shown in the Start-up Funding table under Current Borrowing, is the start-up investment, amortized with a 19% interest rate and paid off in five years.

2. Our long-term commercial loan is amortized at 10% interest over 20 years.

3. All pricing has been set by industry standards and the local market.

4. Revenues are strictly a projection based on gross possible players per venue and then using 35% +/- of that capacity for our base calculation.

5. Contract services include: payroll, pest control, trash removal, cable TV.

6. Employees needed and wages have been projected for full time and eight hour shifts. All payroll will be done through a payroll company, therefore giving a flatter rate and making it easier to project.

7. Weber County tax rates are:

a. Real Estate tax $10.00 per $1,000 of assessed value.

b. Personal Property tax base is .009% of cost of equipment.

c. Business License is $50.00 for first 10,000 sq ft & $5.00 per every additional 1,000 sq. ft. of building space.

General Assumptions

Year 1 Year 2 Year 3 Year 4 Year 5

Plan Month 1 2 3 4 5

Current Interest Rate 19.00% 19.00% 19.00% 19.00% 19.00%

Long-term Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00%

Tax Rate 32.75% 33.00% 32.75% 33.00% 32.75%

Other 0 0 0 0 0

7.2 Valuation

In the following Investment Analysis Table, one should note that the entire (gross loan + points) amount of our long-term liabilities ($4,542,500) is the figure we used to determine the Net Present Value (NPV) and the Internal Rate of Return (IRR) of our company’s projected values.

Investment Analysis

Start Year 1 Year 2 Year 3 Year 4 Year 5

Initial Investment

Investment $4,542,500 $0 $0 $774,000 $0 $0

Dividends $0 $0 $774,000 $0 $0 $0

Ending Valuation $0 $7,370,000 $8,110,000 $11,400,000 $11,050,000 $12,475,000

Combination as Income Stream ($4,542,500) $7,370,000 $8,884,000 $10,626,000 $11,050,000 $12,475,000

Percent Equity Acquired 0%

Net Present Value (NPV) $15,893,745

Internal Rate of Return (IRR) 178%

Assumptions

Discount Rate 10.00%

Valuation Earnings Multiple 10 10 10 10 10

Valuation Sales Multiple 2 2 2 2 2

Investment (calculated) $965,000 $0 $0 $774,000 $0 $0

Dividends $0 $774,000 $0 $0 $0

Calculated Earnings-based Valuation $7,380,000 $8,110,000 $11,440,000 $11,050,000 $12,220,000

Calculated Sales-based Valuation $7,120,000 $7,480,000 $11,590,000 $12,170,000 $12,780,000

Calculated Average Valuation $7,250,000 $7,795,000 $11,515,000 $11,610,000 $12,500,000

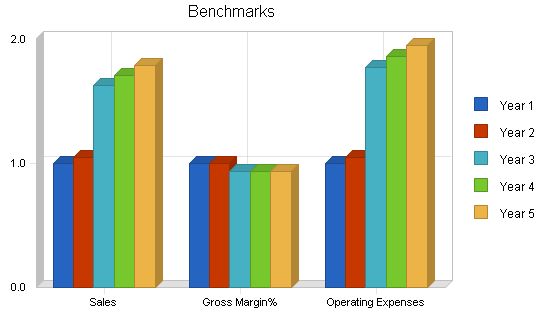

7.3 Key Financial Indicators

These benchmark indicators give I&B Investments a sense of relative comparison for five years of projections.

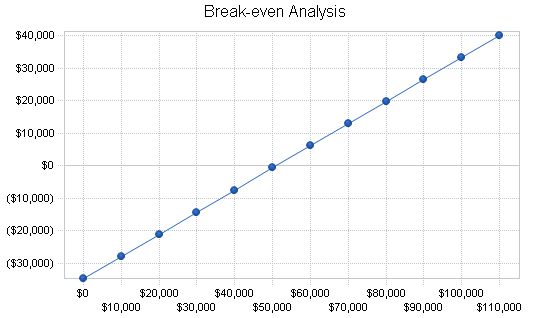

7.4 Break-even Analysis

Important notice regarding Break-even Analysis

The figures in this analysis are connected to the costs in the Start-up, Start-up Funding, and Use of Funds tables.

The following chart shows the monthly sales needed to break-even, which is less than half of our planned sales for 2003 and less than one third for subsequent years. We are confident in our ability to succeed and provide profitable returns for our owners/investors.

For the Break-even Analysis, we assume our fixed costs per month include management’s payroll, loan payments, investor repayments, and basic expenses.

It is more difficult to determine margins. Our average of $8.50 in goods/services sold per person is based on the local market average sales, with a gross profit of $6.80 per unit after deducting the average cost of 20%.

We believe that we will not only attract a higher number of monthly customers than shown in this break-even chart, but we also expect to possibly double the projected amount in our cash flow charts in this business plan. This is because we will be the only facilities of its kind within a 50-mile radius.

| Break-even Analysis | |

| Monthly Revenue Break-even | $51,010 |

| Assumptions: | |

| Average Percent Variable Cost | 32% |

| Estimated Monthly Fixed Cost | $34,725 |

7.5 Projected Profit and Loss

Important notes regarding Depreciation & Payroll Burden:

- The depreciation of assets was calculated separately from this Profit and Loss statement due to accounting issues in our industry and this program. It deducted our depreciation as cash expenses instead of tax deductions, causing the cash tables to not reflect the true cash flow statement as per our industry (see further explanation below).

- Payroll Burden (overhead/taxes) has been excluded from the Profit and Loss table because payroll costs and taxes were pre-calculated and included in the personnel plan table. We plan to use a payroll company, so all employee payroll fees, taxes, insurances, and other payroll burdens are charged as a flat fee (our industry average fee is wages + 15% +/- .5%).

Regarding depreciation figures, our preliminary assessment using a standard 200% declining balance on equipment and assets gives us a first-year figure of $190,000 +/-. This figure is considered our income tax deductible base and will adjust each year depending on taxable items, gross income, actual values, and depreciation of assets.

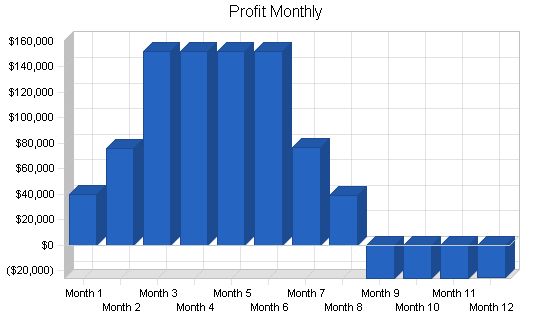

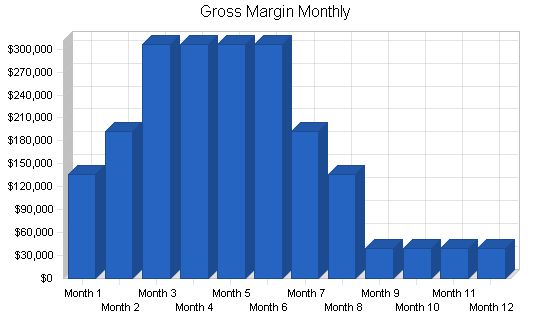

When reviewing the Profit & Loss table, note that the company is profitable in the first month of operation. The yearly analysis is indicated in the table below. Monthly analyses can be found in the appendix.

The provided text is as follows:

| Pro Forma Profit and Loss | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 | |

| $1,136,888 | $1,193,733 | $1,850,286 | $1,942,800 | $2,039,940 | |

| $388,656 | $408,089 | $836,582 | $878,411 | $922,332 | |

| $0 | $0 | $0 | $0 | $0 | |

| $1,525,544 | $1,601,821 | $2,686,868 | $2,821,211 | $2,962,272 | |

| $2,035,564 | $2,137,342 | $3,108,836 | $3,264,277 | $3,427,491 | |

| 57.16% | 57.16% | 53.64% | 53.64% | 53.64% | |

| $55,200 | $57,960 | $60,858 | $63,901 | $67,096 | |

| $18,000 | $18,900 | $29,295 | $30,760 | $32,298 | |

| $1,800 | $1,890 | $2,930 | $3,076 | $3,230 | |

| $6,000 | $6,300 | $9,765 | $10,253 | $10,766 | |

| $81,000 | $85,050 | $102,848 | $107,990 | $113,389 | |

| 2.27% | 2.27% | 1.77% | 1.77% | 1.77% | |

| $171,120 | $179,676 | $326,605 | $342,935 | $360,082 | |

| $0 | $0 | $0 | $0 | $0 | |

| $14,400 | $15,120 | $23,436 | $24,608 | $25,838 | |

| $14,760 | $15,498 | $24,022 | $25,223 | $26,484 | |

| $9,600 | $10,080 | $15,624 | $16,405 | $17,225 | |

| $0 | $0 | $0 | $0 | $0 | |

| $0 | $0 | $0 | $0 | $0 | |

| $209,880 | $220,374 | $389,687 | $409,171 | $429,629 | |

| 5.89% | 5.89% | 6.72% | 6.72% | 6.72% | |

| $77,280 | $81,144 | $166,345 | $174,662 | $183,396 | |

| $0 | $0 | $0 | $0 | $0 | |

| $2,400 | $2,520 | $3,906 | $4,101 | $4,306 | |

| $1,800 | $1,890 | $2,930 | $3,076 | $3,230 | |

| $3,600 | $3,780 | $5,859 | $6,152 | $6,460 | |

| $12,720 | $13,356 | $20,702 | $21,737 | $22,824 | |

| $3,000 | $3,150 | $4,883 | $5,127 | $5,383 | |

| $600 | $630 | $977 | $1,025 | $1,077 | |

| $600 | $630 | $977 | $1,025 | $1,077 | |

| $420 | $441 | $684 | $718 | $754 | |

| $18,000 | $18,900 | $29,295 | $30,760 | $32,298 | |

| $5,400 | $5,670 | $8,789 | $9,228 | $9,689 | |

| $125,820 | $132,111 | $245,344 | $257,611 | $270,492 | |

| 3.53% | 3.53% | 4.23% | 4.23% | 4.23% | |

| $416,700 | $437,535 | $737,878 | $774,772 | $813,511 | |

| $1,618,864 | $1,699,807 | $2,370,958 | $2,489,505 | $2,613,981 | |

| $1,618,864 | $1,699,807 | $2,370,958 | $2,489,505 | $2,613,981 | |

| $519,346 | $489,761 | $670,033 | $839,570 | $797,376 | |

| $361,116 | $399,315 | $557,053 | $544,479 | $594,938 | |

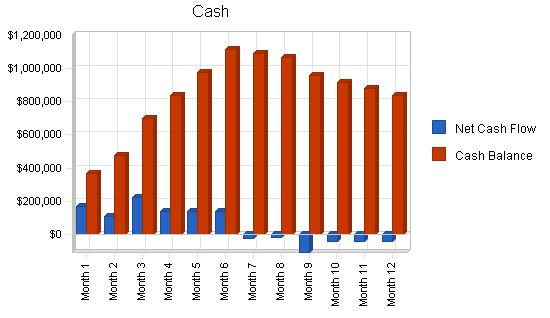

7.6 Projected Cash Flow

The company’s estimated cash flow analysis is outlined in the following table, including the cost and increase in sales and profits made from Phase 2. I&B Investments low overhead will ensure positive cash balance.

Revised text:

Pro Forma Profit and Loss:

Year 1 Year 2 Year 3 Year 4 Year 5

Sales

$3,561,108 $3,739,163 $5,795,703 $6,085,488 $6,389,763

Direct Cost of Sales

$1,136,888 $1,193,733 $1,850,286 $1,942,800 $2,039,940

Operations Payroll

$388,656 $408,089 $836,582 $878,411 $922,332

Known expenses

$0 $0 $0 $0 $0

Total Cost of Sales

$1,525,544 $1,601,821 $2,686,868 $2,821,211 $2,962,272

Gross Margin

$2,035,564 $2,137,342 $3,108,836 $3,264,277 $3,427,491

Gross Margin %

57.16% 57.16% 53.64% 53.64% 53.64%

Operating Expenses:

Sales and Marketing Expenses

Sales and Marketing Payroll

$55,200 $57,960 $60,858 $63,901 $67,096

Advertising/Promotion

$18,000 $18,900 $29,295 $30,760 $32,298

Travel

$1,800 $1,890 $2,930 $3,076 $3,230

Miscellaneous

$6,000 $6,300 $9,765 $10,253 $10,766

Total Sales and Marketing Expenses

$81,000 $85,050 $102,848 $107,990 $113,389

Sales and Marketing %

2.27% 2.27% 1.77% 1.77% 1.77%

General and Administrative Expenses

General and Administrative Payroll

$171,120 $179,676 $326,605 $342,935 $360,082

Sales and Marketing and Other Expenses

$0 $0 $0 $0 $0

Depreciation

$0 $0 $0 $0 $0

Utilities

$14,400 $15,120 $23,436 $24,608 $25,838

Insurance

$14,760 $15,498 $24,022 $25,223 $26,484

Telephone

$9,600 $10,080 $15,624 $16,405 $17,225

Payroll Taxes

$0 $0 $0 $0 $0

Other General and Administrative Expenses

$0 $0 $0 $0 $0

Total General and Administrative Expenses

$209,880 $220,374 $389,687 $409,171 $429,629

General and Administrative %

5.89% 5.89% 6.72% 6.72% 6.72%

Other Expenses:

Other Payroll

$77,280 $81,144 $166,345 $174,662 $183,396

Consultants

$0 $0 $0 $0 $0

Office Supplies

$2,400 $2,520 $3,906 $4,101 $4,306

Postal Fees

$1,800 $1,890 $2,930 $3,076 $3,230

Professional Fees

$3,600 $3,780 $5,859 $6,152 $6,460

Housekeeping Supplies

$12,720 $13,356 $20,702 $21,737 $22,824

Unknown

$3,000 $3,150 $4,883 $5,127 $5,383

Bad Checks

$600 $630 $977 $1,025 $1,077

Bank Card Fees

$600 $630 $977 $1,025 $1,077

Business License

$420 $441 $684 $718 $754

Facility Maintenance

$18,000 $18,900 $29,295 $30,760 $32,298

Contract/Consultants

$5,400 $5,670 $8,789 $9,228 $9,689

Total Other Expenses

$125,820 $132,111 $245,344 $257,611 $270,492

Other %

3.53% 3.53% 4.23% 4.23% 4.23%

Total Operating Expenses

$416,700 $437,535 $737,878 $774,772 $813,511

Profit Before Interest and Taxes

$1,618,864 $1,699,807 $2,370,958 $2,489,505 $2,613,981

EBITDA

$1,618,864 $1,699,807 $2,370,958 $2,489,505 $2,613,981

Interest Expense

$519,346 $489,761 $670,033 $839,570 $797,376

| Pro Forma Cash Flow | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Cash Received | |||||

| Cash from Operations | |||||

| Cash Sales | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Subtotal Cash from Operations | $3,561,108 | $3,739,163 | $5,795,703 | $6,085,488 | $6,389,763 |

| Additional Cash Received | |||||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $4,386,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $774,000 | $0 | $0 |

| Subtotal Cash Received | $3,561,108 | $3,739,163 | $10,955,703 | $6,085,488 | $6,389,763 |

| Expenditures | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Expenditures from Operations | |||||

| Cash Spending | $692,256 | $726,869 | $1,390,390 | $1,459,909 | $1,532,905 |

| Bill Payments | $2,054,748 | $2,096,316 | $3,174,328 | $3,498,861 | $3,625,734 |

| Subtotal Spent on Operations | $2,747,004 | $2,823,185 | $4,564,718 | $4,958,770 | $5,158,639 |

| Additional Cash Spent | |||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $117,854 | $135,758 | $163,922 | $197,927 | $67,125 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $60,434 | $65,126 | $146,052 | $161,678 | $178,607 |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $774,000 | $0 | $0 | $0 |

| Subtotal Cash Spent | $2,925,292 | $3,798,069 | $4,874,692 | $5,318,375 | $5,404,371 |

| Net Cash Flow | $635,816 | ($58,905) | $6,081,011 | $767,113 | $985,392 |

| Cash Balance | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

7.7 Projected Balance Sheet

Estimated balance sheets for the years 2003-2008, including Phase 2 in 2006, are provided below.

| Pro Forma Balance Sheet | |||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Assets | |||||

| Cash | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $835,816 | $776,910 | $6,857,922 | $7,625,035 | $8,610,427 |

| Long-term Assets | |||||

| Long-term Assets | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 | $5,077,925 |

| Total Assets | $5,913,741 | $5,854,835 | $11,935,847 | $12,702,960 | $13,688,352 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Current Liabilities | |||||

| Accounts Payable | $75,702 | $180,950 | $268,064 | $289,325 | $298,783 |

| Current Borrowing | $772,146 | $636,388 | $472,466 | $274,539 | $207,414 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $847,848 | $817,338 | $740,530 | $563,864 | $506,197 |

| Long-term Liabilities | $3,592,066 | $3,526,940 | $7,766,888 | $7,605,210 | $7,426,603 |

| Total Liabilities | $4,439,914 | $4,344,278 | $8,507,418 | $8,169,074 | $7,932,800 |

| Paid-in Capital | $965,000 | $965,000 | $1,739,000 | $1,739,000 | $1,739,000 |

| Retained Earnings | ($229,575) | ($265,174) | $545,557 | $1,689,429 | $2,794,886 |

| Earnings | $738,401 | $810,731 | $1,143,872 | $1,105,457 | $1,221,667 |

| Total Capital | $1,473,826 | $1,510,557 | $3,428,429 | $4,533,886 | $5,755,552 |

| Total Liabilities and Capital | $5,913,741 | $5,854,835 | $11,935,847 | $12,702,960 | $13,688,352 |

| Net Worth | $1,473,826 | $1,510,557 | $3,428,429 | $4,533,886 | $5,755,552 |

7.8 Business Ratios

The company’s projected business ratios are provided in the table below. The final column, Industry Profile, shows significant ratios for the Amusement and Entertainment Industry, as determined by the Standard Industry Classification (SIC) Index code 7999.

|

Sales Forecast Amusement 0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Bumper Boats 0% $18,605 $24,806 $37,209 $37,209 $37,209 $37,209 $24,806 $18,605 $6,202 $6,202 $6,202 $6,202 Mini-Golf 0% $33,351 $44,467 $66,701 $66,701 $66,701 $66,701 $44,467 $33,351 $11,117 $11,117 $11,117 $11,117 Go-Carts 0% $85,272 $113,695 $170,543 $170,543 $170,543 $170,543 $113,695 $85,272 $28,424 $28,424 $28,424 $28,424 Gaming Center 0% $2,756 $3,675 $5,512 $5,512 $5,512 $5,512 $3,675 $2,756 $919 $919 $919 $919 Sky Coaster 0% $11,025 $14,700 $22,050 $22,050 $22,050 $22,050 $14,700 $11,025 $3,675 $3,675 $3,675 $3,675 Batting Cages 0% $10,336 $13,781 $20,671 $20,671 $20,671 $20,671 $13,781 $10,336 $3,445 $3,445 $3,445 $3,445 Climbing Walls 0% $3,652 $4,869 $7,304 $7,304 $7,304 $7,304 $4,869 $3,652 $2,435 $2,435 $2,435 $2,435 Air/Foosball 0% $1,194 $1,592 $2,388 $2,388 $2,388 $2,388 $1,592 $1,194 $796 $796 $796 $796 Souvenirs 0% $1,838 $2,450 $3,675 $3,675 $3,675 $3,675 $2,450 $1,838 $1,225 $1,225 $1,225 $1,225 Party Rooms 0% $30,016 $40,021 $60,031 $60,031 $60,031 $60,031 $40,021 $30,016 $20,010 $20,010 $20,010 $20,010 Food & Drinks 0% $48,234 $64,312 $96,468 $96,468 $96,468 $96,468 $64,312 $48,234 $32,156 $32,156 $32,156 $32,156 Total Sales $246,276 $328,368 $492,552 $492,552 $492,552 $492,552 $328,368 $246,276 $110,403 $110,403 $110,403 $110,403 Direct Cost of Sales Amusement $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Bumper Boats $4,651 $6,202 $9,302 $9,302 $9,302 $9,302 $6,202 $4,651 $1,550 $1,550 $1,550 $1,550 Mini-Golf $5,003 $6,670 $10,005 $10,005 $10,005 $10,005 $6,670 $5,003 $1,668 $1,668 $1,668 $1,668 Go-Carts $21,318 $28,424 $42,636 $42,636 $42,636 $42,636 $28,424 $21,318 $7,106 $7,106 $7,106 $7,106 Gaming Center $1,378 $1,837 $2,756 $2,756 $2,756 $2,756 $1,837 $1,378 $459 $459 $459 $459 Sky Coaster $2,756 $3,675 $5,513 $5,513 $5,513 $5,513 $3,675 $2,756 $919 $919 $919 $919 Batting Cages $1,550 $2,067 $3,101 $3,101 $3,101 $3,101 $2,067 $1,550 $517 $517 $517 $517 Climbing Walls $913 $1,217 $1,826 $1,826 $1,826 $1,826 $1,217 $913 $609 $609 $609 $609 Air/Foosball $179 $239 $358 $358 $358 $358 $239 $179 $119 $119 $119 $119 Souvenirs $459 $613 $919 $919 $919 $919 $613 $459 $306 $306 $306 $306 Party Rooms $15,008 $20,010 $30,016 $30,016 $30,016 $30,016 $20,010 $15,008 $10,005 $10,005 $10,005 $10,005 Food & Drinks $24,117 $32,156 $48,234 $48,234 $48,234 $48,234 $32,156 $24,117 $16,078 $16,078 $16,078 $16,078 Subtotal Direct Cost of Sales $77,332 $103,110 $154,665 $154,665 $154,665 $154,665 $103,110 $77,332 $39,336 $39,336 $39,336 $39,336 Personnel Plan Operations Personnel John A 100% $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 John B 100% $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 John C 100% $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 $1,932 John D 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John E 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John F 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John G 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John H 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John I 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John J 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John K 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John L 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John M 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John N 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John O 100% $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 $1,250 John P 100% $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 John Q 100% $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 John R 100% $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 John S 100% $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 John T 100% $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 John U 100% $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 Subtotal $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 $32,388 Sales and Marketing Personnel Darren Strebel 100% $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 Other 100% $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 $2,300 Subtotal $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 $4,600 General and Administrative Personnel Joe Hull 100% $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 Rod Schaffer 100% $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 $1,564 Restaurant Manager 100% $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 $3,404 Laura Strebel 100% $1,748 $1,748 $1 |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | 19.00% | |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| 30.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | 33.00% | |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| $246,276 | $328,368 | $492,552 | $492,552 | $492,552 | $492,552 | $328,368 | $246,276 | $110,403 | $110,403 | $110,403 | $110,403 | ||

| $77,332 | $103,110 | $154,665 | $154,665 | $154,665 | $154,665 | $103,110 | $77,332 | $39,336 | $39,336 | $39,336 | $39,336 | ||

| $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | $32,388 | ||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| $109,720 | $135,498 | $187,053 | $187,053 | $187,053 | $187,053 | $135,498 | $109,720 | $71,724 | $71,724 | $71,724 | $71,724 | ||

| $136,556 | $192,870 | $305,499 | $305,499 | $305,499 | $305,499 | $192,870 | $136,556 | $38,679 | $38,679 | $38,679 | $38,679 | ||

| 55.45% | 58.74% | 62.02% | 62.02% | 62.02% | 62.02% | 58.74% | 55.45% | 35.03% | 35.03% | 35.03% | 35.03% | ||

| $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | $4,600 | |

| $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | |

| $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | $150 | |

| $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | $500 | |

| $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | $6,750 | |

| 2.74% | 2.06% | 1.37% | 1.37% | 1.37% | 1.37% | 2.06% | 2.74% | 6.11% | 6.11% | 6.11% | 6.11% | ||

| $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | $14,260 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| $1,230 | $1,230 | $1,230 | $1,230 | $1,230 | $1,230 | ||||||||

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $246,276 | $328,368 | $492,552 | $492,552 | $492,552 | $492,552 | $328,368 | $246,276 | $110,403 | $110,403 | $110,403 | $110,403 | |

| Subtotal Cash from Operations | $246,276 | $328,368 | $492,552 | $492,552 | $492,552 | $492,552 | $328,368 | $246,276 | $110,403 | $110,403 | $110,403 | $110,403 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $246,276 | $328,368 | $492,552 | $492,552 | $492,552 | $492,552 | $328,368 | $246,276 | $110,403 | $110,403 | $110,403 | $110,403 | |

| Expenditures | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | $57,688 | |

| Bill Payments | $4,945 | $149,881 | $197,264 | $282,903 | $282,776 | $282,646 | $279,558 | $192,181 | $146,820 | $78,731 | $78,592 | $78,451 | |

| Subtotal Spent on Operations | $62,633 | $207,569 | $254,952 | $340,591 | $340,464 | $340,334 | $337,246 | $249,869 | $204,508 | $136,419 | $136,280 | $136,139 | |

| Additional Cash Spent | |||||||||||||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!