Investment Consulting Business Plan

Our firm will offer the Vista Total Market Equity strategy initially through a mutual fund registered with the U.S. Securities Exchange Commission (SEC). Technological advancements also allow for economically feasible distribution channels, such as separately managed portfolios for large accounts. The details of our investment product offerings are revealed in another section of this plan. However, we are encouraged by a research piece to be published in the Journal of Portfolio Management, which supports the philosophy behind our primary product offering. Ennis Knupp, a premier institutional investment consulting firm, published a study called "Failure of the Multiple-Specialist Strategy: The Case for Whole Stock Portfolios," which suggests that specialization within equity portfolio management has gone too far and resulted in sub-optimal portfolios.

VISTA INVESTORS will be structured as a partnership that capitalizes on industry research performed by one of the founding entrepreneurs, Michael Douglas, during his professional career in investment management research. Last year, Mr. Douglas conducted research visits at the investment offices of over 30 firms and had meetings with key investment professionals from around the globe. Mr. Douglas’s team presents this business plan as a "start from scratch" outline of a successful investment management organization as the industry evolves in response to various influences.

VISTA INVESTORS will offer high net worth or "angel" investors the opportunity to assume minority ownership positions in exchange for contributions to VISTA INVESTORS’ operating capital and seed assets to establish the investment products described herein. This document alone does not constitute an offer of any type, nor does it provide any guarantee, financial or otherwise. Risks associated with the VISTA INVESTORS’ business plan are not limited to those detailed in this document.

VISTA INVESTORS aims to create value for owners, employees, and investors through an investment management organization designed for the Third Generation, as defined by Merrill Lynch & Co., Inc. and Barra Strategic Consulting Group. Our plan for success is based on extensive research, including our own industry experience.

Our mission is to implement buy and sell decisions quickly and efficiently across all portfolios. We use a trading rotation to avoid any systematic advantage or disadvantage that an account may encounter, and we prioritize discipline in all circumstances.

Performance is the most significant factor in the investment management business, so our primary goal is to achieve a rating from Morningstar, a widely recognized accreditation organization in the mutual fund industry. To be rated by Morningstar, funds must have a minimum performance history of three years.

VISTA INVESTORS will be a partnership structured to capitalize on industry research conducted by one of our founding entrepreneurs, Michael Douglas. What sets us apart is that we differ substantially from the way most existing investment management firms were started. While many firms were created by portfolio managers leaving large financial institutions, VISTA INVESTORS is being created by someone with deep knowledge of all aspects of investment management organizations. We will acquire and retain investment talent by offering competitive compensation and equity stakes.

For more details about the management team, please refer to the enclosed biographies.

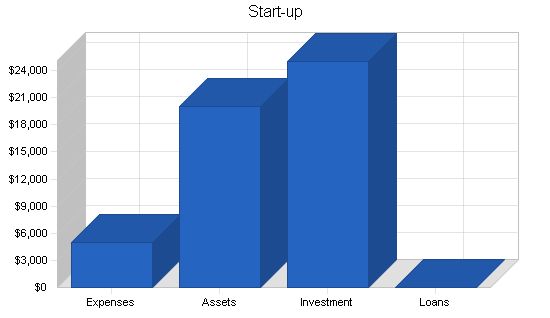

The following tables and chart outline our start-up requirements and planned funding.

| Start-up Funding | |

| Start-up Expenses to Fund | $5,000 |

| Start-up Assets to Fund | $20,000 |

| Total Funding Required | $25,000 |

| Assets | |

| Non-cash Assets from Start-up | $0 |

| Cash Requirements from Start-up | $20,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $20,000 |

| Total Assets | $20,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Michael Douglas | $8,334 |

| Mark Haynes | $8,333 |

| Other | $8,333 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $25,000 |

| Loss at Start-up (Start-up Expenses) | ($5,000) |

| Total Capital | $20,000 |

| Total Capital and Liabilities | $20,000 |

| Total Funding | $25,000 |

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $1,000 |

| Stationery etc. | $200 |

| Brochures | $300 |

| SEC filings | $1,200 |

| Insurance | $300 |

| Research and development | $1,500 |

| Other | $500 |

| Total Start-up Expenses | $5,000 |

| Start-up Assets | |

| Cash Required | $20,000 |

| Other Current Assets | $0 |

| Long-term Assets | $0 |

| Total Assets | $20,000 |

| Total Requirements | $25,000 |

Investment Philosophy

VISTA INVESTORS believes U.S. equity portfolios should outperform the market, as measured by the Wilshire 5000 or Russell 3000. Exposure to economic sectors will approximate the benchmark. Deviation from the benchmark represents a calculated risk that determines performance. Portfolios maintain market cap exposure to large cap (>$10 billion), mid cap ($2 billion to $10 billion), and small cap stocks.

Our process is successful for the following reasons:

- It provides the opportunity to outperform the market without taking undue risks.

- Portfolios are not heavily concentrated in specific areas of the market, reducing the likelihood of prompted redemptions.

- Investor portfolios are simplified by reducing the number of managers or funds needed.

Ennis Knupp, an institutional investment consultant, supports the concept of "whole stock" portfolios over specialized managers. Our decision-making process involves consensus among the portfolio management team. The CIO provides a final decision if consensus cannot be reached. Portfolio managers also serve as analysts, responsible for idea generation, due diligence, and research projects directed by the CIO. Each portfolio manager has experience in various areas but acts as a generalist, allowing for stimulation in their roles. Research assignments cover in-depth reviews of economic sectors, providing broad market coverage.

Market Analysis Summary

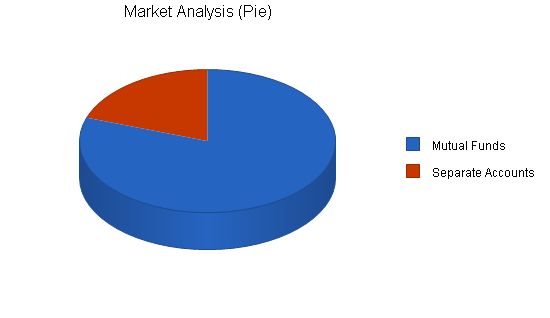

Our analysis focuses on the mutual fund segment of the investment industry, which is a significant component of the overall landscape. We also consider separately managed portfolios ("separate accounts") managed by Registered Investment Advisors. VISTA INVESTORS utilizes both mutual funds and separate accounts.

Our analysis supports projected growth rates of 20% to 25%. Key variables fueling this growth environment are outlined below and are expected to have a positive impact on the investment industry for at least the next three years.

Potential Customers Growth Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Mutual Funds 20% 4,500 5,400 6,480 7,776 9,331 20.00%

Separate Accounts 25% 1,100 1,375 1,719 2,149 2,686 25.01%

Total 21.03% 5,600 6,775 8,199 9,925 12,017 21.03%

4.1 Business Participants

The investment industry has a large number of participants ranging from single investment product providers to multi-product firms with hundreds or thousands of offerings. However, many participants lack the required capabilities for success in the current and future environment.

4.2 Target Market Segment Strategy

Our target market depends on the stage of product development. Initial opportunities include utilizing our transfer agent’s distribution services for high visibility online exposure, marketing to programs that invest in emerging managers, and accessing the high net worth and retail marketplace through creative opportunities and existing relationships.

Like manufacturing organizations, investment management firms must develop products for customers. Our plan analyzes market trends and the demand for investment products. Our hallmark product is the Vista Total Market Equity strategy, designed to outperform the overall market and simplify investment structures.

While it’s important to follow industry trends, providing a solution that withstands the test of time is crucial. Chasing past performance has proven to be unreliable, as the market constantly rotates. Individual investors often mimic the strategies of large institutional investors, but their structures are inefficient for the average investor. Our Whole Portfolio strategy simplifies portfolios and reduces the need for outside counseling.

4.4 Service Business Analysis

The investment industry embraces technology to become more efficient. While consolidation has occurred, fragmentation remains due to differentiation in investment products. The industry is complex, with various moving parts and evolving technologies, creating long-term opportunities.

“The investment industry is complex. It has many moving parts and it’s experiencing dynamic change. If this was not the case, opportunity probably would not exist.”

– Mike Douglas

Great economies of scale can be achieved in investment management when organized efficiently and supported by technology. Related products can be derived from the main product platform. Investment performance is unpredictable, but taking steps to optimize success is crucial. Our plan outlines the right people, efficient processes, and competitive advantages.

4.4.1 The Three P’s

Investment management organizations are associated with three P’s: People, Process, and Performance. People and process determine performance.

While this proposal covers various areas, success ultimately depends on people and process. Our team consists of bright, talented individuals attracted to efficient firms without bureaucracy. Our portfolio management process is supported by cutting-edge research and outsourcing non-essential functions.

Management Summary

VISTA INVESTORS has a preliminary management team and candidates for other key positions.

5.1 Portfolio Management Team

Michael John Douglas, CIO and Portfolio Manager, is responsible for executing the investment process. Mark Francis Haynes, Senior Portfolio Manager, conducts company-specific research. Another team member’s name cannot be disclosed at this time.

5.2 Positions Being Hired

After the first round of funding, we will hire an Operations Director, Marketing Analyst, Portfolio Management Assistant/Analyst, Administrative Assistant, and members for the Fund Board of Directors.

5.3 Operations/Services to be Outsourced

We will outsource Fund Accounting and Fund Custodian, Transfer Agent, Legal, Data Services, and Separate Account Management Services.

VISTA INVESTORS has reserved the domain name vistainvestors.com for our business.

Personnel Plan

Year 1 Year 2 Year 3

Michael Douglas $51,445 $56,590 $62,248

Mark Haynes $51,445 $56,590 $62,248

CFA $51,445 $56,590 $62,248

Operations Director $39,134 $43,047 $47,352

Marketing Analyst $29,351 $32,286 $35,515

Portfolio Manager Assistant/Analyst $22,826 $25,109 $27,619

Administrative Assistant $19,571 $21,528 $23,681

Total People 6 6 6

Total Payroll $265,217 $291,739 $320,913

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!