The Willow Park Golf Course, located near Willow Lake Village, is an 18-hole facility in the expanding Crest Canyon area. It offers a challenging layout with beautiful views and includes a Pro Shop, driving range, cart barn, maintenance buildings, and a pavilion that seats up to 50. The course is easily accessible through the free shuttle service for retirement complexes in the area, and there is also an on-site snack bar.

The Crest Canyon area attracts over 200,000 retirees annually, who spend over $250 million on lodging, food, and recreational activities. This presents a significant opportunity for the Willow Park Golf Course.

Co-owners Marty Snyderman, Palmer St. Andrews, and Luke Roth have signed a 10-year lease with Claremont Properties for $250,000 per year.

1.1 Objectives

– Revitalize the old course and attract local clientele.

– Establish strategic alliances and rely on players’ recommendations to make Willow Park a sought-after destination for vacationers and avid players.

– Exceed customer expectations.

– Build a skilled and efficient staff.

1.2 Mission

The mission of Willow Park Golf Course is to become a popular choice among visitors and residents of the Crest Canyon area.

Willow Park Golf Course is in Crest Canyon, offering an 18-hole layout and scenic views. It includes a Pro Shop, driving range, cart barn, maintenance buildings, and a pavilion for up to 50 guests. There will also be an on-site snack bar.

Previously known as Crescent Hills Golf Course, the facility closed in 1999 and was sold, then purchased by Claremont Properties in 2000 for $2,000,000. Claremont Properties, which owns 4,000 condo units in the Crest Canyon area, also owns Willow Park Condominiums neighboring the golf course. A strategic alliance will be formed between Willow Park Golf Course and Claremont Properties for promotion and advertising.

Prior to the January opening, extensive landscape work will be performed from October to December. Additionally, new equipment such as driving range equipment, greens and landscape maintenance equipment, and food service equipment for the snack bar will be purchased. Thirty-six golf carts will be leased to ensure sufficient transportation, with a staff of four to maintain the golf cart pool.

Marty Snyderman, Palmer St. Andrews, and Luke Roth will invest in the venture, along with securing a long-term loan.

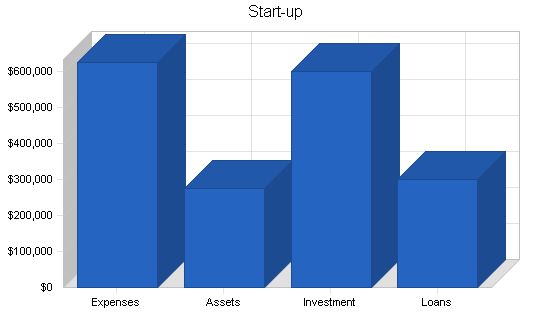

Start-up Requirements:

– Legal: $5,000

– Stationery etc.: $400

– Brochures: $6,000

– Pro Shop Setup: $50,000

– Landscape Development and Repair: $280,000

– Food Service Equipment: $20,000

– Insurance: $4,000

– Driving Range Equipment: $80,000

– Lease Golf Carts: $10,000

– Greens/Landscape Equipment: $170,000

– Other: $0

– Total Start-up Expenses: $625,400

Start-up Assets:

– Cash Required: $34,600

– Start-up Inventory: $30,000

– Other Current Assets: $0

– Long-term Assets: $210,000

– Total Assets: $274,600

Total Requirements: $900,000

Start-up Funding:

– Start-up Expenses to Fund: $625,400

– Start-up Assets to Fund: $274,600

– Total Funding Required: $900,000

Assets:

– Non-cash Assets from Start-up: $240,000

– Cash Requirements from Start-up: $34,600

– Additional Cash Raised: $0

– Cash Balance on Starting Date: $34,600

– Total Assets: $274,600

Liabilities and Capital:

– Liabilities:

– Current Borrowing: $0

– Long-term Liabilities: $300,000

– Accounts Payable (Outstanding Bills): $0

– Other Current Liabilities (interest-free): $0

– Total Liabilities: $300,000

– Capital:

– Planned Investment:

– Marty Snyderman: $200,000

– Luke Roth: $200,000

– Palmer St. Andrews: $200,000

– Additional Investment Requirement: $0

– Total Planned Investment: $600,000

– Loss at Start-up (Start-up Expenses): ($625,400)

– Total Capital: ($25,400)

Total Capital and Liabilities: $274,600

Total Funding: $900,000

Company Ownership:

Marty Snyderman, Luke Roth, and Palmer St. Andrews are co-owners of the Willow Park Golf Course.

Products and Services:

The Willow Park Golf Course will offer the following services:

– 18-hole golf course

– Pro Shop

– Driving range

– Snack bar

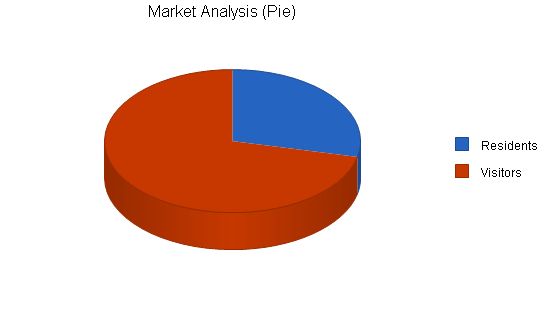

Market Analysis Summary:

Retirement hotel development and operation in the Crest Canyon area has been profitable and successful due to the economic upturn experienced in the mid-1990s. Retirement living and vacation development are currently going strong. In the past two years, condo sales in the Crest Canyon area have increased by over 35%. There are twenty condominium developments, retirement complexes, and hotels within a five-mile radius of Willow Park Golf Course. The area’s room occupancy is consistently 90% year-round. New construction is planned during spring of 2002 for two retirement condo complexes and a hotel.

Market Segmentation:

Our customers can be broadly divided into two groups:

– Retirement Residents: The Crest Canyon area is quickly becoming one of the best retirement locations in the US. The population is growing at a rate of 15% annually. Currently, the Crest Canyon area has a population of 80,000 year-round residents.

– Retirement Visitors: The Crest Canyon area welcomes 200,000 visitors annually, who enjoy the sun and recreational activities throughout the year.

Market Analysis

10. Strategy and Implementation Summary

– Willow Park Golf Course will market aggressively to retired residents and vacationers in the Crest Canyon area.

– For residents, a membership drive will be initiated with discounted fees for course use and purchases in the Pro Shop.

– Visitors will be offered various membership packages, each with savings compared to a single day rate.

– Claremont Properties will market the course to residents and visitors in their condo units.

– Claremont Properties will actively market the course in their 4,000+ condo units, offering residents a discount on membership fees and vacation visitors a discount on the day use fee.

– Willow Park Golf Course will be included in Claremont Properties’ marketing material.

– A strategic alliance with Crest Lake Golf Course, owned by Marty Snyderman, will provide the Pro Shop inventory and recommend players to Willow Park.

– A SWOT analysis is recommended for developing good business strategies.

5.2 Competitive Edge

– Willow Park Golf Course’s competitive edge is its experienced co-owners, Marty Snyderman and Luke Roth, who have managed golf facilities for over twenty years.

– Marty is the owner of Crest Lake Golf Course.

– Luke was the manager of Village Green Golf Course and The Ridge before joining Willow Park.

– Palmer St. Andrews, a former PGA tour pro, brings his reputation and experience to the Pro Shop.

– The course’s free shuttle service makes it easily accessible to local residents.

– The course’s relationship with Claremont Properties, which owns 4,000+ condo units in Crest Canyon, provides another critical advantage.

5.3 Sales Strategy

– The sales strategy is to aggressively gain market share of residents and vacationers.

– Membership fees include discounts on course use and purchases in the Pro Shop.

– Day use fees are discounted for members.

– Day use packages are available for both 9 and 18 holes.

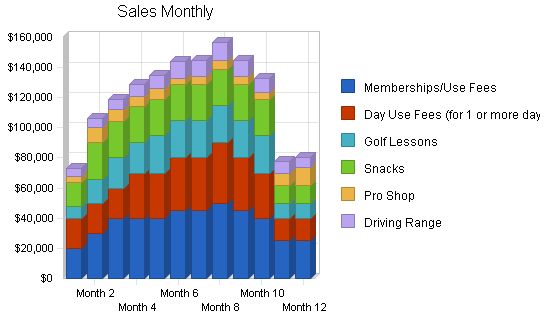

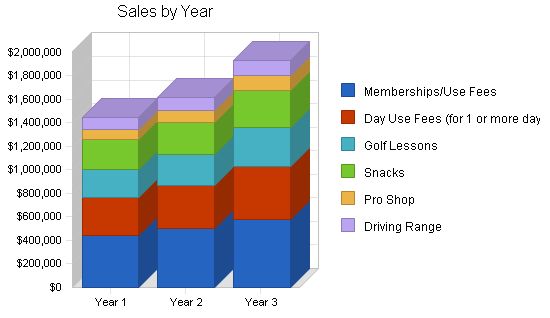

5.3.1 Sales Forecast

– The sales forecast anticipates a fast start in course play sales due to the large local resident population and the warm weather in the area.

– Winter month sales are expected to increase in subsequent years as word spreads about the course.

– The Pro Shop should see increased sales during the holiday season.

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Memberships/Use Fees | $445,000 | $500,000 | $580,000 |

| Day Use Fees (for 1 or more days) | $325,000 | $370,000 | $450,000 |

| Golf Lessons | $234,000 | $260,000 | $330,000 |

| Snacks | $256,000 | $275,000 | $320,000 |

| Pro Shop | $80,500 | $100,000 | $120,000 |

| Driving Range | $103,000 | $115,000 | $130,000 |

| Total Sales | $1,443,500 | $1,620,000 | $1,930,000 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Memberships/Use Fees | $0 | $0 | $0 |

| Day Use Fees (for 1 or more days) | $0 | $0 | $0 |

| Golf Lessons | $117,000 | $133,000 | $150,000 |

| Snacks | $64,000 | $75,000 | $90,000 |

| Pro Shop | $32,300 | $40,000 | $58,000 |

| Driving Range | $21,000 | $23,000 | $25,000 |

| Subtotal Direct Cost of Sales | $234,300 | $271,000 | $323,000 |

Contents

Management Summary

Luke Roth will manage daily operations of Willow Park Golf Course. Palmer St. Andrews will manage the Pro Shop and serve as the Head Teaching Pro and supervisor of the teaching staff. We are currently recruiting an experienced Greens and Landscape Superintendent.

6.1 Personnel Plan

Since Willow Park Golf Course is open year-round, we will recruit and train full-time employees. We aim to have loyal and dedicated staff, so we will not rely on seasonal employees. The minimum personnel needed for the first year of Willow Park Golf Course will be:

- Manager

- Assistant Manager

- Head Teaching Pro/Pro Shop Manager

- Greens and Landscape Superintendent

- 7 Course Staff

- 3 Snack Shop Staff

- 3 Pro Shop Staff

- 3 Greens Maintenance Staff

- 4 Golf Cart Maintenance Staff

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Manager | $54,000 | $59,000 | $64,000 |

| Assistant Manager | $42,000 | $47,000 | $52,000 |

| Pro Shop Manager/Head Teaching Pro | $60,000 | $70,000 | $80,000 |

| Greens/Landscape Superintendent | $48,000 | $53,000 | $58,000 |

| Course Staff | $156,000 | $163,000 | $168,000 |

| Snack Shop Staff | $54,000 | $57,000 | $61,000 |

| Pro Shop Staff | $54,000 | $58,000 | $62,000 |

| Greens Maintenance Staff | $48,000 | $52,000 | $56,000 |

| Golf Cart Maintenance Staff | $72,000 | $76,000 | $79,000 |

| Other | $0 | $0 | $0 |

| Total People | 24 | 24 | 24 |

| Total Payroll | $588,000 | $635,000 | $680,000 |

Financial Plan

This is the financial plan for Willow Park Golf Course. We anticipate fluctuating sales and expenses in the first year as we establish the course and maintenance routines. As our existence and reputation become known, we expect steady growth and increased membership sales as golfers from snowy areas travel to Crest Canyon, particularly Willow Park, to play golf during the winter months.

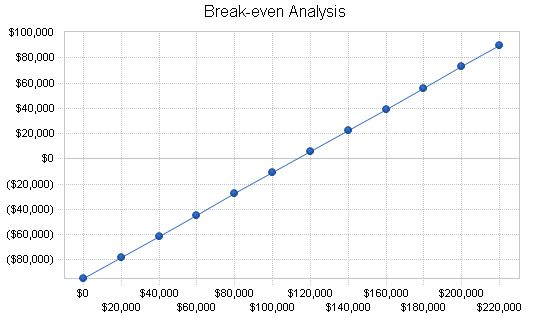

7.1 Break-even Analysis

Using averaged monthly total expenses and an estimated variable cost, the monthly break-even point in sales revenue is calculated and shown below.

Break-even Analysis

Monthly Revenue Break-even: $113,085

Assumptions:

– Average Percent Variable Cost: 16%

– Estimated Monthly Fixed Cost: $94,730

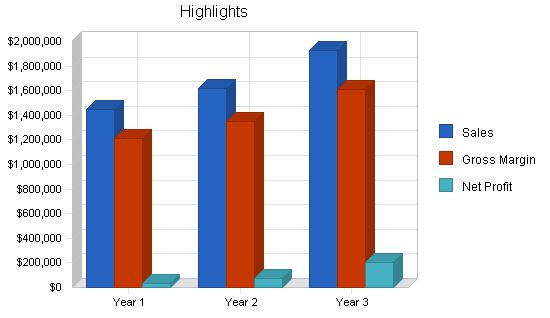

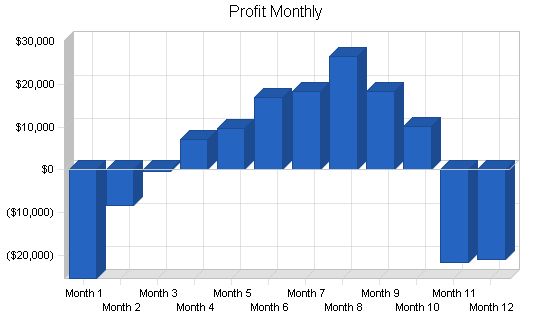

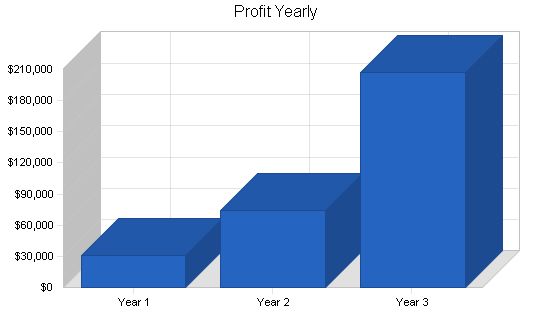

7.2 Projected Profit and Loss

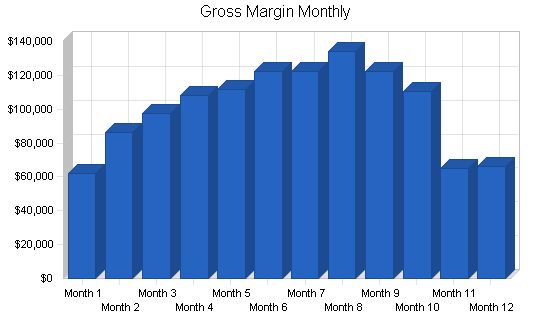

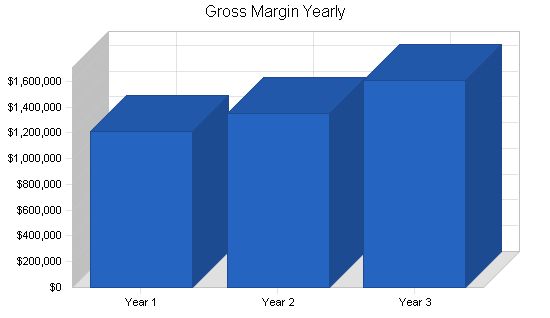

The following table and charts display the projected profit and loss for three years. Monthly figures for the first year are provided in the appendix.

Pro Forma Profit and Loss

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $1,443,500 | $1,620,000 | $1,930,000 |

| Direct Cost of Sales | $234,300 | $271,000 | $323,000 |

| Other Production Expenses | $0 | $0 | $0 |

| Total Cost of Sales | $234,300 | $271,000 | $323,000 |

| Gross Margin | $1,209,200 | $1,349,000 | $1,607,000 |

| Gross Margin % | 83.77% | 83.27% | 83.26% |

| Expenses | |||

| Payroll | $588,000 | $635,000 | $680,000 |

| Sales and Marketing and Other Expenses | $60,000 | $80,000 | $100,000 |

| Depreciation | $28,560 | $28,560 | $28,560 |

| Leased Equipment | $72,000 | $80,000 | $80,000 |

| Utilities | $26,000 | $26,000 | $26,000 |

| Insurance | $24,000 | $24,000 | $24,000 |

| Lease | $250,000 | $250,000 | $250,000 |

| Payroll Taxes | $88,200 | $95,250 | $102,000 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $1,136,760 | $1,218,810 | $1,290,560 |

| Profit Before Interest and Taxes | $72,440 | $130,190 | $316,440 |

| EBITDA | $101,000 | $158,750 | $345,000 |

| Interest Expense | $28,066 | $24,643 | $21,072 |

| Taxes Incurred | $13,312 | $31,664 | $88,610 |

| Net Profit | $31,062 | $73,883 | $206,758 |

| Net Profit/Sales | 2.15% | 4.56% | 10.71% |

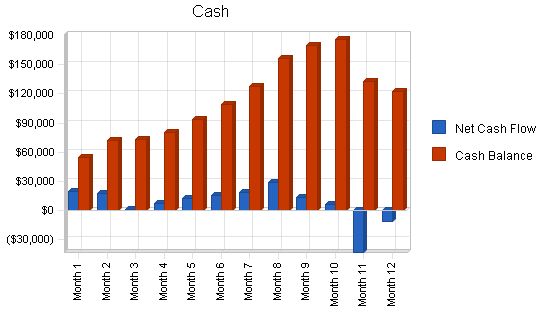

7.3 Projected Cash Flow

The table and chart below show the projected cash flow for three years. Monthly figures for the first year are shown in the appendix.

Pro Forma Cash Flow

| Year 1 | Year 2 | Year 3 | |

| Cash Sales | $1,443,500 | $1,620,000 | $1,930,000 |

| Subtotal Cash from Operations | $1,443,500 | $1,620,000 | $1,930,000 |

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $1,443,500 | $1,620,000 | $1,930,000 |

| Cash Spending | $588,000 | $635,000 | $680,000 |

| Bill Payments | $732,096 | $861,100 | $1,007,098 |

| Subtotal Spent on Operations | $1,320,096 | $1,496,100 | $1,687,098 |

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $35,712 | $35,712 | $35,712 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Net Cash Flow | $87,692 | $88,188 | $207,190 |

| Cash Balance | $122,292 | $210,480 | $417,670 |

Projected Balance Sheet

The following table presents the projected balance sheet for three years.

| Year 1 | Year 2 | Year 3 | |

| Cash | $122,292 | $210,480 | $417,670 |

| Inventory | $15,125 | $17,494 | $20,851 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $137,417 | $227,975 | $438,521 |

| Long-term Assets | $181,440 | $152,880 | $124,320 |

| Total Assets | $318,857 | $380,855 | $562,841 |

| Current Liabilities | $48,907 | $72,734 | $83,674 |

| Long-term Liabilities | $264,288 | $228,576 | $192,864 |

| Total Liabilities | $313,195 | $301,310 | $276,538 |

| Paid-in Capital | $600,000 | $600,000 | $600,000 |

| Retained Earnings | ($625,400) | ($594,338) | ($520,455) |

| Earnings | $31,062 | $73,883 | $206,758 |

| Total Capital | $5,662 | $79,545 | $286,302 |

| Total Liabilities and Capital | $318,857 | $380,855 | $562,841 |

| Net Worth | $5,662 | $79,545 | $286,302 |

Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7997, Membership Sports and Recreation, are shown for comparison.

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 12.23% | 19.14% | 15.20% |

| Inventory | 4.74% | 4.59% | 3.70% | 4.00% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 31.80% |

| Total Current Assets | 43.10% | 59.86% | 77.91% | 40.90% |

| Long-term Assets | 56.90% | 40.14% | 22.09% | 59.10% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 15.34% | 19.10% | 14.87% | 31.60% |

| Long-term Liabilities | 82.89% | 60.02% | 34.27% | 28.00% |

| Total Liabilities | 98.22% | 79.11% | 49.13% | 59.60% |

| Net Worth | 1.78% | 20.89% | 50.87% | 40.40% |

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 83.77% | 83.27% | 83.26% | 0.00% |

| Selling, General & Administrative Expenses | 81.62% | 78.71% | 72.55% | 72.30% |

| Advertising Expenses | 4.16% | 4.94% | 5.18% | 2.70% |

| Profit Before Interest and Taxes | 5.02% | 8.04% | 16.40% | 2.60% |

| Current | 2.81 | 3.13 | 5.24 | 1.23 |

| Quick | 2.50 | 2.89 | 4.99 | 0.83 |

| Total Debt to Total Assets | 98.22% | 79.11% | 49.13% | 59.60% |

| Pre-tax Return on Net Worth | 783.71% | 132.69% | 103.17% | 2.80% |

| Pre-tax Return

Personnel Plan: Manager: 0%, $4,500/month Assistant Manager: 0%, $3,500/month Pro Shop Manager/Head Teaching Pro: 0%, $5,000/month Greens/Landscape Superintendent: 0%, $4,000/month Course Staff: 0%, $13,000/month Snack Shop Staff: 0%, $4,500/month Pro Shop Staff: 0%, $4,500/month Greens Maintenance Staff: 0%, $4,000/month Golf Cart Maintenance Staff: 0%, $6,000/month Other: 0%, $0/month Total People: 24 Total Payroll: $49,000 General Assumptions: Plan Month: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 Current Interest Rate: 10.00% Long-term Interest Rate: 10.00% Tax Rate: 30.00% Other: 0 Pro Forma Profit and Loss: Sales: $73,000, $106,000, $119,000, $129,000, $135,000, $144,000, $145,000, $157,000, $145,000, $132,500, $78,000, $80,000 Direct Cost of Sales: $11,150, $19,750, $21,350, $20,750, $23,250, $21,750, $22,550, $22,950, $22,550, $21,750, $12,750, $13,750 Other Production Expenses: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Cost of Sales: $11,150, $19,750, $21,350, $20,750, $23,250, $21,750, $22,550, $22,950, $22,550, $21,750, $12,750, $13,750 Gross Margin: $61,850, $86,250, $97,650, $108,250, $111,750, $122,250, $122,450, $134,050, $122,450, $110,750, $65,250, $66,250 Gross Margin %: 84.73%, 81.37%, 82.06%, 83.91%, 82.78%, 84.90%, 84.45%, 85.38%, 84.45%, 83.58%, 83.65%, 82.81% Expenses: Payroll: $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000, $49,000 Sales and Marketing and Other Expenses: $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000, $5,000 Depreciation: $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380, $2,380 Leased Equipment: $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000, $6,000 Utilities: $3,000, $3,000, $3,000, $3,000, $3,000, $3,000, $1,500, $1,300, $1,300, $1,300, $1,300, $1,300 Insurance: $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000, $2,000 Lease: $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,833, $20,837 Payroll Taxes: 15%, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350, $7,350 Other: $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0, $0 Total Operating Expenses: $95,563, $95,563, $95,563, $95,563, $95,563, $95,563, $94,063, $93,863, $93,863, $93,863, $93,863, $93,867 Profit Before Interest and Taxes: ($33,713), ($9,313), $2,087, $12,687, $16,187, $26,687, $28,387, $40,187, $28,587, $16,887, ($28,613), ($27,617) EBITDA: ($31,333), ($6,933), $4,467, $15,067, $18,567, $29,067, $30,767, $42,567, $30,967, $19,267, ($26,233), ($25,237) Interest Expense: $2,475, $2,450, $2,426, $2,401, $2,376, $2,351, $2,326, $2,302, $2,277, $2,252, $2,227, $2,202 Taxes Incurred: ($10,856), ($3,529), ($102), $3,086, $4,143, $7,301, $7,818, $11,366, $7,893, $4,391, ($9,252), ($8,946) Net Profit: ($25,332), ($8,234), ($237), $7,200, $9,668, $17,035, $18,242, $26,520, $18,417, $10,245, ($21,588), ($20,874) Net Profit/Sales: -34.70%, -7.77%, -0.20%, 5.58%, 7.16%, 11.83%, 12.58%, 16.89%, 12.70%, 7.73%, -27.68%, -26.09% Pro Forma Cash Flow: Cash Received: Cash Sales: Subtotal Cash from Operations: Additional Cash Received: Sales Tax, VAT, HST/GST Received: New Current Borrowing: New Other Liabilities (interest-free): New Long-term Liabilities: Sales of Other Current Assets: Sales of Long-term Assets: New Investment Received: Subtotal Cash Received: Expenditures: Expenditures from Operations: Cash Spending: Bill Payments: Subtotal Spent on Operations: Additional Cash Spent: Sales Tax, VAT, HST/GST Paid Out: Principal Repayment of Current Borrowing: Other Liabilities Principal Repayment: Long-term Liabilities Principal Repayment: Purchase Other Current Assets: Purchase Long-term Assets: Dividends: Subtotal Cash Spent: Net Cash Flow: Cash Balance: |

Hello!

I’m Andrew Brooks, a seasoned finance consultant from the USA and the mind behind phonenumber247.com.

My career is built on a foundation of helping individuals and businesses thrive financially in an ever-changing economic landscape. At phonenumber247.com, my aim is to demystify the complex world of finance, providing clear, actionable advice that can help you navigate your financial journey with confidence. Whether it’s personal finance management, investment strategies, or understanding the nuances of market dynamics, I’m here to share insights and tools that can propel you towards your financial goals.

Welcome to my digital space, where every piece of advice is a step closer to financial clarity and success!