Chef Vending, LLC is a start-up business specializing in importing vending machines and commercial food & beverage equipment from Spain. Our objective is to penetrate the vending industry with innovative, high-quality vending machines, establish vending routes in the Southern and Central Florida region, and supply high-quality innovative equipment to the $321 billion food & beverage industry. By forming a strategic alliance with a national brand name in either of our vending lines, we aim to exceed our financial forecasts.

Chef Vending’s mission is to be the leader in introducing innovative, quality vending machines and restaurant equipment to the market. We will meet the needs of our customers through close customer contact and excellent relationships.

Chef Vending, LLC is a privately-held Florida corporation with an office and a small warehouse in North Miami Beach.

Three of the four investors in the company have full operational responsibility. Mauricio Ordonez and Javier Palmera, the co-founders, bring entrepreneurial and industry experience, while Charles Mulligan contributes operational management and financial skills.

Chef Vending will have two product lines: vending products and restaurant equipment. Our vending products line includes the unique Sandwich Express machine, Fresh Orange Juice machine, and Multi-line Dispenser. Our restaurant equipment products include toasters, espresso makers, and fresh juice squeezers.

Most of our products, such as Sandwich Express, offer functions and advantages not found in common vending machines, giving Chef Vending a competitive edge.

Our future plans include aggressively enhancing our existing line, offering a larger model of Sandwich Express with a greater variety of sandwiches and a more diverse product line. We are also exploring the development of other products.

We are pursuing supplier relationships with large nationally-branded juice and sandwich manufacturers to customize our machines to their products. This would enable Chef Vending to supply machines to national companies and allow them to brand the machines with their product lines.

The U.S. vending consumable merchandise industry had revenue of $24.5 billion last year, with small companies accounting for 5.8% of the market and projected sales of $1.35 billion.

Snacks and cold beverages are the largest product segments in the vending industry, with the food category growing at a rate of 7% last year. Cold storage machines experienced 42% growth last year, at the expense of shelf-stable products.

According to the National Restaurant Association, revenues from restaurants are expected to reach $321 billion. This indicates a healthy industry in our economy, providing opportunities for suppliers.

We will market our machines to three distinct market segments: distributors, branded sandwich and juice manufacturers, and end users. For our restaurant equipment business, our focus will be on restaurants, hotels, and equipment supply companies.

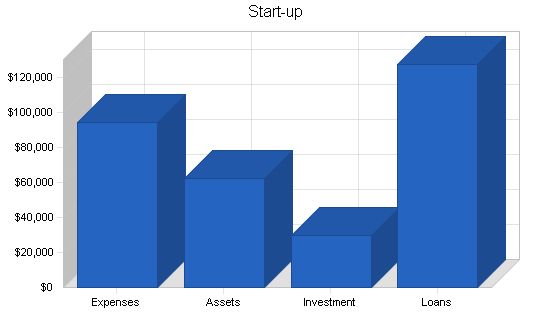

The company has an initial start-up cost of approximately $157,000, with $125,000 coming from a ten-year SBA loan. Short-term borrowing will provide an additional $2,500, and the rest will be provided by investment capital.

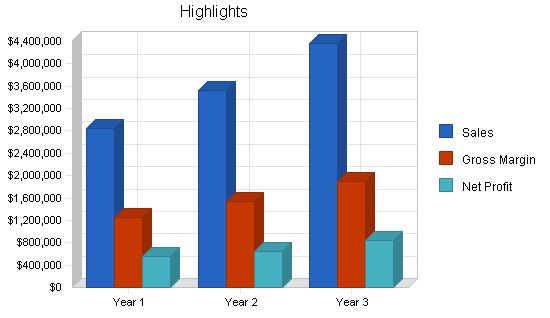

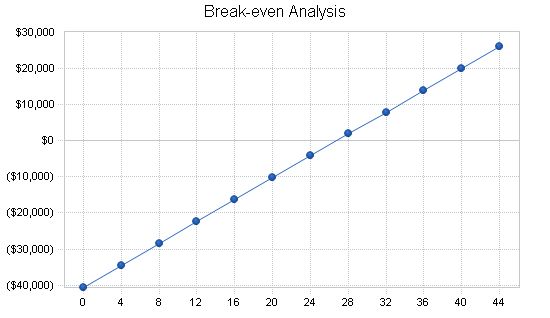

We project our monthly break-even point to be roughly $93,000 or 27 vending units. Our innovative vending machines and restaurant equipment are expected to generate sales levels far above this point. In the first year, we expect to generate $500,000 of net profit on $2.8 million worth of sales.

Contents

1.1 Objectives

Our objectives in our first year of operation are:

- Sell 400 vending machines.

- Directly place 10 vending machines, that we will operate, in the South Florida area.

- Achieve $500,000 in sales in our restaurant equipment line.

For the following two years our growth objectives are:

- Grow our vending machine and equipment business by 20% each year.

- Grow revenues by 25% in our directly operated vending machines.

1.2 Mission

Our mission is to be the leader in introducing innovative, quality vending machines and restaurant equipment to the market. Through close customer contact and excellent relationships, we will meet the needs of our customers wherever we can. We will secure sufficient profits from free cash flow from operations, to sustain our stability and finance future growth. We will add value to our community by maintaining a friendly, familial work environment.

1.3 Keys to Success

As a start-up company, new to the industry, and introducing new products, we must be focused and work hard to create acceptance within the marketplace. The keys to our success are:

- Quality support and service, recognizing that our success depends most critically on the relationships we’re able to create.

- Innovative, quality products that are able to both expand existing markets and create new ones for our customers.

- Steady, disciplined pattern of growth.

- Keeping our customers happy.

Company Summary

Chef Vending, LLC, is a family-owned and operated import company that focuses on importing innovative vending machines and restaurant equipment from Spain. By serving a niche segment of the $24.5 billion dollar vending industry, we will position Chef Vending as a high-quality, innovative company, that creates value for its customers.

Located in North Miami Beach, Florida, three of the four investors have full operational responsibility. Mauricio Ordonez and Javier Palmera, the co-founders, have both entrepreneurial and industry experience. Charles Mulligan brings operational management and financial skills to the operation.

2.1 Company Ownership

Chef Vending, LLC, is a privately-held Florida corporation. Chef Vending is owned by three of its key employees, and one financial investor. The ownership breakdown is as follows:

- Mauricio Ordonez – 40%

- Javier Palmera – 20%

- Charles Mulligan – 20%

- Pedro Herrera – 20%

2.2 Start-up Summary

Our start-up costs, listed below, have been financed to date by the investment from its owners.

Start-up Requirements

Start-up Expenses

Cash Purchases – $2,500

Utilities – $855

Repairs & Maintenance – $2,388

Professional Fees – $500

Insurance – $921

Rent – $7,136

Travel – $9,271

Inventory – $43,086

Telephone – $1,166

Postage – $111

Office Equipment/Supplies – $4,645

Marketing/Advertising – $15,587

Freight – $4,926

Other – $1,400

Total Start-up Expenses – $94,492

Start-up Assets

Cash Required – $25,000

Start-up Inventory – $37,508

Other Current Assets – $0

Long-term Assets – $0

Total Assets – $62,508

Total Requirements – $157,000

Start-up Funding

Start-up Expenses to Fund – $94,492

Start-up Assets to Fund – $62,508

Total Funding Required – $157,000

Assets

Non-cash Assets from Start-up – $37,508

Cash Requirements from Start-up – $25,000

Additional Cash Raised – $0

Cash Balance on Starting Date – $25,000

Total Assets – $62,508

Liabilities and Capital

Liabilities

Current Borrowing – $0

Long-term Liabilities – $125,000

Accounts Payable (Outstanding Bills) – $2,500

Other Current Liabilities (interest-free) – $0

Total Liabilities – $127,500

Capital

Planned Investment

Investor 1 – $10,500

Investor 2 – $9,000

Investor 3 – $5,000

Investor 4 – $5,000

Additional Investment Requirement – $0

Total Planned Investment – $29,500

Loss at Start-up (Start-up Expenses) – ($94,492)

Total Capital – ($64,992)

Total Capital and Liabilities – $62,508

Total Funding – $157,000

Company Locations and Facilities

Chef Vending maintains an office and a small warehouse in North Miami Beach, Florida. We have a showroom for product demonstrations, a warehouse for inventory storage, and an administrative area for business functions.

Products

Chef Vending imports innovative products to serve specific market segments. We offer three vending machines and three lines of restaurant equipment.

Product Description

Our vending machines are:

1. Sandwich Express – This machine stores up to 140 pre-packaged sandwiches, toasts them, and serves a hot sandwich in 60 seconds.

2. Fresh Orange Juice (OJ) Machine – This machine delivers a 7 oz. cup of fresh-squeezed orange juice in 30 seconds.

3. Multi-line – These machines offer a variety of vending options, with two, three, or four product lines.

Our restaurant equipment includes:

1. Toasters – Single or double toasters that automatically toast and dispense sandwiches and pastries.

2. Espresso Maker – A high-quality espresso maker that serves single-serve cups of gourmet coffee.

3. Fresh Juice Squeezer – A commercial-grade machine that squeezes fresh-squeezed orange juice.

Competitive Comparison

Our Sandwich Express and Fresh OJ machines are first to market, providing hot sandwiches and fresh orange juice. Our multi-line machines offer flexibility and competitive pricing. Our toasters and espresso makers are fully automated, freeing up personnel for other tasks. Our machines have a technological advantage over the competition.

Sales Literature

We have developed sales brochures as part of our start-up expenses.

Sourcing

Chef Vending imports machines from Spain and contracts with local suppliers for oranges and sandwiches.

Technology

Chef Vending seeks innovative food preparation technology for our machines. We have a technological advantage as a first-to-market company.

Future Products

We plan to introduce a larger model of the Sandwich Express with a greater variety of sandwiches. We are pursuing relationships with branded sandwich and juice companies to customize our machines for their products. We will continuously seek customer feedback to expand our product line.

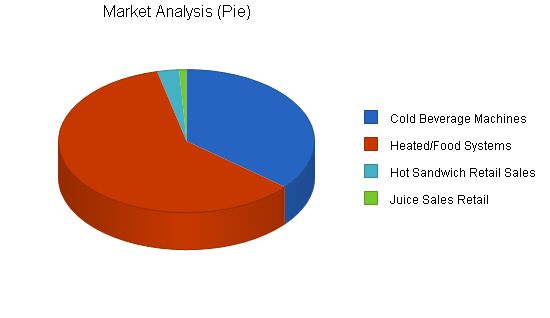

Market Analysis Summary

U.S. vending consumable merchandise revenue was $24.5 billion in 1999, with small companies accounting for 5.8% of the market. Snacks and cold beverages are the largest product segments. Food sales away from home are increasing, favoring the vending industry. Revenues from restaurants are expected to reach $321 billion in 1999, benefiting suppliers to the industry.

Market Segmentation

We will market our machines to end users, distributors, and branded sandwich and juice companies. Our equipment business targets restaurants, hotels, and equipment supply companies.

Overall, the provided text has been edited to eliminate redundant words and phrases, making the content more concise and impactful.

Market Analysis

Year 1 Year 2 Year 3 Year 4 Year 5 CAGR

Potential Customers Growth Total

Cold Beverage Machines 4% 900 936 973 1,012 1,052 3.98%

Heated/Food Systems 5% 1,500 1,575 1,654 1,737 1,824 5.01%

Hot Sandwich Retail Sales 5% 69 72 76 80 84 5.23%

Juice Sales Retail 4% 23 24 25 26 27 4.09%

Total 4.64% 2,492 2,607 2,728 2,855 2,987 4.64%

The U.S vending industry is divided into three main segments:

1. Operators – Companies that buy and place vending machines, sell the product and service the machine.

2. Manufacturers – Companies that manufacture machines for sale to operators.

3. Distributors – The link between the manufacturer and the operator.

The food & beverage industry is divided into similar segments:

1. Food & Beverage Establishments – Bars and restaurants.

2. Suppliers – Companies that supply establishments with food, paper, and equipment.

3. Supply Houses – Firms that supply an area with required supplies.

4.2.1 Competition and Buying Patterns

Both the food & beverage and vending industries are highly competitive. Price, ROI, reliability, and customer service are factors affecting buying decisions.

There are large name brand companies with vending machines in the market. We will focus on creating a niche market for our innovative machines, to compete with larger names. By being first to market, we have a unique opportunity to brand ourselves.

Buying patterns are consistent throughout the year.

4.2.2 Distribution Patterns

Distribution in the vending industry typically runs through a distributor. In some instances, manufacturers sell directly to operators or end users. Similar distribution patterns are established in the food & beverage industry.

4.3 Target Market Segment Strategy

Chef Vending’s initial strategy is to offer products to all market segments. We will focus on both the end user and the distributor initially, as securing accounts with nationally branded companies will take time. We will reach our target market in three ways. Firstly, through advertising in trade publications. Secondly, through participation in industry conventions and shows. Finally, through personalized relationships with contacts developed at these shows and with regional companies.

For equipment sales, we will focus on end users and distributors in the South and Central Florida regions. We will expand geographically as we gain market share in these markets.

4.3.1 Market Needs

The primary market need we address is revenue. Our machines expand existing sales and create new markets. For operators already vending snacks, a high-end sandwich expands sales without cannibalizing existing sales. For coffee vendors, a fresh cup of orange juice complements a gourmet cup of coffee. By creating new untapped markets, operators can expand revenue streams. Another need we fill is price. We price our products competitively to attract clients.

4.3.2 Market Trends

Growth rates in both the vending and restaurant industries remain strong. Workplace and workforce changes are causing workers to consume more meals away from home. Away from home food sales are expected to increase by 53%.

As consumers eat away from home, the demand for higher quality is growing. Vendors are offering packaged frozen meals in their machines. Premium prices are being placed on branded, high-quality products.

Demographic trends, such as young adults who grew up on fast food, and population growth and immigration, will have a positive impact on the vending industry. The Southeast is experiencing significant growth.

4.3.3 Market Growth

Studies reflect an industry growth rate of approximately 4.8% over the last five years, matching the overall growth of the U.S. economy.

Strategy and Implementation Summary

Chef Vending will achieve its sales targets through relationship building and aggressive pricing. Initial targets are medium-sized operators and distributors who can invest in our machines. We will participate in trade shows and expand our advertising budget. Concurrently, we will establish relationships with larger brand name companies.

Chef Vending’s customers will derive immediate and lasting value from our products. Our machines expand markets and offer an ROI exceeding the industry norm. The quality and design features satisfy existing customers and attract new ones.

5.2 Competitive Edge

Chef Vending enjoys the benefits of being first to market. We will leverage this position to establish and solidify our brand. As a small company, we will be attentive and flexible in meeting customer demands. Our design features and competitive pricing give us an edge.

Our marketing strategy emphasizes our strengths. We position ourselves as an aggressive, innovative company with new, high-quality products. We reinforce this strategy through trade shows, publications, and the Internet. Our brochures, letterhead, and correspondence further reinforce our concepts.

Customer satisfaction is crucial. We operate under the principle that our best marketing is an exceedingly satisfied customer.

5.3.1 Promotion Strategy

Chef Vending participates in NAMA-sponsored trade shows. We attend local and regional trade shows and distributor open houses. We expand our advertising budget for trade publications and maintain an online presence for greater exposure and communication.

5.3.2 Distribution Strategy

Chef Vending pursues distribution agreements with large distributors. Until then, we sell directly to operators. We also pursue relationships with nationally-branded companies to supply machines for their products.

5.3.3 Marketing Programs

Our most important marketing program is our participation at the NAMA trade show. We introduce our machines to end users and distributors, follow up with a mailing campaign and phone calls, and track conversions. We also build relationships within our local marketplace and track customer acquisitions.

We expand our advertising budget, participate in shows, and seek innovative ways to market our company.

5.3.4 Pricing Strategy

Chef Vending pursues two pricing strategies. For high-end machines, we price at the higher end of the market. For other machines, we compete aggressively to attract and retain customers.

Machine Cost

Sandwich Express $9,500

Fresh OJ $6,500/$7,500

Multi-line Machines $2,750/$3,800

Toaster $2,750/$3,800

Espresso Maker $250

Juice Machine $4,200

5.4 Sales Strategy

We target large and medium-sized operators, distributors, and manufacturers. We focus on key decision makers and seek leads from our customers.

5.4.1 Sales Forecast

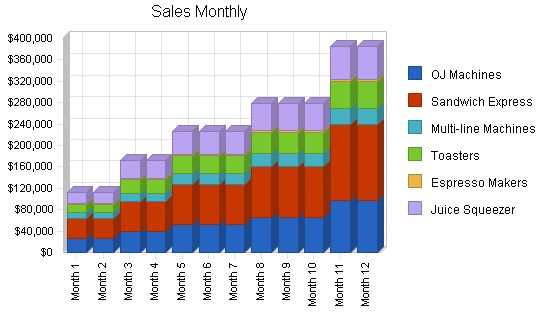

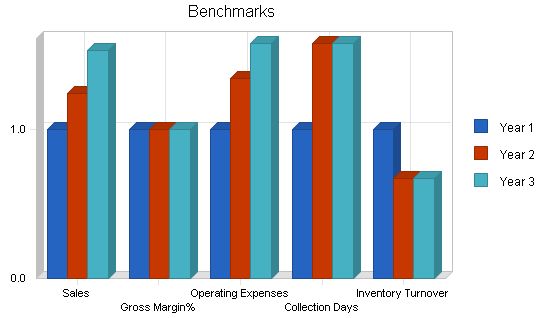

We forecast 20% annual sales growth for vending and equipment sales, and 25% for the vending routes we manage.

Sales Forecast

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Unit Sales | |||

| OJ Machines | 104 | 125 | 150 |

| Sandwich Express | 104 | 125 | 150 |

| Multi-line Machines | 245 | 294 | 353 |

| Toasters | 122 | 146 | 176 |

| Espresso Makers | 122 | 146 | 176 |

| Juice Squeezer | 122 | 146 | 176 |

| Total Unit Sales | 819 | 983 | 1,179 |

| Unit Prices | Year 1 | Year 2 | Year 3 |

| OJ Machines | $6,500.00 | $6,695.00 | $6,895.85 |

| Sandwich Express | $9,500.00 | $9,785.00 | $10,078.55 |

| Multi-line Machines | $1,000.00 | $1,030.00 | $1,060.90 |

| Toasters | $3,275.00 | $3,373.25 | $3,474.45 |

| Espresso Makers | $250.00 | $257.50 | $265.23 |

| Juice Squeezer | $4,200.00 | $4,326.00 | $4,455.78 |

| Sales | |||

| OJ Machines | $676,000 | $835,536 | $1,032,722 |

| Sandwich Express | $988,000 | $1,221,168 | $1,509,364 |

| Multi-line Machines | $245,000 | $302,820 | $374,286 |

| Toasters | $399,550 | $493,844 | $610,391 |

| Espresso Makers | $30,500 | $37,698 | $46,595 |

| Juice Squeezer | $512,400 | $633,326 | $782,791 |

| Total Sales | $2,851,450 | $3,524,392 | $4,356,149 |

| Direct Unit Costs | Year 1 | Year 2 | Year 3 |

| OJ Machines | $4,700.00 | $4,841.00 | $4,986.23 |

| Sandwich Express | $6,326.92 | $6,516.73 | $6,712.23 |

| Multi-line Machines | $500.00 | $515.00 | $530.45 |

| Toasters | $1,650.00 | $1,699.50 | $1,750.49 |

| Espresso Makers | $160.00 | $164.80 | $169.74 |

| Juice Squeezer | $960.00 | $988.80 | $1,018.46 |

| Direct Cost of Sales | |||

| OJ Machines | $488,800 | $604,157 | $746,738 |

| Sandwich Express | $658,000 | $813,288 | $1,005,224 |

| Multi-line Machines | $122,500 | $151,410 | $187,143 |

| Toasters | $201,300 | $248,807 | $307,525 |

| Espresso Makers | $19,520 | $24,127 | $29,821 |

| Juice Squeezer | $117,120 | $144,760 | $178,924 |

| Subtotal Direct Cost of Sales | $1,607,240 | $1,986,549 | $2,455,374 |

5.5 Strategic Alliances

A leading objective of Chef Vending is to develop key strategic alliances. We will pursue alliances with branded sandwich makers such as Oscar Mayer, Pierre, and others to create greater market potential for Sandwich Express. We will also seek strategic alliances with national juice brands, such as Tropicana, Sunkist, and others to increase the market potential for our Fresh OJ machines.

Chef Vending views the relationship between ourselves and our distributors as a strategic alliance. We will work closely with each distributor to co-market and promote our products and will work in partnership to achieve desired market penetration.

Management Summary

Chef Vending is a small, family-owned and operated business. The work is organized by function, and the business is carried out in a logical and organized structure. The work environment is characterized by hard work, respect, and a familial structure.

6.1 Organizational Structure

Chef Vending is organized around three functional areas:

1. Sales and marketing.

2. Finance and administration.

3. Route development and service.

6.2 Management Team

Javier Palmera – Partner and co-founder of Chef Vending. Palmera brings a diverse background in sales, marketing, and promotion in the beverage industry in Colombia. He also has experience in promotions and production through his work at a morning TV program in Philadelphia. He is a graduate of the Art Institute of Philadelphia. Single, 27 years old.

Mauricio Ordonez – Partner and co-founder of Chef Vending. Utilizing his law degree in Colombia, Ordonez has spent time in both public and private enterprises. He has vast entrepreneurial experience, having developed restaurants, hotels, and distribution companies in Miami and Bogota. Married, two children, 50 years old.

Charles Mulligan – Partner. Mulligan has spent the last twelve years in the hospital management business. With an MBA from Drexel University, he has experience in financial and operational management. He also has experience in marketing, contract negotiations, and distribution. Single, 39 years old.

6.3 Management Team Gaps

There are some important gaps:

1. Limited vending industry experience.

2. Technical support needs to be developed.

As we grow and generate additional business, we will look to bring on technical staff to provide support and service capabilities for our customers. We will also look to bring on a sales team and focus on hiring knowledgeable, experienced industry professionals.

6.4 Personnel Plan

Chef Vending will begin with only two employees, Mulligan and Palmera. Chef Vending will contract with Ordonez, through his affiliate company, MO Global. Compensation for this staff is low at the beginning, and we will look for a 15% and 20% increase in the following two years.

As revenue allows, we will add technical staff, sales staff, and an office administrator to handle the increased volume.

Personnel Plan

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Javier Palmera | $43,200 | $49,680 | $59,616 |

| Charles Mulligan | $43,200 | $49,680 | $59,616 |

| Technician | $16,500 | $18,900 | $19,845 |

| M&O | $50,160 | $57,684 | $69,221 |

| Future Staff | $0 | $75,000 | $115,000 |

| Total People | 4 | 7 | 9 |

| Total Payroll | $153,060 | $250,944 | $323,298 |

Chef Vending will meet its future capital needs through free cash flow generated from operations. This will require us to be disciplined, tempered, and prudent in our operations and growth.

7.1 Important Assumptions

The financial plan depends on the following assumptions:

1. Industry growth trends will continue as in the past five years.

2. Inflation will be at 3% for the next two years.

3. We will access the capital needed for the first six months.

General Assumptions

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 11.50% | 11.50% | 11.50% |

| Tax Rate | 25.42% | 25.00% | 25.42% |

| Other | 0 | 0 | 0 |

7.2 Projected Profit and Loss

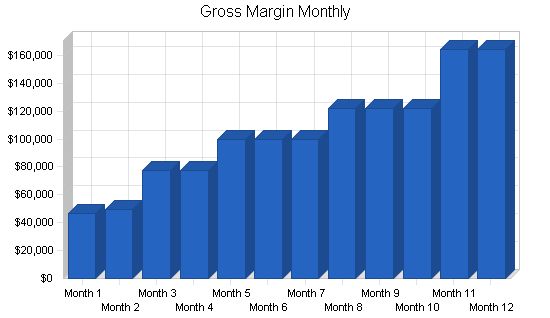

Chef Vending is projected to make over $500,000 profit on $2.8 million sales. The following table indicates how we will achieve this performance.

Pro Forma Profit and Loss:

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| $2,851,450 | $3,524,392 | $4,356,149 | |

| $1,607,240 | $1,986,549 | $2,455,374 | |

| $0 | $0 | $0 | |

| $1,607,240 | $1,986,549 | $2,455,374 | |

| $1,244,210 | $1,537,844 | $1,900,775 | |

| 43.63% | 43.63% | 43.63% | |

| $153,060 | $250,944 | $323,298 | |

| $51,600 | $59,174 | $68,279 | |

| $25,905 | $30,984 | $3,111 | |

| $6,000 | $6,180 | $6,365 | |

| $99,801 | $119,761 | $143,713 | |

| $29,136 | $29,136 | $29,136 | |

| $7,736 | $9,670 | $12,088 | |

| $64,290 | $77,148 | $92,577 | |

| $2,400 | $2,472 | $2,546 | |

| $1,020 | $1,051 | $1,082 | |

| $9,000 | $9,270 | $9,548 | |

| $3,000 | $3,090 | $3,183 | |

| $3,600 | $3,708 | $3,819 | |

| $15,972 | $25,000 | $35,000 | |

| $15,306 | $25,094 | $32,330 | |

| $0 | $0 | $0 | |

| $487,825 | $652,681 | $766,075 | |

| $756,385 | $885,162 | $1,134,699 | |

| $782,290 | $916,146 | $1,137,810 | |

| $15,057 | $15,790 | $14,966 | |

| $185,909 | $217,343 | $284,599 | |

| $555,419 | $652,029 | $835,135 | |

| 19.48% | 18.50% | 19.17% | |

7.3 Key Financial Indicators

- Free cash flow to finance growth.

- Gross margins gauge profitability.

- Exchange rates between the U.S. dollar and the Euro tied to the Spanish Peseta.

7.4 Break-even Analysis

The table below shows our break-even unit volume measure. The product mix included in the unit sales will be a crucial factor. We have created a conservative sales forecast that we expect to achieve by year-end. The initial months will be challenging as we enter the market, but once we have successfully tested our products for three to four months, we anticipate significant sales that will easily meet our year-end targets.

Break-even Analysis

Monthly Units Break-even: 27

Monthly Revenue Break-even: $93,166

Assumptions:

Average Per-Unit Revenue: $3,481.62

Average Per-Unit Variable Cost: $1,962.44

Estimated Monthly Fixed Cost: $40,652

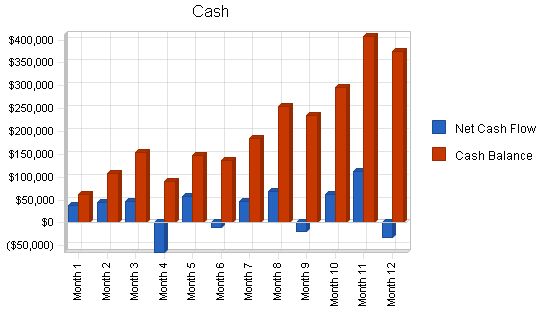

7.5 Projected Cash Flow

We will manage cash flow with an initial Small Business Administration (SBA) loan of $125,000, and then through our free cash flow generated from operations.

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| $1,425,725 | $1,762,196 | $2,178,074 | |

| $1,046,281 | $1,672,647 | $2,067,392 | |

| $2,472,006 | $3,434,843 | $4,245,467 | |

| $125,000 | $0 | $0 | |

| $2,621,286 | $3,439,699 | $4,245,467 | |

| Expenditures | |||

| $153,060 | |||

| $2,048,212 | |||

| $2,201,272 | |||

| $24,280 | $4,856 | $0 | |

| $2,270,872 | $2,968,405 | $3,547,817 | |

| $350,414 | $471,294 | $697,649 | |

| $375,414 | $846,708 | $1,544,358 | |

Projected Balance Sheet

7.6 Projected Balance Sheet

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| $375,414 | $846,708 | $1,544,358 | |

| $379,444 | $468,992 | $579,675 | |

| $243,705 | $301,219 | $372,307 | |

| $0 | $0 | $0 | |

| $998,563 | $1,616,920 | $2,496,339 | |

| $34,095 | $3,111 | $0 | |

| $1,032,658 | $1,620,031 | $2,496,339 | |

| $417,231 | $352,576 | $393,749 | |

| $615,427 | $1,267,456 | $2,102,590 | |

7.7 Business Ratios

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| 0.00% | 23.60% | 23.60% | -1.30% | |

| 36.74% | 28.95% | 23.22% | 19.20% | |

| 23.60% | 18.59% | 14.91% | 36.00% | |

| 0.00% | 0.00% | 0.00% | 24.80% | |

| 96.70% | 99.81% | 100.00% | 80.00% | |

| 3.30% | 0.19% | 0.00% | 20.00% | |

| 100.00% | 100.00% | 100.00% | 100.00% | |

| 40.40% | 21.76% | 15.77% | 48.10% | |

| 59.60% | 78.24% | 84.23% | 51.90% | |

| 0.00% | 0.00% | 0.00% | n.a | |

| 90.25% | 51.44% | 39.72% | n.a | |

| 3.76 | 3.76 | 3.76 | n.a | |

| 56 | 88 | 88 | n.a | |

| 10.91 | 7.29 | 7.29 | n.a | |

| 8.37 | 12.17 | 12.17 | n.a | |

| 27 | 34 | 27 | n.a | |

| 2.76 | 2.18 | 1.75 | n.a | |

| 0.68 | 0.28 | 0.19 | n.a | |

| 0.67 | 0.62 | 0.68 | n.a | |

| $721,012 | $1,399,281 | $2,227,926 | n.a | |

| 50.24 | 56.06 | 75.82 | n.a | |

| 0.36 | 0.46 | 0.57 | n.a | |

| 27% | 13% | 11% | n.a | |

| 1.35 | 3.89 | 5.75 | n.a | |

| 4.63 | 2.78 | 2.07 | n.a | |

| 0.00 | 0.00 | 0.00 | n.a | |

Appendix

"Sales Forecast"

Unit Sales

OJ Machines: 0%, 4, 4, 6, 6, 8, 8, 8, 10, 10, 10, 15, 15

Sandwich Express: 0%, 4, 4, 6, 6, 8, 8, 8, 10, 10, 10, 15, 15

Multi-line Machines: 0%, 10, 10, 15, 15, 20, 20, 20, 25, 25, 25, 30, 30

Toasters: 0%, 5, 5, 8, 8, 10, 10, 10, 12, 12, 12, 15, 15

Espresso Makers: 0%, 5, 5, 8, 8, 10, 10, 10, 12, 12, 12, 15, 15

Juice Squeezer: 0%, 5, 5, 8, 8, 10, 10, 10, 12, 12, 12, 15, 15

Total Unit Sales: 33, 33, 51, 51, 66, 66, 66, 81, 81, 81, 105, 105

Unit Prices

OJ Machines: $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00, $6,500.00

Sandwich Express: $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00, $9,500.00

Multi-line Machines: $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00, $1,000.00

Toasters: $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00, $3,275.00

Espresso Makers: $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00, $250.00

Juice Squeezer: $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00, $4,200.00

Total Sales: $112,625, $112,625, $172,800, $172,800, $225,250, $225,250, $225,250, $277,700, $277,700, $277,700, $385,875, $385,875

"Personnel Plan"

Javier Palmera: 0%, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600

Charles Mulligan: 0%, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600, $3,600

Technician: 0%, $0, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500, $1,500

M&O: 0%, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180, $4,180

Future Staff: 0%, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total People: 3, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4

Total Payroll: $11,380, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880

"General Assumptions"

Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

Current Interest Rate: 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%, 10.00%

Long-term Interest Rate: 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%, 11.50%

Tax Rate: 30.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%, 25.00%

Other: 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0

Pro Forma Profit and Loss

Sales: $112,625, $112,625, $172,800, $172,800, $225,250, $225,250, $225,250, $277,700, $277,700, $277,700, $385,875, $385,875

Direct Cost of Sales: $65,650, $62,850, $95,660, $95,660, $125,700, $125,700, $125,700, $155,740, $155,740, $155,740, $221,550, $221,550

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Cost of Sales: $65,650, $62,850, $95,660, $95,660, $125,700, $125,700, $125,700, $155,740, $155,740, $155,740, $221,550, $221,550

Gross Margin: $46,975, $49,775, $77,140, $77,140, $99,550, $99,550, $99,550, $121,960, $121,960, $121,960, $164,325, $164,325

Gross Margin %: 41.71%, 44.20%, 44.64%, 44.64%, 44.20%, 44.20%, 44.20%, 43.92%, 43.92%, 43.92%, 42.59%, 42.59%

Expenses:

Payroll: $11,380, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880, $12,880

Sales and Marketing and Other Expenses: $7,250, $2,000, $2,500, $4,150, $3,650, $3,900, $7,150, $3,650, $3,900, $3,650, $3,650, $6,150

Depreciation: $1,582, $1,582, $1,582, $2,166, $2,166, $2,166, $2,166, $2,166, $2,582, $2,582, $2,582, $2,582

Repairs & Maintenance: $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500, $500

Commissions: $3,942, $3,942, $6,048, $6,048, $7,884, $7,884, $7,884, $9,720, $9,720, $9,720, $13,506, $13,506

Loan Repayments: $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428, $2,428

Raw Materials: $480, $583, $583, $608, $608, $608, $608, $608, $656, $787, $787, $820

Freight: $2,626, $2,514, $3,826, $3,826, $5,028, $5,028, $5,028, $6,230, $6,230, $6,230, $8,862, $8,862

Office Supplies: $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200, $200

Postage: $85, $85, $85, $85, $85, $85, $85, $85, $85, $85, $85, $85

Telephone: $750, $750, $750, $750, $750, $750, $750, $750, $750, $750, $750, $750

Utilities: $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250, $250

Insurance: $300, $300, $300, $300, $300, $300, $300, $300, $300, $300, $300, $300

Rent: $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331, $1,331

Payroll Taxes: 10%, $1,138, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288, $1,288

Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0

Total Operating Expenses: $34,242, $30,633, $34,552, $36,810, $39,348, $39,598, $42,848, $42,385, $43,099, $42,980, $49,399, $51,932

Profit Before Interest and Taxes: $12,733, $19,142, $42,588, $40,330, $60,202, $59,952, $56,702, $79,575, $78,861, $78,980, $114,926, $112,393

EBITDA: $14,315, $20,724, $44,171, $42,496, $62,368, $62,118, $58,868, $81,741, $81,443, $81,562, $117,508, $114,975

Interest Expense: $1,190, $1,183, $1,198, $1,214, $1,229, $1,245, $1,261, $1,276, $1,292, $1,307, $1,323, $1,339

Taxes Incurred: $3,463, $4,490, $10,348, $9,779, $14,743, $14,677, $13,860, $19,575, $19,392, $19,418, $28,401, $27,764

Net Profit: $8,080, $13,469, $31,043, $29,337, $44,230, $44,030, $41,581, $58,724, $58,177, $58,254, $85,203, $83,291

Net Profit/Sales: 7.17%, 11.96%, 17.96%, 16.98%, 19.64%, 19.55%, 18.46%, 21.15%, 20.95%, 20.98%, 22.08%, 21.58%

Pro Forma Cash Flow

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash from Receivables | $0 | $1,877 | $56,313 | $57,315 | $86,400 | $87,274 | $112,625 | $112,625 | $113,499 | $138,850 | $138,850 | $140,653 | |

| Subtotal Cash from Operations | $56,313 | $58,190 | $142,713 | $143,715 | $199,025 | $199,899 | $225,250 | $251,475 | $252,349 | $277,700 | $331,788 | $333,590 | |

| $56,313 | $56,313 | $86,400 | $86,400 | $112,625 | $112,625 | $112,625 | $138,850 | $138,850 | $138,850 | $192,938 | $192,938 | ||

| $0 | $1,877 | $56,313 | $57,315 | $86,400 | $87,274 | $112,625 | $112,625 | $113,499 | $138,850 | $138,850 | $140,653 | ||

| $56,313 | $58,190 | $142,713 | $143,715 | $199,025 | $199,899 | $225,250 | $251,475 | $252,349 | $277,700 | $331,788 | $333,590 | ||

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | ||

| $0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $0 | $0 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | $2,428 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $0 | $125,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| $56,313 | $183,190 | $145,141 | $146,143 | $201,453 | $202,327 | $227,678 | $253,903 | $254,777 | $280,128 | $334,216 | $336,018 | ||

| $37,423 | $44,709 | $47,121 | ($64,757) | $57,002 | ($9,276) | $47,743 | $69,322 | ($19,780) | $62,389 | $111,431 | ($32,914) | ||

| $62,423 | $107,132 | $154,253 | $89,496 | $146,499 | $137,222 | $184,965 | $254,287 | $234,507 | $296,897 | $408,328 | $375,414 | ||

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!